AS159 Asia Today 2005 Template - Asia Today International

AS159 Asia Today 2005 Template - Asia Today International

AS159 Asia Today 2005 Template - Asia Today International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

15 - 17 April 2008Suntec, Singapore<strong>International</strong> Convention & Exhibition CentreThe <strong>International</strong> Property Investment And Development EventCityscape <strong>Asia</strong> ConferenceHear from over 85 speakers including...Cheong Koon HeanCEOUrban RedevelopmentAuthority ofSingapore, SingaporeDato’ Ikmal HijazHashimCEOIskandar RegionalDevelopmentAuthority, MalaysiaChristopher TangCEOFrasers CentrepointAsset ManagementSingaporeHeiko DavidsChief Investment OfficerRutley Russia Propertyand AssetManagement Co.,RussiaHo Kwon PingExecutive ChairmanBanyan Tree GroupSingaporeTruong Trong NghiaPresidentInvestment and TradePromotion CenterVietnamWorld Architecture CongressProf. Philip Cox AODirectorThe Cox GroupAustraliaKeith GriffithsChairman <strong>Asia</strong>AedasHong KongRaj RewalPrincipalRaj Rewal &AssociatesIndiaPaul Noritaka TangeFounderTange AssociatesJapanAkihiko HamadaSenior ExecutiveOfficer & PrincipalArchitectural DesignNikken SekkeiJapanRichard Hastilow, CBEChief ExecutiveThe Royal Institute ofBritish ArchitectsUK...and many more.6,000+ Real Estate Professionals150 ExhibitorsReal Estate Awards53+ Countries8,000 sqm ExhibitionCocktail PartyCityscape <strong>Asia</strong> ConferenceInteractive WorkshopsWorld Architecture Congresswww.cityscapeasia.com/afiGold SponsorWAC Associate SponsorFor details on how you can exhibit or sponsor at this event contact:Graham Wood (for <strong>International</strong> inquiries):Tel: +971 4 407 2581 Fax: +971 4 335 1891Email: graham.wood@iirme.comFor more information on the conferences or to register:Tel: +65 6514 3180Email: register@ibcasia.com.sg

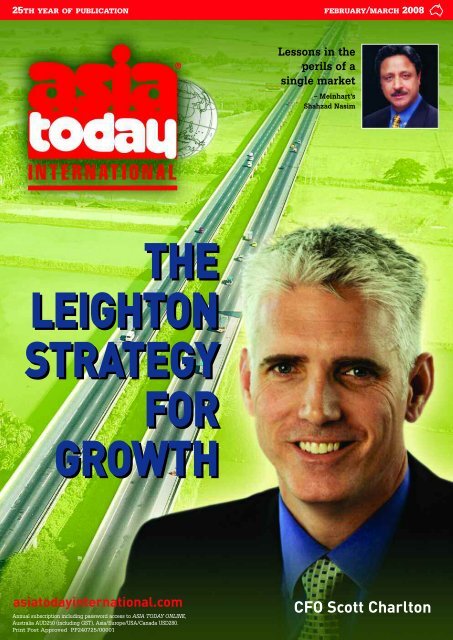

INTERNATIONALContents®COVER REPORTVolume 26 | No.1 | February / March 200825th Year of Publication11-27 ENGINEERS, ARCHITECTSLEAD OFFSHORE PUSHENGINEERING has led the growth ofAustralian professional firms offshoresince 1997, when <strong>Asia</strong>’s economicdownturn caused them to look beyond<strong>Asia</strong> – to the Middle East and even USmarkets. In our special report, we examinethe strategies of key players in infrastructuredevelopment, and emergingissues in the market, including an estimatedannual shortfall of US$200 billionin funding as <strong>Asia</strong> plays catch-up tomeet the needs of major new cities andincreasing urbanisation.Published in Australia since 1983. Published by <strong>Asia</strong> <strong>Today</strong> <strong>International</strong> Pty Limited(ABN 34 109 69 874). Office address: Level 29 Chifley Tower, 2 Chifley Square, SydneyNSW, Australia. Production Office: Suite 2a, 18-20 Waterloo Street, Narrabeen NSW 2101,Australia. Telephone (612) 9970-6477. Fax (61 2) 9913-2003. Mailing address (allcorrespondence): Box N7, Grosvenor Place Post Office, Sydney NSW 1220, Australia.E-mail . Website .11-13 GULF, INDONESIA, INDIA TO LEADLEIGHTON GROWTH – Leighton Holdingshas relocated its international Head Office toDubai, and expects the Middle East to overtakeIndonesia as its largest market outside Australia by end-2008. Chief Financial Officer,Scott Charlton, says India will also be a major market over the medium-term.13-15 KOREA LEADS ON PPPS – South Korea leads <strong>Asia</strong> in the use of the private-public partnership,but infrastructure demand could force more countries to adopt the concept.15-16 MEINHARDT GOES GLOBAL – When the Singapore marketcollapsed, Meinhardt learned not to rely on a single market, saysShahzad Nasim, the firm’s <strong>International</strong> Managing Director.17-18 VIETNAM MOVING TO HIGH-PROFILE PROJECTS – GHDCountry Manager, Glen Reinsch, says Vietnam – where GHD islooking to acquire a local business - is 10 years behind China oninfrastructure development, but will close the gap quickly.18-19 WOODHEAD PLUGS INTO AVIATION DESIGN – Australianarchitectural and design firm Woodhead <strong>International</strong> has seen itswork on Singapore’s Changi Terminal 3 bring potential new projectsin India, Vietnam and Malaysia. Design skills are also drivingrapid growth of BlueScope’s pre-engineered building division inMalaysia.20-21 NEW AVIATION ERA FOR INDIA – Air traffic in India is growing by 25 per cent annually,with the Government scrambling to upgrade aviation facilities through PPPs.22-23 LINKING THE GREATER MEKONG – New highways and railways will open up vastareas of Vietnam, Laos, Cambodia, Thailand, Myanmar and parts of China. In Korea,incoming President, Lee Myung Bak, is fast-tracking a US$15 billion Seoul-Busan canal.OPINIONLeighton’s Scott Charlton – Happyto contribute equity as part of awinning strategy.Shahzad Nasim– Taking on theglobal market.ADDRESSINGTHE BUSINESSISSUES THATMATTER . . .ASIA TODAY INTERNATIONALMagazine offers a differentperspective on <strong>Asia</strong>. We lookforward, assessing issueswith potential to impact onexisting and potential business.We draw views andperspectives from <strong>Asia</strong>’s mostinfluential business and government leaders -decision-makers and policy-makers. We identifyemerging business opportunities.SUBSCRIBE TODAY!Address to ASIA TODAY INTERNATIONALReply Paid 7, Grosvenor Place, NSW 1219AUSTRALIA. Or fax (61 2) 9913-2003.Please enter my subscription toASIA TODAY INTERNATIONAL andASIA TODAY ONLINE for one year.I enclose a cheque/credit cardauthorisation for $250.00 (inc GST),or US$280 (airmail outside Australia).Bill me laterTitle: Mr Mrs MsName: ______________________________________________________________________Company:____________________________________________________________________Address:___________________________________________________________________________________________________________Postcode: ______________________________Email:_______________________________________________________________________Am. Express Visa Mastercard DinersAccount number:Cardholder’s Name:5-6 PROPHECY AND ANALYSIS – Will the Soros prophecy panic the Mumbai andShanghai markets? THAKSIN POWER – Will incoming Prime Minister SamakSundaravej really be running Thailand at all?Expiry Date: /THE REGIONSignature:7 SUB-PRIME FALLOUT – S&P says a’triple-whammy’ is coming for <strong>Asia</strong>n banks;Moody’s says <strong>Asia</strong>n central bankers are fence-sitting on rates; The EconomistIntelligence Unit believes emerging markets will offset an OECD credit crunch.<strong>Asia</strong> is ourbusinessINTERNATIONALONLINEAll contents copyright © ASIA TODAY INTERNATIONAL 2008ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008 | 3

•••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••Leighton - hard at work in<strong>Asia</strong> & the Arabian Gulf•••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••The Leighton Group - Australia’s largest project developer and contractor - has enjoyedworking in <strong>Asia</strong> for over 35 years. In that time, the Leighton Group’s operating companies haveundertaken, and continue to develop, some of the largest and most complex projectsin Australia and <strong>Asia</strong>.<strong>Today</strong>, the Group has a broad footprint on the <strong>Asia</strong>n continent through Leighton <strong>International</strong>,Leighton <strong>Asia</strong> and Thiess. Our operating companies are hard at work in countries as far afield asQatar and the United Arab Emirates in the Arabian Gulf, India, Indonesia, Malaysia, Hong Kong,Macau, the Philippines, Thailand, Laos and Vietnam. Opportunities are also being considered inplaces like China, Taiwan, Korea, Mongolia and Guam.With around A$23.5 billion worth of work in hand, a strong balance sheet and over29,000 employees, the Leighton Group is looking forward to its future in <strong>Asia</strong>. To find outmore about the Leighton Group, including our current projects and prospects, pleasevisit our website at www.leighton.com.au472 Pacific Highway, St Leonards NSW 2065, AustraliaT +61 2 9925 6666 F +61 2 9925 6005W www.leighton.com.au E leighton@leighton.com.au

