Bilancio Ansaldo - Ansaldo Energia

Bilancio Ansaldo - Ansaldo Energia

Bilancio Ansaldo - Ansaldo Energia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

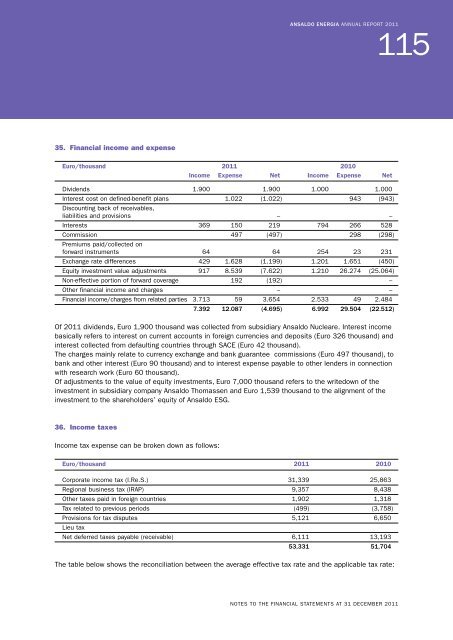

35. Financial income and expense<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

115<br />

Euro/thousand 2011 2010<br />

Income Expense Net Income Expense Net<br />

Dividends 1.900 1.900 1.000 1.000<br />

Interest cost on defined-benefit plans<br />

Discounting back of receivables,<br />

1.022 (1.022) 943 (943)<br />

liabilities and provisions – –<br />

Interests 369 150 219 794 266 528<br />

Commission<br />

Premiums paid/collected on<br />

497 (497) 298 (298)<br />

forward instruments 64 64 254 23 231<br />

Exchange rate differences 429 1.628 (1.199) 1.201 1.651 (450)<br />

Equity investment value adjustments 917 8.539 (7.622) 1.210 26.274 (25.064)<br />

Non-effective portion of forward coverage 192 (192) –<br />

Other financial income and charges – –<br />

Financial income/charges from related parties 3.713 59 3.654 2.533 49 2.484<br />

7.392 12.087 (4.695) 6.992 29.504 (22.512)<br />

Of 2011 dividends, Euro 1,900 thousand was collected from subsidiary <strong>Ansaldo</strong> Nucleare. Interest income<br />

basically refers to interest on current accounts in foreign currencies and deposits (Euro 326 thousand) and<br />

interest collected from defaulting countries through SACE (Euro 42 thousand).<br />

The charges mainly relate to currency exchange and bank guarantee commissions (Euro 497 thousand), to<br />

bank and other interest (Euro 90 thousand) and to interest expense payable to other lenders in connection<br />

with research work (Euro 60 thousand).<br />

Of adjustments to the value of equity investments, Euro 7,000 thousand refers to the writedown of the<br />

investment in subsidiary company <strong>Ansaldo</strong> Thomassen and Euro 1,539 thousand to the alignment of the<br />

investment to the shareholders’ equity of <strong>Ansaldo</strong> ESG.<br />

36. Income taxes<br />

Income tax expense can be broken down as follows:<br />

Euro/thousand 2011 2010<br />

Corporate income tax (I.Re.S.) 31,339 25,863<br />

Regional business tax (IRAP) 9,357 8,438<br />

Other taxes paid in foreign countries 1,902 1,318<br />

Tax related to previous periods (499) (3,758)<br />

Provisions for tax disputes<br />

Lieu tax<br />

5,121 6,650<br />

Net deferred taxes payable (receivable) 6,111 13,193<br />

53,331 51,704<br />

The table below shows the reconciliation between the average effective tax rate and the applicable tax rate:<br />

NOTES TO THE FINANCIAL STATEMENTS AT 31 DECEMBER 2011