Open Access Plus: Cigna Health and Life ... - Valley Hospital

Open Access Plus: Cigna Health and Life ... - Valley Hospital

Open Access Plus: Cigna Health and Life ... - Valley Hospital

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

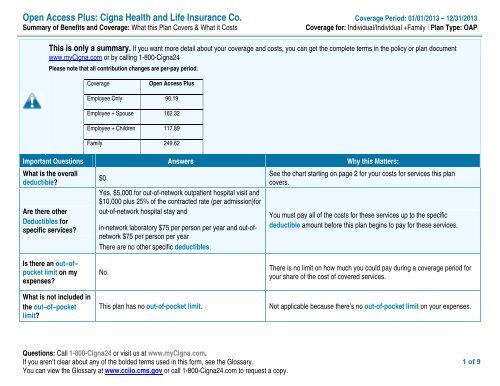

<strong>Open</strong> <strong>Access</strong> <strong>Plus</strong>: <strong>Cigna</strong> <strong>Health</strong> <strong>and</strong> <strong>Life</strong> Insurance Co. Coverage Period: 01/01/2013 – 12/31/2013Summary of Benefits <strong>and</strong> Coverage: What this Plan Covers & What it CostsCoverage for: Individual/Individual +Family | Plan Type: OAPThis is only a summary. If you want more detail about your coverage <strong>and</strong> costs, you can get the complete terms in the policy or plan documentwww.my<strong>Cigna</strong>.com or by calling 1-800-<strong>Cigna</strong>24Please note that all contribution changes are per-pay period.Coverage<strong>Open</strong> <strong>Access</strong> <strong>Plus</strong>Employee Only 90.19Employee + Spouse 162.32Employee + Children 117.89Family 249.62Important Questions Answers Why this Matters:What is the overalldeductible?Are there otherDeductibles forspecific services?$0Yes, $5,000 for out-of-network outpatient hospital visit <strong>and</strong>$10,000 plus 25% of the contracted rate (per admission)forout-of-network hospital stay <strong>and</strong>in-network laboratory $75 per person per year <strong>and</strong> out-ofnetwork$75 per person per yearThere are no other specific deductibles.See the chart starting on page 2 for your costs for services this plancovers.You must pay all of the costs for these services up to the specificdeductible amount before this plan begins to pay for these services.Is there an out–of–pocket limit on myexpenses?What is not included inthe out–of–pocketlimit?No.This plan has no out-of-pocket limit.There is no limit on how much you could pay during a coverage period foryour share of the cost of covered services.Not applicable because there’s no out-of-pocket limit on your expenses.Questions: Call 1-800-<strong>Cigna</strong>24 or visit us at www.my<strong>Cigna</strong>.com.If you aren’t clear about any of the bolded terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-800-<strong>Cigna</strong>24.com to request a copy.1 of 9

Common MedicalEventIf you visit a healthcare provider’s officeor clinicIf you have a testIf you need drugs totreat your illness orconditionMore information aboutprescription drugcoverage is available atwww.my<strong>Cigna</strong>.com.If you have outpatientsurgeryServices You May NeedClient SpecificNetworkYour cost if you use anIn-Network ProviderOut-of-networkProviderLimitations & ExceptionsPrimary care visit to treat aninjury or illness$30 co-pay/visit $40 co-pay/visit 50% co-insurance –––––––––––none–––––––––––Specialist visit $40 co-pay/visit $50 co-pay/visit 50% co-insurance –––––––––––none–––––––––––Other practitioner office visit Not ApplicableCoverage for chiropractic services is$40 co-pay/visit for50% co-insurance limited to 20 days annual max.chiropractorPreventive care/screening /immunizationDiagnostic test (x-ray, bloodwork)Imaging (CT/PET scans,MRIs)No Charge No Charge 50% co-insurance –––––––––––none–––––––––––No Charge$75 laboratorydeductible per year50% co-insurance –––––––––––none–––––––––––No Charge No charge 50% co-insurance –––––––––––none–––––––––––Generic drugs Not Covered Not Covered Not CoveredPreferred br<strong>and</strong>-name drugs Not Covered Not Covered Not CoveredNon-preferred br<strong>and</strong>-namedrugsNot Covered Not Covered Not CoveredSpecialty drugs Not Covered Not Covered Not CoveredFacility fee (e.g., ambulatorysurgery center)No Charge$5,000 co-pay/visit$5,000 deductible /visit, plus 50% coinsuranceContact your employer for non-<strong>Cigna</strong> coverage that may beavailableContact your employer for non-<strong>Cigna</strong> coverage that may beavailableContact your employer for non-<strong>Cigna</strong> coverage that may beavailableContact your employer for non-<strong>Cigna</strong> coverage that may beavailablePer visit co-pay is waived for nonsurgicalproceduresPhysician/surgeon fees No Charge No Charge 50% co-insurance –––––––––––none–––––––––––3 of 9

