Annual Report on Form 10-K for the year ended 12 ... - Affinity Gaming

Annual Report on Form 10-K for the year ended 12 ... - Affinity Gaming

Annual Report on Form 10-K for the year ended 12 ... - Affinity Gaming

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

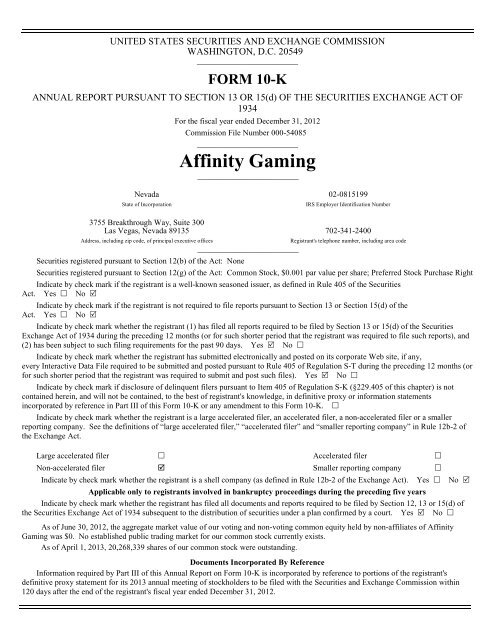

UNITED STATES SECURITIES AND EXCHANGE COMMISSIONWASHINGTON, D.C. 20549_________________________FORM <strong>10</strong>-KANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF1934For <strong>the</strong> fiscal <strong>year</strong> <strong>ended</strong> December 31, 20<strong>12</strong>Commissi<strong>on</strong> File Number 000-54085_________________________<strong>Affinity</strong> <strong>Gaming</strong>_________________________Nevada 02-0815199State of Incorporati<strong>on</strong>IRS Employer Identificati<strong>on</strong> Number3755 Breakthrough Way, Suite 300Las Vegas, Nevada 89135 702-341-2400Address, including zip code, of principal executive officesSecurities registered pursuant to Secti<strong>on</strong> <strong>12</strong>(b) of <strong>the</strong> Act: N<strong>on</strong>e_________________________Registrant's teleph<strong>on</strong>e number, including area codeSecurities registered pursuant to Secti<strong>on</strong> <strong>12</strong>(g) of <strong>the</strong> Act: Comm<strong>on</strong> Stock, $0.001 par value per share; Preferred Stock Purchase RightIndicate by check mark if <strong>the</strong> registrant is a well-known seas<strong>on</strong>ed issuer, as defined in Rule 405 of <strong>the</strong> SecuritiesAct. Yes No Indicate by check mark if <strong>the</strong> registrant is not required to file reports pursuant to Secti<strong>on</strong> 13 or Secti<strong>on</strong> 15(d) of <strong>the</strong>Act. Yes No Indicate by check mark whe<strong>the</strong>r <strong>the</strong> registrant (1) has filed all reports required to be filed by Secti<strong>on</strong> 13 or 15(d) of <strong>the</strong> SecuritiesExchange Act of 1934 during <strong>the</strong> preceding <strong>12</strong> m<strong>on</strong>ths (or <strong>for</strong> such shorter period that <strong>the</strong> registrant was required to file such reports), and(2) has been subject to such filing requirements <strong>for</strong> <strong>the</strong> past 90 days. Yes No Indicate by check mark whe<strong>the</strong>r <strong>the</strong> registrant has submitted electr<strong>on</strong>ically and posted <strong>on</strong> its corporate Web site, if any,every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulati<strong>on</strong> S-T during <strong>the</strong> preceding <strong>12</strong> m<strong>on</strong>ths (or<strong>for</strong> such shorter period that <strong>the</strong> registrant was required to submit and post such files). Yes No Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulati<strong>on</strong> S-K (§229.405 of this chapter) is notc<strong>on</strong>tained herein, and will not be c<strong>on</strong>tained, to <strong>the</strong> best of registrant's knowledge, in definitive proxy or in<strong>for</strong>mati<strong>on</strong> statementsincorporated by reference in Part III of this <strong>Form</strong> <strong>10</strong>-K or any amendment to this <strong>Form</strong> <strong>10</strong>-K. Indicate by check mark whe<strong>the</strong>r <strong>the</strong> registrant is a large accelerated filer, an accelerated filer, a n<strong>on</strong>-accelerated filer or a smallerreporting company. See <strong>the</strong> definiti<strong>on</strong>s of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule <strong>12</strong>b-2 of<strong>the</strong> Exchange Act.Large accelerated filer Accelerated filer N<strong>on</strong>-accelerated filer Smaller reporting company Indicate by check mark whe<strong>the</strong>r <strong>the</strong> registrant is a shell company (as defined in Rule <strong>12</strong>b-2 of <strong>the</strong> Exchange Act). Yes No Applicable <strong>on</strong>ly to registrants involved in bankruptcy proceedings during <strong>the</strong> preceding