The TCS Cloud Study

The TCS Cloud Study

The TCS Cloud Study

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Demographics and Research Process066

001I. Executive Summary

Executive SummaryIn the fall of 2011, Tata Consultancy Services (<strong>TCS</strong>) conducted an extensive study on how600+ primarily large companies (most with more than $1 billion in revenue) were usingapplications in “the cloud” – software residing on remote data centers that organizationsaccess via the Internet. Such data centers can be run by third parties that co-locateapplications of multiple companies (so-called public clouds). Or these data centers can berun for the sole use of one organization, operated by that organization itself (privateclouds).Public cloud computing vendors provide shared computing resources (hardware andsoftware) to companies that don’t want to incur the cost of such IT infrastructure. A cloudvendor’s offerings typically provide computing resources on demand, automated systemdeployment and scaling, and pay-per-usage pricing. <strong>The</strong>re are three primary benefits ofcloud services: computing resources on-demand (which saves companies from having toplan ahead for securing such resources); the elimination of upfront commitments to IT(and thus avoid purchasing new hardware, software or whole data centers for computingdemand that may be uncertain in the future); and pay-per-usage pricing (e.g., processorsby the hour), which reduces the amount of computing resources that are sitting idle.<strong>TCS</strong> believed that while numerous studies have been published on cloud computing since2008, none had deeply explored how business functions such as marketing, sales, R&D,distribution, manufacturing, operations, finance and others were using cloud applications(also known as “software as a service,” or SaaS).We designed the study to explore five core issues:<strong>The</strong> factors that are driving companies to put theirapplications software in the cloud – whether those cloudapplications were shifted from computers on-premises orwere entirely new applications that had no on-premisespredecessorsWhich cloud applications have been adopted by whatbusiness functions and why<strong>The</strong> benefits they had generated to date from shifting onpremisesapps to the cloud and from launching entirelynew apps in the cloud<strong>The</strong> success factors to generating buy-in, adoption andbenefits<strong>The</strong>ir future plans for cloud apps – specifically, what typesof cloud apps their business functions planned to have by2014We conducted several research streams.<strong>The</strong> first was quantitative research: anonline survey of 600+ companies fromfour regions of the world. <strong>The</strong> survey wasextensive and polled the experiences ofboth senior business functionalmanagers and corporate IT executives.<strong>The</strong> second stream of research wasin-depth interviews with six companieson their attitudes and experiences withcloud applications. <strong>The</strong>ir stories shedfurther light on what’s drivingcompanies to shif t existingapplications or put new applications inthe cloud, the benefits and competitiveadvantages those applications aregenerating, and the challenges togetting the organization to adopt cloudapplications (both those in public andprivate clouds). <strong>The</strong>se companies were:003

Executive SummaryFinding No. 3: <strong>The</strong> early returns on cloud applications are impressive. Companies usingcloud applications are increasing the number of standard applications and businessprocesses, reducing cycle times to ramp up IT resources, cutting IT costs, and launchinga greater number of new products and processes. <strong>The</strong> story of a major telco shows theambitions of the some of the most aggressive cloud adopters. (See Page 15.)Finding No. 4: Customer-facing business functions are garnering the largest share of thecloud application budget. Marketing, sales and service are capturing at least 40% of thatbudget in all four regions. <strong>The</strong> experiences of Dell’s enterprise sector online marketingfunction shows how one large company is trying to get closer to customers through cloudmarketing applications. And a new private cloud at Web media company AOL Inc.explains how a technology-dependent company can make its technology moreresponsive and cost-effective. (See Page 28.)Finding No. 5: Many companies are reluctant to put applications with sensitive data in thecloud. In the U.S. and Europe, the applications least frequently shifted from on-premisescomputers to the cloud were those that compiled data on employees (e.g., payroll), legalissues (legal management systems), product (pricing and product testing), and certaincustomer information (e.g., customer loyalty and e-commerce transactions). Still, somecompanies had shifted applications with customer data to the cloud, especially incustomer service, and many planned to shift a number of customer-related applicationsto the cloud by 2014. (See Page 32.)Finding No. 6: <strong>The</strong> heaviest users of cloud applications are the companies thatmanufacture the technology hardware that enables cloud computing(computers/electronics/telecom equipment), while healthcare services providers arethe lightest users (in terms of average number cloud apps per business function).(See Page 44.)Finding No. 7: <strong>The</strong> most aggressive adopters of cloud applications are companies in Asia-Pacific and Latin America. <strong>The</strong>y report having much higher percentages of cloud appsto total apps – and bigger results from cloud apps than their peers in the U.S. and Europe.(See Page 54.) We show how a large consumer products company uses the cloud torespond rapidly and effectively to consumer issues around the world.Finding No. 8: Despite a significant shift to cloud applications, most companies(especially in Europe) remain conservative about which applications they put in publicclouds. Less than 20% of U.S. and European companies would consider or seriouslyconsider putting their most critical applications in public clouds. But 66% of U.S. and48% of European companies would consider putting core applications in private clouds.(See Page 58.)Finding No. 9: <strong>The</strong> keys to adopting and benefiting from cloud applications areovercoming fear of security risks and skepticism about ROI. (See Page 62.)Finding No. 10: Companies evaluate cloud vendors most on their security andreliability/uptime capabilities – and far less on their price. This was the case in all fourregions. In fact, price typically finished at the bottom of a list of nine factors in making thecloud application purchasing decision. (See Page 68.)In the following pages, we dive deeply into these and other statistics and stories.005

II.<strong>The</strong> State of Adoptionof <strong>Cloud</strong> Applications005

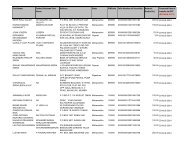

<strong>The</strong> State of Adoption of <strong>Cloud</strong> ApplicationsDespite all the press and technology research firm coverage of cloud computing in the lastfew years (especially in 2011), software applications that are hosted in public or privateclouds still represent only a minority of total applications software for large companies.<strong>The</strong> clear majority of applications in 2011 – 81% in the U.S. companies and 88%in European companies – were resident on computers located on their premises.To a lesser extent, this was also the case in the Asia-Pacific and Latin American companiesthat we surveyed. In Asia-Pacific, on-premises applications were 72% of all applicationsin 2011, while 28% were based in the cloud. In Latin America, 61% of all corporateapplications software were on-premises vs. 39% that were in the cloud.However, the companies we surveyed expected these percentages to changesignificantly by 2014. American companies projected cloud applications to increase from19% of all applications (cloud + on-premises) to 34% by then. <strong>The</strong> European companiessurveyed expected that cloud applications as a percent of total applications woulddouble, from 12% in 2011 to 24% by 2014.In Asia-Pacific and Latin America, cloud applications are expected to be at least half of totalcorporate applications by 2014 – 50% for Asia-Pacific companies and 56% for LatinAmerican firms.Exhibit II-1<strong>Cloud</strong> Applications as % of Total CorporateApplications -- 2011 and 2014 (Projected)United States19%34%Europe12%24%Asia-Pacific28%50%Latin America39%56%0% 10% 20% 30% 40% 50% 60%2011: # of <strong>Cloud</strong> Apps as % of Total Apps (Average Per Company)2014: # of <strong>Cloud</strong> Apps as % of Total Apps (Projected) (Average Per Company)007

MICROTOOLS in shopsA lighting solution with convincing benefits<strong>The</strong> product has complete attention<strong>The</strong> miniaturised LED lighting system promotes the dialoguebetween customers and the products on offer by placing goodscentre stage and by efficiently presenting attractive details.<strong>The</strong> combination of almost invisibly integrated yet gimbal-mountedluminaires gives new perspectives to planners, shop operators andshop fitters. <strong>The</strong> goods themselves become attractive eye-catchersthanks to the flexibly alignable luminaires, so that shoppers aretempted to stay and browse. <strong>The</strong> energetic benefit compared toconventional systems with low voltage halogen lamps is that consumptionis reduced significantly.Save energy and protect resources with a durable solutionEnergy consumption is considerably reduced if light is emitted notfrom the ceiling but directly from within the shelves. A furtheradvantage gained by the short distance is that despite less effortthe presentation becomes more exciting. Because the LEDsdissipate only low quantities of heat in the direction of illumination,goods are protected from unintended damage and prematureageing. <strong>The</strong> long service life is a major benefit for the sustainabilityof the lighting solution; a MICROTOOLS lighting head has a servicelife of 50,000 hours or more, meaning that in retail practice relampingis no longer required.

