21. the all india services (leave travel concession) rules, 1975

21. the all india services (leave travel concession) rules, 1975

21. the all india services (leave travel concession) rules, 1975

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>21.</strong> THE ALL INDIA SERVICES (LEAVE TRAVELCONCESSION) RULES, <strong>1975</strong>In exercise of <strong>the</strong> powers conferred by sub-section (1) of Section 3 of <strong>the</strong> All IndiaServices Act, 1951 (61 of 1951), <strong>the</strong> Central Government, after consultation with <strong>the</strong>Governments of <strong>the</strong> States concerned, hereby makes <strong>the</strong> following <strong>rules</strong>, namely :—1. Short title and commencement.—(1) These <strong>rules</strong> may be c<strong>all</strong>ed <strong>the</strong> All India Services (Leave Travel Concession)Rules, <strong>1975</strong>.(2) They sh<strong>all</strong> come into force on <strong>the</strong> date of <strong>the</strong>ir publication in <strong>the</strong> Official Gazette.2. Definition—In <strong>the</strong>se <strong>rules</strong>, unless <strong>the</strong> context o<strong>the</strong>rwise requires, a “member of <strong>the</strong>Service” means a member of an All India Service, as defined in section 2 of <strong>the</strong> All IndiaServices Act, 1951 (61 of 1951).13. Regulation of Leave Travel Concession—(1) The Leave Travel Concession of a member of <strong>the</strong> Service, serving in connectionwith <strong>the</strong> affairs of <strong>the</strong> Union, sh<strong>all</strong> be regulated in <strong>the</strong> same manner and subjectto <strong>the</strong> same conditions, as are applicable to <strong>the</strong> officers of <strong>the</strong> Central CivilServices, Group ‘A’.(2) The Leave Travel Concession of a member of <strong>the</strong> Service serving in connectionwith <strong>the</strong> affairs of <strong>the</strong> State, sh<strong>all</strong> be regulated in <strong>the</strong> same manner, and subjectto <strong>the</strong> same conditions, as are applicable to <strong>the</strong> officers of <strong>the</strong> State CivilServices, Class I:Provided that <strong>the</strong> <strong>concession</strong> afforded to a member of <strong>the</strong> Service under this sub-<strong>rules</strong>h<strong>all</strong> not at any time be inferior to that to which he would be entitled under sub-rule (1), hadhe been appointed to serve in connection with <strong>the</strong> affairs of <strong>the</strong> Union.24. Interpretation—If any question arises as to <strong>the</strong> interpretation of <strong>the</strong>se <strong>rules</strong>, it sh<strong>all</strong>be referred to <strong>the</strong> Central Government for decision.1Substituted vide Notification No. 11022/1/76-AIS(II), dated 12th May, 19772Added vide DP&AR Notification No. 24/2/74-AIS(II), dated 10.2.<strong>1975</strong>,747

produce <strong>the</strong> air-ticket/boarding pass and a receipt from <strong>the</strong> concerned airlines showing<strong>the</strong> fare paid by <strong>the</strong> concerned officers, if <strong>the</strong> ticket does not indicate <strong>the</strong> airfare, whileclaiming reimbursement of LTC.3. The above <strong>concession</strong> is fur<strong>the</strong>r subject to <strong>the</strong> following conditions:-(i) Conditions laid down in Department of Expenditure OM No.19024/1/E.IV/2005dated 24.03.2006 (copy enclosed) regarding air <strong>travel</strong> by Government servantswithin India during official visits would be applicable in case of LTC, mutatismutandis.(ii) In case <strong>the</strong> cost paid for an air ticket (in view of promotional schemes ofprivate airlines) is less than <strong>the</strong> train fare by <strong>the</strong> entitled class, <strong>the</strong>reimbursement by <strong>the</strong> Government will be limited to <strong>the</strong> actual air fare or entitledtrain fare whichever is less.4. In <strong>the</strong>ir application to <strong>the</strong> staff serving in <strong>the</strong> Indian Audit and AccountsDepartment, <strong>the</strong>se orders issue after consultation with <strong>the</strong> Comptroller and AuditorGeneral of India.5. This issues in consultation with Ministry of Finance (Department ofExpenditure) vide <strong>the</strong>ir ID No. 145/E.IV/05 dated 12.04.2006.Copy of <strong>the</strong> Ministry of Finance, Department of Expenditure’sO.M.No.19024/1/E.IV/2005 dated 24 thMarch, 2006 regarding Air Travel byGovernment servants within India.The existing instructions on <strong>travel</strong> by air by Government servants during officialvisits within India provide that air <strong>travel</strong> is permissible by <strong>the</strong> National Carriers viz.Indian Airlines and Air India in ordinary circumstances. Department of Expenditure OMNo. 19036/8/95-E.IV dated 4 th December,1997 and OM No.19036/8/95-99/E.IV dated20 th August, 1999 refer in <strong>the</strong> matter.2. Department of Expenditure OM No. 7(2)E.Coord/2005, dated November 23, 2005regarding “Budget/Expenditure Management: Economy measures rationalization ofexpenditure, and measures for augmentation of revenues”, inter alia, provides that:-“The air <strong>travel</strong>, both domestic and overseas, on official account would not bepermissible on airlines o<strong>the</strong>r than Air India/Indian Airlines also, provided <strong>the</strong>criteria for selecting <strong>the</strong> alternative airline for official <strong>travel</strong> are based on betterand more competitive prices being offered by <strong>the</strong> o<strong>the</strong>r airlines. Various incentiveschemes and <strong>concession</strong>al fares offered by Air India/Indian Airlines will also befully utilized to ensure utmost economy in air <strong>travel</strong>.”750

