ussd: a communication technology to potentially oust sms ... - Aricent

ussd: a communication technology to potentially oust sms ... - Aricent

ussd: a communication technology to potentially oust sms ... - Aricent

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

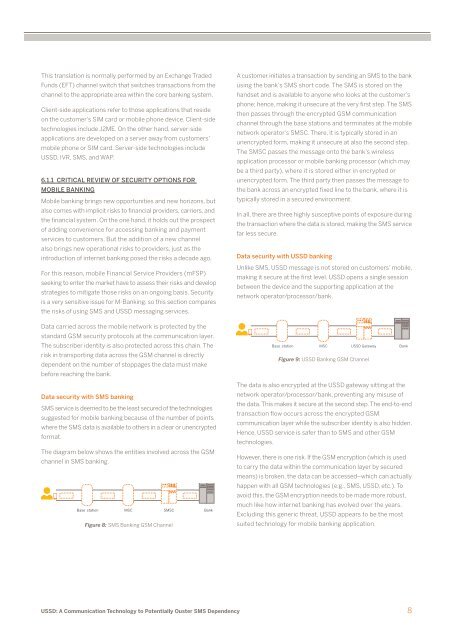

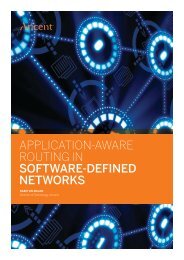

This translation is normally performed by an Exchange TradedFunds (EFT) channel switch that switches transactions from thechannel <strong>to</strong> the appropriate area within the core banking system.Client-side applications refer <strong>to</strong> those applications that resideon the cus<strong>to</strong>mer’s SIM card or mobile phone device. Client-sidetechnologies include J2ME. On the other hand, server-sideapplications are developed on a server away from cus<strong>to</strong>mers’mobile phone or SIM card. Server-side technologies includeUSSD, IVR, SMS, and WAP.6.1.1 CRITICAL REVIEW OF SECURITY OPTIONS FORMOBILE BANKINGMobile banking brings new opportunities and new horizons, butalso comes with implicit risks <strong>to</strong> financial providers, carriers, andthe financial system. On the one hand, it holds out the prospec<strong>to</strong>f adding convenience for accessing banking and paymentservices <strong>to</strong> cus<strong>to</strong>mers. But the addition of a new channelalso brings new operational risks <strong>to</strong> providers, just as theintroduction of internet banking posed the risks a decade ago.For this reason, mobile Financial Service Providers (mFSP)seeking <strong>to</strong> enter the market have <strong>to</strong> assess their risks and developstrategies <strong>to</strong> mitigate those risks on an ongoing basis. Securityis a very sensitive issue for M-Banking, so this section comparesthe risks of using SMS and USSD messaging services.Data carried across the mobile network is protected by thestandard GSM security pro<strong>to</strong>cols at the <strong>communication</strong> layer.The subscriber identity is also protected across this chain. Therisk in transporting data across the GSM channel is directlydependent on the number of s<strong>to</strong>ppages the data must makebefore reaching the bank.Data security with SMS bankingSMS service is deemed <strong>to</strong> be the least secured of the technologiessuggested for mobile banking because of the number of pointswhere the SMS data is available <strong>to</strong> others in a clear or unencryptedformat.The diagram below shows the entities involved across the GSMchannel in SMS banking.Base stationMSC SMSC BankFigure 8: SMS Banking GSM ChannelA cus<strong>to</strong>mer initiates a transaction by sending an SMS <strong>to</strong> the bankusing the bank’s SMS short code. The SMS is s<strong>to</strong>red on thehandset and is available <strong>to</strong> anyone who looks at the cus<strong>to</strong>mer’sphone; hence, making it unsecure at the very first step. The SMSthen passes through the encrypted GSM <strong>communication</strong>channel through the base stations and terminates at the mobilenetwork opera<strong>to</strong>r’s SMSC. There, it is typically s<strong>to</strong>red in anunencrypted form, making it unsecure at also the second step.The SMSC passes the message on<strong>to</strong> the bank’s wirelessapplication processor or mobile banking processor (which maybe a third party), where it is s<strong>to</strong>red either in encrypted orunencrypted form. The third party then passes the message <strong>to</strong>the bank across an encrypted fixed line <strong>to</strong> the bank, where it istypically s<strong>to</strong>red in a secured environment.In all, there are three highly susceptive points of exposure duringthe transaction where the data is s<strong>to</strong>red, making the SMS servicefar less secure.Data security with USSD bankingUnlike SMS, USSD message is not s<strong>to</strong>red on cus<strong>to</strong>mers’ mobile,making it secure at the first level. USSD opens a single sessionbetween the device and the supporting application at thenetwork opera<strong>to</strong>r/processor/bank.Base stationMSC USSD Gateway BankFigure 9: USSD Banking GSM ChannelThe data is also encrypted at the USSD gateway sitting at thenetwork opera<strong>to</strong>r/processor/bank, preventing any misuse ofthe data. This makes it secure at the second step. The end-<strong>to</strong>-endtransaction flow occurs across the encrypted GSM<strong>communication</strong> layer while the subscriber identity is also hidden.Hence, USSD service is safer than <strong>to</strong> SMS and other GSMtechnologies.However, there is one risk. If the GSM encryption (which is used<strong>to</strong> carry the data within the <strong>communication</strong> layer by securedmeans) is broken, the data can be accessed–which can actuallyhappen with all GSM technologies (e.g., SMS, USSD, etc.). Toavoid this, the GSM encryption needs <strong>to</strong> be made more robust,much like how internet banking has evolved over the years.Excluding this generic threat, USSD appears <strong>to</strong> be the mostsuited <strong>technology</strong> for mobile banking application.USSD: A Communication Technology <strong>to</strong> Potentially Ouster SMS Dependency8