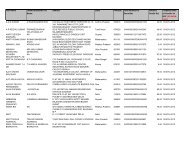

<strong>The</strong> State of Adoption of <strong>Cloud</strong> ApplicationsIn each region, we looked at cloud apps as a percent of total apps by company size and sawsome interesting patterns. One was that in American companies the “mid-sized” largefirms ($1 billion to $10 billion in revenue) were the heaviest users of cloud applications. Inthese companies, cloud applications represented 27% - 28% of total applications. And by2014, U.S. companies with revenue of between $1B-$5B said they expected cloudapplications to be 52% of all applications – more than twice the percentage (23%)expected by companies of more than $50B in revenue. (See Exhibit II-3.)Exhibit II-3U.S.: Number of cloud applications asa % of all applications20112014All companies (>$500M)Companies $500M-$1BCompanies $1B-$5BCompanies $5B-$10BCompanies $10B-$20BCompanies $20B-$50BCompanies > $50B19%16%27%28%17%17%14%34%44%52%31%35%30%23%009

Notes on lighting qualityWhen erroneous colouration or heat cause damage ...Binning – constant colour locationsfor high quality illuminationWhen LED chips are manufactured, LEDs from different productionbatches have variable properties. This may affect luminousflux, the colour location or forward voltage. <strong>The</strong> importance ofsuch criteria varies according to the application and product.With white LEDs the binning process is especially important, andselecting a specific binning group ensures that the colour locationof LED light remains constant. This in turn ensures a uniformappearance for all LED luminaires equipped within the definedbinning range. <strong>The</strong> more precisely this range is limited, the lowerare the visible fluctuations.For this product assortment Zumtobel guarantees1/16 binning (approximately corresponding to a 2-stepMacAdam ellipse, see the diagram below) and therefore auniform appearance for all LED modules: colour stability isguaranteed over the complete service life (50,000 hours).CCy0.460.452700 K0.443000 K0.433500 K0.424000 K0.410.404500 K0.395000 K0.380.370.360.350.340.330.33 0.34 0.35 0.36 0.37 0.38 0.39 0.40 0.41 0.42 0.43 0.44 0.45 0.46 0.47 0.48 0.49CCx<strong>The</strong> precise selection of LED chips (1/16 binning, coloured sections)guarantees very high colour stability.

<strong>The</strong> State of Adoption of <strong>Cloud</strong> Applications<strong>Cloud</strong> Adoption: Reaching Critical Mass<strong>The</strong> numbers showing future cloud usage by 2014 are striking – ranging from one-quarterof all corporate applications being in the cloud in Europe, to one-third in U.S. companies toabout half in Asia-Pacific and Latin American companies. Yet even though these numbersare projections of future adoption trends, we nonetheless believe that large corporationshave passed the inflection point, or critical mass, in adopting cloud applications – at thevery least, in private clouds that a company owns (or are run for them by a third party).Our study of a large telco illustrates this point. Today, about 30% of its applications arecloud-based (mostly private cloud-based systems that it runs in its own data centers). Inthe last two years, the company has moved all its financial systems for its general ledger,payables and fixed assets to the cloud. At the end of 2011, it was moving all HRapplications to the cloud, standardizing on SAP and other enterprise applications.However, by the end of this year the company expects 80% of its applications to be in itsprivate clouds. <strong>The</strong> company has also launched many new cloud applications that had noon-premises predecessors. A good number of these were cloud-based financialapplications – specifically, general ledger and fixed asset applications that are helping thecompany track its sizable capital investments in both its wire-line and wireless networks.<strong>The</strong> telecommunications services company’s aggressive of adoption of cloud computingwas far from unusual, even outside the U.S. Consider the Commonwealth Bank ofAustralia. <strong>The</strong> bank began shifting applications to the cloud in 2008. Today, the bank hasdozens of cloud applications serving its sales, customer service, HR, operations and ITfunctions. And the bank continues to identify which of its more than 3,500 applicationsthat it has amassed over the last 30 years can (and can’t) be shifted to the cloud.<strong>The</strong> objective, however, is to put as many applications into the cloud as possible, saidDilan Rajasingham, executive advisor to the bank’s chief information officer. (See case011

Commonwealth Bank of Australia: Using the <strong>Cloud</strong> toFund a Wave of Innovative Financial ServicesFounded exactly 100 years ago and headquartered today in Australia’s largest city(Sydney), Commonwealth Bank of Australia is the country’s largest bank, withrevenue of US $35 billion. Naturally, as a large financial institution, the bank has ahealthy appetite for IT, spending nearly $1 billion on it annually. It has more than3,500 software applications, amassed over 30 years.That’s where cloud computing comes in: Given the bank’s penchant forintroducing a steady stream of innovative technology-based services to its retailand other customers, it must find ways to economize on IT. Four years ago, thebank launched what it refers to as a core banking modernization program for itsvast number of information systems. It has also been identifying applications thatshould go in public clouds, a private cloud or a hybrid of the two.By shifting dozens of on-premises applications to the cloud starting four yearsago, the bank has reduced operational costs. This has freed up money that thebank has reallocated into delivering new services. “We want to get out ofinfrastructure computing and into fine-grain components and highly granulardata so that our customers enjoy new services,” the bank’s chief informationofficer, Michael Harte, explained to CIO magazine.To reduce costs, CBA has created “As a Service”/ cloud offerings in sales, customerservice, HR, operations and IT applications and environments over the last fouryears, says Dilan Rajasingham, executive adviser to the CIO. Some of these are coreenterprise systems – e.g., payments and talent management, while others arepilots and proof of concepts such as “Big Data,” and others still are supportenvironments such as development and testing.How can moving to “As a Service” and cloud reduce IT costs at CBA? A primeexample is the bank’s “as a service” payment hub. By developing a single paymentsolution once to be used across the bank, from front office to back office, and withstandard interfaces, CBA has achieved significant savings in system integrationand development costs and time. Components of the solution’s modulararchitecture, such as SWIFT (for international money transfers), have also beenextended to CBA group entities across Australia and Asia.<strong>The</strong> bank has also become a provider of cloud services to its customers.For example:It has collaborated with pharmaceutical, manufacturing, and distributioncompanies – and even other banks -- in the creation and provision of cloudbaseddatabases “as a service.”Itprovides cloud infrastructure services running on CBA servers (as well as thecapability to run on Amazon’s cloud servers). With these services, CBA developsand tests new computing applications used internally and externally. Hartetold CIO magazine that the bank can launch new cloud computing services inless than 10 minutes and at as little as one-tenth the cost of testing anddeveloping applications in the past.012

<strong>The</strong> State of Adoption of <strong>Cloud</strong> ApplicationsSo how do you add up the benefits? Rajasingham categorizes them in threeways:Cost reduction. For example, “as a service” storage has cut CBA’s cost ofcomputing storage by around 40%. Even more impressively, the “as a service”overdraft offering has reduced processing time of standard overdrafts by 90%.Harte told the Australian Financial Review that CBA was “saving tens of millionsof dollars and [potentially] hundreds of millions [over the next three or fouryears] from buying services on demand, paying a unit price for them andhaving the flexibility.”Faster development of computer systems. <strong>The</strong> bank refers to this benefit asone of “agility.” <strong>The</strong> bank’s payment system – which combines a stack oftechnologies necessary to offer payment services (the application, itsunderlying middleware, operating system and other infrastructure, and theserver and storage hardware) – is a case in point. No longer does the bank needto build a new payment system every time a business unit or department asksfor one.Mindset shifts from getting business units to share IT applications. CBA’sHR function has adopted so-called talent management applications to betterunderstand trends in turnover, recruitment, hiring patterns and future hiringneeds, absenteeism and other areas. CBA has created a cloud-based talentmanagement application that any of its banking units – e.g., Bankwest (a 2008acquisition) and ASB (its New Zealand bank) – could adopt. This has reducedcosts dramatically.Harte has talked publicly about how the IT infrastructure cost savings from cloudcomputing is freeing up time and money for CBA to focus on providing newbanking services (much of it online) that let customers do such things as get offerson financial products in real time. This is because more bank people can now focuson evaluating customers’ individual needs and pricing products and servicesbased on their risk profile and loyalty. <strong>Cloud</strong> computing, he said, will let CBA shiftfrom spending “half of our budget on maintaining lights-on [IT] infrastructure, andget more of that money into creating really high-value, highly responsive services.”He sees cloud computing as enabling banks like CBA to invest less in the backendIT infrastructure and more in online banking services that customers have come todemand – applications to bank from their mobile phones, tablet computers andother digital devices.Shifting technology spending from backroom to front office applications isnecessary because banks are no longer competing just against other banks inexploding areas such as mobile payments, CBA’s CEO Ralph Norris said in a 2011presentation to investors. “Our business is not going to be about competingagainst banks or other current payment players; it’s against phone companies,providers of technology themselves, and the new social media entities,” saidNorris. “You have to bring to bear new features and functions that are goingto resonate with customers using those sorts of facilities.”013

