Review for the June 2008 CFA Level 1 CFA Exam - CFA Society of ...

Review for the June 2008 CFA Level 1 CFA Exam - CFA Society of ...

Review for the June 2008 CFA Level 1 CFA Exam - CFA Society of ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

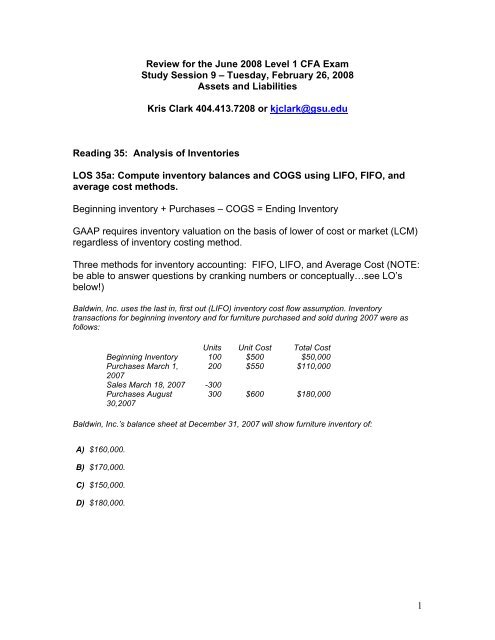

In 2004, Torrence Co. had a beginning inventory <strong>of</strong> $19,924 and made purchases <strong>of</strong> $15,923. If<strong>the</strong> ending inventory level was $19,204, what was <strong>the</strong> Cost <strong>of</strong> Goods Sold <strong>for</strong> year 2004?A) $15,923.B) $15,203.C) $720.D) $16,643.A company's beginning inventory was overstated by $3,000, now ending inventory is understatedby $2,000. If purchases were properly reported, <strong>the</strong>n earnings be<strong>for</strong>e taxes will be:A) overstated by $5,000.B) understated by $1,000.C) overstated by $1,000.D) understated by $5,000.While attending a local college, music major Anjolie Webster accepts a temporary position with asmall manufacturing firm. Currently, <strong>the</strong> firm uses LIFO to account <strong>for</strong> inventory, but <strong>the</strong> owner is“just curious” about how <strong>the</strong> financial results would look if <strong>the</strong> company used FIFO. Be<strong>for</strong>e <strong>the</strong>owner leaves <strong>for</strong> her voice lesson, she hands Webster a photocopy <strong>of</strong> <strong>the</strong> inventory data <strong>for</strong> <strong>the</strong>current period (summarized below).• Beginning inventory <strong>of</strong> 1,000 units at $30 cost.• Ending inventory <strong>of</strong> 800 units.• Sales <strong>of</strong> 1,100 units.• Three inventory purchases (listed from earliest purchase to latest purchase): 400 units at$27 each, 300 units at $25 each, and an unreadable number <strong>of</strong> units at $22 each.(Un<strong>for</strong>tunately, when <strong>the</strong> owner copied <strong>the</strong> original document, she left a yellow stickynote covering some <strong>of</strong> <strong>the</strong> inventory in<strong>for</strong>mation.)• Current assets (less inventory) <strong>of</strong> $75,000.• Current liabilities <strong>of</strong> $65,000.Using <strong>the</strong> in<strong>for</strong>mation provided, determine which <strong>of</strong> <strong>the</strong> following statements is least accurate? Allelse equal, compared to LIFO, using FIFO would result in:A) a lower gross margin.B) a lower ending inventory balance.C) cost <strong>of</strong> goods sold <strong>of</strong> $32,700.D) a current ratio <strong>of</strong> approximately 1.60.2

LOS 35b: Explain <strong>the</strong> relationship among and <strong>the</strong> usefulness <strong>of</strong> inventoryand COGS data provided by LIFO, FIFO, and average cost methods whenprices are stable or changing.In periods <strong>of</strong> changing prices, different inventory costing methods affect <strong>the</strong>comparability <strong>of</strong> financial statements between firms. If prices <strong>of</strong> good do notchange, <strong>the</strong> n <strong>the</strong> different inventory valuation methods do not affect <strong>the</strong> financialstatements.During periods <strong>of</strong> changing prices, FIFO will provide <strong>the</strong> most useful estimate <strong>of</strong><strong>the</strong> inventory value and LIFO will provide <strong>the</strong> most useful estimate <strong>of</strong> <strong>the</strong> COGS.Which <strong>of</strong> <strong>the</strong> following statements is least accurate?A)B)In a period <strong>of</strong> rising prices, LIFO gives <strong>the</strong> best COGS, whereas FIFO gives <strong>the</strong> bestinventory balance on <strong>the</strong> balance sheet.In a period <strong>of</strong> rising prices, FIFO gives <strong>the</strong> best COGS, whereas LIFO gives <strong>the</strong> bestinventory balance on <strong>the</strong> balance sheet.C) In a period <strong>of</strong> stable prices, LIFO and FIFO will produce similar account balances.D)LIFO produces a tax benefit in a period <strong>of</strong> rising prices, <strong>the</strong>re<strong>for</strong>e results in higher cashflows than FIFO.During inflationary periods, which <strong>of</strong> <strong>the</strong> following statements is TRUE?A) LIFO will generate lower earnings, but lower after tax cash flows.B) FIFO will generate higher earnings, but lower after tax cash flows.C) FIFO will generate lower earnings, but lower after tax cash flows.D) LIFO will generate higher earnings, but lower after tax cash flows.LOS 35c: Compare and contrast <strong>the</strong> effect <strong>of</strong> <strong>the</strong> different methods onCOGS and inventory balances and discuss how a company’s choice <strong>of</strong>inventory accounting method affects o<strong>the</strong>r financial items such as income,cash flow, and work capital.The LIFO to FIFO conversion….FIFO Inventory = LIFO Inventory + LIFO ReserveCOGS FIFO = COGS LIFO – (LIFO reserve ENDING – LIFO reserve BEGINNING )3