OPINIONCHINA, INDIA HOLD ECONOMIC KEYOFPROPHECYANDANALYSISIS THE WORLD returning toan equilibrium of 200 yearsago, when China and Indiadrove the global economy . . .ANALYSISAlistair Nicholas*“Prediction is very hard, especially aboutthe future.” – Niels Bohr, Danish physicistand Nobel Prize winner.❝ The Soros prophecycould set panic into theMumbai and Shanghaimarkets ❞BEIJING – With many pundits forecastinga bleak year ahead for the world economy,off the back of the US sub-prime housingmarket collapse and consequent downturn ofstock markets – from New York to London toTokyo to Shanghai to Sydney – is there anysilver lining to the economic doom and gloom?With the news getting more dismal day-bydayso early in the New Year, it would appearnot. Some, including finance wiz GeorgeSoros, have even ventured that the worst globalrecession in 60 years has already commenced.Soros’ view is the most interesting.Because, while he accepts that domestic consumptionin key emerging markets – primarilyIndia and China – could help stave off a worldwiderecession, Soros has muted concernsthat the rebalancing of the international economicpower could lead to political tensionsthat would “plunge the world into recession orworse”.Soros makes his remarks in an Op-Ed, publishedby the Financial Times of January 23.Soros’ thesis is that a recession impactingthe West, particularly the US, could see aresurgence of protectionist trade policies thatcould severely impact the global economywith a prolonged recession. Scary stuff.Unfortunately, Soros did not elaborate afterdropping this bombshell.The US Presidential election notwithstanding,there is little reason to presume a recessionhitting the US and other Western nationswould result in recidivist protectionism.Indeed, even if the ultimate Democrat orRepublican candidates for the White Housebecome born-again protectionists, there is littlereason to believe their new-found faithwould carry into the Presidency. And, even ifit did, that the impact on the world economywould be as big as Soros suggests.China and India both continue to post phenomenalgrowth rates. More importantly, theirgrowth rates now result from two factors thathave become more important than their tradewith the US or Europe.The first of these is domestic consumption.Indeed, part of the US economy’s woes havebeen created by record oil prices – whichpushed past US$100 a barrel preciselybecause India and China’s huge energydemands are placing considerable pressureon supply.Secondly, Soros, and other world economydoomsayers, have failed to take into accountthe growing importance of intra-regionaltrade for both China and India. Both countriesnow conduct more trade with the rest of theregion than with either the US or Europe.While a North American and WesternEuropean slowdown would certainly impactboth nations, it is unlikely to drive them intofull-blown recession. Figures released onJanuary 24 show that China grew by 11.4 percent in 2007, marking 13 straight years ofdouble-digit growth. The Central Governmentin Beijing has been struggling to slow growthfor several years, and a slowdown of Westerneconomies may now assist it in bringing economicgrowth to manageable levels.While India is less desirous of slowergrowth, it, too, is unlikely to take a major blowfrom the West’s woes. India is experiencinggrowth of nine per cent, and is forecast to surpassBritain’s economy in a few years.Rather than either of these economiesbeing massively affected by economic policiesof the US or EU countries, we are probablyreturning to an economic equilibrium of200 years ago, when India and China drovethe world economy. Back then, European andAmerican powers dispatched envoys andwarships to pressure these two to open theirdoors to foreign trade.It is presumptuous to think the US can nowafford protectionist policies when hit by aneconomic downturn. More likely, US (andEuropean) trade representatives will be callingon Beijing and New Delhi with their capsfirmly in hand for trade concessions from theworld’s rising economic stars.The only fear now is whether Soros’ vainglorious prediction could itself plunge theworld into “economic recession or worse”.Sometimes, the world would be better off ifseers kept their prophecies to themselves. Butnow that George Soros has put his moniker tosuch a dismal prediction, it could set panicinto the Mumbai and Shanghai markets.If that were to transpire, no-one isequipped to predict the outcome.* Alistair Nicholas is a former AustralianTrade Commissioner and advisor to theLiberal Party of Australia. He currently headshis own public relations agency, AC CapitalStrategic Public Relations, based in Beijing.■ US sub-prime fallout, page 7.From the pages of ASIA TODAY INTERNATIONALFEBRUARY 1988 – Japan ‘recycles’ US$20 billionin aid for foreign projects; Philippines curbs softloans for industry; Indo-China a growing market foragricultural consultants; Gold lures more miners tothe Philippines.FEBRUARY 1993 – Leighton CEO Wal King saysthe Australian Government is doing too little to helpAustralian companies seeking business in <strong>Asia</strong>;Volume of infrastructure projects poised to acceleratein <strong>Asia</strong>; China economic reforms create opportunityfor foreign professional firms.FEBRUARY 1998 – <strong>Asia</strong>’s economic crisis sees areassessment of mining and infrastructure projectsand a new focus on debt and cost-cutting as bankcredit goes on hold; Coherent cyber laws a key issuefor Malaysia’s Multimedia Corridor; Worse to comeas Indonesia’s rupiah collapses.FEBRUARY 2003 – Singapore seeks to position ashigh-tech hub with 15-year, US$8.2 billion projectknown as ‘one north’; Consumers drive <strong>Asia</strong> intraregionalgrowth, with <strong>Asia</strong>, ex-Japan, tipped for 6%growth in 2003; China plans tax breaks for high-techR&D; India stumbles, IMF sees risks; Philippineswindow to 2008 to bring deficit under control.FEBRUARY 2007 – Chinese manufacturers challengingKorea in virtually every industry; Capital controlsspook Thai investors; US housing slump couldtrigger recession; Surprise economic leap for India;Infrastructure gap hits Australian manufacturers.PEOPLEPOWER,THAKSINPOWERWILL incoming Prime MinisterSamak Sundaravej really berunning Thailand at all . . .PERSPECTIVERobert Horn*BANGKOK – As January drew to aclose, Samak Sundaravej finally achieved his➔ CONTINUED PAGE 6ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008 | 5

