ZxeYlo

ZxeYlo

ZxeYlo

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

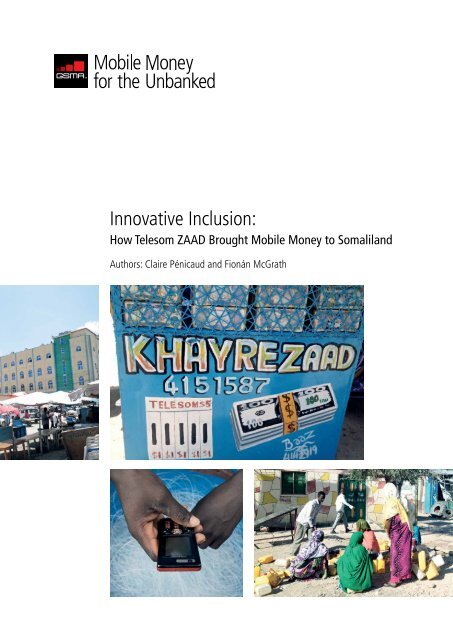

Innovative Inclusion:How Telesom ZAAD Brought Mobile Money to SomalilandAuthors: Claire Pénicaud and Fionán McGrath

Contents1271117Introductionsection 1section 2section 3conclusionDeveloping a mobile money strategy for SomalilandImplementing an effective distribution strategy andcreating the mobile money ecosystemResults of the strategyTables and FiguresThe MMU programme is supported by The Bill &Melinda Gates Foundation, The Mastercard Foundation and Omidyar Network.41012121313141516table 1 A comparison of Safaricom’s M-PESA and Telesom’s ZAADfigure 1 Telesom ZAAD’s business structurefigure 2 Subscriber growth over timefigure 3 Growth in Telesom ZAAD customer-initiated P2P transactions over timefigure 4 Growth in Telesom ZAAD bill and merchant payment transactions over timefigure 5 Average number of Telesom ZAAD transactions per active usertable 2 Total transactions on Telesom ZAAD in March 2013figure 6 Growth in cash-in and cash-out volumes over timefigure 7 M-PESA and Telesom ZAAD usage (October 2012 – March 2013)

