Oilfield Equipment & Services Report 2013 - Clearwater Corporate ...

Oilfield Equipment & Services Report 2013 - Clearwater Corporate ...

Oilfield Equipment & Services Report 2013 - Clearwater Corporate ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

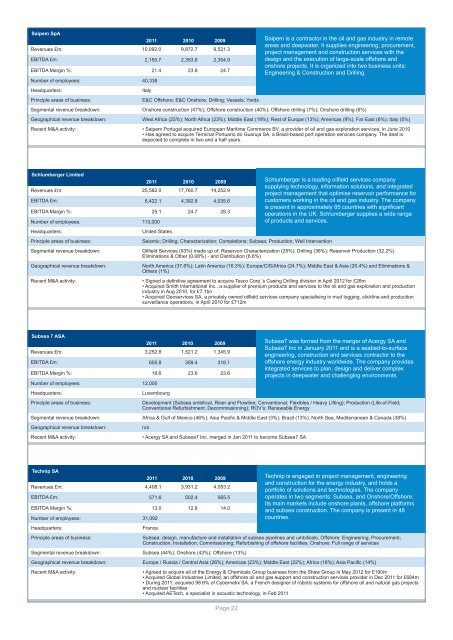

Saipem SpARevenues £m:EBITDA £m:EBITDA Margin %:Number of employees: 40,338Headquarters:Principle areas of business:201110,092.02,155.7Italy21.42010 20099,872.72,353.823.8E&C Offshore; E&C Onshore; Drilling; Vessels; YardsSegmental revenue breakdown: Onshore construction (47%); Offshore construction (40%); Offshore drilling (7%); Onshore drilling (6%)9,521.32,354.924.7Saipem is a contractor in the oil and gas industry in remoteareas and deepwater. It supplies engineering, procurement,project management and construction services with thedesign and the execution of large-scale offshore andonshore projects. It is organized into two business units:Engineering & Construction and Drilling.Geographical revenue breakdown: West Africa (25%); North Africa (23%); Middle East (19%); Rest of Europe (13%); Americas (9%); Far East (6%); Italy (5%)Recent M&A activity: • Saipem Portugal acquired European Maritime Commerce BV, a provider of oil and gas exploration services, in June 2010• Has agreed to acquire Terminal Portuario do Guaruja SA, a Brazil-based port operation services company. The deal isexpected to complete in two and a half years.Schlumberger LimitedRevenues £m:EBITDA £m:EBITDA Margin %:Number of employees: 113,000Headquarters:Principle areas of business:United StatesSeismic; Drilling; Characterization; Completions; Subsea; Production; Well InterventionSegmental revenue breakdown: <strong>Oilfield</strong> <strong>Services</strong> (93%) made up of: Reservoir Characterization (25%); Drilling (36%); Reservoir Production (32.2%)Eliminations & Other (0.08%) - and Distribution (6.6%)Geographical revenue breakdown:201125,582.06,422.125.12010 200917,760.74,392.824.714,252.94,035.628.3Schlumberger is a leading oilfield services companysupplying technology, information solutions, and integratedproject management that optimise reservoir performance forcustomers working in the oil and gas industry. The companyis present in approximately 85 countries with significantoperations in the UK. Schlumberger supplies a wide rangeof products and services.North America (37.6%); Latin America (16.3%); Europe/CIS/Africa (24.7%); Middle East & Asia (20.4%) and Eliminations &Others (1%)Recent M&A activity: • Signed a definitive agreement to acquire Tesco Corp.’s Casing Drilling division in April 2012 for £28m• Acquired Smith International Inc., a supplier of premium products and services to the oil and gas exploration and productionindustry in Aug 2010, for £7.1bn• Acquired Geoservices SA, a privately owned oilfield services company specialising in mud logging, slickline and productionsurveillance operations, in April 2010 for £712mSubsea 7 ASARevenues £m:EBITDA £m:EBITDA Margin %:Number of employees: 12,000Headquarters:Principle areas of business:LuxembourgDevelopment (Subsea umbilical, Riser and Flowline; Conventional; Flexibles / Heavy Lifting); Production (Life-of-Field;Conventional Refurbishment; Decommissioning); ROV’s; Renewable EnergySegmental revenue breakdown: Africa & Gulf of Mexico (46%); Asia Pacific & Middle East (3%); Brazil (13%); North Sea, Mediterranean & Canada (38%)Geographical revenue breakdown:Recent M&A activity:n/a20113,252.8605.818.62010 20091,521.2359.423.61,345.9318.123.6• Acergy SA and Subsea7 Inc. merged in Jan 2011 to become Subsea7 SASubsea7 was formed from the merger of Acergy SA andSubsea7 Inc in January 2011 and is a seabed-to-surfaceengineering, construction and services contractor to theoffshore energy industry worldwide. The company providesintegrated services to plan, design and deliver complexprojects in deepwater and challenging environments.Technip SA2011 2010 2009Technip is engaged in project management, engineeringand construction for the energy industry, and holds aRevenues £m:4,408.1 3,931.2 4,053.2portfolio of solutions and technologies. The companyEBITDA £m:571.6 502.4 565.5operates in two segments: Subsea, and Onshore/Offshore.Its main markets include onshore plants, offshore platformsEBITDA Margin %:Number of employees:13.031,09212.8 14.0and subsea construction. The company is present in 48countries.Headquarters:Principle areas of business:FranceSegmental revenue breakdown: Subsea (44%); Onshore (43%); Offshore (13%)Subsea: design, manufacture and installation of subsea pipelines and umbilicals; Offshore: Engineering; Procurement;Construction; Installation; Commissioning; Refurbishing of offshore facilities; Onshore: Full range of servicesGeographical revenue breakdown: Europe / Russia / Central Asia (26%); Americas (23%); Middle East (22%); Africa (16%); Asia Pacific (14%)Recent M&A activity: • Agreed to acquire all of the Energy & Chemicals Group business from the Shaw Group in May 2012 for £190m• Acquired Global Industries Limited, an offshore oil and gas support and construction services provider in Dec 2011 for £684m• During 2011, acquired 98.6% of Cybernetix SA, a French designer of robotic systems for offshore oil and natural gas projectsand nuclear facilities• Acquired AETech, a specialist in acoustic technology, in Feb 2011Page 22