The FIFO to LIFO conversion….Not done <strong>for</strong> inventory since inventory under LIFO is not a reflection <strong>of</strong> currentvalue.COGS LIFO = COGS FIFO + (BI FIFO x inflation rate)NOTE: Inflation rate should not be a general inflation rate <strong>for</strong> <strong>the</strong> economy butshould be an inflation rate appropriate <strong>for</strong> <strong>the</strong> firm or industry.When prices are changing, an analyst should use LIFO-based values <strong>for</strong> incomestatement items and ratios, and FIFO-based values <strong>for</strong> balance sheet items andratios.In periods <strong>of</strong> rising prices and stable or increasing inventories:LIFOHigher COGSLower taxesLower net income (EBT & EAT)Lower inventory balancesLower working capitalHigher cash flows (less taxes paid out)FIFOLower COGSHigher taxesHigher net income (EBT & EAT)Higher inventory balancesHigher working capitalLower cash flows (more taxes paid out)In periods <strong>of</strong> rising prices and stable or increasing inventories:LIFOHigher COGSLower taxesLower net income (EBT & EAT)Lower inventory balancesLower working capitalHigher cash flows (less taxes paid out)FIFOLower COGSHigher taxesHigher net income (EBT & EAT)Higher inventory balancesHigher working capitalLower cash flows (more taxes paid out)Given <strong>the</strong> following data:• Beginning LIFO Reserve $2,300• Cost <strong>of</strong> Goods Sold (COGS) using LIFO $6,100• COGS using FIFO <strong>of</strong> $4,300What is <strong>the</strong> Ending LIFO reserve?A) $4,100.B) $500.C) $2,300.D) $2,800.4

If a company using last in, first out (LIFO) reports an inventory balance <strong>of</strong> $22,000 and a LIFOreserve <strong>of</strong> $4,000, <strong>the</strong> estimated value <strong>for</strong> <strong>the</strong> inventory on a first in, first out (FIFO) basis wouldbe:A) $13,000.B) $26,000.C) $18,000.D) $24,000.LOS 35d: Compare and contrast <strong>the</strong> effects <strong>of</strong> <strong>the</strong> choice <strong>of</strong> inventorymethod on pr<strong>of</strong>itability, liquidity, activity, and solvency ratios.Pr<strong>of</strong>itability• LIFO produces COGS balances that are higher• Pr<strong>of</strong>itability ratios are lower under LIFOLiquidity• FIFO produces inventory figures that are higher• Liquidity ratios are higher under FIFOActivity• LIFO produces a better estimate <strong>of</strong> COGS• FIFO produces a better estimate <strong>of</strong> inventory• Inventory turnover ratio is always higher when using LIFOSolvency• The balance sheet must be adjusted by accounting <strong>for</strong> <strong>the</strong> LIFO reserve• Solvency ratios will be lower under FIFO5

Selected in<strong>for</strong>mation from Oldtown, Inc.’s financial statements <strong>for</strong> <strong>the</strong> year endedDecember 31, 2004 included <strong>the</strong> following (in $):Cash 1,320,000 Accounts Payable 1,620,000Accounts Receivable 2,430,000 Deferred Tax Liability 715,000Inventory 6,710,000 Long-term Debt 15,230,000Property, Plant & Equip. 12,470,000 Common Stock 1,000,000Total Assets 22,930,000 Retained Earnings 4,365,000Total Liabilities & Equity 22,930,000Sales 15,000,000Net Income 3,000,000LIFO Reserve at Jan. 1 1,620,000LIFO Reserve at Dec. 31 1,620,000Oldtown uses <strong>the</strong> last in, first out (LIFO) inventory cost flow assumption. The tax rate was 40percent. If Oldtown changed from LIFO to first in, first out (FIFO) <strong>for</strong> 2004, net pr<strong>of</strong>it marginwould:A) decrease from 20.0 to 13.5 percent.B) decrease from 20.0 to 9.2 percent.C) decrease from 20.0 to 16.8 percent.D) remain unchanged at 20.0 percent.LOS 35e: Indicate <strong>the</strong> reasons that a LIFO reserve might declineduring agiven period and evaluate <strong>the</strong> implications <strong>of</strong> such a decline <strong>for</strong> financialanalysis.The LIFO reserve will decline if inventory quantity is falling and/or prices arefalling.In periods <strong>of</strong> falling prices, which <strong>of</strong> <strong>the</strong> following statements is TRUE? Compared to FIFO, LIFOresults in:A) higher inventory balances and higher working capital.B) higher inventory balances and lower working capital.C) lower COGS, lower taxes and higher net income.D) higher COGS, lower taxes and higher net income.6

LOS 35f: Ilustrate how inventory are reported in <strong>the</strong> financial statementsand how <strong>the</strong> lower <strong>of</strong> cost or market principles is used and applied.GAAP requires inventory valuation on <strong>the</strong> basis <strong>of</strong> lower <strong>of</strong> cost or market (LCM)regardless <strong>of</strong> inventory costing method. (Concept <strong>of</strong> Conservatism)Cost is calculated using <strong>the</strong> actual purchase prices <strong>of</strong> <strong>the</strong> items.Market is <strong>the</strong> replacement cost which consists <strong>of</strong> a range <strong>of</strong> values from “netrealizable value less a normal pr<strong>of</strong>it margin” to “net realizable value”.Barber Inc. sells DVD recorders. On October 14, it purchased a large number <strong>of</strong> recorders at acost <strong>of</strong> $90 each. Due to an oversupply <strong>of</strong> recorders remaining in <strong>the</strong> marketplace due to lowerthan anticipated demand during <strong>the</strong> Christmas season, <strong>the</strong> selling price at December 31 is $80and <strong>the</strong> replacement cost is $73. The normal pr<strong>of</strong>it margin is 5 percent <strong>of</strong> <strong>the</strong> selling price and <strong>the</strong>selling costs are $2 per recorder.What should Barber value <strong>the</strong> recorders at on December 31?A) $74.B) $73.C) $78.D) $80.Reading 36: Long-Lived Assets: CapitalizationLOS 36a: Demonstrate <strong>the</strong> effects <strong>of</strong> capitalizing versus expensing on netincome, shareholders’ equity, cash flow from operations, and financialratios.Capitalizing ExpensingIncome Variability Lower HigherPr<strong>of</strong>itability-Early Years(ROA&ROE)Pr<strong>of</strong>itability-Later Years(ROA&ROE)HigherLowerLowerHigherTotal Cash Flows Same SameCash Flow from Operations Higher LowerCash Flow from Investing Lower HigherLeverage Ratios (D/E & D/A) Lower Higher7

