Citigroup Inc.

Citigroup Inc.

Citigroup Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

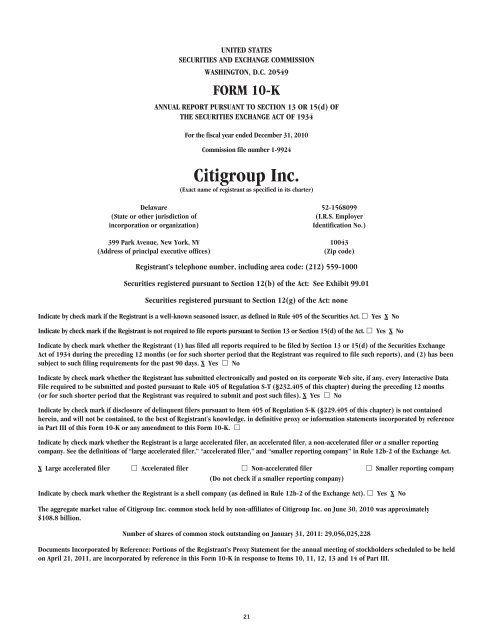

UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWASHINGTON, D.C. 20549FORM 10-KANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OFTHE SECURITIES EXCHANGE ACT OF 1934For the fiscal year ended December 31, 2010Commission file number 1-9924<strong>Citigroup</strong> <strong>Inc</strong>.(Exact name of registrant as specified in its charter)Delaware(State or other jurisdiction ofincorporation or organization)399 Park Avenue, New York, NY(Address of principal executive offices)52-1568099(I.R.S. EmployerIdentification No.)10043(Zip code)Registrant’s telephone number, including area code: (212) 559-1000Securities registered pursuant to Section 12(b) of the Act: See Exhibit 99.01Securities registered pursuant to Section 12(g) of the Act: noneIndicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X NoIndicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes X NoIndicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities ExchangeAct of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has beensubject to such filing requirements for the past 90 days. X Yes NoIndicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive DataFile required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months(or for such shorter period that the Registrant was required to submit and post such files). X Yes NoIndicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not containedherein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by referencein Part III of this Form 10-K or any amendment to this Form 10-K. Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reportingcompany. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.X Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company(Do not check if a smaller reporting company)Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes X NoThe aggregate market value of <strong>Citigroup</strong> <strong>Inc</strong>. common stock held by non-affiliates of <strong>Citigroup</strong> <strong>Inc</strong>. on June 30, 2010 was approximately$108.8 billion.Number of shares of common stock outstanding on January 31, 2011: 29,056,025,228Documents <strong>Inc</strong>orporated by Reference: Portions of the Registrant’s Proxy Statement for the annual meeting of stockholders scheduled to be heldon April 21, 2011, are incorporated by reference in this Form 10-K in response to Items 10, 11, 12, 13 and 14 of Part III.21

10-K CROSS-REFERENCE INDEXThis Annual Report on Form 10-K incorporates the requirements of the accounting profession and the Securities and Exchange Commission.Form 10-KItem NumberPagePart IIIPart I1. Business . . . . . . . . . . . . . . . . . . . . . 24-53, 57, 134-141,144-145, 182, 301-3021A. Risk Factors . . . . . . . . . . . . . . . . . . 71-801B. Unresolved Staff Comments ...... Not Applicable2. Properties . . . . . . . . . . . . . . . . . . . . 302-3033. Legal Proceedings . . . . . . . . . . . . . 283-2884. (Removed and Reserved) ........ —Part II5. Market for Registrant’s CommonEquity, Related StockholderMatters, and Issuer Purchases ofEquity Securities ............... 60, 189, 299,303-304, 3066. Selected Financial Data . . . . . . . . . 28-297. Management’s Discussion andAnalysis of Financial Conditionand Results of Operations . . . . . . . 24-70, 81-1337A. Quantitative and QualitativeDisclosures About Market Risk . . . 81-133, 183-184,203-228,231-2758. Financial Statements andSupplementary Data ............ 151-30010. Directors, Executive Officers andCorporate Governance . . . . . . . . . . . . . . 305-306, 308*11. Executive Compensation . . . . . . . . . . . . **12. Security Ownership of CertainBeneficial Owners andManagement and RelatedStockholder Matters ................ ***13. Certain Relationships and RelatedTransactions, and DirectorIndependence ..................... ****14. Principal Accounting Fees andServices . . . . . . . . . . . . . . . . . . . . . . . . . *****Part IV15. Exhibits and Financial StatementSchedules ........................* For additional information regarding <strong>Citigroup</strong>’s Directors, see “Corporate Governance,”“Proposal 1: Election of Directors” and “Section 16(a) Beneficial Ownership ReportingCompliance” in the definitive Proxy Statement for <strong>Citigroup</strong>’s Annual Meeting of Stockholdersscheduled to be held on April 21, 2011, to be filed with the SEC (the Proxy Statement),incorporated herein by reference.** See “Executive Compensation—Compensation Discussion and Analysis,” “—2010 SummaryCompensation Table” and “—The Personnel and Compensation Committee Report” in the ProxyStatement, incorporated herein by reference.*** See “About the Annual Meeting,” “Stock Ownership” and “Proposal 3: Approval ofAmendment to the <strong>Citigroup</strong> 2009 Stock <strong>Inc</strong>entive Plan” in the Proxy Statement, incorporatedherein by reference.**** See “Corporate Governance—Director Independence,” “—Certain Transactionsand Relationships, Compensation Committee Interlocks and Insider Participation,”“—Indebtedness,” “Proposal 1: Election of Directors” and “Executive Compensation” in theProxy Statement, incorporated herein by reference.***** See “Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm”in the Proxy Statement, incorporated herein by reference.9. Changes in and Disagreementswith Accountants on Accountingand Financial Disclosure . . . . . . . .Not Applicable9A. Controls and Procedures . . . . . . . . 142-1439B. Other Information .............. Not Applicable22

CITIGROUP’S 2010 ANNUAL REPORT ON FORM 10-KOVERVIEW 24CITIGROUP SEGMENTS AND REGIONS 25MANAGEMENT’S DISCUSSION AND ANALYSISOF FINANCIAL CONDITION AND RESULTSOF OPERATIONS 26EXECUTIVE SUMMARY 26RESULTS OF OPERATIONS 28FIVE-YEAR SUMMARY OF SELECTEDFINANCIAL DATA 28SEGMENT, BUSINESS AND PRODUCT—INCOME (LOSS) AND REVENUES 30CITICORP 32Regional Consumer Banking 33North America Regional Consumer Banking 34EMEA Regional Consumer Banking 36Latin America Regional Consumer Banking 38Asia Regional Consumer Banking 40Institutional Clients Group 42Securities and Banking 43Transaction Services 45CITI HOLDINGS 46Brokerage and Asset Management 47Local Consumer Lending 48Special Asset Pool 50CORPORATE/OTHER 53BALANCE SHEET REVIEW 54Segment Balance Sheet at December 31, 2010 57CAPITAL RESOURCES AND LIQUIDITY 58Capital Resources 58Funding and Liquidity 64CONTRACTUAL OBLIGATIONS 70RISK FACTORS 71MANAGING GLOBAL RISK 81Risk Management—Overview 81Risk Aggregation and Stress Testing 82Risk Capital 82Credit Risk 83Loan and Credit Overview 83Loans Outstanding 84Details of Credit Loss Experience 86Impaired Loans, Non-Accrual Loans and Assets, andRenegotiated Loans 88U.S. Consumer Mortgage Lending 92North America Cards 99Consumer Loan Details 103Consumer Loan Modification Programs 105Consumer Mortgage Representations and Warranties 110Securities and Banking-Sponsored Private LabelResidential Mortgage Securitizations 113Corporate Loan Details 114Exposure to Commercial Real Estate 116Market Risk 117Operational Risk 126Country and Cross-Border Risk Management Process;Sovereign Exposure 128DERIVATIVES 130SIGNIFICANT ACCOUNTING POLICIES ANDSIGNIFICANT ESTIMATES 134DISCLOSURE CONTROLS AND PROCEDURES 142MANAGEMENT’S ANNUAL REPORT ONINTERNAL CONTROL OVER FINANCIALREPORTING 143FORWARD-LOOKING STATEMENTS 144REPORT OF INDEPENDENT REGISTEREDPUBLIC ACCOUNTING FIRM—INTERNALCONTROL OVER FINANCIAL REPORTING 146REPORT OF INDEPENDENT REGISTEREDPUBLIC ACCOUNTING FIRM—CONSOLIDATED FINANCIAL STATEMENTS 147FINANCIAL STATEMENTS AND NOTES TABLEOF CONTENTS 149CONSOLIDATED FINANCIAL STATEMENTS 151NOTES TO CONSOLIDATED FINANCIALSTATEMENTS 159FINANCIAL DATA SUPPLEMENT (Unaudited) 300Ratios 300Average Deposit Liabilities in Offices Outside the U.S. 300Maturity Profile of Time Deposits ($100,000 or more) in U.S. Offices 300SUPERVISION AND REGULATION 301Customers 302Competition 302Properties 302LEGAL PROCEEDINGS 303Unregistered Sales of Equity;Purchases of Equity Securities;Dividends 303PERFORMANCE GRAPH 304CORPORATE INFORMATION 305<strong>Citigroup</strong> Executive Officers 305CITIGROUP BOARD OF DIRECTORS 30823