five <strong>year</strong>sIndicate by check mark whe<strong>the</strong>r <strong>the</strong> registrant has filed all documents and reports required to be filed by Secti<strong>on</strong> <strong>12</strong>, 13 or 15(d) of<strong>the</strong> Securities Exchange Act of 1934 subsequent to <strong>the</strong> distributi<strong>on</strong> of securities under a plan c<strong>on</strong>firmed by a court. Yes No As of June 30, 20<strong>12</strong>, <strong>the</strong> aggregate market value of our voting and n<strong>on</strong>-voting comm<strong>on</strong> equity held by n<strong>on</strong>-affiliates of <strong>Affinity</strong><strong>Gaming</strong> was $0. No established public trading market <strong>for</strong> our comm<strong>on</strong> stock currently exists.As of April 1, 2013, 20,268,339 shares of our comm<strong>on</strong> stock were outstanding.Documents Incorporated By ReferenceIn<strong>for</strong>mati<strong>on</strong> required by Part III of this <str<strong>on</strong>g>Annual</str<strong>on</strong>g> <str<strong>on</strong>g>Report</str<strong>on</strong>g> <strong>on</strong> <strong>Form</strong> <strong>10</strong>-K is incorporated by reference to porti<strong>on</strong>s of <strong>the</strong> registrant'sdefinitive proxy statement <strong>for</strong> its 2013 annual meeting of stockholders to be filed with <strong>the</strong> Securities and Exchange Commissi<strong>on</strong> within<strong>12</strong>0 days after <strong>the</strong> end of <strong>the</strong> registrant's fiscal <strong>year</strong> <strong>ended</strong> December 31, 20<strong>12</strong>.

TABLE OF CONTENTSPart IItem 1. Business 3Item 1A. Risk Factors 27Item 1B. Unresolved Staff Comments 40Item 2. Properties 40Item 3. Legal Proceedings 41Item 4. Mine Safety Disclosures 42Part IIItem 5.Market <strong>for</strong> Registrant’s Comm<strong>on</strong> Equity, Related Stockholder Matters and Issuer Purchases ofEquity Securities 43Item 6. Selected Financial Data 44Item 7. Management’s Discussi<strong>on</strong> and Analysis of Financial C<strong>on</strong>diti<strong>on</strong> and Results of Operati<strong>on</strong>s 45Item 7A. Quantitative and Qualitative Disclosures About Market Risk 60Item 8. Financial Statements and Supplementary Data 60Item 9. Changes in and Disagreements with Accountants <strong>on</strong> Accounting and Financial Disclosures 60Item 9A. C<strong>on</strong>trols and Procedures 61Item 9B. O<strong>the</strong>r In<strong>for</strong>mati<strong>on</strong> 62Part IIIItem <strong>10</strong>. Directors, Executive Officers and Corporate Governance 63Item 11. Executive Compensati<strong>on</strong> 63Item <strong>12</strong>.Security Ownership of Certain Beneficial Owners and Management and Related StockholderMatters 63Item 13. Certain Relati<strong>on</strong>ships and Related Transacti<strong>on</strong>s and Director Independence 63Item 14. Principal Accountant Fees and Services 63Part IVItem 15. Exhibits and Financial Statement Schedules 64Exhibit Index 65Signatures 701

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTSThis <str<strong>on</strong>g>Annual</str<strong>on</strong>g> <str<strong>on</strong>g>Report</str<strong>on</strong>g> <strong>on</strong> <strong>Form</strong> <strong>10</strong>-K <strong>for</strong> <strong>the</strong> <strong>year</strong> <strong>ended</strong> December 31, 20<strong>12</strong> (”20<strong>12</strong> <strong>Form</strong> <strong>10</strong>-K”) c<strong>on</strong>tains <strong>for</strong>ward-lookingstatements within <strong>the</strong> meaning of <strong>the</strong> U.S. federal securities laws. You can identify <strong>for</strong>ward-looking statements by words suchas “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects”, “projects,” “may,” “will” or “should,” or <strong>the</strong>negative or o<strong>the</strong>r variati<strong>on</strong> of <strong>the</strong>se or similar words, or by discussi<strong>on</strong>s of strategy or risks and uncertainties, and similarreferences to future