contacts

contacts

contacts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

David M. Lobotka, Navrátil, P. Bártek, Mária Fehérová, M. Krajhanzl, Martin V. Lobotka, Kmínek, R. Luboš Kramule Mokráš<br />

tel.: 224 995 177, e-mail: research@csas.cz<br />

u<br />

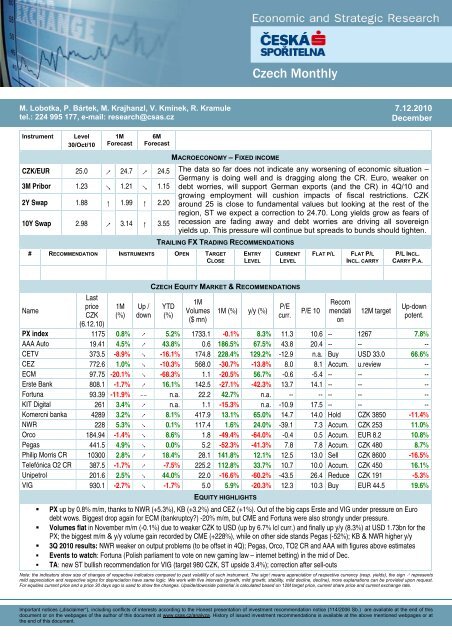

Instrument Level<br />

30/Oct/10<br />

1M<br />

Forecast<br />

6M<br />

Forecast<br />

CZK/EUR 25.0 ↗ 24.7 ↗ 24.5<br />

3M Pribor 1.23 ↘ 1.21 ↘ 1.15<br />

2Y Swap 1.88 ↑ 1.99 ↑ 2.20<br />

10Y Swap 2.98 ↗ 3.14 ↑ 3.55<br />

MACROECONOMY – FIXED INCOME<br />

Czech Monthly<br />

prosinec 7.12.2010 2010<br />

December<br />

The data so far does not indicate any worsening of economic situation –<br />

Germany is doing well and is dragging along the CR. Euro, weaker on<br />

debt worries, will support German exports (and the CR) in 4Q/10 and<br />

growing employment will cushion impacts of fiscal restrictions. CZK<br />

around 25 is close to fundamental values but looking at the rest of the<br />

region, ST we expect a correction to 24.70. Long yields grow as fears of<br />

recession are fading away and debt worries are driving all sovereign<br />

yields up. This pressure will continue but spreads to bunds should tighten.<br />

TRAILING FX TRADING RECOMMENDATIONS<br />

# RECOMMENDATION INSTRUMENTS OPEN TARGET<br />

CLOSE<br />

Name<br />

Last<br />

price<br />

CZK<br />

(6.12.10)<br />

1M<br />

(%)<br />

Up /<br />

down<br />

Důležitá Important upozornění notices („disclaimer“), (tzv. „disclaimer“), including včetně conflicts případného of interests konfliktu according zájmů, to dle the Vyhlášky Honest o presentation poctivé prezentaci of investment investičních recommendation doporučení (114/2006 notice (114/2006 Sb.) jsou Sb.) k dispozici are available na webových at the end stránkách of this<br />

document tvůrce tohoto or on dokumentu the webpages – of odboru the author Ekonomických of this document a strategických at www.csas.cz/analyza. analýz České History spořitelny of issued www.csas.cz/analyza. investment recommendations Přímý odkaz is available na dokument at the above s důležitými mentioned upozorněními webpages or je: at<br />

www.csas.cz/analyza_upozorneni. the end of this document. Historie vydaných investičních doporučení je k dispozici v Měsíčních strategiích, které jsou dostupné na výše uvedené webové adrese.<br />

ENTRY<br />

LEVEL<br />

CURRENT<br />

LEVEL<br />

CZECH EQUITY MARKET & RECOMMENDATIONS<br />

YTD<br />

(%)<br />

1M<br />

Volumes<br />

($ mn)<br />

1M (%) y/y (%)<br />

P/E<br />

curr.<br />

P/E 10<br />

FLAT P/L FLAT P/L<br />

INCL. CARRY<br />

Recom<br />

mendati<br />

on<br />

12M target<br />

P/L INCL.<br />

CARRY P.A.<br />

Up-down<br />

potent.<br />

PX index 1175 0.8% ↗ 5.2% 1733.1 -0.1% 8.3% 11.3 10.6 -- 1267 7.8%<br />

AAA Auto 19.41 4.5% ↗ 43.8% 0.6 186.5% 67.5% 43.8 20.4 -- -- --<br />

CETV 373.5 -8.9% ↘ -16.1% 174.8 228.4% 129.2% -12.9 n.a. Buy USD 33.0 66.6%<br />

CEZ 772.6 1.0% ↘ -10.3% 568.0 -30.7% -13.8% 8.0 8.1 Accum. u.review --<br />

ECM 97.75 -20.1% ↘ -68.3% 1.1 -20.5% 56.7% -0.6 -5.4 -- -- --<br />

Erste Bank 808.1 -1.7% ↗ 16.1% 142.5 -27.1% -42.3% 13.7 14.1 -- -- --<br />

Fortuna 93.39 -11.9% -- n.a. 22.2 42.7% n.a. -- -- -- -- --<br />

KIT Digital 261 3.4% ↗ n.a. 1.1 -15.3% n.a. -10.9 17.5 -- -- --<br />

Komercni banka 4289 3.2% ↗ 8.1% 417.9 13.1% 65.0% 14.7 14.0 Hold CZK 3850 -11.4%<br />

NWR 228 5.3% ↘ 0.1% 117.4 1.6% 24.0% -39.1 7.3 Accum. CZK 253 11.0%<br />

Orco 184.94 -1.4% ↘ 8.6% 1.8 -49.4% -64.0% -0.4 0.5 Accum. EUR 8.2 10.8%<br />

Pegas 441.5 4.9% ↘ 0.0% 5.2 -52.3% -41.3% 7.8 7.8 Accum. CZK 480 8.7%<br />

Philip Morris CR 10300 2.8% ↗ 18.4% 28.1 141.8% 12.1% 12.5 13.0 Sell CZK 8600 -16.5%<br />

Telefónica O2 CR 387.5 -1.7% ↗ -7.5% 225.2 112.8% 33.7% 10.7 10.0 Accum. CZK 450 16.1%<br />

Unipetrol 201.6 2.5% ↘ 44.0% 22.0 -16.6% -60.2% -43.5 26.4 Reduce CZK 191 -5.3%<br />