ISSN 1445-4300OPINIONINTERNATIONALVolume 26, No. 1,February/March 2008email: asiatoday@asiatoday.com.auwww.asiatodayinternational.comPUBLISHERBarry PeartonEDITORFlorence ChongCHIEF CORRESPONDENTPhilip BowringCORRESPONDENTSHong Kong – K.K. Chadha, James Yapp, India – N.Hariharan, Rajendra Bajpai; Japan – Russell McCulloch;Korea – Peter Sylvestre; Malaysia – Zari Bukhari;Pakistan – Raja Ashgar; Philippines – Abby Tan;Singapore – Andrew Symon; Thailand – Robert Horn;Taiwan – Michael Taylor.ADVERTISINGAUSTRALIA – ASIA TODAY INTERNATIONAL, Level 29Chifley Tower, 2 Chifley Square, Sydney NSW 2000,tel (61 2) 9970-6477, fax (61 2) 9913-2003,email advertising@asiatoday.com.auASIA – Herb Moskowitz, Regional Advertising Manager,The Media Representative Company, 39th FloorExchange Square One, 8 Connaught Place, Central,Hong Kong, tel (852) 2838-8702, fax (852) 2572-5468,email herbmosk@yahoo.com.hkPUBLISHER’S REPRESENTATIVESUSA/CANADAInterMark3 <strong>International</strong> Communications, Inc.5929 Albervan Street, Shawnee, KS 66216 USA.Tel (91 3) 248-7770, Fax (91 3) 248-7771Contact: Fred Baehner,email: fbaehner@intermark3.comEUROPELIVEpr, 4th Floor, 124 Victoria Street, LondonSW1E 5LA United Kingdom. Tel (44 (0)20) 7630-1100,Fax (44 (0)870) 121-5572, email info@livepr.netContact: Ross Clarke, David Wallen.Office Manager: Khin Htwe SpalivieroProduction: Lana RoachDAILY ONLINE UPDATES – and, for subscribers, aweekly email summary of items you may havemissed. Visit www.asiatodayinternational.com orfor further details of online benefits available tosubscribers, email admin@asiatoday.com.auCOPYRIGHT© All material in ASIA TODAY INTERNATIONALis copyright. Reproduction in whole or in part is not permittedwithout written permission of the publisher.Member of Circulations Audit BoardAverage nett circulation, 9,065 copies perissue (six months to September 2007)®➔ FROM PAGE 6lifelong ambition of becoming Prime Ministerof Thailand. His People Power Party had wonthe most seats during national elections onDecember 23 – the first since a military coupousted the former Prime Minister, ThaksinShinawatra, in September 2006. Now, the 72-year-old Samak, with Thaksin's help behindthe scenes, has drawn five other political partiesinto a Coalition government.But even as he assumed the premiership,Samak was dogged by questions overwhether or not he is the right man to runThailand at this critical and complex juncture– or whether he will really be runningThailand at all.Samak has declared himself Thaksin'snominee, and, in late January, dozens ofPeople Power Party members flew to HongKong, where Thaksin lives in self-imposedexile rather than return to fight corruptioncharges in court. The party members were inHong Kong to lobby for Cabinet posts.Stung by suggestions that he isn't the manin charge of Thailand, Samak reportedly madelast-minute changes to the Cabinet lineupdrawn up by Thaksin, before submitting it toconstitutional monarch, King BhumibolAdulyadej, for formal approval. When thisissue went to press, approval had not yetcome, so no names were formally announced."Thailand is facing difficult and complicatedtimes both politically and economically,'' saysPanitan Wattanayagorn, a political scientist atChulalongkorn University in Bangkok."Samak is already facing legitimacy questionsbecause he's Thaksin's nominee. If he and his❝ Thailand is facingdifficult and complicatedtimes, both politicallyand economically.Samak is already facinglegitimacy questionsbecause he isThaksin’s nominee ❞Cabinet aren't up to the job of solving thepolitical and economic problems, those questionsabout legitimacy will only intensify.''The post of chief concern is that of FinanceMinister. Several prominent bankers, economistsand former Finance Ministers havebeen offered the position, but turned it down.Samak is still hoping that former FinanceMinister, Virabongse Ramakura, will ultimatelyaccept, but the fallback candidate is PeoplePower Party Secretary-General, SurapongSuebwonglee, a medical doctor by training.That has failed to inspire confidence in thebusiness community, especially consideringThailand's shaky economic prospects thiscoming year.Rising oil prices, a strengthening currencythat threatens export growth, recession in akey market, the United States, and inflationrisks are all problems facing Thailand in 2008.At best, most economists are predictingfive per cent growth this year, which isinsipid in comparisonwith other economies inthe region, such asChina and Vietnam. TheBank of Thailand hasbeen struggling to keepthe national currency,the baht, steady atabout 33 to the dollar,but pressure on it to furtherappreciate ismounting.Some analysts, suchas Supavud Sai-cheau,of Phatra Securities inBangkok, believe theSamakSundaravej –declared himselfThaksin’snomineecentral bank should allow the baht to risefreely. That, in turn, would make oil importsmore affordable, and allow the bank to cutinterest rates to spur domestic consumption –which has been sluggish ever since politicalproblems began plaguing Thailand late <strong>2005</strong>.But it is exports, not consumption, that hasbeen the chief driver of the Thai economy,and upon which most industries depend.Federation of Thai Industries Chairman,Santi Vilassakdanont, is urging an interestrate cut as part of a 13-point economic actionplan he wants the new Government to adopt.Among those 13 points is a call for the centralbank to retain the capital controls thatsent the stock market plunging in late 2006.The market recovered as the controls wereeased slightly, but Santi and others are stillconcerned about currency speculators andinflows of hot money the controls wereintended to discourage.Other points in the plan are – keeping theValue Added Tax at seven per cent, with noincrease; cutting the corporate income taxrate from 30 per cent to 25 per cent; increasedtax deductions for businesses for hedgingcurrency risks; a progressive tax rate for middleand low income earners; soft loans forindustries using 75 per cent local content; abroadening of the tax payer base; accelerationof infrastructure mega-projects, such asmass transit rail lines; using two per cent ofthe Government budget for research anddevelopment; a corporate income tax cut forbusinesses using 75 per cent local content;speeding feasibility studies for constitution ofa nuclear power plant; and reform of the legalsystem.It's a massive wish list, and it remainsunclear whether or not the new Governmentwill be receptive to the suggestions.Outgoing Finance Minister, ChalongphobSussangkarn, has urged Samak and thePeople Power Party not to focus on short-termpopulist policies to win support, as they couldinflict long-term damage on the economicstability of Thialand.But the People Power Party was elected onprecisely that platform of delivering funds,loans and debt relief to the rural poor.So whoever Samak chooses as his economicczar will find it easier to meet all 13 suggestionsfrom the Federation of Thai Industries,than to heed the one word of cautionfrom Chalongphob.* Robert Horn is Bangkok correspondentfor ATI Magazine.6 | ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008

THE REGION‘Triple-whammy’coming for<strong>Asia</strong>n banks: S&PHONG KONG — <strong>Asia</strong>n banks face a"triple-whammy" as fallout from the US subprimemortgage crisis continues to wash uparound the world, according to ratings agencyStandard & Poor's.S&P says <strong>Asia</strong>n banks will incur losses fromdirect exposure to structured securities backedby or linked to US sub-prime mortgages.Their liquidity and revenue will suffer due tolinkages between local and global markets and,thirdly, the agency says, banks will feel theimpact on business or local portfolio qualitydue to economic linkages to the global system.S&P says that, while <strong>Asia</strong>n banks' directexposure to the US sub-prime mortgages islimited, a handful of institutions have "relativelysignificant exposures". These include Bankof China (China), Mega <strong>International</strong>Commercial Bank (Taiwan) and DBS Bank(Singapore).And while <strong>Asia</strong>n banks have been able toabsorb the initial waves of revaluation of USsub-prime exposure, there remains a risk of furtherwrite-downs should global market sentimenttoward such securities and underlyingsub-prime mortgage performance worsen.According to S&P, the vast majority of <strong>Asia</strong>nbanks which it rates have negligible exposure.However, there is a second group with exposureconsidered to be "somewhat significantbut manageable". This group includes a smallnumber of Taiwanese financial institutions."We currently anticipate the losses from suchinvestments will not materially damage eachindividual entity financial profile," S&P says. Itincludes Mega Bank and DBS in this group.But the agency does identify a third group,which includes Bank of China, saying that it issignificantly exposed. "These entities will bearmarket-to-market and/or credit losses on theirexposures, but their existing capitalisation andprofitability will help them cushion any adversefinancial impact with minimal or no change intheir ratings or outlooks."The agency says even banks that may nothold structured securities, but are dependenton wholesale funding from the global debt markets,especially short-term funding, will be vulnerableto liquidity pressure. "To some extent,the dichotomy between global and localdomestic currency credit markets has cushioned<strong>Asia</strong>n banks from the full brunt of the late2007 credit spread repricing."S&P notes that banks in Indonesia and thePhilippines, which have relied on foreign currencyborrowings — more than their counterpartsin other <strong>Asia</strong>n countries — could havesome difficulties in raising funds from the globalcapital market. The linkages between globaland domestic equities market will also adverselyaffect the earnings of <strong>Asia</strong>n banks.It says eventual losses will vary across themarkets, depending on the proportion of portfoliolinked to property, the effectiveness of thebank's risk management systems, and lengthand extent of property market slumps. In thisinstance, banks in China, Singapore and Indiaare relatively more susceptible.The anticipated economic slowdown in <strong>Asia</strong>in 2008 will come from a slowdown in exportsgrowth, a key factor in the economic strengthof the region. S&P says that banks in Pakistan,Korea, the Philippines and Thailand are relativelymore vulnerable to a global trade slowdownbecause of their closer dependenceon their economies.www.standardandpoors.com/ratingsdirectInflation the coreissue for AustraliaMELBOURNE – The key risk for theAustralian economy in the present global creditcrunch is domestic inflation, says ANZ Bank.With the economy booming, it is becomingincreasingly difficult to escape the conclusionthat Australia’s Reserve Bank has fallen‘behind the curve’ on inflation, the bank says.“Core inflation is already sitting at the top ofthe Bank’s 2-3 per cent target band, and is likelyto have breached it in the final quarter. Theoutlook doesn’t look pretty, either, with pricepressures evident across a number of householdstaples, including food, petrol, rents andutilities. RBA interest rate deliberations in theyear ahead are going to have to balance thethreat associated with slower growth in the USand global economies with the reality of rampantinflation. For an inflation-targetting centralbank, that’s a no-brainer”.www.anzeconomics.comCentral bankers‘fence-sitting’on rates: Moody’sHONG KONG – Most central banks in<strong>Asia</strong> have chosen to sit on the fence to betterassess their economic conditions and outlook,says ratings agency Moody’s.The biggest challenge facing central banksin 2008 is to sustain economic growth whilecurbing inflation, it says.Assessing emerging economies, Moody’ssays Bank Indonesia has decided to keep interestrates unchanged rather than resume itsmonetary easing cycle. “Given that investmentgrowth is crucial to Indonesia’s economicexpansion, Government authorities will bekeen to see interest rates continue to fall.”For the same reason, Bank of Thailand choseto sit tight (in December), but Moody’s says furtherrate cuts cannot be completely ruled out asthe central bank may need to use monetary policytools to stimulate consumption and investment,depending on how the political situationunfolds. Meanwhile, the Philippines hasentered a ‘loosening’ cycle because it is keento preserve growth amid the uncertain globaloutlook and a rising peso, which continues toSUB-PRIME FALLOUT CONTINUESthreaten export performance.Bank Negara Malaysia looks set to maintainits neutral stance, with the Malaysian economyin a very well-balanced state.Moody’s says the Reserve Bank of India looksset to leave interest rates unchanged in thenear term. “In fact, given that inflation hascooled, a loosening cycle may commencetowards the end of the year, which will help tosupport economic growth amid weakeningexternal demand. On the other hand, China willcertainly maintain a tightening bias due toconcerns about an overheating economy andheightened inflation, which has reportedly disruptedsocial stability. Interest rate hikes lookset to continue, with the PBC also likely to continuetightening reserve requirements, to controllending activity.”Heightened concerns about inflation willallow Taiwan’s Central Bank to continue itsmonetary tightening cycle, says Moody’s.The Bank of Korea in January opted to leaveinterest rates unchanged. “Amid rising externaland domestic uncertainties, the centralbank appears to have no choice but to sit pat orto risk derailing healthy economicgrowth,” the ratings agency adds.www.Moody's Economy.comEmerging marketsto offset OECDcredit crunch: EIULONDON – The credit crunch in severalkey markets, coupled with housing marketwoes, will result in a sharp slowdown in OECDeconomic growth in 2008, according to theEconomist Intelligence Unit.But the impact of this developed worldweakening on the global economy will be partlyoffset by continued robust growth in manyemerging market countries, the EIU says.Its new report, “2008: country by country”,predicts that the world’s two largest developedeconomies, the US and Japan, will be amongthe 10 slowest-growing countries in 2008. Butfour emerging market economies, includingChina, will grow at double digit pace.Continued robust economic growth will,however, will be accompanied by an unusuallyhigh level of political and economic risk during2008. Downside threats include a furtherincrease in the severity of global financial-marketwoes; strong inflationary pressures arisingfrom higher food and oil prices; a sharper-thanexpectedslowdown in world trade growth; andgeopolitical risks, including continued worriesabout Iran's nuclear ambitions, ongoing tensionsin the Middle East and political instabilityin a number of key countries.The full report is available for US$555at www.store.eiu.com.ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008 | 7