1 GSMA - Mobile Money for the Unbanked Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland 2IntroductionIn June 2009, Somaliland’s leading mobilenetwork operator (MNO) Telesom launchedTelesom ZAAD, the country’s first mobilemoney service. Since then, the service hasgained significant traction: in June 2012, almost40% of Telesom GSM subscribers wereactive users of Telesom ZAAD. What ismost striking about the service is the levelof activity on the mobile money platform.Active Telesom ZAAD users perform over30 transactions per month on average, farabove the global average of 8.5 per month. 1Telesom ZAAD is one of the 14 GSMAMobile Money Sprinters 2 and is recognisedas one of the most successful mobile moneyservices in the world.ecosystem works and how the business isstructured is discussed in section two ofthe case study.The results of this original and ambitiousmobile money strategy are presented insection three. These results frame a discussionof how successful Telesom ZAAD hasbeen at functioning as a cash replacement.The case study concludes with a brief discussionof the challenges facing TelesomZAAD as they evolve their service overthe coming years.1 See Claire Pénicaud, 2013, “Stateof the Industry: Results from the 2012Global Mobile Money Adoption Survey,”GSMA Mobile Money for the UnbankedProgramme. Available online: http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2013/02/MMU_State_of_industry.pdf2 Ibid.The World Bank’s Global Financial InclusionDatabase (Findex) recently revealedthat Somalia was one of the most activemobile money markets: 26% of the populationreported using mobiles to pay bills,which is the highest rate in the world, and32% to send and receive money. Most ofthis mobile money activity has been drivenby Telesom ZAAD.This case study details the success of TelesomZAAD and the factors underlying thissuccess. The objective for Telesom’s mobilemoney service, in the words of its CEO,has always been to bring financial inclusionto Somaliland. It was this vision thatdrove the company to offer their service tocustomers for free, and it has produced anumber of other unique outcomes as well,which are discussed in the first section ofthe case study.To transform its vision of financial inclusioninto a reality, Telesom’s strategyhas been to develop the mobile moneyecosystem around Telesom ZAAD. Thisecosystem is focussed on solving twoissues faced by mobile money servicesaround the world: getting money into thesystem and then keeping it there. Mostmobile money services are still functioningas a money transfer service, with customerswithdrawing all their funds fromthe system as soon as they receive them.However, Telesom ZAAD has succeededin convincing users to keep money in theire-wallets by building an ecosystem of salarypayers and merchants. Exactly how theSection 1Developing a mobile moneystrategy for SomalilandTelesom is the leading MNO in Somalilandwith close to 1 million mobile connections(about 85% market share). Founded in 2002,Telesom is a privately held company ownedby 1,500 shareholders – all Somalilanderswho live locally or abroad. The TelesomCEO, Abdikarim Mohamed Eid, was alsoone of the seven founders of Telesom andhe has been driving Telesom’s works forthe past 12 years.There is no formal banking infrastructurein Somaliland and no internationallyrecognised banks operate there. Mr.Abdikarim Mohamed Eid and his managementrecognised the negative impact thatthe lack of formal financial services werehaving on Somaliland’s economy and thatthere was an opportunity for Telesom toaddress this issue through Telesom ZAAD.Their broader vision was to bring financialservices to Somalilanders, while ona strategic level the service was initiallydesigned as a customer retention tool.Learning from M-PESA and adaptingthe model to SomalilandPrior to launching Telesom ZAAD, a teamof senior Telesom officers travelled toKenya and Tanzania to study Safaricom’sand Vodacom’s M-PESA services. Theylearned a lot about the model, but identifiedsome aspects of the services that would nottranslate to Somaliland. Telesom decidedto adapt the M-PESA model to its countrycontext in three distinct ways.• Making the service free. In an interviewwith MMU, Mr. AbdikarimMohamed Eid told us, “We decided tooffer the service for free. The M-PESAbusiness model was not applicablein the context of Somaliland wherepeople are very poor and not familiar