III.Why Companies areUsing <strong>Cloud</strong> Applications

Why Companies are Using <strong>Cloud</strong> ApplicationsWe asked companies to rate on a scale of importance (1 to 5) what had driventhem to implement two kinds of cloud applications:<strong>Cloud</strong> applications that had previously been installed on on-premisescomputersEntirely new cloud-based applications for which there had been noon-premises versions beforeHow they rated a set of drivers that we offered provides insights into themotivations for adopting cloud applications. We’ll start with the factors thatpushed companies to shift on-premises apps to the cloud.Shifting On-Premises Apps to the <strong>Cloud</strong>: IT Cost-Cutting Isn’tthe Leading DriverAmong U.S. and Asia-Pacific companies, the most important driver of shifting onpremisesapplications to the cloud is not what many think it would be – to reducetechnology costs (although that is a key driver). Ahead of that is something that isnot as well understood by the press, analysts and others covering cloud trends:standardizing applications and the business operations that those applicationssupport.Numerous large companies – especially those with multiple businessunits/divisions – are saddled with huge duplications in technologies: commercialapplication software packages, hardware and data centers that are serveindividual business units (and sometimes even just a single compute-intensivebusiness function such as R&D or manufacturing in a division). By givingcompanies the ability to take such applications out of departmental or businessunit data centers and put them in a centrally accessible location – a privateor public data center that hosts the applications – cloud computing creates theprospect of standardizing applications across a big business.<strong>The</strong> major telco that we spoke with said offering standardized cloud applicationswill help its business units reduce their IT costs and the need for so many datacenters (which today are in the hundreds). Having dozens of financial, HR,customer management and other applications today – each devoted to a narrowslice of its business – has resulted in huge IT costs (software, hardware and datacenters). In fact, the company believes that its shift to cloud applications will helpit reduce its number of data centers by 80%, which would produce an estimatedannual cost savings of $100 million to $200 million.015

Another highly rated driver of cloud applications in both the U.S. and Asia-Pacificcompanies was increasing applications or systems “flexibility.” In both regions, this was thethird most important driver of shifting on-premises applications to the cloud. What doesthis mean? It refers to the ability to scale an application up or down.Exhibit III-1U.S.: Why Companies are Shifting On-Premises Applications to the <strong>Cloud</strong>To standardize applications andbusiness processes46%32%To reduce IT costs41%30%To increase application flexibility (ability tolaunch or shut down applications quickly)45%26%To improve data and trend analysis41%24%To make faster applications enhancements46%19%To reduce application downtime39%25%To improve applications maintenance43%17%0% 10% 20% 30% 40% 50% 60% 70% 80% 90%Important FactorVery Important Factor<strong>The</strong> need to process “big data” – huge volumes of transactional and other digitized data(video, social media chatter, and other) -- appears to be a big driver of cloud applications.Nearly two-thirds (65%) of the U.S. survey respondents they were driven to the cloudto improve the way they gathered and analyzed data (rated as an important or veryimportant factor). A similar number of Asia-Pacific companies said this was an importantor very important driver of their shift to the cloud. Less than half (47%) of the Europeancompanies said it was an important or very important factor in using cloud. However, 80%of the Latin American companies said this was an important or very important factor. Oneof the biggest differences that we found between the companies that had generated thelargest benefits from the cloud and the ones that had generated the least benefits was, infact, their interest in using the cloud to manage “big data.” (See sidebar, “Big Data and thePush for <strong>Cloud</strong>.”)016

Why Companies are Using <strong>Cloud</strong> ApplicationsBig Data and the Push for <strong>Cloud</strong>Our U.S. data shows that savvier uses of cloud applications are distinct in many ways – oneof which is their interest in using the cloud to process and analyze volumes of digital data.We compared the answers of the companies in the top quartile of benefits achieved fromshifting on-premises apps to the cloud (the “leaders”) to those in the bottom quartile(“laggards”). Some 74% of the leaders said using the cloud to process and analyze data fortrend identification was important or very important. But a much lower percentageof laggards (55%) said that was a key driver.We found a similar set of drivers in the Asia-Pacific companies that we polled. <strong>The</strong> threemost important drivers in this region – just like in the U.S. – were 1) standardizingapplications and business processes, 2) reducing IT costs, and 3) increasing applicationflexibility.<strong>The</strong> biggest factor driving Commonwealth Bank of Australia to shift on-premisesapplications to its private cloud was to use the savings in IT costs to providing more bankservices through mobile applications and social media. “For us, cloud is not just abouton-demand, selective scalability and automation,” says Rajasingham. “It’s also about selffundingIT, removing cost from running the business – and reallocating that intodelivering more value-added services.”Exhibit III-2U.S.: <strong>Cloud</strong> "Leaders" Place Much GreaterImportance on Using <strong>Cloud</strong> to Process andAnalyze Data to Identify Trends50.00%44.78%45.00%38.81%40.00%35.00%32.84%29.85%30.00%25.00%20.00%19.40%16.42%15.00%10.00%7.46%4.48% 5.97%5.00%0.00%0.00%Not at all Importantof Minor ImportanceSomewhat ImportantImportantVery ImportantLaggardLeader017

Exhibit III-3Asia-Pacific: Why Companies are Shifting On-Premises Applicationsto the <strong>Cloud</strong>To standardize applications andbusiness processesTo reduce IT costsTo increase application flexibiity (ability tolaunch of shut down applications quickly)To reduce application downtimeTo improve applications maintenanceTo improve data and trend analysisTo make faster application enhancements44%46%45%44%45%34%40%33%29%29%27%24%32%26%0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%ImportantVery ImportantIn both Europe and Latin America, the most important driver of shifting to cloudapplications was the need to increase “system flexibility” – the ability to launch or shutdown applications quickly.Exhibit III-4Europe: Why Companies are Shifting On-PremisesApplications to the <strong>Cloud</strong>To increase applications flexibility (ability tolaunch or shut down applications quickly)46%20%To reduce IT costsTo standardize applications andbusiness processesTo reduce application downtime34%38%37%29%24%21%To improve applications maintenance39%13%To make faster applications enhancements37%15%To improve data and trend analysis34%13%0% 10% 20% 30% 40% 50% 60% 70%ImportantVery Important018

Why Companies are Using <strong>Cloud</strong> ApplicationsIn Latin America, standardizing applications and business processes ranked below fourother drivers, which were led by increasing application flexibility. IT cost-cutting was ratedthe lowest of the seven options we provided. Perhaps Latin American companies look atcloud less as giving them more efficient ways to deploy computing applications and moreas a tool giving them a greater ability to adopt strategic applications of technology.Exhibit III-5Latin America: Why Companies are Shifting On-PremisesApplications to the <strong>Cloud</strong>Increasing applications flexibility (ability tolaunch or shut down applications quickly)To improve applications maintenanceTo make faster applications enhancementsTo improve data and trend analysisTo standardize applications andbusiness processesTo reduce systems downtimeTo reduce IT costs39%47%35%40%37%46%32%44%35%47%40%42%32%37%0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%ImportantVery ImportantWhy Companies are Launching Entirely New Applications in the <strong>Cloud</strong>: <strong>The</strong>yWant to be Quicker to the Punch with New Business ProcessesWe also surveyed companies about any new applications that they launched inthe cloud – applications for which they had no previous versions installed on theiron-premises computers. In three of the four regions (all except for Europe), thefactor rated as the most important was the need to institute new businessprocesses to generate revenue and increase customer loyalty.This was not a surprise to us. Increasingly, companies are doing business withcustomers online, and cloud computing can give those businesses a faster route tochanging the way they do business on the Web. <strong>The</strong> Web has become a criticalplace for many customers to find out about a company’s products and services,place orders, check on shipment status, and (post-delivery) get answers toquestions about how to use the product or otherwise get support.019