An analyst should adjust income statements and balance sheets to reverse <strong>the</strong>impact <strong>of</strong> capitalized interest.Selected in<strong>for</strong>mation from <strong>the</strong> financial statements <strong>of</strong> Salvo Company <strong>for</strong> <strong>the</strong> years endedDecember 31, 2003 and 2004 is as follows (in $ millions):2003 2004Sales $21 $23Cost <strong>of</strong> Goods Sold (8) (9)Gross Pr<strong>of</strong>it 13 14Cost <strong>of</strong> Franchise (6) 0O<strong>the</strong>r Expenses (6) (6)Net Income $1 $8Cash $4 $5Accounts Receivable 6 5Inventory 9 7Property, Plant & Equip. (net) 12 15Total Assets $31 $32Accounts Payable $7 $5Long-term Debt 10 5Common Stock 8 8Retained Earnings 6 14Total Liabilities and Equity $31 $32Salvo’s return on average total equity <strong>for</strong> 2004 was ($8 / (($8 + $6) + ($8 + $14)) / 2 =) 44.4percent.If Salvo had amortized <strong>the</strong> cost <strong>of</strong> <strong>the</strong> franchise acquired in 2003 over six years instead <strong>of</strong>expensing it, Salvo’s return on average total equity <strong>for</strong> 2004 would have decreased from 44.4percent to:A) 38.9 percent.B) 31.1 percent.C) 35.6 percent.D) 25.6 percent.LOS 36b: Determine which intangible assets should be capitalizedaccording to GAAP and international accounting standards.An intangible asset is an asset that has no physical existence and has a highdegree <strong>of</strong> uncertainty regarding future benefits.8

Under U.S. generally accepted accounting principles (GAAP), which <strong>of</strong> <strong>the</strong> following costsassociated with intangible assets is most likely to be capitalized?A) Research and development costs associated with s<strong>of</strong>tware development.B) The costs associated with an internally created trademark.C) The cost <strong>of</strong> an acquisition <strong>of</strong> a patent from an outside entity.D) Advertising expenses.Reading 37: Long-Lived Assets: Depreciation and ImpairmentLOS 37a: Demonstrate <strong>the</strong> different depreciation methods and explain how<strong>the</strong> choice <strong>of</strong> depreciation method affects a company’s financial statement,ratios, and taxes.Depreciation is <strong>the</strong> systematic allocation <strong>of</strong> <strong>the</strong> asset’s cost over time.Straight LineUnits <strong>of</strong> Production or Service HoursSum <strong>of</strong> <strong>the</strong> Year’s DigitsDouble Declining BalanceNOTE: Sinking fund depreciation where depreciation expense actually increaseseach year so that <strong>the</strong> asset earns <strong>the</strong> same rate <strong>of</strong> return each year is prohibitedin <strong>the</strong> U.S.This in<strong>for</strong>mation pertains to equipment owned by Brigade Company.• Cost <strong>of</strong> equipment $10,000• Estimated residual value $2,000• Estimated useful life 5 years• Depreciation method Straight-lineThe accumulated depreciation at <strong>the</strong> end <strong>of</strong> year 3 is:A) $4,800.B) $1,600.C) $3,200.D) $5,200.9

On January 1, 2004, JME purchased a truck that cost $24,000. The truck had an estimated usefullife <strong>of</strong> 5 years and $4,000 salvage value. The amount <strong>of</strong> depreciation expense recognized in 2006assuming that JME uses <strong>the</strong> double declining balance method is:A) $4,000.B) $3,456.C) $5,760.D) $8,000.Straight LineAcceleratedDepreciation expense Lower HigherNet income Higher LowerAssets Higher LowerEquity Higher LowerROA Higher LowerROE Higher LowerTurnover ratios Lower HigherCash flow Same SameRoger Margotta, <strong>the</strong> CFO <strong>of</strong> Brainchild, Inc., is considering several alternative methods <strong>of</strong>depreciation <strong>for</strong> long-term assets. With respect to double-declining method <strong>of</strong> depreciation, which<strong>of</strong> <strong>the</strong> following statements is <strong>the</strong> most accurate?A) Current ratio will increase over <strong>the</strong> life <strong>of</strong> <strong>the</strong> asset.B) Return on Investment will increase over <strong>the</strong> life <strong>of</strong> <strong>the</strong> asset.C) Asset turnover ratio will decrease over <strong>the</strong> life <strong>of</strong> <strong>the</strong> asset.D)Depreciation expense will increase over <strong>the</strong> life <strong>of</strong> <strong>the</strong> asset, thus showing a decreasingearnings trend.LOS 37b: Demonstrate how modifying <strong>the</strong> depreciation method, <strong>the</strong>estimated useful life, and/or <strong>the</strong> salvage value affect financial statementsand ratios.Change in depreciation method is a change in an accounting principles and<strong>the</strong>re<strong>for</strong>e requires <strong>the</strong> cumulative effect <strong>of</strong> <strong>the</strong> change on past income to beshown net <strong>of</strong> tax on <strong>the</strong> income statement.10

