dAnA JOnES JOhn JOnES 1111-9999 TAX YEAR ... - Charles Schwab

dAnA JOnES JOhn JOnES 1111-9999 TAX YEAR ... - Charles Schwab

dAnA JOnES JOhn JOnES 1111-9999 TAX YEAR ... - Charles Schwab

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

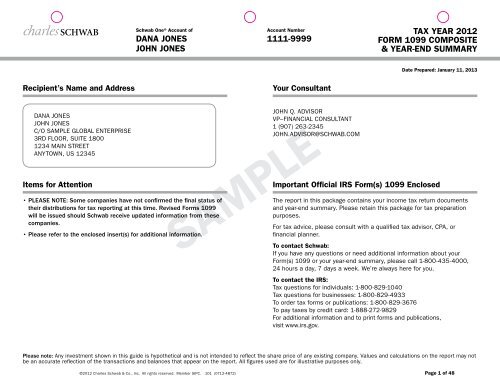

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITERecipient’s Name and AddressPayer’s Name and AddressDate Prepared: January 11, 2013dana jonesjohn jonesc/o sample global enterprise3rd floor, suite 18001234 main streetanytown, us 12345Taxpayer ID Number: ***-**-0000Account Number: <strong>1111</strong>-<strong>9999</strong>Dividends and Distributions—2012SAMPLEForm 1099-DIVDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0110)Box Description Amount Total1aTotal Ordinary Dividends(Includes amount shown in box 1b)1b Qualified Dividends $ 2,380.002aTotal Capital Gain Distributions(Includes amounts shown in boxes 2b, 2c and 2d)2b Unrecap. Sec. 1250 Gain $ 400.002c Section 1202 Gain $ 325.002d Collectibles (28%) Gain $ 400.00$ 5,805.00$ 1,575.003 Nondividend Distributions $ 933.004 Federal Income Tax Withheld $ 450.005 Investment Expenses $ 240.006 Foreign Tax Paid $ 300.007 Foreign Country or U.S. Possession Canada8 Cash Liquidation Distributions $ 950.009 Noncash Liquidation Distributions $ 2,700.0010 Exempt-interest Dividends $ 2,700.0011 Specified Private Activity Bond Interest Dividends $ 2,700.0012 State Various13 State Identification No. VariousCHARLES SCHWAB & CO., INC.211 MAIN STREETSAN FRANCISCO, CA 94105Telephone No: (800) 435-4000Federal ID Number: 94-173778214 State Tax Withheld $ 2,700.00This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 3 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITE1099-DIV: Dividends and Distributions (continued)Date Prepared: January 11, 2013Boxes 8 and 9.Shows cash and noncash liquidation distributions.Box 10.Shows exempt-interest dividends from a mutul fund or other regulated investmentcompany paid to you during the calendar year. Include this amount on line 8b ofForm 1040 or 1040A as tax-exempt interest. This amount may be subject to backupwithholding. See box 4.Box 11.Shows exempt-interest dividends subject to the alternative minimum tax. This amountis included in box 10. See the instructions for Form 6251.Boxes 12–14.State income tax withheld reporting boxes.NomineesIf this form includes amounts belonging to another person, you are considered anominee recipient. You must file Form 1099-DIV (with a Form 1096) with the IRS foreach of the other owners to show their share of the income, and you must furnish aForm 1099-DIV to each. A husband or wife is not required to file a nominee return toshow amounts owned by the other. See the 2012 General Instructions for CertainInformation Returns.SAMPLE©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 5 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITERecipient’s Name and AddressPayer’s Name and AddressDate Prepared: January 11, 2013dana jonesjohn jonesc/o sample global enterprise3rd floor, suite 18001234 main streetanytown, us 12345Taxpayer ID Number: ***-**-0000Account Number: <strong>1111</strong>-<strong>9999</strong>Interest Income—2012SAMPLEForm 1099-INTDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0112)Box Description Total1 Interest Income $ 2,060.003 Interest on U.S. Savings Bonds and Treasury Obligations $ 700.004 Federal Income Tax Withheld $ 65.005 Investment Expenses $ 85.006 Foreign Tax Paid $ 100.007 Foreign Country or U.S. Possession Canada8 Tax-Exempt Interest $ 425.009 Specified Private Activity Bond Interest $ 225.0010 Tax-Exempt Bond CUSIP No. Various11 State Various12 State Identification No. VariousCHARLES SCHWAB & CO., INC.211 MAIN STREETSAN FRANCISCO, CA 94105Telephone No: (800) 435-4000Federal ID Number: 94-173778213 State Tax Withheld $ 2,700.00This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 6 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITEInstructions for Recipients of Form 1099We are required by the Internal Revenue Service (“IRS”) to furnish the appropriate Forms 1099-DIV, 1099-INT, 1099-MISC, 1099-OID and 1099-B to you. Theamounts listed on this composite form represent dividends, interest, and/or other reportable payments made or credited to you through your brokerage accountduring 2012. This information will be reported to the IRS.1099-INT: Interest IncomeRecipient’s identification number.For your protection, this form may show only the last four digits of your social securitynumber (SSN), individual taxpayer identification number (ITIN), or adoption taxpayeridentification number (ATIN). However, the issuer has reported your complete identificationnumber to the IRS and, where applicable, to state and/or local governments.Account number.May show an account or other unique number the payer assigned to distinguish youraccount.Box 1.Shows taxable interest paid to you during the calendar year by the payer. Thisdoes not include interest shown in box 3. May also show the total amount of thecredits from clean renewable energy bonds, Gulf tax credit bonds, qualified forestryconservation bonds, new clean renewable energy bonds, qualified energy conservationbonds, qualified zone academy bonds, Midwestern tax credit bonds, qualified schoolconstruction bonds, and build America bonds that must be included in your interestincome. These amounts were treated as paid to you during 2012 on the creditallowance dates (March 15, June 15, September 15, and December 15). For moreinformation, see Form 8912, Credit to Holders of Tax Credit Bonds.Box 2.Shows interest or principal forfeited because of early withdrawal of time savings. Youmay deduct this amount to figure your adjusted gross income on your income tax return.See the instructions for Form 1040 to see where to take the deduction.Box 3.Shows interest on U.S. savings bonds, Treasury bills, Treasury bonds, and Treasurynotes. This may or may not all be taxable. See Pub. 550. This interest is exempt fromstate and local income taxes. This interest is not included in box 1.Box 4.Shows backup withholding. Generally, a payer must backup withhold if you did notfurnish your taxpayer identification number (TIN) or you did not furnish the correctTIN to the payer. See Form W-9. Include this amount on your income tax return as taxwithheld.Box 5.Any amount shown is your share of investment expenses of a single-class REMIC. Ifyou file Form 1040, you may deduct these expenses on the “Other expenses” line ofSchedule A (Form 1040) subject to the 2% limit. This amount is included in box 1.Box 6.Shows foreign tax paid. You may be able to claim this tax as a deduction or a credit onyour Form 1040. See your Form 1040 instructions.Box 8.Shows tax-exempt interest paid to you during the calendar year by the payer. Reportthis amount on line 8b of Form 1040 or Form 1040A. This amount may be subject tobackup withholding. See box 4.Box 9.Shows tax-exempt interest subject to the alternative minimum tax. This amount isincluded in box 8. See the Instructions for Form 6251.Box 10.Shows CUSIP number(s) for tax-exempt bond(s) on which tax-exempt interest was paidto you during the calendar year and reported in box 8. If blank, no CUSIP number wasissued for the bond(s).Boxes 11–13.State tax withheld reporting boxes.Nominees.If this form includes amounts belonging to another person(s), you are considered anominee recipient. Complete a Form 1099-INT for each of the other owners showingthe income allocable to each. File Copy A of the form with the IRS. Furnish Copy B toeach owner. List yourself as the “payer” and the other owner(s) as the “recipient.” FileForm(s) 1099-INT with Form 1096 with the Internal Revenue Service