- Page 1:

Real Options "in" Projects and Syst

- Page 4 and 5:

4Committee Member: Dr. David H. Mar

- Page 6 and 7:

6Table of Contents:Acknowledgements

- Page 8 and 9:

84.4.3. Binomial Tree______________

- Page 10 and 11:

108.7. Contributions and Conclusion

- Page 12 and 13:

12Figure 5-3: Scenario tree _______

- Page 14 and 15:

14Table 6-12 Sources of options val

- Page 16 and 17:

16fFC s∆F sthiH sh tThe ratio of

- Page 18 and 19:

18X styyY jYYjAverage flow from sit

- Page 20 and 21: 201.1. The problemWith the recognit

- Page 22 and 23: 22The first thread - engineering sy

- Page 24 and 25: 24The second thread - options theor

- Page 26 and 27: 26The third thread - mathematical p

- Page 28 and 29: 28especially the difference between

- Page 30 and 31: 30every area in a more and more det

- Page 32 and 33: 32made between forecasts of the lev

- Page 34 and 35: 34memory (whereas modern computers

- Page 36 and 37: 36model and presented a multiple-yi

- Page 38 and 39: 38such designs exist) by simply rec

- Page 40: 40mathematical properties of maximi

- Page 43 and 44: 43that incorporates important perfo

- Page 45 and 46: 45Dixit and Pindyck (1994) stressed

- Page 47 and 48: 47The real options “in projects

- Page 49 and 50: 491980s, Merck began to use simulat

- Page 51 and 52: 51that the integrated approach (the

- Page 53 and 54: 53blurs the exercise condition, bec

- Page 55 and 56: 55Goldberg and Read (2000) found th

- Page 57 and 58: 57In general, real options “in”

