Overview of Malaysian PSC - CCOP

Overview of Malaysian PSC - CCOP

Overview of Malaysian PSC - CCOP

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

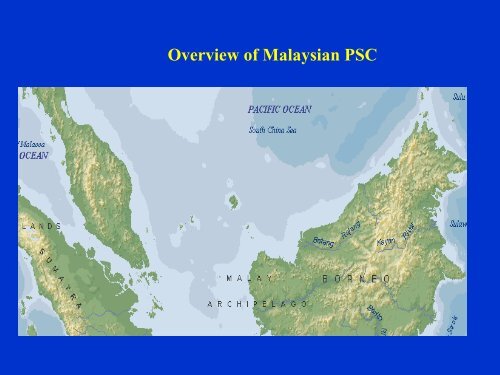

<strong>Overview</strong> <strong>of</strong> <strong>Malaysian</strong> <strong>PSC</strong>

FIELD LOCATION MALAYSIAKangarM’sia / ThaiDevelopment AreaPM3 CommercialArrangement M’sia-VietnamGeorgetownGurunKualaTerengganuSABAHLumutKg. TOK ARUNKemamanKERTIHMeruKuantanKUALA LUMPURSerembanSegamatMelakaJohore BahruPENINSULARMALAYSIASARAWAKLNG PLANTSOIL AND GAS FIELDS*FIELD OIL GASDISCOVERED 134 178PRODUCING 47 14

MALAYSIA EXPLORATION AND PRODUCTIONBLOCKS9°7°5°3°98° 100° 102° 104° 106° 108° 110° 112° 114° 116° 118° 120°PM320THAILANDPulauLangkawiPM321PulauPinangStraits <strong>of</strong> MelakaPM322Malaysia / ThailandJoint DevelopmentAreaPM301PENINSULARMALAYSIAVI ETNAMPM3Commercial ArrangementAreaPM302PM311PM303PM313PM306PM314PM307PM308PulauTiomanPM312PM305PM309PulauDjemadjaKepulauanAnambasSouth ChinaSea200mPulauNatunaPulauSubiBesarSK331BRUN EIPALAWAN(PHILIPPINES)PulauBugsukPulauBalabacPulauBalambanganPulauND5ND4BanggiH SB303 Pulau SB304MalawaliK SB302PulauND2 ND3JambonganND1GSB330Sulu SeaCSB305F ALSB301B D MSABAHBEPulauSB331TawitawiJ Pulau LabuanSK301 SK312SB332SK3SK 307PulauSK308Pulau SibutuSK310Timbun MataSK302 SK306SB306SK333PulauSK311SebatikND6SK334ND7SK303 SK5SK332SK305SK309SK309200m9°7°5°3°1°SUMATRASI NGAPORE0 200KmSK304SARAWAKKALI MANTANCelebesSea1°98° 100° 102° 104° 106° 108° 110° 112° 114° 116° 118° 120°Development & Producing <strong>PSC</strong>s : 24

CONCEPT OF PRODUCTION SHARINGCONTRACT (<strong>PSC</strong>)GOVERNMENTPDAPETRONAS<strong>PSC</strong>CONTRACTORSEntire owne rship <strong>of</strong> Nation'spetroleum resources isvested to PETRONAS.PETRONAS has exclusiverig hts to e xploit Nation'spetroleum resources.Conve rte d Conce ssionSystem to Production SharingContracts (<strong>PSC</strong>).Oblig ate s Partne rs to provideall financing and insulatePETRONAS from risks.Provides a more equitablepartnership.Stipulates contractual period,management <strong>of</strong> ope rations,recovery <strong>of</strong> costs, division <strong>of</strong>pr<strong>of</strong>it, obligations <strong>of</strong> parties.PETRONAS, as a custodian,manag e s the pe trole umre sources <strong>of</strong> the Nation.Formulate s re le vant policy andguideline s.Provide s ne ce ssary incentivesand conducive investme ntenvironment for upstreampetroleum business.Adds value to the petrole umre sources.Plans and secures long termdevelopment <strong>of</strong> Nation'spetroleum resource base.Promotes sustainableexploration, development andproduction <strong>of</strong> resources for themaximum be ne fit to the nation.Manages performance <strong>of</strong> <strong>PSC</strong>Partne rs.Brings in fore ign investme nt andte chnolog y.

