Practice Note No 04/2004 Date of Issue 15th December 2004 ... - TRA

Practice Note No 04/2004 Date of Issue 15th December 2004 ... - TRA

Practice Note No 04/2004 Date of Issue 15th December 2004 ... - TRA

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

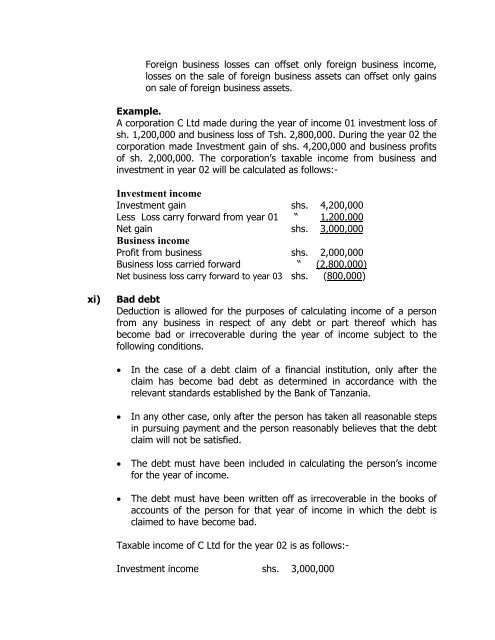

Foreign business losses can <strong>of</strong>fset only foreign business income,losses on the sale <strong>of</strong> foreign business assets can <strong>of</strong>fset only gainson sale <strong>of</strong> foreign business assets.Example.A corporation C Ltd made during the year <strong>of</strong> income 01 investment loss <strong>of</strong>sh. 1,200,000 and business loss <strong>of</strong> Tsh. 2,800,000. During the year 02 thecorporation made Investment gain <strong>of</strong> shs. 4,200,000 and business pr<strong>of</strong>its<strong>of</strong> sh. 2,000,000. The corporation’s taxable income from business andinvestment in year 02 will be calculated as follows:-Investment incomeInvestment gain shs. 4,200,000Less Loss carry forward from year 01 “ 1,200,000Net gain shs. 3,000,000Business incomePr<strong>of</strong>it from business shs. 2,000,000Business loss carried forward “ (2,800,000)Net business loss carry forward to year 03 shs. (800,000)xi)Bad debtDeduction is allowed for the purposes <strong>of</strong> calculating income <strong>of</strong> a personfrom any business in respect <strong>of</strong> any debt or part there<strong>of</strong> which hasbecome bad or irrecoverable during the year <strong>of</strong> income subject to thefollowing conditions.In the case <strong>of</strong> a debt claim <strong>of</strong> a financial institution, only after theclaim has become bad debt as determined in accordance with therelevant standards established by the Bank <strong>of</strong> Tanzania.In any other case, only after the person has taken all reasonable stepsin pursuing payment and the person reasonably believes that the debtclaim will not be satisfied.The debt must have been included in calculating the person’s incomefor the year <strong>of</strong> income.The debt must have been written <strong>of</strong>f as irrecoverable in the books <strong>of</strong>accounts <strong>of</strong> the person for that year <strong>of</strong> income in which the debt isclaimed to have become bad.Taxable income <strong>of</strong> C Ltd for the year 02 is as follows:-Investment income shs. 3,000,000