OVERVIEWIntroduction<strong>Citigroup</strong>’s history dates back to the founding of Citibank in 1812.<strong>Citigroup</strong>’s original corporate predecessor was incorporated in 1988 underthe laws of the State of Delaware. Following a series of transactions over anumber of years, <strong>Citigroup</strong> <strong>Inc</strong>. was formed in 1998 upon the merger ofCiticorp and Travelers Group <strong>Inc</strong>.<strong>Citigroup</strong> is a global diversified financial services holding company whosebusinesses provide consumers, corporations, governments and institutionswith a broad range of financial products and services. Citi has approximately200 million customer accounts and does business in more than 160 countriesand jurisdictions.<strong>Citigroup</strong> currently operates, for management reporting purposes, via twoprimary business segments: Citicorp, consisting of Citi’s Regional ConsumerBanking businesses and Institutional Clients Group; and Citi Holdings,consisting of Citi’s Brokerage and Asset Management and Local ConsumerLending businesses, and a Special Asset Pool. There is also a third segment,Corporate/Other. For a further description of the business segments andthe products and services they provide, see “<strong>Citigroup</strong> Segments” below,“Management’s Discussion and Analysis of Financial Condition and Resultsof Operations” and Note 4 to the Consolidated Financial Statements.Throughout this report, “<strong>Citigroup</strong>”, “Citi” and “the Company” refer to<strong>Citigroup</strong> <strong>Inc</strong>. and its consolidated subsidiaries.Additional information about <strong>Citigroup</strong> is available on the company’s Website at www.citigroup.com. <strong>Citigroup</strong>’s recent annual reports on Form 10-K,quarterly reports on Form 10-Q, current reports on Form 8-K, as well as itsother filings with the SEC are available free of charge through the company’sWeb site by clicking on the “Investors” page and selecting “All SEC Filings.”The SEC’s Web site also contains periodic and current reports, proxy andinformation statements, and other information regarding Citi at www.sec.gov.Within this Form 10-K, please refer to the tables of contents on pages 23and 149 for page references to Management’s Discussion and Analysis ofFinancial Condition and Results of Operations and Notes to ConsolidatedFinancial Statements, respectively.At December 31, 2010, Citi had approximately 260,000 full-timeemployees compared to approximately 265,300 full-time employees atDecember 31, 2009.Impact of Adoption of SFAS 166/167As previously disclosed, effective January 1, 2010, <strong>Citigroup</strong> adoptedAccounting Standards Codification (ASC) 860, Transfers and Servicing,formerly SFAS No. 166, Accounting for Transfers of FinancialAssets, an amendment of FASB Statement No. 140 (SFAS 166), andASC 810, Consolidations, formerly SFAS No. 167, Amendments to FASBInterpretation No. 46(R) (SFAS 167). Among other requirements, theadoption of these standards includes the requirement that Citi consolidatecertain of its credit card securitization trusts and cease sale accountingfor transfers of credit card receivables to those trusts. As a result, reportedand managed-basis presentations are comparable for periods beginningJanuary 1, 2010. For comparison purposes, prior period revenues, net creditlosses, provisions for credit losses and for benefits and claims and loans arepresented where indicated on a managed basis in this Form 10-K. Managedpresentations were applicable only to Citi’s North American brandedand retail partner credit card operations in North America RegionalConsumer Banking and Citi Holdings—Local Consumer Lendingand any aggregations in which they are included. See “Capital Resourcesand Liquidity” and Note 1 to the Consolidated Financial Statements foran additional discussion of the adoption of SFAS 166/167 and its impacton <strong>Citigroup</strong>.Please see “Risk Factors” below for a discussion ofcertain risks and uncertainties that could materially impact<strong>Citigroup</strong>’s financial condition and results of operations.Certain reclassifications have been made to the prior periods’ financialstatements to conform to the current period’s presentation.24

As described above, <strong>Citigroup</strong> is managed pursuant to the following segments:CITIGROUP SEGMENTSCiticorpCiti HoldingsCorporate/OtherRegionalConsumerBanking- Retail banking, localcommercial bankingand branch-basedfinancial advisorsin North America,EMEA, Latin Americaand Asia; Residentialreal estate- Citi-branded cardsin North America,EMEA, Latin Americaand Asia- Latin America assetmanagementInstitutionalClientsGroup• Securities andBanking- Investmentbanking- Debt and equitymarkets (includingprime brokerage)- Lending- Private equity- Hedge funds- Real estate- Structuredproducts- Private Bank- Equity and fixedincome research• Transaction Services- Treasury and tradesolutions- Securities and fundservices• Brokerage and AssetManagement- Primarily includesinvestment in andassociated earningsfrom MorganStanley SmithBarney joint venture- Retail alternativeinvestments• Local ConsumerLending- Consumer financelending: residentialand commercialreal estate; auto,personal andstudent loans; andconsumer branchlending- Retail partner cards- Investment inPrimerica FinancialServices- Certain internationalconsumer lending(including WesternEurope retailbanking and cards)• Special Asset Pool- Certain institutionaland consumer bankportfolios- Treasury- Operations andtechnology- Global stafffunctions and othercorporate expenses- DiscontinuedoperationsThe following are the four regions in which <strong>Citigroup</strong> operates. The regional results are fully reflected in the segment results above.CITIGROUP REGIONS (1)NorthAmericaEurope,Middle East andAfrica(EMEA)Latin AmericaAsia(1) Asia includes Japan, Latin America includes Mexico, and North America comprises the U.S., Canada and Puerto Rico.25

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION ANDRESULTS OF OPERATIONSEXECUTIVE SUMMARY2010 Summary ResultsDuring 2010, Citi continued to execute its strategy of growing and investingin its core businesses in Citicorp—Regional Consumer Banking, Securitiesand Banking and Transaction Services—while at the same time windingdown the assets and businesses in Citi Holdings in an economicallyrational manner.<strong>Citigroup</strong><strong>Citigroup</strong> reported net income for 2010 of $10.6 billion, compared to a netloss of $1.6 billion in 2009. Diluted EPS was $0.35 per share in 2010 versusa loss of $0.80 per share in 2009, and net revenues were $86.6 billion in2010, versus $91.1 billion in 2009, on a comparable basis. On a reportedbasis, net interest revenue increased by $5.7 billion, or 12%, to $54.7 billionin 2010, generally as a result of the adoption of SFAS 166/167, partiallyoffset by the continued run-off of higher-yielding assets in Citi Holdings andinvestments in lower-yielding securities. Non-interest revenues improved byapproximately $578 million, or 2%, to $31.9 billion in 2010, primarily dueto positive gross revenue marks in the Special Asset Pool in Citi Holdings of$2.0 billion in 2010 versus negative revenue marks of $4.6 billion in 2009, a$11.1 billion gain in 2009 on the sale of Smith Barney, a $1.4 billion pretaxgain related to the public and private exchange offers consummated in Julyand September of 2009, and a $10.1 billion pretax loss associated with therepayment of TARP and the exit from the loss-sharing agreement with theU.S. government in December 2009.CiticorpDespite continued weaker market conditions, Citicorp net income remainedstrong in 2010 at $14.9 billion versus $15.3 billion in 2009, with earningsin Asia and Latin America contributing more than half of the total. Thecontinued strength of the core Citi franchise was demonstrated by Citicorprevenues of $65.6 billion for 2010, with a 3% growth in revenues in RegionalConsumer Banking on a comparable basis and a 3% growth in TransactionServices, offset by lower revenues in Securities and Banking.Business drivers in international Regional Consumer Banking reflectedthe impact in 2010 of the accelerating pace of economic recovery in regionsoutside of North America and increased investment spending by Citi:• Revenues of $17.7 billion were up 9% year over year.• Net income more than doubled to $4.2 billion.• Average deposits and average loans each grew by 12% year over year.• Card purchase sales grew 17% year over year.Securities and Banking revenues declined 15% to $23.1 billion in 2010.Excluding the impact of credit value adjustments (CVA), revenues were down19% year over year to $23.5 billion. The decrease mainly reflected the impactof lower overall client market activity and more challenging global capitalmarket conditions in 2010, as compared to 2009, which was a particularlystrong year driven by robust fixed income markets and higher client activitylevels in investment banking, especially in the first half of the year.Citi HoldingsCiti Holdings’ net loss decreased 52%, from $8.9 billion to $4.2 billion, ascompared to 2009. Lower revenues reflected the absence of the $11.1 billionpretax gain on the sale of Smith Barney in 2009 as well as a declining loanbalance resulting mainly from asset sales and net paydowns.Citi Holdings assets stood at $359 billion at the end of 2010, down$128 billion, or 26%, from $487 billion at the end of 2009. Adjusting for theimpact of adopting SFAS 166/167, which added approximately $43 billion ofassets to the balance sheet on January 1, 2010, Citi Holdings assets were downby $171 billion during 2010, consisting of approximately:• $108 billion in asset sales and business dispositions;• $50 billion of net run-off and paydowns; and• $13 billion of net cost of credit and net asset marks.As of December 31, 2010, Citi Holdings represented 19% of <strong>Citigroup</strong>assets, as compared to 38% in the first quarter of 2008. At December 31, 2010,Citi Holdings risk-weighted assets were approximately $330 billion, or 34%, oftotal <strong>Citigroup</strong> risk-weighted assets.Credit CostsGlobal credit continued to recover with the sixth consecutive quarter ofsustained improvement in credit costs in the fourth quarter of 2010. Forthe full year, <strong>Citigroup</strong> net credit losses declined $11.4 billion, or 27%, to$30.9 billion in 2010 on a comparable basis, reflecting improvement innet credit losses in every region. During 2010, Citi released $5.8 billion innet reserves for loan losses and unfunded lending commitments, primarilydriven by international Regional Consumer Banking, retail partner cardsin Local Consumer Lending and the Corporate loan portfolio, while it built$8.3 billion of reserves in 2009. The total provision for credit losses and forbenefits and claims of $26.0 billion in 2010 decreased 50% on a comparablebasis year over year.Net credit losses in Citicorp declined 10% year-over-year on a comparablebasis to $11.8 billion, and Citicorp released $2.2 billion in net reserves forloan losses and unfunded lending commitments, compared to a $2.9 billionreserve build in 2009. Net credit losses in Citi Holdings declined 35% on acomparable basis to $19.1 billion, and Citi Holdings released $3.6 billion innet reserves for loan losses and unfunded lending commitments, comparedto a $5.4 billion reserve build in 2009.26

