Practice Note No 04/2004 Date of Issue 15th December 2004 ... - TRA

Practice Note No 04/2004 Date of Issue 15th December 2004 ... - TRA

Practice Note No 04/2004 Date of Issue 15th December 2004 ... - TRA

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

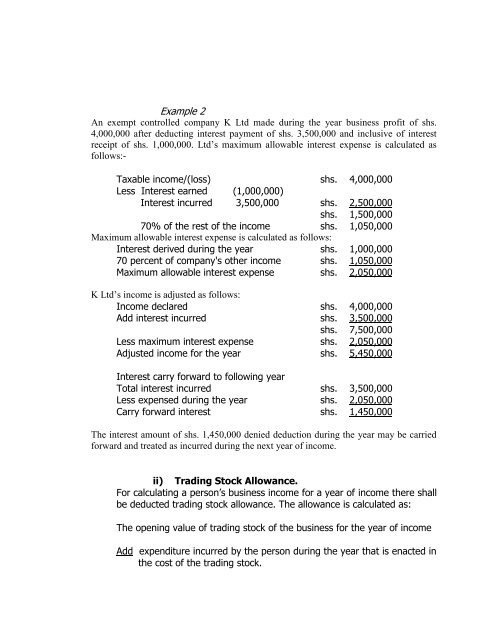

Example 2An exempt controlled company K Ltd made during the year business pr<strong>of</strong>it <strong>of</strong> shs.4,000,000 after deducting interest payment <strong>of</strong> shs. 3,500,000 and inclusive <strong>of</strong> interestreceipt <strong>of</strong> shs. 1,000,000. Ltd’s maximum allowable interest expense is calculated asfollows:-Taxable income/(loss) shs. 4,000,000Less Interest earned (1,000,000)Interest incurred 3,500,000 shs. 2,500,000shs. 1,500,00070% <strong>of</strong> the rest <strong>of</strong> the income shs. 1,050,000Maximum allowable interest expense is calculated as follows:Interest derived during the year shs. 1,000,00070 percent <strong>of</strong> company's other income shs. 1,050,000Maximum allowable interest expense shs. 2,050,000K Ltd’s income is adjusted as follows:Income declared shs. 4,000,000Add interest incurred shs. 3,500,000shs. 7,500,000Less maximum interest expense shs. 2,050,000Adjusted income for the year shs. 5,450,000Interest carry forward to following yearTotal interest incurred shs. 3,500,000Less expensed during the year shs. 2,050,000Carry forward interest shs. 1,450,000The interest amount <strong>of</strong> shs. 1,450,000 denied deduction during the year may be carriedforward and treated as incurred during the next year <strong>of</strong> income.ii) Trading Stock Allowance.For calculating a person’s business income for a year <strong>of</strong> income there shallbe deducted trading stock allowance. The allowance is calculated as:The opening value <strong>of</strong> trading stock <strong>of</strong> the business for the year <strong>of</strong> incomeAdd expenditure incurred by the person during the year that is enacted inthe cost <strong>of</strong> the trading stock.