periods. Examples of <strong>for</strong>ward-looking statements include, but are not limited to, statements we makeregarding (i) <strong>the</strong> adequacy of cash flows from operati<strong>on</strong>s and available cash, and (ii) <strong>the</strong> effects <strong>on</strong> our business as a result of<strong>the</strong> reorganizati<strong>on</strong> proceedings of our predecessor, Herbst <strong>Gaming</strong>, Inc. and its wholly-owned subsidiaries (collectively,“Predecessor”) under title 11 of <strong>the</strong> United States Code (<strong>the</strong> “Bankruptcy Code”), 11 U.S.C. §§ <strong>10</strong>1, et seq., as am<strong>ended</strong>(“Chapter 11”), in <strong>the</strong> United States Bankruptcy Court <strong>for</strong> <strong>the</strong> District of Nevada, Nor<strong>the</strong>rn Divisi<strong>on</strong> (<strong>the</strong> “Bankruptcy Court”).We base <strong>for</strong>ward-looking statements <strong>on</strong> our current expectati<strong>on</strong>s and assumpti<strong>on</strong>s regarding our business, <strong>the</strong> ec<strong>on</strong>omy ando<strong>the</strong>r future c<strong>on</strong>diti<strong>on</strong>s. Because <strong>for</strong>ward-looking statements relate to <strong>the</strong> future, by <strong>the</strong>ir nature, <strong>the</strong>y are subject to inherentuncertainties, risks and changes in circumstances that we cannot easily predict. Our actual results may differ materially fromthose c<strong>on</strong>templated by <strong>the</strong> <strong>for</strong>ward-looking statements. We cauti<strong>on</strong> you, <strong>the</strong>re<strong>for</strong>e, that you should not rely <strong>on</strong> any of <strong>the</strong>se<strong>for</strong>ward-looking statements as statements of historical fact or as guarantees or assurances of future per<strong>for</strong>mance. These risksand uncertainties include, but are not limited to, statements we make regarding: (i) <strong>the</strong> potential adverse impact of <strong>the</strong>Chapter 11 filing <strong>on</strong> our operati<strong>on</strong>s, management and employees; (ii) customer resp<strong>on</strong>se to <strong>the</strong> Chapter 11 filing; (iii) <strong>the</strong>adequacy of cash flows from operati<strong>on</strong>s, available cash and available amounts under our credit facility to meet future liquidityneeds; (iv) expectati<strong>on</strong>s regarding <strong>the</strong> operati<strong>on</strong> of slot machines at our casino properties; (v) our c<strong>on</strong>tinued viability, ouroperati<strong>on</strong>s and results of operati<strong>on</strong>s; or (vi) expectati<strong>on</strong>s related to integrati<strong>on</strong> of newly acquired casino properties. Additi<strong>on</strong>alimportant factors that could cause actual results to differ materially and adversely from those in <strong>the</strong> <strong>for</strong>ward-looking statementsinclude regi<strong>on</strong>al, nati<strong>on</strong>al or global political, ec<strong>on</strong>omic, business, competitive, market and regulatory c<strong>on</strong>diti<strong>on</strong>s, as well as <strong>the</strong>following:• our debt service requirements may adversely affect our operati<strong>on</strong>s and ability to complete,• our ability to generate cash to service our substantial indebtedness depends <strong>on</strong> many factors that we cannot c<strong>on</strong>trol,• rising gasoline prices,• intense competiti<strong>on</strong>,• extensive regulati<strong>on</strong> from gaming and o<strong>the</strong>r government authorities,• changes to applicable gaming and tax laws could have a material adverse effect <strong>on</strong> our financial c<strong>on</strong>diti<strong>on</strong>,• severe wea<strong>the</strong>r c<strong>on</strong>diti<strong>on</strong>s and o<strong>the</strong>r natural disasters that affect visitati<strong>on</strong> to our casinos,• envir<strong>on</strong>mental c<strong>on</strong>taminati<strong>on</strong> and