Center for yourarea. On Form 1096 list yourself as the “filer.” A husband or wife is not required to filea nominee return to show amounts owned by the other.SAMPLE©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 7 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITERecipient’s Name and AddressPayer’s Name and AddressDate Prepared: January 11, 2013dana jonesjohn jonesc/o sample global enterprise3rd floor, suite 18001234 main streetanytown, us 12345Taxpayer ID Number: ***-**-0000Account Number: <strong>1111</strong>-<strong>9999</strong>Miscellaneous Income—2012SAMPLEForm 1099-MISCDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0115)Box Description Total2 Royalties $ 1,155.004 Federal Income Tax Withheld $ 15.008 Substitute Payments in Lieu of Dividends or Interest $ 810.0016 State Tax Withheld $ 1,300.0017 State/Payer’s State No. VariousCHARLES SCHWAB & CO., INC.211 MAIN STREETSAN FRANCISCO, CA 94105Telephone No: (800) 435-4000Federal ID Number: 94-173778218 State Income $ 3,244.00This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 8 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITEInstructions for Recipients of Form 1099We are required by the Internal Revenue Service (“IRS”) to furnish the appropriate Forms 1099-DIV, 1099-INT, 1099-MISC, 1099-OID and 1099-B to you. Theamounts listed on this composite form represent dividends, interest, and/or other reportable payments made or credited to you through your brokerage accountduring 2012. This information will be reported to the IRS.1099-MISC: Miscellaneous IncomeRecipient’s identification number.For your protection, this form may show only the last four digits of your social securitynumber (SSN), individual taxpayer identification number (ITIN), or adoption taxpayeridentification number (ATIN). However, the issuer has reported your complete identificationnumber to the IRS and, where applicable, to state and/or local governments.Account number.May show an account or other unique number the payer assigned to distinguish youraccount.Form 1099-MISC incorrect?If this form is incorrect or has been issued in error, contact the payer. If you cannot getthis form corrected, attach an explanation to your tax return and report your incomecorrectly.Box 2.Report royalties from oil, gas, or mineral properties, copyrights, and patents onSchedule E (Form 1040). For royalties on timber, coal, and iron ore, see Pub. 544.Box 4.Shows backup withholding or withholding on Indian gaming profits. Generally, a payermust backup withhold if you did not furnish your taxpayer identification number. SeeForm W-9 and Pub. 505 for more information. Report this amount on your income taxreturn as tax withheld.Box 8.Shows substitute payments in lieu of dividends or tax-exempt interest received by yourbroker on your behalf as a result of a loan of your securities. Report on the “Otherincome” line of Form 1040 (or Form 1040NR).Boxes 16–18.Shows state or local income tax withheld from the payments.SAMPLE©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 9 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITERecipient’s Name and AddressPayer’s Name and AddressDate Prepared: January 11, 2013dana jonesjohn jonesc/o sample global enterprise3rd floor, suite 18001234 main streetanytown, us 12345Taxpayer ID Number: ***-**-0000Account Number: <strong>1111</strong>-<strong>9999</strong>Original Issue Discount—2012SAMPLEForm 1099-OIDDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0117)6–Original Issue Discount5–Description Cusip Number 1–Original Issue Discount*4–Federal Income TaxWithheldon U.S. TreasuryObligations*123 ENERGY CAP 11.8% 69331XXXX $ 1333.33 $ 100.00 $ 0.00A FAKE CAP 11.6% PXXX 86794XXXX $ 499.00 $ 0.00 $ 0.00STRIP 0XXX 91283XXXX $ 0.00 $ 0.00 $ 5,555.00STRIP 0%03 91283XXXX $ 0.00 $ 100.00 $ 8,888.00STRIP 0%11 91283XXXX $ 0.00 $ 0.00 $ 3,232.62Total Original Issue Discount (Box 1) $ 1,832.33Total Federal Income Tax Withheld (Box 4) $ 200.00CHARLES SCHWAB & CO., INC.211 MAIN STREETSAN FRANCISCO, CA 94105Telephone No: (800) 435-4000Federal ID Number: 94-1737782Total Original Issue Discount on U.S. Treasury Obligations (Box 6) $ 17,675.62Original Issue Discount from each of your securities is reported individually to the IRS.Original Issue Discounts in aggregate are not reported to the IRS and should not be so reported on your tax return.*This may not be the correct figure to report on your income tax return. See instructions on the back.This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 10 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITEInstructions for Recipients of Form 1099We are required by the Internal Revenue Service (“IRS”) to furnish the appropriate Forms 1099-DIV, 1099-INT, 1099-MISC, 1099-OID and 1099-B to you. Theamounts listed on this composite form represent dividends, interest, and/or other reportable payments made or credited to you through your brokerage accountduring 2012. This information will be reported to the IRS.1099-OID: Original Issue DiscountOriginal issue discount (OID) is the excess of an obligation’s stated redemption priceat maturity over its issue price (acquisition price for a stripped bond or coupon). OIDis taxable as interest over the life of the obligation. If you are the holder of an OIDobligation, generally you must include an amount of OID in your gross income each yearyou hold the obligation. Obligations that may have OID include a bond, debenture, note,certificate, or other evidence of indebtedness having a term of more than 1 year. Forexample, the OID rules may apply to certificates of deposit (CDs), time deposits, bonussavings plans, and other deposit arrangements, especially if the payment of interest isdeferred until maturity. In addition, the OID rules apply to Treasury inflation-protectedsecurities. See Pub. 550, Investment Income and Expenses, for more information.If, as the record holder, you receive Form 1099-OID showing amounts belonging toanother person, you are considered a nominee recipient. Complete a Form 1099-OIDfor each of the other owners showing the amounts allocable to each. File Copy A of theform with the IRS. Furnish Copy B to each owner. List yourself as the “payer” and theother owner as the “recipient.” File Form(s) 1099-OID with Form 1096, Annual Summaryand Transmittal of U.S. Information Returns, with the Internal Revenue Service Centerfor your area. On Form 1096, list yourself as the “filer.” A husband or wife is notrequired to file a nominee return to show amounts owned by the other. If you bought orsold an obligation during the year and you are not a nominee, you are not required toissue or file Form 1099-OID showing the OID or stated interest allocable to the seller/buyer of the obligation.Recipient’s identification number.For your protection, this form may show only the last four digits of your socialsecurity number (SSN), individual taxpayer identification number (ITIN), or adoptiontaxpayer identification number (ATIN). However, the issuer has reported your completeidentification number to the IRS and, where applicable, to state and/or localgovernments.Account number.May show an account or other unique number the payer assigned to distinguish youraccount.Box 1.Shows the OID on the obligation for the part of the year you owned it. Report theamount in box 1 as interest income on your income tax return. However, dependingon the type of debt instrument, the issue or acquisition date, and other factors (forexample, if you paid acquisition or bond premium, or the obligation is a stripped bondor coupon), you may have to figure the correct amount of OID to report on your return.See Pub. 1212, Guide to Original Issue Discount (OID) Instruments, for details on howto figure the correct OID.Box 4.Shows backup withholding. Generally, a payer must backup withhold if you did notfurnish your taxpayer identification number (TIN) or you did not furnish the correct TIN tothe payer. See Form W-9, Request for Taxpayer Identification Number and Certification,for information on backup withholding. Include this amount on your income tax returnas tax withheld.Box 5.Shows the identification (CUSIP) number or description of the obligation (may includethe stock exchange, issuer, coupon rate, and year of maturity).Box 6.Shows OID on a U.S. Treasury obligation for the part of the year you owned it. Reportthis amount as interest income on your federal income tax return, and see Pub. 1212to figure any appropriate adjustments to this amount. This OID is exempt from stateand local income taxes and is not included in box 1.SAMPLE©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 11 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITERecipient’s Name and AddressPayer’s Name and AddressDate Prepared: January 11, 2013dana jonesjohn jonesc/o sample global enterprise3rd floor, suite 18001234 main streetanytown, us 12345Taxpayer ID Number: ***-**-0000Account Number: <strong>1111</strong>-<strong>9999</strong>Proceeds From Broker Transactions—2012 Form 1099-BDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0715)1c–Type of gain or loss: Short-term (Report on Form 8949, Part I, with Box A checked.)6b–Basis reported to IRS1b–Date of 2a–Sales price ofacquisition stocks, bonds, etc.CUSIP Number1a–Date(less commissions1d-Stock or of sale orand options premiums)8–Descriptionother symbol ** exchange 1e-Quantity soldsample corpsample corp30246XXXX SXXYYSAMPLE04/01/1230246XXXX SS 08/18/12XXYY 10/11/12$ 101,902.745,952.00CHARLES SCHWAB & CO., INC.211 MAIN STREETSAN FRANCISCO, CA 94105Telephone No: (800) 435-4000Federal ID Number: 94-1737782SHORT-TERM HOLDING PERIODCOST BASIS IN THIS SECTION IS REPORTED TO THE IRS3–Cost orother basis5–Wash saleloss disallowed4–Federal incometax withheld$ 114,092.06 $ 0.00 $ 0.00$ 16,965.80300.00 S $ 18,062.05 $ 0.00 $ 0.00Security Subtotal $ 118,868.54 $ 132,154.11 $ 0.00 $ 0.00sample muni fund67062XXXXABCXXS 09/14/1211/11/12$ 23,604.951,700.00$ 22,379.62 $ 0.00 $ 0.00Security Subtotal $ 23,604.95 $ 22,379.62 $ 0.00 $ 0.00Total Short-Term (Cost basis is reported to the IRS) $ 142,473.49 $ 154,533.73Please see the “Notes for Your Form 1099-B” section for additional explanation of this Form 1099-B report.This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 12 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITEInstructions for Recipients of Form 1099We are required by the Internal Revenue Service (“IRS”) to furnish the appropriate Forms 1099-DIV, 1099-INT, 1099-MISC, 1099-OID and 1099-B to you. Theamounts listed on this composite form represent dividends, interest, and/or other reportable payments made or credited to you through your brokerage accountduring 2012. This information will be reported to the IRS.1099-B: Proceeds from Broker TransactionsBrokers and barter exchanges must report proceeds from transactions to you and theIRS on Form 1099-B. Reporting is also required when your broker knows or has reasonto know that a corporation in which you own stock has had a reportable change incontrol or capital structure. You may be required to recognize gain from the receipt ofcash, stock, or other property that was exchanged for the corporation’s stock. If yourbroker reported this type of transaction to you, the corporation is identified in box 9.Recipient’s identification number.For your protection, this form may show only the last four digits of your socialsecurity number (SSN), individual taxpayer identification number (ITIN), or adoptiontaxpayer identification number (ATIN). However, the issuer has reported your completeidentification number to the IRS and, where applicable, to state and/or localgovernments.Account number.May show an account or other unique number the payer assigned to distinguish youraccount.CUSIP number.For broker transactions, may show the CUSIP (Committee on Uniform SecurityIdentification Procedures) number of the item reported.Box 1a.Shows the trade date of the sale or exchange. For short sales, the date shown is thedate the security was delivered to close the short sale. For aggregate reporting inboxes 9 through 12, no entry will be present.Box 1b.This box may be blank if the securities are noncovered or if the securities sold wereacquired on a variety of dates. For short sales, the date shown is the date you acquiredthe security delivered to close the short sale.Box 2a.Shows the aggregate cash proceeds from transactions involving stocks, bonds, otherdebt obligations, commodities, or forward contracts. May show the proceeds from thedisposition of your interest(s) in a widely held fixed investment trust. May also showthe aggregate amount of cash and the fair market value of any stock or other propertyreceived in a reportable change in control or capital structure arising from the corporatetransfer of property to a foreign corporation. Losses on forward contracts are shown inparentheses. This box does not include proceeds from regulated futures contracts.The broker must indicate whether the sales price or the sales price less commissions(including transfer taxes) and option premiums was reported to the IRS. Report thisamount as explained in the instructions for Schedule D (Form 1040).Box 2b.If checked, you cannot take a loss on your tax return based on gross proceeds from areportable change in control or capital structure reported in box 2a. Do not report thisloss on Form 8949 or Schedule D.Box 3.Shows the cost or other basis of securities sold. If securities are noncovered, box 3 maybe blank. See the Schedule D (Form 1040) instructions or Pub. 550 for details aboutbasis.Box 4.Shows backup withholding. Generally, a payer must backup withhold if you did notfurnish your taxpayer identification number to the payer. See Form W-9 for informationon backup withholding. Include this amount on your income tax return as tax withheld.Box 5.Shows the amount of nondeductible loss in a wash sale transaction. For details onwash sales, see the Schedule D (Form 1040) instructions and Pub. 550.Box 6a.The securities sold were noncovered securities and boxes 1b, 1c, 3, and 5 may beblank. Generally, a noncovered security means: a security other than stock; stockpurchased before 2011; stock in most mutual funds and other regulated investmentcompanies purchased before 2012; and stock purchased in or transferred to a dividendreinvestment plan before 2012.Box 6b.The basis in box 3 has been reported to the IRS.Box 8.Shows a brief description of the item or service for which the proceeds or barteringincome is being reported. For regulated futures contracts and forward contracts, “RFC”or other appropriate description may be shown. For a corporation that had a reportablechange in control or capital structure, this box may show the class of stock as C(common), P (preferred), or O (other).Boxes 13–15.Shows state income tax withheld.SAMPLE©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 13 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITERecipient’s Name and AddressPayer’s Name and AddressDate Prepared: January 11, 2013dana jonesjohn jonesc/o sample global enterprise3rd floor, suite 18001234 main streetanytown, us 12345Taxpayer ID Number: ***-**-0000Account Number: <strong>1111</strong>-<strong>9999</strong>CHARLES SCHWAB & CO., INC.211 MAIN STREETSAN FRANCISCO, CA 94105Telephone No: (800) 435-4000Federal ID Number: 94-1737782Proceeds From Broker Transactions—2012 (continued) Form 