Change in useful life and/or salvage value is a change in accounting estimateand do not require past income to be restated.In 2005, Carpet Company decides to change from <strong>the</strong> straight-line method <strong>of</strong> depreciation to <strong>the</strong>sum <strong>of</strong> <strong>the</strong> year’s digits method. The following in<strong>for</strong>mation is available:Pre-2005 2005Straight Line Depreciation $1,600,000 $400,000Sum <strong>of</strong> <strong>the</strong> Years Digits $2,300,000 $500,000On its 2005 financial statements, Carpet will report:A)B)C)D)$400,000 depreciation expense in <strong>the</strong> 2005 income statement and $800,000 separately asa change in accounting principle net <strong>of</strong> taxes.$1,200,000 depreciation expense in <strong>the</strong> 2005 income statement and include a footnote <strong>of</strong>explanation including <strong>the</strong> tax effect.$500,000 depreciation expense and restate prior period financial statements to reflect <strong>the</strong>change net <strong>of</strong> taxes.$500,000 depreciation expense in <strong>the</strong> 2005 income statement and $700,000 separately asa change in accounting principle net <strong>of</strong> taxes.LOS 37c: Determine <strong>the</strong> average age and average depreciable life <strong>of</strong> acompany’s assets using <strong>the</strong> company’s fixed asset disclosures.Average Age in Years:accumulated depreciationdepreciation expenseRelative Age:accumulated depreciationending gross investmentAverage Depreciable Life: ending gross investmentdepreciation expense11

Determine <strong>the</strong> average age as a percent <strong>of</strong> depreciable life and <strong>the</strong> average age <strong>of</strong> <strong>the</strong> plant andequipment given <strong>the</strong> following in<strong>for</strong>mation:• Depreciation expense is $15,000.• Plant and equipment is $250,000.• Accumulated depreciation is $60,000.Average Age (%)Average Age (Years)A) 25% 4B) 24% 6C) 25% 6D) 24% 4LOS 37d: Explain and illustrate <strong>the</strong> use <strong>of</strong> impairment charges and <strong>the</strong>ireffect on financial statements and ratios.GAAP require that assets be carried at acquisition cost less accumulateddepreciation AND that carrying amounts be reduced to market value when <strong>the</strong>reis no longer an expectation that net balance sheet values can be recovered fromfuture operations.Impairments are reported on <strong>the</strong> income statement pretax (above <strong>the</strong> line) as acomponent <strong>of</strong> income from continuing operations. In <strong>the</strong> U.S. impairmentscannot be restored. However, <strong>the</strong> IASB allow firms to recognize increases invalue.In testing <strong>for</strong> impairment, undiscounted future cash flows are used to compare to<strong>the</strong> carrying value <strong>of</strong> <strong>the</strong> asset. However, once impairment has been detected,<strong>the</strong> amount <strong>of</strong> <strong>the</strong> impairment is estimated using discounted future cash flows.An impairment write-down results in a decrease in all <strong>of</strong> <strong>the</strong> following financial statement itemsand ratios EXCEPT:A) assets.B) <strong>the</strong> debt-to-equity ratio.C) stockholders' equity.D) future depreciation expense.12

LOS 37e: Discuss accounting requirements related to remedyingenvironmental damage caused by operating assets and <strong>the</strong> relatedfinancial statement and ratio effects.SFAS 143 requires a consistent treatment <strong>of</strong> <strong>the</strong> ARO (asset retirementobligation) from obligations related to remedying environmental damage causedby a company.Which <strong>of</strong> <strong>the</strong> following statements regarding <strong>the</strong> financial statement impact <strong>of</strong> recording liabilitiesresulting from <strong>the</strong> application <strong>of</strong> SFAS 143 is TRUE? In accounting periods following an assetacquisition, liability values are:A)B)C)D)accreted in a manner similar to interest <strong>for</strong> bond amortization. The difference here is that <strong>the</strong>interest component falls through time instead <strong>of</strong> rising.accreted in a manner similar to interest <strong>for</strong> bond amortization. This accretion is recorded asa gain on <strong>the</strong> income statement.recorded as an expense on <strong>the</strong> income statement that is recorded over a period <strong>of</strong> ten yearsor <strong>the</strong> life <strong>of</strong> an asset whichever is less.accreted in a manner similar to interest <strong>for</strong> bond amortization. The difference here is that <strong>the</strong>interest component rises through time instead <strong>of</strong> falling.Reading 38: Analysis <strong>of</strong> Income TaxesLOS 38a: Explain <strong>the</strong> key terms related to income tax accounting and <strong>the</strong>origin <strong>of</strong> deferred tax liabilities and assets.Taxable Income: income subject to tax based on <strong>the</strong> tax return.Taxes Payable: <strong>the</strong> tax liability on <strong>the</strong> balance sheet caused by taxable income.Pretax Income: Income be<strong>for</strong>e income tax expense.Income Tax Expense: The expense recognized on <strong>the</strong> income statement thatincludes taxes payable and deferred income tax expense. NOTE: <strong>the</strong> incometax expense is composed <strong>of</strong> taxes payable plus noncash items such as changesin deferred tax assets and liabilities.Income Tax Expense = Taxes Payable + ∆DTL - ∆DTAA deferred tax liability is created when an income or expense item is treateddifferently on financial statements that it is on <strong>the</strong> company’s tax returns, and thatdifference results in greater tax expense on <strong>the</strong> financial statements that taxespayable on <strong>the</strong> tax return. Often occurs when an accelerated method <strong>of</strong>depreciation is used on <strong>the</strong> tax return and straight line is used <strong>for</strong> book purposes.13