3 GSMA - Mobile Money for the Unbanked Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland 4with mobile money.” Telesom ZAADaimed to achieve an active rate of 40%of their GSM customer base beforerevisiting that policy.• Using in-house agents. Telesomdecided to utilise its own distributionnetwork and not to recruit externalagents. This meant relying on thestores it already owned and operatedwith salaried employees. Thisdecision was driven in part by thefact that there was no formal bankinginfrastructure or suitable chain ofretail stores/businesses in Somalilandequipped to deliver the service or toprovide an adequate distribution solutionfor Telesom ZAAD. Since mobilemoney was a completely new conceptin Somaliland, Telesom managementalso realised that it would be challengingto convince external agents to offerthe service. For both these reasons,Telesom decided to use its own outletnetwork as mobile money agents.• Including merchants from the start.While Telesom has offered moneyCustomeroutreachstrategyDistributionstrategyProductstrategySafaricom’s M-PESAAgents are the key points of contact betweenSafaricom and its customers.• Has closely monitored the ratio of customersto agents since launch• About 260 registered customers per registeredagent (March 2013) 5Use both internal and external agents for cash-in/cash-out; most M-PESA agents are external agentsFocus on domestic P2P transfersTelesom’s ZAADMerchants are the key points of contact betweenTelesom and its customers.• Stable ratio of customers to merchantssince launch• About 43 registered customer perregistered merchantOnly use Telesom’s stores for cash-in/cash-outFocus on merchant payments and salary paymentsBusiness modelPaying service; M-PESA represents 18% ofSafaricom’s revenuesFree-of-charge service; focus on indirect revenuesa Ministry of National Planning andDevelopment, Somaliland, 2012,“Somaliland In Figures.” http://slministryofplanning.org/images/somalilandin-figures/somaliland-8edition.pdf(accessed 5 April 2013).b World Bank DataSomaliland is a small territory locatedin the Horn of Africa. In May1991, after years of civil war, thepeople of Somaliland declared unilateralindependence from SomaliDemocratic Republic. AlthoughSomaliland is not recognised asa country by the internationalcommunity, it has developed itsown governing institutions andcurrency and it functions independentlyfrom the rest of Somalia.Constitutionally, the Republic ofSomaliland is a democratic countrywith a multi-party system.Telecommunicationsin SomalilandTelecommunications is one ofthe most dynamic and innovativeindustry sectors in Somaliland, butit is also very competitive. There arefour MNOs operating in Somalilandalone and seven more in the restof Somalia. Mobile penetration isless than 45% and fierce competitionhas led MNOs to offer some ofthe world’s cheapest mobile rates. bThe telecommunications industry isinvesting heavily in this region toimprove connectivity; 3G has alreadybeen rolled out in some regions andthe port city of Berbera will soon beconnected to the Eastern Africa SubmarineCable System via Djibouti.kenyadjiethiopiagulf of adenberberahargeisashimbirispopulation in 20103.85m55%700,000Yearly per capita incomeindianoceanof Somalilandersare nomadspeople live in Hargeisa,the capital city. a$250-$350National employment rate52.6%gdp$1.05bnominal price$2.10b(ppp) aOfficial currencySomaliland shilling. While Somaliland shillings arewidely used for small value transactions, Somaliland isa dual currency market and US dollars are widely usedand generally more trusted.table 1A comparison of Safaricom’s M-PESA and Telesom’s ZAADtransfer as a core product from thestart, management saw an opportunityfor goods and services payments tospur growth and to help the companykeep up with its growing numbers ofcustomers. As a result, merchant acquisitiontook the place of agent acquisitionin the Kenyan model.Investment and returnsFrom the very start, Mr. Abdikarim MohamedEid’s commitment to the servicewas matched by strong investment: “Wedecided early on to invest heavily in theservice. We knew customer educationwould be difficult as the level of financialliteracy in Somaliland was far behind thatin either Kenya or Tanzania.”An open book approach to budgeting wastaken in the first year to get the serviceoff the ground. One quarter of the initialinvestment of US$ 1 million 4 was put intodeveloping the in-house platform usingTelesom’s own coding and developmentexpertise. Since Telesom ZAAD has alwaysbeen treated as a separate business fromTelesom’s core GSM business, it has had itsown dedicated business unit from the start.Another half of the initial investment wasused to build and equip the Telesom ZAADhead office where the team now works.The investment strategy takes on a newlight when the business model was discussed:Telesom ZAAD has been a free-touseservice from the start. Although thisis both a financial and strategic decision,it is driven by a commitment to financialinclusion and the recognition that customereducation would pose a major challenge tothe success of the service.From a financial perspective, althoughTelesom decided to offer its mobile moneyservice for free, the company was able toquickly recoup its initial investments fromindirect revenues:• Savings on airtime distribution havebeen significant, with almost 70%of Telesom airtime sold over TelesomZAAD in April 2013 rather thanthrough scratch cards. These savingsamounted to US$ 2 million in 2012, $1.8million in 2011, and $865,000 in 2010.• Telesom also measure increasedairtime sales due to Telesom ZAAD.This represents the difference betweenprojected sales growth and actualgrowth. In 2010 soon after the launchof the service, Telesom registered a 33%increase in airtime sales, 22% in 2011and 17% in 2012.• Finally, Telesom managed to reducecustomer churn from 5% beforethe launch of Telesom ZAADto 2% in 2013.over70%of Telesomairtime is soldover mobilemoney4 This figure of US$ 1 million is inline with most other mobile moneysprinters. See Claire Pénicaud, 2013,“State of the Industry: Results from the2012 Global Mobile Money AdoptionSurvey,” GSMA Mobile Money for theUnbanked Programme, available at:http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2013/02/MMU_State_of_industry.pdf5 Safaricom fiscal year 2013 results,available at: http://www.safaricom.co.ke/images/Downloads/Resources_Downloads/FY_2013_Results_Presentation.pdf