VIG 930.1 -2.7% ↘ -1.7% 5.0 5.9% -20.3% 12.3 10.3 Buy EUR 44.5 19.6%<br />

EQUITY HIGHLIGHTS<br />

� PX up by 0.8% m/m, thanks to NWR (+5.3%), KB (+3.2%) and CEZ (+1%). Out of the big caps Erste and VIG under pressure on Euro<br />

debt wows. Biggest drop again for ECM (bankruptcy?) -20% m/m, but CME and Fortuna were also strongly under pressure.<br />

� Volumes flat in November m/m (-0.1%) due to weaker CZK to USD (up by 6.7% lcl curr.) and finally up y/y (8.3%) at USD 1.73bn for the<br />

PX; the biggest m/m & y/y volume gain recorded by CME (+228%), while on other side stands Pegas (-52%); KB & NWR higher y/y<br />

� 3Q 2010 results: NWR weaker on output problems (to be offset in 4Q); Pegas, Orco, TO2 CR and AAA with figures above estimates<br />

� Events to watch: Fortuna (Polish parliament to vote on new gaming law – internet betting) in the mid of Dec.<br />

� TA: new ST bullish recommendation for VIG (target 980 CZK, ST upside 3.4%); correction after sell-outs<br />

Note: the indicators show size of changes of respective indicators compared to past volatility of such instrument. The sign means appreciation of respective currency (resp. yields), the sign ↗ represents<br />

mild appreciation and respective signs for depreciation have same logic. We work with five intervals (growth, mild growth, stability, mild decline, decline), more explanations can be provided upon request.<br />

For equities current price and a price 30 days ago is used to show the changes. Upside/downside potential is calculated based on 12M target price, current share price and current exchange rate.

MACRO<br />

Martin Lobotka, mlobotka@csas.cz ; tel: 224 995 192<br />

Real economy is doing well; strong German economy is dragging along also the Czech Republic and other economies tightly linked to<br />

Germany - this is also visible from 3Q/10 GDP data (Czech economy grew by 1.1% q/q, Poland by 1.3% q/q). Also preliminary data<br />

for 4Q/10 does not point to any substantial slowdown – leading indicators remain high (PMI slightly higher in November - at 57.3,<br />

German IFO continues increasing) pointing to a continued recovery and what will likely be a two-digit growth of industry also in 4Q<br />

(and that despite a higher base from 2009). PMI also suggests further growth of employment which is highest since 4Q/07. That,<br />

together with weaker Euro (on continued debt worries) and falling unemployment in Germany, raises hopes that recovery will go on<br />

– in the near future the recovery will still be able to rely on strong German export; after this factor wears out (due to stronger Euro<br />

and weaker dynamics of China on the back of monetary tightening) there will already be revived consumer demand to (at least<br />

partially) step in. We thus expect no dramatic slowdown, not at all another wave of recession. The planned fiscal restriction should<br />

also by far avoid disrupting the ongoing recovery.<br />

Czech National Bank published its new inflation projection and it is almost as pessimistic as that of labor union CMKOS. CNB expects<br />

the economy to grow by 1.2% which is some 0.8pp below the consensus as well as our forecast or that of the MinFin. We find CNB<br />

overly pessimistic (similarly as it was in 2009, when it expected the economy to grow by 1.4% in 2010 vs. our forecast of 2.0%<br />

which will likely undershoot the actual figure by some 0.2-0.3pp). What are the implications for rates? For the central bank,<br />

everything is crystal clear – the economy will grow around 1% y/y, there will be no inflation whatsoever, and thus rates can remain<br />

low for quite some time. We are more concerned – yes, we are more bullish on the real economy but having seen what was going<br />

on last year (economy growing on average by 0.7pp q/q since summer 2009 and koruna giving no reasons to worry and rates still<br />

went down by 50bp), we are more careful. Yes, we think that rates should be some 25-50bp higher than they are at this point, but<br />

the cautiousness on the side of CNB, still not-so-good labor market, and low current inflation will likely keep the central bank from<br />

hiking at least for one quarter’s time. February is probably the earliest possible candidate for a rate hike, as at that point new<br />

inflation prognosis will be ready and CNB will see a confirmation of solid growth in the real data by then. The risks of further delays<br />

because of this cautiousness on the side of CNB are still present, though.<br />

EURCZK is momentarily weaker but that will not be a factor in rate-setting decision. We think that values around 25 are fundamentally<br />

justifiable and therefore neutral for monetary policy. Within the next couple of weeks we expect it to strengthen mildly or, better said,<br />

to oscillate within the region of 24.5-25.0. Levels below 24.5, close to 24, would make sense in the second half of the year. Risks of<br />

further weakening are relatively small – it would require a serious trouble in EMU for koruna to rally above 25.5. Given that Polish<br />

zloty and Hungarian forint have already went through certain correction after the recent sell-off (driven to 4.10 and 285, respectively)<br />

– it is just koruna that remains around its lows – we think that some strengthening (to below 24.70) can be expected.<br />

Long-end swap and bond yields grew last month (by 40 and 25bp, respectively) which was in line with our prognosis (we’ve been<br />

expecting higher yields for quite some time). The main reason was debt crisis and correction from levels that corresponded to<br />

recession expectations. The same factors are affecting other sovereign yields; naturally, yields of structurally unbalanced south<br />

(+Ireland) are some 200bp (and more) above German yields and we also see an upside pressure for the strong core of EMU<br />

(Germany and France). In the coming months we expect slightly higher yields in Germany as well as in CR, but the spread between<br />

the two should contract mildly; from about 100bp to some 75-80bp. If it is debt worries and expected cost to western economies of<br />

rescue package for south that is driving yields up, then the Czech Republic should not be affected that much<br />

- 2 - 7.12.2010

EQUITIES<br />

Petr Bartek, Vaclav Kminek, Martin Krajhanzl, Radim Kramule, research@csas.cz; tel: +420 224 995 177<br />

Comments & Highlights<br />

� CEZ: The Czech Parliament approved (in line with expectations) taxes on solar power and CO2 allowances for 2011-12<br />

as a response to a boom in expensive solar energy. The government will impose a 26% tax on solar power revenues,<br />

while electricity producers will pay 32% tax from the value of CO2 permits granted to them for free. On a positive note,<br />

the Czech Ministry of Industry said that it would like to keep the current system of CO2 permit allocation for the<br />

period 2013-20 (gradual decline from 70% allocation to zero) unchanged and to finance the increased costs related to<br />

solar power from other sources after 2013 (the government earlier said it could sell 100% of CO2 permits as of 2013).<br />

� NWR reported 3Q10 EBITDA increased 19% q/q to EUR 133mn, what was 11% below the consensus. Sales came in at<br />