3. The following guidelines are being issued accordingly to take advantage of<strong>the</strong> increasing competition and <strong>the</strong> air <strong>travel</strong> schemes of various airlines offeringsignificant discounts on normal fares, in order to enable economy in undertaking air<strong>travel</strong>, without in any way taking away <strong>the</strong> existing entitlements:-(i) The basic criteria for selecting airlines o<strong>the</strong>r than Indian Airlines/Air Indiawould be better and more competitive prices being offered by he o<strong>the</strong>rairlines.(ii) Various incentive schemes and <strong>concession</strong>al fares offered by IndianAirlines/Air India will also be fully utilized.(iii) Each officer who is undertaking domestic <strong>travel</strong> by air, within his entitledclass, should endeavour to take advantage of <strong>the</strong> <strong>concession</strong>s beingprovided by <strong>the</strong> airlines, to effect possible savings vis-à-vis <strong>the</strong> normalfares.(iv) Officers should try to make <strong>the</strong>ir bookings in advance to <strong>the</strong> extentpossible, so that benefits of discounted fares can be obtained. However,<strong>the</strong> official work should not be deferred because discounted fares are notavailable.(v) Under no circumstances, should <strong>the</strong> fare exceed <strong>the</strong> normal fare of <strong>the</strong>entitled class offered by Indian Airlines/Air India or <strong>the</strong>ir subsidiaries.(vi) Individual officers are encouraged to make bookings through <strong>the</strong> internet. Itwould require a credit card through which payments can be made.Reimbursement of service charge expenses on such credit card would bepermissible.(vii) Schemes offered by airlines which are co-branded with <strong>the</strong> credit cards canalso be availed. However, this would need one time prior approval of <strong>the</strong>concerned Financial Adviser/Competent Authority for obtaining andutilizing such credit card.(viii) Wherever <strong>the</strong> officer seeks to utilize <strong>the</strong> service of <strong>travel</strong> agents, it shouldbe limited to M/s Balmer Lawrie & Company and M/s Ashok Travels andTours. The above agencies would also ensure that procurement of ticketsis made on <strong>the</strong> best available bargain across <strong>all</strong> airlines.4. These guidelines are issued in partial modification of any o<strong>the</strong>r existing orderson <strong>the</strong> subject and would apply to domestic air <strong>travel</strong> only. The guidelines for air <strong>travel</strong>abroad will be issued separately.5. All Ministries/Departments of <strong>the</strong> India of India are requested to strictly adhereto <strong>the</strong>se instructions.Copy of DOPT O.M.No. 31011/2/2006-Estt (A) dated 21 st May, 2007 regardingregulation of journeys by private airlines while availing Leave TravelConcession: The undersigned is directed to refer to this Department’sO.M.No.31011/2/2006-Estt.(A) dated 24 th April, 2006 regarding regularization ofjourney by private airline while availing Leave Travel Concession (LTC), where it hasbeen inter alia stated that air journeys by non-entitled officers between placesconnected by train may be <strong>all</strong>owed, provided <strong>the</strong> reimbursement of <strong>the</strong> fare would berestricted to <strong>the</strong> entitled class by rail o<strong>the</strong>r than RajdhaniShatabdi Express.2. In partial modification of <strong>the</strong> above provision, it has now been decided that <strong>the</strong>reimbursement may also be given at <strong>the</strong> rates applicable for Rajdhani/ShatabdiExpress trains, provided <strong>the</strong> Government servant is entitled to it and <strong>the</strong> headquarter of<strong>the</strong> Government servant/permissible place of commencement of journey and <strong>the</strong> hometown/destination under All India LTC is directly connected by <strong>the</strong> above mentionedtrains and two stations between which <strong>the</strong> air <strong>travel</strong> has been performed are connectedby Rajdhani/Shatabdi trains. In case <strong>the</strong> fare paid for <strong>the</strong> air ticket on LTC is less than751

<strong>the</strong> fare being charged for Rajdhani/Shatabdi type trains, <strong>the</strong> reimbursement would belimited to <strong>the</strong> actual expenditure. All pending cases may be settled accordingly interms of this order. However, past cases already settled will not be re-opened.3. The above orders will be applicable with effect from <strong>the</strong> date of issue of thisOffice Memorandum.4. In <strong>the</strong>ir application to <strong>the</strong> staff serving in <strong>the</strong> Indian Audit and AccountsDepartment, <strong>the</strong>se orders issue after consultation with <strong>the</strong> Comptroller and AuditorGeneral of India.5. This issues in consultation with Ministry of Finance (Department ofExpenditure) vide <strong>the</strong>ir I.D.No.84/E-IV/2007, dated 9 th May, 2007.Copy of DOPT O.M.No. 31011/5/2007-Estt (A) dated 7 th September, 2007 regardingrelaxation in LTC Rules – delegation of powers to Ministries/Departmentsregarding time limit for <strong>the</strong> submission of <strong>the</strong> claim: Rules 14 & 15 of LTC Rulesprovide that a claim for reimbursement of expenditure incurred is to be submitted withinthree months after <strong>the</strong> completion of <strong>the</strong> return journey, if no advance had been drawn.It has now been decided to delegate <strong>the</strong> powers to relax <strong>the</strong>se provisions to <strong>the</strong>Ministries/Departments, where a Government servant is not in a position to submit <strong>the</strong>claim within <strong>the</strong> prescribed time limit and <strong>the</strong> Ministry/Department is satisfied that hewas not able to do so due to compelling circumstances beyond his control. TheMinistry/Department concerned with <strong>the</strong> concurrence of Financial Advisor can admit<strong>the</strong> claims in such cases in relaxation of <strong>the</strong> provisions subject to <strong>the</strong> following timelimit without reference to DoP&T:-(a) Where no LTC advance is taken, LTC bill submitted within a period notexceeding six months.(b) Where LTC advance has been drawn <strong>the</strong> LTC claim for reimbursementsubmitted within a period of three months after <strong>the</strong> completion of return journey(provided <strong>the</strong> Government servant refunds <strong>the</strong> entire advance within 45 daysafter <strong>the</strong> completion of <strong>the</strong> ruturn journey).2. Ministries/Department are requested to keep <strong>the</strong>se instruction in view whileprocessing belated LTC claims.3. These instructions will be effective from <strong>the</strong> date of issue of this O.M.Copy of DOPT O.M.No. 31011/2/2006-Estt (A) dated 3 rd December, 2007 regardingCentral Civil Services(LTC) Rules, 1988 – clarification regarding reimbursement of farein respect of air <strong>travel</strong> by non-entitled officers: After issue of DOP&T O.M. No.31011/2/2006-Estt.(A) dated 24 th April, 2006 and dated 21 st May, 2007 regardingregulation of journeys by private airlines while availing Leave Travel Concession.Certain clarifications have been sought by Government sevants/variousMinistries/Departments from time to time. The doubt raised by various authorities areclarified as under:Points raised1. As per DOP&T O.M.No. 31011/2/2006-Estt.(A) dated 24 th April, 2006 journey byprivate airlines is permissible to non-entitledClarificationYes. As per DOP&T O.M.No.31011/2/2007-Estt.(A) dt. 21 stMay,2007 re-imbursement at <strong>the</strong>752