Operating Expenses<strong>Citigroup</strong> operating expenses were down 1% versus the prior year at$47.4 billion in 2010, as increased investment spending, FX translation, andinflation in Citicorp were more than offset by lower expenses in Citi Holdings.In Citicorp, expenses increased 10% year over year to $35.9 billion, mainlydue to higher investment spending across all Citicorp businesses as wellas FX translation and inflation. In Citi Holdings, operating expenses weredown 31% year over year to $9.6 billion, reflecting the continued reductionof assets.Capital and Loan Loss Reserve PositionsCiti increased its Tier 1 Common and Tier 1 Capital ratios during 2010. AtDecember 31, 2010, Citi’s Tier 1 Common ratio was 10.8% and its Tier 1Capital ratio was 12.9%, compared to 9.6% and 11.7% at December 31, 2009,respectively. Tier 1 Common was relatively flat year over year at $105 billion,even after absorbing a $14.2 billion reduction from the impact of SFAS166/167 in the first quarter, while total risk-weighted assets declined 10% to$978 billion.<strong>Citigroup</strong> ended the year with a total allowance for loan losses of$40.7 billion, up $4.6 billion, or 13%, from the prior year, reflecting theimpact of adopting SFAS 166/167 which added $13.4 billion on January1, 2010. The allowance represented 6.31% of total loans and 209% ofnon-accrual loans as of December 31, 2010, up from 6.09% and 114%,respectively, at the end of 2009. The consumer loan loss reserve was$35.4 billion at December 31, 2010, representing 7.77% of total loans, versus$28.4 billion, or 6.70%, at December 31, 2009.Liquidity and Funding<strong>Citigroup</strong> maintained a high level of liquidity, with aggregate liquidityresources (including cash at major central banks and unencumbered liquidsecurities) of $322 billion at year-end 2010, up from $316 billion at year-end2009. Citi also continued to grow its deposit base, closing 2010 with $845billion in deposits, up 1% from year-end 2009. Structural liquidity (defined asdeposits, long-term debt and equity as a percentage of total assets) remainedstrong at 73% as of December 31, 2010, flat compared to December 31, 2009,and up from 66% at December 31, 2008.<strong>Citigroup</strong> issued approximately $22 billion (excluding local country andsecuritizations) of long-term debt in 2010, representing just over half of its2010 long-term maturities, due to its strong liquidity position and proceedsreceived from asset reductions in Citi Holdings. For additional information,see “Capital Resources and Liquidity—Funding and Liquidity” below.2011 Business OutlookIn 2011, management will continue its focus on growing and investing inthe core Citicorp franchise, while economically rationalizing Citi Holdings.However, <strong>Citigroup</strong>’s results will continue to be affected by factors outsideof its control, such as the global economic and regulatory environmentin the regions in which Citi operates. In particular, the macroeconomicenvironment in the U.S. remains challenging, with unemployment levelsstill elevated and continued pressure and uncertainty in the housing market,including home prices. Additionally, the continued implementation ofthe Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010(Financial Reform Act), including the ongoing extensive rulemaking andinterpretive issues, as well as the new capital standards for bank holdingcompanies as adopted by the Basel Committee on Banking Supervision(Basel Committee) and U.S. regulators, will remain a significant sourceof uncertainty in 2011. Moreover, the implementation of the change inmethodology for calculating FDIC insurance premiums, to be effective inthe second quarter 2011, will have a negative impact on Citi’s earnings.(For additional information on these factors, see “Capital Resources andLiquidity” and “Risk Factors” below.)In Citicorp, Securities and Banking results for 2011 will depend on thelevel of client activity and on macroeconomic conditions, market valuationsand volatility, interest rates and other market factors. Transaction Servicesbusiness performance will also continue to be impacted by macroeconomicconditions as well as market factors, including interest rate levels, globaleconomic and trade activity, volatility in capital markets, foreign exchangeand market valuations.In Regional Consumer Banking, results during the year are likely tobe driven by different trends in North America versus the internationalregions. In North America, if economic recovery is sustained, revenues couldgrow modestly, particularly in the second half of the year, assuming loandemand begins to recover. However, net credit margin in North America willlikely continue to be driven primarily by improvement in net credit losses.Internationally, given continued economic expansion in these regions, netcredit margin is likely to be driven by revenue growth, particularly in thesecond half of the year, as investment spending should continue to generatevolume growth to outpace spread compression. International credit costs arelikely to increase in 2011, reflecting a growing loan portfolio.In Citi Holdings, revenues for Local Consumer Lending should continueto decline reflecting a shrinking loan balance resulting from paydowns andasset sales. Based on current delinquency trends and ongoing loss-mitigationactions, credit costs are expected to continue to improve. Overall, however,Local Consumer Lending will likely continue to drive results in Citi Holdings.Operating expenses are expected to show some variability across quartersas the Company continues to invest in Citicorp while rationalizing CitiHoldings and maintaining expense discipline. Although Citi currentlyexpects net interest margin (NIM) to remain under pressure during thefirst quarter of 2011, driven by continued low yields on investments and therun-off of higher yielding loan assets, NIM could begin to stabilize during theremainder of the year.27

RESULTS OF OPERATIONSFIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA—Page 1<strong>Citigroup</strong> <strong>Inc</strong>. and Consolidated SubsidiariesIn millions of dollars, except per-share amounts, ratios and direct staff 2010 (1)(2) 2009 (2) 2008 (2) 2007 (2) 2006 (2)Net interest revenue $ 54,652 $ 48,914 $ 53,749 $ 45,389 $ 37,928Non-interest revenue 31,949 31,371 (2,150) 31,911 48,399Revenues, net of interest expense $ 86,601 $ 80,285 $ 51,599 $ 77,300 $ 86,327Operating expenses 47,375 47,822 69,240 58,737 50,301Provisions for credit losses and for benefits and claims 26,042 40,262 34,714 17,917 7,537<strong>Inc</strong>ome (loss) from continuing operations before income taxes $ 13,184 $ (7,799) $ (52,355) $ 646 $ 28,489<strong>Inc</strong>ome taxes (benefits) 2,233 (6,733) (20,326) (2,546) 7,749<strong>Inc</strong>ome (loss) from continuing operations $ 10,951 $ (1,066) $ (32,029) $ 3,192 $ 20,740<strong>Inc</strong>ome (loss) from discontinued operations, net of taxes (3) (68) (445) 4,002 708 1,087Net income (loss) before attribution of noncontrolling interests $ 10,883 $ (1,511) $ (28,027) $ 3,900 $ 21,827Net income (loss) attributable to noncontrolling interests 281 95 (343) 283 289<strong>Citigroup</strong>’s net income (loss) $ 10,602 $ (1,606) $ (27,684) $ 3,617 $ 21,538Less:Preferred dividends–Basic $ 9 $ 2,988 $ 1,695 $ 36 $ 64Impact of the conversion price reset related to the $12.5 billionconvertible preferred stock private issuance—Basic — 1,285 — — —Preferred stock Series H discount accretion—Basic — 123 37 — —Impact of the public and private preferred stock exchange offer — 3,242 — — —Dividends and undistributed earnings allocated to participatingsecurities, applicable to Basic EPS 90 2 221 261 512<strong>Inc</strong>ome (loss) allocated to unrestricted common shareholders for basic EPS $ 10,503 $ (9,246) $ (29,637) $ 3,320 $ 20,962Less: Convertible preferred stock dividends — (540) (877) — —Add: <strong>Inc</strong>remental dividends and undistributed earnings allocated to participating securities,applicable to Diluted EPS 2 — — — 2<strong>Inc</strong>ome (loss) allocated to unrestricted common shareholders for diluted EPS $ 10,505 $ (8,706) $ (28,760) $ 3,320 $ 20,964Earnings per shareBasic<strong>Inc</strong>ome (loss) from continuing operations 0.37 (0.76) (6.39) 0.53 4.07Net income (loss) 0.36 (0.80) (5.63) 0.68 4.29Diluted (4)<strong>Inc</strong>ome (loss) from continuing operations $ 0.35 $ (0.76) $ (6.39) $ 0.53 $ 4.05Net income (loss) 0.35 (0.80) (5.63) 0.67 4.27Dividends declared per common share 0.00 0.01 1.12 2.16 1.96Statement continues on the next page, including notes to the table.28