1099-BDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0715)1c–Type of gain or loss: Short-term (Report on Form 8949, Part I, with Box B checked.)SHORT-TERM HOLDING PERIOD6a–Noncovered securityCOST BASIS IN THIS SECTION IS AVAILABLE BUT NOT REPORTED TO THE IRS1b–Date ofacquisition2a–Sales price ofstocks, bonds, etc.CUSIP Number1a–Date(less commissions1d-Stock or of sale orand options premiums)3–Cost or5–Wash sale 4–Federal income8–Descriptionother symbol ** exchange 1e-Quantity soldother basis loss disallowedtax withheldsample corp bond **called** 04939XXXX R 12/01/1104/08/12SAMPLE$ 10,406.2510,000.00$ 10,408.00 $ 0.00 $ 0.00Security Subtotal $ 10,406.25 $ 10,408.00 $ 0.00 $ 0.00sample LTD PARTNERSHIP28370XXXXXXXS 04/27/1209/08/12$ 1,828.8550.00$ 1,854.98 $ 0.00 $ 512.0813–State CA 14–State id. no. 00-0000000 15–State tax withheld $ 128.02Security Subtotal $ 1,828.85 $ 1,854.98 $ 0.00 $ 512.08Total Short-Term (Cost basis is available but not reported to the IRS) $ 12,235.10 $ 12,262.98Please see the “Notes for Your Form 1099-B” section for additional explanation of this Form 1099-B report.This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 14 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITERecipient’s Name and AddressPayer’s Name and AddressDate Prepared: January 11, 2013dana jonesjohn jonesc/o sample global enterprise3rd floor, suite 18001234 main streetanytown, us 12345Taxpayer ID Number: ***-**-0000Account Number: <strong>1111</strong>-<strong>9999</strong>CHARLES SCHWAB & CO., INC.211 MAIN STREETSAN FRANCISCO, CA 94105Telephone No: (800) 435-4000Federal ID Number: 94-1737782Proceeds From Broker Transactions—2012 (continued) Form 1099-BDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0715)1c–Type of gain or loss: Short-term (Report on Form 8949, in either Part I or Part II as appropriate, with Box B checked.)SHORT-TERM HOLDING PERIOD6a–Noncovered securityCOST BASIS IN THIS SECTION IS MISSING AND NOT REPORTED TO THE IRS1b–Date ofacquisition2a–Sales price ofstocks, bonds, etc.CUSIP Number1a–Date(less commissions1d-Stock or of sale orand options premiums)3–Cost or5–Wash sale 4–Federal income8–Descriptionother symbol ** exchange 1e-Quantity soldother basis loss disallowedtax withheldsample corpSAMPLE30246XXXX S 12/12/11 $ 1,720.95XXYY 01/18/12100.00Missing – – $ 0.00Security Subtotal $ 1,720.95 – – – – $ 0.00sample STOCK12345XXXXYYYYS 12/12/1103/15/12$ 3,352.95500.00Missing – – $ 0.00Security Subtotal $ 3,352.95 – – – – $ 0.00Total Short-Term (Cost basis is missing and not reported to the IRS) $ 5,073.90 – –Total Short-Term Sales Price of Stocks, Bonds, etc. $ 159,782.49 $ 166,796.71Please see the “Notes for Your Form 1099-B” section for additional explanation of this Form 1099-B report.This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 15 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITETaxpayer ID Number: ***-**-0000Date Prepared: January 11, 2013Proceeds From Broker Transactions—2012 (continued) Form 1099-BDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0715)1c–Type of gain or loss: Long-term (Report on Form 8949, Part II, with Box A checked.)6b–Basis reported to IRS1b–Date of 2a–Sales price ofacquisition stocks, bonds, etc.CUSIP Number1a–Date(less commissions1d-Stock or of sale orand options premiums)8–Descriptionother symbol ** exchange 1e-Quantity soldEXAMPLE COMMON STOCK2b17296XXXX C 04/07/11 $ 22.03ABC 05/10/120.50X (Please note that you can not claim a loss based on the amount in box 2a.)SAMPLELONG-TERM HOLDING PERIODCOST BASIS IN THIS SECTION IS REPORTED TO THE IRS3–Cost orother basis5–Wash saleloss disallowed4–Federal incometax withheld$ 19.16 $ 0.00 $ 0.00Security Subtotal $ 22.03 $ 19.16 $ 0.00 $ 0.00SAMPLE COMMON STOCK03759XXXX S 01/21/11 $ 1,183.69XYZ 02/08/1298.00$ 1,326.07 $ 142.38 $ 0.00Security Subtotal $ 1,183.69 $ 1,326.07 $ 142.38 $ 0.00SAMPLE REALTY TRUST REIT00423XXXX S 06/30/11 $ 1,165.83ZZZ 12/05/12100.00$ 1,228.75 $ 0.00 $ 326.4313–State CA 14–State id. no. 00-0000000 15–State tax withheld $ 81.61Security Subtotal $ 1,165.83 $ 1,228.75 $ 0.00 $ 326.43Total Long-Term (Cost basis is reported to the IRS) $ 2,371.55 $ 2,573.98Please see the “Notes for Your Form 1099-B” section for additional explanation of this Form 1099-B report.This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 16 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITETaxpayer ID Number: ***-**-0000Date Prepared: January 11, 2013Proceeds From Broker Transactions—2012 (continued) Form 1099-BDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0715)1c–Type of gain or loss: Long-term (Report on Form 8949, Part II, with Box B checked.)LONG-TERM HOLDING PERIOD6a–Noncovered securityCOST BASIS IN THIS SECTION IS AVAILABLE BUT NOT REPORTED TO THE IRS1b–Date ofacquisition2a–Sales price ofstocks, bonds, etc.CUSIP Number1a–Date(less commissions1d-Stock or of sale orand options premiums)3–Cost or5–Wash sale 4–Federal income8–Descriptionother symbol ** exchange 1e-Quantity soldother basis loss disallowedtax withheldEXAMPLE CORP BOND **MATURED 12589XXXX MT 07/02/1004/15/12$ 10,000.0010,000.00SAMPLE$ 10,605.97 $ 0.00 $ 0.00Security Subtotal $ 10,000.00 $ 10,605.97 $ 0.00 $ 0.00EXAMPLE MUNI BOND 34114XXXX R 10/11/8601/01/12$ 5,000.005,000.00$ 5,000.00 $ 0.00 $ 0.00Security Subtotal $ 5,000.00 $ 5,000.00 $ 0.00 $ 0.00Total Long-Term (Cost basis is available but not reported to the IRS) $ 15,000.00 $ 15,605.97Please see the “Notes for Your Form 1099-B” section for additional explanation of this Form 1099-B report.This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 17 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITETaxpayer ID Number: ***-**-0000Date Prepared: January 11, 2013Proceeds From Broker Transactions—2012 (continued) Form 1099-BDepartment of the Treasury–Internal Revenue Service Copy B for Recipient (OMB No. 1545-0715)1c–Type of gain or loss: Long-term (Report on Form 8949, Part II, with Box B checked.)LONG-TERM HOLDING PERIOD6a–Noncovered securityCOST BASIS IN THIS SECTION IS MISSING AND NOT REPORTED TO THE IRS1b–Date ofacquisition2a–Sales price ofstocks, bonds, etc.CUSIP Number1a–Date(less commissions1d-Stock or of sale orand options premiums)3–Cost or5–Wash sale 4–Federal income8–Descriptionother symbol ** exchange 1e-Quantity soldother basis loss disallowedtax withheldSAMPLE REMIC 31392XXXX R 10/12/0601/18/12$ 1,000.001,000.00SAMPLEMissing – – $ 0.00Security Subtotal $ 1,000.00 – – – – $ 0.00SAMPLE UNIT INVSTMT TRUST 45808XXXX P – –10/25/12$ 171.18– –Not Provided – – $ 0.00Security Subtotal $ 171.18 – – – – $ 0.00Total Long-Term (Cost basis is missing and not reported to the IRS) $ 1,171.18 – –Total Long-Term Sales Price of Stocks, Bonds, etc. $ 18,542.73 $ 18,179.95Total Sales Price of Stocks, Bonds, etc. $ 178,325.22Total Federal Income Tax Withheld $ 838.51Please see the “Notes for Your Form 1099-B” section for additional explanation of this Form 1099-B report.This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed onyou if this income is taxable and the IRS determines that it has not been reported.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 18 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012FORM 1099 COMPOSITENotes for Your Form 1099-B:Date Prepared: January 11, 2013<strong>Schwab</strong> has provided cost basis information whenever possible for most investments. Cost basis data may be incomplete or unavailable for some of your holdings.When value for the report is unavailable, it is noted as follows: “Missing” or “Not Provided”Not <strong>Schwab</strong> is not providing Cost Basis on this security type.ProvidedMissing Cost Basis may be missing due to one of the following reasons:• Cost basis data may not be available for a number of reasons (for example, the security was purchased outside of <strong>Schwab</strong> and we did notreceive cost basis from the transferring firm).