Common MedicalEventIf you need immediatemedical attentionIf you have a hospitalstayServices You May NeedClient SpecificNetworkYour cost if you use anIn-Network ProviderOut-of-networkProviderEmergency room services $100 co-pay/visit $100 co-pay/visit $100 co-pay/visitEmergency medicaltransportationLimitations & ExceptionsPer visit co-pay is waived if admittedNo Charge No Charge No Charge –––––––––––none–––––––––––Urgent care No Charge $40 co-pay/visit $40 co-pay/visitFacility fee (e.g., hospitalroom)No Charge$10,000 plus 25% ofthe contracted rate(per admission)$10,000 plus 25% ofthe contracted ratethen 50% of theapproved fee (peradmission)Per visit co-pay is waived if admitted–––––––––––none–––––––––––If you have mentalhealth, behavioralhealth, or substanceabuse needsPhysician/surgeon fee No Charge No Charge 50% co-insurance –––––––––––none–––––––––––Mental/Behavioral healthoutpatient services$40 co-pay/office visit $50 co-pay/office visit 50% co-insurance –––––––––––none–––––––––––Mental/Behavioral healthinpatient servicesSubstance use disorderoutpatient servicesSubstance use disorderinpatient servicesNot ApplicableNo Charge$10,000 plus 25% ofthe contracted ratethen 50% of theapproved fee (peradmission)–––––––––––none–––––––––––$40 co-pay/office visit $50 co-pay/office visit 50% co-insurance –––––––––––none–––––––––––Not ApplicableNo Charge$10,000 plus 25% ofthe contracted ratethen 50% of theapproved fee (peradmission)–––––––––––none–––––––––––If you are pregnant Prenatal <strong>and</strong> postnatal care No Charge No Charge 50% co-insurance –––––––––––none–––––––––––4 of 9

Common MedicalEventIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careServices You May NeedDelivery <strong>and</strong> all inpatientservicesClient SpecificNetworkNo ChargeYour cost if you use anIn-Network Provider$10,000 plus 25% ofthe contracted rate(per admission)Out-of-networkProvider$10,000 plus 25% ofthe contracted ratethen 50% of theapproved fee (peradmission)Limitations & Exceptions–––––––––––none–––––––––––Home health care No Charge No Charge Not CoveredCoverage is limited to 60 daysannual maxRehabilitation services No Charge No Charge Not CoveredCoverage is limited to 60 daysannual maxHabilitation services Not Covered Not Covered Not Covered –––––––––––none–––––––––––Skilled nursing care Not Applicable No Charge Not CoveredCoverage is limited to 60 daysannual maxDurable medical equipment No Charge No Charge Not Covered –––––––––––none–––––––––––Hospice service Not Applicable No Charge Not Covered –––––––––––none–––––––––––Eye exam No Charge No Charge Not CoveredCoverage is limited to $300 annualmaxGlasses Not Covered Not Covered Not Covered –––––––––––none–––––––––––Dental check-up Not Covered Not Covered Not Covered –––––––––––none–––––––––––5 of 9

Excluded Services & Other Covered Services:Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.)AcupunctureHabilitation servicesPrescription drugsCosmetic surgeryInfertility treatmentPrivate-duty nursingDental care (Adult)Long-term careRoutine foot careDental care (Children)Non-emergency care when traveling outside the U.S.Weight loss programsOther Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services <strong>and</strong> your costs for these services.Bariatric surgeryHearing aidsWigsChiropracticRoutine eye care (Adults)Eye exam (Children)6 of 9

Your Rights to Continue Coverage:If you lose coverage under the plan, then, depending upon the circumstances, Federal <strong>and</strong> State laws may provide protections that allow you to keep healthcoverage. Any such rights may be limited in duration <strong>and</strong> will require you to pay a premium, which may be significantly higher than the premium you pay whilecovered under the plan. Other limitations on your rights to continue coverage may also apply.For more information on your rights to continue coverage, contact the plan at 1-800-<strong>Cigna</strong>24. You may also contact your state insurance department, the U.S.Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S. Department of <strong>Health</strong> <strong>and</strong> Human Services at1-877-267-2323 x61565 or www.cciio.cms.gov.Your Grievance <strong>and</strong> Appeals Rights:If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. For questions aboutyour rights, this notice, or assistance, you can contact <strong>Cigna</strong> Customer service at 1-800-<strong>Cigna</strong>24. You may also contact the Department of Labor’s EmployeeBenefits Security Administration at 1-266-444-EBSA (3272) or www.dol.gov/ebsa/healthreform. Additionally, a consumer assistance program can help you file yourappeal. Contact the program for this plan’s state: New Jersey Department of Banking <strong>and</strong> Insurance at 800-446-7467. However, for information regarding your ownstate’s consumer assistance program refer to www.healthcare.gov .––––––––––––––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next page.––––––––––––––––––––––7 of 9

