Infrastrucure 2007.pmd - Afcons Infrastructure Ltd.

Infrastrucure 2007.pmd - Afcons Infrastructure Ltd.

Infrastrucure 2007.pmd - Afcons Infrastructure Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

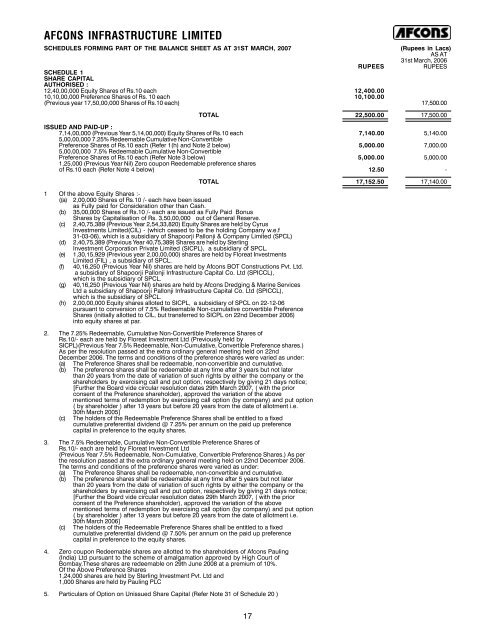

AFCONS INFRASTRUCTURE LIMITEDSCHEDULES FORMING PART OF THE BALANCE SHEET AS AT 31ST MARCH, 2007(Rupees in Lacs)AS AT31st March, 2006RUPEESRUPEESSCHEDULE 1SHARE CAPITALAUTHORISED :12,40,00,000 Equity Shares of Rs.10 each 12,400.0010,10,00,000 Preference Shares of Rs. 10 each 10,100.00(Previous year 17,50,00,000 Shares of Rs.10 each) 17,500.00TOTAL 22,500.00 17,500.00ISSUED AND PAID-UP :7,14,00,000 (Previous Year 5,14,00,000) Equity Shares of Rs.10 each 7,140.00 5,140.005,00,00,000 7.25% Redeemable Cumulative Non-ConvertiblePreference Shares of Rs.10 each (Refer 1(h) and Note 2 below) 5,000.00 7,000.005,00,00,000 7.5% Redeemable Cumulative Non-ConvertiblePreference Shares of Rs.10 each (Refer Note 3 below) 5,000.00 5,000.001,25,000 (Previous Year Nil) Zero coupon Reedemable preference sharesof Rs.10 each (Refer Note 4 below) 12.50 -TOTAL 17,152.50 17,140.001 Of the above Equity Shares :-((a) 2,00,000 Shares of Rs.10 /- each have been issuedas Fully paid for Consideration other than Cash.(b) 35,00,000 Shares of Rs.10 /- each are issued as Fully Paid BonusShares by Capitalisation of Rs. 3,50,00,000 out of General Reserve.(c) 2,40,75,389 (Previous Year 2,54,33,820) Equity Shares are held by CyrusInvestments Limited(CIL) - (which ceased to be the holding Company w.e.f31-03-06), which is a subsidiary of Shapoorji Pallonji & Company Limited (SPCL)(d) 2,40,75,389 (Previous Year 40,75,389) Shares are held by SterlingInvestment Corporation Private Limited (SICPL), a subsidiary of SPCL.(e) 1,30,15,929 (Previous year 2,00,00,000) shares are held by Floreat InvestmentsLimited (FIL) , a subsidiary of SPCL.(f) 40,16,250 (Previous Year Nil) shares are held by <strong>Afcons</strong> BOT Constructions Pvt. <strong>Ltd</strong>.a subsidiary of Shapoorji Pallonji <strong>Infrastructure</strong> Capital Co. <strong>Ltd</strong> (SPICCL),which is the subsidiary of SPCL.(g)40,16,250 (Previous Year Nil) shares are held by <strong>Afcons</strong> Dredging & Marine Services<strong>Ltd</strong> a subsidiary of Shapoorji Pallonji <strong>Infrastructure</strong> Capital Co. <strong>Ltd</strong> (SPICCL),which is the subsidiary of SPCL.(h) 2,00,00,000 Equity shares alloted to SICPL, a subsidiary of SPCL on 22-12-06pursuant to conversion of 7.5% Redeemable Non-cumulative convertible PreferenceShares (initially allotted to CIL, but transferred to SICPL on 22nd December 2006)into equity shares at par.2. The 7.25% Redeemable, Cumulative Non-Convertible Preference Shares ofRs.10/- each are held by Floreat Investment <strong>Ltd</strong> (Previously held bySICPL)(Previous Year 7.5% Redeemable, Non-Cumulative, Convertible Preference shares.)As per the resolution passed at the extra ordinary general meeting held on 22ndDecember 2006. The terms and conditions of the preference shares were varied as under:(a)(b)(c)The Preference Shares shall be redeemable, non-convertible and cumulative.The preference shares shall be redeemable at any time after 3 years but not laterthan 20 years from the date of variation of such rights by either the company or theshareholders by exercising call and put option, respectively by giving 21 days notice;[Further the Board vide circular resolution dates 29th March 2007, ( with the priorconsent of the Preference shareholder), approved the variation of the abovementioned terms of redemption by exercising call option (by company) and put option( by shareholder ) after 13 years but before 20 years from the date of allotment i.e.30th March 2005]The holders of the Redeemable Preference Shares shall be entitled to a fixedcumulative preferential dividend @ 7.25% per annum on the paid up preferencecapital in preference to the equity shares.3. The 7.5% Redeemable, Cumulative Non-Convertible Preference Shares ofRs.10/- each are held by Floreat Investment <strong>Ltd</strong>(Previous Year 7.5% Redeemable, Non-Cumulative, Convertible Preference Shares.) As perthe resolution passed at the extra ordinary general meeting held on 22nd December 2006.The terms and conditions of the preference shares were varied as under:(a)(b)(c)The Preference Shares shall be redeemable, non-convertible and cumulative.The preference shares shall be redeemable at any time after 5 years but not laterthan 20 years from the date of variation of such rights by either the company or theshareholders by exercising call and put option, respectively by giving 21 days notice;[Further the Board vide circular resolution dates 29th March 2007, ( with the priorconsent of the Preference shareholder), approved the variation of the abovementioned terms of redemption by exercising call option (by company) and put option( by shareholder ) after 13 years but before 20 years from the date of allotment i.e.30th March 2006]The holders of the Redeemable Preference Shares shall be entitled to a fixedcumulative preferential dividend @ 7.50% per annum on the paid up preferencecapital in preference to the equity shares.4. Zero coupon Redeemable shares are allotted to the shareholders of <strong>Afcons</strong> Pauling(India) <strong>Ltd</strong> pursuant to the scheme of amalgamation approved by High Court ofBombay.These shares are redeemable on 29th June 2008 at a premium of 10%.Of the Above Preference Shares1,24,000 shares are held by Sterling Investment Pvt. <strong>Ltd</strong> and1,000 Shares are held by Pauling PLC5. Particulars of Option on Unissued Share Capital (Refer Note 31 of Schedule 20 )17