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA—Page 2<strong>Citigroup</strong> <strong>Inc</strong>. and Consolidated SubsidiariesIn millions of dollars, except per-share amounts, ratios and direct staff 2010 (1) 2009 (2) 2008 (2) 2007 (2) 2006 (2)At December 31Total assets $1,913,902 $1,856,646 $1,938,470 $2,187,480 $1,884,167Total deposits 844,968 835,903 774,185 826,230 712,041Long-term debt 381,183 364,019 359,593 427,112 288,494Mandatorily redeemable securities of subsidiary trusts (included in long-term debt) 18,131 19,345 24,060 23,756 8,972Common stockholders’ equity 163,156 152,388 70,966 113,447 118,632Total stockholders’ equity 163,468 152,700 141,630 113,447 119,632Direct staff (in thousands) 260 265 323 375 327RatiosReturn on average common stockholders’ equity (5) 6.8% (9.4)% (28.8)% 2.9% 18.8%Return on average total stockholders’ equity (5) 6.8 (1.1) (20.9) 3.0 18.7Tier 1 Common (6) 10.75% 9.60% 2.30% 5.02% 7.49%Tier 1 Capital 12.91 11.67 11.92 7.12 8.59Total Capital 16.59 15.25 15.70 10.70 11.65Leverage (7) 6.60 6.87 6.08 4.03 5.16Common stockholders’ equity to assets 8.52% 8.21% 3.66% 5.19% 6.30%Total stockholders’ equity to assets 8.54 8.22 7.31 5.19 6.35Dividend payout ratio (8) NM NM NM 322.4 45.9Book value per common share $ 5.61 $ 5.35 $ 13.02 $ 22.71 $ 24.15Ratio of earnings to fixed charges and preferred stock dividends 1.52x NM NM 1.01x 1.50x(1) On January 1, 2010, <strong>Citigroup</strong> adopted SFAS 166/167. Prior periods have not been restated as the standards were adopted prospectively. See Note 1 to the Consolidated Financial Statements.(2) On January 1, 2009, <strong>Citigroup</strong> adopted SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements (now ASC 810-10-45-15, Consolidation: Noncontrolling Interest in a Subsidiary), and FSP EITF 03-6-1,“Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities” (now ASC 260-10-45-59A, Earnings Per Share: Participating Securities and the Two-Class Method). All priorperiods have been restated to conform to the current period’s presentation.(3) Discontinued operations for 2006 to 2009 reflect the sale of Nikko Cordial Securities to Sumitomo Mitsui Banking Corporation, the sale of <strong>Citigroup</strong>’s German retail banking operations to Crédit Mutuel, and the sale ofCitiCapital’s equipment finance unit to General Electric. In addition, discontinued operations for 2006 include the operations and associated gain on sale of substantially all of <strong>Citigroup</strong>’s asset management business.Discontinued operations for 2006 to 2010 also include the operations and associated gain on sale of <strong>Citigroup</strong>’s Travelers Life & Annuity; substantially all of <strong>Citigroup</strong>’s international insurance business; and <strong>Citigroup</strong>’sArgentine pension business sold to MetLife <strong>Inc</strong>. Discontinued operations for the second half of 2010 also reflect the sale of The Student Loan Corporation. See Note 3 to the Consolidated Financial Statements.(4) The diluted EPS calculation for 2009 and 2008 utilizes basic shares and income allocated to unrestricted common stockholders (Basic) due to the negative income allocated to unrestricted common stockholders. Usingdiluted shares and income allocated to unrestricted common stockholders (Diluted) would result in anti-dilution.(5) The return on average common stockholders’ equity is calculated using net income less preferred stock dividends divided by average common stockholders’ equity. The return on total stockholders’ equity is calculatedusing net income divided by average stockholders’ equity.(6) As defined by the banking regulators, the Tier 1 Common ratio represents Tier 1 Capital less qualifying perpetual preferred stock, qualifying noncontrolling interests in subsidiaries and qualifying mandatorily redeemablesecurities of subsidiary trusts divided by risk-weighted assets.(7) The Leverage ratio represents Tier 1 Capital divided by adjusted average total assets.(8) Dividends declared per common share as a percentage of net income per diluted share.NM Not meaningful29

SEGMENT, BUSINESS AND PRODUCT—INCOME (LOSS) AND REVENUESThe following tables show the income (loss) and revenues for <strong>Citigroup</strong> on a segment, business and product view:CITIGROUP INCOME (LOSS)In millions of dollars 2010 2009 2008<strong>Inc</strong>ome (loss) from continuing operationsCITICORP% Change2010 vs. 2009% Change2009 vs. 2008Regional Consumer BankingNorth America $ 607 $ 730 $ (1,504) (17)% NMEMEA 103 (209) 50 NM NMLatin America 1,885 525 (3,083) NM NMAsia 2,172 1,432 1,770 52 (19)%Total $ 4,767 $ 2,478 $ (2,767) 92% NMSecurities and BankingNorth America $ 2,537 $ 2,385 $ 2,395 6% —EMEA 1,832 3,426 588 (47) NMLatin America 1,072 1,536 1,113 (30) 38%Asia 1,138 1,838 1,970 (38) (7)Total $ 6,579 $ 9,185 $ 6,066 (28)% 51%Transaction ServicesNorth America $ 544 $ 615 $ 323 (12)% 90%EMEA 1,224 1,287 1,246 (5) 3Latin America 653 604 588 8 3Asia 1,253 1,230 1,196 2 3Total $ 3,674 $ 3,736 $ 3,353 (2)% 11%Institutional Clients Group $10,253 $ 12,921 $ 9,419 (21)% 37%Total Citicorp $15,020 $ 15,399 $ 6,652 (2)% NMCITI HOLDINGSBrokerage and Asset Management $ (203) $ 6,937 $ (851) NM NMLocal Consumer Lending (4,993) (10,416) (8,357) 52% (25)%Special Asset Pool 1,173 (5,369) (27,289) NM 80Total Citi Holdings $ (4,023) $ (8,848) $(36,497) 55% 76%Corporate/Other $ (46) $ (7,617) $ (2,184) 99% NM<strong>Inc</strong>ome (loss) from continuing operations $10,951 $ (1,066) $(32,029) NM 97%Discontinued operations $ (68) $ (445) $ 4,002 NM NMNet income (loss) attributable to noncontrolling interests 281 95 (343) NM NM<strong>Citigroup</strong>’s net income (loss) $10,602 $ (1,606) $(27,684) NM 94%NM Not meaningful30

CITIGROUP REVENUESIn millions of dollars 2010 2009 2008CITICORP% Change2010 vs. 2009% Change2009 vs. 2008Regional Consumer BankingNorth America $14,790 $ 8,576 $ 8,607 72% —%EMEA 1,511 1,555 1,865 (3) (17)Latin America 8,727 7,917 9,488 10 (17)Asia 7,414 6,766 7,461 10 (9)Total $32,442 $ 24,814 $ 27,421 31% (10)%Securities and BankingNorth America $ 9,392 $ 8,833 $ 10,821 6% (18)%EMEA 6,842 10,049 5,963 (32) 69Latin America 2,532 3,421 2,374 (26) 44Asia 4,318 4,806 5,570 (10) (14)Total $23,084 $ 27,109 $ 24,728 (15)% 10%Transaction ServicesNorth America $ 2,483 $ 2,526 $ 2,161 (2)% 17%EMEA 3,356 3,389 3,677 (1) (8)Latin America 1,490 1,373 1,439 9 (5)Asia 2,705 2,501 2,669 8 (6)Total $10,034 $ 9,789 $ 9,946 3% (2)%Institutional Clients Group $33,118 $ 36,898 $ 34,674 (10)% 6%Total Citicorp $65,560 $ 61,712 $ 62,095 6% (1)%CITI HOLDINGSBrokerage and Asset Management $ 609 $ 14,623 $ 7,963 (96)% 84%Local Consumer Lending 15,826 17,765 23,498 (11) (24)Special Asset Pool 2,852 (3,260) (39,699) NM 92Total Citi Holdings $19,287 $ 29,128 $ (8,238) (34)% NMCorporate/Other $ 1,754 $(10,555) $ (2,258) NM NMTotal net revenues $86,601 $ 80,285 $ 51,599 8% 56%NM Not meaningful31

CITICORPCiticorp is the Company’s global bank for consumers and businesses and represents Citi’s core franchise. Citicorp is focused on providing best-in-class productsand services to customers and leveraging <strong>Citigroup</strong>’s unparalleled global network. Citicorp is physically present in approximately 100 countries, many forover 100 years, and offers services in over 160 countries and jurisdictions. Citi believes this global network provides a strong foundation for servicing thebroad financial services needs of large multinational clients and for meeting the needs of retail, private banking, commercial, public sector and institutionalcustomers around the world. <strong>Citigroup</strong>’s global footprint provides coverage of the world’s emerging economies, which Citi believes represent a strong area ofgrowth. At December 31, 2010, Citicorp had approximately $1.3 trillion of assets and $760 billion of deposits, representing approximately 67% of Citi’s totalassets and approximately 90% of its deposits.Citicorp consists of the following businesses: Regional Consumer Banking (which includes retail banking and Citi-branded cards in four regions—NorthAmerica, EMEA, Latin America and Asia) and Institutional Clients Group (which includes Securities and Banking and Transaction Services).In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $38,820 $34,432 $35,328 13% (3)%Non-interest revenue 26,740 27,280 26,767 (2) 2Total revenues, net of interest expense $65,560 $61,712 $62,095 6% (1)%Provisions for credit losses and for benefits and claimsNet credit losses $11,789 $ 6,155 $ 4,984 92% 23%Credit reserve build(release) (2,167) 2,715 3,405 NM (20)Provision for loan losses $ 9,622 $ 8,870 $ 8,389 8% 6%Provision for benefits and claims 151 164 176 (8) (7)Provision for unfunded lending commitments (32) 138 (191) NM NMTotal provisions for credit losses and for benefits and claims $ 9,741 $ 9,172 $ 8,374 6% 10%Total operating expenses $35,859 $32,640 $44,625 10% (27)%<strong>Inc</strong>ome from continuing operations before taxes $19,960 $19,900 $ 9,096 — NMProvisions for income taxes 4,940 4,501 2,444 10% 84%<strong>Inc</strong>ome from continuing operations $15,020 $15,399 $ 6,652 (2)% NMNet income attributable to noncontrolling interests 122 68 29 79 NMCiticorp’s net income $14,898 $15,331 $ 6,623 (3)% NMBalance sheet data (in billions of dollars)Total EOP assets $ 1,283 $ 1,138 $ 1,067 13% 7%Average assets 1,257 1,088 1,325 16% (18)%Total EOP deposits 760 734 675 4% 9%NM Not meaningful32