A deferred tax asset is when <strong>the</strong> difference results in lower income tax expenseon <strong>the</strong> financial statements than on <strong>the</strong> tax return. Warranty expense is a goodexample since warranty expense is accrued <strong>for</strong> financial reporting purposes butis not deductible on <strong>the</strong> tax return until actual warranty claims have been paid.Which <strong>of</strong> <strong>the</strong> following statements about tax deferrals is FALSE?A) Income tax paid can include payments or refunds <strong>for</strong> o<strong>the</strong>r years.B) Tax deferrals are created due to <strong>the</strong> difference in financial and tax accounting.C) Taxes payable are determined by pretax income and <strong>the</strong> tax rate.D) A deferred tax liability is expected to result in future cash outflow.LOS 38b: Demonstrate <strong>the</strong> liability method <strong>of</strong> accounting <strong>for</strong> deferredtaxes.The liability method <strong>of</strong> accounting <strong>for</strong> deferred taxes starts from <strong>the</strong> premise thatdifferences between taxes calculated on <strong>the</strong> income statement (GAAP) and taxesfrom <strong>the</strong> income tax return (IRS code) will be reversed at some future date.Regarding <strong>the</strong> liability method <strong>of</strong> accounting <strong>for</strong> deferred taxes, which <strong>of</strong> <strong>the</strong> following statementsis FALSE?A) Taxes payable are affected by changes in deferred taxes.B)C)D)Deferred taxes are calculated by multiplying <strong>the</strong> temporary differences by <strong>the</strong> current taxrate.Income tax expense = Taxes payable - Change in Deferred tax asset + Change inDeferred tax liability.Changes in <strong>the</strong> tax rate are recognized in <strong>the</strong> reported income <strong>the</strong> year <strong>the</strong> change isenacted.LOS 38c: Discuss <strong>the</strong> use <strong>of</strong> valuation allowances <strong>for</strong> deferred tax assetsand <strong>the</strong>ir implications <strong>for</strong> financial statement analysis.Deferred tax assets can have a valuation allowance, which is a contra accountagainst deferred tax assets based on <strong>the</strong> likelihood that <strong>the</strong>se assets will not berealized. For deferred tax assets to be beneficial, <strong>the</strong> firm must have futuretaxable income. If <strong>the</strong>re is a greater than 50% probability that a portion <strong>of</strong>deferred tax assets will not be realized, <strong>the</strong> deferred tax asset must be reducedby a valuation allowance. NOTE: We are only talking about deferred tax assets!14

Which <strong>of</strong> <strong>the</strong> following situations will most likely require a company to record a valuationallowance on its balance sheet?A)To report depreciation, a firm uses <strong>the</strong> double-declining balance method <strong>for</strong> tax purposesand <strong>the</strong> straight-line method <strong>for</strong> financial reporting purposes.B) A firm with deferred tax assets expects an increase in <strong>the</strong> tax rate.C)D)A firm has differences between taxable and pretax income that are never expected toreverse.A firm is unlikely to have future taxable income that would enable it to take advantage <strong>of</strong>deferred tax assets.LOS 38d: Explain <strong>the</strong> factors that determine whe<strong>the</strong>r a company’s deferredtax liabilities should be treated as a liability or as equity <strong>for</strong> purposes <strong>of</strong>financial analysis.If deferred tax liabilities are expected to reverse in <strong>the</strong> future, <strong>the</strong>n <strong>the</strong>y are bestclassified as liabilities.If deferred tax liabilities are not expected to reverse in <strong>the</strong> future, <strong>the</strong>y are bestclassified as equity.Which <strong>of</strong> <strong>the</strong> following financial ratios is least likely to be affected by classification <strong>of</strong> deferredtaxes as a liability or equity?A) Return on equity (ROE).B) Debt-to-equity.C) Return on assets (ROA).D) Debt-to-total assets.LOS 38e: Distinguish between temporary and permanent items in pretaxfinancial income and taxable income.Temporary differences are differences in taxable and pretax incomes that willreverse in future years. They result in deferred tax assets or liabilities.Permanent differences are differences in taxable and pretax incomes that will notreverse. They do not result in deferred tax liabilities or assets. Permanentdifferences are reflected in a difference between a firm’s effective tax rate and itsstatutory tax rate.15

LOS 38f: Calculate and interpret income tax expense, income taxespayable, deferred tax assets, and deferred tax liabilities.A dance club purchased new sound equipment <strong>for</strong> $25,352. It will work <strong>for</strong> 5 years and has nosalvage value. Their tax rate is 41 percent, and <strong>the</strong>ir annual revenues are constant at $14,384.For financial reporting, <strong>the</strong> straight-line depreciation method is used, but <strong>for</strong> tax purposesdepreciation is accelerated to 35 percent in years 1 and 2 and 30 percent in Year 3. For purposes<strong>of</strong> this exercise ignore all expenses o<strong>the</strong>r than depreciation.What is <strong>the</strong> tax payable <strong>for</strong> year one?A) $779.B) $1,909.C) $2,259.D) $1,626.What is <strong>the</strong> deferred tax liability as <strong>of</strong> <strong>the</strong> end <strong>of</strong> year one?A) $1,909.B) $1,559.C) $1,129.D) $320.What is <strong>the</strong> deferred tax liability as <strong>of</strong> <strong>the</strong> end <strong>of</strong> year three?A) $780.B) $1,029.C) $1,909.D) $4,158.LOS 38g: Calculate and interpret <strong>the</strong> adjustment(s) to <strong>the</strong> deferred taxaccounts related to a change in <strong>the</strong> tax rate.All balance sheet deferred tax assets and liabilities are revalued when <strong>the</strong> taxrate <strong>the</strong> firm will face in <strong>the</strong> future changes. If <strong>the</strong> tax rate increases, <strong>the</strong>increase in deferred tax liabilities increases <strong>the</strong> income tax expense and <strong>the</strong>increase in deferred tax assets decreases <strong>the</strong> income tax expense. If <strong>the</strong> t axrate decreases, <strong>the</strong> decrease in deferred tax liabilities decreases income taxexpense, and <strong>the</strong> decrease in deferred tax assets increases income tax expense.NOTE: The most common occurrence is that deferred tax liabilities exceeddeferred tax assets.16

