By Professor Bryan Horrigan Report Co-Author Louis Waller Chair of ...

By Professor Bryan Horrigan Report Co-Author Louis Waller Chair of ...

By Professor Bryan Horrigan Report Co-Author Louis Waller Chair of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

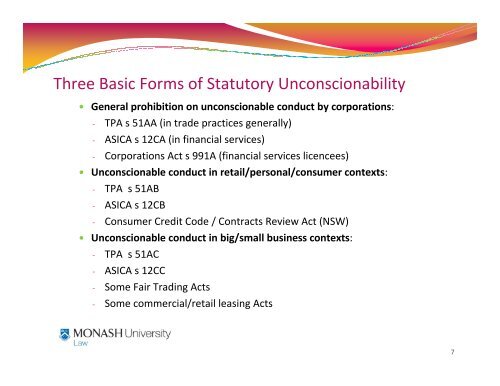

Three Basic Forms <strong>of</strong> Statutory Unconscionability General prohibition on unconscionable conduct by corporations:- TPA s 51AA (in trade practices generally)- ASICA s 12CA (in financial services)- <strong>Co</strong>rporations Act s 991A (financial services licencees) Unconscionable conduct in retail/personal/consumer contexts:- TPA s 51AB- ASICA s 12CB- <strong>Co</strong>nsumer Credit <strong>Co</strong>de / <strong>Co</strong>ntracts Review Act (NSW) Unconscionable conduct in big/small business contexts:- TPA s 51AC- ASICA s 12CC- Some Fair Trading Acts- Some commercial/retail leasing Acts7