OSBM Budget Manual - Office of State Budget and Management

OSBM Budget Manual - Office of State Budget and Management

OSBM Budget Manual - Office of State Budget and Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

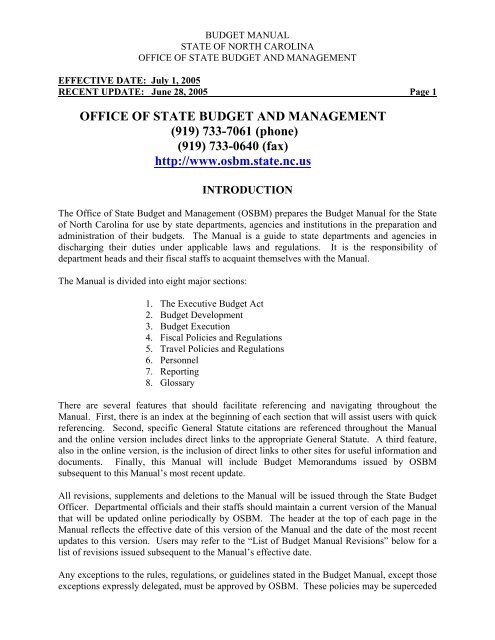

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 1OFFICE OF STATE BUDGET AND MANAGEMENT(919) 733-7061 (phone)(919) 733-0640 (fax)http://www.osbm.state.nc.usINTRODUCTIONThe <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> (<strong>OSBM</strong>) prepares the <strong>Budget</strong> <strong>Manual</strong> for the <strong>State</strong><strong>of</strong> North Carolina for use by state departments, agencies <strong>and</strong> institutions in the preparation <strong>and</strong>administration <strong>of</strong> their budgets. The <strong>Manual</strong> is a guide to state departments <strong>and</strong> agencies indischarging their duties under applicable laws <strong>and</strong> regulations. It is the responsibility <strong>of</strong>department heads <strong>and</strong> their fiscal staffs to acquaint themselves with the <strong>Manual</strong>.The <strong>Manual</strong> is divided into eight major sections:1. The Executive <strong>Budget</strong> Act2. <strong>Budget</strong> Development3. <strong>Budget</strong> Execution4. Fiscal Policies <strong>and</strong> Regulations5. Travel Policies <strong>and</strong> Regulations6. Personnel7. Reporting8. GlossaryThere are several features that should facilitate referencing <strong>and</strong> navigating throughout the<strong>Manual</strong>. First, there is an index at the beginning <strong>of</strong> each section that will assist users with quickreferencing. Second, specific General Statute citations are referenced throughout the <strong>Manual</strong><strong>and</strong> the online version includes direct links to the appropriate General Statute. A third feature,also in the online version, is the inclusion <strong>of</strong> direct links to other sites for useful information <strong>and</strong>documents. Finally, this <strong>Manual</strong> will include <strong>Budget</strong> Memor<strong>and</strong>ums issued by <strong>OSBM</strong>subsequent to this <strong>Manual</strong>’s most recent update.All revisions, supplements <strong>and</strong> deletions to the <strong>Manual</strong> will be issued through the <strong>State</strong> <strong>Budget</strong><strong>Office</strong>r. Departmental <strong>of</strong>ficials <strong>and</strong> their staffs should maintain a current version <strong>of</strong> the <strong>Manual</strong>that will be updated online periodically by <strong>OSBM</strong>. The header at the top <strong>of</strong> each page in the<strong>Manual</strong> reflects the effective date <strong>of</strong> this version <strong>of</strong> the <strong>Manual</strong> <strong>and</strong> the date <strong>of</strong> the most recentupdates to this version. Users may refer to the “List <strong>of</strong> <strong>Budget</strong> <strong>Manual</strong> Revisions” below for alist <strong>of</strong> revisions issued subsequent to the <strong>Manual</strong>’s effective date.Any exceptions to the rules, regulations, or guidelines stated in the <strong>Budget</strong> <strong>Manual</strong>, except thoseexceptions expressly delegated, must be approved by <strong>OSBM</strong>. These policies may be superceded

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 2by <strong>OSBM</strong> directives or agency policies as long as they conform to the basic principles <strong>of</strong> the<strong>State</strong> <strong>Budget</strong> <strong>Manual</strong>.An <strong>OSBM</strong> staff directory is available at http://www.osbm.state.nc.us/osbm/osbmstaff.html.Questions, comments, or suggestions concerning the <strong>Budget</strong> <strong>Manual</strong> may be sent to <strong>Budget</strong>-<strong>Manual</strong>-<strong>OSBM</strong>@ncmail.net. Periodically, <strong>OSBM</strong> will revise the <strong>Budget</strong> <strong>Manual</strong> to reflectpolicy <strong>and</strong> procedure changes <strong>and</strong> to make the <strong>Budget</strong> <strong>Manual</strong> more user-friendly.

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 3List <strong>of</strong> <strong>Budget</strong> <strong>Manual</strong> RevisionsDate <strong>of</strong> Revision Topic Section Page7/1/2003 Subsistence Rates Travel 141-142, 150-1511/12/2004 Misuse <strong>of</strong> <strong>State</strong> Property Personnel 1741/12/2004 Safety Shoe Allowance Personnel 161-1621/12/2004 Special Appropriations <strong>Budget</strong> Execution 1061/12/2004 Transp. By Personal Vehicle Travel 1466/28/2005 Subsistence Rate Revision Travel

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 4List <strong>of</strong> <strong>OSBM</strong>’s <strong>Budget</strong> Memor<strong>and</strong>umsBelow is a list <strong>of</strong> <strong>OSBM</strong> budget memor<strong>and</strong>ums issued after the most recent update. A completelist <strong>of</strong> all <strong>OSBM</strong> budget memor<strong>and</strong>ums may be found at the <strong>of</strong>fice’s websitehttp://www.osbm.state.nc.us/osbm/index.html.Date <strong>of</strong> Issuance Topic Time Limited

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 5TABLE OF CONTENTSOnline Start PageSection 1: Executive <strong>Budget</strong> Act 6Section 2: <strong>Budget</strong> Development 57Section 3: <strong>Budget</strong> Execution 68Section 4: Fiscal Policies <strong>and</strong> Regulations 127Section 5: Travel Policies <strong>and</strong> Regulations 140Section 6: Personnel 159Section 7: Reporting 175Section 8: Glossary 198

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 6EXECUTIVE BUDGET ACT INDEXSection Title Page143-1 Scope <strong>and</strong> definitions 9143-2 Purposes 9143-3 Examination <strong>of</strong> <strong>of</strong>ficers <strong>and</strong> agencies; disbursements 9143-3.1 Transfer <strong>of</strong> functions 10143-3.2 Issuance <strong>of</strong> warrants upon <strong>State</strong> Treasurer; delivery <strong>of</strong> warrants <strong>and</strong>disbursements for non-<strong>State</strong> entities 11143-3.3 Assignments <strong>of</strong> claims against <strong>State</strong> 12143-3.4 Warrants for money paid into treasury by mistake 14143-3.5 Coordination <strong>of</strong> statistics; fiscal analysis required for any bill proposed bya <strong>State</strong> agency that affects the budget 14143-4 Advisory <strong>Budget</strong> Commission 15143-4.1 Biennial inspection 17143-5 Appropriation rules 17143-6 Information from departments <strong>and</strong> agencies asking <strong>State</strong> aid 17143-6.1 Reports on use <strong>of</strong> <strong>State</strong> funds by non-<strong>State</strong> entities 18143-7 Itemized statements <strong>and</strong> forms; exemptions from G.S. 143-64.6(c)(10) 19143-8 Reporting <strong>of</strong> legislative <strong>and</strong> judicial expenditures <strong>and</strong> financial needs 20143-9 Information to be furnished upon request 20143-10 Preparation <strong>of</strong> budget <strong>and</strong> public hearing 20143-10.1A <strong>Budget</strong> required to include <strong>State</strong> cost <strong>of</strong> local programs - Continuation <strong>and</strong>expansion costs 21143-10.2 Limit on number <strong>of</strong> <strong>State</strong> employees 21143-10.7 Review <strong>of</strong> department forms <strong>and</strong> reports 21143-11 Survey <strong>of</strong> departments 21143-12 Bills containing proposed appropriations 24143-12.1 Vending facilities 25143-13 Printing copies <strong>of</strong> budget report <strong>and</strong> bills <strong>and</strong> rules for the introduction <strong>of</strong>the same 26143-14 Joint meetings <strong>of</strong> committees considering the budget report <strong>and</strong>appropriation bill 26143-15 Reduction <strong>and</strong> increase <strong>of</strong> items by General Assembly 27143-15.1 Current Operations Appropriations Act; General Fund Financial Model 28143-15.2 Use <strong>of</strong> General Fund credit balance; priority uses 28143-15.3 Savings Reserve Account 29143-15.3A Repairs <strong>and</strong> Renovations Reserve Account 29143-15.3B The Clean Water <strong>Management</strong> Trust Fund 30143-15.3C Work First Reserve Fund 31