An analyst has ga<strong>the</strong>red <strong>the</strong> following tax in<strong>for</strong>mation:Year 1 Year 2Pretax Income $60,000 $60,000Taxable Income $50,000 $65,000The current tax rate is 40 percent. Assume <strong>the</strong> tax rate is reduced to 30 percent and <strong>the</strong> changeis enacted at <strong>the</strong> beginning <strong>of</strong> Year 2.In year 1, what are <strong>the</strong> taxes payable and what is <strong>the</strong> deferred tax liability?Taxes PayableDeferred Tax LiabilityA) $20,000 $1,500B) $24,000 $3,000C) $24,000 $1,500D) $20,000 $3,000LOS 38h: Interpret a deferred tax footnote disclosure that reconciles <strong>the</strong>effective and statutory tax rates. SFAS 109While evaluating <strong>the</strong> financial statements <strong>of</strong> Omega, Inc., <strong>the</strong> analyst observes that <strong>the</strong> effectivetax rate is 7% less than <strong>the</strong> statutory rate. The source <strong>of</strong> this difference is determined to be a taxholiday on a manufacturing plant located in South Africa. This item is most likely to be:A)sporadic in nature, but <strong>the</strong> effect is typically neutralized by higher home country taxes on <strong>the</strong>repatriated pr<strong>of</strong>its.B) continuous in nature, so <strong>the</strong> termination date is not relevant.C)D)sporadic in nature, and <strong>the</strong> analyst should try to identify <strong>the</strong> termination date and determineif taxes will be payable at that time.continuous in nature, but <strong>the</strong> analyst will want to determine if <strong>the</strong> size <strong>of</strong> <strong>the</strong> tax benefit willchange during <strong>the</strong> <strong>for</strong>eseeable future.LOS 38i: Analyze disclosures relating to, and <strong>the</strong> effect <strong>of</strong>, deferred taxes.LOS 38j: Compare and contrast a company’s deferred tax items andeffective tax rate reconciliation (1) between reporting periods and (2) with<strong>the</strong> comparable items reported by o<strong>the</strong>r companies.17

An analyst ga<strong>the</strong>red <strong>the</strong> following in<strong>for</strong>mation about a company:• Pretax income <strong>of</strong> $10,000• Taxes payable <strong>of</strong> $2,500• Deferred taxes <strong>of</strong> $500• Tax expense <strong>of</strong> $3,000What is <strong>the</strong> firm's reported effective tax rate?A) 5%.B) 25%.C) 30%.D) 35%.Reading 39: Analysis <strong>of</strong> Financing LiabilitiesLOS 39a: Distinguish between operating and trade debt related to operatingactivities and debt generated by financing activities.Current liabilities can be from operating activities (trade debt, wages payable, oradvances from customers) or from financing activities (short-term debt and <strong>the</strong>current portion <strong>of</strong> long-term debt). A shift from operating liabilities to financingliabilities signals liquidity problems.Which <strong>of</strong> <strong>the</strong> following situations most likely describes a situation with deteriorating creditimplications?A)The ratio <strong>of</strong> short-term debt to trade payables increases because vendors reduce creditavailable to <strong>the</strong> firm.B)The ratio <strong>of</strong> short-term debt to trade payables increases because bank credit is less costlythan <strong>the</strong> vendors’ credit terms.C) The level <strong>of</strong> trade payables increases more rapidly than sales.D) There is a significant increase in cash advances from customers.LOS 39b: Determine <strong>the</strong> effects <strong>of</strong> debt issuance and amortization <strong>of</strong> bonddiscounts and premiums on financial statements and financial ratios.Balance Sheet: Bonds are always listed as a liability. Bonds issued at par arecarried at face value. Bonds issued at a premium will be carried at face valueplus <strong>the</strong> premium on <strong>the</strong> balance sheet and <strong>the</strong> premium is amortized to zeroover <strong>the</strong> life <strong>of</strong> <strong>the</strong> bond. Bonds issued at a discount will be carried at face valueless <strong>the</strong> discount on <strong>the</strong> balance sheet and <strong>the</strong> discount is amortized to zero over<strong>the</strong> life <strong>of</strong> <strong>the</strong> bond.18

Income Statement (interest expense effect): Interest expense is equal to <strong>the</strong>book value <strong>of</strong> <strong>the</strong> bonds at <strong>the</strong> beginning <strong>of</strong> <strong>the</strong> period multiplied by <strong>the</strong> marketrate <strong>of</strong> interest at issuance. For premium bonds, <strong>the</strong> interest expense will belower than <strong>the</strong> coupon, and <strong>the</strong> amortization <strong>of</strong> <strong>the</strong> premium will serve to reduce<strong>the</strong> interest expense that is shown on <strong>the</strong> income statement. For discount bonds,<strong>the</strong> interest expense will be higher than <strong>the</strong> coupon, and <strong>the</strong> amortization <strong>of</strong> <strong>the</strong>discount will serve to increase <strong>the</strong> interest expense that is reported on <strong>the</strong>income statement.Cash Flow: Cash flow from operations includes a deduction <strong>for</strong> interest expense.The amortization <strong>of</strong> bond discount or premium is a noncash charge to income,and <strong>the</strong>re<strong>for</strong>e excluded from CFO. Since <strong>the</strong> coupon is higher <strong>for</strong> premiumbonds, CFO is understated relative to a firm that does not have premium bonds.The opposite is true <strong>for</strong> discount bonds - <strong>the</strong> CFO is overstated. Upon issuance<strong>of</strong> a bond, CFF is increased by <strong>the</strong> amount <strong>of</strong> <strong>the</strong> proceeds and upon repayment<strong>of</strong> <strong>the</strong> bond, CFF is reduced by <strong>the</strong> par value.A company issued an annual-pay bond with <strong>the</strong> following characteristics:Face value $67,831Maturity4 yearsCoupon 7.00%Market interest rates 8.00%What is <strong>the</strong> present value <strong>of</strong> <strong>the</strong> interest payments on <strong>the</strong> date when <strong>the</strong> bonds are issued?A) $65,582.B) $49,857.C) $18,992.D) $15,726.What is <strong>the</strong> unamortized discount on <strong>the</strong> date when <strong>the</strong> bonds are issued?A) $2,249.B) $15,729.C) $1,748.D) $499.19