7 GSMA - Mobile Money for the Unbanked Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland 8Convincing merchants and institutions to make and accept paymentsusing Telesom ZAADKaah Electric Power CompanyKaah is the main electricity provider in Somaliland. Before the launch of Telesom ZAAD, Kaahemployed 50 bill collectors who collected payments door-to-door. This system was not only unsafefor the bill collectors, it also lacked the traceability and transparency the company neededto monitor its payments properly. Kaah’s customers could also go to the company office to paytheir bill with cash, but this was not a convenient solution. Soon after Telesom ZAAD launchedin 2009, Kaah allowed its customers to pay their electricity bill with mobile money. Today, 85%of Kaah’s 12,000 customers use Telesom ZAAD to pay their electricity bill.In 2010, Kaah began paying the salaries of its 400 employees through Telesom ZAAD. AbdirahmanFarah Jama from Kaah’s finance department told us that employees were very satisfiedwith this new system as they no longer need to go to the headquarters to pick up their salariesevery month, and can use Telsom ZAAD to make payments and transfers remotely when theywork in other areas of the country.Amoud UniversityAmoud University in Boroma is Somaliland’s oldest university and one of the most reputable.Amoud only accepts Telesom ZAAD as a means of payment for the tuition fees of its 3,000 students.Three hundred of Amoud’s 450 employees receive 100% of their salary through TelesomZAAD and all suppliers to the university are paid using Telesom ZAAD.section 2Implementing an effectivedistribution strategy andcreating the mobilemoney ecosystemAccording to Ahmed Abdullahi Boqorre, the VP of Administration at Amoud, “Using TelesomZAAD has saved us time and money and added traceability and transparency to our accountingsystems. Students pay fees in installments so we can quickly track payment, which we couldnot before.” Amoud required their suppliers to move to Telesom ZAAD for payment and thelarger suppliers, in turn, have required their suppliers to convert to Telesom ZAAD as well.Approach to corporate usersAcquiring Kaah and Amoud as corporate users was strategically very important to Telesom, as theirreach and influence would filter down to others through suppliers, employees, and customers.Telesom is committed to working closely with their corporate clients and has developed customisedplatform features for their business. For example, when Amoud University asked TelesomZAAD to develop a new feature on their web-based interface, they were quick to react.As Ahmed Abdullahi Boqorre explained, “We requested a filter feature to allow us to searchvia student number and pull up all transactions. This was not a field Telesom ZAAD offered asstandard but they turned it around very fast for us.”Understanding the socio-economic characteristicsstatus of Somaliland was an importantstarting point in the developmentof Telesom ZAAD’s distribution strategy.In order to realise their vision of deliveringfinancially inclusive services, Telesom choseto use a wallet-based mobile money servicewith a focus on keeping cash in the system.To do this, they focussed on developing astrong mobile money ecosystem around theservice, which has informed its approach toboth products and distribution.Commitment to merchant paymentsand salary paymentsTelesom ZAAD was launched with a focuson salary payments and merchant payments.The idea was to create a mobilemoney system that did not require serviceusers to repeatedly cash-in and cash-out.Instead, Telesom ZAAD users would regularlyreceive money in their wallet (theirsalary, for example), maintain a small balance,and use it for daily transactions, suchas paying for goods and services. In orderto promote both products successfully, Telesomconcentrated its efforts on two targetgroups: merchants and employers.In the beginning, the team spent a lotof time educating merchants about theservice. Telesom also offered free handsetsto new merchants as an incentive to acceptpayments via Telesom ZAAD, but theyquickly halted this program as merchantsstarted to come to Telesom ZAAD evenwithout the incentive. When TelesomZAAD was launched in June 2009, 170merchants had already agreed to acceptpayments via mobile money. Merchantswere encouraged to use the e-money intheir account to buy Telesom productsinstead of cashing out, which has helpedto keep money in the system. Many mobilemoney services struggle to get customers

