A-Franco-German-Tale

A-Franco-German-Tale

A-Franco-German-Tale

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

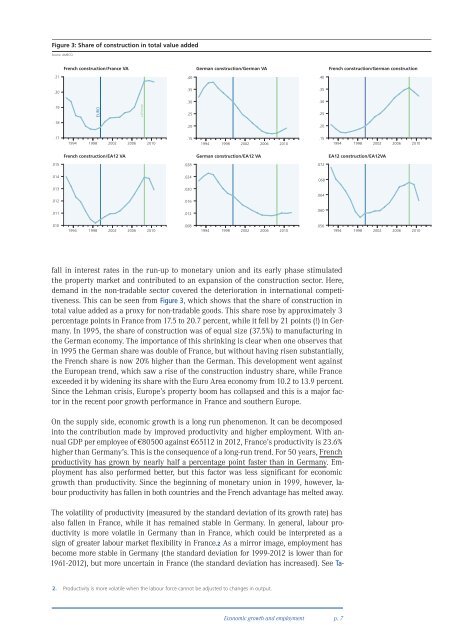

Figure 3: Share of construction in total value addedSource: AMECOFrench construction/France VA<strong>German</strong> construction/<strong>German</strong> VAFrench construction/<strong>German</strong> construction.21.40.40.20.35.35.19EUROLehman.30.25.30.25.18.20.20.171994 1998 2002 2006 2010.151994 1998 2002 2006 2010.151994 1998 2002 2006 2010French construction/EA12 VA<strong>German</strong> construction/EA12 VAEA12 construction/EA12VA.015.028.072.014.024.068.013.012.020.016.064.011.012.060.0101994 1998 2002 2006 2010.0081994 1998 2002 2006 2010.0561994 1998 2002 2006 2010fall in interest rates in the run-up to monetary union and its early phase stimulatedthe property market and contributed to an expansion of the construction sector. Here,demand in the non-tradable sector covered the deterioration in international competitiveness.This can be seen from Figure 3, which shows that the share of construction intotal value added as a proxy for non-tradable goods. This share rose by approximately 3percentage points in France from 17.5 to 20.7 percent, while it fell by 21 points (!) in <strong>German</strong>y.In 1995, the share of construction was of equal size (37.5%) to manufacturing inthe <strong>German</strong> economy. The importance of this shrinking is clear when one observes thatin 1995 the <strong>German</strong> share was double of France, but without having risen substantially,the French share is now 20% higher than the <strong>German</strong>. This development went againstthe European trend, which saw a rise of the construction industry share, while Franceexceeded it by widening its share with the Euro Area economy from 10.2 to 13.9 percent.Since the Lehman crisis, Europe’s property boom has collapsed and this is a major factorin the recent poor growth performance in France and southern Europe.On the supply side, economic growth is a long run phenomenon. It can be decomposedinto the contribution made by improved productivity and higher employment. With annualGDP per employee of €80500 against €65112 in 2012, France’s productivity is 23.6%higher than <strong>German</strong>y’s. This is the consequence of a long-run trend. For 50 years, Frenchproductivity has grown by nearly half a percentage point faster than in <strong>German</strong>y. Employmenthas also performed better, but this factor was less significant for economicgrowth than productivity. Since the beginning of monetary union in 1999, however, labourproductivity has fallen in both countries and the French advantage has melted away.The volatility of productivity (measured by the standard deviation of its growth rate) hasalso fallen in France, while it has remained stable in <strong>German</strong>y. In general, labour productivityis more volatile in <strong>German</strong>y than in France, which could be interpreted as asign of greater labour market flexibility in France.2 As a mirror image, employment hasbecome more stable in <strong>German</strong>y (the standard deviation for 1999-2012 is lower than for1961-2012), but more uncertain in France (the standard deviation has increased). See Ta-2. Productivity is more volatile when the labour force cannot be adjusted to changes in output.Economic growth and employmentp. 7