• The security was purchased more than 10 years ago.AcquisitionDateSymbolLong-termShort-termIf there is more than one lot in a sell transaction, the acquisition date for the individual lot in the transaction can be found in the Realized Gain Losssection of the Year End Summary.(1) If the acquisition date is blank, your sell transaction included multiple tax lots purchased on different acquisition dates within the same holdingperiod and covered/non-covered status. The lots in the transaction are rolled up into a single sell transaction and thus Box 1b–Date ofAcquisition will be blank.(2) If the cost basis is missing or not provided, a short-term holding period may have been applied for a position that may have been held long term.Box (1c) Type of Gain or LossLong-Term Realized Gain or Loss has a holding period greater than one year.Short-Term Realized Gain or Loss has a holding period of one year or less.**Activity Codes (Not reported to the IRS)SAMPLEC = Cash in Lieu E = Exchange P = Principal S = Sale T = TenderCV = Conversion M = Cash Merger MT = Maturity R = Redemption SS = Short Sale· The cost basis and basis adjustments for covered securities are reported to the IRS.· Gross Proceeds from each of your security transactions are reported individually to the IRS.· Gross Proceeds in aggregate are not reported to the IRS and should not be so reported on your tax return.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 19 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Interest & DividendsThe information in the following sections may be helpful for, but not limited to, Schedule B. Please consult with your tax advisor or financial advisor regardingspecific questions.Detail Information of Dividends and DistributionsDescriptionOrdinary DividendsNon-Qualified DividendsCusipNumber Paid in 2012SAMPLEPaid/Adjusted in2013 for 2012 Amount123 ASIA PACIFIC 90300XXXX $ 500.00 $ (25.00) $ 475.00ABC SECS DEFINED 18384XXXX $ 210.00 $ (60.00) $ 150.00EXAMPLE UNIT 999 30214XXXX $ 850.00 $ (150.00) $ 700.00FAKE FUND 47102XXXX $ 600.00 $ 50.00 $ 650.00MONEY MARKET FUND 80851XXXX $ 800.00 $ 0.00 $ 800.00Total Non-Qualified Dividends (Included in Box 1a) $ 2,960.00 $ (185.00) $ 2,775.00Short-Term Capital GainsMADE UP REAL ESTATE 19829XXXX $ 200.00 $ 100.00 $ 300.00SAMPLE NATIONAL FD 78621XXXX $ 500.00 $ (150.00) $ 350.00XYZ INTL FD 87654XXXX $ 350.00 $ 75.00 $ 0.00Total Short-Term Capital Gains (Included in Box 1a) $ 1,050.00 $ 25.00 $ 650.00Qualified Dividends123 ASIA PACIFIC 90300XXXX $ 400.00 $ 200.00 $ 600.00ABC FUND 41383XXXX $ 300.00 $ 100.00 $ 400.00ABC INTL FUND 41382XXXX $ 500.00 $ 100.00 $ 600.00EXAMPLE COMPANY 80852XXXX $ 300.00 $ 80.00 $ 380.00FAKE TRUST STXX 93142XXXX $ 600.00 $ (200.00) $ 400.00Total Qualified Dividends (Box 1b and included in Box 1a) $ 2,100.00 $ 280.00 $ 2,380.00Total Ordinary Dividends (Box 1a) $ 6,110.00 $ 120.00 $ 5,805.00(Total Non-Qualified Dividends, Short-Term Capital Gains and Qualified Dividends)©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 20 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Detail Information of Dividends and Distributions (continued)DescriptionCapital Gain DistributionsCusipNumber Paid in 2012SAMPLEPaid/Adjusted in2013 for 2012 Amount15% Rate GainSAMPLE NATIONAL FD 78621XXXX $ 0.00 $ 150.00 $ 150.00XYZ HEALTH CARE FD 92190XXXX $ 100.00 $ 200.00 $ 300.00Total 15% Rate Gain (Included in Box 2a) $ 100.00 $ 350.00 $ 450.00Unrecap. Sec. 1250 Gain123 RESDTL 7.23%G PFD 29476XXXX $ 300.00 $ (200.00) $ 100.00FAKE BIOTECH FUND CO 19AB1XXXX $ 200.00 $ 100.00 $ 300.00Total Unrecap. Sec. 1250 Gain (Box 2b and included in Box 2a) $ 500.00 $ (100.00) $ 400.00Section 1202 GainABC intl FUND 1AB19XXXX $ 100.00 $ 150.00 $ 250.00FAKE BIOTECH FUND CO 87654XXXX $ 0.00 $ 75.00 $ 75.00Total Section 1202 Gain (Box 2c and included in Box 2a) $ 100.00 $ 225.00 $ 325.00Collectibles (28%) GainSAMPLE INC 48374XXXX $ 0.00 $ 150.00 $ 150.00ZZZ NATIONAL CORP 65748XXXX $ 175.00 $ 75.00 $ 250.00Total Collectibles (28%) Gain (Box 2d and included in Box 2a) $ 175.00 $ 225.00 $ 400.00Total Capital Gain Distributions (Box 2a) $ 875.00 $ 700.00 $ 1,575.00©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 21 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Detail Information of Dividends and Distributions (continued)DescriptionNondividend Distributions (Return of Capital)CusipNumber Paid in 2012SAMPLEPaid/Adjusted in2013 for 2012 Amount123 INDUSTRY FUND CO 38374XXXX $ 0.00 $ 188.00 $ 188.00EXAMPLE COMPANY 22191XXXX $ 0.00 $ 25.00 $ 25.00FAKE GOVT FUND SER I* 44890XXXX $ 0.00 $ 220.00 $ 220.00MADE UP INVT TRUST 75321XXXX $ 0.00 $ 300.00 $ 300.00XYZ INVT TR SR 12* 93142XXXX $ 0.00 $ 200.00 $ 200.00Total Nondividend Distributions (Box 3) $ 0.00 $ 933.00 $ 933.00Federal Income Tax WithheldSAMPLE NATL FD 78621XXXX $ (140.00) $ 0.00 $ (140.00)XYZ INTL FD 87654XXXX $ (105.00) $ (5.00) $ (110.00)ZZZ HEALTH CARE FD 92190XXXX $ (200.00) $ 0.00 $ (200.00)Total Federal Income Tax Withheld (Box 4) $ (445.00) $ (5.00) $ (450.00)Investment ExpensesABC SECS DEFINED 18384XXXX $ 0.00 $ (100.00) $ (100.00)EXAMPLE UNIT 999 30214XXXX $ 0.00 $ (60.00) $ (60.00)FAKE TRUST STXX 80852XXXX $ 0.00 $ (80.00) $ (80.00)Total Investment Expenses (Box 5) $ 0.00 $ (240.00) $ (240.00)Foreign Tax PaidCountry123 ASIA PACIFIC Not Provided 90300XXXX $ (100.00) $ (25.00) $ (125.00)XYZ INTL FD Canada 87654XXXX $ (100.00) $ (75.00) $ (175.00)Total Foreign Tax Paid (Box 6) $ (200.00) $ 100.00 $ (300.00)©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 22 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Detail Information of Dividends and Distributions (continued)DescriptionCash Liquidation DistributionsCusipNumber Paid in 2012SAMPLEPaid/Adjusted in2013 for 2012 AmountFAKE EQUITY CO 22545XXXX $ 350.00 $ 0.00 $ 350.00SAMPLE EQUITY CO 98456XXXX $ 600.00 $ 0.00 $ 600.00Total Cash Liquidation Distributions (Box 8) $ 950.00 $ 0.00 $ 950.00Noncash Liquidation DistributionsFAKE EQUITY CO 22545XXXX $ 1,200.00 $ 0.00 $ 1,200.00SAMPLE EQUITY CO 98456XXXX $ 1,500.00 $ 0.00 $ 1,500.00Total Noncash Liquidation Distributions (Box 9) $ 2,700.00 $ 0.00 $ 2,700.00Exempt-Interest DividendsFAKE EQUITY CO 22545XXXX $ 1,200.00 $ 0.00 $ 1,200.00SAMPLE EQUITY CO 98456XXXX $ 1,500.00 $ 0.00 $ 1,500.00Total Exempt-Interest Dividends (Box 10) $ 2,700.00 $ 0.00 $ 2,700.00Specified Private Activity Bond Interest DividendsFAKE EQUITY CO 22545XXXX $ 1,200.00 $ 0.00 $ 1,200.00SAMPLE EQUITY CO 98456XXXX $ 1,500.00 $ 0.00 $ 1,500.00Total Specified Private Activity Bond Interest Dividends (Box 11) $ 2,700.00 $ 0.00 $ 2,700.00State Tax Withheld State ID. No. StateFAKE EQUITY CO 00-0000000 CA 22545XXXX $ (1,200.00) $ 0.00 $ (1,200.00)SAMPLE EQUITY CO 00-0000000 VT 98456XXXX $ (1,500.00) $ 0.00 $ (1,500.00)Total State Tax Withheld (Box 12–14) $ (2,700.00) $ 0.00 $ (2,700.00)©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 23 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Detail Information of Interest IncomeDescriptionCusipNumber Paid in 2012SAMPLEPaid/Adjusted in2013 for 2012 AmountInterest IncomeBANK INTEREST $ 175.00 $ 0.00 $ 175.00FAKE MTG 6.25% 16 3133FXXXX $ 300.00 $ 0.00 $ 300.00MADE UP CORP 8.75%12 12000XXXX $ 850.00 $ 0.00 $ 850.00SAMPLE INTEREST $ 75.00 $ 0.00 $ 75.00Total Interest Income (Included in Box 1) $ 1,400.00 $ 0.00 $ 1,400.00Accrued Interest Income from SaleEXAMPLE FIN CO 6.25%23 44181XXXX $ 200.00 $ 0.00 $ 200.00ZZZ CORP 9.625%12 88160XXXX $ 460.00 $ 0.00 $ 460.00Total