9 GSMA - Mobile Money for the Unbanked Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland 10to maintain balance but Telesom havebeen very successful.Today, two members of the TelesomZAAD team are dedicated to merchantsupervision and monitor their activities ona daily basis. They also identify merchantswith limited activity and visit them tounderstand why.The Telesom ZAAD team knew that convincingemployers to pay salaries throughmobile money would be particularly challengingsince mobile money was so new toSomaliland. Telesom decided to lead theway, and two months before the commerciallaunch of Telesom ZAAD, it started topay its 1,430 employees exclusively withmobile money. This was a bold decision –most mobile money providers that want topush salary payments start by paying onlya small percentage (usually between 5%and 10%) of their employees’ salaries usingmobile money. This helped to convinceother companies to start paying their employeesusing Telesom ZAAD.Telesom also wanted their employees tobecome brand ambassadors and to startusing Telesom ZAAD to pay their rent, buygoods and services, and transfer money.As relatively high net-worth customers totheir local businesses, Telesom employeespromoted the service very effectively. Toencourage uptake by word-of-mouth, Telesomtrained all its employees on TelesomZAAD so that they were fluent in using andpromoting the new service.Mobile money distributionTelesom ZAAD has taken a unique approachto mobile money distribution bynot relying on external agents. Telesomdecided to use its own retail stores exclusivelyto register new customers andoffer cash-in and cash-out services. Asmentioned earlier, this approach has beenpossible due to the unique market conditionsin Somaliland and Telesom’s strongpresence and brand recognition.Telesom operates 178 of its own retailoutlets distributed around Somaliland,which has been sufficient to reach its subscriberbase. The 20 largest stores, whichTelesom calls “dealers”, are responsiblefor managing the liquidity of the smallerstores. In the Telesom ZAAD model,people who work for stores that facilitateTelesom ZAAD’s currentproduct offeringsTransfers:• Domestic money transfer• Inter-network money transfer• International money transferPayments and disbursements:• P2B – purchases (shopping);educational institutions (schoolfee payments); health serviceproviders (charge collection);utility providers (monthly bills forelectricity, water, waste, TV, etc.)• B2B – businesses (purchasesand bill payments)• B2P – payroll and bulk payments,expenses• Airtime, Internet data rechargesConversion transactions:• Cash-ins and cash-outscash-ins and cash-outs, as well as dealerswho supervise smaller stores, are allTelesom employees. As such, they receivea monthly salary from Telesom. Offering ahigh-quality mobile money service is oneof their objectives and their bonus dependson whether or not they are able to reachtheir mobile money targets.Interestingly, dealers are also responsiblefor recruiting and supervising merchants.This reflects the importance of merchantsin Telesom ZAAD’s business structure. ForTelesom, agents and merchants are the twoways customers can directly interact withthe company, and both groups are seen asequally important. All Telesom ZAAD staffare trained to use the service when they arehired and then given refresher training eachfollowing year. This training has ensuredthat staff knowledge and customer servicelevels are kept very high. Weak links inthe value chain are also discovered anddealer 1identified quickly which, in addition to thein-house distribution system, preservestrust in the Telesom ZAAD brand.The wider ecosystemFocussing on the ecosystem has meant thatTelesom ZAAD has had to connect withother key financial service stakeholders,including money changers (also calledcurrency exchangers) and neighbouringmobile money services.Because the Telesom ZAAD platform usesonly US dollars, money changers are an importantpart of the extended mobile moneyecosystem. Telesom ZAAD customers oftenTELESOM ZAADdealer 2customerdealer nstores merchants stores merchants stores merchantsFigure 1Telesom ZAAD’s business structureMoney changers on a Hargeisa streetneed to change Somaliland shillings intodollars before they can perform a cash-ininto their Telesom ZAAD account. TelesomZAAD users can either go to a Telesom storeto do this, or they can go to one of Somaliland’s6,500 money changers. When they goto a money changer, Telesom ZAAD userssimply have to bring Somaliland shillingsand ask for the equivalent amount in USdollars to be deposited into their account.This is performed as a traditional P2P transfersince money changers also have standardcustomer accounts. Every time they putdollar value into a Telesom ZAAD wallet,money changers are helping to facilitate andexpand mobile money transactions.