REGIONAL CONSUMER BANKINGRegional Consumer Banking (RCB) consists of <strong>Citigroup</strong>’s four RCB businesses that provide traditional banking services to retail customers. RCB alsocontains <strong>Citigroup</strong>’s branded cards business and Citi’s local commercial banking business. RCB is a globally diversified business with over 4,200 branches in 39countries around the world. During 2010, 54% of total RCB revenues were from outside North America. Additionally, the majority of international revenues andloans were from emerging economies in Asia, Latin America, Central and Eastern Europe and the Middle East. At December 31, 2010, RCB had $330 billion ofassets and $309 billion of deposits.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $23,244 $16,404 $17,275 42% (5)%Non-interest revenue 9,198 8,410 10,146 9 (17)Total revenues, net of interest expense $32,442 $24,814 $27,421 31% (10)%Total operating expenses $16,454 $15,041 $23,618 9% (36)%Net credit losses $11,221 $ 5,410 $ 4,068 NM 33%Credit reserve build (release) (1,543) 1,819 2,091 NM (13)Provisions for unfunded lending commitments (4) — — — —Provision for benefits and claims 151 164 176 (8)% (7)Provisions for credit losses and for benefits and claims $ 9,825 $ 7,393 $ 6,335 33% 17%<strong>Inc</strong>ome (loss) from continuing operations before taxes $ 6,163 $ 2,380 $ (2,532) NM NM<strong>Inc</strong>ome taxes (benefits) 1,396 (98) 235 NM NM<strong>Inc</strong>ome (loss) from continuing operations $ 4,767 $ 2,478 $ (2,767) 92% NMNet income (loss) attributable to noncontrolling interests (9) — 11 — (100)Net income (loss) $ 4,776 $ 2,478 $ (2,778) 93% NMAverage assets (in billions of dollars) $ 311 242 268 29% (10)%Return on assets 1.54% 1.02% (1.04)%Total EOP assets $ 330 $ 256 $ 245 29 5Average deposits (in billions of dollars) 295 275 269 7 2Net credit losses as a percentage of average loans 5.07% 3.63% 2.58%Revenue by businessRetail banking $15,834 $14,842 $15,427 7% (4)%Citi-branded cards 16,608 9,972 11,994 67 (17)Total $32,442 $24,814 $27,421 31% (10)%<strong>Inc</strong>ome (loss) from continuing operations by businessRetail banking $ 3,231 $ 2,593 $ (3,592) 25% NMCiti-branded cards 1,536 (115) 825 NM NMTotal $ 4,767 $ 2,478 $ (2,767) 92% NMNM Not meaningful33

NORTH AMERICA REGIONAL CONSUMER BANKINGNorth America Regional Consumer Banking (NA RCB) provides traditional banking and Citi-branded card services to retail customers and small to mid-sizebusinesses in the U.S. NA RCB’s approximate 1,000 retail bank branches and 13.1 million retail customer accounts are largely concentrated in the greatermetropolitan areas of New York, Los Angeles, San Francisco, Chicago, Miami, Washington, D.C., Boston, Philadelphia, and certain larger cities in Texas. AtDecember 31, 2010, NA RCB had $30.7 billion of retail banking and residential real estate loans and $144.8 billion of average deposits. In addition, NA RCBhad 21.2 million Citi-branded credit card accounts, with $77.5 billion in outstanding card loan balances.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $11,216 $ 5,204 $ 4,332 NM 20%Non-interest revenue 3,574 3,372 4,275 6% (21)Total revenues, net of interest expense $14,790 $ 8,576 $ 8,607 72% —Total operating expenses $ 6,224 $ 5,987 $ 9,105 4% (34)%Net credit losses $ 8,022 $ 1,151 $ 617 NM 87%Credit reserve build (release) (313) 527 465 NM 13Provisions for benefits and claims 24 50 4 (52)% NMProvisions for loan losses and for benefits and claims $ 7,733 $ 1,728 $ 1,086 NM 59%<strong>Inc</strong>ome (loss) from continuing operations before taxes $ 833 861 $(1,584) (3)% NM<strong>Inc</strong>ome taxes (benefits) 226 131 (80) 73 NM<strong>Inc</strong>ome (loss) from continuing operations $ 607 $ 730 $(1,504) (17)% NMNet income attributable to noncontrolling interests — — — — —Net income (loss) $ 607 $ 730 $(1,504) (17)% NMAverage assets (in billions of dollars) $ 119 $ 73 $ 75 63% (3)%Average deposits (in billions of dollars) $ 145 $ 140 $ 125 4% 12%Net credit losses as a percentage of average loans 7.48% 2.43% 1.39%Revenue by businessRetail banking $ 5,325 $ 5,237 $ 4,613 2% 14%Citi-branded cards 9,465 3,339 3,994 NM (16)Total $14,790 $ 8,576 $ 8,607 72% —<strong>Inc</strong>ome (loss) from continuing operations by businessRetail banking $ 771 $ 805 $(1,714) (4)% NMCiti-branded cards (164) (75) 210 NM NMTotal $ 607 $ 730 $(1,504) (17)% NMNM Not meaningful2010 vs. 2009Revenues, net of interest expense increased 72% from the prior year,primarily due to the consolidation of securitized credit card receivablespursuant to the adoption of SFAS 166/167 effective January 1, 2010. On acomparable basis, Revenues, net of interest expense, declined 3% from theprior year, mainly due to lower volumes in branded cards as well as the netimpact of the Credit Card Accountability Responsibility and Disclosure Actof 2009 (CARD Act) on cards revenues. This decrease was partially offset bybetter mortgage-related revenues.Net interest revenue was down 6% on a comparable basis drivenprimarily by lower volumes in cards, with average managed loans down 7%from the prior year, and in retail banking, where average loans declined 11%.The increase in deposit volumes, up 4% from the prior year, was offset bylower spreads in the current interest rate environment.Non-interest revenue increased 9% on a comparable basis from the prioryear mainly driven by better servicing hedge results and higher gains fromloan sales in mortgages.Operating expenses increased 4% from the prior year, driven by the impactof litigation reserves in the first quarter of 2010 and higher marketing costs.Provisions for loan losses and for benefits and claims increased$6.0 billion primarily due to the consolidation of securitized credit cardreceivables pursuant to the adoption of SFAS 166/167. On a comparablebasis, Provisions for loan losses and for benefits and claims decreased$0.9 billion, or 11%, primarily due to a net loan loss reserve release of$0.3 billion in 2010 compared to a $0.5 billion loan loss reserve build in theprior year, and lower net credit losses in the branded cards portfolio. Also ona comparable basis, the cards net credit loss ratio increased 61 basis points to10.02%, driven by lower average loans.34

2009 vs. 2008Revenues, net of interest expense were fairly flat as higher credit lossesin the securitization trusts were offset by higher net interest margin incards, higher volumes in retail banking, and higher gains from loan salesin mortgages.Net interest revenue was up 20% driven by the impact of pricing actionsrelating to the CARD Act and lower funding costs in Citi-branded cards, andby higher deposit and loan volumes in retail banking, with average depositsup 12% and average loans up 11%.Non-interest revenue declined 21%, driven by higher credit lossesflowing through the securitization trusts and by the absence of a$349 million gain on the sale of Visa shares and a $170 million gain froma cards portfolio sale in 2008. This decline was partially offset by highergains from loan sales in mortgages.Operating expenses declined 34%. Excluding a 2008 goodwillimpairment charge of $2.3 billion, expenses were down 12% reflecting thebenefits from re-engineering efforts, lower marketing costs, and the absenceof $217 million of repositioning charges in 2008 offset by the absence of a$159 million Visa litigation reserve release in 2008.Provisions for credit losses and for benefits and claims increased$642 million, or 59%, primarily due to rising net credit losses in both cardsand retail banking. The continued weakening of leading credit indicators andtrends in the macroeconomic environment during the period, including risingunemployment and higher bankruptcy filings, drove higher credit costs. Thecards managed net credit loss ratio increased 376 basis points to 9.41%, whilethe retail banking net credit loss ratio increased 44 basis points to 0.90%.35

