1086 AnnRep-Investment S04-3 - Pumpkin Patch investor relations

1086 AnnRep-Investment S04-3 - Pumpkin Patch investor relations

1086 AnnRep-Investment S04-3 - Pumpkin Patch investor relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

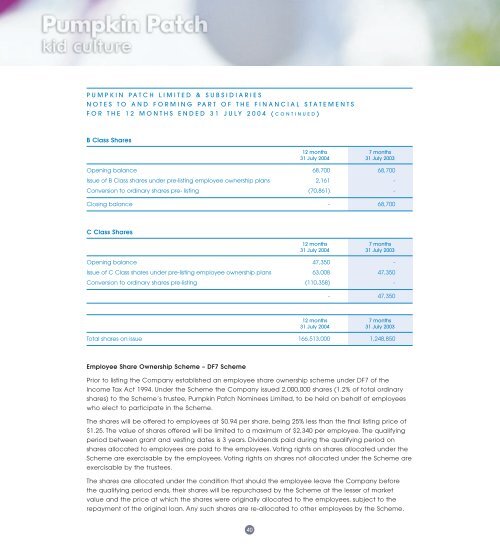

PUMPKIN PATCH LIMITED & SUBSIDIARIESNOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTSFOR THE 12 MONTHS ENDED 31 JULY 2004 (CONTINUED)B Class Shares12 months 7 months31 July 2004 31 July 2003Opening balance 68,700 68,700Issue of B Class shares under pre-listing employee ownership plans 2,161 -Conversion to ordinary shares pre- listing (70,861) -Closing balance - 68,700C Class Shares12 months 7 months31 July 2004 31 July 2003Opening balance 47,350 -Issue of C Class shares under pre-listing employee ownership plans 63,008 47,350Conversion to ordinary shares pre-listing (110,358) -- 47,35012 months 7 months31 July 2004 31 July 2003Total shares on issue 166,513,000 1,248,850Employee Share Ownership Scheme – DF7 SchemePrior to listing the Company established an employee share ownership scheme under DF7 of theIncome Tax Act 1994. Under the Scheme the Company issued 2,000,000 shares (1.2% of total ordinaryshares) to the Scheme’s trustee, <strong>Pumpkin</strong> <strong>Patch</strong> Nominees Limited, to be held on behalf of employeeswho elect to participate in the Scheme.The shares will be offered to employees at $0.94 per share, being 25% less than the final listing price of$1.25. The value of shares offered will be limited to a maximum of $2,340 per employee. The qualifyingperiod between grant and vesting dates is 3 years. Dividends paid during the qualifying period onshares allocated to employees are paid to the employees. Voting rights on shares allocated under theScheme are exercisable by the employees. Voting rights on shares not allocated under the Scheme areexercisable by the trustees.The shares are allocated under the condition that should the employee leave the Company beforethe qualifying period ends, their shares will be repurchased by the Scheme at the lesser of marketvalue and the price at which the shares were originally allocated to the employees, subject to therepayment of the original loan. Any such shares are re-allocated to other employees by the Scheme.40