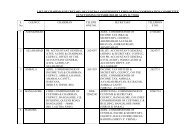

officer for LTC subject to condition that reimbursementof fare would be restricted to<strong>the</strong> entitled class by rail. Whe<strong>the</strong>r train fareupto Rajdhani/Shatabdi Express isreimbursable?2. If <strong>the</strong> Home Town/place of visit under AllIndia LTC of an employee is connected byTrain/Road but is not directly connected byAir Rajdhani/Shatabdi Express Trains. Insuch a case can <strong>the</strong> employee be entitled tore-imbursement of fare byRajdhani/Shatabdi Express Trains and partlyby rail/road.3. If a Government employee/his familymember is entitled to <strong>concession</strong>al train faresuch as Senior citizen, Student <strong>concession</strong>,children etc. whe<strong>the</strong>r in case of air <strong>travel</strong>, <strong>the</strong>reimbursement would be restricted to such<strong>concession</strong>al fare by train to entitled class.rates applicable for Rajdhani/Shatabdi Express trains is permissibleprovided <strong>the</strong> Government servant isentitled to <strong>travel</strong> by such trains insuch class and <strong>the</strong> places visited or<strong>the</strong> portion <strong>travel</strong>ed by air is directlyconnected by Rajdhani /Shatabdi.Thus, <strong>the</strong> DOP&T O.M.No.31011/8/1998-Estt.(A) dated31.3.1999 stands modified to thisextent in respect of item 5 <strong>the</strong>rein.All <strong>the</strong> o<strong>the</strong>r clarifications regardingreimbursement of fare byRajdhani/Shatabdi trains contained inthis Department’s O.M.No.31011/8/1998-Estt(A) dated31.3.1999 will continue to apply whileregulating <strong>the</strong> admissible fare in <strong>the</strong>case of such air journeys on LTC.If full air fare has been charged by <strong>the</strong>airlines and paid by <strong>the</strong> Governmentservant <strong>the</strong> reimbursement would berestricted to <strong>the</strong> full train fare entitledclass including Rajdhani/Shatabdi.8. Issue of fresh instructions under All India Services (Leave Travel Concession)Rules, <strong>1975</strong>: It is conveyed that <strong>the</strong> instructions/clarifications contained in this Department’sfollowing four Office Memoranda may be extended to <strong>the</strong> All India Services officers:1. No.31011/3/2008-Estt.(A), dated 07.02.2007.2. No.31011/6/2002-Estt.(A), dated 26.03.2008.3. No.31011/4/2007-Estt.(A), dated 02.05.2008.4. No.31011/4/2007-Estt.(A), dated 14.05.2008.[DOPT letter No.11022/2/2008-AIS-II, dated 10 th June, 2008]Copy of DOPT Office Memorandum No. 31011/3/2008-Estt.(A), dated 07.02.2007The undersigned is directed to say that as per instructions contained inMinistry of Home Affairs OM No.43/15/59-Estt.(A) dated 19.7.1960, LTC (HomeTown) may be availed in combination with transfer/tour. The question of extendingthis facility to All India LTC (anywhere in <strong>the</strong> country in a block of 4 years) has beenconsidered and it has been decided that <strong>the</strong> provisions of <strong>the</strong> aforesaid OM dated19.7.1960 will also be applicable for All India LTC availed in combination withtransfer/tour.753

4. In <strong>the</strong>ir application to <strong>the</strong> staff serving in <strong>the</strong> Indian Audit and AccountsDepartment, <strong>the</strong>se orders issue after consultation with <strong>the</strong> Comptroller and AuditorGeneral of India.Copy of DOPT Office Memorandum No. No.31011/4/2007-Estt.(A) dated 14 th May,2008 Regarding Central Civil Services (LTC) Rules, 1988- clarification regardingreimbursement of fare in respect of <strong>travel</strong> by air to visit NER :After issue of DOP&T O.M. No. 31011/4/2007-Estt.(A) dated 2nd May, 2008 <strong>all</strong>owingGovernment servants to <strong>travel</strong> by air to North Eastern Region on LTC Clarificationson certain points have been sought by Government servants/ various Ministries/Departments. The doubts raised by various authorities are clarified as under:-Points raised1. Whe<strong>the</strong>r Sikkim isincluded in NER?2. Whe<strong>the</strong>r Governmentemployees <strong>travel</strong> byHelicopter?3. Whe<strong>the</strong>r a Governmentservant can <strong>travel</strong> byprivate airlines?4. Whe<strong>the</strong>r a Governmentservant visiting Sikkim can<strong>travel</strong> by air uptoBagdogra which is notsituated in NER?5. Whe<strong>the</strong>r a Governmentemployee who has alreadyavailed All India LTC isentitled for LTC to visitNER in terms of O.M.dated 2.5.2008?6. Whe<strong>the</strong>r air fare ofchildren whose full fare ischarged by <strong>the</strong> airlines isreimbursed?7. Whe<strong>the</strong>r Non GazettedGroup B officers areentitled to <strong>travel</strong> by air toClarificationYes. NER includes Arunachal Pradesh, Assam,Manipur, Meghalaya, Mizoram, Nagaland, Sikkim&Tripura.No. On LTC Government employees can <strong>travel</strong>only in (y) class in a passenger plane of airlines.Yes. DOP&T vide O.M. No. 31011/2/2006-Estt.(A)dated 24/4/2006 has <strong>all</strong>owed LTC journey byprivate airlines subject <strong>the</strong> conditions laid down in<strong>the</strong> Department of Expenditure O.M.No.19024/1/E.IV/2005 dated 24th March, 2006regarding air <strong>travel</strong> by Government servants withinIndia during official visits. However, in <strong>the</strong> case ofvisit to NER in terms of O.M. dated 2.5.2008, fullfare will be admissible to <strong>the</strong> categories ofemployees indicated <strong>the</strong>rein.Yes. A Government employees is entitled to <strong>travel</strong>by air from <strong>the</strong>ir place of posting (or nearestairport) to a city in <strong>the</strong> NER (or nearest airport)A Government employee can avail LTC to visitNER by conversion of one block of home-townLTC, if <strong>the</strong> same is available. However, <strong>the</strong>Governmentemployees whose headquarters and home-townbeing same are not entitled for home-town LTCand <strong>the</strong> question of conversion of home-town LTCinto LTC for NER in such cases does not arise.If full air fare has been charged by <strong>the</strong> airlines andpaid by <strong>the</strong> Government servant <strong>the</strong> same will bereimbursed.Yes. Group A Group B Central Governmentemployees (Gazetted and Non-Gazetted) will beentitled to <strong>travel</strong> by Air from <strong>the</strong>ir place of posting755