remediati<strong>on</strong> costs,• <strong>the</strong> recessi<strong>on</strong> and, in particular, <strong>the</strong> ec<strong>on</strong>omic downturn in Nevada and Cali<strong>for</strong>nia,• changes in income and payroll tax laws,• additi<strong>on</strong>al gaming licenses being granted in limited license jurisdicti<strong>on</strong>s where we operate,• changes in <strong>the</strong> smoking laws, and• o<strong>the</strong>r factors as described in “Risk Factors.”Any <strong>for</strong>ward-looking statement made by us in this 20<strong>12</strong> <strong>Form</strong> <strong>10</strong>-K speaks <strong>on</strong>ly as of <strong>the</strong> date of this 20<strong>12</strong> <strong>Form</strong> <strong>10</strong>-K.Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible <strong>for</strong> us topredict all of <strong>the</strong>m. We undertake no obligati<strong>on</strong> to publicly update any <strong>for</strong>ward-looking statement, whe<strong>the</strong>r as a result of newin<strong>for</strong>mati<strong>on</strong>, future developments or o<strong>the</strong>rwise.2

PART IITEM 1. BUSINESSOUR COMPANYWe are a Nevada corporati<strong>on</strong>, headquartered in Las Vegas, which owns and operates <strong>12</strong> casinos in four states—six inNevada, three in Colorado, two in Missouri and <strong>on</strong>e in Iowa. In additi<strong>on</strong> to our diverse, multi-jurisdicti<strong>on</strong>al casino operati<strong>on</strong>s,we provide c<strong>on</strong>sulting services to <strong>the</strong> operator of <strong>the</strong> Rampart Casino at <strong>the</strong> JW Marriott Resort in Las Vegas, <strong>for</strong> which wereceive a fixed m<strong>on</strong>thly fee and are eligible to receive a percentage of revenue in excess of specified thresholds.On December 20, 20<strong>12</strong> (<strong>the</strong> “Effective Time”), <strong>Affinity</strong> <strong>Gaming</strong>, LLC c<strong>on</strong>verted from a Nevada limited liability companyinto a Nevada corporati<strong>on</strong> after adopting an Agreement and Plan of C<strong>on</strong>versi<strong>on</strong> (<strong>the</strong> “C<strong>on</strong>versi<strong>on</strong> Agreement”) and filing itsArticles of C<strong>on</strong>versi<strong>on</strong> (<strong>the</strong> “Articles of C<strong>on</strong>versi<strong>on</strong>”) with <strong>the</strong> Secretary of State of <strong>the</strong> State of Nevada. The resulting entity isnow known as <strong>Affinity</strong> <strong>Gaming</strong> (such c<strong>on</strong>versi<strong>on</strong>, <strong>the</strong> “C<strong>on</strong>versi<strong>on</strong>”). Pursuant to <strong>the</strong> C<strong>on</strong>versi<strong>on</strong>, at <strong>the</strong> Effective Time,am<strong>on</strong>g o<strong>the</strong>r things, (i) <strong>the</strong> membership interests of <strong>Affinity</strong> <strong>Gaming</strong>, LLC held by its members were c<strong>on</strong>verted into comm<strong>on</strong>shares of <strong>Affinity</strong> <strong>Gaming</strong> <strong>on</strong> a <strong>on</strong>e-to-<strong>on</strong>e basis, and <strong>the</strong> members of <strong>Affinity</strong> <strong>Gaming</strong>, LLC became stockholders of <strong>Affinity</strong><strong>Gaming</strong>, (ii) all property, subsidiaries, rights, privileges, powers and franchises of <strong>Affinity</strong> <strong>Gaming</strong>, LLC vested in <strong>Affinity</strong><strong>Gaming</strong>, and all liabilities and obligati<strong>on</strong>s of <strong>Affinity</strong> <strong>Gaming</strong>, LLC became liabilities and obligati<strong>on</strong>s of <strong>Affinity</strong> <strong>Gaming</strong>, and(iii) <strong>the</strong> Articles of Organizati<strong>on</strong> and <strong>the</strong> Operating Agreement of <strong>Affinity</strong> <strong>Gaming</strong>, LLC, in each case as in effect immediatelyprior to <strong>the</strong> Effective Time, ceased to have any <strong>for</strong>ce or effect, and <strong>the</strong> Articles of Incorporati<strong>on</strong> and Bylaws of <strong>Affinity</strong> <strong>Gaming</strong>were adopted. Up<strong>on</strong> c<strong>on</strong>summati<strong>on</strong> of <strong>the</strong> C<strong>on</strong>versi<strong>on</strong>, shares of our comm<strong>on</strong> stock were deemed to be registered underSecti<strong>on</strong> <strong>12</strong>(g) of <strong>the</strong> Securities Exchange Act of 1934, as am<strong>ended</strong>, pursuant to Rule <strong>12</strong>g-3(a) promulgated <strong>the</strong>reunder. Forpurposes of Rule <strong>12</strong>g-3(a), we are <strong>the</strong> successor issuer to <strong>Affinity</strong> <strong>Gaming</strong>, LLC.OUR BUSINESS STRATEGYWe focus <strong>on</strong> earning <strong>the</strong> loyalty primarily of local, value-oriented gaming patr<strong>on</strong>s who gamble frequently. Because suchpatr<strong>on</strong>s represent a high potential <strong>for</strong> repeated visits, generating customer satisfacti<strong>on</strong> and loyalty is a critical comp<strong>on</strong>ent of ourstrategy. We also cater to <strong>the</strong> drive-in tourist patr<strong>on</strong>s whom we can entice to repeat <strong>the</strong>ir visits.Local patr<strong>on</strong>s are typically sophisticated gaming customers who seek c<strong>on</strong>venient locati<strong>on</strong>s, high payouts, a good meal anda pleasant atmosphere. Although perceived value initially attracts a customer to our casino properties, actual value generatescustomer satisfacti<strong>on</strong> and loyalty. We <strong>the</strong>re<strong>for</strong>e seek to provide attentive customer service in a friendly, casual atmosphere,recognizing that c<strong>on</strong>sistent quality and a com<strong>for</strong>table atmosphere stem from <strong>the</strong> collective care and friendliness of eachemployee.During 20<strong>12</strong> and <strong>the</strong> first m<strong>on</strong>th of 2013, we divested of a slot machine route operati<strong>on</strong> and six Nevada casinos, whileacquiring three casinos in Black Hawk, Colorado. These acquisiti<strong>on</strong> and dispositi<strong>on</strong> transacti<strong>on</strong>s were critical to and c<strong>on</strong>sistentwith our l<strong>on</strong>g-term strategic visi<strong>on</strong>.We anticipate that our growth will come from <strong>the</strong> diversificati<strong>on</strong> and expansi<strong>on</strong> of our existing properties and throughstrategic acquisiti<strong>on</strong>s. Our key focus remains <strong>on</strong> expanding <strong>the</strong> operating margins of our existing properties through acombinati<strong>on</strong> of top-line revenue growth and stringent expense management. We have invested in both human capital andbusiness intelligence tools to optimize our slot operati<strong>on</strong>s and improve <strong>the</strong> overall effectiveness of our marketing ef<strong>for</strong>ts. Wec<strong>on</strong>tinuously review <strong>the</strong> operating per<strong>for</strong>mance of each of our existing properties and <strong>the</strong> feasibility of enhancing <strong>the</strong>irper<strong>for</strong>mance through targeted capital expenditures and expense savings programs. In doing so, we assess <strong>the</strong> anticipatedrelative costs and benefits of <strong>the</strong> projects under c<strong>on</strong>siderati<strong>on</strong>, <strong>the</strong> availability of cash flows and debt financing to fund capitalexpenditures, and competitive and o<strong>the</strong>r relevant factors.OUR PROPERTIESOn February 29, 20<strong>12</strong>, we acquired <strong>the</strong> land and buildings of <strong>the</strong> Golden Mardi Gras Casino, Golden Gates Casino andGolden Gulch Casino (toge<strong>the</strong>r, <strong>the</strong> “Black Hawk Casinos”), all of which are located in Black Hawk, Colorado (<strong>the</strong> “Golden<strong>Gaming</strong> Acquisiti<strong>on</strong>”), pursuant to <strong>the</strong> Asset Purchase Agreement (“Black Hawk Agreement”) with Golden Mardi Gras, Inc.Pursuant to <strong>the</strong> Black Hawk Agreement, we simultaneously leased <strong>the</strong> Black Hawk Casinos back to Golden <strong>Gaming</strong>, LLC3