EVOLUTION OF <strong>PSC</strong> INLINE WITH CHANGINGENVIRONMENTRevenue-over-cost(R/C)DEEPWATER<strong>PSC</strong>To attract new foreigninvestment through smartpartnership concept1985 <strong>PSC</strong>Target for big playerswith deepwaterexperience1976 <strong>PSC</strong>To attract other oilcompanies besidesESSO and SHELLCONCESSIONAGREEMENTConvert existingConcession into <strong>PSC</strong>sOil companies andState government

<strong>PSC</strong>s IN OPERATION IN MALAYSIA(As at January 2004)50401976 <strong>PSC</strong> 1985 <strong>PSC</strong>D E E P W A T E R& R /C P S C434241374446302730 3029 2931 3127332021101154 4 45 56 6 6 6401976 1980 1984 1988 1992 1996 2000

SPLIT OF THE BARREL UNDER <strong>PSC</strong>lessRevenue (A)Royalty (B)10% <strong>of</strong> (A)RoyaltylessCost Recovery (C)Max 50% <strong>of</strong> (A)Cost Recovery to ContrequalsPr<strong>of</strong>it Oil(A)- (B)-(C)plusPr<strong>of</strong>it to ContrequalsEntitlement to ContrPr<strong>of</strong>it to NOCequalsEntitlement to NOClesslessTaxExpenseslessTaxplusContr tax paidplusNOC tax paidequalsContractor NCFequalsContractor NCFequalsGOV NCFContractorNational Oil CompanyGovernment

76 <strong>PSC</strong>GovernmentCash FlowLess Royalty10%Actual UsedCostGross RevenueLess CostCost Oil Ceiling20%Contractor’sPr<strong>of</strong>it OilPr<strong>of</strong>it Oil SplitContr : PET30% :70%PETRONASPr<strong>of</strong>it OilLess PITA38% Less PITA38%Contractor Cash FlowPETRONAS Cash Flow

85 <strong>PSC</strong>GovernmentCash FlowLess Royalty10%Actual UsedCostGross RevenueLess CostCost Oil Ceiling50% Oil, 60% GasContractor’sPr<strong>of</strong>it OilPr<strong>of</strong>it Oil SplitContr : PETSlidingContrPETHPETRONASPr<strong>of</strong>it OilLess PITA First 10 kbd 50 5038%Next 10 kbd 40 60Less PITA38%Ecxess 20 kbd 30 70Contractor Cash FlowPETRONAS Cash Flow

ROC (Revenue Over Cost) <strong>PSC</strong>GovernmentCash FlowLess Royalty10%Gross RevenueActual UsedCostLess CostCost Oil CeilingDepend on R/CUnused Cost OilContr : PETContractor’sPr<strong>of</strong>it OilPr<strong>of</strong>it Oil SplitContr : PETDepend on R/CPETRONASPr<strong>of</strong>it OilLess PITA38% Less PITA38%Contractor Cash FlowPETRONAS Cash Flow

APPROACH : REVENUE-OVER-COST (R/C) INDEXOne <strong>of</strong> the "yardsticks" to gauge Contractors' pr<strong>of</strong>itability at any time is bythe RATIO <strong>of</strong> Contractors' Cumulative REVENUE over Cumulative COSTS.We define the above yardstick as Contractors' R/C IndexR/C Index =Contractors' Cumulative Cost Oil +Pr<strong>of</strong>it Oil From The Effective DateContractors' Cumulative Petroleum Costs From The Effective DateContractor's Cum.Costs & Cum.RevCumulative Revenue(PO+CO)0 2 4 6 8 10 12 14 16 18 20 22 24 26 28YearCumulative CostsContractor's R/C Index2.502.001.501.000.500.000 2 4 6 8 10 12 14 16 18 20 22 24 26 28YearR/C = 1; Represents PAYOUT (undiscounted), but true Payout (consideringtime value <strong>of</strong> money, tax payment, etc.) occurs when R/C is around 1.4Outline

R/C TABLEContractor’s R/CRatioCOSTOILPROFIT OILCostOilCeilingUnused CostOilPET : ContPr<strong>of</strong>it OilPET : Cont0.0 < R/C

FISCAL IMPROVEMENTFiscal terms are tied to rate/volume level, NOT related to PROFITABILITYFixed Cost Oil/Gas is NOT sensitive to investment level especially in theearly <strong>of</strong> the project lifeFiscal terms applied to Contract Area (rather than field basis)Higher pr<strong>of</strong>it split benefits accrue to First field. Subsequent developmentdoes not enjoy higher pr<strong>of</strong>it split.NO fiscal incentives to save costsAny Unused Cost Oil/Gas becomes pr<strong>of</strong>it and share in a bigger proportionto PETRONASNO fiscal incentives for re-investmentAdditional investment will not enjoy the same benefit as in earlierinvestment