EUR 408.4mn (+40% y/y) and were 7% below the consensus. NWR’s operating result jumped, thanks to rapid doubledigit<br />

increases in coal prices, while sold volumes were weak in coke and coking coal. The company said production was<br />

affected by geological conditions, but October was strong and it sticks to its FY10 selling and production volumes<br />

guidance.<br />

� NWR did not reach the 75% threshold in its offer to acquire Bogdanka. The offer has therefore lapsed. NWR said it will<br />

not come with a new offer. NWR’s stock was driven by the fear that it could overpay for the acquisition. The end of the<br />

offer can therefore be seen as slightly positive. We believe that NWR will come up with other interesting acquisitions in<br />

the future, as it has sufficient cash and appetite.<br />

� Orco reported 3Q10 net income of EUR 4.2mn, somewhat above both our (EUR -3.6mn) and market estimates, thanks<br />

to high FX gains. Revenues were EUR 65.2mn, 8% above the consensus thanks to volatile development revenues. Orco<br />

set its FY11 revenue target at between EUR 350mn and EUR 380mn (approx. +30%y/y thanks to planned sale of one<br />

skyscraper), slightly below our estimate (EUR 387mn), but this should be a positive message for the market.<br />

� Pegas reported solid 3Q 2010 figures beating our and market consensus on higher volumes and stronger positive impact<br />

of pass-through mechanism. FY outlook has been confirmed. Management also informed that the NWs pricing pressure<br />

for 2011 was small and it has 95% capacity sell-out. We have updated our report, keeping Acc. with CZK 480 12M target<br />

� Fortuna: solid 3Q results supported by Fifa World Cup. Fortuna published several figures for 9M2010, with gross win<br />

at EUR 66.5mn (+12.4% y/y) and net profit at EUR 11.9mn (21% y/y). The growth of gross win from 1H (+10% y/y)<br />

continued also in 3Q2010 (+17.6% y/y), fuelled by online gross win growth (+51% y/y), while retail booked 10% y/y<br />

increase in 3Q2010. The future development of share price movement will be dependent mainly on the launching of the<br />

Lottery project in Czech Republic (expected by the end of 1H2011) and allowing the online betting in Poland.<br />

� PMCR 3Q10 highlights – lower volumes, higher prices. Revenues for 3Q10 were down 3.9% y/y to CZK 3bn (CZK<br />

8.55bn for 9M, -0.8% y/y), as mainly shipments came down significantly, -9.3% y/y to CZK 6.96mn (Czech Rep. -10.1%,<br />

Slovakia -5.4%, exports -9.7%). PM CR clearly continues with its strategy of lower market share (lower volumes) at<br />

higher prices (revenues came down by only 4%). Until dividends the share price is likely to hold at current levels.<br />

� Czech banks with improved outlook from Moody´s (from negative to stable). KB had also its outlook upgraded on asset<br />

quality improvement and good outlook for sustainable revenues. Also several foreign houses continue upgrading KB on<br />

solid outlook for profitability (lower provisioning) and dividends. We stick to Hold as core business remains flattish.<br />

Selected detailed info<br />

NWR: Weaker 3Q10 results, FY guidance confirmed<br />

NWR reported 3Q10 net income of EUR 48.5mn (EUR 27.6mn loss in 3Q09), which was 32% below the consensus. EBITDA increased<br />

19% q/q to EUR 133mn and was 11% below the consensus. Sales came in at EUR 408.4mn (+40% y/y) and were 7% below the<br />

consensus. The company produced 8.1Mt of coal, 6% more than last year, but 2% below our estimates. NWR’s operating result jumped,<br />

thanks to rapid double-digit increases in coal prices, while sold volumes were weak in coke and coking coal. The company said<br />

production was affected by worsening geological conditions and that pig iron production was temporarily weaker in the region in 3Q10,<br />

but October was strong and it sticks to its FY10 selling and production (11.5Mt) volumes guidance. The results are weaker than<br />

expected at first sight, due to lower production and sales volumes in coke. However, NWR confirmed its FY targets and we expect a very<br />

strong 4Q10. The coal and coke market still seems very tight in the region and NWR’s average coal and coke prices are expected to<br />

grow further in 2011.<br />

CETV: Down with high volumes (removal from MSCI EM, index), improved debt profile<br />

CETV had experienced high traded volumes after the news that it would be removed from MSCI EM index and consequently lost almost<br />

10% during last month (CETV was removed at the end of Nov 2010). CME also re-financed its 2010-2012 maturing debt until 2016 but<br />

at a higher interest rate (+3pp), while issued EUR 170mn denominated senior notes to repay its outstanding indebtedness maturing<br />

2010-2012. CETV already purchased USD 104mn (EUR 78mn) of outstanding debt and already refinanced all maturing debt before<br />

2013. There were also couple of news and sales of stocks carried by its senior management (including CEO). Despite the risks that CME<br />

faces (leverage), we still believe that it should sooner or later benefit from the CEE ad spending rebound and stick to Buy.<br />

Unipetrol prepares new strategy, but needs to wait for PKN’s plans<br />

Unipetrol is currently preparing a new strategy for its business operations and potential investments. The company has practically no<br />

debt and management said that it has room to leverage the company by approx. CZK 16bn (approx. EUR 650mn), which is a decent<br />

- 3 - 7.12.2010

amount of money for investment. Management is not specific, but we would bet that the new investments could be flowing to petchem<br />

and retail. The energy unit also awaits a solution, while the company again has all options on the table (shutting down the obsolete T200<br />

and keeping only T700, or refurbishing T700, or building additional capacity). More concrete plans are to be announced sometime in<br />

1H11, while bigger CAPEX is forecasted to come in 2012/13. Dividends are also on the table, but we see little chance for major payouts,<br />

as the company sees the current level of profitability as subdued and would consider paying something only if it saw its profits as<br />

satisfactory. We would like to underline that Unipetrol has a major maintenance shutdown scheduled for 2011 (for some one month of<br />

operations) and that the company could face CZK 300-400mn in extra charges on CO2 credit tax. We stick to Reduce.<br />

Pegas with solid set of results, updated report and ‘ever-decreasing’ prices<br />

Pegas beat our and market estimates with its 3Q10 results, as sales volumes were clearly above our estimates and the price mechanism<br />