NER8. Whe<strong>the</strong>r Governmentemployee who has alreadyavailed one home townLTC in <strong>the</strong> current blockcan avail LTC to visitNER?9. India Airlines etc. areoffering Package Tours.Whe<strong>the</strong>r total package isreimbursable?(or nearest airport) to a city in <strong>the</strong> NER (or nearestairport).Yes. He can avail it against All India LTC.In LTC, fare at <strong>the</strong> normal rate for <strong>the</strong> entitledclass between headquarters and place of visit byshortest route or cost actu<strong>all</strong>y paid whichever isless is reimbursable.9. Acceptance of recommendations of 6 th Central Pay Commission relating toLTC for All India Services officers:I am directed to enclose herewith copy of <strong>the</strong> latest instructions of <strong>the</strong> Government regardingLTC to Central Government employees and to state that <strong>the</strong> instructions contained in thisDepartment’s Office Memorandum no. 31011/4/2008-Estt.(A), dated 23 rd September, 2008will also be applicable to <strong>the</strong> All India Services officers.[DOPT letter no.11022/2/2008-AIS-II, dated 7 th October, 2008]Copy of DOPT Office Memorandum No. F.No. 31011/4/2008- Estt.(A) dated 23 rdSeptember, 2008 regarding Acceptance of Recommendations of Sixth CentralPay Commission relating to LTC :Consequent upon <strong>the</strong> acceptance of <strong>the</strong> recommendations of Sixth Central PayCommission, it has been decided to make necessary additions/changes in <strong>the</strong>CCS(LTC) Rules, 1988 as indicated below:-Rule 4(d) Definition of familyThe parents and /or step parents (stepmo<strong>the</strong>r and stepfa<strong>the</strong>r)who are whollydependenton <strong>the</strong> Government employees sh<strong>all</strong> be included in <strong>the</strong> definition of familyfor <strong>the</strong> purpose ofLTC, irrespective of whe<strong>the</strong>r <strong>the</strong>y are residing with <strong>the</strong> Governmentemployee or not.The definition of dependency will be linked to <strong>the</strong> minimum family pension prescribedin Central Government and dearness relief <strong>the</strong>reon. The extant conditions in respect ofo<strong>the</strong>r relations included in <strong>the</strong> family including married / divorced / abandoned /separated / widowed daughters sh<strong>all</strong> continue without any change.Rule 8 Types of LTCFresh recruits to Central Government may be are <strong>all</strong>owed to <strong>travel</strong> to <strong>the</strong>ir hometown along with <strong>the</strong>ir families on three occasions in a block of four years and to anyplace in India on <strong>the</strong> fourth occasion. This facility sh<strong>all</strong> be available to <strong>the</strong> Governmentofficers only for <strong>the</strong> first two blocks of four years applicable after joining <strong>the</strong>Government for <strong>the</strong> first time. The blocks of 4 years sh<strong>all</strong> apply with reference to <strong>the</strong>initial date of joining <strong>the</strong> Government even though <strong>the</strong> employee changes <strong>the</strong> jobwithin Government subsequently. The existing blocks will remain <strong>the</strong> same but <strong>the</strong>entitlements of <strong>the</strong> new recruit will be different in <strong>the</strong> first eight years of service. Allo<strong>the</strong>r provisions concerning frequency of <strong>travel</strong> under LTC are retained.756

Rule 12 EntitlementTravel entitlements, for <strong>the</strong> purpose of official tour/transfer or LTC, will be <strong>the</strong> samebut no daily <strong>all</strong>owance sh<strong>all</strong> be admissible for <strong>travel</strong> on LTC. Fur<strong>the</strong>r, <strong>the</strong> facility sh<strong>all</strong>be admissible only in respect of journeys performed in vehicles operated by <strong>the</strong>Government or any Corporation in <strong>the</strong> public sector run by <strong>the</strong> Central or StateGovernment or a local body. Air Journey by Private Airlines will however, continue tobe admissible as per Ministry of Finance O.M. No. 19024/1/E-IV/2005 dated <strong>the</strong> 24thMarch, 2006 and in terms of <strong>the</strong> orders of DOPT in this regard..Encashment of Earned Leave alongwith LTCGovernment officers are <strong>all</strong>owed to encash ten days earned <strong>leave</strong> at <strong>the</strong> time ofavailing of LTC to <strong>the</strong> extent of sixty days during <strong>the</strong> entire career. The <strong>leave</strong> encashedat <strong>the</strong> time of LTC will not be deducted from <strong>the</strong> maximum amount of earned <strong>leave</strong>encashable at <strong>the</strong> time of retirement. It is fur<strong>the</strong>r clarified that where both husband andwife are Government servants, <strong>the</strong> present entitlement for availing LTC sh<strong>all</strong> remainunchanged, and encashment of <strong>leave</strong> equal to 10 days at <strong>the</strong> time of availing of LTCwill continue to be available to both, subject to a maximum of sixty days each during<strong>the</strong> career.2. These changes are effective from 1 st September, 2008.3. The LTC claim pertaining to <strong>the</strong> period prior to 318t August, 2008 sh<strong>all</strong> beregulated as per <strong>rules</strong> applicable on <strong>the</strong> date of journey and LTC claims already settledwill not be reopened.4. In so far as persons working in <strong>the</strong> Indian Audit & Accounts Department areconcerned, <strong>the</strong>se orders are being issued in consultation with C & A.G. of India.5. Hindi version will follow.Copy of Ministry of Finance, Department of Expenditure OM No. 7(1)/E.Coord./2008,dated 10 th November, 2008 regarding guidelines on Economy Measures andRationalization of Expenditure in connection with LTC: Reference is invited to<strong>the</strong> guidelines on austerity measures issued vide O.M. of even number dated 5 th June,2008 and DoPT O.M. No. 31011/4/2008-Estt.(A) dated 23 rd September, 2008regarding acceptance of Sixth Pay Commission’s recommendations related to LTC.Vide <strong>the</strong> O.M. of DoPT, it has been stipulated that <strong>travel</strong> entitlements for <strong>the</strong> purpose foofficial tour/transfer of LTC will be <strong>the</strong> same but no daily <strong>all</strong>owance will be admissiblefor <strong>travel</strong> on LTC. In order to meet <strong>the</strong> objective of expenditure management in view of<strong>the</strong> corrent Economy Measures, it is fur<strong>the</strong>r stipulated that insofar as <strong>travel</strong> on LTC isconcerned for those entitled to <strong>travel</strong> by air, <strong>the</strong> cheapest economy fare ticket will be<strong>all</strong>owed, irrespective of entitlement of such officers to <strong>travel</strong> while on tour.These orders come into effect from <strong>the</strong> date of issue.10. Expenditure Management – Economy Measures and Rationalization ofExpenditure – Guidelines relating to LTC – clarification for All India Service officers :I am directed to enclose herewith copy of <strong>the</strong> latest guidelines of <strong>the</strong> Government regardingLTC to Central Government employees and to state that <strong>the</strong> instructions contained in this757