EMEA REGIONAL CONSUMER BANKINGEMEA Regional Consumer Banking (EMEA RCB) provides traditional banking and Citi-branded card services to retail customers and small to mid-sizebusinesses, primarily in Central and Eastern Europe, the Middle East and Africa. Remaining activities in respect of Western Europe retail banking are includedin Citi Holdings. EMEA RCB has generally repositioned its business, shifting from a strategy of widespread distribution to a focused strategy concentrating onlarger urban markets within the region. An exception is Bank Handlowy, which has a mass market presence in Poland. The countries in which EMEA RCB hasthe largest presence are Poland, Turkey, Russia and the United Arab Emirates. At December 31, 2010, EMEA RCB had 298 retail bank branches with 3.7 millioncustomer accounts, $4.4 billion in retail banking loans and $9.2 billion in average deposits. In addition, the business had 2.5 million Citi-branded cardaccounts with $2.8 billion in outstanding card loan balances.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $ 931 $ 979 $1,269 (5)% (23)%Non-interest revenue 580 576 596 1 (3)Total revenues, net of interest expense $1,511 $1,555 $1,865 (3)% (17)%Total operating expenses $1,169 $1,094 $1,500 7% (27)%Net credit losses $ 320 $ 487 $ 237 (34)% NMProvision for unfunded lending commitments (4) — — — NMCredit reserve build (release) (119) 307 75 NM NMProvisions for loan losses $ 197 $ 794 $ 312 (75)% NM<strong>Inc</strong>ome (loss) from continuing operations before taxes $ 145 $ (333) $ 53 NM NM<strong>Inc</strong>ome taxes (benefits) 42 (124) 3 NM NM<strong>Inc</strong>ome (loss) from continuing operations $ 103 $ (209) $ 50 NM NMNet income (loss) attributable to noncontrolling interests (1) — 12 — (100)%Net income (loss) $ 104 $ (209) $ 38 NM NMAverage assets (in billions of dollars) $ 10 $ 11 $ 13 (9)% (15)%Return on assets 1.04% (1.90)% 0.29%Average deposits (in billions of dollars) $ 9 $ 9 $ 11 — (18)Net credit losses as a percentage of average loans 4.34% 5.81% 2.48%Revenue by businessRetail banking $ 830 $ 889 $1,160 (7)% (23)%Citi-branded cards 681 666 705 2 (6)Total $1,511 $1,555 $1,865 (3)% (17)%<strong>Inc</strong>ome (loss) from continuing operations by businessRetail banking $ (40) $ (179) $ (57) 78% NMCiti-branded cards 143 (30) 107 NM NMTotal $ 103 $ (209) $ 50 NM NMNM Not meaningful2010 vs. 2009Revenues, net of interest expense declined 3% from the prior-year period.The decrease was due to lower lending revenues, driven by the repositioningof the lending strategy toward better profile customer segments for newacquisitions and liquidation of the existing non-strategic customer portfolios,across EMEA RCB markets. The lower lending revenues were partiallyoffset by a 45% growth in investment sales with assets under managementincreasing by 14%.Net interest revenue was 5% lower than the prior year due to lower retailvolumes, with average loans for retail banking down 17%.Non-interest revenue was higher by 1%, reflecting a marginal increasein the contribution from an equity investment in Turkey.Operating expenses increased by 7%, reflecting targeted investmentspending, expansion of the sales force and regulatory and legal expenses.Provisions for loan losses decreased by $597 million to $197 million. Netcredit losses decreased from $487 million to $320 million, while the loanloss reserve had a release of $119 million in 2010 compared to a build of$307 million in 2009. These numbers reflected the ongoing improvement incredit quality during the period.36

2009 vs. 2008Revenues, net of interest expense declined 17%. More than half of therevenue decline was attributable to the impact of foreign currency translation(FX translation). Other drivers included lower wealth-management andlending revenues due to lower volumes and spread compression from credittightening initiatives. Investment sales declined by 26% due to marketconditions at the start of 2009, with assets under management increasing by9% by year end.Net interest revenue was 23% lower than the prior year due to externalcompetitive pressure on rates and higher funding costs, with average loansfor retail banking down 18% and average deposits down 18%.Non-interest revenue decreased by 3%, primarily due to the impact of FXtranslation. Excluding FX translation, there was marginal growth.Operating expenses declined 27%, reflecting expense control actions,lower marketing expenses and the impact of FX translation. Cost savingswere achieved by branch closures, headcount reductions and processre-engineering efforts.Provisions for loan losses increased $482 million to $794 million. Netcredit losses increased from $237 million to $487 million, while the loan lossreserve build increased from $75 million to $307 million. Higher credit costsreflected the continued credit deterioration across the region during the period.37

LATIN AMERICA REGIONAL CONSUMER BANKINGLatin America Regional Consumer Banking (LATAM RCB) provides traditional banking and Citi-branded card services to retail customers and small to midsizebusinesses, with the largest presence in Mexico and Brazil. LATAM RCB includes branch networks throughout Latin America as well as Banco Nacional deMexico, or Banamex, Mexico’s second largest bank, with over 1,700 branches. At December 31, 2010, LATAM RCB had 2,190 retail branches, with 26.6 millioncustomer accounts, $21.3 billion in retail banking loan balances and $42.6 billion in average deposits. In addition, the business had 12.5 million Citi-brandedcard accounts with $13.4 billion in outstanding loan balances.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $6,009 $5,399 $ 6,604 11% (18)%Non-interest revenue 2,718 2,518 2,884 8 (13)Total revenues, net of interest expense $8,727 $7,917 $ 9,488 10% (17)%Total operating expenses $5,060 $4,438 $ 9,123 14% (51)%Net credit losses $1,867 $2,433 $ 2,204 (23)% 10%Credit reserve build (release) (826) 462 1,116 NM (59)Provision for benefits and claims 127 114 172 11 (34)Provisions for loan losses and for benefits and claims $1,168 $3,009 $ 3,492 (61)% (14)%<strong>Inc</strong>ome (loss) from continuing operations before taxes $2,499 $ 470 $(3,127) NM NM<strong>Inc</strong>ome taxes (benefits) 614 (55) (44) NM (25)%<strong>Inc</strong>ome (loss) from continuing operations $1,885 $ 525 $(3,083) NM NMNet (loss) attributable to noncontrolling interests (8) — — NM —Net income (loss) $1,893 $ 525 $(3,083) NM NMAverage assets (in billions of dollars) $ 74 66 $ 83 12% (20)%Return on assets 2.56% 0.80% (3.72)%Average deposits (in billions of dollars) $ 40 $ 36 $ 40 11% (10)%Net credit losses as a percentage of average loans 5.79% 8.52% 7.05%Revenue by businessRetail banking $5,075 $4,435 $ 4,807 14% (8)%Citi-branded cards 3,652 3,482 4,681 5 (26)Total $8,727 $7,917 $ 9,488 10% (17)%<strong>Inc</strong>ome (loss) from continuing operations by businessRetail banking $1,039 $ 749 $(3,235) 39% NMCiti-branded cards 846 (224) 152 NM NMTotal $1,885 $ 525 $(3,083) NM NMNM Not meaningful2010 vs. 2009Revenues, net of interest expense increased 10%, driven by higher loanvolumes and higher investment assets under management in the retailbusiness, as well as the impact of FX translation.Net interest revenue increased 11%, driven by higher loan volumes,primarily in the retail business, and FX translation impact offset by spreadcompression.Non-interest revenue increased 8%, driven by higher branded cards feeincome from increased customer activity.Operating expenses increased 14% as compared to the prior year,primarily driven by investments and the impact of FX translation. Theincrease in 2010 was primarily driven by an increase in transaction volumes,higher investment spending and FX translation.Provisions for loan losses and for benefits and claims decreased 61%,primarily reflecting loan loss reserve releases of $826 million compared to abuild of $426 million in the prior year. This decrease resulted from improvedcredit conditions, improved portfolio quality and lower net credit losses inthe branded cards portfolio driven by Mexico, partially offset by higher creditcosts attributable to higher volumes, particularly as the year progressed.38

2009 vs. 2008Revenues, net of interest expense declined 17%, driven by the impact of FXtranslation as well as lower activity in the branded cards business.Net interest revenue decreased 18%, mainly driven by FX translationas well as lower volumes and spread compression in the branded cardsbusiness that offset the growth in loans, deposits and investment productsin the retail business.Non-interest revenue decreased 13%, driven also by FX translation andlower branded cards fee income from lower customer activity.Operating expenses decreased 51%, primarily driven by the absence of thegoodwill impairment charge of $4.3 billion in 2008, the benefit associatedwith FX translation and savings from restructuring actions implementedprimarily at the end of 2008. A $125 million restructuring charge in 2008was offset by an expense benefit of $257 million related to a legal vehiclerestructuring. Expenses increased slightly in the fourth quarter 2009,primarily due to selected marketing and investment spending.Provisions for loan losses and for benefits and claims decreased 14%primarily reflecting lower loan loss reserve builds as a result of lower volumes,improved portfolio quality and lower net credit losses in the branded cardsportfolio, primarily in Mexico due to repositioning in the portfolio.39

