PRICE OF CRUDE OIL: HOW IT IS FORMED FROM ... - Wbiaus.org

PRICE OF CRUDE OIL: HOW IT IS FORMED FROM ... - Wbiaus.org

PRICE OF CRUDE OIL: HOW IT IS FORMED FROM ... - Wbiaus.org

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

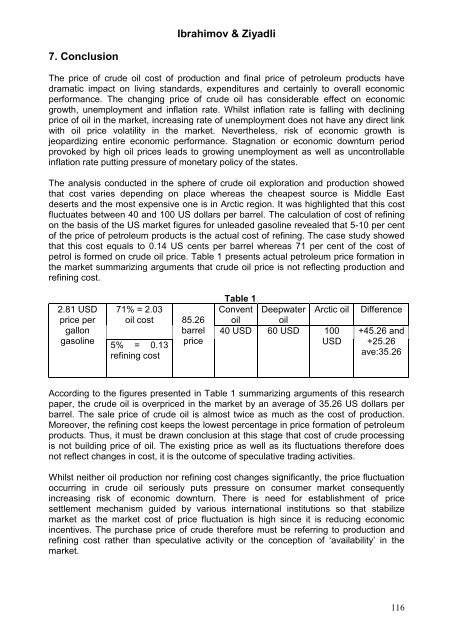

Ibrahimov & Ziyadli7. ConclusionThe price of crude oil cost of production and final price of petroleum products havedramatic impact on living standards, expenditures and certainly to overall economicperformance. The changing price of crude oil has considerable effect on economicgrowth, unemployment and inflation rate. Whilst inflation rate is falling with decliningprice of oil in the market, increasing rate of unemployment does not have any direct linkwith oil price volatility in the market. Nevertheless, risk of economic growth isjeopardizing entire economic performance. Stagnation or economic downturn periodprovoked by high oil prices leads to growing unemployment as well as uncontrollableinflation rate putting pressure of monetary policy of the states.The analysis conducted in the sphere of crude oil exploration and production showedthat cost varies depending on place whereas the cheapest source is Middle Eastdeserts and the most expensive one is in Arctic region. It was highlighted that this costfluctuates between 40 and 100 US dollars per barrel. The calculation of cost of refiningon the basis of the US market figures for unleaded gasoline revealed that 5-10 per centof the price of petroleum products is the actual cost of refining. The case study showedthat this cost equals to 0.14 US cents per barrel whereas 71 per cent of the cost ofpetrol is formed on crude oil price. Table 1 presents actual petroleum price formation inthe market summarizing arguments that crude oil price is not reflecting production andrefining cost.2.81 USDprice pergallongasoline71% = 2.03oil cost 85.265% = 0.13barrelpricerefining costTable 1Convent Deepwater Arctic oiloil oil40 USD 60 USD 100USDDifference+45.26 and+25.26ave:35.26According to the figures presented in Table 1 summarizing arguments of this researchpaper, the crude oil is overpriced in the market by an average of 35.26 US dollars perbarrel. The sale price of crude oil is almost twice as much as the cost of production.Moreover, the refining cost keeps the lowest percentage in price formation of petroleumproducts. Thus, it must be drawn conclusion at this stage that cost of crude processingis not building price of oil. The existing price as well as its fluctuations therefore doesnot reflect changes in cost, it is the outcome of speculative trading activities.Whilst neither oil production nor refining cost changes significantly, the price fluctuationoccurring in crude oil seriously puts pressure on consumer market consequentlyincreasing risk of economic downturn. There is need for establishment of pricesettlement mechanism guided by various international institutions so that stabilizemarket as the market cost of price fluctuation is high since it is reducing economicincentives. The purchase price of crude therefore must be referring to production andrefining cost rather than speculative activity or the conception of ‘availability’ in themarket.116