Ministry of Finance, Department of Expenditure’s Office Memorandum no.7(1)/E.Coord/2008, dated 10 th November, 2008 and 4 th December, 2008 will also beapplicable to <strong>the</strong> All India Services officers.[DOPT letter no.11022/2/2008-AIS-II, dated 15 th January, 2009]Copy of Ministry of Finance, Department of Expenditure OM No. 7(1)/E.Coord./2008,dated 4 th December, 2008.The undersigned is directed to refer to OM of even number dated 10 November2008 regarding expenditure management and guidelines for LTC. In view of <strong>the</strong>reference received in regard to <strong>the</strong> difficulties in determination of cheapest’ economyfare, it is clarified that officers and/or <strong>the</strong>ir families may choose to <strong>travel</strong> on LTC by anyairline provided that <strong>the</strong> fare does not exceed <strong>the</strong> fares offered by NACL (Air India)under <strong>the</strong>ir LTC 80 scheme effective from 1 December, 2008 for sectors covered under<strong>the</strong> scheme, details of which are available on <strong>the</strong> websitehttp://www.<strong>india</strong>nairlines.in/scripts/<strong>leave</strong><strong>travel</strong> <strong>concession</strong>. For sectors not covered by<strong>the</strong> LTC 80 scheme of NACIL, officers should ensure that cheapest economytickets are purchased by ei<strong>the</strong>r booking through internet/ airlines directly/authorized<strong>travel</strong> agents.2. It may also be certified by each officer while submitting his/her LTC claim thatno o<strong>the</strong>r benefit, o<strong>the</strong>r than air <strong>travel</strong>, has been availed of as a part of any packageoffered by any airline.3. These orders will be applicable in <strong>the</strong> case of tickets booked on after <strong>the</strong> dateof issue. In respect of tickets booked between 10 November 2008 and <strong>the</strong> date of issueof <strong>the</strong>se orders. LTC claims may be processed for clearance provided full fareeconomy tickets have not been purchased and no o<strong>the</strong>r benefits, except air <strong>travel</strong>,have been availed of.Copy of DOPT Office Memorandum No. 3l0II/4/2008-Est1.(A) dated 3 rd June, 2009regarding <strong>travel</strong> entitlement for <strong>the</strong> purpose of Leave Travel Concession: Theundersigned is directed to refer to O.M. of even No. dated 23 rd September, 2008 whichsays that <strong>the</strong> <strong>travel</strong> entitlements while on LTC and official tour/transfer will be <strong>the</strong> samebut no daily <strong>all</strong>owance sh<strong>all</strong> be admissible for <strong>travel</strong> on LTC. Subsequently, <strong>the</strong> Ministryof Finance, vide <strong>the</strong>ir O.M.No.7(1)/E.Coord/2008 dated 10 th November, 2008, hadstipulated that in <strong>the</strong> case of <strong>travel</strong> on LTC for those entitled to <strong>travel</strong> by air, only <strong>the</strong>cheapest economy fare ticket will be <strong>all</strong>owed, irrespective of <strong>the</strong>ir entitlements on tour.A number of references are being received in this Department to restore <strong>the</strong> <strong>travel</strong>entitlements as per <strong>the</strong> O.M. dated 23 rd September, 2008.2. The matter has been examined in this Department in consultation with <strong>the</strong>Ministry of Finance and it has now been decided to restore <strong>the</strong> <strong>travel</strong> entitlements forLTC as stipulated vide O.M. dated 23 rd September, 2008. The Ministry of Civil Aviationmay bring out a scheme on <strong>the</strong> lines of LTC 80 for <strong>travel</strong> by business class. Theofficers and/or <strong>the</strong>ir families may chose to <strong>travel</strong> on LTC by any airline provided <strong>the</strong>fare does not exceed <strong>the</strong> fares offered by NACIL (Air India) under <strong>the</strong>ir new LTCscheme for business class.3. These orders sh<strong>all</strong> take effect from <strong>the</strong> date of issue.758

11. Issue of fresh instructions under All India Services (Leave Travel Concession)Rules, <strong>1975</strong>: I am directed to enclose herewith copies of <strong>the</strong> instructions/clarificationsissued by <strong>the</strong> Central Government under CCS(LTC) Rules, 1988 during 2009-2010and to state that, <strong>the</strong>se instructions wherever applicable, may be invoked in respectof All India Services officers in respective State cadre in terms of <strong>the</strong> provisionscontained in rule 3 of All India Services(Leave Travel Concession) Rules, <strong>1975</strong>. Thelist of such OMs issued by <strong>the</strong> Central Government is as follows:-1. No.31011/4/2008-Estt.(A) dated 3.6.2009.2. No.31011/2/2006-Estt.(A) dated 27.7.2009.3. No.19024/1/2009-E.IV dated 13.7.2009.4. No.31011/2/2006-Estt.(A) dated 9.9.2009.5. No.31011/3/2009-Estt.(A) dated 28.10.2009.6. No.31011/6/2002-Estt.(A) dated 2.12.2009.7. No.31011/2/2006-Estt.(A) dated 11.3.2010.8. No.31011/4/2007-Estt.(A) dated 20.4.2010.9. No.31011/4/2007-Estt.(A) dated 23.4.2010.10. No.31011/2/2003-Estt.(A-IV) dated 18.6.2010.11. No.31011/2/2003-Estt.(A) dated 5.8.2010.12. No.19024/1/2009-E.IV dated 16.9.2010.[DOPT letter no.11022/2/2008-AIS-II, dated 18 th October, 2010]Copy of DOPT Office Memorandum No.31011/4/2008-Estt.(A) dated 3 rd June, 2009regarding Travel entitlement for <strong>the</strong> purpose of Leave Travel Concession: Theundersigned is directed to OM of even No. dated 23 rd September, 2008 which saysthat <strong>the</strong> <strong>travel</strong> entitlements while on LTC and official tour/transfer will be <strong>the</strong> same butno daily sh<strong>all</strong> be admissible for <strong>travel</strong> on LTC. Subsequently, <strong>the</strong> Ministry of Finance,vide <strong>the</strong>ir O.M. No.7(1)/E.Coord./2008 dated 10 th November, 2008, had stipulated thatin <strong>the</strong> case of <strong>travel</strong> on LTC for those entitled to <strong>travel</strong> by air, only <strong>the</strong> cheapesteconomy fare ticket will be <strong>all</strong>owed, irrespective of <strong>the</strong>ir entitlement on tour. A numberof references are being received in his Department to restore <strong>the</strong> <strong>travel</strong> entitlements asper <strong>the</strong> O.M. dated 23 rd September, 2008.2. The matter has been examined in this Department in consultation with <strong>the</strong>Ministry of Finance and it has now been decided to restore <strong>the</strong> <strong>travel</strong> entitlement forLTC as stiplulated vide O.M. dated 23 rd September, 2008. The Ministry of CivilAviation may bring out a scheme on <strong>the</strong> lines of LTC 80 for <strong>travel</strong> by business class.The officers and/or <strong>the</strong>ir families may chose to <strong>travel</strong> on LTC by any airline provided<strong>the</strong> fare does not exceed <strong>the</strong> fare offered by NACIL (Air India) under <strong>the</strong>ir new LTCscheme for business class.3. These orders sh<strong>all</strong> take effect from <strong>the</strong> date of issue.4. Hindi version will follow.Copy of Ministry of Finance, Department of Expenditure OM No. 19024/2/2009-E.IV,dated 13 th July, 2010 regarding Air Travel on official account – both domestic andinternational : In partial modification of this Ministry’s OM No.F.No.7(2)/E.Coord /2005and in supersession of this Ministry’s OM No.19024/1/E.IV/2005 dated 24.3.2006, it759

