Microfinance in Latin America - Wsbi

Microfinance in Latin America - Wsbi

Microfinance in Latin America - Wsbi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

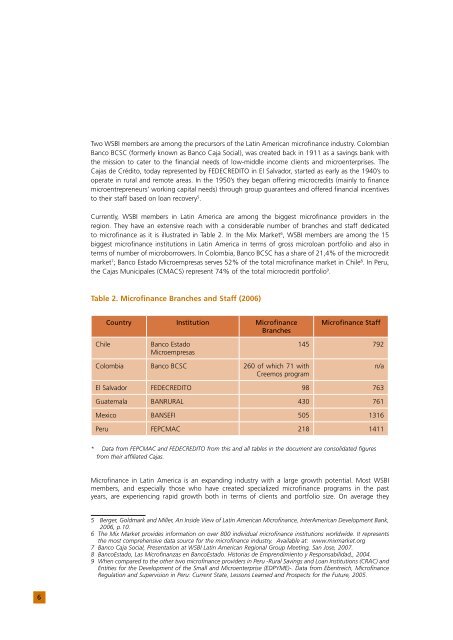

Two WSBI members are among the precursors of the Lat<strong>in</strong> <strong>America</strong>n microf<strong>in</strong>ance <strong>in</strong>dustry. ColombianBanco BCSC (formerly known as Banco Caja Social), was created back <strong>in</strong> 1911 as a sav<strong>in</strong>gs bank withthe mission to cater to the f<strong>in</strong>ancial needs of low-middle <strong>in</strong>come clients and microenterprises. TheCajas de Crédito, today represented by FEDECREDITO <strong>in</strong> El Salvador, started as early as the 1940’s tooperate <strong>in</strong> rural and remote areas. In the 1950’s they began offer<strong>in</strong>g microcredits (ma<strong>in</strong>ly to f<strong>in</strong>ancemicroentrepreneurs’ work<strong>in</strong>g capital needs) through group guarantees and offered f<strong>in</strong>ancial <strong>in</strong>centivesto their staff based on loan recovery 5 .Currently, WSBI members <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> are among the biggest microf<strong>in</strong>ance providers <strong>in</strong> theregion. They have an extensive reach with a considerable number of branches and staff dedicatedto microf<strong>in</strong>ance as it is illustrated <strong>in</strong> Table 2. In the Mix Market 6 , WSBI members are among the 15biggest microf<strong>in</strong>ance <strong>in</strong>stitutions <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>in</strong> terms of gross microloan portfolio and also <strong>in</strong>terms of number of microborrowers. In Colombia, Banco BCSC has a share of 21,4% of the microcreditmarket 7 ; Banco Estado Microempresas serves 52% of the total microf<strong>in</strong>ance market <strong>in</strong> Chile 8 . In Peru,the Cajas Municipales (CMACS) represent 74% of the total microcredit portfolio 9 .Table 2. <strong>Microf<strong>in</strong>ance</strong> Branches and Staff (2006)Country Institution <strong>Microf<strong>in</strong>ance</strong>Branches<strong>Microf<strong>in</strong>ance</strong> StaffChileBanco EstadoMicroempresas145 792Colombia Banco BCSC 260 of which 71 withCreemos programn/aEl Salvador FEDECREDITO 98 763Guatemala BANRURAL 430 761Mexico BANSEFI 505 1316Peru FEPCMAC 218 1411* Data from FEPCMAC and FEDECREDITO from this and all tables <strong>in</strong> the document are consolidated figuresfrom their affiliated Cajas.<strong>Microf<strong>in</strong>ance</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> is an expand<strong>in</strong>g <strong>in</strong>dustry with a large growth potential. Most WSBImembers, and especially those who have created specialized microf<strong>in</strong>ance programs <strong>in</strong> the pastyears, are experienc<strong>in</strong>g rapid growth both <strong>in</strong> terms of clients and portfolio size. On average they5 Berger, Goldmark and Miller, An Inside View of Lat<strong>in</strong> <strong>America</strong>n <strong>Microf<strong>in</strong>ance</strong>, Inter<strong>America</strong>n Development Bank,2006, p.10.6 The Mix Market provides <strong>in</strong>formation on over 800 <strong>in</strong>dividual microf<strong>in</strong>ance <strong>in</strong>stitutions worldwide. It representsthe most comprehensive data source for the microf<strong>in</strong>ance <strong>in</strong>dustry. Available at: www.mixmarket.org7 Banco Caja Social, Presentation at WSBI Lat<strong>in</strong> <strong>America</strong>n Regional Group Meet<strong>in</strong>g, San Jose, 2007.8 BancoEstado, Las Microf<strong>in</strong>anzas en BancoEstado. Historias de Emprendimiento y Responsabilidad,, 2004.9 When compared to the other two microf<strong>in</strong>ance providers <strong>in</strong> Peru -Rural Sav<strong>in</strong>gs and Loan Institutions (CRAC) andEntities for the Development of the Small and Microenterprise (EDPYME)-. Data from Ebentreich, <strong>Microf<strong>in</strong>ance</strong>Regulation and Supervision <strong>in</strong> Peru: Current State, Lessons Learned and Prospects for the Future, 2005.6