What is <strong>the</strong> unamortized discount at <strong>the</strong> end <strong>of</strong> <strong>the</strong> first year?A) $1,209.B) $538.C) $1,750.D) $2,247.LOS 39c: Analyze <strong>the</strong> effect on financial statements and financial ratios <strong>of</strong>issuing zero-coupon debt.Zero-coupon debt is debt issued with no periodic payments <strong>of</strong> interest andprincipal is paid back with one lump sum payment upon maturity; <strong>the</strong>re<strong>for</strong>e, <strong>the</strong>irannual interest expense is implied. This severely overstates cash flow fromoperations.Which <strong>of</strong> <strong>the</strong> following statements regarding zero-coupon bonds is TRUE?A) A company should initially record zero-coupon bonds at <strong>the</strong>ir discounted present value.B) Interest expense is a combination <strong>of</strong> operating and financing cash flows.C)The interest expense in each period is found by applying <strong>the</strong> discount rate to <strong>the</strong> book value<strong>of</strong> debt at <strong>the</strong> end <strong>of</strong> <strong>the</strong> period.D) The discount rate used to value <strong>the</strong> bond is <strong>the</strong> average current bond market interest rate.LOS 39d: Classify a debt security with equity features as a debt or equitysecurity and demonstrate <strong>the</strong> effect <strong>of</strong> issuing debt with equity features on<strong>the</strong> financial statements and ratios.Convertible Bonds – GAAP requires that convertible bonds are recorded on <strong>the</strong>balance sheet as if <strong>the</strong>re were no conversion feature. For analysis, comparestock price to conversion price. If stock price is significantly higher thanconversion price, treat as an equity <strong>for</strong> calculating debt ratios. If <strong>the</strong> stock priceis significantly lower than <strong>the</strong> conversion price, treat like debtBonds with Warrants - When bonds are issued with warrants attached, <strong>the</strong>proceeds are allocated between <strong>the</strong> two components. The bond portion isrecognized as a liability and <strong>the</strong> warrants are recognized as equity.20

Jones Inc. has a capital structure consisting <strong>of</strong> $8 million <strong>of</strong> liabilities and $10 million <strong>of</strong> equity.Included in liabilities is $1.2 million worth <strong>of</strong> exchangeable bonds. Immediately afterwards, Jonesissues $0.7 million <strong>of</strong> redeemable preferred shares <strong>for</strong> cash proceeds and also calls its entiregroup <strong>of</strong> exchangeable bonds, netting a gain <strong>of</strong> $0.3 million on <strong>the</strong> bonds.Which <strong>of</strong> <strong>the</strong> following amounts is Jones’ revised debt to total capital ratio upon completion <strong>of</strong> <strong>the</strong>two new transactions?A) 0.458.B) 0.728.C) 0.845.D) 0.421.LOS 39e: Describe <strong>the</strong> disclosures relating to financing liabilities, anddiscuss <strong>the</strong> advantages/disadvantages to <strong>the</strong> company <strong>of</strong> selecting a givenfinancing instrument.Which <strong>of</strong> <strong>the</strong> following statements regarding commodity-linked bonds is least accurate?A) Commodity-linked bonds effectively convert interest expense from a fixed to a variable cost.B)C)D)Commodity-linked bonds are typically issued as part <strong>of</strong> a hedging strategy by firms that use<strong>the</strong> commodity extensively in production.A higher commodity price increases <strong>the</strong> payments to bondholders but that is <strong>of</strong>fset by <strong>the</strong>fact that <strong>the</strong>re is more cash available to pay interest expense.For a commodity producer, issuing commodity-linked bonds will result in more stable timesinterest-earnedand cash-interest coverage ratios, compared to issuing conventional debt.LOS 39f: Determine <strong>the</strong> effects <strong>of</strong> changing interest rates on <strong>the</strong> marketvalue <strong>of</strong> debt and on financial statements and ratios.Under GAAP, balance sheet values <strong>for</strong> outstanding debt must be based on <strong>the</strong>market rate on <strong>the</strong> date <strong>of</strong> issuance. Changes in market interest rates lead tochanges in <strong>the</strong> market values <strong>of</strong> debt. These gains and losses are not reflectedin <strong>the</strong> financial statements. For purposes <strong>of</strong> analysis, market value may be moreappropriate than book values.SFAS 107 requires disclosures about <strong>the</strong> fair value <strong>of</strong> outstanding debt based onyear-end or quarter-end prices.21

An increase in interest rates is most likely to benefit:A) firms with better credit ratings.B) firms that issued debt at a lower cost than current rates.C) firms with more equity than debt.D) firms with no debt.LOS 39g: Calculate and describe <strong>the</strong> accounting treatment <strong>of</strong>, andeconomic gains and losses resulting from, <strong>the</strong> various methods <strong>of</strong> retiringdebt prior to its maturity.When <strong>the</strong> payment to retire <strong>the</strong> debt prior to its maturity is greater than or lessthan its book value, a gain or loss is recorded. Unless <strong>the</strong> debt retirement is anextraordinary item, <strong>the</strong> gains and losses recorded affect income from continuingoperations. Analysts should back <strong>the</strong>se gains and losses out <strong>of</strong> operatingearnings since <strong>the</strong>re is no economic gain on <strong>the</strong> transaction.Retiring non-callable debt by funding a trust that will be used to meet <strong>the</strong> interest and principalpayments on <strong>the</strong> debt is called:A) defeasance.B) effective retirement.C) trust retirement.D) de facto termination.LOS 39h: Analyze <strong>the</strong> implications <strong>of</strong> debt covenants <strong>for</strong> creditors and <strong>the</strong>issuing company.Which <strong>of</strong> <strong>the</strong> following statements regarding bond covenants is least accurate?A) Bond covenants are typically disclosed in <strong>the</strong> footnotes to <strong>the</strong> financial statements.B) Bond covenants are important in valuing a firm’s credit risk.C) Bond covenants are important in valuing a firm’s equity including its growth prospects.D) All bond covenants are accounting-based, and affect a firm’s choice <strong>of</strong> accounting policies.22