MEETING ALTERNATIVE ENERGY NEEDSTHE REGIONChina agencies signup on Australian‘hot rock’ knowhowADELAIDE – Four Chinese Governmentagencies have signed an exclusive agreementwith Australian hot rock proponent, PetrathermLimited, to identify high prospect geothermalenergy projects in China.ASX-listed Petratherm will help identify projectsbest able to exploit China’s vast geothermalresources for base-load, large-scale andemission-free sources of heat and electricity.The agreement is the first commercial stepupfor Petratherm’s entry into the world’slargest-growing energy market since theAustralian hot rock company achievedapproval, under the Federal Government’s <strong>Asia</strong>Pacific Partnership Programme, to undertake aunique renewable energy initiative in China.Petratherm will work on a co-operative projectover the next 12 months with four ChineseGovernment institutions – the ChinaGeothermal Energy Society; the ChineseGeological Survey; the Chinese Academy ofSciences; and the China Institute of Geo-Environment Monitoring.Petratherm’s Managing Director, Terry Kallis,describes the project as a major opportunity forAustralian geothermal know-how to ultimatelymake a substantial contribution to global greenhousegas abatement. “Significantly, the intellectualproperty generated by the project will bejointly owned by Petratherm and the fourChinese agencies,” he says. “We also retain theright to bring in joint venture partners, as andwhen required, to develop those geothermalprojects we identify over the next year asexhibiting the earliest commercial opportunity.Kallis says China boasts more than 40 recordedgeothermal sites, some with the potential toproduce around 1400 megawatts of power.www.petratherm.com.au/Nanjing base forglobal sales ofVmoto scootersPERTH – An Australian company hasbegun construction in Nanjing, China, of anadvanced scooter assembly plant, targettingannual revenue of more than AUD100 million by2011 for ASX-listed Vmoto Limited.Stage 1 of the 10,000 sq m plant is expectedto be operational by mid-year. Stages 2 and 3,will provide capacity for 200,000 scooter andengine units annually for export to Vmoto’sglobal client base in more than 100 countries.Vmoto’s Managing Director, Patrick Davin,says Vmoto is one of the few independent foreign-ownedenterprises given approval toestablish and operate such facilities in China.Pre-orders account for the entire 15,000 scooterrun in the Nanjing plant’s maiden start-up period.Vmoto earlier acquired the Shanghai-basedFreedomotor Company Limited, one of China’slargest independent distributors and exportersof scooters, motorcycles, ATVs and hi-performanceoff-road karts. Freedomotor has distributionrights in more than 50 countries.AUSTRALIAIN ASIAINDIA ADOPTING HYDROGEN-GAS BLENDPERTH – A decision by the IndianGovernment to have a fifth of the country’svehicles running by 2020 on new, lower emissionhydrogen-gas fuel blends, has been welcomedby an Australian company at the forefrontof developing and marketing such fuels.ASX-listed Eden Energy says the decision isa significant boost to it’s first-mover advantagein establishing a competitive foothold in alternativelow-emission fuel supplies for India’stransport and power generation markets.“We have been actively and successfully promoting,marketing and trialling Eden’sHythane® fuel, a blend of hydrogen andmethane gas, in India for two years now,” saysEden’s Executive Chairman, Greg Solomon. Headds that India is expected to lead world conversionrates in the next 10-12 years to alternativefuels, particularly hydrogen-based blends.“The Government’s decision sends a clearsignal that India’s energy economy will becomeincreasingly hydrogen-focussed”, Solomonsays. “That can be expected to precipitate arush for fuel technologies able to service publictransport needs and both back-up and base-loadpower generation requirements.“The pace at which these technologies andfuel blends is introduced will burgeon in theCBA Branch forHCMC in AprilSYDNEY – Commonwealth Bank ofAustralia has won approval from the State Bankof Vietnam to open a branch in Ho Chi MinhCity, the bank’s first in Vietnam.Garry Mackrell, Commonwealth Bank GroupExecutive, <strong>International</strong> Financial Services,said that, with some 300,000 Vietnamese peopleliving in Australia – one of the largest populationsoutside Vietnam itself – and moreAustralian visiting Vietnam every year, thenew presence represents a strong opportunityfor the Bank. "Vietnam continues to be animportant economic partner to Australia,” hesaid. The Branch is expected to open in April.very near term because of a campaign by manyIndian states to rush the roll-out of gas distributionnetworks able to service fuel-blenddemand.” The Government decision to targethaving all natural gas-powered vehicles runningon a mixture of hydrogen and natural gaswithin 12 years is expected to impact one millionvehicles, 20 per cent of the market.Eden’s drive into India’s alternative energymarkets has already seen the Perth-based companysecure agreement with the major Indianengine manufacturer, Ashok Leyland; GujaratState Petroleum, one of India’s largest Stateownednatural gas producers and retailers; andthe world-ranked Larsen & Toubro, the largestengineering group in India. The agreementwith L & T covers the manufacture and marketingthroughout India of Eden’s entire range ofhydrogen and Hythane® technologies.The Ashok Leyland partnership is a 10-yearagreement to develop Hythane® versions ofAshok’s natural gas bus engines (Ashok currentlymanufactures more than 11,000 busesyearly and provides the major share of all metropolitanState transport buses in India).The agreement with Gujarat State PetroleumCorporation provides for joint demonstrationand promotion of Hythane® as a vehicle fuel.Westpac Branchopen in ShanghaiSHANGHAI – Australia’s WestpacBanking Corporation has opened a Branch inShanghai following approval from the ChinaBanking Regulatory Commission. Westpac hashad a permanent presence in China since 1982through its representative office in Beijing.Westpac General Manager, <strong>Asia</strong>, YoganRasanayakam, said that, given the deep tradinglinks between China, Australia and NewZealand, it made good business sense to establisha Branch in China’s financial capital. “Inparticular, it will assist customers who are benefittingfrom China’s demand for Australia’sresources and New Zealand’s agricultural products,”he said.ANL, USL realignthree trade-lanesMELBOURNE – U.S. Lines (USL) andANL have made a major realignment of theirservice structure in three key tradelanes.USL & ANL’s joint service will turn its shipsNorthbound from Australia and New Zealand.They will no longer operate the presentTriangle Service around the Pacific Rim, butinstead will initiate a dedicated North/Southservice from Oakland/Los Angeles to/fromAustralia/New Zealand. John Lines, ManagingDirector of ANL, says the initiative will significantlyimprove Northbound transit times fromAustralia, and will, for the first time, offer acompetitive alternative to exporters from NewZealand to the US West Coast.USL & ANL will transfer their Transpacificvolumes aboard CMA-CGM’s Pearl RiverExpress service effective mid-February, with a12-day transit from South China to LA. ThePearl River Express provides weekly fixed daysailings from Xiamen, Chiwan, Hong Kong,and Yantian, direct to Los Angeles andOakland.8 | ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008

