IRADESSO QUARTERLY - BMIR - Bryan Mills Iradesso

IRADESSO QUARTERLY - BMIR - Bryan Mills Iradesso

IRADESSO QUARTERLY - BMIR - Bryan Mills Iradesso

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

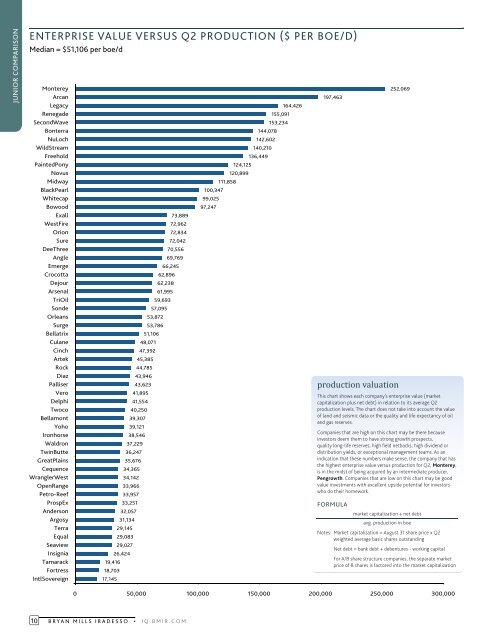

Junior coMpariSonenterpriSe Value VerSuS Q2 proDuction ($ per Boe/D)Median = $51,106 per boe/dMontereyArcanLegacyRenegadeSecondWaveBonterraNuLochWildStreamFreeholdPaintedPonyNovusMidwayBlackPearlWhitecapBowoodExallWestFireOrionSureDeeThreeAngleEmergeCrocottaDejourArsenalTriOilSondeOrleansSurgeBellatrixCulaneCinchArtekRockDiazPalliserVeroDelphiTwocoBellamontYohoIronhorseWaldronTwinButteGreatPlainsCequenceWranglerWestOpenRangePetro-ReefProspExAndersonArgosyTerraEqualSeaviewInsigniaTamarackFortressIntlSovereign19,41618,70317,14545,38544,78543,94640,25039,30739,12138,54637,22934,36534,14233,96633,95733,25132,05731,13429,14551,10648,07147,39241,89541,55435,67629,08329,02726,42436,24743,62362,89662,23861,99559,69357,09553,87253,78673,88972,96272,83472,04270,55669,76966,245100,34799,02597,247111,858124,125120,899144,078142,602140,210136,449155,091153,234164,426197,463production valuation252,069This chart shows each company’s enterprise value (marketcapitalization plus net debt) in relation to its average Q2production levels. The chart does not take into account the valueof land and seismic data or the quality and life expectancy of oiland gas reserves.Companies that are high on this chart may be there becauseinvestors deem them to have strong growth prospects,quality long-life reserves, high field netbacks, high dividend ordistribution yields, or exceptional management teams. As anindication that these numbers make sense, the company that hasthe highest enterprise value versus production for Q2, monterey,is in the midst of being acquired by an intermediate producer,pengrowth. Companies that are low on this chart may be goodvalue investments with excellent upside potential for investorswho do their homework.forMulamarket capitalization + net debtavg. production in boeNotes: Market capitalization = August 31 share price x Q2weighted average basic shares outstandingNet debt = bank debt + debentures - working capitalFor A/B share structure companies, the separate marketprice of B shares is factored into the market capitalization0 50,000 100,000 150,000 200,000 250,000 300,00010BRYAN MILLS <strong>IRADESSO</strong> • i Q . BMir.coM