Annual Report 2006-2007 - Farmington Public Schools

Annual Report 2006-2007 - Farmington Public Schools

Annual Report 2006-2007 - Farmington Public Schools

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

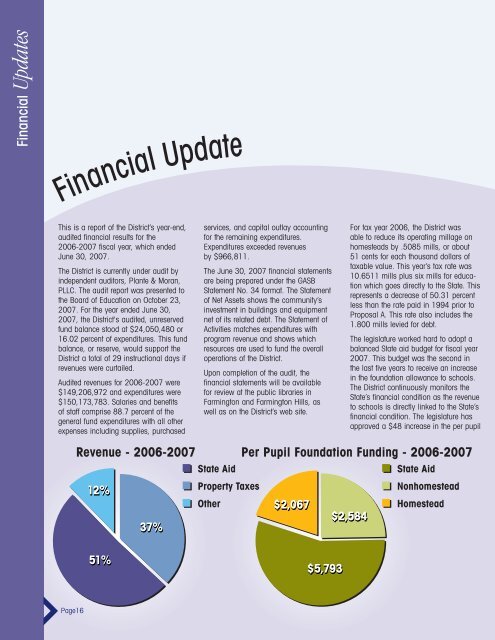

Financial UpdatesFinancial UpdateThis is a report of the District’s year-end,audited financial results for the<strong>2006</strong>-<strong>2007</strong> fiscal year, which endedJune 30, <strong>2007</strong>.The District is currently under audit byindependent auditors, Plante & Moran,PLLC. The audit report was presented tothe Board of Education on October 23,<strong>2007</strong>. For the year ended June 30,<strong>2007</strong>, the District's audited, unreservedfund balance stood at $24,050,480 or16.02 percent of expenditures. This fundbalance, or reserve, would support theDistrict a total of 29 instructional days ifrevenues were curtailed.Audited revenues for <strong>2006</strong>-<strong>2007</strong> were$149,206,972 and expenditures were$150,173,783. Salaries and benefitsof staff comprise 88.7 percent of thegeneral fund expenditures with all otherexpenses including supplies, purchasedservices, and capital outlay accountingfor the remaining expenditures.Expenditures exceeded revenuesby $966,811.The June 30, <strong>2007</strong> financial statementsare being prepared under the GASBStatement No. 34 format. The Statementof Net Assets shows the community’sinvestment in buildings and equipmentnet of its related debt. The Statement ofActivities matches expenditures withprogram revenue and shows whichresources are used to fund the overalloperations of the District.Upon completion of the audit, thefinancial statements will be availablefor review at the public libraries in<strong>Farmington</strong> and <strong>Farmington</strong> Hills, aswell as on the District’s web site.For tax year <strong>2006</strong>, the District wasable to reduce its operating millage onhomesteads by .5085 mills, or about51 cents for each thousand dollars oftaxable value. This year’s tax rate was10.6511 mills plus six mills for educationwhich goes directly to the State. Thisrepresents a decrease of 50.31 percentless than the rate paid in 1994 prior toProposal A. This rate also includes the1.800 mills levied for debt.The legislature worked hard to adopt abalanced State aid budget for fiscal year<strong>2007</strong>. This budget was the second inthe last five years to receive an increasein the foundation allowance to schools.The District continuously monitors theState’s financial condition as the revenueto schools is directly linked to the State’sfinancial condition. The legislature hasapproved a $48 increase in the per pupilRevenue - <strong>2006</strong>-<strong>2007</strong> Per Pupil Foundation Funding - <strong>2006</strong>-<strong>2007</strong>State AidState Aid12%Property TaxesNonhomesteadOther $2,067Homestead$2,58437%51%$5,793Page16