(pass through) had a stronger effect. The outlook for 4Q10 remains good, as the decrease in PP/PE material inputs should be positively<br />

reflected in profitability. Management has therefore reiterated its guidance of EBITDA declining no less than 10% (we now expect Pegas<br />

to reach EUR 35mn in 2010). On top of that, management gave a bit of color to 2011, with capacity bookings standing at 95% (positive<br />

and in line with expectations), a production launch in 3Q11 (we hoped for earlier term) and ‘no significant pricing pressure on NW<br />

textiles’ (we hoped for stabilization). All in all, the story of Pegas has not changed. It is able to generate strong CF, pay out dividends,<br />

invest and maintain above-average margins. At the same time, the pricing pressures on NWs seem like a never-ending story. Some life<br />

could be pushed into the weak ‘growth’ prospects through M&A, as the company has set up an SPV for such purposes (no details given<br />

yet). After the results, we decided to update our model. Few changes were needed, but we cut our profit outlook slightly for the next<br />

couple of years, due to the NW pricing pressure, and slightly decreased our 12M target price, from CZK 500 to CZK 480. At the same<br />

time, we still believe it is worth an investment and maintain our Accumulate recommendation.<br />

PX vs. CEE region<br />

Prague stock exchange markedly underperformed the average of the selected indices having added only 0.18% m/m during the last<br />

month, which is markedly lower growth compared to 3.5% m/m average growth. The development of CEE indices (Czech Republic,<br />

Poland, Hungary, Austria and Germany) is illustrated on the graph below. On the other hand the development of PX index is still Okay,<br />

compared to Hungarian BUX, which lost almost 8% after the frightening the investors by the further government steps. Hungarian<br />

government proposed “nationalization” of the private pillar of the pension system and further steps are highly unpredictable. Investors will<br />

likely continue staying away from Hungary for quite some time.<br />

Graph: Development of PX index, other CEE indexes and SP 500 index as of beginning of 2010<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

31/12/09 31/01/10 28/02/10 31/03/10 30/04/10 31/05/10 30/06/10 31/07/10 31/08/10 30/09/10 31/10/10 30/11/10<br />

Source: Bloomberg<br />

PX Index WIG20 Index BUX Index ATX Index DAX Index RTSI$ Index SPX Index<br />

The following graph illustrates the development of P/E2010 ratios of regional indices (including US SP500 for comparison). American SPX<br />

is still traded above the emerging CEE indices. Regional P/Es increased in November in the region except of PX (down by 1.1%), which<br />

slightly decreased to 11.3 from 11.5 during the last month and BUX (-10.6%) to 11.4 from 12.7. We still see the levels of P/E as<br />

attractive for investors in case of PX index, especially in comparison to the sovereign bonds prices. Our 12M target price of PX index is<br />

set at 1267bp (8% upside potential). The most undervalued index seems to be DAX at the moment and PX index, which is quite<br />

surprising looking at the strong figures delivered by German economy and Czech economy as well.<br />