Take the case of Dell Inc., the multibillion-dollar supplier of innovative technology andtechnology services. One of the Round Rock, Texas-based company’s online marketinggroups caters to large corporate and government customers (the Public and LargeEnterprise business unit). It has put cloud applications at the center of the marketing toolstrategy that it uses, according to Rishi Dave executive director of online marketing. Manyvendors of online marketing tools – for example, those that assess social mediainfluencers – provide their products via the cloud, he explained. Using cloud vendors’applications enables Dell’s online marketing function to execute online marketing, socialand community programs without having to “touch our internal infrastructure,” Daveexplains.<strong>The</strong> cloud helped Dell introduce gamification to customers and prospects at the 2011 DellWorld conference. In the four months prior to Dell’s first Dell World client conference(which ran from Oct. 12-14, 2011 in Austin, Texas), Dell’s online marketing group decidedto provide gamification to motivate customers to download Dell marketing content, visitphysical locations at the conference, and network with each other. By using the cloudbasedgamification services of one vendor, Dell was able to plan and execute the projectin less than four months.Exhibit III-6Europe: Why Companies are LaunchingWhole New Applications in the <strong>Cloud</strong>To launch new applications fasterTo launch new business processes that increaserevenue and customer loyaltyTo enter new markets faster36%37%33%20%24%22%To test new products/servicesTo test new business processesTo launch new products/services thatgenerate revenue32%33%32%18%16%17%0% 10% 20% 30% 40% 50% 60% 70%ImportantVery Important020

Why Companies are Using <strong>Cloud</strong> ApplicationsExhibit III-7U.S.: Why Companies are LaunchingWhole New Applications in the <strong>Cloud</strong>To launch new business processes that increaserevenue and customer loyaltyTo launch new applications fasterTo enter new markets fasterTo launch new products/services thatgenerate revenueTo test new business processesTo test new products/services39%47%36%34%35%39%32%22%24%23%19%14%0% 10% 20% 30% 40% 50% 60% 70% 80%Important FactorVery Important FactorExhibit III-8Latin America: Why Companies are LaunchingWhole New Applications in the <strong>Cloud</strong>To test new business processesTo enter new markets fasterTo launch new applications fasterTo launch new products/services thatgenerate revenueTo test new products/servicesTo launch new business processes that increaserevenue and customer loyalty49%37%37%37%49%40%35%42%40%39%26%25%0% 10% 20% 30% 40% 50% 60% 70% 80% 90%ImportantVery Important021

Exhibit III-9Asia-Pacific: Why Companies are LaunchingWhole New Applications in the <strong>Cloud</strong>To test new business processesTo launch new applications fasterTo launch new products/services thatgenerate revenueTo enter new markets fasterTo test new products/services thatgenerate revenueTo launch business processes43%44%39%32%41%43%31%26%28%34%25%20%0% 10% 20% 30% 40% 50% 60% 70% 80%ImportantVery ImportantCTB/McGraw-Hill: Looking to the <strong>Cloud</strong> to Set the Pacein Online Student TestingCTB/McGraw-Hill is one of the three largest suppliers of assessment tests for public andprivate schools in the U.S. and other countries. Million of students in all 50 states take CTB’stests. <strong>The</strong>y help school districts and states rate the quality of the teaching delivered in theirclassrooms, as well as determine how to improve it.<strong>The</strong> company, based in Monterey, Calif., believes cloud computing will be essential forcompeting in a highly price-sensitive market (U.S. public schools). CTB/McGraw-Hill alsofeels that cloud will be critical to shifting its testing services from a paper-and-pencilprocess to an online experience – one with great potential to improve teachers’ abilityto address students’ learning deficiencies. <strong>The</strong> company believes cloud computing willbe a crucial channel for delivering its products and services to school districts in the future.But given the nature of CTB’s business – delivering tests to hundreds of thousands of K-12students over two weeks each year – that creates enormous demand for the ability to scalecomputing resources up or down to administer online tests, which it believes will be thewave of the future. “Given that we have high spikes in capacity, we must be able to increaseit and lower it quickly,” says CTB’s chief technology officer, Jayaram “Bala” Balachander.“We can’t do that today. That’s where cloud will be critical.”022

Why Companies are Using <strong>Cloud</strong> ApplicationsIn 2011, CTB delivered online assessment testing to 180,000 U.S. K-12 students over a twoweekperiod. With each student taking as many as five tests, this meant the company hadto score 800,000 online tests concurrently. “This lends itself very much to the cloudbecause we can go up or down depending on the activity in our business.” In 2012, thenumbers are expected to more than double, creating an increasing need for ramping upand down infrastructure resources. As a result, CTB is experimenting with cloud-basedsolutions.Balachander predicts that about a million U.S. students will take their assessment testsonline (including CTB’s tests) in 2012. Moreover, with U.S. schools wanting 100% of theirassessment testing to be online at some point, that would require CTB to have thecomputing resources to serve the online assessment needs of millions of Americanchildren in K-12 grades at once, a number he believes could be reached as early as 2015.Even if that turns out to be a smaller number in three years – say 75% of the 55 million U.S.students take online assessment tests -- if CTB commanded a 20% share of that market,it would need computing resources to support the delivery and scoring of more than 40million tests in a short period of time. “It would be very difficult for us to do that without thecloud – to invest in the infrastructure from a capital expenditure standpoint, and thenmake the ongoing technology investments,” Balachander explains.By this August, CTB intends to shift six to eight on-premises applications to the cloud, oneof which is the online testing. <strong>The</strong> firm’s website and extranet are also being evaluatedas potential candidates to put in the cloud.Balachander believes all new CTB applications should be cloud applications. “With newapplications, we are saying that by default we should put them in the cloud.”“At the end of the day, CTB needs IT services that can adapt to varying scalability demands,”Balachander says. “We clearly don’t want to invest in fixed infrastructure costs to handleour spikes in volume and scalability. <strong>The</strong> current set of cloud services and ongoingadvances in technology in this area give us an ability to approach our infrastructure needsin a whole different way.”023

IV.<strong>The</strong> Benefits ThatCompanies Have Gainedfrom <strong>Cloud</strong> Applications021

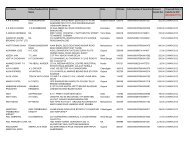

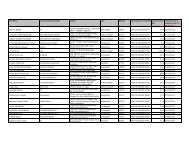

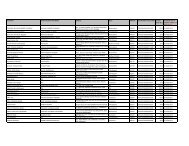

<strong>The</strong> Benefits That Companies Have Gained from <strong>Cloud</strong> ApplicationsWe asked the companies we surveyed whether their use of cloud applications hadgenerated benefits – both cloud applications that they shifted from on-premisescomputers, as well as whole new cloud applications for which they previously had no onpremisesversions. For both types of cloud applications, their answers indicate that cloudapplications are generating significant improvements in operational and financialperformance.Benefits from Shifting Existing Apps to the <strong>Cloud</strong>In all four regions of the world, the average benefits from cloud applications of this typewere impressive, especially in Latin American and Asia-Pacific companies:In IT costs, 28% (Europe) to 55% (Latin America) average reductionsIn standard applications and business processes, between 34% (Europe) and 60%(Latin America) increases in the number of apps and business processes that have beenmade common across a company or business unitIn cycle-time reductions to ramp IT resources up or down (a measure of “flexibility”):between 35% (U.S.) and 64% (Latin America) reductionsIn systems downtime, 33% (Europe) to 59% (Latin America) reductionsIn the time it takes to enhance applications, 37% (U.S. and Europe) to 57% (LatinAmerica) reductionsApplication fixes, from 35% (U.S.) to 64% (Latin America) reductions in the numberof patchesInanalytic reports, from 34% (Europe) to 66% (Latin America) increases in the numberof reports, which gives companies greater ability to mine and analyze volumes of data<strong>The</strong> more aggressive adopters of cloud computing – Latin American and Asia-Pacificcompanies (which had higher percentages of cloud apps to total corporate apps) – alsoreported much greater benefits from their cloud apps. Why is this the case? Perhapsgreater benefits is a function of experience; the more you use cloud applications, the moreknowledge you gain about how to deploy and use them, and thus the greater likelihoodto generate benefits. Or it could be that using a higher number of cloud applicationssimply brings more cumulative benefits.025