Reading #40: Leases and Off-Balance Sheet DebtLOS 40a: Discuss <strong>the</strong> incentives <strong>for</strong> leasing assets instead <strong>of</strong> purchasing<strong>the</strong>m, and <strong>the</strong> incentives <strong>for</strong> reporting leases as operating leases ra<strong>the</strong>rthan capital leases.Penguin Company is planning to lease a $5 million machine to produce goods <strong>for</strong> eventual sale.Penguin is able to structure <strong>the</strong> lease so as to classify it as ei<strong>the</strong>r an operating or a capital lease.The advantages to Penguin <strong>of</strong> classifying this lease as an operating lease include all <strong>of</strong> <strong>the</strong>following EXCEPT:The present value <strong>of</strong> <strong>the</strong> lease payments <strong>for</strong> Lease ABC is equal to 75 percent <strong>of</strong> <strong>the</strong> fair value <strong>of</strong><strong>the</strong> asset, and <strong>the</strong> lease contains a bargain purchase option. Lease XYZ does not contain abargain purchase option, but <strong>the</strong> lease term is equal to 80 percent <strong>of</strong> <strong>the</strong> estimated economic life<strong>of</strong> <strong>the</strong> property. How should <strong>the</strong>se leases be classified in <strong>the</strong> financial statements <strong>of</strong> <strong>the</strong> lessee?A) Both leases should be classified as operating leases.B) Lease ABC should be a capital lease, but Lease XYZ should be an operating lease.C) Both leases should be classified as capital leases.D) Lease ABC should be an operating lease, but Lease XYZ should be a capital lease.A)<strong>the</strong> lease is not reported as debt on Penguin's balance sheet, so leverage ratios are notincreased.B) <strong>the</strong> lease is not reported as an asset, so pr<strong>of</strong>itability ratios are not reduced.C) no disclosures <strong>of</strong> payments due under <strong>the</strong> lease are required.D) depreciation is not recorded.LOS 40b: Contrast <strong>the</strong> effects <strong>of</strong> capital and operating leases on <strong>the</strong>financial statements and ratios <strong>of</strong> lessees and lessors.Statements: Capital lease Operating leaseAssets Higher LowerLiabilities Higher LowerNet income (in <strong>the</strong> early yrs) Lower HigherCFO Higher LowerCFF Lower HigherTotal cash flow Same Same23

Ratios: Capital lease Operating leaseCurrent ratio (CA/CL) Lower HigherAsset turnover (Sales/TA) Lower HigherROA (EAT/TA) Lower HigherROE (EAT/E) Lower HigherDebt to Equity (D/E) Higher LowerOn December 31, Sandy Company enters into an 8-year lease <strong>for</strong> a printing press. The economiclife <strong>of</strong> <strong>the</strong> press is 10 years. Lease payments <strong>of</strong> $1,000,000 annually are due on December 31,beginning one year after lease signing. The interest rate implicit in <strong>the</strong> lease is 7%. SandyCompany’s incremental borrowing rate is 6%. Be<strong>for</strong>e entering into this lease, <strong>the</strong> balance sheet<strong>for</strong> Sandy Company was as follows (in $):Cash 100,000 Accounts Payable 200,000Accounts Receivable 300,000 Long-term Debt 1,700,000Inventory 1,500,000 Common Stock 600,000Property, Plant & Equip. 5,200,000 Retained Earnings 4,600,000Total Assets 7,100,000 Total Liab. & Equity 7,100,000After executing this lease, Sandy Company’s long-term debt-to-equity ratio will:A) increase to 1.559.B) increase to 1.227.C) increase to 1.521.D) remain unchanged.LOS 40c: Describe <strong>the</strong> types <strong>of</strong> <strong>of</strong>f-balance sheet financing and analyze<strong>the</strong>ir effects on selected financial ratios.Although <strong>the</strong> most common type <strong>of</strong> <strong>of</strong>f-balance sheet financing, operating leasesare not <strong>the</strong> only type.Which <strong>of</strong> <strong>the</strong> following best describes a take-or-pay contract? In a take-or-pay contract:A)<strong>the</strong> purchasing firm commits to buying up to a maximum quantity <strong>of</strong> an input over aspecified time period.B) input prices are fixed over <strong>the</strong> life <strong>of</strong> <strong>the</strong> contract.C) input prices are based on market prices over <strong>the</strong> life <strong>of</strong> <strong>the</strong> contract.D)<strong>the</strong> purchasing firm commits to buying a minimum quantity <strong>of</strong> an input over a specified timeperiod.24

LOS 40d: Distinguish between sales-type leases and direct financingleases and explain <strong>the</strong>ir effects on <strong>the</strong> financial statements <strong>of</strong> <strong>the</strong> lessors.A lessor will most likely record a lease as a sales-type lease when:A) it is a dealer or seller <strong>of</strong> <strong>the</strong> leased equipment and <strong>the</strong> lease is a capital lease.B) it is a dealer or seller <strong>of</strong> <strong>the</strong> leased equipment.C) it is a dealer or seller <strong>of</strong> <strong>the</strong> leased equipment, and <strong>the</strong> lease is an operating lease.D) <strong>the</strong> lease is an operating lease.25