Graph: Development of P/E2010 ratio of CEE indexes<br />

- 4 - 7.12.2010

16<br />

15.5<br />

15<br />

14.5<br />

14<br />

13.5<br />

13<br />

12.5<br />

12<br />

11.5<br />

11<br />

10.5<br />

I-10<br />

Source: Bloomberg<br />

II-10<br />

III-10<br />

IV-10<br />

FWD P/E for respective indices<br />

V-10<br />

VI-10<br />

VII-10<br />

- 5 - 7.12.2010<br />

VIII-10<br />

IX-10<br />

PX BUX ATX WIG20 DAX SPX<br />

X-10<br />

XI-10<br />

XII-10

Relative valuation<br />

Data from Bloomberg, Factset and Erste Group research<br />

Banks<br />

performance (%)<br />

3M avg<br />

Name Ticker Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

Komercni banka KOMB CP 4293 163 176 4,3 3,2 9,3 294 3250 4380<br />

Erste Bank* RBAG CP 814 307 836 2,9 2,2 17,4 148 642 890<br />

Name<br />

Ticker P/E<br />

P/BV<br />

dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

Komercni banka KOMB CP 13,6 14,0 2,21 2,51 4,3% 4,3% -16,4% -3,2%<br />

Erste Bank RBAG CP 13,6 14,1 0,90 1,03 2,0% 2,2% -6,2% -10,3%<br />

CEE Median 11,0 11,7 1,67 1,52 1,2% 1,8% 16,0% -6,0%<br />

EuroStoxx Banks 11,5 9,0 0,68 0,63 2,6% 3,8% 28,8% 29,6%<br />

Name Ticker<br />

Net interest margin<br />

ROE loans/deposit ratio Tier1 deposits/assets<br />

2009 2010e 2009 2010e 2009 2010e 2010e<br />

Komercni banka KOMB CP 3,2% 3,2% 17,0% 17,6% 70% 68% 13,6% 82,1%<br />

Erste Bank RBAG CP 2,6% 2,6% 8,2% 7,3% 72% 69% 11,4% n.a.<br />

CEE Median 4,8% 4,5% 15,3% 14,6% 89% 96% n.a. 66,3%<br />

EuroStoxx Banks 1,5% 1,6% 5,8% 6,9% n.a. n.a. n.a. n.a.<br />

Utility<br />

performance (%)<br />

3M avg<br />

Name Ticker Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

CEZ CEZ CP<br />

779 415 332 2,0 1,8 -9,9 684 742 942<br />

Name<br />

Ticker P/E EV/EBITDA dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

CEZ CEZ CP<br />

8,9 8,1 6,6 6,1 6,4% 6,8% 11,1% -1,0%<br />

CEE Median 11,5 15,0 6,4 6,7 4,2% 3,5% 14,7% -23,2%<br />

EuroStoxx Utilities 11,7 11,0 7,0 6,7 5,9% 5,9% 21,1% 7,2%<br />

Name Ticker EBITDA margin Net margin<br />

ROE net debt/equity liabilities/equity<br />

2009 2010e 2009 2010e 2009 2010e 2009 2009<br />

CEZ CEZ CP 46,4% 46,2% 26,4% 27,3% 27,6% 24,2% 63% 61%<br />

CEE Median 36,5% 33,1% 20,1% 15,0% 11,8% 8,6% n.a. n.a.<br />

EuroStoxx Utilities 27,5% 27,5% 9,7% 9,2% 12,7% 12,5% n.a. n.a.<br />

Oil&Gas<br />

performance (%)<br />

3M avg<br />

Name Ticker Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

Unipetrol UNIP CP<br />

203 36 793 4,6 3,2 45,4 30 134 228<br />

Name<br />

Ticker P/E EV/EBITDA dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

Unipetrol UNIP CP<br />

nm 26,6 9,6 7,0 0,0% 0,0% n/m n/m<br />

CEE Median 12,2 14,5 5,8 6,8 0,0% 0,0% -174,3% -15,7%<br />

EuroStoxx Oil & Gas 16,3 12,9 7,7 7,0 2,6% 3,0% -10,2% 27,0%<br />

Name Ticker<br />

EBITDA margin Net margin ROE net debt/equity liabilities/equity<br />

2009 2010e 2009 2010e 2009 2010e 2009 2009<br />

Unipetrol UNIP CP 4,1% 6,8% -1,3% 1,8% -2,2% 3,6% 3% 63%<br />

CEE Median 5,9% 9,9% 3,3% 2,2% 5,9% 7,0% n.a. n.a.<br />

EuroStoxx Oil & Gas 18,3% 19,7% 7,0% 7,3% 13,4% 13,7% n.a. n.a.<br />

- 6 - 7.12.2010

Telecoms<br />

performance (%)<br />

3M avg<br />

Name Ticker Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

Telefonica O2 CR SPTT CP 389 125 422 5,0 -1,2 -6,8 177 369 453<br />

Name<br />

Ticker P/E EV/EBITDA dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

Telefonica O2 CR SPTT CP 11,5 10,0 5,0 4,5 9,6% 10,3% 0,3% 14,8%<br />

CEE Median 12,6 12,4 4,9 5,1 9,3% 8,4% -48,1% 1,9%<br />

EuroStoxx Telecom 11,0 10,7 5,2 5,3 7,3% 7,7% 11,2% 2,7%<br />

Name Ticker EBITDA margin Net margin<br />

ROE net debt/equity liabilities/equity<br />

2009 2010e 2009 2010e 2009 2010e 2009 2009<br />

Telefonica O2 CR SPTT CP 45,2% 48,9% 19,5% 22,4% 15,3% 16,9% 3% 20%<br />

CEE Median 38,2% 34,5% 15,1% 14,6% 14,5% 16,0% n.a. n.a.<br />

EuroStoxx Telecom 34,3% 34,2% 11,6% 11,7% 19,8% 23,5% n.a. n.a.<br />

Non-financials<br />

performance (%)<br />

3M avg<br />

Name Description Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

CME media<br />

382 24 256 7,3 -4,8 -14,4 59 356 730<br />

NWR mining<br />

229 60 534 11,2 5,5 41,7 93 157 286<br />

Pegas Nonwovens chemicals<br />

444 4 098 4,5 5,5 -0,1 19 410 468<br />

Philip Morris CR personal goods 10299 28 275 2,0 3,0 17,1 15 7950 10400<br />

Name<br />

Ticker P/E EV/EBITDA dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

CME CETV CP<br />

nm nm -296,0 14,9 0,0% 0,0% n/m n/m<br />

NWR NWR CP<br />

nm 7,2 11,7 4,9 0,0% 6,9% n/m n/m<br />

Pegas Nonwovens PEGAS CP 7,5 7,7 6,5 7,2 5,3% 5,4% n/m -3,2%<br />

Philip Morris CR TABAK CP 12,5 13,0 7,2 8,1 7,8% 7,2% 33,9% -3,9%<br />

Name Ticker EBITDA margin Net margin<br />

ROE net debt/equity liabilities/equity<br />

2009 2010e 2009 2010e 2009 2010e 2009 2009<br />

CME CETV CP -1,1% 20,6% -15,1% -0,3% -9,0% -0,2% 78% 59%<br />

NWR NWR CP 15,7% 34,1% -5,6% 20,1% -10,1% 46,8% 85% 75%<br />

Pegas Nonwovens PEGAS CP 31,4% 23,5% 16,9% 14,1% 19,4% 16,9% 84% 52%<br />

Philip Morris CR TABAK CP 29,9% 28,3% 20,5% 19,4% 27,3% 25,2% -49% 44%<br />

Financials<br />

performance (%)<br />

3M avg<br />

Name Description Last price (CZK) MCap (mn) weekly monthly YTD volume (mn) 52 week low 52 week high<br />

Orco Property Group real estates<br />

182 2 553 -4,4 -2,1 13,1 3 119 207<br />

Vienna Insurance insurance<br />

927 118 658 2,8 -2,6 2,7 4 792 1013<br />

Name<br />

Ticker<br />

P/E P/BV<br />

dividend yield<br />

EPS growth<br />

2009 2010e 2009 2010e 2009 2010e 2009 2010e<br />

Orco Property Group ORCO CP nm 0,4 1,24 0,32 0,0% 0,0% n/m n/m<br />

Vienna Insurance VIG CP<br />

13,5 12,1 1,20 1,15 2,5% 3,0% -74,2% 529,5%<br />

Name Ticker<br />

Net margin<br />

BV Growth ROE net debt/equity liabilities/equity<br />

2009 2010e 2009 2010e 2009 2010e 2009 2009<br />

Orco Property Group ORCO CP n.a. 83,0% -74,0% 285,1% n.a. 123,2% 1424% 95%<br />

Vienna Insurance VIG CP<br />

0,3% 1,9% -29,0% 4,3% 12,8% 9,0% n.a. n.a.<br />

- 7 - 7.12.2010

Technical part: short term technical upside potential for VIG (3.4%, target level 980 pts.)<br />

Martin Krajhanzl, mkrajhanzl@csas.cz; tel: +420 224 995 434<br />

Vienna Insurance Group (VIG)<br />

� Main trend: Short-term trend:<br />

R2: 1,011.0 Local peak<br />

R1: 960.8 Local peak<br />

S1: 943.8 50 EMA<br />

S2: 930.4 200 EMA<br />

S3: 900.0 Local bottom<br />

S4: 878.2 Local bottom<br />

� VIG has recently got above 200 EMA and 20 EMA<br />

stopped its decline on 200 EMA level.<br />

� MACD crossed signal line sending buy signal.<br />

� Both ROC20 and ROC60 rising. ROC20 to the zero level,<br />

ROC60 above its 20MA.<br />

� RSI got above 50 level and is currently above its 14MA.<br />

� Both MACD and RSI look positive. In connection with<br />

crossing 200 EMA VIG seems to get momentum recently.<br />

� We expect VIG currently supported by the 200 EMA to<br />

move towards the next resistance level at 960.8 pts (R1)<br />

which doesn’t look so strong so it can handily get above it.<br />

Daily QVIGRsp.PR 24.6.2010 - 20.12.2010 (VIE)<br />

EMA;; 934,66<br />

EMA;; 943,84<br />

Cndl;; 948,00<br />

EMA;; 930,36<br />

870<br />

.12<br />

28 07 12 19 26 02 09 16 23 30 06 13 20 27 04 11 18 25 01 08 15 22 29 06 13 20<br />

VI 10 červenec 2010 srpen 2010 září 2010 říjen 2010 listopad 2010 prosinec 2010<br />

