discharge of estate tax lien - Rhode Island Division of Taxation

discharge of estate tax lien - Rhode Island Division of Taxation

discharge of estate tax lien - Rhode Island Division of Taxation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

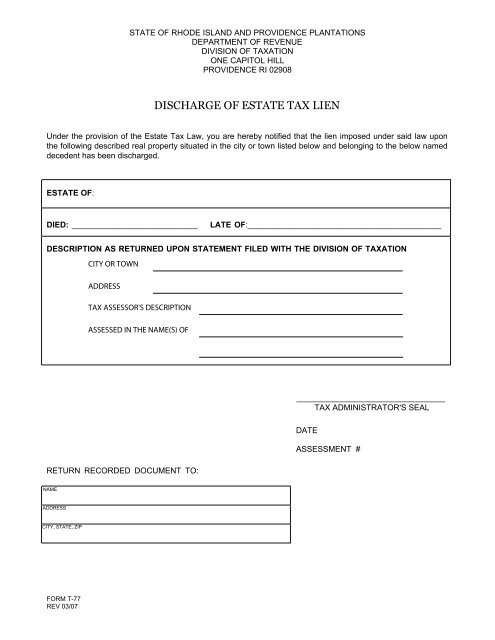

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONSDEPARTMENT OF REVENUEDIVISION OF TAXATIONONE CAPITOL HILLPROVIDENCE RI 02908DISCHARGE OF ESTATE TAX LIENUnder the provision <strong>of</strong> the Estate Tax Law, you are hereby notified that the <strong>lien</strong> imposed under said law uponthe following described real property situated in the city or town listed below and belonging to the below nameddecedent has been <strong>discharge</strong>d.ESTATE OF:DIED: ____________________________LATE OF:___________________________________________DESCRIPTION AS RETURNED UPON STATEMENT FILED WITH THE DIVISION OF TAXATIONCITY OR TOWNADDRESSTAX ASSESSOR'S DESCRIPTIONASSESSED IN THE NAME(S) OF_________________________________TAX ADMINISTRATOR'S SEALRETURN RECORDED DOCUMENT TO:DATEASSESSMENT #NAMEADDRESSCITY, STATE, ZIPFORM T-77REV 03/07

INSTRUCTIONS FOR FORM T-77THIS FORM MUST BE TYPED AND SUBMITTED IN TRIPLICATEONE PROPERTY PER FORMESTATE OF: The full name <strong>of</strong> the deceasedCITY OR TOWN: Please indicate the city or town where the property is located.DO NOT USE VILLAGE NAMES (i.e. Esmond, Wakefield, etc)TAX IN THE NAME(S) OF: Please include the names as listed on the property <strong>tax</strong> bill(John Smith et als; Joe Jones et ux Mary; Jane Smith and Mary Jones, JT)DESCRIPTION RETURNED: The property description should reflect the TAX ASSESSOR'S DESCRIPTION(Usually PLAT & LOT; MAP, BLOCK & PARCEL or BLOCK & PARCEL)• ANY FORMS NOT PROPERLY COMPLETED WILL BE RETURNED• FORM T-77 MUST BE TYPED AND BE WITHOUT ERROR OR IT WILL BE RETURNED• A PROCESSING FEE MAY BE CHARGED FOR CORRECTIVE DISCHARGES.FORM T-77REV 03/07