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 7Section Title Page143-15.3D Trust Fund for Mental Health, Development Disabilities, <strong>and</strong> SubstanceAbuse Services <strong>and</strong> Bridge Funding Needs 31143-15.4 (Effective beginning with the 1993-94 General Fund Operating <strong>Budget</strong>)General Fund Operating <strong>Budget</strong> size limited 32143-16 Article governs all departmental, agency, etc., appropriations 32143-16.1 Federal funds 33143-16.2 Reports 33143-16.3 No expenditures for purposes for which the General Assembly hasconsidered but not enacted an appropriation 34143-16.4 Settlement Reserve Fund 34143-17 Requisition for allotment 34143-18 Unencumbered balances to revert to treasury; capital appropriations 35excepted143-18.1 Decrease <strong>of</strong> projects within capital improvement appropriations;requesting authorization <strong>of</strong> capital projects not specifically provided 35for143-19 Help for the Director 36143-20 Accounting records 37143-20.1 Annual financial statements 37143-21 Issuance <strong>of</strong> subpoenas 37143-22 Surveys, studies, <strong>and</strong> examinations <strong>of</strong> departments <strong>and</strong> institutions 38143-23 All maintenance funds for itemized purposes; transfers between objects orline items 38143-23.2 Transfers to Department <strong>of</strong> Health <strong>and</strong> Human Services 41143-23.3 Transfer <strong>of</strong> certain funds authorized 41143-24 Borrowing <strong>of</strong> money by <strong>State</strong> Treasurer 41143-25 Maintenance appropriations dependent upon adequacy <strong>of</strong> revenue tosupport them 41143-26 Director to have discretion as to manner <strong>of</strong> paying annual appropriations 43143-27 Appropriations to educational, charitable, <strong>and</strong> correctional institutions arein addition to receipts by them 43143-27.2 Discontinued service retirement allowance <strong>and</strong> severance wages for certain<strong>State</strong> employees 44143-28 All <strong>State</strong> agencies under provisions <strong>of</strong> this Article 45143-28.1 Highway Fund appropriation 45143-29 Delegation <strong>of</strong> power by Director 47143-30 <strong>Budget</strong> <strong>of</strong> <strong>State</strong> institutions 47143-31 Building <strong>and</strong> permanent improvement funds spent in accordance with 47budget143-31.1 Study <strong>and</strong> review <strong>of</strong> plans <strong>and</strong> specifications for building, improvement,etc., projects 48

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 8143-31.2 Appropriation, allotment, <strong>and</strong> expenditure <strong>of</strong> funds for historic <strong>and</strong>archeological property 48Section Title Page143-31.3 Grants to nonstate health <strong>and</strong> welfare agencies 49143-31.4 Non-<strong>State</strong> match restrictions 49143-31.5 Repayment <strong>of</strong> certain unexpended <strong>and</strong> unencumbered sums; reports 49143-32 Person expending an appropriation wrongfully 49143-33 Intent 50143-34 Penalties <strong>and</strong> punishment for violations 50143-34.1 Positions included in the <strong>State</strong>'s payroll must be approved by the Director<strong>of</strong> <strong>Budget</strong>; payment <strong>of</strong> benefits <strong>and</strong> other salary-related items must bemade from same source as salary; dependent care assistance programauthorized; flexible compensation benefits authorized 51143-34.2 Information as to requests for nonstate funds for projects imposingobligation on <strong>State</strong>; statement <strong>of</strong> participation in contacts, etc., fornonstate funds; limiting clause required in certain contracts or grants 52143-34.6 Deposit <strong>of</strong> payroll deductions 53143-34.7 Participation by Legislative <strong>Office</strong>rs 53Chapter 143Article 1BCapital Improvement Planning Act(G.S. 143-34.40 through 143-34.45)143-34.40 Definition 54143-34.41 Legislative intent, purpose 54143-34.42 Capital improvement facilities inventory 54143-34.43 Capital improvement needs criteria 54143-34.44 Agency capital improvement needs estimates 55143-34.45 Six year capital improvement plan 55

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 9§ 143-1. Scope <strong>and</strong> definitions.This Article shall be known, <strong>and</strong> may be cited, as "The Executive <strong>Budget</strong> Act." Whenever theword "Director" is used herein, it shall be construed to mean "Director <strong>of</strong> the <strong>Budget</strong>."Whenever the word "Commission" is used herein, it shall be construed to mean "Advisory<strong>Budget</strong> Commission," if the context shows that it is used with reference to any power or dutybelonging to the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> <strong>and</strong> to be performed by it, but it shallmean when used otherwise any <strong>State</strong> agency, <strong>and</strong> any other agency, person or commission bywhatever name called, that uses or expends or receives any <strong>State</strong> funds. "<strong>State</strong> funds" are herebydefined to mean any <strong>and</strong> all moneys appropriated by the General Assembly <strong>of</strong> North Carolina, ormoneys collected by or for the <strong>State</strong>, or any agency there<strong>of</strong>, pursuant to the authority granted inany <strong>of</strong> its laws. (1925, c. 89, s. 1; 1929, c. 100, s. 1; 1957, c. 269, s. 2; 1979, 2 nd Sess., c. 1137, s.37; 2000-140, s. 93.1(a); 2001-424, s. 12.2(b).)§ 143-2. Purposes.It is the purpose <strong>of</strong> this Article to vest in the Governor <strong>of</strong> the <strong>State</strong> a direct <strong>and</strong> effectivesupervision <strong>of</strong> all agencies, institutions, departments, bureaus, boards, commissions, <strong>and</strong>every <strong>State</strong> agency by whatsoever name now or hereafter called, including the same power <strong>and</strong>supervision over such private corporations <strong>and</strong> persons <strong>and</strong> organizations <strong>of</strong> all kinds that mayreceive, pursuant to statute, any funds either appropriated by, or collected for, the <strong>State</strong> <strong>of</strong> NorthCarolina, or any <strong>of</strong> its departments, boards, divisions, agencies, institutions <strong>and</strong> commissions; forthe efficient <strong>and</strong> economical administration <strong>of</strong> all agencies, institutions, departments, bureaus,boards, commissions, persons or corporations that receive or use <strong>State</strong> funds; <strong>and</strong> for theinitiation <strong>and</strong> preparation <strong>of</strong> a balanced budget <strong>of</strong> any <strong>and</strong> all revenues <strong>and</strong> expenditures for eachsession <strong>of</strong> the General Assembly.The Governor shall be ex <strong>of</strong>ficio Director <strong>of</strong> the <strong>Budget</strong>. The purpose <strong>of</strong> this Article is to includewithin the powers <strong>of</strong> the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> all agencies, institutions,departments, bureaus, boards, <strong>and</strong> commissions <strong>of</strong> the <strong>State</strong> <strong>of</strong> North Carolina under whatevername now or hereafter known, <strong>and</strong> the change <strong>of</strong> the name <strong>of</strong> such agencies hereafter shall notaffect or lessen the powers <strong>and</strong> duties <strong>of</strong> the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> in respectthereto.The test as to whether an institution, department, agency, board, commission, or corporation orperson is included within the purpose <strong>and</strong> powers <strong>and</strong> duties <strong>of</strong> the Director <strong>of</strong> the <strong>Budget</strong> shallbe whether such agency or person receives for use, or expends, any <strong>of</strong> the funds <strong>of</strong> the <strong>State</strong> <strong>of</strong>North Carolina, including funds appropriated by the General Assembly <strong>and</strong> funds arising fromthe collection <strong>of</strong> fees, taxes, donations appropriative, or otherwise. (1925, c. 89, s. 2; 1929, c.100, s. 2; 1955, c. 578, s. 1; c. 743; 1957, c. 269, ss. 1, 2; 1979, 2nd Sess., c. 1137, s. 37; 1981, c.859, s. 47.1; 1983 (Reg. Sess., 1984), c. 1109, s. 10; 1985, c. 290, s. 1; 2000-140, s. 93.1(a);2001-424, s. 12.2(b).)§ 143-3. Examination <strong>of</strong> <strong>of</strong>ficers <strong>and</strong> agencies; disbursements.The Director shall have power to examine under oath any <strong>of</strong>ficer or any head, any clerk oremployee, <strong>of</strong> any department, institution, bureau, division, board, commission, corporation,