Daily QVIGRsp.PR 24.6.2010 - 20.12.2010 (VIE)<br />

MACDF;; 2,00<br />

MACD;; -6,07; -8,07<br />

ROC;; 2,321<br />

ROC;; -1,250<br />

EMA;; 1,296<br />

RSI;; 52,460<br />

MARSI;; 44,834<br />

28 07 12 19 26 02 09 16 23 30 06 13 20 27 04 11 18 25 01 08 15 22 29 06 13 20<br />

VI 10 červenec 2010 srpen 2010 září 2010 říjen 2010 listopad 2010 prosinec 2010<br />

Chart: Reuters<br />

- 8 - 7.12.2010<br />

1 010,98<br />

960,79<br />

900<br />

878,21<br />

Price<br />

CZK<br />

1 010<br />

1 000<br />

990<br />

980<br />

970<br />

960<br />

950<br />

940<br />

930<br />

920<br />

910<br />

900<br />

890<br />

880<br />

Value<br />

CZK<br />

8<br />

4<br />

0<br />

-4<br />

-8<br />

.12<br />

Value<br />

CZK<br />

10<br />

5<br />

0<br />

-5<br />

.123<br />

Value<br />

CZK<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

.123

Czech Republic – Long-term prognosis<br />

2007 2008 2009 2010f 2011f 2012f<br />

Real GDP y/y % 6.1 2.3 -4.0 1.8 1.7 2.8<br />

Household Consumption y/y % 4.9 3.5 -0.2 -0.1 1.5 1.8<br />

Investment y/y % 10.9 -1.5 -9.2 -4.3 2.3 2.9<br />

Nominal Wages y/y % 7.3 8.4 4.0 2.1 3.5 3.6<br />

Retail Sales y/y % 10.2 3.2 -4.2 -1.4 2.1 2.1<br />

Manufacturing y/y % 9.2 7.2 -11.4 5.6 3.0 3.9<br />

CPI y/y %, year-end 5.4 3.6 1.0 1.8 2.5 2.2<br />

Unemployment (%) 6.6 5.4 8.1 9.1 9.2 9.1<br />

Trade Balance (% GDP) 85.1 70.9 150.3 145.1 120.4 98.0<br />

FDI (USD bn.) 10.4 6.5 2.7 2.8 4.3 4.4<br />

Budget (% GDP) -0.7 -0.5 -5.3 -5.3 -3.9 -3.2<br />

2W Repo (year-end) 3.5 2.5 1.1 1.0 1.8 2.5<br />

3M PRIBOR (average %) 3.1 4.0 2.2 1.3 1.5 2.1<br />

10Y Swap (average %) 4.2 4.2 3.7 3.1 3.3 3.4<br />

CZK / USD (average) 20.3 17.1 19.0 19.5 19.6 17.5<br />

CZK / USD (year-end) 18.1 19.4 17.9 19.3 18.2 17.1<br />

CZK / EUR (average) 27.8 25.0 26.4 25.5 24.4 23.5<br />

CZK / EUR (year-end) 26.4 26.2 26.1 24.7 24.0 23.1<br />

Calendars<br />

Macro<br />

CZ Monthly Forecast / December 2010<br />

Trade Balance (CZK bn.) 10/2010 already out 9:00 15.3 12.4<br />

Industrial production (% y/y) 11/2010 already out 9:00 6.3% 12.2%<br />

Retail Sales (incl. cars, % y/y) 10/2010 already out 9:00 -0.7% 3.5%<br />

Unemployment (new, %) 10/2010 8.12. 9:00 8.4% 8.5%<br />

CPI (% m/m) 11/2010 9.12. 9:00 0.3% -0.2%<br />

CPI (% y/y) 11/2010 9.12. 9:00 2.1% 2.0%<br />

GDP, % q/q, Final 3Q/10 9.12. 9:00 1.1%<br />

Current account (CZK bn.) 10/2010 14.12. 10:00 -12.04 mld. CZK -18.55 mld. CZK<br />

PPI (m/m) 11/2010 15.12. 9:00 0.2% 0.0%<br />

PPI (y/y) 11/2010 15.12. 9:00 2.4% 2.6%<br />

CNB Repo-rate setting, % 22.12. 13:00 0.75% 0.75%<br />

CZ Monthly Forecast / January 2010<br />

Trade Balance (CZK bn.) 11/2010 6.1. 9:00 15.3<br />

Industrial production (% y/y, F) 11/2010 7.1. 9:00 6.9%<br />

Unemployment (%) 12/2010 10.1. 9:00<br />

CPI (% m/m) 12/2010 10.1. 9:00<br />

CPI (% y/y) 12/2010 10.1. 9:00<br />

Retail Sales (incl. cars, % y/y) 11/2010 11.1. 9:00 -0.7%<br />

PPI (m/m) 12/2010 17.1. 9:00<br />

PPI (y/y) 12/2010 17.1. 9:00<br />

Industrial production (% y/y, P) 12/2010 27.1. 9:00<br />

Equities<br />

December 2010<br />

Company Event<br />

20.12. PX index Index base regular change<br />

24.12. non-trading day Prague Stock Exchange<br />

31.12. non-trading day Prague Stock Exchange<br />

January 2011<br />

25.1. VIG Preliminary unconsolidated premiums 2010<br />

- 9 - 7.12.2010

26.1. Unipetrol Trading statement Q410<br />

Table of past investment recommendations (12M) on stocks covered within SPAD system (PX index)<br />

ČEZ<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

Unipe tr ol<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

8.2.10 980 accumulate 30.9.2010 191 reduce<br />

4.2.09 1230 buy 28.9.2009 140 reduce<br />

3.9.08 1316 hold 30.3.2009 120 reduce<br />

14.2.08 1 255 hold 24.9.2008 250 buy<br />

8.6.07 1 045 hold 17.3.08 358 buy<br />

Telefónica O2 ČR<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

Orco<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

11.11.10 450 accumulate 24.9.10 8,2 (€) accumulate<br />

9.9.10 425 hold 7.10.09 7,2 (€) reduce<br />

4.8.10 470 hold 3.4.09 3.7 (€) reduce<br />

23.3.10 480 hold 25.9.08 41 (€) buy<br />

13.10.09 500 accumulate 21.7.08 48 (€) hold<br />

12.8.09 500 hold<br />

Kom e rční banka<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

ECM<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

8.2.10 3 850 hold not rated not rated not rated<br />

22.10.09 3 850 hold 28.2.08 1 380 buy<br />

29.7.09 3 290 accumulate 1.10.07 1 880 accumulate<br />

28.4.09 2 870 accumulate 14.6.07 2 160 accumulate<br />

CM E<br />

Date<br />

12M Target price<br />

Recommendation<br />

(USD)<br />

Philip M orris CR<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

16.6.10 33 buy 12.3.10 8 600 sell<br />

23.11.09 27 reduce 25.6.09 7 150 accumulate<br />

16.2.09 35 buy 14.10.08 8 900 buy<br />

27.2.08 93 reduce<br />

Pegas<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

NWR<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

26.11.10 480 accumulate 1.9.2010 253 accumulate<br />

10.3.10 500 accumulate 6.5.2010 306 buy<br />

20.5.09 350 hold 16.4.2010 306 hold<br />

25.4.08 505 hold 18.2.2010 211 accumulate<br />

3.9.2009 134 reduce<br />

VIG<br />

Date<br />

12M Target price<br />

Recommendation<br />

(CZK)<br />

4.2.10 44.5 buy<br />

21.11.08 44 buy<br />

11.7.08 66 buy<br />

23.11.07 72 buy<br />

Disclaimer<br />

Ceska sporitelna, a.s., Erste Group, their subsidiaries and clients may have positions in the investment instruments referred to in the<br />