ASIA REGIONAL CONSUMER BANKINGAsia Regional Consumer Banking (Asia RCB) provides traditional banking and Citi-branded card services to retail customers and small to mid-sizebusinesses, with the largest Citi presence in South Korea, Japan, Taiwan, Singapore, Australia, Hong Kong, India and Indonesia. At December 31, 2010, AsiaRCB had 711 retail branches, 16.1 million retail banking accounts, $105.6 billion in average customer deposits, and $61.2 billion in retail banking loans. Inaddition, the business had 15.1 million Citi-branded card accounts with $20.4 billion in outstanding loan balances.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $5,088 $4,822 $5,070 6% (5)%Non-interest revenue 2,326 1,944 2,391 20 (19)Total revenues, net of interest expense $7,414 $6,766 $7,461 10% (9)%Total operating expenses $4,001 $3,522 $3,890 14% (9)%Net credit losses $1,012 $1,339 $1,010 (24)% 33%Credit reserve build (release) (285) 523 435 NM 20Provisions for loan losses and for benefits and claims $ 727 $1,862 $1,445 (61)% 29%<strong>Inc</strong>ome from continuing operations before taxes $2,686 $1,382 $2,126 94% (35)%<strong>Inc</strong>ome taxes (benefits) 514 (50) 356 NM NM<strong>Inc</strong>ome from continuing operations $2,172 $1,432 $1,770 52% (19)%Net income attributable to noncontrolling interests — — (1) — —Net income $2,172 $1,432 $1,771 52% (19)%Average assets (in billions of dollars) $ 108 $ 93 $ 98 16% (5)%Return on assets 2.01% 1.54% 1.81%Average deposits (in billions of dollars) $ 100 $ 89 $ 93 12% (4)%Net credit losses as a percentage of average loans 1.36% 2.07% 1.40%Revenue by businessRetail banking $4,604 $4,281 $4,847 8% (12)%Citi-branded cards 2,810 2,485 2,614 13 (5)Total $7,414 $6,766 $7,461 10% (9)%<strong>Inc</strong>ome from continuing operations by businessRetail banking $1,461 $1,218 $1,414 20% (14)%Citi-branded cards 711 214 356 NM (40)Total $2,172 $1,432 $1,770 52% (19)%NM Not meaningful2010 vs. 2009Revenues, net of interest expense increased 10%, driven by higher cardspurchase sales, investment sales and loan and deposit volumes, as well as theimpact of FX translation, partially offset by lower spreads.Net interest revenue was 6% higher than the prior-year period, mainlydue to higher lending and deposit volumes and the impact of FX translation,partially offset by lower spreads.Non-interest revenue increased 20%, primarily due to higher investmentrevenues, higher cards purchase sales, and the impact of FX translation.Operating expenses increased 14%, primarily due to an increase involumes, continued investment spending, and the impact of FX translation.Provisions for loan losses and for benefits and claims decreased 61%,mainly due to the impact of a net credit reserve release of $285 million in2010, compared to a $523 million net credit reserve build in the prioryearperiod, and a 24% decline in net credit losses. These declines werepartially offset by the impact of FX translation. The decrease in provisionfor loan losses and for benefits and claims reflected continued credit qualityimprovement across the region, particularly in India, partially offset byincreasing volumes.During 2010, the effective tax rate in Japan was approximately 19%,which reflected continued tax benefits (APB 23). These benefits are not likelyto continue, or continue at the same levels, in 2011, however, which willlikely lead to an increase in the effective tax rate for Asia RCB in 2011.40

2009 vs. 2008Revenues, net of interest expense declined 9%, driven by the absence of thegain on Visa shares in 2008, lower investment product revenues and cardspurchase sales, lower spreads, and the impact of FX translation.Net interest revenue was 5% lower than in 2008. Average loans anddeposits were down 10% and 4%, respectively, in each case partly due to theimpact of FX translation.Non-interest revenue declined 19%, primarily due to the decline ininvestment revenues, lower cards purchase sales, the absence of the gain onVisa shares and the impact of FX translation.Operating expenses declined 9%, reflecting the benefits of re-engineeringefforts and the impact of FX translation. Expenses increased slightly in thefourth quarter 2009, primarily due to targeted marketing and investmentspending.Provisions for loan losses and for benefits and claims increased 29%,mainly due to the impact of a higher credit reserve build and an increase innet credit losses, partially offset by the impact of FX translation. In the firsthalf of 2009, rising credit losses were particularly apparent in the portfoliosin India and South Korea. However, delinquencies improved in the latter partof the year and net credit losses flattened as the region showed early signs ofeconomic recovery and increased levels of customer activity.41

INSTITUTIONAL CLIENTS GROUPInstitutional Clients Group (ICG) includes Securities and Banking and Transaction Services. ICG provides corporate, institutional, public sector andhigh-net-worth clients with a full range of products and services, including cash management, trade finance and services, securities services, trading,underwriting, lending and advisory services, around the world. ICG’s international presence is supported by trading floors in approximately 75 countries and aproprietary network within Transaction Services in over 95 countries. At December 31, 2010, ICG had $953 billion of assets and $451 billion of deposits.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Commissions and fees $ 4,266 $ 4,194 $ 5,136 2% (18)%Administration and other fiduciary fees 2,747 2,850 3,178 (4) (10)Investment banking 3,520 4,687 3,334 (25) 41Principal transactions 5,567 5,626 6,102 (1) (8)Other 1,442 1,513 (1,129) (5) NMTotal non-interest revenue $17,542 $18,870 $16,621 (7)% 14%Net interest revenue (including dividends) 15,576 18,028 18,053 (14) —Total revenues, net of interest expense $33,118 $36,898 $34,674 (10)% 6%Total operating expenses 19,405 17,599 21,007 10 (16)Net credit losses 568 745 916 (24) (19)Provision (release) for unfunded lending commitments (28) 138 (191) NM NMCredit reserve build (release) (624) 896 1,314 NM (32)Provisions for loan losses and benefits and claims $ (84) $ 1,779 $ 2,039 NM (13)%<strong>Inc</strong>ome from continuing operations before taxes $13,797 $17,520 $11,628 (21)% 51%<strong>Inc</strong>ome taxes 3,544 4,599 2,209 (23) NM<strong>Inc</strong>ome from continuing operations $10,253 $12,921 $ 9,419 (21)% 37%Net income attributable to noncontrolling interests 131 68 18 93 NMNet income $10,122 $12,853 $ 9,401 (21)% 37%Average assets (in billions of dollars) $ 946 $ 846 $ 1,057 12% (20)%Return on assets 1.07% 1.52% 0.89%Revenues by regionNorth America $11,875 $11,359 $12,982 5% (13)%EMEA 10,198 13,438 9,640 (24) 39Latin America 4,022 4,794 3,813 (16) 26Asia 7,023 7,307 8,239 (4) (11)Total $33,118 $36,898 $34,674 (10)% 6%<strong>Inc</strong>ome from continuing operations by regionNorth America $ 3,081 $ 3,000 $ 2,718 3% 10%EMEA 3,056 4,713 1,834 (35) NMLatin America 1,725 2,140 1,701 (19) 26Asia 2,391 3,068 3,166 (22) (3)Total $10,253 $12,921 $ 9,419 (21)% 37%Average loans by region (in billions of dollars)North America $ 66 $ 52 $ 58 27% (10)%EMEA 38 45 56 (16) (20)Latin America 22 22 25 — (12)Asia 36 28 37 29 (24)Total $ 162 $ 147 $ 176 10% (16)%NM Not meaningful42

SECURITIES AND BANKINGSecurities and Banking (S&B) offers a wide array of investment and commercial banking services and products for corporations, governments, institutionaland retail investors, and high-net-worth individuals. S&B includes investment banking and advisory services, lending, debt and equity sales and trading,institutional brokerage, foreign exchange, structured products, cash instruments and related derivatives, and private banking. S&B revenue is generatedprimarily from fees for investment banking and advisory services, fees and interest on loans, fees and spread on foreign exchange, structured products, cashinstruments and related derivatives, income earned on principal transactions, and fees and spreads on private banking services.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $ 9,927 $12,377 $12,568 (20)% (2)%Non-interest revenue 13,157 14,732 12,160 (11) 21Revenues, net of interest expense $23,084 $27,109 $24,728 (15)% 10%Total operating expenses 14,537 13,084 15,851 11 (17)Net credit losses 563 742 898 (24) (17)Provisions for unfunded lending commitments (28) 138 (185) NM NMCredit reserve build (release) (560) 892 1,291 NM (31)Provisions for loan losses and benefits and claims $ (25) $ 1,772 $ 2,004 NM (12)%<strong>Inc</strong>ome before taxes and noncontrolling interests $ 8,572 $12,253 $ 6,873 (30)% 78%<strong>Inc</strong>ome taxes 1,993 3,068 807 (35) NM<strong>Inc</strong>ome from continuing operations 6,579 9,185 6,066 (28) 51Net income (loss) attributable to noncontrolling interests 110 55 (13) 100 NMNet income $ 6,469 $ 9,130 $ 6,079 (29)% 50%Average assets (in billions of dollars) $ 875 $ 786 $ 986 11% (20)%Return on assets 0.74% 1.16% 0.62%Revenues by regionNorth America $ 9,392 $ 8,833 $10,821 6% (18)%EMEA 6,842 10,049 5,963 (32) 69Latin America 2,532 3,421 2,374 (26) 44Asia 4,318 4,806 5,570 (10) (14)Total revenues $23,084 $27,109 $24,728 (15)% 10%Net income from continuing operations by regionNorth America $ 2,537 $ 2,385 $ 2,395 6% —EMEA 1,832 3,426 588 (47) NMLatin America 1,072 1,536 1,113 (30) 38%Asia 1,138 1,838 1,970 (38) (7)Total net income from continuing operations $ 6,579 $ 9,185 $ 6,066 (28)% 51%Securities and Banking revenue detailsTotal investment banking $ 3,828 $ 4,767 $ 3,251 (20)% 47%Lending 932 (2,480) 4,771 NM NMEquity markets 3,501 3,183 2,878 10 11Fixed income markets 14,075 21,296 13,606 (34) 57Private bank 2,004 2,068 2,326 (3) (11)Other Securities and Banking (1,256) (1,725) (2,104) 27 18Total Securities and Banking revenues $23,084 $27,109 $24,728 (15)% 10%NM Not meaningful43