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 10association, or any agency; to cause the attendance <strong>of</strong> all such persons, requiring such persons t<strong>of</strong>urnish any <strong>and</strong> all information desired relating to the affairs <strong>of</strong> such agency; to compel theproduction <strong>of</strong> books, papers, accounts, or other documents in the possession or under the control<strong>of</strong> such person so required to attend. The Director or his authorized representative shall have theright <strong>and</strong> the power to examine any <strong>State</strong> institution or agency, board, bureau, division,commission, corporation, person, <strong>and</strong> to inspect its property, <strong>and</strong> inquire into the method <strong>of</strong>operation <strong>and</strong> management.The Director shall have power to have the books <strong>and</strong> accounts <strong>of</strong> any <strong>of</strong> such agencies or personsaudited, <strong>and</strong> supervise generally the budget accounts <strong>of</strong> such departments, institutions <strong>and</strong>agencies within the terms <strong>of</strong> this Article. The Director may require that the cost <strong>of</strong> making allaudits shall be paid from the regular maintenance appropriation made by the General Assemblyfor such department, institution or agency which may be thus audited.It shall be the duty <strong>of</strong> the Director to recommend to the General Assembly at each session suchchanges in the organization, management <strong>and</strong> general conduct <strong>of</strong> the various departments,institutions <strong>and</strong> other agencies <strong>of</strong> the <strong>State</strong>, <strong>and</strong> included within the terms <strong>of</strong> this Article, as in hisjudgment will promote the more efficient <strong>and</strong> economical operation <strong>and</strong> management there<strong>of</strong>.The <strong>State</strong> Controller under the provisions <strong>of</strong> the Executive <strong>Budget</strong> Act shall prescribe themanner in which disbursements <strong>of</strong> the several institutions <strong>and</strong> departments shall be made <strong>and</strong>mayrequire that all warrants, vouchers or checks, except those drawn by the <strong>State</strong> Auditor, <strong>State</strong>Treasurer, <strong>and</strong> Administrative <strong>Office</strong>r <strong>of</strong> the Courts shall bear two signatures <strong>of</strong> such <strong>of</strong>ficersas will be designated by the <strong>State</strong> Controller. (1925, c. 89, s. 3; 1929, c. 100, s. 3; c. 337, s. 4;1969, c. 458, s. 3; 1981, c. 859, s. 47.1; 1985 (Reg. Sess., 1986), c. 1024, s. 2.)§ 143-3.1. Transfers <strong>of</strong> functions.The functions <strong>of</strong> preaudit <strong>of</strong> <strong>State</strong> agency expenditures, issuance <strong>of</strong> warrants on the <strong>State</strong>Treasurer for <strong>State</strong> agency expenditures, <strong>and</strong> maintenance <strong>of</strong> records pertaining to thesefunctions shall be transferred from the Director <strong>of</strong> the <strong>Budget</strong> to the <strong>Office</strong> <strong>of</strong> the <strong>State</strong>Controller. All statutory authority, personnel, unexpended balances <strong>of</strong> appropriations or otherfunds, books, papers, reports, files <strong>and</strong> other records <strong>of</strong> the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong><strong>Management</strong> pertaining to <strong>and</strong> used in the performance <strong>of</strong> these functions shall be transferred tothe <strong>Office</strong> <strong>of</strong> the <strong>State</strong> Controller; <strong>of</strong>fice machinery <strong>and</strong> equipment used primarily in theperformance <strong>of</strong> these functions shall also be transferred to the <strong>Office</strong> <strong>of</strong> the <strong>State</strong> Controller. TheGovernor is authorized to do all things necessary to effect an orderly <strong>and</strong> efficient transfer.The functions <strong>of</strong> accounting systems development, maintenance, <strong>and</strong> coordination shall betransferred from the <strong>Office</strong> <strong>of</strong> the <strong>State</strong> Auditor to the <strong>Office</strong> <strong>of</strong> the <strong>State</strong> Controller. All statutoryauthority, personnel, unexpended balances <strong>of</strong> appropriations or other funds, books, papers,reports, files, s<strong>of</strong>tware, documentation, <strong>and</strong> other records <strong>of</strong> the Auditor's <strong>Office</strong> pertaining to<strong>and</strong> used in the performance <strong>of</strong> these functions shall be transferred to the <strong>Office</strong> <strong>of</strong> the <strong>State</strong>Controller; <strong>of</strong>fice machinery, equipment, terminals <strong>and</strong> the like used primarily in theperformance <strong>of</strong> these functions shall also be transferred to the <strong>Office</strong> <strong>of</strong> the <strong>State</strong> Controller. The

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 11<strong>State</strong> Auditor, with the advice <strong>and</strong> consent <strong>of</strong> the Governor, is authorized to do all thingsnecessary to effect an orderly <strong>and</strong> efficient transfer. (1955, c. 578, s. 2; 1957, c. 269, s. 2; 1979,2nd Sess., c. 1137, s. 37; 1985 (Reg. Sess., 1986), c. 1024, s. 3; 2000-140, c. 93.1(i).)§ 143-3.2. Issuance <strong>of</strong> warrants upon <strong>State</strong> Treasurer; delivery <strong>of</strong> warrants <strong>and</strong>disbursements for non-<strong>State</strong> entities.(a) The <strong>State</strong> Controller shall have the exclusive responsibility for the issuance <strong>of</strong> all warrantsfor the payment <strong>of</strong> money upon the <strong>State</strong> Treasurer. All warrants upon the <strong>State</strong> Treasurer shallbe signed by the <strong>State</strong> Controller, who before issuing them shall determine the legality <strong>of</strong>payment <strong>and</strong> the correctness <strong>of</strong> the accounts. All warrants issued for non-<strong>State</strong> entities shall bedelivered by the appropriate agency to the entity's legally designated recipient by United <strong>State</strong>smail or its equivalent, including electronic funds transfer.When the <strong>State</strong> Controller finds it expedient to do so because <strong>of</strong> a <strong>State</strong> agency's size <strong>and</strong>location, the <strong>State</strong> Controller may authorize a <strong>State</strong> agency to make expenditures through adisbursing account with the <strong>State</strong> Treasurer. The <strong>State</strong> Controller shall authorize the JudicialDepartment <strong>and</strong> the General Assembly to make expenditures through such disbursingaccounts. All disbursements made to non-<strong>State</strong> entities shall be delivered by the appropriateagency to the entity's legally designated recipient by United <strong>State</strong>s mail or its equivalent,including electronic funds transfer. All deposits in these disbursing accounts shall be by the <strong>State</strong>Controller's warrant. A copy <strong>of</strong> each voucher making withdrawals from these disbursingaccounts <strong>and</strong> any supporting data required by the <strong>State</strong> Controller shall be forwarded to the<strong>Office</strong> <strong>of</strong> the <strong>State</strong> Controller monthly or as otherwise required by the <strong>State</strong> Controller.Supporting data for a voucher making a withdrawal from one <strong>of</strong> these disbursing accounts tomeet a payroll shall include the amount <strong>of</strong> the payroll <strong>and</strong> the employees whose compensation ispart <strong>of</strong> the payroll.A central payroll unit operating under the <strong>Office</strong> <strong>of</strong> the <strong>State</strong> Controller may make deposits <strong>and</strong>withdrawals directly to <strong>and</strong> from a disbursing account. The disbursing account shall constitute arevolving fund for servicing payrolls passed through the central payroll unit.The <strong>State</strong> Controller may use a facsimile signature machine in affixing his signature to warrants.(b) The <strong>State</strong> Treasurer may impose on an agency a fee <strong>of</strong> fifteen dollars ($15.00) for each checkdrawn against the agency's disbursing account that causes the balance in the account to be inoverdraft or while the account is in overdraft. The financial <strong>of</strong>ficer shall pay the fee from non-<strong>State</strong> or personal funds to the General Fund to the credit <strong>of</strong> the miscellaneous non-tax revenueaccount by the agency. (1955, c. 578, s. 2; 1957, c. 269, s. 2; 1961, c. 1194; 1969, c. 844, s. 12;1979, 2nd Sess., c. 1137, s. 37; 1981, c. 859, s. 47.1; c. 884, s. 10; 1985, c. 290, s. 2; 1985 (Reg.Sess., 1986), c. 1024, s. 4; 1989 (Reg. Sess., 1990), c. 1074, s. 17; 1991, c. 542, s. 5; 1995, c.507, s. 27.4.)§ 143-3.3. Assignments <strong>of</strong> claims against <strong>State</strong>.(a) Definitions. - The following definitions apply in this section:

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 12(1) Assignment. An assignment or transfer <strong>of</strong> a claim, or a power <strong>of</strong> attorney, an order, oranother authority for receiving payment <strong>of</strong> a claim.(2) Claim. A claim, a part or a share <strong>of</strong> a claim, or an interest in a claim, whether absoluteor conditional.(3) Qualified charitable organization. A charitable organization that is exempt from federalincome tax pursuant to section 501(c)(3) <strong>of</strong> the Internal Revenue Code.(4) <strong>State</strong> employee credit union. A credit union organized under Chapter 54 <strong>of</strong> the GeneralStatutes whose membership is at least one-half employees <strong>of</strong> the <strong>State</strong>.(5) The <strong>State</strong>. The <strong>State</strong> <strong>of</strong> North Carolina <strong>and</strong> any department, bureau, or institution <strong>of</strong> the<strong>State</strong> <strong>of</strong> North Carolina.(b) Assignments Prohibited. - Except as otherwise provided in this section, any assignment <strong>of</strong> aclaim against the <strong>State</strong> is void, regardless <strong>of</strong> the consideration given for the assignment, unlessthe claim has been duly audited <strong>and</strong> allowed by the <strong>State</strong> <strong>and</strong> the <strong>State</strong> has issued a warrant forpayment <strong>of</strong> the claim. Except as otherwise provided in this section, the <strong>State</strong> shall not issue awarrant to an assignee <strong>of</strong> a claim against the <strong>State</strong>.(c) Assignments in Favor <strong>of</strong> Certain Entities Allowed. – This section does not apply to anassignment in favor <strong>of</strong>:(1) A hospital.(2) A building <strong>and</strong> loan association.(3) A uniform rental firm in order to allow an employee <strong>of</strong> the Department <strong>of</strong>Transportation to rent uniforms that include day-glo orange shirts or vests as requiredby federal <strong>and</strong> <strong>State</strong> law.(4) An insurance company for medical, hospital, disability, or life insurance.(d) Assignments to Meet Child Support Obligations Allowed. - This section does not apply toassignments made to meet child support obligations pursuant to G.S. 110-136.1.(e) Assignments for Prepaid Legal Services Allowed. – This section does not apply to anassignment for payment for prepaid legal services.(f) Payroll Deduction for <strong>State</strong> Employee Credit Union Accounts Allowed. - An employee <strong>of</strong> the<strong>State</strong> who is a member <strong>of</strong> a <strong>State</strong> employee credit union may authorize, in writing, the periodicdeduction from the employee's salary or wages paid for employment by the <strong>State</strong> <strong>of</strong> a designatedlump sum for deposit to any credit union accounts, purchase <strong>of</strong> any credit union shares, orpayment <strong>of</strong> any credit union obligations agreed to by the employee <strong>and</strong> the <strong>State</strong> employee creditunion.(g) Payroll Deduction for Payments to Certain Employees' Associations Allowed. - An employee<strong>of</strong> the <strong>State</strong> or any <strong>of</strong> its institutions, departments, bureaus, agencies or commissions, or any <strong>of</strong>its local boards <strong>of</strong> education or community colleges, who is a member <strong>of</strong> a domiciled employees'association that has at least 2,000 members, the majority <strong>of</strong> whom are employees <strong>of</strong> the <strong>State</strong> orpublic school employees, may authorize, in writing, the periodic deduction each payroll period

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 13from the employee's salary or wages a designated lump sum to be paid to the employees'association.An employee <strong>of</strong> any local board <strong>of</strong> education who is a member <strong>of</strong> a domiciled employees'association that has at least 40,000 members, the majority <strong>of</strong> whom are public school teachers,may authorize in writing the periodic deduction each payroll period from the employee's salaryor wages a designated lump sum or sums to be paid for dues <strong>and</strong> voluntary contributions for theemployees' association.An authorization under this subsection shall remain in effect until revoked by the employee. Aplan <strong>of</strong> payroll deductions pursuant to this subsection for employees <strong>of</strong> the <strong>State</strong> <strong>and</strong> otherassociation members shall become void if the employees' association engages in collectivebargaining with the <strong>State</strong>, any political subdivision <strong>of</strong> the <strong>State</strong>, or any local schooladministrative unit. This subsection does not apply to county or municipal governments or anylocal governmental unit, except for local boards <strong>of</strong> education.(h) Payroll Deduction for <strong>State</strong> Employees Combined Campaign Allowed. - Subject to rulesadopted by the <strong>State</strong> Controller, an employee <strong>of</strong> the <strong>State</strong> may authorize, in writing, the periodicdeduction from the employee's salary or wages paid for employment by the <strong>State</strong> <strong>of</strong> a designatedlump sum to be paid to satisfy the employee's pledge to the <strong>State</strong> Employees CombinedCampaign.(i) Payroll Deduction for Public School <strong>and</strong> Community College Employees' Contributions toCharitable Organizations Allowed. - Subject to rules adopted by the <strong>State</strong> Controller, anemployee <strong>of</strong> a local board <strong>of</strong> education or community college may authorize, in writing, theperiodic deduction from the employee's salary or wages paid for employment by the board <strong>of</strong>education or community college <strong>of</strong> a designated lump sum to be contributed to a qualifiedcharitable organization that has first been approved by the employee's board <strong>of</strong> education orcommunity college board.(j) Payroll Deduction for University <strong>of</strong> North Carolina System Employees' Contributions toCertain Charitable Organizations Allowed. - Subject to rules adopted by the <strong>State</strong> Controller, ifa constituent institution <strong>of</strong> The University <strong>of</strong> North Carolina approves a payroll deduction planunder this subsection, an employee <strong>of</strong> the constituent institution may authorize, in writing, theperiodic deduction from the employee's salary or wages paid for employment by the constituentinstitution <strong>of</strong> a designated lump sum to be contributed to a qualified charitable organization thatexists to support athletic or charitable programs <strong>of</strong> the constituent institution <strong>and</strong> that has firstbeen approved by the President <strong>of</strong> The University <strong>of</strong> North Carolina as existing to supportathletic or charitable programs. If a payroll deduction plan under this subsection results inadditional costs to a constituent institution, these costs shall be paid by the qualified charitableorganizations receiving contributions under the plan.(k) Payroll Deduction for University <strong>of</strong> North Carolina System Employees to Pay forDiscretionary Privileges <strong>of</strong> University Service. - Subject to rules adopted by the <strong>State</strong> Controller,if a constituent institution <strong>of</strong> The University <strong>of</strong> North Carolina approves a payroll deduction plan