has been decided that in <strong>all</strong> cases of air <strong>travel</strong>, both domestic and international, where<strong>the</strong> Government of India bears <strong>the</strong> cost of air passage, <strong>the</strong> official concerned may<strong>travel</strong> only by Air India.2. For <strong>travel</strong> to stations not connected by Air India, <strong>the</strong> officials may <strong>travel</strong> by AirIndia to <strong>the</strong> hub/point closet to <strong>the</strong>ir eventual destination, beyond which <strong>the</strong>y mayutilise <strong>the</strong> <strong>services</strong> of ano<strong>the</strong>r airline which should also preferably be an <strong>all</strong>iancepartner of Air India.3. In <strong>all</strong> cases of deviation from <strong>the</strong>se orders because of operational or o<strong>the</strong>rreasons or on account of non-availability, individual cases may be referred to <strong>the</strong>Ministry of Civil Aviation for relaxation.4. All Ministries/Departments of <strong>the</strong> Government of India are requested to strictlyadhered to <strong>the</strong>se instructions.5. These orders will also apply to officials in autonomous bodies funded byGovernment of India.Copy of DOPT Office Memorandum No. 3l0II/2/2006-Est1.(A) dated 27 th July, 2009regarding Regulation of Journey by air while availing Leave Travel Concessionclarification: The undersigned is directed to refer to Ministry of Finance,Department of Expenditure O.M.No. I9024/1/2009-E.lV dated 13/7/2009 modifying <strong>the</strong>O.M. No. 7(2)/E.Coord/2005 dated 23rd November, 2005 and superseding of O.M.No.I9024/l/E.lV/2005 dated 24/3/2006. It has been decided by <strong>the</strong> Department ofExpenditure that in <strong>all</strong> cases of air <strong>travel</strong> both domestic and international where <strong>the</strong>Government of India bears <strong>the</strong> cost of air passage, <strong>the</strong> officials concerned may <strong>travel</strong>only by air India. The matter whe<strong>the</strong>r <strong>the</strong>se orders will apply in cases of LTC has beenconsidered in consultation with Ministry of Finance, Department of expenditure and it isconfirmed that <strong>the</strong>se orders/conditions will apply in cases of LTC also.Copy of DOPT Office Memorandum No. 31011/2/2006-Estt.(A) dated 9 th Sept, 2009regarding regulation of journey by air while availing Leave Travel Concessionclarification: The undersigned is directed to refer to this Department's O.M. of even No.dated 27.7.2009 on <strong>the</strong> above subject and to say that consequent to issue of Ministryof Finance, Department of Expenditure O.M.No. 7(1) E.Coord/2009 dated 7/9/2009 onexpenditure management <strong>the</strong> reimbursement of <strong>the</strong> expenses on air <strong>travel</strong> whileavailing of <strong>the</strong> Leave Travel Concession by Government servants will be restricted to<strong>the</strong> cost of <strong>travel</strong> by <strong>the</strong> economy class, irrespective of entitlement, with immediateeffect.Copy of DOPT Office Memorandum No. 31011/3/2009-Estt.(A) dated 28 th October,2009 regarding use of own car/hired taxi on LTC journey on account of physicalhardship:1. The undersigned is directed to refer to this Department’s O.M.No.31011/4/2008-Estt.(A) dated 23.9.2008 in which it was stipulated that LTC facility760

sh<strong>all</strong> be admissible only in respect of journeys performed in vehicles operated by <strong>the</strong>Government or any corporation in <strong>the</strong> public sector run by <strong>the</strong> Central or StateGovernment or a local body.2. Instances have come to notice where Government servants on account ofphysical hardship/disability of self or dependant family members are unable to perform<strong>the</strong> LTC journey by <strong>the</strong> authorized modes of transport and are compelled to undertake<strong>the</strong> journey by own car or private taxi. Representations are being received to <strong>all</strong>owreimbursement in such cases. Matter has been examined in consultation with <strong>the</strong>Ministry of Finance, Department of Expenditure and it has been decided in relaxationof LTC Rules to authorize <strong>the</strong> Head of Department to <strong>all</strong>ow use of own/hired taxi forLTC journey on account of disability of <strong>the</strong> Government servant or dependent familymember after obtaining following papers/conditions to avoid misuse of suchrelaxation:-(i)Medical Certificate from competent authority.(ii) Undertaking from Government servant that journey in authorizedmode is not feasible and he actu<strong>all</strong>y <strong>travel</strong>led by own car/hired taxi.(iii) Such claim should not be more than journey performed by <strong>the</strong> entitledclass by rail/air by <strong>the</strong> shortest route.3. Hindi version will follow.Copy of DOPT Office Memorandum No. 14028/3/2008-Estt.(L) dated 16 th November,2009 regarding Recommendations of <strong>the</strong> Sixth Central Pay Commission relating toencashment of <strong>leave</strong> in respect of Central Government employees:1. The undersigned is directed to refer to this Department's O.M. of evennumber dated 25th September, 2008 on <strong>the</strong> subject mentioned above according towhich encashment of <strong>leave</strong> in respect of central Government employees will beconsidered both for earned <strong>leave</strong> and half pay <strong>leave</strong> subject to over<strong>all</strong> limit of 300 daysand in respect of encashment of half pay <strong>leave</strong>, no reduction sh<strong>all</strong> be made on accountof pension and pension equivalent of o<strong>the</strong>r retirement benefits. In case of shortf<strong>all</strong> inearned <strong>leave</strong>, no commutation of half pay <strong>leave</strong> is permissible. The order was madeeffective from <strong>the</strong> lSt September, 2008. The matter was reconsidered in thisDepartment in consultation with <strong>the</strong> Department of Expenditure (Implementation Cell)and it has been decided to modify <strong>the</strong> date of effect of this Department's 0.M of evennumber dated 25th September, 2008 to O1.01.2006 instead of 01.09.2008 subject to<strong>the</strong> following conditions:-(i)(ii)(iii)The benefit will be admissible in respect of past cases on receipt ofapplications to that effect from <strong>the</strong> pensioners concerned by <strong>the</strong>Administrative Ministry concerned.In respect of retirees who have already received encashment of earned <strong>leave</strong>of maximum limit of 300 days toge<strong>the</strong>r with encashment of HPL standing at<strong>the</strong>ir credit on <strong>the</strong> date of retirement, such cases need not be reopened.However, such cases in which <strong>the</strong>re was a shortf<strong>all</strong> in reaching <strong>the</strong> maximumlimit of 300 days can be reopened.Calculation of cash equivalent in respect of HPL at credit sh<strong>all</strong> be mademutatis mutandis in <strong>the</strong> manner given in this Department's O.M. of evennumber dated 25.09.2008.761

