Infrastrucure 2007.pmd - Afcons Infrastructure Ltd.

Infrastrucure 2007.pmd - Afcons Infrastructure Ltd.

Infrastrucure 2007.pmd - Afcons Infrastructure Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

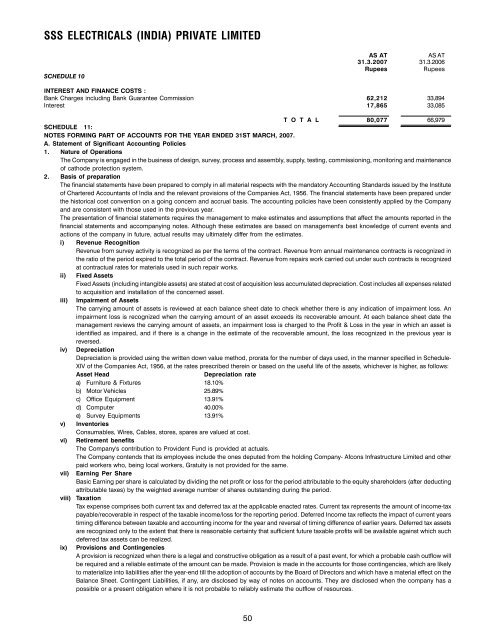

SSS ELECTRICALS (INDIA) PRIVATE LIMITEDSCHEDULE 10AS ATAS AT31.3.2007 31.3.2006RupeesRupeesINTEREST AND FINANCE COSTS :Bank Charges including Bank Guarantee Commission 62,212 33,894Interest 17,865 33,085T O T A L 80,077 66,979SCHEDULE 11:NOTES FORMING PART OF ACCOUNTS FOR THE YEAR ENDED 31ST MARCH, 2007.A. Statement of Significant Accounting Policies1. Nature of OperationsThe Company is engaged in the business of design, survey, process and assembly, supply, testing, commissioning, monitoring and maintenanceof cathode protection system.2. Basis of preparationThe financial statements have been prepared to comply in all material respects with the mandatory Accounting Standards issued by the Instituteof Chartered Accountants of India and the relevant provisions of the Companies Act, 1956. The financial statements have been prepared underthe historical cost convention on a going concern and accrual basis. The accounting policies have been consistently applied by the Companyand are consistent with those used in the previous year.The presentation of financial statements requires the management to make estimates and assumptions that affect the amounts reported in thefinancial statements and accompanying notes. Although these estimates are based on management's best knowledge of current events andactions of the company in future, actual results may ultimately differ from the estimates.i) Revenue RecognitionRevenue from survey activity is recognized as per the terms of the contract. Revenue from annual maintenance contracts is recognized inthe ratio of the period expired to the total period of the contract. Revenue from repairs work carried out under such contracts is recognizedat contractual rates for materials used in such repair works.ii) Fixed AssetsFixed Assets (including intangible assets) are stated at cost of acquisition less accumulated depreciation. Cost includes all expenses relatedto acquisition and installation of the concerned asset.iii) Impairment of AssetsThe carrying amount of assets is reviewed at each balance sheet date to check whether there is any indication of impairment loss. Animpairment loss is recognized when the carrying amount of an asset exceeds its recoverable amount. At each balance sheet date themanagement reviews the carrying amount of assets, an impairment loss is charged to the Profit & Loss in the year in which an asset isidentified as impaired, and if there is a change in the estimate of the recoverable amount, the loss recognized in the previous year isreversed.iv) DepreciationDepreciation is provided using the written down value method, prorata for the number of days used, in the manner specified in Schedule-XIV of the Companies Act, 1956, at the rates prescribed therein or based on the useful life of the assets, whichever is higher, as follows:Asset HeadDepreciation ratea) Furniture & Fixtures 18.10%b) Motor Vehicles 25.89%c) Office Equipment 13.91%d) Computer 40.00%e) Survey Equipments 13.91%v) InventoriesConsumables, Wires, Cables, stores, spares are valued at cost.vi) Retirement benefitsThe Company's contribution to Provident Fund is provided at actuals.The Company contends that its employees include the ones deputed from the holding Company- <strong>Afcons</strong> <strong>Infrastructure</strong> Limited and otherpaid workers who, being local workers, Gratuity is not provided for the same.vii) Earning Per ShareBasic Earning per share is calculated by dividing the net profit or loss for the period attributable to the equity shareholders (after deductingattributable taxes) by the weighted average number of shares outstanding during the period.viii) TaxationTax expense comprises both current tax and deferred tax at the applicable enacted rates. Current tax represents the amount of income-taxpayable/recoverable in respect of the taxable income/loss for the reporting period. Deferred Income tax reflects the impact of current yearstiming difference between taxable and accounting income for the year and reversal of timing difference of earlier years. Deferred tax assetsare recognized only to the extent that there is reasonable certainty that sufficient future taxable profits will be available against which suchdeferred tax assets can be realized.ix) Provisions and ContingenciesA provision is recognized when there is a legal and constructive obligation as a result of a past event, for which a probable cash outflow willbe required and a reliable estimate of the amount can be made. Provision is made in the accounts for those contingencies, which are likelyto materialize into liabilities after the year-end till the adoption of accounts by the Board of Directors and which have a material effect on theBalance Sheet. Contingent Liabilities, if any, are disclosed by way of notes on accounts. They are disclosed when the company has apossible or a present obligation where it is not probable to reliably estimate the outflow of resources.50