Step in ZERO - it’s the way of the future<strong>International</strong> professional services company, GHD, recently showcased what can be achieved in anAppropriately named ‘zero’, the building concept was unveiled at GHD’s world-class sustainabilityforum, titled OUR PLANET - LEAVING A LEGACY, where the Keynote Presenter was The HonourableThe design was evaluated according to the Green Star rating system, a framework developed bythe Green Building Council of Australia as a comprehensive, national, voluntary environmental ratingThe design benchmarks current best-pactice building design worldwide and has improved theseAt GHD we believe innovation and creativity is needed to overcome the challenges that are facingFor more information please contact:Jeff FokGHDT 852 3658 8000 F 852 3658 8088 EW

BUSINESS ACTIONTHE MONTH IN REVIEWThe informationheartbeat of <strong>Asia</strong>ASIA PULSE is a jointventure involving theresources of (AAP) – AustralianAssociated Press Pty Ltd(Australia); (ANTARA) – LKBNANTARA (Indonesia); (CNA) –Central News Agency (Taiwan);(DPM) – DubaiPhotoMedia (Dubai);(IRNA) – Islamic Republic NewsAgency (Iran); (Nikkei) – NihonKeizai Shimbun Inc (Japan); (ONA)– Oman News Agency (Oman);(Pacnews) – Pacific Islands NewsAssociation; (Pajhwok) – PajhwokAfghan News (Afghanistan);(PNA) – Philippines News Agency(Philippines); (PPI) – PakistanPress <strong>International</strong> (Pakistan);(PTI) – The Press Trust of India Ltd(India); (TCA) – Times of Central<strong>Asia</strong> (Central <strong>Asia</strong>); (UNB) – UnitedNews of Bangladesh (Bangladesh);(UzReport) – UzReport.com(Uzbekistan); (VNA) – VietnamNews Agency (Vietnam); (XIC) –Xinhua Information Centre(China); (Yonhap) – Yonhap NewsAgency (Korea); and sources inMalaysia and Singapore.INDONESIA TO BOOSTSHARIA ECONOMYJAKARTA – The President of Indonesia, SusiloBambang Yudhoyono, said the Government willinclude sharia economy in the national agendathis year to boost development. Yudhoyonopledged that the Government will remove legalrestrictions hampering development of thesharia economy. He said he was optimistic thetarget for the sharia banking industry set byBank Indonesia could be achieved. He askedthe Ministries of Justice, Finance and ReligiousAffairs to speed up preparation of a draft law onsharia State securities.© <strong>Asia</strong> Pulse Pte Ltd.CHINA’S CENTRAL BANKRAISES RESERVE RATIOBEIJING – China's central bank raised therequired reserve ratio for commercial banks byhalf a percentage point as of January 25. Theratio went to 15 per cent, the highest since1984. This increase, the first this year, comes amonth after the ratio was raised by a percentagepoint on December 25. The People's Bank ofChina said the adjustment, part of its stringentmonetary policy, is to draw back excess liquidityat banks and curb overly fast credit growth.Excess liquidity is a major challenge for theGovernment as it could result in bubbles andeconomic overheating.HONG KONG FOLLOWS U.S.,CUTS BASE INTEREST RATEHONG KONG – The Hong Kong MonetaryAuthority, the de facto central bank, on January23 lowered its Base Rate by 75 basis points to5% with immediate effect, according to a presetformula. The reduction followed the 75 basispoints cut in the US Federal funds target rateovernight, the Monetary Authority said. TheBase Rate in Hong Kong is the interest rateforming the foundation upon which theDiscount Rates for repurchase-agreementtransactions through the Discount Window arecomputed.KOREA WOORI BANK SETS UPSUBSIDIARY IN RUSSIASEOUL – Woori Bank (KSE:000030), SouthKorea's No. 2 lender by assets, has set up awholly-owned subsidiary in Russia to helpexpand its overseas network. Woori Bank, theflagship unit of Woori Finance Holdings(KSE:053000), launched Zao Woori Bank inMoscow on January 9, becoming the first SouthKorean lender to set up a subsidiary in Russia.The Russian unit is part of plans by Woori toexpand its global network. It aims at opening200 branches around the world.U.S. FUND COMPLETES TENDEROFFER FOR SHINSEI BANKTOKYO – US fund J.C. Flowers & Co. has completeda tender offer for 22.7% of the ShinseiBank (TSE:8303), making it the Japanese bank'stop shareholder. J.C. Flowers will add the 22.7%stake to its existing interest, replacing theGovernment-run Resolution and CollectionCorp. as the bank's largest investor. In addition,the fund plans to buy 50 billion yen (US$467 million)of new shares to be issued in February bythe bank. As a result of that, the fund's ownershipwill increase to 32.6 per cent.VIETNAM TO BUILD MAJORSEAPORTS IN 2008HANOI – Vietnam National Shipping Lines(Vinalines) plans to carry out several major projectsat seaports in 2008. Construction of theVan Phong international transit seaport, in thecentral province of Khanh Hoa, and the LachHuyen deep water port, in the northern city ofHai Phong, will start in the first quarter of thisyear. Van Phong port will have capacity to handle300 million tonnes of goods per year andEach day <strong>Asia</strong> Pulse creates up to 300 items of news, business opportunities,expert commentary and industry profiles covering over 30 countries and over 50industries across <strong>Asia</strong>. <strong>Asia</strong> Pulse is a unique joint venture involving the resourcesof <strong>Asia</strong>'s major news and information groups.receive 400,000-tonne ships. Vinalines will alsobreak ground for construction of three wharfs atCai Lan port in northern Quang Ninh provinceto receive 40,000 DWT ships, and five newwharfs for 20,000 DWT ships at Dinh Vu port inHai Phong.CHINA PLANS SECONDWEST-EAST GAS PIPELINESHENZHEN – China has laid out a primaryplan for its second pipeline of the West-Eastnatural gas transmission project. Constructionof the 8,794 km gas pipeline will consist of onemajor line and eight sub-lines and involveinvestment of some 143.5 billion yuan (US$19.8billion). The pipeline will carry natural gas fromcentral <strong>Asia</strong>n countries and Xinjiang to the economically-prosperousbut energy-thirsty easternand southern China areas, including Shanghaiand Guangdong Province. Construction willbegin this year and the pipeline is expected togo into operation in 2010.CHINA'S INCOME FROM TOURISMTOPS US$150 BILLIONBEIJING – China's income from tourismtopped 1.09 trillion yuan (US$150 billion) in2007, and is expected to reach 1.2 trillion yuanin 2008, said Shao Qiwei, Director of the ChinaNational Tourism Administration (CNTA). Shaosaid China received 132 million tourists fromoverseas in 2007, up 5.5% year-on-year, ofwhich 54.72 million spent at least a night inChina, up 9.6%, to earn China US$41.9 billion,up 23.5%. China retained its status as theworld's fourth-largest destination for foreigntourists in 2007.CHINA-ASEAN TRADEHITS US$200 BILLIONBEIJING – Trade volume between China andthe Association of Southeast <strong>Asia</strong>n Nations(ASEAN) hit US$202.6 billion in 2007, up 25.9%year-on-year, the China-ASEAN BusinessCouncil said. The two sides originally expectedtrade volume to reach the US$200 billion markin 2010. China-ASEAN trade volume first surpassedUS$100 billion in <strong>2005</strong>.CHINA TO START HIGH-SPEEDBEIJING-SHANGHAI RAILBEIJING – Construction of the high-speed railwaybetween Beijing and financial hubShanghai – a five-year project, was to begin onJanuary 18. The Ministry of Railways will contribute78.9% of the total investment, estimatedat 160 billion yuan (US$22 billion), while theremaining 21.1 per cent will come from otherinvestors. China hopes to run the China RailwayHigh-speed (CRH) train, with a speed of 350 kmper hour, on the new railway. On completion in2013, the high-speed railway will cut travel timebetween the Chinese capital and its largesteconomic hub from the current 10 hours toabout five hours, and double existing transportcapacity of 160 million passengers annually.Contact: <strong>Asia</strong> Pulse Production CentrePhone: (612) 9322 8634Fax: (612) 9322 8639http://www.asiapulse.comEmail: asiapulse@asiapulse.com.au10 | ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008