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 14under this subsection, an employee <strong>of</strong> the constituent institution may authorize, in writing, theperiodic deduction from the employee's salary or wages paid for employment by the constituentinstitution, <strong>of</strong> one or more designated lump sums to be applied to the cost <strong>of</strong> correspondingdiscretionary privileges available at employee expense from the employing institution.Discretionary privileges from the employing institution that may be paid for through thissubsection include parking privileges, athletic passes, use <strong>of</strong> recreational facilities, admission tocampus concert series, <strong>and</strong> access to other institutionally hosted or provided entertainments,events, <strong>and</strong> facilities.(l) Assignment <strong>of</strong> Payments From the Underground Storage Tank Cleanup Funds. - This sectiondoes not apply to an assignment <strong>of</strong> any claim for payment or reimbursement from theCommercial Leaking Petroleum Underground Storage Tank Cleanup Fund established by G.S.143-215.94B or the Noncommercial Leaking Petroleum Underground Storage Tank CleanupFund established by G.S. 143-215.94D. (1925, c. 249; 1935, c. 19; 1939, c. 61; 1941, c. 128;1965, c. 1179; 1969, c. 625; 1977, c. 88; 1981, c. 869; 1981 (Reg. Sess., 1982), c. 1282, ss. 14,15; 1983, c. 680; c. 913, s. 49; 1983 (Reg. Sess., 1984), c. 1034, s. 147; c. 1036, s. 1; 1985 (Reg.Sess., 1986), c. 1024, s. 5; 1987, c. 738, s. 223; 1989, c. 215; 1989 (Reg. Sess., 1990), c. 1066, s.82; 1991, c. 688, s. 1; 1993, c. 561, s. 63(a); 1997-412, s. 9; 1998-161, s. 7; 2002-126, s. 6.4(a).)§ 143-3.4. Warrants for money paid into treasury by mistake.(a) Whenever the Governor <strong>and</strong> Council <strong>of</strong> <strong>State</strong> are satisfied that moneys have been paid intothe treasury through mistake, they may direct a warrant be drawn therefor on the Treasurer, infavor <strong>of</strong> the person who made such payment; but this provision shall not extend to payments onaccount <strong>of</strong> taxes nor to payments on bonds <strong>and</strong> mortgages.(b) Whenever any real property mortgaged to the <strong>State</strong>, or bought in for the benefit <strong>of</strong> the <strong>State</strong>,<strong>of</strong> which a certificate shall have been given to a former purchaser, is sold by the AttorneyGeneral on a foreclosure by notice, or under a judgment, for a greater sum than the amount dueto the <strong>State</strong>, with costs <strong>and</strong> expenses, the surplus money received into the treasury, after aconveyance has been executed to the purchaser, shall be paid to the person legally entitled tosuch real property at the time <strong>of</strong> the foreclosure on the forfeiture <strong>of</strong> the original contract. Awarrant shall not be drawn for such surplus money but upon satisfactory pro<strong>of</strong>, by affidavit orotherwise, <strong>of</strong> the legal rights <strong>of</strong> such person. (1868-9, c. 270, ss. 66, 68; Code, ss. 3351, 3352;Rev., ss. 5366, 5368; C.S., ss. 7676, 7678; 1983, c. 913, ss. 50, 51.)§ 143-3.5. Coordination <strong>of</strong> statistics; fiscal analysis required for any bill proposed by a<strong>State</strong> agency that affects the budget.(a) It shall be the duty <strong>of</strong> the Director, through the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> tocoordinate the efforts <strong>of</strong> governmental agencies in the collection, development, dissemination<strong>and</strong> analysis <strong>of</strong> <strong>of</strong>ficial economic, demographic <strong>and</strong> social statistics pertinent to <strong>State</strong> budgeting.The Director shall:(1) Prepare <strong>and</strong> release the <strong>of</strong>ficial demographic <strong>and</strong> economic estimates <strong>and</strong> projectionsfor the <strong>State</strong>;(2) Conduct special economic <strong>and</strong> demographic analyses <strong>and</strong> studies to support statewidebudgeting;

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 15(3) Develop <strong>and</strong> coordinate cooperative arrangements with federal, <strong>State</strong> <strong>and</strong> localgovernmental agencies to facilitate the exchange <strong>of</strong> data to support <strong>State</strong> budgeting;(4) Compile, maintain, <strong>and</strong> disseminate information about <strong>State</strong> programs which involvethe distribution <strong>of</strong> <strong>State</strong> aid funds to local governments including those variables usedin their allocation;(5) Develop <strong>and</strong> maintain in cooperation with other <strong>State</strong> <strong>and</strong> local governmental agencies,an information system providing comparative data on resources <strong>and</strong> expenditures <strong>of</strong>local governments; <strong>and</strong>(6) Report major trends that influence revenues <strong>and</strong> expenditures in the <strong>State</strong> budget in thecurrent fiscal year <strong>and</strong> that may influence revenues <strong>and</strong> expenditures over the next fivefiscal years.Every fiscal analysis prepared by the Director or the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong>addressing the <strong>State</strong> budget outlook shall encompass the upcoming five-year period. Everyfiscal analysis prepared by the Director or the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong>addressing the impact <strong>of</strong> proposed legislation on the <strong>State</strong> budget shall estimate the impact forthe first five fiscal years the legislation would be in effect. To minimize duplication <strong>of</strong> effort incollecting or developing new statistical series pertinent to <strong>State</strong> planning <strong>and</strong> budgeting,including contractual arrangements, <strong>State</strong> agencies must submit to the Director proposedprocedures <strong>and</strong> funding requirements.(b) Any bill proposed by an executive or judicial department, agency, institution, board, orcommission that affects the <strong>State</strong> budget shall be accompanied by a fiscal analysis. The fiscalanalysis shall estimate the impact <strong>of</strong> the legislation on the <strong>State</strong> budget for the first five fiscalyears the legislation would be in effect.(c) This section shall not apply to the General Assembly, any <strong>of</strong> its committees <strong>and</strong>subcommittees, the Legislative Research Commission, the Legislative Services Commission, orany other committee or commission in the legislative branch. (1979, 2 nd Sess., c. 1137, s. 41;1991, c. 689, s. 341; 1993 (Reg. Sess., 1994), c. 769, s. 11.1(b); 2000-140, s. 93.1(f); 2001-424,s. 12.2(b).)§ 143-3.6: Expired.§ 143-3.7. Repealed by Session Laws 1997-443, s. 23(b).§ 143-4. Advisory <strong>Budget</strong> Commission.(a) Five Senators appointed by the President Pro Tempore <strong>of</strong> the Senate, five Representativesappointed by the Speaker <strong>of</strong> the House <strong>and</strong> five persons appointed by the Governor shallconstitute the Advisory <strong>Budget</strong> Commission. If the Governor appoints any members <strong>of</strong> theGeneral Assembly to the Advisory <strong>Budget</strong> Commission, he must appoint an equal number fromthe Senate <strong>and</strong> House <strong>of</strong> Representatives.(b) The Chairman <strong>of</strong> the Advisory <strong>Budget</strong> Commission shall also receive an additional twothous<strong>and</strong> five hundred dollars ($2,500) payable in quarterly installments, for expenses.

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 16The members <strong>of</strong> the Advisory <strong>Budget</strong> Commission shall receive no per diem compensation fortheir services, but shall receive the same subsistence <strong>and</strong> travel allowance as are provided formembers <strong>of</strong> the General Assembly for services on interim legislative committees.(c) The Governor may call a meeting <strong>of</strong> the Commission during the period beginning with theconvening <strong>of</strong> each regular session <strong>and</strong> ending 30 days later. Otherwise, meetings <strong>of</strong> theCommission may be called by the Governor or by the chairman.Members <strong>of</strong> the Commission shall take the oath <strong>of</strong> <strong>of</strong>fice at or before the first meeting <strong>of</strong> theCommission they attend.The <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong>, under the direction <strong>of</strong> the <strong>State</strong> <strong>Budget</strong> <strong>Office</strong>r,may serve as staff to the Commission. The <strong>State</strong> <strong>Budget</strong> <strong>Office</strong>r shall designate a secretary to theCommission.(d) After the agenda for a meeting has been delivered to the members <strong>of</strong> the Commission, noother item shall be considered at that meeting except upon the approval <strong>of</strong> a majority <strong>of</strong> themembers present <strong>and</strong> voting.Except for the Governor, persons who are not members <strong>of</strong> the Commission may address theCommission only at the invitation <strong>of</strong> the Governor, the chairman, or a majority <strong>of</strong> the memberspresent <strong>and</strong> voting.A vacancy in one <strong>of</strong> the seats on the Commission shall be filled by appointment by the <strong>of</strong>ficerwho appointed the person causing the vacancy.(e) Before the end <strong>of</strong> each fiscal year or as soon thereafter as practicable, the Advisory <strong>Budget</strong>Commission shall contract with a competent certified public accountant who is in no wayotherwise affiliated with the <strong>State</strong> or with any agency there<strong>of</strong> to conduct a thorough <strong>and</strong>complete audit <strong>of</strong> the receipts <strong>and</strong> expenditures <strong>of</strong> the <strong>State</strong> Auditor's <strong>of</strong>fice during theimmediate fiscal year just ended, <strong>and</strong> to report to the Advisory <strong>Budget</strong> Commission on suchaudit not later than the following October first. A sufficient number <strong>of</strong> copies <strong>of</strong> such audit shallbe provided so that at least one copy is filed with the Governor's <strong>Office</strong>, one copy with the<strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> <strong>and</strong> at least two copies filed with the Secretary <strong>of</strong> <strong>State</strong>.(f) In all matters where action on the part <strong>of</strong> the Advisory <strong>Budget</strong> Commission is required by thisArticle, 10 members <strong>of</strong> the Commission shall constitute a quorum for performing the duties oracts required by the Commission. (1925, c. 89, s. 4; 1929, c. 100, s. 4; 1931, c. 295; 1951, c. 768;1955, c. 578, s. 3; 1957, c. 269, s. 2; 1973, c. 820, ss. 1-3; 1979, 2nd Sess., c. 1137, ss. 25, 29.1,37; 1981, c. 859, s. 47.1; 1983, c. 48, ss. 1-3; 1983 (Reg. Sess., 1984), c. 1034, s. 148; 1985, c. 3,ss. 1-2.1; c. 290, s. 3; 1985 (Reg. Sess., 1986), c. 955, ss. 56, 57; 1989, c. 781, s. 41; 1991, c.739, s. 22; 2000-140, s. 93.1(a); 2001-424, s. 12.2(b).)§ 143-4.1. Biennial inspection.