For a $5 billion consumer products company, the cloud enabled one of its businessfunctions to implement a new application without needing the typical “$10 million and18 months to build it,” says an IT executive in the company. And the aforementioned telcohopes that standardizing applications through its private cloud data centers will help itreduce the number of those centers by 80% and save as much as $200 million in annualIT costs.Exhibit IV-1Comparing 4 Regions of the World on Benefits Achieved FromShifting On-Premises Applications to the <strong>Cloud</strong>% increase in number of analytic reports(ability to mine and analyze data)% reduction in number of application fixes% cycle-time reduction in makingapplication enhancements% reduction in systems downtime% reduction in cycle time to ramp ITresources up or down% increase in standardized apps andbusiness processes they support% reduction in IT costs40%34%42%35%36%43%37%37%42%34%33%39%35%36%41%38%34%41%31%28%37%66%64%57%59%64%60%55%0% 10% 20% 30% 40% 50% 60% 70%United States Europe Asia-Pacific Latin America026

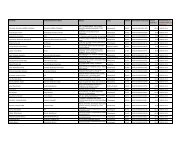

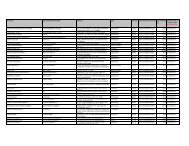

<strong>The</strong> Benefits That Companies Have Gained from <strong>Cloud</strong> ApplicationsCompanies Report Sizable Benefits from Launching WholeNew Apps in the <strong>Cloud</strong>We also asked survey respondents to report on benefits received to date from newapplications that they launched in the cloud. Specifically, we had them indicateimprovements in six areas:Testing of new business processes that they would have considered too costly to testprior to the advent of the cloud (because of excessive technology costs). Here we askedthem to indicate the percentage increase in new business processes tested.<strong>The</strong> number of new business processes they actually launched or instituted<strong>The</strong> number of new products/services they tested<strong>The</strong> number of new products/services they launched<strong>The</strong> annual revenue increase from launching new products/services in markets thatthey already served<strong>The</strong> average reduction in the time it took to enter new markets with newproducts/servicesWhile the average percentage improvements in these areas were about half those thatcompanies reported from shifting on-premises applications to the cloud, they werenonetheless noteworthy:Increases from 15% to 19% in the number of new business processes tested andlaunched in U.S., Europe and Asia-Pacific companies. Latin American companies,however, reported higher average numbers (22-27%)Increases from 13% to 19% in the number of new products or services tested andlaunched by companies in the U.S., Europe and Asia-Pacific (which, again, trailed the31-32% increases in new products/services in Latin America)An average 14-17% reduction in cycle time to enter new markets with newproducts/services in the U.S., Europe and Asia-Pacific (bested again by Latin Americancompanies, which claimed an average 35% cycle time reduction)Average revenue increases of 13-17% from launching new, cloud-based products andservices in existing markets (vs. an average 32% revenue increase reported by LatinAmerican companies)027

Exhibit IV-2Comparing 4 Regions of the World on Benefits Achieved FromLaunching Whole New Applications in the <strong>Cloud</strong>% cycle-time reduction to enternew markets% increase in revenue from newproducts/services in existing markets% increase in number of newproducts/services launched% increase in number of newproducts/services tested14%16%17%13%14%18%13%17%18%15%17%19%35%32%32%31%% increase in number of new businessprocesses launched% increase in number of new businessprocesses tested15%17%18%15%16%19%22%27%0% 5% 10% 15% 20% 25% 30% 35% 40%United States Europe Asia-Pacific Latin AmericaAt AOL, a Private <strong>Cloud</strong> is Helping the Shift to a WebAdvertising ModelThree decades ago AOL Inc. was a trailblazer in opening the online world to the Americanpublic. Today, despite competition from Facebook, Google, Yahoo and many other sites,AOL remains the sixth most heavily visited U.S. Website, with 106 million unique visitors inNovember 2011. <strong>The</strong> $2.4 billion company will be 30 years old next year, an unusuallifespan in an industry that buried AltaVista, Boo.com, Pets.com and many other onlinecompanies long ago.AOL outlasted them all because of its ability to shift strategies quickly and capably as theWeb created new capabilities and competitors. <strong>The</strong> company has reincarnated itselfseveral times – from proprietary online service in the early 1990s (supported bysubscription fees) to Internet access provider in the late 1990s and 2000s (dial-up accessfees) to online media content provider today (funded by advertising). In just the last fiveyears, the company’s revenue mix has changed from about 43% advertising/54%subscription to 60% advertising/40% subscription and other.028

<strong>The</strong> Benefits That Companies Have Gained from <strong>Cloud</strong> ApplicationsBut because of its long history of providing online services such as email, instantmessaging and Web media and entertainment content, AOL had accumulated a vastamount of computers, storage, other computing devices and software over that time, saysMichael Manos, senior vice president of technologies at AOL. He has a playful name for thistechnology tangle: “cruft.” <strong>The</strong>se legacy systems can weigh down companies that mustcontinually adopt new web technologies while keeping IT infrastructure costs low.This is especially the case at AOL, whose strategy today requires focusing investmentson online content and the people who produce it.“Cruft adds tremendous complexity to a company’s technology operations and makesit difficult for it to be agile,” Manos explains.To reduce its IT costs, AOL has embraced a private cloud infrastructure over the last year.It has dramatically lowered the technology expenses of sales, marketing and customerservice. Manos estimated that 20% of the company’s business applications have movedto cloud in the last six months, and that another 15% will shift by mid-year.That’s crucial in a company whose subscriber revenue has been falling sharply over theyears. A decade ago, AOL had about 30 million subscribers. Today, the number is around4 million. In 2011, the company reduced total expenses more than $500 million to makeup for the decline in subscription revenue.Adopting a Private <strong>Cloud</strong> at Light SpeedManos joined AOL in January 2011 after 17 years of managing data centers for such mediaand technology icons as Walt Disney Co., Microsoft, and Nokia. He had earned a solid trackrecord in making data centers more effective and efficient.In just 90 days, Manos and his team implemented AOL’s first-ever private cloud in a newdata center the company calls ATC. (AOL operates three other data centers in the U.S. – twoin Virginia and one in Silicon Valley.) Since going live last Oct. 1, ATC and the private cloudhave enabled AOL to shut down about 10,000 computer servers at its other computerfacilities. Furthermore, AOL’s private cloud can more quickly increase the firm’s computingcapacity on demand, without the need for additional manpower. Such “dynamicscalability” is essential in a business like AOL, where breaking news such as election resultsgenerates huge spikes in viewers clicking on its websites.Because of its private cloud, AOL can now get a new server up and running in just minutes,compared to 6-12 weeks a decade ago. In fact, on the ATC data center’s first day ofoperation, it took only an hour to have nearly 100 virtual servers running. Manos saysprovisioning a new server now takes only about 5 minutes via the cloud, compared to the8-12 hours it previously took. “We now can spin up capacity extremely quickly,” he says.“More importantly, we can spin down capacity very quickly. So it’s given us a substantialamount of agility within our business that we’ve never had before.” <strong>The</strong> cloud has alsoreduced energy costs. <strong>The</strong> more efficient servers at ATC (about 800 in all) have replaced3,000 old servers, paring AOL’s electricity bill by about $700,000 a year.029

Biggest Barrier to Embracing the <strong>Cloud</strong>: IT PeopleManos says the biggest barrier to adopting cloud technology at AOL is that IT employeesworry that cloud technology will replace them. However, companies like AOL have nochoice but to reduce costs in technology and other realms. ATC is a 100% “lights-out”facility, meaning it doesn’t need anyone operating the machines on its premises. Manos’team of five people can now manage 12,000-15,000 servers that are spread across thecompany’s data centers. Still, the main objective is not to eliminate IT staff but ratherto deploy them in jobs where they can play a more important role.Manos has gained support for cloud computing throughout AOL, from the CEO down.Through regular emails, newsletters and meetings, CEO Tim Armstrong has gone to greatlengths to make the transition transparent. Armstrong has become a big proponent of thefirm’s private cloud because of the cost savings and ability to launch new Web contentmore quickly.“If you would have told me nine months ago that the CEO would be talking about thetechnology side of the business, I would have said you were crazy,” Manos says. “But he isnow saying that AOL is a technology company as well as a media company.”Major Telco: <strong>Cloud</strong> as Game-Changer and Data CenterConsolidatorThis company sees cloud as a major external and internal opportunity -- to sell newservices to customers and induce large reductions in its technology costs as wellas standardized business processes and applications software.Top management at the telco believes that if the company wishes to get numerouscustomers to adopt cloud services, it must demonstrate how it has benefited from usingthe cloud internally. With that mandate, the company in the last two years has movedfinancial systems such as general ledger, payables and fixed assets to its private cloud. It isalso moving human resource applications to the cloud (including the corporate emailsystem, and employee savings and financial plans). Customer records ordering andprocessing will move to cloud as well. All in all, the company has moved 30% of itsapplications to its private clouds (data centers that it owns and operates), a number ithopes will reach 80% by year-end.<strong>The</strong> company is moving to organize its IT architecture completely around its privateclouds, with the intention of eventually putting all applications in the cloud and providingcloud services for each company business unit. Today, its business units have their ownfinancial, HR, customer management and other systems. That, of course, results in largeduplications of software, hardware and data center space that could be consolidatedif business units could standardize on many fewer applications and let them run onhardware at fewer but centrally managed data centers.030