2. In respect of persons serving in <strong>the</strong> Indian Audit & Accounts Departments,<strong>the</strong>se O.M. issues with <strong>the</strong> concurrence of <strong>the</strong> Comptroller and Auditor General ofIndia.Copy of DOPT Office Memorandum No. 14028/2/2009-Estt.(L) dated 24th November,2009 regarding Encashment of earned <strong>leave</strong> along with LTC:The undersigned is directed to refer to DOP&T O.M.No. 31011/4/2008-Estt.(A),dated 24th November, 2009 <strong>all</strong>owing encashment of earned <strong>leave</strong> alongwith LTC andto say that various references are being received from Ministries Departments withregard to <strong>the</strong> applicability of Rule 38-A of <strong>the</strong> CCS (Leave) Rules, 1972 to <strong>the</strong> CentralGovt. employees. In this regard it is clarified that:(1) Central Govt. employees governed by CCS (Leave)Rules, 1972 who areentitled to LTC but opt for <strong>the</strong> facility of LTC provided to <strong>the</strong>ir spouses employed inPSUs / Corporation/Autonomous Bodies etc. and(2) Central Govt. employees governed by CCS (Leave) Rules, 1972 who areo<strong>the</strong>rwise not entitled to LTC, on account of <strong>the</strong>ir spouse being employed in IndianRailways/National Airlines who are entitled to privilege passes/ <strong>concession</strong>al ticketsare entitled to <strong>leave</strong> encashment while availing <strong>the</strong> LTC facility of <strong>the</strong>ir spouse/privilegepasses/<strong>concession</strong>al tickets of <strong>the</strong>ir spouse on fulfilment of <strong>all</strong> <strong>the</strong> conditions asstipulated in Rule 38-A of <strong>the</strong> CCS (Leave) Rules, 1972 twice in a four years blockof LTC.Copy of DOPT Office Memorandum No. 1402812/2009-Estt.(L)dated 24th November,2009 regarding Encashment of earned <strong>leave</strong> along with LTC –Clarification: Theundersigned is directed to refer to DOP&T O.M.No.31011/4/2008-Estt.(A), dated 23rdSeptember, 2008 <strong>all</strong>owing encashment of earned <strong>leave</strong> along with LTC and to say thatvarious references are being received from Ministries/Departments with regard to <strong>the</strong>applicability of Rule 38-A of <strong>the</strong> CCS (Leave) Rules, 1972 to <strong>the</strong> Central Govt.employees. In this regard it is clarified that(1) Central Govt. employees governed by CCS (Leave)Rules, 1972 who areentitled to LTC but opt for <strong>the</strong> facility of LTC provided to <strong>the</strong>ir spouses employed inPSUs/Corporation/Autonomous Bodies etc. and(2) Central Govt. employees governed by CCS (Leave) Rules, 1972 who areo<strong>the</strong>rwise not entitled to LTC, on account of <strong>the</strong>ir spouse being employed in IndianRailways/National Airlines who are entitled to privilege Passes/<strong>concession</strong>al ticketsare entitled to <strong>leave</strong> encashment while availing <strong>the</strong> LTC facility of <strong>the</strong>irspouse/privilege passes/ <strong>concession</strong>al tickets of <strong>the</strong>ir spouse on fulfillment of <strong>all</strong> <strong>the</strong>conditions as stipulated in Rule 38-A of <strong>the</strong> CCS (Leave) Rules, 1972 twice in a fouryears block of LTC.Copy of DOPT Office Memorandum No. 31011/6/2002-Estt.(A) dated 2nd December.2009 regarding LTC to Central Government Employees -Travel by tour packagesoperated by IRCTC:762

1. The undersigned is directed to refer to DOP&T O.M. of even number dated14.3.08, <strong>all</strong>owing tours by road conducted by <strong>the</strong> Indian Railway Catering and TourismCorporation (IRCTC), a Government of India's undertaking under <strong>the</strong> Min. of Railwaysfor <strong>the</strong> purpose of reimbursement of LTC by Government servants on <strong>the</strong> lines ofITDCISTDC and to say that as <strong>the</strong> IRCTC is also offering tour packages involving air<strong>travel</strong> in <strong>the</strong> sectors like Delhi - Leh, Delhi - Srinagar, Jaipur -Goa, Chennai, Calcutta -Port Blair etc., <strong>the</strong> question of <strong>all</strong>owing LTC packages of IRCTC, including <strong>the</strong>component of air <strong>travel</strong> has been examined in consultation with <strong>the</strong> Min. of Finance.2. It has now been decided to <strong>all</strong>ow <strong>the</strong> re-imbursement of air fare along with railand road fare in <strong>the</strong> case of LTC journey 'of Government servants in tours offered byIRCTC for reimbursement under LTC provided <strong>the</strong> IRCTC indicates and certifies <strong>the</strong> 3components separately and booking of tickets is done by IRCTC fully complying with<strong>the</strong> instructions of Govt. of lndia issued from time to time in this regard such as journeyby Air lndia under LTC 80 scheme in economy class without package benefits etc.Copy of DOPT Office Memorandum No. 31011/2/2006-Estt.(A) dated 11 th March, 2010regarding Regulation of journeys by private airlines while availing Leave TravelConcession:1. The undersigned is directed to refer to Department of Expenditure O.M.No.19024/4/2009-E.IV dated 13/7/2009 and this Department’s O.M.No.31011/2/ 2006-Estt.(A) dated 27.7.2009 regarding journey by air while availing Leave TravelConcessions(LTC), stipulating that in <strong>all</strong> cases of air <strong>travel</strong> (including LTC) bothdomestic and international where <strong>the</strong> Government of India bears <strong>the</strong> cost of airpassage, <strong>the</strong> official concerned may <strong>travel</strong> by Air India only.2. It is clarified that restriction of <strong>travel</strong> by Air India only need not apply to nonentitledofficers who <strong>travel</strong> by air and claim LTC reimbursement by entitled class of rail.3. The above orders will be applicable with effect from <strong>the</strong> date of issue of thisOffice Memorandum. Past cases already settled will not be re-opened.Copy of DOPT Office Memorandum No. No. 31011/4/12007-Estt.(A) dated 20th April,2010 regarding relaxation for <strong>travel</strong> by air to visit NER under CCS (LTC) Rules, 1988:The undersigned is directed to refer to this Department O.M. of even no. dated2.5.2008 on <strong>the</strong> subject mentioned above and to say that <strong>the</strong> relaxation for <strong>travel</strong> by airto visit North Eastern Region under CCS (LTC) Rules, 1988 is extended for fur<strong>the</strong>r twoyears beyond 1'' May. 2010.Copy of DOPT Office Memorandum No. No. 31011/4/2007-Estt.(A) dated 23rd April,2010 regarding relaxation for <strong>travel</strong> by air to visit NER under CCS (LTC) Rules, 1988 -:The undersigned is directed to refer to this Department O.M. of even No. dated20.4.20l0 and to clarify that <strong>the</strong> validity of this Department O.M. of even No. dated2.5.2008 stands extended on <strong>the</strong> same terms and conditions for a fur<strong>the</strong>r period of twoyears beyond 1.5.2010 in relaxation of CCS (LTC) Rules,1988 to visit North EasternRegion of India.763