13 GSMA - Mobile Money for the Unbanked Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland 141,800,0001,600,000April 2010Cash replacementTransactions1,400,0001,200,0001,000,000800,000Mobile money services all over the world have struggled to develop their service into somethingmore than a simple remittance tool. As outlined previously in the paper, Telesom has succeededin getting their customers to keep money in their Telesom ZAAD wallets and to use mobile moneyinstead of cash for a variety of everyday transactions.What benefits does cash replacement actually bring?600,000400,000200,000may, 2009july, 2009sept, 2009nov, 2009jan, 2010march, 2010May, 2010july, 2010sept, 2010nov, 2010jan, 2011march, 2011May, 2011july, 2011sept, 2011nov, 2011jan, 2012march, 2012May, 2012july, 2012sept, 2012nov, 2012jan, 2013march, 2013For customers, mobile money offers a secure and convenient alternative to cash. By givingconsumers secure and immediate access to all of their funds on demand, Telesom has significantlyimproved the ability of consumers from Somaliland to make better buying decisions. Forthe private sector, mobile money has improved the ease of business transactions, particularly byimproving traceability and giving merchants access to a large pool of customers with a meansof easy payment. Finally, for central banks, digitising transactions brings increased transparency,reduced production costs, and better visibility into the economic environment.41Number oftransactions peractive user ofZAAD in March2013Figure 4Growth in Telesom ZAAD bill and merchant payment transactions over time24.7Telesom ZAAD as a cash replacementtool (April 2010 to March 2013)In March 2013, customer usage of the servicehad surpassed the averages of mobilemoney sprinters. Each active customer onaverage performed almost 25 P2P transfersand just over six bill payments in March2013 alone. Meanwhile, the frequency ofcash-ins and cash-outs declined from 1.3to 0.5 respectively in March 2010 and 1.3to 0.3 in March 2013. These are clear signsthat Telesom ZAAD is evolving into a cashreplacement tool.Telesom ZAAD’s ecosystem strategy andfocus on salary payments and merchantpayments have clearly worked. Customersare getting money into the systemthrough other means than just cash-in,and the money is staying in the system.Instead of cashing out, Telesom ZAAD userskeep a balance in their account and useTransaction typeTotal number oftransactionsTotal number oftransactionsper activesubscriber 8Total numberof subscribersperforming atransactionPercentage ofsubscribersperforming atransaction 92.0 2.28.3P2P Transfers andBulk Payments6.13.54.4 5.2 9.20.3 0.3 0.8 1.4 1.8 1.3 0.51.6 1.9 1.3 0.3Bill andMerchant PaymentsAirtime Top Ups Cash-Ins Cash-OutsP2P transfer initiatedby a customerP2P transfer initiated by amerchant and salary paymentAirtime top-upCustomer bill paymentand merchant paymentMerchant tomerchant payment6,507,315294,9122,478,0101,652,15029,59324.246.89.26.14.7244,4055,162184,796160,5483,82566.4%59.9%50.2%43.6%44.4%Global average in June 2012Zaad in March 2010Customer cash-in147,4790.553,55814.6%7 Global averages and averages fromMobile Money Sprinters come fromthe GSMA 2012 Global Mobile MoneyAdoption Survey.Average for Mobile Money Sprinters in June 2012Zaad in March 2013Figure 5Average number of Telesom ZAAD transactions per active user 7Customer cash-outMerchant cash-out78,3593,435table 2Total transactions on Telesom ZAAD in March 20130.30.528,9567557.9%8.8%8 In March 2013, there were 275,38230-day active Telesom ZAAD subscribers,including an estimated 269,079active customers and 6,303 activemerchants.9 There were 368,023 registeredcustomers and 8,620 registeredmerchants in March 2013.