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 17The Commission shall make a biennial inspection <strong>of</strong> those physical facilities <strong>of</strong> the <strong>State</strong> itdeems necessary. The Governor may make a biennial inspection <strong>of</strong> those facilities <strong>of</strong> the <strong>State</strong> hedeems necessary. (1983, (Reg. Sess., 1984), c. 1034, s. 149; 1985 (Reg. Sess., 1986), c. 955, s.59.)§ 143-5. Appropriation rules.All moneys heret<strong>of</strong>ore <strong>and</strong> hereafter appropriated shall be deemed <strong>and</strong> held to be within theterms <strong>of</strong> this Article <strong>and</strong> subject to its provisions unless it shall be otherwise provided in the actappropriating the same; <strong>and</strong> no money shall be disbursed from the <strong>State</strong> treasury except as hereinprovided. (1925, c. 89, s. 5; 1929, c. 100, s. 5.)§ 143-6. Information from departments <strong>and</strong> agencies asking <strong>State</strong> aid.(a) On or before the first day <strong>of</strong> September in the even-numbered years, each <strong>of</strong> the departments,bureaus, divisions, <strong>of</strong>ficers, boards, commissions, institutions, <strong>and</strong> other <strong>State</strong> agencies <strong>and</strong>undertakings receiving or asking financial aid from the <strong>State</strong>, or receiving or collecting fundsunder the authority <strong>of</strong> any general law <strong>of</strong> the <strong>State</strong>, shall furnish the Director all the information,data <strong>and</strong> estimates which he may request with reference to past, present <strong>and</strong> futureappropriations <strong>and</strong> expenditures, receipts, revenue, <strong>and</strong> income.(b) Any department, bureau, division, <strong>of</strong>ficer, board, commission, institution, or other <strong>State</strong>agency or undertaking desiring to request financial aid from the <strong>State</strong> for the purpose <strong>of</strong>constructing or renovating any <strong>State</strong> building, utility, or other property development (except arailroad, highway, or bridge structure) shall, before making any such request for <strong>State</strong> financialaid, submit to the Department <strong>of</strong> Administration a statement <strong>of</strong> its needs in terms <strong>of</strong> space <strong>and</strong>other physical requirements, <strong>and</strong> shall furnish the Department with such additional informationas it may request. The Department <strong>of</strong> Administration shall then review the statement <strong>of</strong> needssubmitted by the requesting department, bureau, division, <strong>of</strong>ficer, board, commission, institution,or other <strong>State</strong> agency or undertaking <strong>and</strong> perform additional analysis, as necessary, to complywith G.S. 143-341.(b1) All requests for financial aid for the purpose <strong>of</strong> constructing or renovating any <strong>State</strong>building, utility, or other property development (except a railroad, highway, or bridge structure)shall be accompanied by a certification from the Department <strong>of</strong> Administration as outlined inG.S. 143-341. The General Assembly may provide advanced planning funds but shall onlyprovide construction funds when the requirements <strong>of</strong> this subsection have been met. Thissubsection shall not apply to requests for appropriations <strong>of</strong> less than one hundred thous<strong>and</strong>dollars ($100,000).(b2) Any department, bureau, division, <strong>of</strong>ficer, board, commission, institution, or other <strong>State</strong>agency or undertaking desiring to request financial aid from the <strong>State</strong> for the purpose <strong>of</strong>acquiring or maintaining information technology as defined by G.S. 147-33.81(2) shall, beforemaking the request for <strong>State</strong> financial aid, submit to the <strong>State</strong> Chief Information <strong>Office</strong>r (CIO) astatement <strong>of</strong> its needs in terms <strong>of</strong> information technology <strong>and</strong> other related requirements <strong>and</strong>shall furnish the

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 18CIO with any additional information requested by the CIO. The CIO shall then review thestatement <strong>of</strong> needs submitted by the requesting department, bureau, division, <strong>of</strong>ficer, board,commission, institution, or other <strong>State</strong> agency or undertaking <strong>and</strong> perform additional analysis, asnecessary, to comply with G.S. 147-33.82. All requests for financial aid for the purpose <strong>of</strong>acquiring or maintaining information technology shall be accompanied by a certification fromthe CIO deeming the request for financial aid to be consistent with Article 3D <strong>of</strong> Chapter 147 <strong>of</strong>the General Statutes. The CIO shall make recommendations to the Governor regarding the merits<strong>of</strong> requests for financial aid for the purpose <strong>of</strong> acquiring or maintaining information technology.This subsection shall not apply to requests for appropriations <strong>of</strong> less than one hundred thous<strong>and</strong>dollars ($100,000).(c) On or before the first day <strong>of</strong> September in the even-numbered years, each <strong>of</strong> the departments,bureaus, divisions, <strong>of</strong>ficers, boards, commissions, institutions, <strong>and</strong> other <strong>State</strong> agencies receivingor asking financial aid or support from the <strong>State</strong>, under the authority <strong>of</strong> any general law <strong>of</strong> the<strong>State</strong>, shall furnish the Director with the following information:(1) The amount <strong>of</strong> <strong>State</strong> funds disbursed in the immediately preceding two fiscal years <strong>and</strong>the purpose for which the funds were disbursed <strong>and</strong> used, the amount being requestedas continuation funds for the upcoming fiscal year, <strong>and</strong> the justification for continued<strong>State</strong> support; <strong>and</strong>(2) Justification for continued <strong>State</strong> support shall include information on the extent <strong>of</strong> thepublic benefit being derived from <strong>State</strong> support.(d) The <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> <strong>and</strong> the Director <strong>of</strong> the <strong>Budget</strong> shall provide tothe General Assembly, on or before January 15 <strong>of</strong> each odd-numbered year, a report thatadequately <strong>and</strong> fairly presents the information required in this section. (1925, c. 89, s. 6; 1929, c.100, s. 6; 1957, c. 584, s. 4; 1965, c. 310, s. 4; 1991, c. 689, s. 190(b); 1998-45, s. 2; 2000-140, s.93.1(a); 2001-424, ss. 12.2(b), 15.3(a).)§ 143-6.1. Report on use <strong>of</strong> <strong>State</strong> funds by non-<strong>State</strong> entities.(a) Disbursement <strong>and</strong> Use <strong>of</strong> <strong>State</strong> Funds. – Every corporation, organization, <strong>and</strong> institution thatreceives, uses, or expends any <strong>State</strong> funds shall use or expend the funds only for the purposes forwhich they were appropriated by the General Assembly or collected by the <strong>State</strong>. <strong>State</strong> fundsinclude federal funds that flow through the <strong>State</strong>. For the purposes <strong>of</strong> this section, the term"grantee" means a corporation, organization, or institution that receives, uses, or expends any<strong>State</strong> funds. The <strong>State</strong> may not disburse <strong>State</strong> funds appropriated by the General Assembly toany grantee or collected by the <strong>State</strong> for use by any grantee if that grantee has failed to provideany reports or financial information previously required by this section. In addition, beforedisbursing the funds, the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> may require the grantee tosupply information demonstrating that the grantee is capable <strong>of</strong> managing the funds inaccordance with law <strong>and</strong> has established adequate financial procedures <strong>and</strong> controls. Allfinancialstatements furnished to the <strong>State</strong> Auditor pursuant to this section, <strong>and</strong> any audits or other reportsprepared by the <strong>State</strong> Auditor, are public records.