Accrued Interest Income from Sale (Included in Box 1) $ 660.00 $ 0.00 $ 660.00Total Interest Income (Box 1) $ 2,060.00 $ 0.00 $ 2,060.00©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 24 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Detail Information of Interest Income (continued)DescriptionInterest on U.S. Savings Bonds and Treasury ObligationsCusipNumber Paid in 2012SAMPLEPaid/Adjusted in2013 for 2012 AmountUS TREAS BOND 8.75%12 3257AXXXX $ 100.00 $ 0.00 $ 100.00US TREAS BOND 8.75%13 3257AXXXX $ 240.00 $ (30.00) $ 210.00US TREAS BOND 8.75%14 3257AXXXX $ 240.00 $ 0.00 $ 240.00Total U.S. Savings Bonds & Treasury Obligations Interest (Included in Box 3) $ 580.00 $ (30.00) $ 550.00Accrued Interest from Sale of Treasury ObligationsUS TREASURY NOTE 5%12 3257AXXXX $ 50.00 $ 0.00 $ 50.00US TREASURY NOTE 5%13 3257AXXXX $ 100.00 $ 0.00 $ 100.00Total Accrued Interest from Sale of Treasury Obligations (Included in Box 3) $ 150.00 $ 0.00 $ 150.00Total Interest on U.S. Savings Bonds and Treasury Obligations (Box 3) $ 730.00 $ (30.00) $ 700.00Federal Income Tax WithheldSAMPLE INTEREST $ (65.00) $ 0.00 $ (65.00)Total Federal Income Tax Withheld (Box 4) $ (65.00) $ 0.00 $ (65.00)Investment ExpensesMADE UP CORP 8.75%12 12000XXXX $ (85.00) $ 0.00 $ (85.00)Total Investment Expenses (Box 5) $ (85.00) $ 0.00 $ (85.00)Foreign Tax PaidCountryMADE UP CORP 8.75%12 Canada 12000XXXX $ (100.00) $ 0.00 $ (100.00)Total Foreign Tax Paid (Box 6) $ (100.00) $ 0.00 $ (100.00)©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 25 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Detail Information of Interest Income (continued)DescriptionCusipNumber Paid in 2012SAMPLEPaid/Adjusted in2013 for 2012 AmountTax-Exempt InterestANY STATE REV BOND 12345678A $ 50.00 $ 0.00 $ 50.00ANY <strong>TAX</strong>-EXEMPT BOND FUND 12345678B $ 375.00 $ 0.00 $ 75.00Total Tax-Exempt Interest (Box 8) $ 425.00 $ 0.00 $ 425.00Specified Private Activity Bond Interest (Amount subject to Alternative Minimum Tax already included in Box 8)ANY STATE REV BOND 12345678A $ 50.00 $ 0.00 $ 50.00ANY <strong>TAX</strong>-EXEMPT BOND FUND 12345678B $ 175.00 $ 0.00 $ 75.00Total Specified Private Activity Bond Interest (Box 9) $ 225.00 $ 0.00 $ 225.00State Tax Withheld State ID. No. StateFAKE EQUITY CO 00-0000000 CA 22545XXXX $ (1,200.00) $ 0.00 $ (1,200.00)SAMPLE EQUITY CO 00-0000000 VT 98456XXXX $ (1,500.00) $ 0.00 $ (1,500.00)Total State Tax Withheld (Box 11–13) $ (2,700.00) $ 0.00 $ (2,700.00)Accrued Interest Paid on PurchasesDescriptionCusipNumber Paid in 2012Paid/Adjusted in2013 for 2012 AmountA FALSE CORP 9.375%16 54215XXXX $ (250.00) $ 0.00 $ (250.00)Total Accrued Interest Paid on Purchases $ (250.00) $ 0.00 $ (250.00)©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 26 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Realized Gain or (Loss)The information in the following sections include all your realized gain or (loss) transactions during the tax year. They may be helpful for, but not limited to,Schedule D. Please consult with your tax advisor or financial advisor regarding specific questions.Short-Term Realized Gain or (Loss)This section is for covered securities and corresponds to transactions reported on your 1099-B as “cost basis is reported to the IRS.” Report on Form 8949, Part I, with Box Achecked.DescriptionCusipNumberQuantity/ParDate ofAcquisitionDate ofSale Total Proceeds Cost BasisSAMPLEWash SaleLoss DisallowedRealizedGain or (Loss)sample corp 30246xxxx 285.00 02/10/12 04/01/12 $ 4,901.65 $ 5,483.49 $ 0.00 $ (581.84)sample corp 30246xxxx 484.00 02/10/12 04/01/12 $ 8,324.21 $ 9,355.87 $ 0.00 $ (1,031.66)sample corp 30246xxxx 618.00 02/10/12 04/01/12 $ 10,628.84 $ 11,890.58 $ 0.00 $ (1,261.74)sample corp 30246xxxx 800.00 02/10/12 04/01/12 $ 13,759.02 $ 15,480.26 $ 0.00 $ (1,721.24)sample corp 30246xxxx 316.00 02/15/12 04/01/12 $ 5,434.81 $ 6,108.38 $ 0.00 $ (673.57)sample corp 30246xxxx 15.00 02/20/12 04/01/12 $ 257.98 $ 289.65 $ 0.00 $ (31.67)sample corp 30246xxxx 300.00 02/20/12 04/01/12 $ 5,159.63 $ 5,793.13 $ 0.00 $ (633.50)sample corp 30246xxxx 685.00 02/20/12 04/01/12 $ 11,781.16 $ 13,227.58 $ 0.00 $ (1,446.42)sample corp 30246xxxx 422.00 03/10/12 04/01/12 $ 7,257.90 $ 8,081.47 $ 0.00 $ (823.57)sample corp 30246xxxx 97.00 03/15/12 04/01/12 $ 1,668.28 $ 1,866.32 $ 0.00 $ (198.34)sample corp 30246xxxx 903.00 03/15/12 04/01/12 $ 15,530.49 $ 17,324.91 $ 0.00 $ (1,794.42)sample corp 30246xxxx 903.00 03/15/12 04/01/12 $ 15,530.49 $ 17,324.91 $ 0.00 $ (1,794.42)sample corp 30246xxxx 300.00 S 08/18/12 10/11/12 $ 16,965.80 $ 18,062.05 $ 0.00 $ (1,096.25)Security Subtotal $ 118,868.54 $ 132,154.11 $ 0.00 $ (13,285.57)sample muni fund 67062XXXX 1,700.00 09/14/12 11/11/12 $ 23,604.95 $ 22,379.62 $ 0.00 $ 1,225.33Security Subtotal $ 23,604.95 $ 22,379.62 $ 0.00 $ 1,225.33Total Short-Term (Cost basis is reported to the IRS) $ 142,473.49 $ 154,533.73 $ 0.00 $ (12,060.24)Please see the “Endnotes for Your Realized Gain or (Loss)” for an explanation of the codes and symbols in this Realized Gain or (Loss) section.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 27 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Short-Term Realized Gain or (Loss) (continued)This section is for noncovered securities and corresponds to transactions reported on your 1099-B as “cost basis is available but not reported to the IRS.” Report on Form 8949,Part I, with Box B checked.Descriptionsample corp bond**called**CusipNumberQuantity/ParDate ofAcquisitionDate ofSaleTotal ProceedsSAMPLECost BasisAdjustedWash SaleLoss Disallowed04939XXXX 10,000.00 12/01/11 04/08/12 $ 10,406.25 $$10,408.0010,408.00 $ 0.00 $ $RealizedGain or (Loss)AdjustedSecurity Subtotal $ 10,406.25 $ 10,408.00 $ 0.00 $ (1.75)$ 10,408.00 $ (1.75)SAMPLE ltd partners 28370XXXX 50.00 04/27/12 09/08/12 $ 1,828.85 $ 1,854.98 $ 0.00 $ (26.13)Security Subtotal $ 1,828.85 $ 1,854.98 $ 0.00 $ (26.13)Total Short-Term (Cost basis is available but not reported to the IRS) $ 12,235.10 $$Short-Term Realized Gain or (Loss) (continued)12,262.9812,262.98$ 0.00 $$This section is for noncovered securities and corresponds to transactions reported on your 1099-B as “cost basis is missing and not reported to the IRS.” Report on Form 8949, ineither Part I or Part II as appropriate, with Box B checked.DescriptionCusipNumberQuantity/ParDate ofAcquisitionDate ofSaleTotal ProceedsCost BasisAdjustedWash SaleLoss Disallowed(1.75)(1.75)(27.88)(27.88)RealizedGain or (Loss)Adjustedsample corp 30246XXXX 100.00 12/12/11 01/18/12 $ 1,720.95 Missing – – – –Security Subtotal $ 1,720.95 – – – – – –sample stock 12345XXXX 500.00 12/12/11 03/15/12 $ 3,352.95 Missing – – – –Security Subtotal $ 3,352.95 – – – – – –Total Short-Term (Cost basis is missing and not reported to the IRS) $ 5,073.90 – – – – – –Please see the “Endnotes for Your Realized Gain or (Loss)” for an explanation of the codes and symbols in this Realized Gain or (Loss) section.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 28 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Short-Term Realized Gain or (Loss) (continued)The transactions in this section are not reported on Form 1099-B or to the IRS. Report on Form 8949, in either Part I or Part II as appropriate, with Box C checked.Descriptioncall example inc$5 EXP 07/21/12call example inc$5 EXP 07/21/12CusipNumberQuantity/ParDate ofAcquisitionDate ofSaleTotal ProceedsSAMPLECost BasisAdjustedWash SaleLoss DisallowedRealizedGain or (Loss)Adjusted1.00 04/29/12 06/18/12 $ 0.00 $ 201.65 $ 0.00 $ (201.65)9.00 04/29/12 06/18/12 $ 0.00 $ 1,814.87 $ 0.00 $ (1,814.87)Security Subtotal $ 0.00 $ 2,016.52 $ 0.00 $ (2,016.52)put sample corp$7.50 EXP 03/15/121.00 S 02/02/12 03/02/12 $ 1,867.42 $ 2,289.70 $ 0.00 $ (422.28)Security Subtotal $ 1,867.42 $ 2,289.70 $ 0.00 $ (422.28)Total Short-Term (Transactions are not reported on Form 1099-B or to the IRS) $ 1,867.42 $ 4,306.22 $ 0.00 $ (2,438.88)Total Short-Term $ 161,649.91 $i171,102.93i171,102.93$ 0.00 $i(14,527.00)(14,527.00)biPlease see the “Endnotes for Your Realized Gain or (Loss)” for an explanation of the codes and symbols in this Realized Gain or (Loss) section.