PROFESSIONAL SERVICESENGINEERING LEADS OFFSHORE MARKET PUSHThe Gudang Hitam coal mine at Sanga-Sanga, near Samarinda in East Kalimantan – Leighton <strong>International</strong> has a US$60 millioncontract over five years for overburden removal, coal mining, handling and delivery; (inset) Leighton CFO Scott Charlton.Gulf, Indonesia, India tolead Leighton’s growthAUSTRALIAN civil engineering major, Leighton Holdings, hasrelocated its Leighton <strong>International</strong> Head Office to Dubai, andexpects the Middle East to overtake Indonesia as its largestmarket outside Australia by end-2008. But Leighton’s ChiefFinancial Officer, Scott Charlton, is also bullish on Indonesia,where subsidiary Thiess is heavily involved in mining and toll roads.And he says India – where Thiess-Leighton has formed a jointventure – will be a major market over the medium-term . . .Florence ChongEditor, ATI MagazineSYDNEY – The Middle East is poised tobecome the largest offshore market for theLeighton Group, which invested AUD870 millionto acquire a 45 per cent stake in the Gulfengineering company, Al Habtoor, last September.The acquisition immediately deliveredsome US$1 billion of work in hand, and positionedthe Al Habtoor Leighton joint ventureamong the top three construction companies inthe United Arab Emirates and Qatar.Leighton <strong>International</strong>, which covers thegroup's operations from Indonesia to India andthe Middle East, has since relocated its corporateHead Office to Dubai.“The Middle East is likely to become ourlargest market outside Australia by the end ofthis year,” says Scott Charlton, LeightonGroup's Chief Financial Officer.At the time of the Al Habtoor acquisition,Charlton said it would boost Leighton's revenue,in 2007/08, by AUD800 million, and heforecast that revenue for Al Habtoor-Leighton inthe 2008-09 year would be more than AUD3.2billion – up from AUD2.75 billion this year.The Leighton Group itself expects to lift netprofit by 30 per cent this financial year – upfrom last year's AUD450 million. The value ofwork in hand was at a record level of AUD24.5billion as of November last year.Leighton entered the Gulf region just overCONTINUED PAGE 122 ➔FUNDING SHORTFALLS THE BIGGEST CHALLENGE FOR INFRASTRUCTUREENGINEERS have led the growth ofAustralian professional firms offshore since1997, when <strong>Asia</strong>’s economic downturncaused them to look beyond <strong>Asia</strong> – to theMiddle East and even the US markets.<strong>Asia</strong> has lagged in infrastructure developmentover the past decade, and now facesfunding shortfalls of up to US$200 billionannually as it plays catch-up to meet theneeds of major new cities.The funding dilemma poses challenges forforeign contractors, who will need to considertaking equity positions in, for example, tollroads,or seeking working capital guaranteesfrom their own government credit agencies.The recent example of a Hong KongGovernment tender which provided no upfrontor progress payments over the 18-monthlife of the contract is a case in point.There is also the spectre of soft loans beingoffered by individual governments seeking totie up major infrastructure projects andsecure resource deposits. Beijing is pursuinga ‘China Inc’ approach to trade and investmentin sub-Saharan Africa, and could steal amarch in other countries.In this special report (pages 11-27), weexamine the strategies of key players in infrastructuredevelopment, and emergingissues in the market . . .ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008 | 11

TAKING EQUITY IN INFRASTRUCTURE➔ FROM PAGE 11two years ago, when it worked on the City ofArabia development. It then won its first majorproject, the US$407 million Al Shaqab equestrianproject, in Doha, Qatar.Even though it had a small presence,Leighton was approached to take on otherwork. "We could not handle the work withoutadditional capability," Charlton told ATI.He describes the tie-up with Al Habtoor as amutually-beneficial partnership. "We were lookingaround to see how wecould expand our operation,and Al Habtoor was lookingto take its company to thenext step." Charlton says thepartnership is a "fantastic fit"with the Gulf company,which focusses on buildingand local contacts. Leightonis bringing in its civil engineeringskills. The Group iswell-placed to look at otheropportunities, including public-privatepartnership (PPP)projects in Abu Dhabi, theUAE capital, he says.According to the UAEYearbook, Abu Dhabi (thecapital) has plans for morethan US$120 billion in infrastructureprojects over thenext four to five years.Leighton has also entereda joint venture in India withthe Gulf firm, Emmar MGF, which paves theway for greater participation in India's activebuilding sector. India is another relatively newmarket for Leighton, which went there initiallyto build factories for multinational companieslike Nokia. "India will be as big a market for usas Indonesia is over the medium time-frame –we are putting a lot of time into developing thismarket,” says Charlton. “India took off quickerthan the Middle East, but growth will be fasterin the Middle East."Leighton wants to increase its exposure inIndia's infrastructure sector. Charlton, a formerHead of Transport and Infrastructure, <strong>Asia</strong>Pacific, with Deutsche Bank, says India'sNational Highway Authority has developedsome good toll roads, and Leighton wants to getinvolved. It is constructing two toll roads inIndia with local partner Oriental StructuralEngineers (OSE). The Australian company hasinvested "small equity – a couple of hundredmillion dollars" – in these projects. Charltonsays: "If the returns are commensurate with therisks, we are happy to contribute equity as partof a winning strategy." Leighton is prepared toinvest in economic infrastructure projects inHong Kong, Indonesia, India and thePhilippines.Leighton is doing some work – building nearshorepipelines – in India’s oil and gas sector.More particularly, it has been looking at India'smining sector in the past three years. "We holdout great promise for the mining sector. TheIndian Government has been changing the wayit hands out coal blocks, to allow private developmentaround steel mills and power plants.Coal in these blocks cannot be exported, butcan be used by the steel mill or power plant."Leighton's subsidiary, Thiess Leighton India,signed a heads of agreement in November lastyear for its first mining project with the AbhijeetLeighton operations at ABKLoa Janan coal mine in EastKalimantan.Group. The project, worth AUD1.5 billion, willinvolve development and 20-year operation of agreenfield open-cut coal mine, with output tobe used for Abhijeet's steel plant and itsplanned mine-mouth power station project.Charlton says that, while Coal India (the nationalcoal body), does not outsource mining, intime it could choose to go down this track toimprove delivery and lift mining capacity."We hope that, in the next year or so, we willbreak into this sectorbecause we think long-termcontract mining has a greatfuture in India. India has ahuge need for power.”India also mines as muchiron ore (150 million tonnes ayear) as coal, and, through itsacquisition of the Queenslandmining company, HWE,Leighton has become theworld's largest contract minerfor iron ore – as it is for coal.While Indonesia has lostfavour with many foreigninvestors in the past decade,it remains Leighton's largestoffshore market, and doeshave, according to Charlton,good growth prospects. "Wehave 30-40 per cent of thecontract mining market inIndonesia, including severallife-of-mine contracts,” hesays. “Last year, we added an AUD600-millioncontract for a new client, PT Wahana BaratamaMining."Charlton is encouraged by the opening of themining sector as Jakarta eases some restrictions."We are starting to see more exploration,"he says. But Indonesia has been disappointingin the infrastructure sector. Despite several falsestarts, Indonesia is yet to seriously embark onmajor infrastructure development.In the past two years, Leighton has beennegotiating on three toll roads there. It is morecomfortable with projects such as toll roads, andports, Charlton says."The biggest issue for us is getting theGovernment to commit to land acquisition, andto reasonable commercial terms for concessionagreements, to ensure that we can get finance,he says.” We need to prove that, economically,we can stack up the Government’s existing tollrates. We need to fund that debt and to find anequity provider willing to participate.""We will take equity positions in toll roads (inIndonesia), as we would in other markets, butwe share our risk with domestic and internationalinstitutions. We find that, even in some ofthe more difficult jurisdictions, like thePhilippines – or Indonesia – there are still peopleprepared to participate in infrastructure."As one of the few foreign contractors inIndonesia, with a history of almost 30 years, wefeel comfortable in the Indonesian environmentif the Government finds the political will tomake these (infrastructure projects) happen. Webelieve we can find a way with our partners tomake these things work." Even if Indonesiadoes slip from being the largest offshore market(after the Middle East) for Leighton, Charltonsays it will continue to be the second-largestmarket into the foreseeable future.Mining has started to pick up – in a muchPROFESSIONAL SERVICESsmaller way – in the Philippines, says Charlton.The Group is working on a new mine there,and, with the commodity boom and industrialisation,he sees mining markets like Vietnamalso becoming more important.Leighton <strong>Asia</strong>, which looks after the GreaterChina area, including South Korea, has traditionallyfocussed on Hong Kong and SouthernChina, particularly Macau. It has not made a bigmark on the huge Chinese market. Charltonsays one reason is the presence of large, wellcapitalisedChinese contractors, some biggerthan Leighton itself. "They don't need capital,and certainly don't need people," he says.Chinese authorities, through licensing, makeit difficult for foreigners to participate on theirown in an economical way, Charlton adds. "It iseasier with joint ventures." Leighton partnerswith China State Construction for many projectsin Hong Kong and Macau.Now 55 per cent-owned by the German company,Hochtief, Leighton has opened an officein Beijing to pursue work in the mining sector,and in infrastructure work associated withmines. It sees opportunities in Mongolia andNorthern Inner Mongolia in these sectors.Leighton is also chasing work in Guam,where it is bidding for a port. With Washingtonplanning to move the US military out ofOkinawa to Guam, Charlton says Leightonexpects more work there.Acquisitions have played an important role inthe growth of the Group, and it continues tolook for opportunities to acquire businesses inHong Kong and Indonesia. Not, however, inIndia, where Charlton says companies arefully-priced. "If you look at our revenue today,about 40 per cent is from companies weacquired. We can grow at a certain rate (but) weneed to make acquisitions to achieve a highergrowth rate over time. We continue to see goodopportunities, (but) it is harder to acquire businessesin some countries than in others."❝ If the returns arecommensurate with therisks, we are happy tocontribute equity as partof a winning strategy ❞Acquisitions can be especially difficult wherethese are family-controlled businesses, Charltonsays. "We don't necessarily want full control,but we want equal say – and we don't want tobe controlled by families.”Australia remains a solid base for Leighton,with the ongoing global resources boom andthe shift to PPPs for large infrastructure projects,such as desalination plants and toll roads. Someof these projects are large, like the Sydney M4East toll road extension, estimated to costAUD3-AUD5 billion. This trend will continueinto the foreseeable future.Provided India and China continue to grow,Charlton says Leighton is “pretty optimistic” onthe outlook of the Australian economy."We would like to see active involvement bythe Rudd Government in areas such as industrialrelations and interest rates to ensure that theeconomy continues to perform well," hesays.12 | ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008

