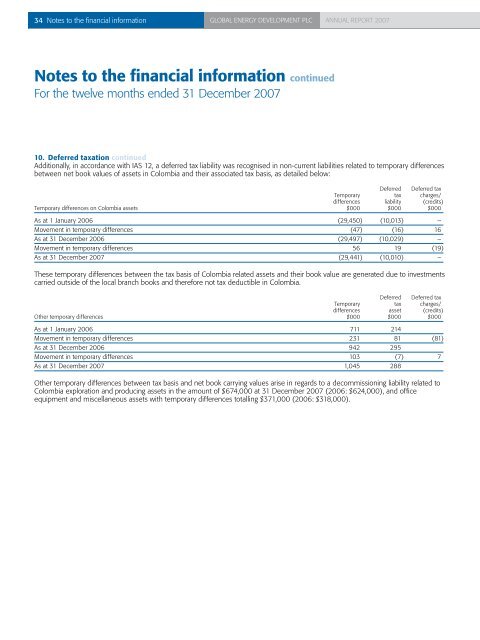

34 Notes to the financial information <strong>Global</strong> <strong>Energy</strong> <strong>Development</strong> PLC<strong>Annual</strong> report <strong>2007</strong>Notes to the financial information continuedFor the twelve months ended 31 December <strong>2007</strong>10. Deferred taxation continuedAdditionally, in accordance with IAS 12, a deferred tax liability was recognised in non-current liabilities related to temporary differencesbetween net book values of assets in Colombia and their associated tax basis, as detailed below:Deferred Deferred taxtemporary tax charges/differences liability (credits)Temporary differences on Colombia assets $000 $000 $000As at 1 January 2006 (29,450) (10,013) –Movement in temporary differences (47) (16) 16As at 31 December 2006 (29,497) (10,029) –Movement in temporary differences 56 19 (19)As at 31 December <strong>2007</strong> (29,441) (10,010) –These temporary differences between the tax basis of Colombia related assets and their book value are generated due to investmentscarried outside of the local branch books and therefore not tax deductible in Colombia.Deferred Deferred taxtemporary tax charges/differences asset (credits)Other temporary differences $000 $000 $000As at 1 January 2006 711 214Movement in temporary differences 231 81 (81)As at 31 December 2006 942 295Movement in temporary differences 103 (7) 7As at 31 December <strong>2007</strong> 1,045 288Other temporary differences between tax basis and net book carrying values arise in regards to a decommissioning liability related toColombia exploration and producing assets in the amount of $674,000 at 31 December <strong>2007</strong> (2006: $624,000), and officeequipment and miscellaneous assets with temporary differences totalling $371,000 (2006: $318,000).

35 Notes to the financial information <strong>Global</strong> <strong>Energy</strong> <strong>Development</strong> PLC<strong>Annual</strong> report <strong>2007</strong>11. Intangible exploration and evaluation (E&E) assets<strong>2007</strong> 2006$000 $000CostsColombiaAt 1 January 1,157 2,257Additions 7,476 –Exploration expenditure written off (65) –Transfer to tangible assets (8,568) (1,100)At 31 December – 1,157PeruAt 1 January 2,807 1,508Additions 667 1,299Exploration expenditure written off (33) –At 31 December 3,441 2,807PanamaAt 1 January 694 527Additions 284 167At 31 December 978 694Total intangible costs at 31 December 4,419 4,658The amounts for intangible E&E assets represent costs incurred on active oil and gas exploration projects. In accordance with oil andgas asset accounting policies described in note 1, E&E assets are evaluated when circumstances exist that suggest the possibility ofimpairment, as well as when E&E assets are reclassed to the <strong>Development</strong> and Producing phase. The outcome of ongoing exploration,and therefore whether the carrying value of assets will ultimately be recovered, is inherently uncertain.In June <strong>2007</strong>, the exploration and producing contract with the Colombian Agencia Nacional de Hidrocarburos covering the Los Saucesarea in Colombia was terminated. In September <strong>2007</strong>, after negotiations to modify terms and conditions of the contract obligationsfailed, investment totalling $1,075,000 was reclassified to depreciable facilities in accordance with the accounting policies describedin note 1.Further during the year, <strong>Global</strong> invested $7.4m in the drilling of two wells on the Luna Llena contract area which were initially classifiedas E&E costs in the balance sheet. In March 2008, that contract was terminated, therefore in light of the financial impact and inaccordance with accounting policies described in note 1 and IAS 10, those assets were reclassed to depreciable assets in <strong>2007</strong>, theappropriate depreciation expense was charged to the income statement, and related reserves were eliminated from commercialreserves estimates detailed above.In accordance with the provisions of IFRS 6 and IAS 36 the Group has considered, in detail, the definition of CGU for the purposes ofassessing the accounting treatment of the E&E assets referred to above. The considerations have taken into account the operatingstructure of the terminated licences alongside existing D&P assets, the interdependence of future cash flows arising from theterminated licences alongside existing D&P projects and hence the extent to which individual assets in each CGU generate cash flowswhich are largely independent of those from other assets, the operating segment to which the assets had belonged under IFRS 8 andan assessment of the recoverable amount of the CGU in which the assets were held. Accordingly the Directors consider that thecarrying value of the D&P assets as disclosed in note 12 are not impaired based on an assessment of the recoverable amount of eachof the Group’s CGUs.