COMPARISON OF <strong>PSC</strong> - OIL100<strong>PSC</strong> Partner10.114.016.412.7Percent <strong>of</strong> Gross Revenue806040PETRONASGOVERNMENT28.738.115.842.213.342.312.530.120COST23.128.028.044.701976 <strong>PSC</strong> 1985R/C DEEPWATER<strong>PSC</strong>Note : The 1976, 1985 and R/C <strong>PSC</strong>s are based on 40 million bbls crude oil reserve volume. The Deepwater <strong>PSC</strong> assumes alarge oil discovery in excess <strong>of</strong> 1 billion bbls.

VARIABLE COST SHARING LEVELS AND PROFIT SPLITSIt allows Contractor to take more when its pr<strong>of</strong>itability is low and PETRONAS' takeprogressively increases when Contractor's pr<strong>of</strong>itability improves:1. Higher Cost Tranche is given when Contractors' Pr<strong>of</strong>itability is low anddecreases as Contractor's Pr<strong>of</strong>itability increases.HighCOST TRANCHELowContractor's Pr<strong>of</strong>itability (as indicated by R/C)2. Higher Contractor's share <strong>of</strong> Pr<strong>of</strong>it Oil/Gas is given when Contractor'sHighPr<strong>of</strong>itability is low and decreases as Contractor's Pr<strong>of</strong>itability increases.CONTRACTOR'S SHAREOF PROFIT OIL/GASHighLowContractor's Pr<strong>of</strong>itability (as indicated by R/C)High

Salient Features <strong>of</strong> ROC <strong>PSC</strong>- Sensitivity <strong>of</strong> IRR on Oil Price and Cost222018100 mmbblOil PriceCost100 mmbblContractor's IRR (%MOD)1614121086440 mmbbl 40 mmbblSalient Features:Under the new R/C fiscal terms, Cost Reduction provides as much impact onContractors' IRR as that caused by oil price increaseCost Reduction is fully within our control, unlike oil price. Therefore, Contractorswill be enticed to reduce cost rather than to hope for oil price to improve. Thisleads to larger share in revenue for all parties involved.-30% -20% -10% Base Case 10% 20% 30%DecreasePercent VariationIncrease

PROFITABILITY BASED FISCAL REGIME :Sensitive to Re-investmentREVENUECUMULATIVEANNUALCOSTS2.01st round investment2nd round investmentCumulative RevenueCumulative Costs1.5RCINDEX1.00.50.0ECA-1 / mcprer3c/JAN 1996 EMDDip in R/C Indexas a result <strong>of</strong>additionalinvestment.0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20YEARE&P Business

R/C IS SELF-ADJUSTINGCosts, Reserves & Oil Price are estimated based on current conditions andcurrent Technology when a Contract is negotiated and agreed.Estimates likely to change, New technologies may evolve over time.CONTRACTOR'S R/C INDEX3.02.01.00.0R/C INDEX PROFILE IF OIL PRICETURNS OUT TO BE 25% HIGHERR/C INDEX PROFILE BASED ONESTIMATES DURING NEGOTIATIONS2 4 6 8 10 12 14 16 18 20CONTRACTOR'S R/C INDEX3.02.01.0IF PRICE TURNS OUT 25% HIGHER& COSTS 25% LOWERR/C INDEX PROFILE BASED ONESTIMATES DURING NEGOTIATIONS0.00 2 4 6 8 10 12 14 16 18 20CONTRACTOR'S R/C INDEX3.02.01.0IF RESERVES & PRODUCTIVITYTURNS OUT 50% BETTERR/C INDEX PROFILE BASED ONESTIMATES DURING NEGOTIATIONS0.00 2 4 6 8 10 12 14 16 18 20CONTRACTOR'S R/C INDEX3.02.01.0IF NEW TECHNOLOGY IS USEDTO ENHANCE RESERVESCOST EFFECTIVELYR/C INDEX PROFILE BASED ONESTIMATES DURING NEGOTIATIONS0.01 3 5 7 9 11 13 15 17 19

Sliding Scale 85 <strong>PSC</strong>ROYALTY( 10% )COSTRECOVERYup to 50%Below10 kbbl/d50 : 50Below 50 MMbbls 50 : 50Next10 kbbl/d40 : 60Above20 kbbl/d30 : 70Above 50MMbbls30 : 70PS Cont.PROFIT OIL20 %16 %12 %12 %PETT.PROFIT OIL20 %24 %28 %28 %