PROFESSIONAL SERVICESFUNDING THE FINANCIAL SHORTFALLThiess Indonesia short-listed for three toll roadsJAKARTA – Thiess Indonesia is currentlyengaged in the tendering process forthree toll road BOOT (build own operatetransfer) schemes in Indonesia — the JakartaOuter Ring Road 2 Package 3 Serpong-Cinere(Jakarta); the Trans-Java Toll Road Ngawi-Kertosono Package (Central Java); and theTrans-Java Toll Road Solo-Mantingan-Ngawi(Central Java). Thiess Indonesia has beenshort-listed for all three.SINGAPORE – With few exceptions,the concept of the public private partnership(PPP) has not yet been adopted widely in <strong>Asia</strong>,even though the region is familiar with PPP’spredecessors – BOOT (build-own-operatetransfer)and BOT (build-own-transfer).Indonesia and the Philippines are amongthose to use the BOOT or BOT concepts to constructlarge infrastructure projects. But the PPP,or the PFI (private finance initiative) as it isknown in Britain, has not been popular as anoption to finance infrastructure.Now, as the region is forced to meet the challengesof developing and upgrading infrastructureto meet growing demand caused by populationgrowth and rapid urbanisation, it willneed to consider the PPP as another avenue offinancing. Ernst & Young estimates that <strong>Asia</strong>will have a financial shortfall of more thanUS$200 billion annually in infrastructure spendingin coming years.Russell Lamb, Director of Ernst & Young’sInfrastructure and Projects Finance/PPP inSingapore, says South Korea, Singapore andMalaysia have started using PPPs. But hebelieves it requires a cultural change, asoccurred in the UK 10 years ago, for governmentsto allow the private sector absolute controlof day-to-day management of infrastructure.For PPPs to flourish, he says, there has tobe a more "genuine partnership”.Lamb told ATI that, for the past decade – andmore-so in the last five years – South Korea hasused its version of PPPs to develop projects. Hebelieves South Korea has a more structuredapproach, and issues a standard document forthese projects.As it becomes a more mature market, Lambfeels the South Korean Government no longerneeds to provide guarantees to private sectorparticipants, as it did in the early days.Between 1997 and <strong>2005</strong>, it is believed theOn the Serpong-Cinere project, it is PreferredTenderer and is in the final stages of negotiatingterms for a Concession Agreement in conjunctionwith alliance partner PT WaskitaKarya (which holds a 20 per cent investment).For both the Ngawi-Kertosono and Solo-Mantingan-Ngawi projects, Thiess Indonesia issole tenderer. As such, it is in the evaluationand negotiation process, working towards theGovernment issuing preferred tenderer status.Korea leads on PPPs,S’pore in stop-startSOUTH KOREA leads <strong>Asia</strong> in the use of the private-public partnership(the PPP), but infrastructure demand could force morecountries to adopt the concept – and this may require a culturalchange allowing for more genuine Government partnerships withthe private sector . . .South Korean Government approved some 118PPP projects, with a capital value of US$38 billion,including roads, rail, water, airports, portsand parking. In the last three years, it isbelieved close to 154 deals had been finalised.Lamb believes that, since <strong>2005</strong>, the programmehas extended to cover schools andother social projects. It is understood Seoulplans to have 154 schools builtunder the PPP model, offering25-year concessions.Macquarie Bank has been astrong player in the marketsince it established theMacquarie Korea InfrastructureFund, which now ownsnine infrastructure assets, andhas six under construction –including expressways, bridgesand tunnels. Some of the projectstoday are more complexand larger – for example, the12.3-km Incheon Bridge. Therewas a time when the Koreanswould not contemplate havinga project of this size built usingPPP, Lamb says.The British firm, AMEC Plc,has inked an agreement tofund and start work on theUS$1.45 billion bridge development. It is thefirst foreign investor to lead a major PPP projectin South Korea under a 30-year concession.Singapore's Ministry of Finance originallypublished its PPP outline in 2004, and soonannounced three high-profile PPP projects.These include Sports Hub, billed as the largestsporting infrastructure to be developed by theprivate sector; development of a campus townshipfor the National University of Singapore;and the Institute of Technical Education (ITE)West campus.Ernst & Young’s RussellLamb – a US$200 billionannual funding shortfall.Thiess says all these projects are reliant onthe Indonesian Government completing landacquisition. This requires a number of legislativechanges and there is no certainty as towhen this will be.As well as an investment opportunity, constructionwork will be undertaken by ThiessIndonesia, which is hopeful that work willstart at the end of 2008. Indonesiacurrently has 650 km of toll roads.The Sports Council subsequently asked forre-submission of bids for the Sports Hub, theMinistry of Education withdrew the NUS projectsto go down the traditional procurementroute, and a decision on the ITE West projectwas delayed.At the end of November, Gammon Capital,the Southeast <strong>Asia</strong>n PPP vehicle of Britain'slargest construction conglomerate, BalfourBeatty, was appointed "preferred bidder" forITE West College's new 10-hectare campus, ata cost of S$270 million. The project was the firstPPP of its type for the British Group outside theUnited Kingdom.In January the Singapore Sports Councilchose, as its preferred bidder, the Sports HubConsortium, led by French contractor Dragages– to build the S$1.2 billion Sports Hub. The consortiumwill run and operate the stadium andattendant facilities over 25 years.But there is lingering bad taste over the NUScampus project, which attracted a wide field ofAustralian companies, including MacquarieBank, Babcock and Brown, Transfield Holdingsand the Plenary Group from Melbourne.Australian companies were represented in fourof the five competing consortiums.Ignatius Hwang, a partnerwith the Australian law firm,Freehills, in Singapore, saysthat, before the current cropof projects in Singaporeunder the PPP programme,there were projects whichcould be considered PPPs.These include Singapore’sfirst desalination plant, builtand operated by Hyflux, theUlu Pandan NEWater Plant,built and operated by KeppelSeghers – both projects tenderedout by the SingaporePublic Utilities Board – andthe fifth incinerator plant, tobe built and operated also byKeppel Seghers.Hwang says that, for future projects, there istalk of bringing hospitals and toll roads into thePPP programme, but he thinks these are“a bit of a long way off".■ The export credit agency fundingoption, page 13COPYRIGHT © 2008 All material in ASIA TODAYINTERNATIONAL is copyright. Reproduction in whole or inpart is not permitted without written permission of thepublisher, <strong>Asia</strong> <strong>Today</strong> <strong>International</strong> Pty Limited.ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008 | 13