2010 vs. 2009Revenues, net of interest expense of $23.1 billion decreased 15%, or$4.0 billion, from $27.1 billion in 2009, which was a particularly strongyear driven by robust fixed income markets and higher client activity levelsin investment banking, especially in the first half of that year. The declinein revenue was mainly due to fixed income markets, which decreased from$21.0 billion to $14.3 billion (excluding CVA, net of hedges, of negative$0.2 billion and positive $0.3 billion in the current year and prior year,respectively). This decrease primarily reflected weaker results in rates andcurrencies, credit products and securitized products, due to an overallweaker market environment. Equity markets declined from $5.4 billionto $3.7 billion (excluding CVA, net of hedges, of negative $0.2 billion andnegative $2.2 billion in the current year and prior year, respectively), drivenby lower trading revenues linked to the derivatives business and principalpositions. Investment banking revenues declined from $4.8 billion to$3.8 billion, reflecting lower levels of market activity in debt and equityunderwriting. The declines were partially offset by an increase in lendingrevenues and CVA. Lending revenues increased from negative $2.5 billion topositive $0.9 billion, mainly driven by a reduction in losses on credit defaultswap hedges. CVA increased $1.6 billion to negative $0.4 billion, mainly dueto a larger narrowing of <strong>Citigroup</strong> spreads in 2009 compared to 2010.Operating expenses increased 11%, or $1.5 billion. Excluding the 2010U.K. bonus tax impact and litigation reserve releases in 2010 and 2009,operating expenses increased 8%, or $1.0 billion, mainly as a result of highercompensation and transaction costs.Provisions for loan losses and for benefits and claims decreased by$1.8 billion, to negative $25 million, mainly due to credit reserve releasesand lower net credit losses as the result of an improvement in the creditenvironment during 2010.2009 vs. 2008Revenues, net of interest expense of $27.1 billion increased 10%, or$2.4 billion, from $24.7 billion, as markets began to recover in the earlypart of 2009, bringing back higher levels of volume activity and higherlevels of liquidity, which began to decline again in the third quarter of2009. The growth in revenue was driven mainly by an $8.1 billion increaseto $21.0 billion in fixed income markets (excluding CVA, net of hedges, ofpositive $0.3 billion and positive $0.7 billion in 2009 and 2008, respectively),reflecting strong trading opportunities across all asset classes in the first halfof 2009. Equity markets doubled from $2.7 billion to $5.4 billion (excludingCVA, net of hedges, of negative $2.2 billion and positive $0.1 billion in 2009and 2008, respectively), with growth being driven by derivatives, convertibles,and equity trading. Investment banking revenues grew $1.5 billion, from$3.3 billion to $4.8 billion, primarily from increases in debt and equityunderwriting activities reflecting higher transaction volumes from depressed2008 levels. These increases were partially offset by decreases in lendingrevenues and CVA. Lending revenues decreased by $7.3 billion, from$4.8 billion to negative $2.5 billion, primarily from losses on credit defaultswap hedges. CVA decreased from $0.9 billion to negative $2.0 billion, mainlydue to the narrowing of <strong>Citigroup</strong> spreads throughout 2009.Operating expenses decreased 17%, or $2.8 billion. Excluding the2008 repositioning and restructuring charges and a 2009 litigation reserverelease, operating expenses declined 9%, or $1.4 billion, mainly as a result ofheadcount reductions and benefits from expense management.Provisions for loan losses and for benefits and claims decreased 12%,or $232 million, to $1.8 billion, mainly due to lower credit reserve builds andnet credit losses, due to an improved credit environment, particularly in thelatter part of 2009.44

TRANSACTION SERVICESTransaction Services is composed of Treasury and Trade Solutions (TTS) and Securities and Fund Services (SFS). TTS provides comprehensive cashmanagement and trade finance and services for corporations, financial institutions and public sector entities worldwide. SFS provides securities services toinvestors, such as global asset managers, custody and clearing services to intermediaries such as broker-dealers, and depository and agency/trust services tomultinational corporations and governments globally. Revenue is generated from net interest revenue on deposits in TTS and SFS, as well as from trade loansand fees for transaction processing and fees on assets under custody and administration in SFS.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $ 5,649 $5,651 $5,485 — 3%Non-interest revenue 4,385 4,138 4,461 6% (7)Total revenues, net of interest expense $10,034 $9,789 $9,946 3% (2)%Total operating expenses 4,868 4,515 5,156 8 (12)Provisions (releases) for credit losses and for benefits and claims (59) 7 35 NM (80)<strong>Inc</strong>ome before taxes and noncontrolling interests $ 5,225 $5,267 $4,755 (1)% 11%<strong>Inc</strong>ome taxes 1,551 1,531 1,402 1 9<strong>Inc</strong>ome from continuing operations 3,674 3,736 3,353 (2) 11Net income attributable to noncontrolling interests 21 13 31 62 (58)Net income $ 3,653 $3,723 $3,322 (2)% 12%Average assets (in billions of dollars) $ 71 $ 60 $ 71 18% (15)%Return on assets 5.15% 6.21% 4.69%Revenues by regionNorth America $ 2,483 $2,526 $2,161 (2)% 17%EMEA 3,356 3,389 3,677 (1) (8)Latin America 1,490 1,373 1,439 9 (5)Asia 2,705 2,501 2,669 8 (6)Total revenues $10,034 $9,789 $9,946 3% (2)%<strong>Inc</strong>ome from continuing operations by regionNorth America $ 544 $ 615 $ 323 (12)% 90%EMEA 1,224 1,287 1,246 (5) 3Latin America 653 604 588 8 3Asia 1,253 1,230 1,196 2 3Total net income from continuing operations $ 3,674 $3,736 $3,353 (2)% 11%Key indicators (in billions of dollars)Average deposits and other customer liability balances $ 333 $ 304 $ 281 10% 8%EOP assets under custody (in trillions of dollars) 12.6 12.1 11.0 4 10NM Not meaningful2010 vs. 2009Revenues, net of interest expense, grew 3% compared to 2009, reflecting astrong year despite a low interest rate environment, driven by growth in boththe TTS and SFS businesses. TTS revenues grew 2% as a result of increasedcustomer liability balances and solid growth in trade and fees, partially offsetby spread compression. SFS revenues improved by 3% on higher volumes andbalances reflecting the impact of sales and increased market activity.Average deposits and other customer liability balances grew 10%,driven by strong growth in the emerging markets.Operating expenses grew 8% due to investment spending and higherbusiness volumes.Provisions for credit losses and for benefits and claims declined ascompared to 2009, attributable to overall improvement in portfolio quality.2009 vs. 2008Revenues, net of interest expense declined 2% compared to 2008 as stronggrowth in balances was more than offset by lower spreads driven by lowinterest rates and reduced securities asset valuations globally. TTS revenuesgrew 7% as a result of strong growth in balances and higher trade revenues.SFS revenues declined 18%, attributable to reductions in asset valuations andvolumes.Average deposits and other customer liability balances grew 8%, drivenby strong growth in all regions.Operating expenses declined 12%, mainly as a result of benefits fromexpense management and re-engineering initiatives.Provisions for credit losses and for benefits and claims declined 80%,primarily attributable to overall portfolio management.45

CITI HOLDINGSCiti Holdings contains businesses and portfolios of assets that <strong>Citigroup</strong> has determined are not central to its core Citicorp businesses. Consistent with its strategy,Citi intends to exit these businesses as quickly as practicable in an economically rational manner through business divestitures, portfolio run-offs and assetsales. During 2009 and 2010, Citi made substantial progress divesting and exiting businesses from Citi Holdings, having completed more than 30 divestituretransactions, including Smith Barney, Nikko Cordial Securities, Nikko Asset Management, Primerica Financial Services, various credit card businesses(including Diners Club North America) and The Student Loan Corporation (which is reported as discontinued operations within the Corporate/Other segmentfor the second half of 2010 only). Citi Holdings’ GAAP assets of $359 billion have been reduced by $128 billion from December 31, 2009, and $468 billionfrom the peak in the first quarter of 2008. Citi Holdings’ GAAP assets of $359 billion represent approximately 19% of Citi’s assets as of December 31, 2010. CitiHoldings’ risk-weighted assets of approximately $330 billion represent approximately 34% of Citi’s risk-weighted assets as of December 31, 2010.Citi Holdings consists of the following: Brokerage and Asset Management, Local Consumer Lending, and Special Asset Pool.In millions of dollars 2010 2009 2008% Change2010 vs. 2009% Change2009 vs. 2008Net interest revenue $14,773 $ 16,139 $ 21,092 (8)% (23)%Non-interest revenue 4,514 12,989 (29,330) (65) NMTotal revenues, net of interest expense $19,287 $ 29,128 $ (8,238) (34)% NMProvisions for credit losses and for benefits and claimsNet credit losses $19,070 $ 24,585 $ 14,026 (22)% 75%Credit reserve build (release) (3,500) 5,305 11,258 NM (53)Provision for loan losses $15,570 $ 29,890 $ 25,284 (48)% 18%Provision for benefits and claims 813 1,094 1,228 (26) (11)Provision (release) for unfunded lending commitments (82) 106 (172) NM NMTotal provisions for credit losses and for benefits and claims $16,301 $ 31,090 $ 26,340 (48)% 18%Total operating expenses $ 9,563 $ 13,764 $ 24,104 (31) (43)%Loss from continuing operations before taxes $ (6,577) $(15,726) $(58,682) 58% 73%Benefits for income taxes (2,554) (6,878) (22,185) 63 69(Loss) from continuing operations $ (4,023) $ (8,848) $(36,497) 55% 76%Net income (loss) attributable to noncontrolling interests 207 29 (372) NM NMCiti Holdings net loss $ (4,230) $ (8,877) $(36,125) 52% 75%Balance sheet data (in billions of dollars)Total EOP assets $ 359 $ 487 $ 650 (26)% (25)%Total EOP deposits $ 79 $ 89 $ 81 (11)% 10%NM Not meaningful46