recommendations, may trade in the investment instruments of the companies referred to in the recommendations or may provide these<br />

companies with investment or banking services. The Department of Economic and Strategic Analyses of Ceska sporitelna, a.s. is<br />

organizationally and physically separated from the departments of the Division of Financial Markets of Ceska sporitelna, a.s. The<br />

interests and the possible resulting conflicts of interest of the Financial Group of Ceska sporitelna in relation to the analyzed joint-stock<br />

companies in the Czech Republic (companies traded in the SPAD system outside Erste Group) are mentioned in Table below.<br />

Type of conflict of interest<br />

(1) ČS and/or a related person has direct or indirect interest in the registered capital of the issuer of more than 5%.<br />

(2) The issuer has direct or indirect interest in the registered capital of ČS and/or a related person of more than 5%.<br />

(3) ČS and/or a related person has another major financial interest in relation to the issuer.<br />

(4) ČS and/or a related person is the market maker or a person otherwise ensuring liquidity in relation to the financial instruments issued by the issuer.<br />

(5) ČS and/or a related person has been in the last 12 months a supervising manager or co-supervising manager of a public tender for financial<br />

instruments issued by the issuer.<br />

(6) ČS and/or a related person has concluded with the issuer another contract for investment services.<br />

(7) ČS and/or a related person has concluded with the issuer an agreement regarding development and distribution of investment recommendations.<br />

- 10 - 7.12.2010

Conflict of interest<br />

Company name (type of conflict of interest)<br />

AAA Auto 4<br />

C ETV 4, 5, 6<br />

CEZ 4, 5, 6<br />

ECM 4<br />

KIT Digital 4<br />

Komercni banka 4<br />

NWR 4<br />

ORCO 4, 6<br />

Pegas 4<br />

Philip M orris C R 4<br />

TO 2 C R 4<br />

Unipetrol 4<br />

VIG 3, 4, 5<br />

Source: CS/Erste Group<br />

SPAD 9<br />

Erste Group interest<br />

(3)<br />

Buy 22% 67%<br />

Accumulate 33% 33%<br />

Hold 22% 0%<br />

Reduce 11% 0%<br />

Sell 11% 0%<br />

Source: CS/Erste Group<br />

This research report was prepared by Erste Group Bank AG (”Erste Group”) or its affiliate named herein. The individual(s) involved in the preparation of the report were at the<br />

relevant time employed in Erste Group or any of its affiliates. The report was prepared for Erste Group clients. The information herein has been obtained from, and any opinions<br />

herein are based upon, sources believed reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All opinions, forecasts and<br />

estimates herein reflect our judgment on the date of this report and are subject to change without notice. The report is not intended to be an offer, or the solicitation of any offer,<br />

to buy or sell the securities referred to herein. From time to time, Erste Group or its affiliates or the principals or employees of Erste Group or its affiliates may have a position in<br />

the securities referred to herein or hold options, warrants or rights with respect thereto or other securities of such issuers and may make a market or otherwise act as principal<br />

in transactions in any of these securities. Erste Group or its affiliates or the principals or employees of Erste Group or its affiliates may from time to time provide investment<br />

banking or consulting services to or serve as a director of a company being reported on herein. Further information on the securities referred to herein may be obtained from<br />

Erste Group upon request. Past performance is not necessarily indicative for future results and transactions in securities, options or futures can be considered risky. Not all<br />

transactions are suitable for every investor. Investors should consult their advisor, to make sure that the planned investment fits into their needs and preferences and that the<br />

involved risks are fully understood. This document may not be reproduced, distributed or published without the prior consent of Erste Group. Erste Group Bank AG confirms<br />

that it has approved any investment advertisements contained in this material. Erste Group Bank AG is regulated by the Financial Market Authority (FMA) Otto-Wagner-Platz<br />

5,1090 Vienna, and for the conduct of investment business in the UK by the Financial Services Authority (FSA).<br />

Notice to Turkish Investors: As required by the Capital Markets Board of Turkey, investment information, comments and recommendations stated here, are not within the scope<br />

of investment advisory activity. Investment advisory service is provided in accordance with a contract of engagement on investment advisory concluded between brokerage<br />

houses, portfolio management companies, non-deposit banks and clients. Comments and recommendations stated here rely on the individual opinions of the ones providing<br />

these comments and recommendations. These opinions may not fit to your financial status, risk and return preferences. For this reason, to make an investment decision by<br />

relying solely to this information stated here may not bring about outcomes that fit your expectations.<br />

Published by Erste Group Bank AG, Neutorgasse 17, 1010 Vienna, Austria. Phone +43 (0)5 0100 - ext.<br />

Erste Group Homepage: www.erstegroup.com On Bloomberg please type: ERBK .<br />

Please refer to www.erstegroup.com for the current list of specific disclosures and the breakdown of Erste Group’s investment<br />

recommendations.<br />

- 11 - 7.12.2010

CONTACTS HTTP://WWW.CSAS.CZ/ANALYZA<br />

Economic and strategic research unit<br />

Head of dept., Chief economist David Navratil +420/224 995 439 dnavratil@csas.cz<br />

Macro (CEE) Jana Krajčová +420/224 995 232 jkrajcova@csas.cz<br />

Macro (ČR) Martin Lobotka +420/224 995 192 mlobotka@csas.cz<br />

Macro (USA, EMU) Luboš Mokráš +420/224 995 456 lmokras@csas.cz<br />

Macro (Banking strategist) Petr Bittner +420/224 995 172 pbitner@csas.cz<br />

Equities (ČEZ, NWR, CEE Real Estate) Petr Bártek +420/224 995 227 pbartek@csas.cz<br />

Equities (ČR, CEE Oil & gas) Radim Kramule +420/224 995 213 rkramule@csas.cz<br />