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 29 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Long-Term Realized Gain or (Loss)This section is for covered securities and corresponds to transactions reported on your 1099-B as “cost basis is reported to the IRS.” Report on Form 8949, Part II, with Box Achecked.DescriptionCusipNumberQuantity/ParDate ofAcquisitionDate ofSale Total Proceeds Cost BasisSAMPLEWash SaleLoss DisallowedRealizedGain or (Loss)example common stock 17296XXXX 0.50 04/07/11 05/10/12 $ 22.03 $ 19.16 $ 0.00 $ 2.87Security Subtotal $ 22.03 $ 19.16 $ 0.00 $ 2.87sample common stock 03759XXXX 98.00 01/21/11 02/08/12 $ 1,183.69 $ 1,326.07 $ 142.38 $ 0.00Security Subtotal $ 1,183.69 $ 1,326.07 $ 142.38 $ 0.00SAMPLE realty trust 00432XXXX 100.00 06/30/11 12/05/12 $ 1,165.83 $ 1,228.75 $ 0.00 $ (62.92)Security Subtotal $ 1,165.83 $ 1,228.75 $ 0.00 $ (62.92)Total Long-Term (Cost basis is reported to the IRS) $ 2,371.55 $ 2,573.98 $ 142.38 $ (60.05)Please see the “Endnotes for Your Realized Gain or (Loss)” for an explanation of the codes and symbols in this Realized Gain or (Loss) section.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 30 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Long-Term Realized Gain or (Loss) (continued)This section is for noncovered securities and corresponds to transactions reported on your 1099-B as “cost basis is available but not reported to the IRS.” Report on Form 8949,Part II, with Box B checked.Descriptionexample corp bond**matured**CusipNumberQuantity/ParDate ofAcquisitionDate ofSaleTotal ProceedsSAMPLECost BasisAdjustedWash SaleLoss Disallowed12589XXXX 10,000.00 07/02/10 04/15/12 $ 10,000.00 $$10,605.9710,605.97 $ 0.00 $ $RealizedGain or (Loss)Adjusted(605.97)(605.97)Security Subtotal $ 10,000.00 $ 10,605.97 $ 0.00 $ (605.97)$ 10,605.97 $ (605.97)example muni bond 34114XXXX 5,000.00 10/11/86 01/01/12 $ 5,000.00 $$5,555.005,000.00 $ 0.00 $ $(555.00)0.00Security Subtotal $ 5,000.00 $ 5,555.00 $ 0.00 $ (555.00)$ 5,000.00 $ 0.00Total Long-Term (Cost basis is available but not reported to the IRS) $ 15,000.00 $$Long-Term Realized Gain or (Loss) (continued)16,160.9715,605.97$ 0.00 $$This section is for noncovered securities and corresponds to transactions reported on your 1099-B as “cost basis is missing and not reported to the IRS.” Report on Form 8949,Part II, with Box B checked.DescriptionCusipNumberQuantity/ParDate ofAcquisitionDate ofSale Total Proceeds Cost BasisWash SaleLoss Disallowed(1,160.97)(605.97)RealizedGain or (Loss)SAMPLE remic 31392XXXX 1,000.00 10/12/06 01/18/12 $ 1,000.00 Missing – – – –Security Subtotal $ 1,000.00 – – – – – –Total Long-Term (Cost basis is missing and not reported to the IRS) $ 1,000.00 – – – – – –Please see the “Endnotes for Your Realized Gain or (Loss)” for an explanation of the codes and symbols in this Realized Gain or (Loss) section.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 31 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Long-Term Realized Gain or (Loss) (continued)The transactions in this section are not reported on Form 1099-B or to the IRS. Report on Form 8949, Part II, with Box C checked.DescriptionCusipNumberQuantity/ParDate ofAcquisitionDate ofSaleTotal ProceedsSAMPLECost BasisAdjustedWash SaleLoss DisallowedRealizedGain or (Loss)Adjustedsample common stock 03759XXXX 0.25 01/21/11 11/28/12 $ 13.60 $ 12.16 $ 0.00 $ 1.44Security Subtotal $ 13.60 $ 12.16 $ 0.00 $ 1.44Total Long-Term (Transactions are not reported on Form 1099-B or to the IRS) $ 13.60 $ 12.16 $ 0.00 $ 1.44Total Long-Term $ 18,385.15 $i18,747.11i18,192.11$ 142.38 $i(1,219.58)(644.98)biPlease see the “Endnotes for Your Realized Gain or (Loss)” for an explanation of the codes and symbols in this Realized Gain or (Loss) section.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 32 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Realized Gain or (Loss) SummaryTotal Realized Gain or (Loss)DescriptionTotal Short-Term Realized Gain or (Loss) (Cost basis is reported to the IRS. Report on Form 8949, PartI, with Box A checked.)Total Short-Term Realized Gain or (Loss) (Cost basis is available but not reported to the IRS. Report onForm 8949, Part I, with Box B checked.)Total Short-Term Realized Gain or (Loss) (Cost basis is missing and not reported to the IRS. Report onForm 8949, in either Part I or Part II as appropriate, with Box B checked.)Total Short-Term Realized Gain or (Loss) (Transactions are not reported on Form 1099-B or to the IRS.Report on Form 8949, in either Part I or Part II as appropriate, with Box C checked.)Total ProceedsSAMPLECost BasisAdjustedWash SaleLoss DisallowedRealizedGain or (Loss)Adjusted$ 142,473.49 $ 154,533.73 $ 0.00 $ (12,060.24)$ 12,235.10 $ 12,262.98 $ 0.00 $ (27.88)$ 12,262.98 $ (27.88)$ 5,073.90 – – – – – –$ 1,867.42 $ 4,306.22 $ 0.00 $ (2,438.88)Total Short-Term Realized Gain or (Loss) $ 161,649.91 $ 171,102.93 i $ 0.00 $ (14,527.00) iTotal Long-Term Realized Gain or (Loss) (Cost basis is reported to the IRS. Report on Form 8949, PartII, with Box A checked.)Total Long-Term Realized Gain or (Loss) (Cost basis is available but not reported to the IRS. Report onForm 8949, Part II, with Box B checked.)Total Long-Term Realized Gain or (Loss) (Cost basis is missing and not reported to the IRS. Report onForm 8949, Part II, with Box B checked.)Total Long-Term Realized Gain or (Loss) (Transactions are not reported on Form 1099-B or to the IRS.Report on Form 8949, Part II, with Box C checked.)Total Long-Term Realized Gain or (Loss) $ 18,385.15 $$$ 171,102.93 i $ (14,527.00) bi$ 2,371.55 $ 2,573.98 $ 142.38 $ (60.05)$ 15,000.00 $ 16,160.97 $ 0.00 $ (1,160.97)$ 15,605.97 $ (605.97)$ 1,000.00 – – – – – –$ 13.60 $ 12.16 $ 0.00 $ 1.44i18,747.11i18,192.11$ 142.38 $$i(1,219.58)(644.98)biTotal Realized Gain or (Loss) $ 180,035.06 $$i189,850.04i189,295.04$ 142.38 $$i(15,746.58)(15,191.98)bi©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 33 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Notes for Your Realized Gain or (Loss)<strong>Schwab</strong> has provided realized gain and loss information whenever possible for most investments. Cost basis data may be incomplete or unavailable for some ofyour holdings. See Terms and Conditions.When value for the report is unavailable, it is noted as follows: “Missing” or “Not Provided”Not <strong>Schwab</strong> is not providing Cost Basis on this security type.ProvidedMissing Cost Basis may be missing due to one of the following reasons:• Cost basis data may not be available for a number of reasons (for example, the security was purchased outside of <strong>Schwab</strong> and we did notreceive cost basis from the transferring firm).• The security was purchased more than 10 years ago.Acquisition If the cost basis is missing or not provided, a short-term holding period may have applied for position that may have been long term.DateEndnotes for Your Realized Gain or (Loss)SymbolbiSAMPLEEndnote LegendWhen available, Adjusted Cost Basis values are used in Gain or (Loss) calculations.Value includes incomplete cost basis.