<strong>The</strong> Benefits That Companies Have Gained from <strong>Cloud</strong> ApplicationsIf the firm can achieve this, it believes it will reduce the need for dozens of data centers(reducing the number by as much as 80%), which would achieve cost savings in the rangeof $100 million to $200 million.What must the company do to reach such ambitious goals? <strong>The</strong> two biggest obstacles thatwe heard were “fear of the unknown” and “fear of losing control” – both coming especiallyfrom the IT functions within the company’s business units.That said, the company believes the issue is no longer whether the company will broadlyadopt cloud computing but rather how quickly it will do so. “We believe cloud issomething that is going to be gaming-changing,” said one executive. “It’s going to becomea way of life. I think we’re at the very beginning of this, and that many companies have a‘toe in the water’ approach because of the security concerns.” <strong>The</strong> gating factor, hebelieves, is whether cloud vendors can provide a highly secure service with nearly 100%uptime.031

029V. Which Business Functionsare Using the Most <strong>Cloud</strong>Applications

Which Business Functions are Using the Most <strong>Cloud</strong> ApplicationsWith cloud applications representing anywhere from 12% (Europe) to 39% (Latin America)of total applications at the companies we surveyed, it is clear that they have becomea fixture in large corporations. But we also wanted to know exactly how companies wereallocating their cloud application budget, business function by business function.So we asked our respondents to estimate how their companies had apportioned theirspending on cloud applications across 10 core business functions: customer service,marketing, sales, manufacturing (or the equivalent of “production” or “operations” inservice firms), research & development, human resources, distribution, purchasing,finance, and legal. Furthermore, we asked companies to estimate their budget allocationsat present (for 2011) and their projections for 2014.For 2011, spending on cloud applications is, for the most part, spread well across all 10functions. Across all four regions of the world, not one business function had commandedmore than 19% of the total cloud applications budget. In Latin America, customer servicecloud applications were 19% of total cloud applications spending. And in Europe, themarketing function garnered the largest slice of the total cloud applications budget,at 18%.On the other end of the spectrum, none of the 10 business functions received an averageshare of less than 4% of total cloud applications spending in any region of the world.Distribution and purchasing received 4% of the total cloud applications budget in Europe,and legal received 4% of the average cloud applications budget in Asia-Pacific companies.Despite that fragmented spending, in all four regions three functions collectivelycommanded at least 40% of total cloud applications investments: customer service (15%of total spending across all four regions), marketing (14%) and sales (13%). Of course,these three functions are “customer-facing”: their operations directly touch a company’scustomers on a daily basis. In contrast, three functions that don’t touch customers everyday – legal, purchasing/procurement and HR – collectively accounted for only 19% of thetotal cloud applications budget.033

<strong>The</strong>re were a few regional exceptions to overall trend. In Asia-Pacific companies, themanufacturing/production function accounted for 14% of total cloud applicationsspending – twice the percentage of U.S. companies. In Latin America, companies spentmore on manufacturing/production cloud apps (12% of total cloud applicationsspending) than they did on marketing apps.Exhibit V-12011: How Companies Around the World are Dividing <strong>The</strong>ir <strong>Cloud</strong>Applications Budgets(Functional Spending on <strong>Cloud</strong> Apps as % of Total Company <strong>Cloud</strong>Apps Spending)20%18%16%14%12%10%8%6%4%2%0%18%16%13%10%19%17%15% 15%13% 13%11%9%14%12%10%10% 9% 9% 10% 10% 10%8%8%8% 8%7%6%5%6% 6% 6% 6%5%4%4% 4%5%7%5%4%14%9%2%0%MarketingSalesCustomer ServiceManufacturing/ProductionHuman ResourcesFinanceR&DDistributionPurchasingLegalOtherUnited States Europe Asia-Pacific Latin AmericaWhy are companies in all four regions putting more of their cloud applicationsinvestments in these three customer-facing functions? We believe it’s in part because suchcloud applications are more directly able to generate revenue or increase customer loyaltythan cloud applications supporting back-room functions. <strong>The</strong> other part of it is thatcompanies are starting to recognize the value of cloud computing for processing andanalyzing enormous volumes of customer data – particularly data generated fromcustomers and prospects on the Web from social media.034

Which Business Functions are Using the Most <strong>Cloud</strong> ApplicationsIn the U.S., 58% of companies had shifted to the cloud on-premises applications thatreported and analyzed sales data. Nearly half (45%) had created entirely new applicationin the cloud for sales analysis and reporting. And 44% of U.S. companies plan by 2014to have new cloud applications that collect and analyze social media data, four times thenumber of companies that had such cloud applications in 2011.How Companies Plan to Allocate the <strong>Cloud</strong> Applications Budget in 2014<strong>The</strong> companies we surveyed believe that sales, marketing and customer service willcontinue to snare the largest shares of their cloud applications investments through 2014.Among U.S. companies, marketing (15% of all cloud applications spending), sales (15%)and customer service (14%) will lead the way. In Europe, marketing (16%), sales (19%) andcustomer service (10%) will account for 45% of all cloud apps spending. Asia-Pacificcompanies expect to continue investing more heavily in cloud manufacturing apps (15%of the total cloud apps budget), although they project that 35% of total spending will go tomarketing, sales and service. And Latin American companies expect marketing, sales andservice cloud apps to be 44% of total cloud apps spending.Exhibit V-22014: How Companies Around the World Project How <strong>The</strong>y'll Divide<strong>The</strong>ir <strong>Cloud</strong> Applications Budget(Functional Spending on <strong>Cloud</strong> Apps as % of Total Company <strong>Cloud</strong> Apps Spending)20%18%16%14%12%10%8%6%4%2%0%19%19%16%15% 15%14% 14%11% 12%11%12%15%14%12%10% 10%9%10%9% 9% 9%8%8% 8% 8% 8%7% 7%7% 7% 7%6% 6%6%6%5% 4%4%4% 4%5%8%1% 1%MarketingSalesCustomer ServiceManufacturing/ProductionHuman ResourcesFinanceR&DDistributionPurchasingLegalOtherUnited States Europe Asia-Pacific Latin America035

VI.<strong>The</strong> Most and Least Popular<strong>Cloud</strong> Applications033

<strong>The</strong> Most and Least Popular <strong>Cloud</strong> ApplicationsIn the previous section, we mentioned that across all four regions of the world, companieswere in most cases putting the largest share of their cloud applications budgets inmarketing, sales and service. Yet in spite of that, many companies appear to be stayingclear of putting sensitive data into cloud applications.We found this to be the case in looking at other data in our survey. In the U.S. and Europe(where we had large-enough sample sizes to explore what applications companies had inthe cloud in each of the 10 core business functions), we found that the applications thatwere most frequently shifted from on-premises computers to the cloud were those thattypically do not have highly sensitive information on employees, customers, new-productplans, and other data that companies go to great lengths to protect (see Exhibit VI-1).Exhibit VI-1US (2011): Applications Most Frequently Shifted fromOn - Premises Technology to the <strong>Cloud</strong> (% of Companies)Recruitment/staffingWarehouse managementInventory managementSales analysis and reportingEnterprise resource planning ...Vendor managementProduction mgt (product ...69%67%67%58%56%54%53%0% 20% 40% 60% 80%037