Equities (ČR, CEE Media) Václav Kmínek +420/224 995 289 vkminek@csas.cz<br />

Equities (Market analyst) Martin Krajhanzl +420/224 995 434 mkrajhanzl@csas.cz<br />

Financial markets division – Sales & Trading<br />

Head of dept. Petr Witowski +420/224 995 800 pwitowski@csas.cz<br />

Co-head Robert Novotný +420/224 995 148 rnovotny@csas.cz<br />

Debt Capital markets unit – Head of unit Tomáš Černý +420/224 995 197 tcerny@csas.cz<br />

Alice Racková +420/224 995 197 arackova@csas.cz<br />

Martin Chudoba +420/224 995 138 mchudoba@csas.cz<br />

Treasury unit – Head of unit Libor Vošický +420/224 995 592 lvosicky@.csas.cz<br />

Capital markets trading – Head of unit Ondřej Čech +420/224 995 577 ocech@csas.cz<br />

Institutional asset management – Head of unit Viktor Kotlán +420/224 995 217 vkotlan@csas.cz<br />

Proprietary trading unit – Head of unit Robert Novotný +420/224 995 417 rnovotny@csas.cz<br />

Equity sales Jiri Feres +420 224 995 551 jferes@csas.cz<br />

Equity sales Martin Urban +420 224 995 554 murban@csas.cz<br />

Foreign equity sales Jiri Smehlik +420 224 995 510 jsmehlik@csas.cz<br />

Investment banking unit<br />

Head of dept. Jan Brabec +420/224 995 816 jbrabec@csas.cz<br />

Private Equity a Venture Capital – Head of unit František Havrda +420/224 995 836 fhavrda@csas.cz<br />

Correspondent banking – Head of unit Barbora Procházková +420/224 995 338 bprochazkova@csas.cz<br />

Financial institutions – Head of unit Pavel Bříza +420/224 995 176 pbriza@csas.cz<br />

IPO – Head of unit Antonín Piskáček +420/224 995 810 apiskacek@csas.cz<br />

Hanna Zikmundová +420/224 995 259 hzikmundova@csas.cz<br />

M&A Frank Nosek +420/224 995 231 Frank.Nosek@erste-cf.com<br />

Jan Vrátník +420/224 995 211 jan.vratnik@erste-cf.com<br />

Erste Bank Vienna – CEE Equity<br />

Head of Group Research Friedrich Mostböck +43 501 00 119 02 friedrich.mostboeck@erstegroup.com<br />

Co-Head of CEE Equities Henning Esskuchen +43 501 00 196 34 henning.esskuchen@erstegroup.com<br />

Co-Head of CEE Equities Guenther Artner +43 501 00 115 23 guenther.artner@erstegroup.com<br />

Equities – CEE construction & steel Franz Hoerl +43 501 00 18 506 Franz.hoerl@csas.cz<br />

Equities – CEE banking Guenter Hohberger +43 501 00 173 54 guenter.hohberger@erstegroup.com<br />

Equities – CEE banking, real estate Gernot Jany +43 501 00 119 03 Černot.jany@erstegroup.com<br />

Equities – CEE Oil & gas Thomas Unger +43 501 00 17 344 Thomas.unger@erstegroup.com<br />

Equities – CEE Telecoms Vera Sutedja, CFA +43 501 00 119 05 Mariaveronika.sutedja@erstegroup.com<br />

Equities – CEE Pharma Vladimíra Urbánková +43 501 00 17 343 Vladimira.urbankova@erstegroup.com<br />

Equities – IT Daniel Lion +43 501 00 174 20 daniel.lion@erstegroup.com<br />

Equities – Engineering Gerald Walek, CFA +43 501 00 163 60 gerald.walek@erstegroup.com<br />

Equities – CEE Insurance Christoph Schultes +43 501 00 163 14 christoph.schultes@erstegroup.com<br />

Erste Bank Víenna –Macro/Fixed Income<br />

Head of Macro/ Fixed Income Research Gudrun Egger +43 501 00 119 09 Gudrun.Egger@erstegroup.com<br />

Co-Head of CEE Fixed Income Research Rainer Singer +43 501 00 111 85 rainer.singer@erstegroup.com<br />

Co-Head of CEE Fixed Income Research Juraj Kotian +43 501 00 173 57 juraj.kotian@erstegroup.com<br />

Brokerjet On-line trading +420 224 995 777 www.brokerjet.cz<br />

Institutional Equity Sales Vienna<br />

Head Brigitte Zeitlberger-Schmid +43 501 00 831 23 brigitte.zeitlberger@erstebank.at<br />

Institutional Equity Sales London<br />

Head Michal Rizek +44 20 7623 4154 michal.rizek@erstegroup.com<br />

Dieter Benesch +44 20 7623 4154 dieter.benesch@erstegroup.com<br />

Declan Wooloughan +44 20 7623 - 4154 declan.wooloughan@erstegroup.com<br />

This research report was prepared by Erste Group Bank AG (”Erste Group”) or its affiliate named herein. The individual(s) involved in the preparation of the report were at the<br />

relevant time employed in Erste Group or any of its affiliates. The report was prepared for Erste Group clients. The information herein has been obtained from, and any opinions<br />

herein are based upon, sources believed reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All opinions, forecasts and<br />

estimates herein reflect our judgment on the date of this report and are subject to change without notice. The report is not intended to be an offer, or the solicitation of any offer,<br />

to buy or sell the securities referred to herein. From time to time, Erste Group or its affiliates or the principals or employees of Erste Group or its affiliates may have a position in<br />

the securities referred to herein or hold options, warrants or rights with respect thereto or other securities of such issuers and may make a market or otherwise act as principal<br />

in transactions in any of these securities. Erste Group or its affiliates or the principals or employees of Erste Group or its affiliates may from time to time provide investment<br />

banking or consulting services to or serve as a director of a company being reported on herein. Further information on the securities referred to herein may be obtained from<br />

Erste Group upon request. Past performance is not necessarily indicative for future results and transactions in securities, options or futures can be considered risky. Not all<br />

transactions are suitable for every investor. Investors should consult their advisor, to make sure that the planned investment fits into their needs and preferences and that the<br />

involved risks are fully understood. This document may not be reproduced, distributed or published without the prior consent of Erste Group. Erste Group Bank AG confirms<br />

that it has approved any investment advertisements contained in this material. Erste Group Bank AG is regulated by the Financial Market Authority (FMA) Otto-Wagner-Platz<br />

5,1090 Vienna, and for the conduct of investment business in the UK by the Financial Services Authority (FSA).<br />

- 12 - 7.12.2010