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 19(b) <strong>State</strong> Agency Reports. - A <strong>State</strong> agency that receives <strong>State</strong> funds <strong>and</strong> then disburses the <strong>State</strong>funds to a grantee must identify the grantee to the <strong>State</strong> Auditor, unless the funds were for thepurchase <strong>of</strong> goods <strong>and</strong> services. The <strong>State</strong> agency must submit documents to the <strong>State</strong> Auditor ina prescribed format describing st<strong>and</strong>ards <strong>of</strong> compliance <strong>and</strong> suggested audit proceduressufficient to give adequate direction to independent auditors performing audits.(c) Grantee Receipt <strong>and</strong> Expenditure Reports. - A grantee that receives, uses, or expendsbetween fifteen thous<strong>and</strong> dollars ($15,000) <strong>and</strong> three hundred thous<strong>and</strong> dollars ($300,000) in<strong>State</strong> funds annually, except when the funds are for the purchase <strong>of</strong> goods or services, must fileannually with the <strong>State</strong> agency that disbursed the funds a sworn accounting <strong>of</strong> receipts <strong>and</strong>expenditures <strong>of</strong> the <strong>State</strong> funds. This accounting must be attested to by the treasurer <strong>of</strong> thegrantee <strong>and</strong> one otherauthorizing <strong>of</strong>ficer <strong>of</strong> the grantee. The accounting must be filed within six months after the end<strong>of</strong> the grantee's fiscal year in which the <strong>State</strong> funds were received. The accounting shall be inthe form required by the disbursing agency. Each <strong>State</strong> agency shall develop a format for theseaccountings <strong>and</strong> shall obtain the <strong>State</strong> Auditor's approval <strong>of</strong> the format.(d) Grantee Audit Reports. - A grantee that receives, uses, or expends <strong>State</strong> funds in the amount<strong>of</strong> three hundred thous<strong>and</strong> dollars ($300,000) or more annually, except when the funds are forthe purchase <strong>of</strong> goods or services, must file annually with the <strong>State</strong> Auditor a financial statementin the form <strong>and</strong> on the schedule prescribed by the <strong>State</strong> Auditor. The financial statement must beaudited in accordance with st<strong>and</strong>ards prescribed by the <strong>State</strong> Auditor to assure that <strong>State</strong> fundsare used for the purposes provided by law.(e) Federal Reporting Requirements. - Federal law may require a grantee to make additionalreports with respect to funds for which reports are required under this section. Notwithst<strong>and</strong>ingthe provisions <strong>of</strong> this section, a grantee may satisfy the reporting requirements <strong>of</strong> subsection (c)<strong>of</strong> this section by submitting a copy <strong>of</strong> the report required under federal law with respect to thesame funds or by submitting a copy <strong>of</strong> the report described in subsection (d) <strong>of</strong> this section.(f) Audit Oversight. - The <strong>State</strong> Auditor has audit oversight, pursuant to Article 5A <strong>of</strong> Chapter147 <strong>of</strong> the General Statutes, <strong>of</strong> every grantee that receives, uses, or expends <strong>State</strong> funds. Such agrantee must, upon request, furnish to the <strong>State</strong> Auditor for audit all books, records, <strong>and</strong> otherinformation necessary for the <strong>State</strong> Auditor to account fully for the use <strong>and</strong> expenditure <strong>of</strong> <strong>State</strong>funds. The grantee must furnish any additional financial or budgetary information requested bythe <strong>State</strong> Auditor. (1989, c. 752, s. 54; 1991, c. 689, ss. 12, 190(a); 1993, c. 321, s. 45; 1995(Reg. Sess., 1996), c. 748, s. 2.1; 1997-443, s. 34.11; 2000-140, s. 93.1(a); 2001-424, s. 12.2(b).)§ 143-7. Itemized statements <strong>and</strong> forms.(a) The statements <strong>and</strong> estimates required under G.S. 143-6 shall be itemized in accordance withthe budget classification adopted by the <strong>State</strong> Controller, <strong>and</strong> upon forms prescribed by theDirector, <strong>and</strong> shall be approved <strong>and</strong> certified by the respective heads or responsible <strong>of</strong>ficer <strong>of</strong>each department, bureau, board, commission, institution, or agency submitting same. Officialestimate blanks which shall be used in making these reports shall be furnished by the Director <strong>of</strong>the <strong>Budget</strong>.

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 20(b) The budget classification adopted by the <strong>State</strong> Controller <strong>and</strong> the forms prescribed by theDirector shall include budget account codes relating specifically to information technology toallow reliable <strong>and</strong> meaningful analysis <strong>of</strong> information technology funding <strong>and</strong> expendituresthroughout <strong>State</strong> government. (1925, c. 89, s. 7; 1929, c. 100, s. 7; 1957, c. 269, s. 2; 1983, c.761, s. 19; 1985 (Reg. Sess., 1986), c. 1024, ss. 6, 7; 2001-424, s. 15.3(b).)§ 143-8. Reporting <strong>of</strong> legislative <strong>and</strong> judicial expenditures <strong>and</strong> financial needs.On or before the first day <strong>of</strong> September, biennially, in the even-numbered years, the LegislativeServices <strong>Office</strong>r shall furnish the Director a detailed statement <strong>of</strong> expenditures <strong>of</strong> the GeneralAssembly for the current fiscal biennium, <strong>and</strong> an estimate <strong>of</strong> its financial needs, itemized inaccordance with the budget classification adopted by the Director <strong>and</strong> approved <strong>and</strong> certified bythe President Pro Tempore <strong>of</strong> the Senate <strong>and</strong> the Speaker <strong>of</strong> the House <strong>of</strong> Representatives foreach year <strong>of</strong> the ensuing biennium, beginning with the first day <strong>of</strong> July thereafter. TheAdministrative <strong>Office</strong>r <strong>of</strong> the Courts shall furnish the Director a detailed statement <strong>of</strong>expenditures <strong>of</strong> the judiciary, <strong>and</strong> for each year <strong>of</strong> the current fiscal biennium an estimate <strong>of</strong> itsfinancial needs as provided by law, itemized in accordance with the budget classificationadopted by the Director <strong>and</strong> approved <strong>and</strong> certified by the Chief Justice for each year <strong>of</strong> theensuing biennium, beginning with the first day <strong>of</strong> July thereafter. The Director shall includethese estimates <strong>and</strong> accompanying explanations in the budget submitted with suchrecommendations as the Director may desire to make in reference thereto. (1925, c. 89, s. 8;1929, c. 100, s. 8; 1961, c. 1181, s. 1; 1971, c. 1200, s. 7; 1985 (Reg. Sess., 1986), c. 1024, ss. 8,9; 1987, c. 738, s. 61; 1996, 2nd Ex. Sess., c. 18, s. 8(m).)§ 143-9. Information to be furnished upon request.The departments, bureaus, divisions, <strong>of</strong>ficers, commissions, institutions, or other <strong>State</strong> agenciesor undertakings <strong>of</strong> the <strong>State</strong>, upon request, shall furnish the Director, in such form <strong>and</strong> at suchtime as he may direct, any information desired by him in relation to their respective activities orfiscal affairs. The <strong>State</strong> Auditor <strong>and</strong> the <strong>State</strong> Controller shall also furnish the Director anyspecial, periodic, or other financial statements as the Director may request. (1925, c. 89, s. 10;1929, c. 100, s. 9; 1985 (Reg. Sess., 1986), c. 1024, s. 10.)§ 143-10. Preparation <strong>of</strong> budget <strong>and</strong> public hearing.The members <strong>of</strong> the Commission shall, at the request <strong>of</strong> the Director, attend such public hearing<strong>and</strong> other meeting as may be held in the preparation <strong>of</strong> the budget. Said Commission shall act atall times in an advisory capacity to the Director on matters relating to the plan <strong>of</strong> proposedexpenditures <strong>of</strong> the <strong>State</strong> government <strong>and</strong> the means <strong>of</strong> financing the same.The Director shall provide for public hearings on any <strong>and</strong> all estimates to be included in thebudget, which shall be held during the months <strong>of</strong> October <strong>and</strong>/or November <strong>and</strong>/or such othertimes as the Director may fix in the even-numbered years, <strong>and</strong> may require the attendance atthese hearings <strong>of</strong> the heads or responsible representatives <strong>of</strong> all <strong>State</strong> departments, bureaus,divisions, <strong>of</strong>ficers, boards, commissions, institutions, or other <strong>State</strong> agencies or undertakings,<strong>and</strong> such other persons, corporations <strong>and</strong> associations, using or receiving or asking for any <strong>State</strong>funds. Prior to taking any action under this subsection to provide for public hearings, the