In the U.S., when we looked at the applications that were least frequently shifted to thecloud from on-premises computers, several of them were applications that often storehighly sensitive data:Legal-related – legal management solutions (which can contain the status of lawsuitsagainst a company)Employee-related – compensation planning (employee salaries) and payroll/time andattendance systems (which, of course, in the U.S. can have Social Security information)Product-related – product testing systems (which often compile data on productefficacy and of course reveal a company’s product launches), and pricing andpromotions systems (which,in competitors’ hands, can tipoff pricing changes)Customer-related - customerloyalty (which can revealb u y i n g p r e f e r e n c e s ) ,customer/market researchapplications, E-commerce,and customer analytics - all ofwhich can risk customerp r i v a c y a n d p r o v i d ecompetitors with usefultargeting informationRisk-related – risk assessmentand monitoring systems,which compile data on acompany’s most vulnerableactivitiesIn all five areas, less than 20% ofcompanies had shifted onpremisesapps to the cloud (seeExhibit VI-2).Exhibit VI-2US (2011): Applications Least Frequently Shifted -fromOnPremises Technology to the <strong>Cloud</strong> (% of Companies)Legal management solutionsE-commercePricing and promotionsCustomer analyticsSocial media data collection and analysisPlant maintenanceCompensation planningPayroll/time and attendanceProduct testing13%16%15%15%18%17%17%17%17%Risk assessment and monitoringCustomer loyalty programsField service/repair12%11%11%Customer/market research6%0% 5% 10% 15% 20%038

<strong>The</strong> Most and Least Popular <strong>Cloud</strong> ApplicationsStill, that doesn’t mean that all customer data is being kept out of the cloud. For U.S.companies’ customer service applications, 42% have shifted customer order-entrysystems from on-premises technology to the cloud. And 37% have moved their archivedcustomer records to the cloud. (See Exhibit VI-3.)Exhibit VI-3US: Customer Service Applications Most FrequentlyShifted from On-Premises Technology to the <strong>Cloud</strong> (% of Companies)Customer product usage tracking26%37%Online customer communities37%63%Post-sales service inquiries37%53%Customer order entry42%58%Archival of customerrecords/company content37%63%0% 10% 20% 30% 40% 50% 60% 70%2014: Expect to Shift Other On-Premises Customer ServiceApplication(s) to <strong>Cloud</strong> by end of 20142011: Have Shifted an On-Premises Customer Service Application(s) to<strong>Cloud</strong> or Will Have Shifted by End of 2011039

In addition, the numbers in the chart above indicate that many companies’ fears aboutputting customer records in the cloud are likely to subside. When asked what customerservice applications they expected to be in the cloud by 2014, the majority expectedto shift their customer order entry, archives of past customer records, post-sales inquiriesand online customer communities from on-premises to cloud-based applications.In looking at marketing applications, we found such hesitation to put customer data in thecloud looks like it will decline by 2014. At least half of U.S. companies plan to shift customerresearch, e-commerce, customer analytics and social media data to the cloud by then. Andeven 39% of companies say they’ll shift customer loyalty systems to the cloud by 2014.(See Exhibit VI-4.)Exhibit VI-4US: Marketing Applications Most Frequently Shifted from On-PremisesTechnology to the <strong>Cloud</strong> (% of Companies)External publications28%39%Website hosting28%44%Advertising22%39%Marketing campaign management22%56%Customer analytics17%50%Social media data collection and analysis17%50%E-commerce (product sales from website)17%56%Pricing and promotionsCustomer loyalty program/customer databasemarketing11%17%39%56%Customer/market research6%56%0% 10% 20% 30% 40% 50% 60%2014 2011040

<strong>The</strong> Most and Least Popular <strong>Cloud</strong> ApplicationsDell: Riding a Tsunami of New <strong>Cloud</strong>-Based Marketing ToolsAs the computer company that became known worldwide for its direct model, Dell Inc.has had to master the Web, email and other online marketing tools to get customers in thefold and keep them there. Of course, the company has much to boast about, growing froma concept in the University of Texas dorm room of founder Michael Dell to a multibilliondollarjuggernaut of the global technology industry in less than 30 years.But now comes the cloud. It ushers in a whole new set of online tools that serious onlinemarketers such as Dell must experiment with. In fact, Dell has adopted a marketingstrategy for public and large enterprises that puts cloud applications at the center of itschannels to customers. “<strong>The</strong> cloud is very appealing to us,” says Rishi Dave, executivedirector of online marketing for Dell’s large corporate, public and government enterprisedivision. “I live in constant paranoia of innovation overtaking us in the online space. So weconstantly are reviewing, evaluating, and testing new offerings from cloud providersto see who is at the leading edge so that we are using the latest, greatest marketing tools.”Online marketing has become a blood sport, especially in the computer industry.Competition in the IT market has become so fierce that products are quicklycommoditized and margins rapidly squeezed. Hundreds of millions of dollars ride everyweek on whether a technology company can troll the vast World Wide Web looking forenterprise customers ready to change vendors. A snarky comment in a LinkedIn orFacebook group, a complaint Tweeted for all to see, and other digital droppings can leada company like Dell to identify a ripe prospect – or a customer ready to defect.Before the advent of social media, the ways companies like Dell used software to trackwhat was being said about them on the Web, in calls with customer reps, and in emails. Butthe world of marketing applications has changed dramatically. Dell uses Salesforce.com tomanage its CRM efforts. And now the Round Rock, Texas-based IT giant is also using othercloud vendors’ marketing-related applications. “This means we can innovate morequickly,” says Dave.He is experimenting with cloud-based gamification - as Wikipedia defines it, “the useof game design techniques and mechanics to solve problems and engage audiences” -to both entertain and enlighten current and prospective customers. <strong>The</strong> company seesgamification as important for getting rapid feedback on new products and marketingcollateral.041

Gamification Delivered in the <strong>Cloud</strong>: <strong>The</strong> New Dell MarketingToolA great example of how Dell drove results fast with cloud-based marketing applicationscame at its first annual conference for global customers, Dell World, held last October inAustin. Four months prior to the conference, Dave and other online marketers at Delldecided they needed a novel way of interacting with attendees, one that would engagethem more deeply and give Dell a deeper understanding of what solutions customerscared about. Working with a cloud-based gamification vendor, Dell used mobilegamification to reward attendees for downloading Dell content at the event, sharing itwith their peers, and letting others know about it through sending out Tweets, visitingphysical locations at the conference, and exchanging contact information.A big advantage of working with a cloud vendor for the game application was that Dell’sonline marketing group didn’t have to request a system that would touch the company’sinternal IT infrastructure.<strong>The</strong> Biggest Barriers to Adopting Whole New <strong>Cloud</strong>Applications: Giving Up Control and Changing the Way DellMarketsIn working with vendors of cloud-based marketing applications, Dell has had to learn howto deal with a new set of business partners – many of which are small startup companiesthat need to handle a large, global firm. “When you no longer own the technology, youhave to be much better at managing cloud vendors and developing partnerships,”explains Dave, who says the firm evaluates as many as a dozen cloud marketingapplication vendors at any one time. “You have to have a process to identify the rightpartners, and you have to learn to relinquish total control.” In contrast to marketingapplications built internally (over which Dell can determine every feature, function andinterface aspect of the software), using cloud vendors’ marketing applications means Dellmust give up control of product features, look and feel.This, in turn, means Dave and his team must carefully evaluate whether Dell can change itsmarketing processes to take advantage of a promising new cloud-based marketingapplication. “It is relatively easy to identify new tools but a big challenge lies in absorbingthem,” he says. “This requires looking at it from an internal business process perspective.”<strong>Cloud</strong> applications that require too many internal changes – or vast amounts of training tomaster it – have a much higher barrier to adoption. “A limiting factor is how much training,additional resources, and process changes are needed. Also, providers must eventually beable to scale their capabilities as their organizations grow.”042

<strong>The</strong> Most and Least Popular <strong>Cloud</strong> ApplicationsOf course, one of the big attractions of cloud marketing applications to Dell (and many,many other companies) is turning a fixed cost (licensing marketing applications softwareand the purchase of servers to run it) into a variable cost. If the company doesn’t likea particular cloud application that it has been using to sort out sentiments aired about thefirm through social media, it simply stops using the service. Dell doesn’t have to removethe software from servers in its data center – and most of all, it doesn’t have to buy the extraservers need to run the software in the first place. Those applications run on a cloudvendor’s software.All in all, Dell sees cloud-based marketing tools as critical to effective marketing in thepresent and future. Online marketing chief Dave believes that cloud vendors sellingapplications for mobile phones, tablet computers and other highly portable digitaldevices will be especially important to Dell given that its large-company customers doa large and increasing share of their daily tasks through such devices.“We constantly trial cloud providers to see who is developing the latest tools,” Dave says.“Our use of such tools will absolutely grow. And as we ramp up our mobile strategy, cloudbecomes critical.” As a case in point, he and his team are already thinking about creatinggames for the next Dell World conference that can be played on any digital interface –smartphones, tablets and PCs.043