In AssociationWith:Adam MaloufHead of Legal & ComplianceARABIAN REAL ESTATEINVESTMENT TRUSTTHE INAUGURALDiego Torres M., Executive Vice-presidentGeneral Manager, BHD VALORESDarine Bejjani, Analyst – Structuring &Arranging Group, BSEC S.A.Iad Georges BoustanyGeneral Manager and Board MemberBSEC S.A.Ibrahim Mardam-BeyBoard Member, BSEC S.A.Klaus Distler, Vice President,JPMORGANJad Haidar, Analyst – Structuring &Arranging Group, BSEC S.A.Rebel Hanna, Director, Asset ManagementGroup, BSEC S.A.Roula SleimanSenior Associate – Capital Markets GroupBSEC S.A.DUBAI CUPof SecuritisationFebruary 27-28, 2008Jumeirah Emirates Towers • Dubai, U.A.E.Over 300 Attendees Expected!Keynote Speaker:FEATURED EXPERT SPEAKERS INCLUDE:Simon StockleyDirector, CATALISStephen de StadlerHead of Business Development-Middle EastFITCH RATINGS LTD.Maan KantarHead of Strucutred Invesment & ProductDevelopment, GICAmr Abou El Seoud, Senior Vice President,INVESTMENT DARRobert C. Bush Jr., Chief Executive OfficerMAJLIS CAPITALJulian A. TuckerPartner- SecuritisationSHEARMAN & STERLING LLPMajid DawoodChief Executive OfficerYASAAR LIMITEDVivek Rao, Chief Executive OfficerMERAAS INVESTMENT GROUPGaurav Aggarwall, Chief Financial OfficerTAMWEEL PJSCMartin Kinsky, Managing Director, MarketsDUBAI FINANCIAL SERVICES AUTHORITY (DFSA)Mohammed Asaria, Head of PrincipalInvestments, RASAMEELHamed Al-Amiri, Vice President, Head ofCapital Markets, RASAMEELFeras Kalthoum, Head of InvestmentsTAMWEEL PJSCNick Eisinger, Emerging MarketsSecuritisation, DEUTSCHE BANKPaul Oliver, Director Financing andTreasury, DUBAI CAPITAL GROUPSandeep Chaudhry, Chief ExecutiveOfficer, EMIRATES NATIONALSECURITIES CORPORATION (ENSEC)Omar Olaf Bolli, Managing Director, Headof Asset Backed Finance, NORD LBOlufemi Oye, Director, DEUTSCHE BANKTRUST & SECURITIES SERVICESMARC WOLF, CEEMEA Securitised ProductsGroup, JPMORGANLead:SPONSORS INCLUDETitanium:Silver:Bronze:For more information about this event, please go to our website at: www.imn.org/esb1022/atm CPE CREDITS AVAILABLE!Te l : 2 1 2/ 7 6 8 - 2 8 0 0 • Fa x : 2 1 2/ 7 6 8 - 2 4 8 4 • Em a i l : m a i l @ i m n . o r g

PROFESSIONAL SERVICESMEETING THE FUNDING CHALLENGEWHERE THE EXPORT CREDIT AGENCY FITSSYDNEY – An additional source offinancing for companies seeking involvement inmajor infrastructure projects offshore, especiallywhere the issue of country risk is involved, isthe national export credit agency. As two examples,Australia’s Export Finance and InsuranceCorporation (EFIC) has taken a position in theLumwana copper mining project in Zambia,and in a major bridge project in Vietnam.EFIC is supporting participation ofBaulderstone Hornibrook in a consortium constructingthe US$104 million Phu My Bridgeacross the Saigon River in Ho Chi Minh City.The project is primarily financed by a loan fromSociete Generale to the Ho Chi Minh CityInvestment Fund for Urban Development.Germany’s export credit agency, Euler Hermes,is providing insurance to Society Generale forthe loan, and EFIC is providing reinsurance toHermes to the value of AUD26 million to supportAustralian content.In Zambia, EFIC is providing substantialpolitical risk insurance to support Australianinvolvement in the development and operationof what will become Africa’s largest open-pitcopper mine. A subsidiary of the Australian andCanadian-listed Equinox Minerals is developingthe US$715 million mine.EFIC has also helped Leighton finance acquisitionof a 45 per cent stake – Leighton investingapproximately AUD870 million – in AlHabtoor Engineering, one of the largest constructioncompanies in the Middle East (seepages 11, 12). The move provides Leighton witha significant increase in capacity to capitaliseon opportunities in the Arabian Gulf.EFIC joined the Abu Dhabi CommercialBank, HSBC, Mashreqbank and Royal Bank ofScotland to provide debt funding for theLeighton acquisition.Peter Swan, a Director in Structured Tradeand Project Finance at EFIC, says there are few❝ Tenderers, suppliersand project sponsors needto look at all possiblefinancing options ❞formalities attached to seeking EFIC support forinfrastructure projects, but there does need tobe a level of Australian content in the project."We assess the characteristics of the transactionand go from there,” Swan told ATI. “Thereare no formal limits on the funding we might beable to guarantee, but if a project requiringexposure of $X million is greater than we wishto accept, we may find ways to transfer part ofthe risk to other parties." Swan says that, giventhe huge requirements for capital expenditurenow involved in infrastructure projects, tenderers,suppliers and project sponsors need to lookat all possible financing options.As reported in ATI in December, EFIC hasprovided a guarantee to allow the Melbournecompany, Environmental Systems and Services(ES&S) to access working capital throughHSBC, permitting it to successfully tender for aHong Kong Government project.Tender documents for the project, a weathersatellite earth station with associated data processingand display systems, did not allow forany upfront or periodic payments during theestimated 18-month construction timeframe.EFIC has also been supporting the Australianroof engineering and construction specialist,Chadwick Group, in a series of projects in <strong>Asia</strong>and the Middle East over the past 12 years.Since 1995, Chadwick has secured contractsworth some AUD150 million in six countries. Itsmost recent project, completed in 2007, wasvalued at AUD27 million – to construct the roofingsystem for a new concourse at Dubai<strong>International</strong> Airport. EFIC provided an AUD2.8million guarantee facility. Other Chadwick contractsinclude design, fabrication and installationof a roofing system for SuvarnabhumiAirport in Bangkok, and a titanium roof structurefor Singapore’s Expo railway station.Engineering ingenuity astrength for MeinhardtWHEN <strong>Asia</strong>n markets collapsed,Meinhardt <strong>International</strong>moved swiftly to diversify,establishing a strong presencein the Middle East,then adding the US and theUK to its list of offices . . .SINGAPORE – The <strong>Asia</strong>n financialcrisis a decade ago came as both a shock anda watershed for the Australian consulting engineeringfirm, Meinhardt which has a big presencein Singapore. It gave Meinhardt impetusto take on the global market."The lesson we learned was not to rely on asingle market – that we must diversify.Adversity gave us the strength to search foroptions," Shahzad Nasim, Meinhardt<strong>International</strong>'s Managing Director, told ATI."As a consequence, we went to Dubai, AbuDhabi, Qatar, Saudi Arabia, Egypt and Libya."Later, Meinhardt added the United Statesand the United Kingdom to its list of offices.<strong>Today</strong>, the firm employs 3,000 people, and has27 offices in 14 countries.Perhaps one of the firm’s most rewardingmoves was to go to Dubai, which, at the time,was on the cusp of a huge construction boom.Dubai is now one of the world's busiest constructionmarkets – to this day, the boomshows no obvious signs of slackening.Based in Singapore, Nasim felt the <strong>Asia</strong>ndownturn acutely. He points out that Singapore'sconstruction industry went into a seven-yearrecession from 1997.Meinhardt first went to Singapore in 1974,and was therefore no stranger to the ups anddowns of market. But the crisis cast a deeperrecession than previously experienced – theeconomy did not recover until 2004. "Whileeveryone else was shrinking – some halved thesize of their operations in Singapore – we continuedto put on staff because we had startedto do work outside the region," says Nasim.<strong>Today</strong>, Meinhardt Group has projects with acollective value of US$10 billion in countrieswhich include developed markets such as theUS – where it has carried out projects in thehealthcare sector – and in the UK – in the buildingand aviation sector. Group’s internationaloperations are expected to generate fees ofUS$150 million this year.Nasim says all international offices workclosely with its Australian parent, theSignature Towers in Dubai – MeinhartSingapore is lead consultant.Meinhardt Group, founded in 1955. He says theAustralian operations and the Group are doingwell under the new Chairman, VickiMeinhardt, (daughter of the firm's founder, thelate Bill Meinhardt), and Phil Treyvaud,Meinhardt’s Global Chief Executive. "We areone of the biggest engineering firm (in theworld) with a complete complement of engi-CONTINUED PAGE 17 ➔ASIA TODAY INTERNATIONAL FEBRUARY/MARCH 2008 | 15