METROPOLITAN EDISON COMPANY - Pennsylvania Public Utility ...

METROPOLITAN EDISON COMPANY - Pennsylvania Public Utility ...

METROPOLITAN EDISON COMPANY - Pennsylvania Public Utility ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

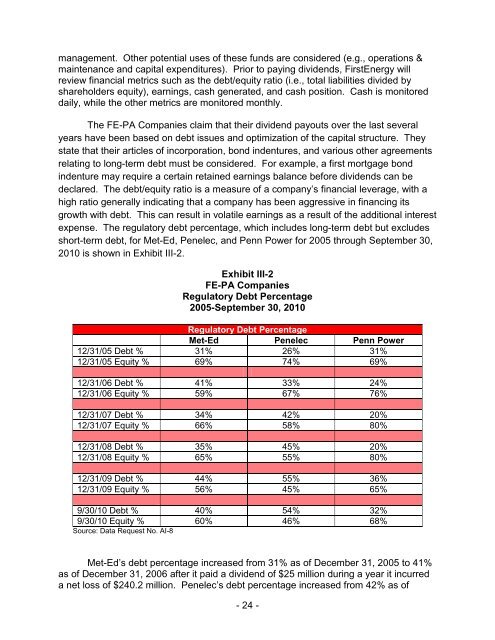

management. Other potential uses of these funds are considered (e.g., operations &maintenance and capital expenditures). Prior to paying dividends, FirstEnergy willreview financial metrics such as the debt/equity ratio (i.e., total liabilities divided byshareholders equity), earnings, cash generated, and cash position. Cash is monitoreddaily, while the other metrics are monitored monthly.The FE-PA Companies claim that their dividend payouts over the last severalyears have been based on debt issues and optimization of the capital structure. Theystate that their articles of incorporation, bond indentures, and various other agreementsrelating to long-term debt must be considered. For example, a first mortgage bondindenture may require a certain retained earnings balance before dividends can bedeclared. The debt/equity ratio is a measure of a company’s financial leverage, with ahigh ratio generally indicating that a company has been aggressive in financing itsgrowth with debt. This can result in volatile earnings as a result of the additional interestexpense. The regulatory debt percentage, which includes long-term debt but excludesshort-term debt, for Met-Ed, Penelec, and Penn Power for 2005 through September 30,2010 is shown in Exhibit III-2.Exhibit III-2FE-PA CompaniesRegulatory Debt Percentage2005-September 30, 2010Regulatory Debt PercentageMet-Ed Penelec Penn Power12/31/05 Debt % 31% 26% 31%12/31/05 Equity % 69% 74% 69%12/31/06 Debt % 41% 33% 24%12/31/06 Equity % 59% 67% 76%12/31/07 Debt % 34% 42% 20%12/31/07 Equity % 66% 58% 80%12/31/08 Debt % 35% 45% 20%12/31/08 Equity % 65% 55% 80%12/31/09 Debt % 44% 55% 36%12/31/09 Equity % 56% 45% 65%9/30/10 Debt % 40% 54% 32%9/30/10 Equity % 60% 46% 68%Source: Data Request No. AI-8Met-Ed’s debt percentage increased from 31% as of December 31, 2005 to 41%as of December 31, 2006 after it paid a dividend of $25 million during a year it incurreda net loss of $240.2 million. Penelec’s debt percentage increased from 42% as of- 24 -