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 21Governor may consult with the Advisory <strong>Budget</strong> Commission. (1925, c. 89, s. 11; 1929, c. 100,s. 10; 1985 (Reg. Sess., 1986), c. 955, ss. 60, 61.)§ 143-10.1. Repealed by Session Laws 1991, c. 689, s. 342.§ 143-10.1A. <strong>Budget</strong> required to include <strong>State</strong> cost <strong>of</strong> local programs - Continuation <strong>and</strong>expansion costs.Effective July 1, 1991, the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> <strong>and</strong> the Director <strong>of</strong> the<strong>Budget</strong>, with the advice <strong>of</strong> the Advisory <strong>Budget</strong> Commission, shall prepare the <strong>State</strong> budgetin a format that adequately <strong>and</strong> fairly reflects the continuation costs for the <strong>State</strong>'s share <strong>of</strong>locally operated programs established by statute or <strong>State</strong> appropriation. These continuation costsshall be computed using the same budget preparation guidelines <strong>and</strong> rules prepared by the <strong>Office</strong><strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> for use in <strong>State</strong> agency <strong>and</strong> institution budgets. Furthermore,in the projections for the expansion costs related to employee compensation, the budget shallinclude the expansion costs necessary to cover the <strong>State</strong>'s share <strong>of</strong> salary <strong>and</strong> salary-related itemsfor employees in locally operated <strong>State</strong>-funded programs. Local governments or organizationsspending <strong>State</strong> funds to operate local programs shall provide necessary information to the <strong>Office</strong><strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong> to establish the necessary continuation <strong>and</strong> expansion costs.(1989 (Reg. Sess., 1990), c. 1066, s. 75; 2000-140, s. 93.1(a); 2001-424, s. 12.2(b).)§ 143-10.2. Limit on number <strong>of</strong> <strong>State</strong> employees.The total number <strong>of</strong> permanent <strong>State</strong>-funded employees, excluding employees in the <strong>State</strong>'spublic school system funded by way <strong>of</strong> <strong>State</strong> aid to local public school units, shall not beincreased by the end <strong>of</strong> any <strong>State</strong> fiscal year by a greater percentage than the percentage rate <strong>of</strong>the residential population growth for the <strong>State</strong> <strong>of</strong> North Carolina. The percentage rates shall becomputed by the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong>. The population growth shall becomputed by averaging the rate <strong>of</strong> residential population growth in each <strong>of</strong> the preceding 10fiscal years as stated in the annual estimates <strong>of</strong> residential population in North Carolina made bythe United <strong>State</strong>s Census Bureau. The growth rate <strong>of</strong> the number <strong>of</strong> employees shall becomputed by averaging the rate <strong>of</strong> growth <strong>of</strong> <strong>State</strong> employees in each <strong>of</strong> the preceding 10 fiscalyears as <strong>of</strong> July 1 <strong>of</strong> each fiscal year as stated in the <strong>State</strong> <strong>Budget</strong>. (1989, c. 752, s. 46(a); 1991,c. 689, s. 343; 2000-140, s. 93.1(a); 2001-424, s. 12.2(b).)§§ 143-10.3 through 143-10.6. Repealed by Session Laws 2001-424, s. 12.2(a), effective July 1,2001.§ 143-10.7. Review <strong>of</strong> department forms <strong>and</strong> reports.The Director, through the <strong>Office</strong> <strong>of</strong> <strong>State</strong> <strong>Budget</strong> <strong>and</strong> <strong>Management</strong>, shall review on three-yearcycles all internal <strong>and</strong> external forms <strong>and</strong> reports in use by <strong>State</strong> departments <strong>and</strong> institutions toconfirm whether these forms <strong>and</strong> reports continue to be needed. If, during the review process, itis determined that these forms <strong>and</strong> reports are no longer necessary, or that they duplicate otherforms or reports either in whole or in part, the Director shall have these forms <strong>and</strong> reportsmodified or eliminated. All departments shall provide the Director with copies <strong>of</strong> all forms <strong>and</strong>reports used, together with any additional information necessary for the review <strong>of</strong> these reports.(1995, c. 324, s. 10.2; 2000-140, s. 93.1(a); 2001-424, s. 12.2(b).)

BUDGET MANUALSTATE OF NORTH CAROLINAOFFICE OF STATE BUDGET AND MANAGEMENTEFFECTIVE DATE: July 1, 2005RECENT UPDATE: June 28, 2005 Page 22§ 143-11. Survey <strong>of</strong> departments.(a) On or before the fifteenth day <strong>of</strong> December, biennially in the even-numbered years, theDirector shall make a complete, careful survey <strong>of</strong> the operation <strong>and</strong> management <strong>of</strong> all thedepartments, bureaus, divisions, <strong>of</strong>ficers, boards, commissions, institutions, <strong>and</strong> agencies <strong>and</strong>undertakings <strong>of</strong> the <strong>State</strong> <strong>and</strong> all persons or corporations who use or expend <strong>State</strong> funds, in theinterest <strong>of</strong> economy <strong>and</strong> efficiency, <strong>and</strong> <strong>of</strong> obtaining a working knowledge upon which to baserecommendations to the General Assembly as to appropriations for maintenance <strong>and</strong> specialfunds <strong>and</strong> capital expenditures for the succeeding biennium. If the Director <strong>and</strong> the Commissionshall agree in their recommendations for the budget for the next biennial period, he shall preparetheir report in the form <strong>of</strong> a proposed budget, together with such comment <strong>and</strong> recommendationsas they may deem proper to make. If the Director <strong>and</strong> Commission shall not agree in substantialparticulars, the Director shall prepare the proposed budget based on his own conclusions <strong>and</strong>judgment, <strong>and</strong> the Commission or any <strong>of</strong> its members retain the right to submit separately to theGeneral Assembly such statement <strong>of</strong> disagreement <strong>and</strong> the particulars there<strong>of</strong> as representingtheir views. The budget report shall contain a complete <strong>and</strong> itemized plan <strong>of</strong> all proposedexpenditures for each <strong>State</strong> department, bureau, board, division, institution, commission, <strong>State</strong>agency or undertaking, person or corporation who receives or may receive for use <strong>and</strong>expenditure any <strong>State</strong> funds, in accordance with the classification <strong>of</strong> funds <strong>and</strong> accounts adoptedby the <strong>State</strong> Controller, <strong>and</strong> <strong>of</strong> the estimated revenues <strong>and</strong> borrowings for each year in theensuing biennial period beginning with the first day <strong>of</strong> July thereafter. Opposite each line item<strong>of</strong> the proposed expenditures, the budget shall show in separate parallel columns:(1) Proposed expenditures <strong>and</strong> receipts for each fiscal year <strong>of</strong> the biennium;(2) The certified budget for the preceding fiscal year;(3) The currently authorized budget for the preceding fiscal year;(4) Actual expenditures <strong>and</strong> receipts for the most recent fiscal year for which actualexpenditure information is available; <strong>and</strong>(5) Proposed increases <strong>and</strong> decreases.Revenue <strong>and</strong> expenditure information shall be no less specific than the two-digit level in the<strong>State</strong> Accounting System Chart <strong>of</strong> Accounts as prescribed by the <strong>State</strong> Controller. The budgetshall clearly differentiate between general fund expenditures for operating <strong>and</strong> maintenance,special fund expenditures for any purpose, <strong>and</strong> proposed capital improvements.(b) The Director shall accompany the budget with:(1) A budget message supporting his recommendations <strong>and</strong> outlining a financial policy <strong>and</strong>program for the ensuing biennium. The message will include an explanation <strong>of</strong> increaseor decrease over past expenditures, a discussion <strong>of</strong> proposed changes in existingrevenue laws <strong>and</strong> proposed bond issues, their purpose, the amount, rate <strong>of</strong> interest,term, the requirements to be attached to their issuance <strong>and</strong> the effect such issues willhave upon the redemption <strong>and</strong> annual interest charges <strong>of</strong> the <strong>State</strong> debt.(2) <strong>State</strong> Controller reports including:a. An itemized <strong>and</strong> complete financial statement for the <strong>State</strong> at the close <strong>of</strong> the lastpreceding fiscal year ending June 30.b. A statement <strong>of</strong> special funds.