contacts

contacts

contacts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

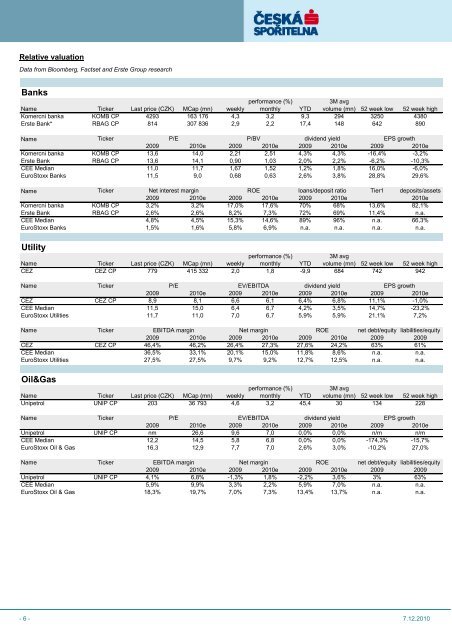

Relative valuation<br />

Data from Bloomberg, Factset and Erste Group research<br />

Banks<br />

performance (%)<br />

3M avg<br />

Name Ticker Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

Komercni banka KOMB CP 4293 163 176 4,3 3,2 9,3 294 3250 4380<br />

Erste Bank* RBAG CP 814 307 836 2,9 2,2 17,4 148 642 890<br />

Name<br />

Ticker P/E<br />

P/BV<br />

dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

Komercni banka KOMB CP 13,6 14,0 2,21 2,51 4,3% 4,3% -16,4% -3,2%<br />

Erste Bank RBAG CP 13,6 14,1 0,90 1,03 2,0% 2,2% -6,2% -10,3%<br />

CEE Median 11,0 11,7 1,67 1,52 1,2% 1,8% 16,0% -6,0%<br />

EuroStoxx Banks 11,5 9,0 0,68 0,63 2,6% 3,8% 28,8% 29,6%<br />

Name Ticker<br />

Net interest margin<br />

ROE loans/deposit ratio Tier1 deposits/assets<br />

2009 2010e 2009 2010e 2009 2010e 2010e<br />

Komercni banka KOMB CP 3,2% 3,2% 17,0% 17,6% 70% 68% 13,6% 82,1%<br />

Erste Bank RBAG CP 2,6% 2,6% 8,2% 7,3% 72% 69% 11,4% n.a.<br />

CEE Median 4,8% 4,5% 15,3% 14,6% 89% 96% n.a. 66,3%<br />

EuroStoxx Banks 1,5% 1,6% 5,8% 6,9% n.a. n.a. n.a. n.a.<br />

Utility<br />

performance (%)<br />

3M avg<br />

Name Ticker Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

CEZ CEZ CP<br />

779 415 332 2,0 1,8 -9,9 684 742 942<br />

Name<br />

Ticker P/E EV/EBITDA dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

CEZ CEZ CP<br />

8,9 8,1 6,6 6,1 6,4% 6,8% 11,1% -1,0%<br />

CEE Median 11,5 15,0 6,4 6,7 4,2% 3,5% 14,7% -23,2%<br />

EuroStoxx Utilities 11,7 11,0 7,0 6,7 5,9% 5,9% 21,1% 7,2%<br />

Name Ticker EBITDA margin Net margin<br />

ROE net debt/equity liabilities/equity<br />

2009 2010e 2009 2010e 2009 2010e 2009 2009<br />

CEZ CEZ CP 46,4% 46,2% 26,4% 27,3% 27,6% 24,2% 63% 61%<br />

CEE Median 36,5% 33,1% 20,1% 15,0% 11,8% 8,6% n.a. n.a.<br />

EuroStoxx Utilities 27,5% 27,5% 9,7% 9,2% 12,7% 12,5% n.a. n.a.<br />

Oil&Gas<br />

performance (%)<br />

3M avg<br />

Name Ticker Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

Unipetrol UNIP CP<br />

203 36 793 4,6 3,2 45,4 30 134 228<br />

Name<br />

Ticker P/E EV/EBITDA dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

Unipetrol UNIP CP<br />

nm 26,6 9,6 7,0 0,0% 0,0% n/m n/m<br />

CEE Median 12,2 14,5 5,8 6,8 0,0% 0,0% -174,3% -15,7%<br />

EuroStoxx Oil & Gas 16,3 12,9 7,7 7,0 2,6% 3,0% -10,2% 27,0%<br />

Name Ticker<br />

EBITDA margin Net margin ROE net debt/equity liabilities/equity<br />

2009 2010e 2009 2010e 2009 2010e 2009 2009<br />

Unipetrol UNIP CP 4,1% 6,8% -1,3% 1,8% -2,2% 3,6% 3% 63%<br />

CEE Median 5,9% 9,9% 3,3% 2,2% 5,9% 7,0% n.a. n.a.<br />

EuroStoxx Oil & Gas 18,3% 19,7% 7,0% 7,3% 13,4% 13,7% n.a. n.a.<br />

- 6 - 7.12.2010