15 GSMA - Mobile Money for the Unbanked Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland 16Telesom is thefirst mobilemoney providerto create amobile moneysystem that isfunctioning as acash replacementtoolthis balance to conduct transfers or makepayments. This point is confirmed uponexamination of the cash-in and cash-outcurves that appear in Figure 6.While customer cash-ins have continuedto increase in volume since April 2010,the rate of increase has slowed down, andalmost three years on the total volume is250% greater. Customer cash-outs, onthe other hand, have increased just 50%since May 2010.Evidence of the success of Telesom ZAADas a cash replacement can be encapsulatedneatly by examining the average balancesof customers’ accounts. On 31 March 2013,59% of customers had a positive balance intheir Telesom ZAAD account, $37 on average.Telesom’s analysis of account balancesover time indicates that customers are nowcomfortable maintaining balances, as theyunderstand there are multiple ways to usethe funds. Retail merchants are also keepingmoney in the system – 83% of maintaina positive balance of $352 on average.One way to assess the extent to which a mobilemoney service has been adopted is tolook at how money flows into, through, andout of the system. In the case of Safaricom’sM-PESA, from October 2012 to March 2013,US$ 5.3 billion entered the system throughcash-ins and $4.6 billion exited throughcash-outs. The total value of all transactionsin the system (transfers and paymentsexcluding cash-ins and cash-outs) duringthis period was $6.2 billion. This means thatevery dollar cashed in moved through thesystem 1.2 times as a transfer or a paymentbefore exiting the system. As a comparison,that ratio was just over 4.1 for TelesomZAAD during the same period.All evidence seems to indicate that Telesomis the first mobile money provider to createa mobile money system that is functioningeffectively as a cash replacement tool.USD 5.26bX 1.181M-PesaUSD 6.19b2zaadX 1.343USD 4.62b4.1Ratio of amountof money beingtransacted toamount beingcashed-in1,800,0001,600,0001,400,000April 2010X 4.122X 4.561,200,0001,000,00013800,000600,000400,000200,0001. Money entering the system through a cash-in2. Money moving into the system as a P2P transfer, bill payment, merchant payment, airtime top-up, etc.3. Money leaving the system through a cash-outmay, 2009july, 2009sept, 2009nov, 2009jan, 2010march, 2010May, 2010july, 2010sept, 2010nov, 2010jan, 2011march, 2011May, 2011july, 2011sept, 2011nov, 2011jan, 2012march, 2012May, 2012july, 2012sept, 2012nov, 2012jan, 2013march, 2013Note: M-PESA figures are sourced from Safaricom fiscal year 2013 results, available at: http://www.safaricom.co.ke/images/Downloads/Resources_Downloads/FY_2013_Results_Presentation.pdfcustomer cash-incustomer cash-outFigure 7M-PESA and Telesom ZAAD usage (October 2012 – March 2013)Figure 6Growth in cash-in and cash-out volumes over time

17 GSMA - Mobile Money for the Unbanked Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland 18ConclusionTelesom has learned from the experiencesof successful mobile money services inneighbouring countries and applied theselessons to Somaliland’s unique culturaland socio-economic context. Apart fromthe no-fee business model and internaldistribution network, the major differencein Telesom’s approach is its commitment tosalary payments and merchant payments.The results have been extremely encouraging;Telesom has created a new modelfor mobile money whereby customers areencouraged to keep money in the systemrather than cashing it out.Telesom ZAAD will soon be facing somemajor challenges, however.First, Telesom ZAAD’s active customer baserecently reached 40%, and its initial planwas to revise the free-to-use business modelonce customer usage reached this level.• Should Telesom start charging customersto use the service?• What could Telesom do to mitigatepossible customer drop-off oncecharges are introduced?Second, although the number of TelesomZAAD customers and customer usagecontinue to increase, the pace has startedto slow. Telesom ZAAD now must answerthe same questions that many other mobilemoney services are asking:• How can mobile money usage beincreased among existing customers?What new services would attract newcustomers?• How can new segments of the GSMsubscriber base be reached?Telesom is also discussing how they couldincrease their footprint in the market byextending their network of cash-in/cashoutpoints and recruiting external agents,which prompts these questions:• What kinds of challenges wouldmanaging external agents create, givenTelesom ZAAD’s current businessstructure?• How could Telesom leverage theecosystem around Telesom ZAAD tocreate new cash-in/cash-out points?Telesom ZAAD has clearly been very successfulin bringing financial services tounbanked people. Its mobile money servicehas changed the way people do business inSomaliland by making transactions easier,faster, and more secure. The MMU teamwill continue to work closely with TelesomZAAD and to learn from them as they continueto grow and overcome new challenges.

The MMU programme is supported by The Bill &Melinda Gates Foundation, The Mastercard Foundation and Omidyar Network.

For further information please contactmmu@gsma.comGSMA London OfficeT +44 (0) 20 7356 0600