- Page 59 and 60: 59- And, mathematical programming,

- Page 61 and 62: 61Example of a stock call option:Jo

- Page 63 and 64: 63or $300. Arbitrage opportunities

- Page 65 and 66: 659 × 0.25 =2.25Regardless of whet

- Page 67 and 68: 67∆Z = ε ∆twhere ε denotes a

- Page 69: 69standard deviation of 1.0. It fol

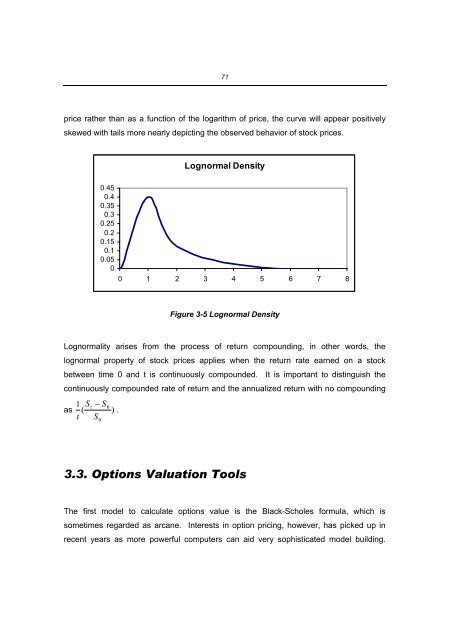

- Page 73 and 74: 73The stock price process is the on

- Page 75 and 76: 75Equation 3-9 is the Black-Scholes

- Page 77 and 78: 7710,000 Trials Frequency Chart90 O

- Page 79 and 80: 79The two are equal whenorS0ux− f

- Page 81 and 82: 81S uuS uf uuS f u S udfS df udf dS

- Page 83 and 84: 83Figure 3-10 Decision Tree for Opt

- Page 85 and 86: 85the Black-Scholes formula is $1.9

- Page 87 and 88: 87The expected growth of the stock

- Page 89 and 90: 89option, the holder has the right

- Page 91 and 92: 91Boston expects to receive a cash

- Page 93 and 94: 93the value of a European put on a

- Page 95 and 96: 95Chapter 4 Real Options“The clas

- Page 97 and 98: 97In addition to understanding the

- Page 99 and 100: 99gas. The development was unsucces

- Page 101 and 102: 101But if we employ Real Options th

- Page 103 and 104: 103Option to switch (e.g.,outputs o

- Page 105 and 106: 105The fifth step, by comparing the

- Page 107 and 108: 107Real Options "in" ProjectsReal O

- Page 109 and 110: 109- 5 and 3.5 billion dollars resp

- Page 111 and 112: 111Real options “on” projectsVa

- Page 113 and 114: 1134.3.4. A Case Example on analysi

- Page 115 and 116: 115Step 1: Table 4-6 illustrates th

- Page 117 and 118: 11710EXPECTED NPV ($, MILLIONS)50-5

- Page 119 and 120: 119PROBABILITY1.00.90.80.70.60.50.4

- Page 121 and 122:

1214.4.1. Black-Scholes FormulaAs d

- Page 123 and 124:

123and buy the real options to earn

- Page 125 and 126:

125computationally prohibitive to c

- Page 127 and 128:

1274.5. Some Implications of Real O

- Page 129 and 130:

129Value of flexibility Appropriate

- Page 131 and 132:

1314.6.2. What is the definition of

- Page 133 and 134:

133- It aims at an expected value o

- Page 135 and 136:

135Chapter 5 Valuation of Real Opti

- Page 137 and 138:

137uncertain environment. Specifica

- Page 139 and 140:

139assuming steady state, i.e. all

- Page 141 and 142:

141modify this standard simulation

- Page 143 and 144:

143Table 5-1: Decision on each node

- Page 145 and 146:

145The objective function is to get

- Page 147 and 148:

1475.3.2. Stochastic mixed-integer

- Page 149 and 150:

149q⎛ R ⎞1⎜ ⎟qR = ⎜ ...

- Page 151 and 152:

151Table 5-4: Stochastic programmin

- Page 153 and 154:

153The real options timing model fo

- Page 155 and 156:

1555.4. A case example on satellite

- Page 157 and 158:

157Table 5-6 Evolution of demand fo

- Page 159 and 160:

1595.4.3. ParametersWe consider thr

- Page 161 and 162:

161Year 0 Year 2.5 Year 5 Year 7.5

- Page 163 and 164:

163scenario trees based on better s

- Page 165 and 166:

165The total length of the river is

- Page 167 and 168:

167Project 1 or 3. A shallow gradie

- Page 169 and 170:

169Table 6-5: Stream flow for Proje

- Page 171 and 172:

171The reservoir cost coefficient a

- Page 173 and 174:

173Q in,tQ in,tProject CSite 3Site

- Page 175 and 176:

175k t= (60Sec/ Min)× (60Min/ Hour

- Page 177 and 178:

177Reservoir cost: α ( Vss) = FCs+

- Page 179 and 180:

179[Power plant cost curve]δ 1 is

- Page 181 and 182:

181Complete formulation of the scre

- Page 183 and 184:

183Table 6-9 List of Parameters for

- Page 185 and 186:

185Step 1. The important uncertain

- Page 187 and 188:

187From the tornado diagram, we und

- Page 189 and 190:

189design feature where we consider

- Page 191 and 192:

191Table 6-13 List of design variab

- Page 193 and 194:

193Table 6-15 List of Parameters fo

- Page 195 and 196:

195A Realization Path of Electricit

- Page 197 and 198:

197Case II: there is enough water t

- Page 199 and 200:

199where the average head*Astis cal

- Page 201 and 202:

201Ball©. All designs from the scr

- Page 203 and 204:

203options sees Table 6-17. This is

- Page 205 and 206:

205XX= Q + Y ∑ Ri31 in,131 j331 i

- Page 207 and 208:

207Objective functionThe objective

- Page 209 and 210:

209According to the screening model

- Page 211 and 212:

211The hydropower benefit coefficie

- Page 213 and 214:

213Table 6-19 List of parameters fo

- Page 215 and 216:

215time to build and gradually incr

- Page 217 and 218:

217example, at year 20, if the pric

- Page 219 and 220:

219from 1 to 8. The hydropower bene

- Page 221 and 222:

221Our planning horizon is three st

- Page 223 and 224:

2235 6 7 82s= R2s= R2sR2sR =1 23sR3

- Page 225 and 226:

225yrsIndicating whether or not the

- Page 227 and 228:

227The overall expected net benefit

- Page 229 and 230:

229contingency plan is to build Pro

- Page 231 and 232:

231Table 6-26 Different water flow

- Page 233 and 234:

233Chapter 7 Policy Implications -O

- Page 235 and 236:

235excess water when water is more

- Page 237 and 238:

237The options methodology develops

- Page 239 and 240:

2397.2.2. Organizational Wisdom to

- Page 241 and 242:

241success. In the bank, the author

- Page 243 and 244:

243method. Sensitivity analysis wit

- Page 245 and 246:

245Chapter 8 Summary and Conclusion

- Page 247 and 248:

2478.2. Real options “in” proje

- Page 249 and 250:

249Note the difference between real

- Page 251 and 252:

251Carlo simulation model to value

- Page 253 and 254:

2538.3.1. Options identificationFor

- Page 255 and 256:

255can catch upside of the uncertai

- Page 257 and 258:

257where r is the drift rate (in th

- Page 259 and 260:

259A joint realization of the probl

- Page 261 and 262:

261Note there is an exercise in sce

- Page 263 and 264:

263The real options decision variab

- Page 265 and 266:

265development case example, we sim

- Page 267 and 268:

267The standard deviation of the co

- Page 269 and 270:

269reservoir fixed cost is less und

- Page 271 and 272:

271time series of the water flow co

- Page 273 and 274:

273Table 8-8 Configurations set Y f

- Page 275 and 276:

275Table 8-9: Results for real opti

- Page 277 and 278:

277inconvenient features and high c

- Page 279 and 280:

279Year 0 Year 2.5 Year 5 Year 7.5

- Page 281 and 282:

281Following is a report on the com

- Page 283 and 284:

283can be found in Chapter 6, whose

- Page 285 and 286:

285This dissertation has successful

- Page 287 and 288:

2878.7. Contributions and Conclusio

- Page 289 and 290:

289ReferencesAberdein, D. A. (1994)

- Page 291 and 292:

291Copeland, T.E. and Antikarov, V.

- Page 293 and 294:

293Jacoby, H.D. and Loucks, D. (197

- Page 295 and 296:

295Mason, S.P. and Merton, R.C. (19

- Page 297 and 298:

297Schoenberger, C. R. (2000) “Si

- Page 299 and 300:

299AppendicesAppendix 3A: Ito’s L

- Page 301 and 302:

301p;Binary variablesX(i,j);X.l('4'

- Page 303 and 304:

303Appendix 5B: GAMS Code for Ameri

- Page 305 and 306:

305n5 non-antipativity constraint 5

- Page 307 and 308:

3072 0.50 1.51 4.57 7.5 4.573 0.50

- Page 309 and 310:

309R(q,i,s)RTD(q,i,s)P1(q,i)P2(q,i)

- Page 311 and 312:

311na28na29na30na31na32na33na34na35

- Page 313 and 314:

313na26(s)..na27(s)..R('14','3',s)

- Page 315 and 316:

315Table DeltaF(s,t)1 21 0 02 0 03

- Page 317 and 318:

317EquationsObjBeneCostCont1Cont2Co

- Page 319 and 320:

319Appendix 6B: GAMS code for the t

- Page 321 and 322:

3213 -63.6 63.6;Scalars f /0.226/;P

- Page 323 and 324:

323Hydro1Hydro2Budget;*costs and be

- Page 325 and 326:

325Scalars es /0.7/;Scalars Kt /15.

- Page 327 and 328:

327VariablesXstiq(s,t,i,q)Pstiq(s,t

- Page 329 and 330:

329f)*Rsiq(s,i,'1') )))))*0.001 + P

- Page 331 and 332:

331Appendix 6D: GAMS code for real

- Page 333 and 334:

3331 2 31 9600 9600 96002 0 0 03 95

- Page 335 and 336:

335Rsiq.l('1','3','4') = 0;Rsiq.l('

- Page 337:

337Cont1(i,q).. Xstiq('3','1',i,q)