Copy of DOPT Office Memorandum No. 31011/2/2003-Estt.(A) dated 18 th June, 2010regarding relaxation for <strong>travel</strong> by air to visit J& under CCS(LTC) Rules, 1988 – Theundersigned is directed to say that in relaxation of CCS(LTC) Rules, 1988, it has beendecided by <strong>the</strong> Government to permit Government employees to <strong>travel</strong> by air to J&Kas per <strong>the</strong> following scheme:-(i)(ii)(iii)(iv)(v)All officers/employees of Government of India will be <strong>all</strong>owed to avail LTC tovisit J&K against conversion of one block of <strong>the</strong>ir Home Town LTC.Officers/employees of Government of India entitled to <strong>travel</strong> by air can availthis LTC in <strong>the</strong>ir entitled class.All o<strong>the</strong>r employees of Government of India can <strong>travel</strong> by air in economyclass from Delhi and Amritsar to any place in J&K by any airlines subject to<strong>the</strong>ir entitlement being limited to LTC-80 fares of Air India. Journey from <strong>the</strong>irplace of posting up to Delhi/Amritsar will have to be undertaken as per <strong>the</strong>irentilement.Restriction of air <strong>travel</strong> only by Air India on LTC to o<strong>the</strong>r places sh<strong>all</strong> continueto remain in force.This scheme sh<strong>all</strong> be effective from <strong>the</strong> date of issuance.2. These orders sh<strong>all</strong> be in operation for a period of two years from <strong>the</strong> date ofissue of this O.M.3. In <strong>the</strong>ir application to <strong>the</strong> staff serving in <strong>the</strong> Indian Audit and AccountsDepartment, <strong>the</strong>se orders issue in consultation with <strong>the</strong> Comptroller and AuditorGeneral of India.Copy of DOPT Office Memorandum No. 31011/2/2003-Estt.(A) dated 5 th August, 2010regarding Regulation of Journeys by private airline while availing Leave TravelConcession to Jammu & Kashmir:1. After issue of DOPT O.M.No. 31011/2/2003-Estt.(A) dated 18 th June, 2010regarding relaxation for <strong>travel</strong> by air to visit J&K, clarifications have been sought byGovernment servants/various Ministries/Departments from time to time. The doubtraised by various authorities have now been clarified by Ministry of Finance(Department of Expenditure) as under:-Point raised1. Whe<strong>the</strong>r entitled officerscan <strong>travel</strong> by Privateairlines to J&K.2. Whe<strong>the</strong>r <strong>the</strong> restrictions ofLTC 80 fare of Air India willapply in <strong>the</strong>se cases.ClarificationYes. Travel by private airlines is availableto <strong>all</strong> <strong>the</strong> categories of Governmentemployees, including those entitled in<strong>travel</strong> by air.LTC-80 fare would apply to <strong>all</strong> casesincluding those entitled to <strong>travel</strong> by airirrespective of <strong>the</strong> airlines.2. This issues in consultation with Ministry of Finance (Department of Expenditure)vide <strong>the</strong>ir I.D.No.821838/SO-E.IV dated 3 rd August, 2010.764

Copy of DOPT Office Memorandum No. 3101112/2006-Estt.(A) dated 9 th September,2010 regarding regulation of Journey by air while availing Leave Travel Concession :The undersigned is directed to refer to this Department's O.M. of even No. dated27.7.2009 on <strong>the</strong> above subject and to say that consequent to issue of Ministry ofFinance, Department of Expenditure O.M.No.7(1)E.Coord/2009 dated 7/9/2009 onexpenditure management <strong>the</strong> reimbursement of <strong>the</strong> expenses on air <strong>travel</strong> whileavailing of <strong>the</strong> Leave Travel Concession by Government servants will be restricted to<strong>the</strong> cost of <strong>travel</strong> by <strong>the</strong> economy class, irrespective of entitlement, with immediateeffect.Copy of DOPT Office Memorandum No. 19024/1/2009-E.IV dated 16 th September,2010 regarding Guidelines on Air Travel on Tours/L.T.C.: This Department is receivingrepeated references seeking clarifications with regard to purchase of Air Ticketsthrough authorised agents and relaxation for <strong>travel</strong> by Airlines o<strong>the</strong>r than IndianAirlines. The following guidelines may be noted for compliance:1. On Official Tours:(i)(ii)For <strong>travel</strong> by Airlines o<strong>the</strong>r than Air India because of operational or o<strong>the</strong>rreasons or on account of non-availability of Air India Flights, individual casesfor relaxation to be referred to M/o Civil Aviation, as stated in this Ministry’sOM No.19024/1/2009-E.IV dated 13.7.09.Air Tickets may be purchases directly from Airlines (at Bookingcounters/Website of Airlines) or by utilizing <strong>the</strong> <strong>services</strong> of Authorised TravelAgents viz. M/s Balmer Lawrie & Company, M/s Ashok Travels & Tours.2. LTC:(i)(ii)(iii)(iv)Travel by Air India only.In Economy class only, irrespective of entitlement.LTC-80 ticket of Air India only to be purchased.Air Tickets may be purchased directly from Airlines (at Bookingcounters/Website of Airlines) or by utilizing <strong>the</strong> <strong>services</strong> of Authorized TravelAgents viz. M/s Balmer Lawrie & Company, M/s Ashok Travels & Tours andIRCTC (to <strong>the</strong> extent IRCTC is authorized as per DoP&T OMNo.31011/6/2002-Estt.(A) dated 2.12.09).3. LTC for J&K:(i)(ii)Relaxation to <strong>travel</strong> by Private Airlines to visit J&K while availing LTC isavailable to <strong>all</strong> <strong>the</strong> categories of Govt. employees, including those entitled to<strong>travel</strong> by Air(DoP&T OM No.31011/2/2003-Estt.(A-IV) dated 18.6.10 and05.08.10 refer).For purchase of Air tickets, however, <strong>the</strong> procedure as given under para 2(iv)above should be followed.4. All Ministries/Departments of Govt. of India are requested to strictly adhere to<strong>the</strong>se instructions.765