©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 34 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Options ActivityThe information in the following sections may be helpful for, but not limited to, Schedule D. Please consult with your tax advisor or financial advisor regardingspecific questions.Investment Activity for Options—2012Description Activity Quantity Trade Date Settle Date Price Net AmountCALL ANY OLD CORP $20 EXP 06/18/11 SALE 1.00 05/15/11 05/16/11 0.5000 $ 50.00CALL ANY OLD CORP $20 EXP 06/18/11 ASSIGNED 1.00 06/15/11 0.0000 $ 0.00Security Subtotal $ 50.00CALL ANY OLD CORP $35 EXP 03/21/11 BUY 10.00 02/21/11 02/22/11 1.0500 $ 1,050.50CALL ANY OLD CORP $35 EXP 03/21/11 EXPIRED 10.00 03/21/11 0.0000 $ 0.00Security Subtotal $ 1,050.50Total Purchases/Adjustments–Options $ 0.00SAMPLETotal Proceeds/Adjustments–Options $ 1,050.50©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 35 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Summary of Fees & ExpensesThe information in the following sections may be helpful for, but not limited to, calculating your itemized deductions for Schedule A. Please consult with your taxadvisor or financial advisor regarding specific questions.Fees—2012DescriptionADVISED FEES $ 5,940.48ADVISor FEES $ 1,500.00Total of Fees—2012 $ 7,440.48Margin InterestDescriptionAmountTotal Margin Interest Charged $ (515.00)UIT (Unit Investment Trust) Organizational ExpenseSAMPLEDescription Cusip Number AmountABC SECS DEFINED 18384XXXX $ (15.00)EXAMPLE UNIT 999 30214XXXX $ (25.00)Total UIT Organizational Expense $ (40.00)AmountADR (American Depositary Receipt) FeesDescription Cusip Number AmountABC SECS DEFINED 18384XXXX $ (15.00)EXAMPLE UNIT 999 30214XXXX $ (25.00)Total ADR Fees $ (40.00)©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 36 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Widely Held Fixed Investment Trusts (WHFIT) ReportingUnit Investment TrustsDescription Cusip Number DateSAMPLECost BasisFactorGOVERMENT SEC 13 123456789 01/01/12 0.123456789GOVERMENT SEC 13 123456789 02/01/12 0.014734100GOVERMENT SEC 13 123456789 03/01/12 0.014734100GOVERMENT SEC 13 123456789 04/01/12 0.014734100GOVERMENT SEC 13 123456789 05/01/12 0.014734100GOVERMENT SEC 13 123456789 06/01/12 0.014734100GOVERMENT SEC 13 123456789 07/01/12 0.014734100GOVERMENT SEC 13 123456789 08/01/12 0.014734100GOVERMENT SEC 13 123456789 09/01/12 0.014734100GOVERMENT SEC 13 123456789 10/11/12 0.014734100GOVERMENT SEC 13 123456789 11/11/12 0.014734100GOVERMENT SEC 13 123456789 12/31/12 0.014734100SCHWAB TEN TRUST 234567890 11/22/12 0.581234560Widely Held Mortgage TrustsDescription Cusip Number Quantity DatePrincipal Factorper $1,000Market DiscountFactorABC MORTGAGE 123456XYZ 123,456,789.00 01/01/12 123456789.12345 0.01234567ABC MORTGAGE 123456XYZ 123,456,789.00 02/01/12 123456789.12345 0.01234567ABC MORTGAGE 123456XYZ 123,456,789.00 03/01/12 123456789.12345 0.01234567ABC MORTGAGE 123456XYZ 123,456,789.00 04/01/12 123456789.12345 0.01234567ABC MORTGAGE 123456XYZ 123,456,789.00 05/01/12 123456789.12345 0.01234567ABC MORTGAGE 123456XYZ 123,456,789.00 06/01/12 123456789.12345 0.01234567ABC MORTGAGE 123456XYZ 123,456,789.00 07/01/12 123456789.12345 0.01234567©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 37 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Non-Mortgage Widely Held Fixed Investment TrustsDescription Cusip Number Quantity DateSAMPLEPrincipal Factorper $1,000Market DiscountFactorABC company 123456XYA 123,456,789.00 11/01/12 123456789.12345 0.01234567ABC company 123456XYA 123,456,789.00 12/01/12 123456789.12345 0.01234567EFG company 223456XYA 123,456,789.00 11/01/12 123456789.12345 0.01234567EFG company 223456XYA 123,456,789.00 12/01/12 123456789.12345 0.01234567Section 1231 GainDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ 3,189.42GOVERNMENT SEC 2 61288XXXX $ 2,751.06Total Section 1231 Gain $ 5,940.48Addition to BasisDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ (3,189.42)GOVERNMENT SEC 2 61288XXXX $ (2,751.06)Total Addition to Basis $ (40.00)Reduction to BasisDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ 3,189.42GOVERNMENT SEC 2 61288XXXX $ 2,751.06Total Reduction to Basis $ 5,940.48©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 38 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Tax Exempt Interest Investment ExpenseDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ (15.00)GOVERNMENT SEC 2 61288XXXX $ (25.00)Total Tax Exempt Interest Investment Expense $ (40.00)Generic Expense (Subject to 2% AGI Limit)Description Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ (15.00)GOVERNMENT SEC 2 61288XXXX $ (25.00)Total Generic Expense (Subject to 2% AGI Limit) $ (40.00)Generic Expense (Not Subject to 2% AGI Limit)SAMPLEDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ (15.00)GOVERNMENT SEC 2 61288XXXX $ (25.00)Total Generic Expense (Not Subject to 2% AGI Limit) $ (40.00)Investment Interest ExpenseDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ (15.00)GOVERNMENT SEC 2 61288XXXX $ (25.00)Total Investment Interest Expense $ (40.00)©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 39 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Gross Proceeds Investment ExpenseDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ (15.00)GOVERNMENT SEC 2 61288XXXX $ (25.00)Total Gross Proceeds Investment Expense $ (40.00)Severance TaxDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ (15.00)GOVERNMENT SEC 2 61288XXXX $ (25.00)Total Severance Tax $ (40.00)Administrative ExpenseSAMPLEDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ (15.00)GOVERNMENT SEC 2 61288XXXX $ (25.00)Total Administrative Expense $ (40.00)WHFIT Miscellaneous IncomeDescription Cusip Number AmountGOVERNMENT SEC 1 54515XXXX $ 15.00GOVERNMENT SEC 2 61288XXXX $ 25.00Total WHFIT Miscellaneous Income $ 40.00©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 40 of 48

<strong>Schwab</strong> One® Account ofdana JONESjohn JONESAccount Number<strong>1111</strong>-<strong>9999</strong><strong>TAX</strong> <strong>YEAR</strong> 2012<strong>YEAR</strong>-END SUMMARY<strong>YEAR</strong>-END SUMMARY INFORMATION IS NOT PROVIDED TO THE IRS.Date Prepared: January 11, 2013The information in this and all subsequent sections is not provided to the IRS by <strong>Charles</strong> <strong>Schwab</strong>. It is provided to you as additional tax reporting information you may need to complete your tax return.Amortization and Accretion Reporting for Fixed IncomeAmortization and AccretionDescription Cusip Number Quantity/Par Acquired/OpenedSAMPLEAdjustedCost BasisPremiumAmortization/Discount AccretionYear to DateCorporate BondsFAKE CORPORATE NOTE 5.000% DUE 12/12 89233XXXX 350.00 12/31/04 $ 351,750.00 $ (18.94)FAKE CORPORATE BOND 5.000% DUE 12/13 93114XXXX 400,000.00 12/31/03 $ 456,000.00 $ (4,446.97)FAKE CORPORATE BOND 5.000% DUE 12/13 93114XXXX 1,250,000.00 12/31/04 $ 1,358,594.00 $ (1,449.21)Total $ (5,915.12)Municipal BondsANY STATE BOND DUE 12/22 02508XXXX 250,000.00 12/31/10 $ 241,800.00 $ 229.03ANY COUNTY NOTE DUE 11/13 79769XXXX 250,000.00 12/31/10 $ 235,925.00 $ 1,049.97Total $ 1,279.00U.S. TreasuriesUS TREASURY NOTE 8.000% DUE 02/20 91282XXXX 500,000.00 12/31/10 $ 577,500.00 $ ( 7,713.41)US TREASURY NOTE 8.000% DUE 02/20 91282XXXX 1,000,000.00 12/31/10 $ 1,147,500.00 $ (14,693.27)US TREASURY BOND 8.000% DUE 12/17 91281XXXX 750,000.00 12/31/10 $ 781,172.00 $ ( 1,002.90)US TREASURY BOND 8.000% DUE 12/17 91281XXXX 500,000.00 12/31/10 $ 520,781.00 $ (668.60)US TREASURY BOND 8.000% DUE 12/17 91281XXXX 250,000.00 12/31/10 $ 245,925.00 $ 127.65US TREASURY BOND 8.000% DUE 12/17 91281XXXX 250,000.00 01/05/11 $ 254,687.00 $ (168.32)Total $ ( 24,118.85)©2012 <strong>Charles</strong> <strong>Schwab</strong> & Co., Inc. All rights reserved. Member SIPC. 101 (0712-4872)Page 41 of 48