Full Version Guinness Anchor Berhad Annual Report 2007 - Gab

Full Version Guinness Anchor Berhad Annual Report 2007 - Gab

Full Version Guinness Anchor Berhad Annual Report 2007 - Gab

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

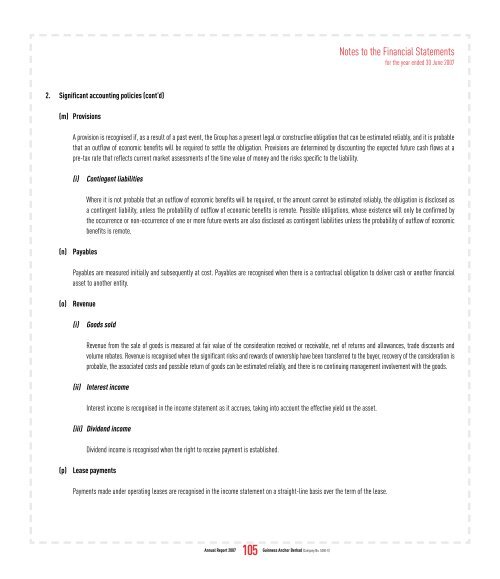

Notes to the Financial Statementsfor the year ended 30 June <strong>2007</strong>2. Significant accounting policies (cont’d)(m) ProvisionsA provision is recognised if, as a result of a past event, the Group has a present legal or constructive obligation that can be estimated reliably, and it is probablethat an outflow of economic benefits will be required to settle the obligation. Provisions are determined by discounting the expected future cash flows at apre-tax rate that reflects current market assessments of the time value of money and the risks specific to the liability.(i)Contingent liabilitiesWhere it is not probable that an outflow of economic benefits will be required, or the amount cannot be estimated reliably, the obligation is disclosed asa contingent liability, unless the probability of outflow of economic benefits is remote. Possible obligations, whose existence will only be confirmed bythe occurrence or non-occurrence of one or more future events are also disclosed as contingent liabilities unless the probability of outflow of economicbenefits is remote.(n)PayablesPayables are measured initially and subsequently at cost. Payables are recognised when there is a contractual obligation to deliver cash or another financialasset to another entity.(o)Revenue(i)Goods soldRevenue from the sale of goods is measured at fair value of the consideration received or receivable, net of returns and allowances, trade discounts andvolume rebates. Revenue is recognised when the significant risks and rewards of ownership have been transferred to the buyer, recovery of the consideration isprobable, the associated costs and possible return of goods can be estimated reliably, and there is no continuing management involvement with the goods.(ii)Interest incomeInterest income is recognised in the income statement as it accrues, taking into account the effective yield on the asset.(iii) Dividend incomeDividend income is recognised when the right to receive payment is established.(p)Lease paymentsPayments made under operating leases are recognised in the income statement on a straight-line basis over the term of the lease.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>105<strong>Guinness</strong> <strong>Anchor</strong> <strong>Berhad</strong> (Company No. 5350-X)