Coverage ExamplesAbout these CoverageExamples:These examples show how this plan might covermedical care in given situations. Use theseexamples to see, in general, how much financialprotection a sample patient might get if they arecovered under different plans.This is not a costestimator.Don’t use these examples to estimate youractual costs under this plan. The actualcare you receive will be different from theseexamples, <strong>and</strong> the cost of that care will alsobe different.See the next page for important informationabout these examples.Note: These numbers assume enrollmentin individual-only coverage.Having a baby(normal delivery)• Amount owed to providers: $7,540• Plan pays $7,330• Patient pays $ 210Sample care costs:<strong>Hospital</strong> charges (mother) $2,700Routine obstetric care $2,100<strong>Hospital</strong> charges (baby) $900Anesthesia $900Laboratory tests $500Prescriptions $200Radiology $200Vaccines, other preventive $40Total $7,540Patient pays:Deductibles $0Co-pays $40Co-insurance $0Limits or exclusions $170Total $210Managing type 2 diabetes(routine maintenance ofawell-controlled condition)• • Amount owed to providers: $5,400• Plan pays $720• Patient pays 4,680Sample care costs:Prescriptions $2,900Medical Equipment <strong>and</strong> Supplies $1,300Office Visits <strong>and</strong> Procedures $700Education $300Laboratory tests $100Vaccines, other preventive $100Total $5,400Patient pays:Deductibles $0Co-pays $320Co-insurance $0Limits or exclusions $4,360Total $4,6808 of 9

Questions <strong>and</strong> answers about the Coverage Examples:What are some of the assumptions behind theCoverage Examples?Costs don’t include premiums.Sample care costs are based on nationalaverages supplied by the U.S. Departmentof <strong>Health</strong> <strong>and</strong> Human Services, <strong>and</strong> aren’tspecific to a particular geographic area orhealth plan.The patient’s condition was not an excluded orpreexisting condition.All services <strong>and</strong> treatments started <strong>and</strong>ended in the same coverage period.There are no other medical expenses forany member covered under this plan.Out-of-pocket expenses are based only ontreating the condition in the example.The patient received all care from innetworkproviders. If the patient hadreceived care from out-of-networkproviders, costs would have been higher.What does a Coverage Example show?For each treatment situation, the CoverageExample helps you see how deductibles, copayments,<strong>and</strong> co-insurance can add up. It alsohelps you see what expenses might be left up toyou to pay because the service or treatment isn’tcovered or payment is limited.Does the Coverage Example predict my owncare needs? No. Treatments shown are just examples. Thecare you would receive for this condition couldbe different based on your doctor’s advice,your age, how serious your condition is, <strong>and</strong>many other factors.Does the Coverage Example predict my futureexpenses? No. Coverage Examples are not costestimators. You can’t use the examples toestimate costs for an actual condition. Theyare for comparative purposes only. Your owncosts will be different depending on the careyou receive, the prices your providerscharge, <strong>and</strong> the reimbursement your healthplan allows.Can I use Coverage Examples to compareplans?Yes. When you look at the Summary ofBenefits <strong>and</strong> Coverage for other plans, you’llfind the same Coverage Examples. When youcompare plans, check the “Patient Pays” boxin each example. The smaller that number,the more coverage the plan provides.Are there other costs I should consider whencomparing plans?Yes. An important cost is the premium youpay. Generally, the lower your premium, themore you’ll pay in out-of-pocket costs, such asco-payments, deductibles, <strong>and</strong> coinsurance.You should also considercontributions to accounts such as healthsavings accounts (HSAs), flexible spendingarrangements (FSAs) or healthreimbursement accounts (HRAs) that help youpay out-of-pocket expenses.Plan ID:Plan Name: <strong>Valley</strong> <strong>Health</strong> Medical Group OAPQuestions: Call 1-800-<strong>Cigna</strong>24 or visit us at www.my<strong>Cigna</strong>.com.If you aren’t clear about any of the bolded terms used in this form, see the Glossary.You can view the Glossary at www.cciio.cms.gov or call 1-800-my<strong>Cigna</strong>.com to request a copy.9 of 9