041VII. Differences in <strong>Cloud</strong> AdoptionAcross Global Industries

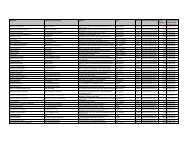

Differences in <strong>Cloud</strong> Adoption Across Global IndustriesWe asked our survey respondents (who worked in a variety of business functionsin addition to IT) to indicate the average number of cloud applications that their functionhad been using in 2011. We then looked at their answers by industry in all four regionscombined (in order to get larger industry samples). We had large enough industry samplesto report on 16 major sectors.Exhibit VII-1Comparing Global Industries by Average Number of <strong>Cloud</strong>Applications Per Company/Industry (2011)Computer/electronics/telecom equipment mfgFinancial services/banking/insuranceIndustrial manufacturingTelecom servicesAutomotiveAerospace & DefenseConsumer products manufacturingTransport/logisticsRetailComputer softwarePharmaceuticalsMedia/entertainment/sportsMetals & MiningEnergy & utilitiesChemicalsHealthcare services3.63.396.816.376.185.835.745.75.655.485.255.14.834.434.458.540 1 2 3 4 5 6 7 8 9Average # of <strong>Cloud</strong> Apps per Business Function (2011)045

<strong>The</strong> industries’ usage of cloud applications per function ranged from 8.54 at the high end(in computer/electronics/telecommunications equipment manufacturing) to 3.39 at thelow end (healthcare services/providers). (See Exhibit VII-1.) For 2011, the industries withthe greatest number of cloud applications per business function were:Computer/electronics/telecom manufacturing (by far the largest number of cloudapps per function)Financial services/banking/insuranceIndustrial manufacturingTelecommunicationsservices (carriers)Industries with the fewest number of cloud apps per function were healthcare services,chemicals, energy and utilities, metals and mining, and media/entertainment/sports. <strong>The</strong>media industry’s relatively low adoption of cloud computing may reflect its reluctance toput its intellectual property in the cloud – particularly, public clouds – for fear of digitaltheft.We also asked the survey respondents to project how many additional cloud applicationsthey expected their business function to have by 2014 – applications not including thosetoday. We thus were able to calculate their projections on the total number of cloudapplications that they expected to see in their functional area. <strong>The</strong> range of thoseapplications/function went from 9.25 to 19.4 – effectively a doubling of apps/functionat the high end and a nearly tripling of apps/function at the low end.Once again the industries expecting the largest number of cloud apps/function were thesame four: computer/electronics/telecom equipment manufacturing, telecom services,financial services and industrial manufacturing.However, the projections of the retail and transportation/logistics survey respondentswould have them vaulting higher in the list by 2014 – over automotive,aerospace/defense and consumer products manufacturers.046

Differences in <strong>Cloud</strong> Adoption Across Global IndustriesExhibit VII-2Comparing Global Industries by Average Number of <strong>Cloud</strong>Applications Per Company/Industry (2014 Projected)Computer/electronics/telecom equipment mfgTelecom servicesFinancial services/banking/insuranceIndustrial manufacturingTransport/logisticsRetailAerospace & DefenseComputer softwarePharmaceuticalsConsumer products manufacturingAutomotiveMetals & MiningEnergy & utilitiesHealthcare servicesChemicalsMedia/entertainment/sports19.4217.9617.5615.2414.3313.5513.3513.3313.2513.2313.1612.3610.8710.789.739.250 5 10 15 20 25Industry Leaders in <strong>Cloud</strong> Apps/Function (2014) Total <strong>Cloud</strong> Apps per Function047

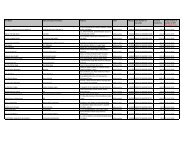

Heavier Users of <strong>Cloud</strong> Applications Get Bigger BenefitsIn addition to wanting to know which industries were heavier users of cloud applicationsthan were other industries, we wanted to know which sectors were better users of thecloud. It turned out that the industries with higher numbers of cloud apps per function in2011 were industries that were enjoying greater benefits from cloud applications – boththose that were shifted from on-premises computers and those that were entirely newapplications made possible by the cloud.To better understand which industries were generating the most value from cloudapplications, we analyzed our data by first rolling up the responses across all four regionsof the world and then categorizing them by industry. That left us with 16 industrysegments with at least 12 respondents per industry. We then sorted these respondentsout by understanding which ones finished in the upper or bottom quartile of resultsto date from cloud applications. That left us with “leaders” and “laggards” in each industrysector based on who had generated the greatest benefits from: sector based on who hadgenerated the greatest benefits from:<strong>Cloud</strong> apps they have shifted from on-premises computers. <strong>The</strong> “leaders” here werecompanies that had generated the greatest improvements in such metrics as IT costreductions, increases in standard apps and business processes, cycle-time reductionsin ramping IT resources up or down and in application enhancements, reductionsin system downtimes and application fixes, and increases in analytics reports.Entirely new cloud apps for which they had no on-premises predecessors. <strong>The</strong>se“leaders” finished in the upper quartile of aggregate benefits in percent increase in newbusiness processes tested and launched, percentage increases in newproducts/services tested and launched, annual revenue increases from new offeringsin existing markets, and cycle-time reductions to enter new markets.Industry by industry, in each of the two areas above, we looked at which ones had a largerpercentage of “leaders” than “laggards.” <strong>The</strong> findings revealed several surprises.Industry Leaders and Laggards in Shifting On-Premises Appsto the <strong>Cloud</strong><strong>The</strong> industries with a much higher percentage of “leaders” than “laggards” were:Automotive (31% of whom were “leaders” and 19% were laggards)Computer/electronics/telecom equipment (29% vs. 17%)Aerospace & defense (29% vs. 19%), andBanking/financial services/insurance (29% vs. 19%).In contrast, the industries with much higher percentages of laggards than leaderswere:Pharmaceuticals (15% were “leaders” vs. 40% that were “laggards”)Media/entertainment/sports (17% to 33%), andEnergy& utilities (21% to 33%)048

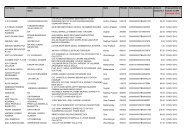

Differences in <strong>Cloud</strong> Adoption Across Global IndustriesExhibit VII-3Global Industry Leaders and Laggards (in % of Companies with Upperand Lower Quartile Results) from Shifting On-Premises Applicationsto the <strong>Cloud</strong>Computer hardware/electronics/telecom …AutomotiveAerospace & DefenseBanking/Financial Services/InsuranceRetailersIndustrial manufacturersConsumer products manufacturingHealthcare servicesMetals & MiningTelecommunications servicesChemicalsTransportation/logisticsComputer softwareEnergy & UtilitiesMedia/entertainment/sportsPharmaceuticals17%19%19%19%21%22%27%21%21%18% 22%20% 27%24%17% 25%21%15%17%29%31%29%29%29%29%33%33%33%32%33%33%40%-30% -20% -10% 0% 10% 20% 30% 40% 50%Differential (% + or -) % of industry sector that are leaders% of industry sector that are laggards049

Industries Leaders and Laggards in Putting New Applicationsin the <strong>Cloud</strong>We did a similar analysis of leaders and laggards by industry around the data on benefitsachieved to date from launching entirely new applications in the cloud. A different set ofindustries emerged as leaders and laggards here – including leaders that had beenlaggards in benefits from shifting existing apps to the cloud, and laggards that had beenleaders.<strong>The</strong> industries on this metric with the highest ratios of leaders to laggards were:Computer hardware/electronics/telecom equipment (46% were leaders and 33% werelaggards)Media/entertainment/sports (42% to 33%)Telecommunications services (33% to 24%)Transportation/logistics (35% to 26%)Technology-enabled innovations in products and services are critical to all four of theabove industries, and perhaps that’s why they have more leaders than laggardsin launching new cloud applications. In the computer industry, Dell Inc. is one of a numberof companies that are tapping cloud services to market products and services to bothenterprise and consumer customers. (See case study on Dell on p. 41.) In the mediaindustry, educational publishing and testing companies like CTB/McGraw-Hill havebecome highly dependent on scalable technologies that enable them to shift the deliveryof their content from print to online. CTB/McGraw-Hill is looking at cloud-based models asa highly cost-effective way to host its public and private school student assessmentexams. (See case study on CTB/McGraw-Hill, p. 22.)In contrast, five industries had a much greater number of laggards than leadersin generating benefits from entirely new applications they put in the cloud:Pharmaceuticals (25% were leaders vs. 55% that were laggards)Healthcare services (22% vs. 50%)Computer software (8% vs. 33%)Automotive (19% vs. 39%)Chemicals(20% vs. 38%)050