(<strong>for</strong>merly, Golden <strong>Gaming</strong>, Inc.) (“Golden <strong>Gaming</strong>”), an affiliate of Golden Mardi Gras, Inc., until we obtained gaminglicenses in Colorado. We were licensed by <strong>the</strong> Colorado <strong>Gaming</strong> Commissi<strong>on</strong> <strong>on</strong> October 18, 20<strong>12</strong>, and we began operating <strong>the</strong>Black Hawk Casinos <strong>on</strong> November 1, 20<strong>12</strong>.Casino Operati<strong>on</strong>sAs of December 31, 20<strong>12</strong>, after giving effect to <strong>the</strong> sale of our Sands Regency Casino Hotel in Reno, Nevada, <strong>the</strong> GoldRanch Casino & RV Resort in Verdi, Nevada, and <strong>the</strong> Dayt<strong>on</strong> Depot Casino in Dayt<strong>on</strong>, Nevada to Truckee <strong>Gaming</strong>, LLC(“Truckee <strong>Gaming</strong>”) <strong>on</strong> February 1, 2013 (<strong>the</strong> “Truckee Dispositi<strong>on</strong>”), our casino properties c<strong>on</strong>sist of six casinos in Nevada,three casinos in Colorado, two casinos in Missouri and <strong>on</strong>e casino in Iowa. The majority of our casino properties focus <strong>on</strong> localcustomers, with an emphasis <strong>on</strong> slot machine play.The following table summarizes our casino operati<strong>on</strong>s as of December 31, 20<strong>12</strong>:PropertyNevadaLocati<strong>on</strong>YearBuilt 1<strong>Gaming</strong>SquareFeetSlotsTableGamesHotelRoomsTerrible’s Las Vegas Las Vegas 2006 25,000 964 <strong>10</strong> 327Henders<strong>on</strong> Casino Henders<strong>on</strong> 1993 4,000 95 — —Primm Valley Primm 1990 38,000 822 26 625Buffalo Bill’s Primm 1994 62,000 889 29 1,243Whiskey Pete’s Primm 1977 36,000 554 <strong>10</strong> 779Rail City Sparks 2007 24,000 882 7 —Total Nevada 189,000 4,206 82 2,974MidwestSt Jo Fr<strong>on</strong>tier St. Joseph, MO 2005 13,000 566 11 —Mark Twain 2 LaGrange, MO 2001 18,000 649 13 —Lakeside Iowa 2, 3 Osceola, IA 2005 36,000 1,027 13 150Total Midwest 67,000 2,242 37 150ColoradoBlack Hawk Casinos Black Hawk431,000 1,065 22 —Total287,000 7,513 141 3,<strong>12</strong>4Additi<strong>on</strong>al <strong>Gaming</strong>In<strong>for</strong>mati<strong>on</strong>Race and sports book;bingoRace and sports book;Cali<strong>for</strong>nia lotterystati<strong>on</strong>Race and sports book;pokerSports book; keno;poker(1) This column presents <strong>the</strong> <strong>year</strong> <strong>the</strong> property was built or <strong>the</strong> <strong>year</strong> of <strong>the</strong> most recent remodel.(2) Mark Twain and Lakeside Iowa also have 8 and 47 RV spaces, respectively.(3) In 20<strong>12</strong>, Lakeside Iowa expanded from 60 to 150 hotel rooms.(4) Golden Mardi Gras Casino, Golden Gulch Casino and Golden Gate Casino were built or remodeled in 2000, 2003 and 1992, respectively.4

Nevada CasinosTerrible’s Las VegasTerrible’s Hotel & Casino in Las Vegas, Nevada (“Terrible’s Las Vegas”) has approximately 25,000 square feet of gamingspace with approximately 964 slot machines, <strong>10</strong> table games, a race and sports book operated by a third party, a 195-seat bingofacility, a buffet and a 24-hour café. There are currently 327 hotel rooms with standard amenities. Terrible’s Las Vegas isc<strong>on</strong>veniently located approximately <strong>on</strong>e mile east of <strong>the</strong> Las Vegas Strip, which we believe appeals to locals who wish to avoid<strong>the</strong> c<strong>on</strong>gesti<strong>on</strong> of <strong>the</strong> Strip. Terrible’s Las Vegas’ favorable locati<strong>on</strong> has made it popular with Strip casino employees.Although not a tourist destinati<strong>on</strong> due to <strong>the</strong> limited number of rooms, <strong>the</strong> property receives some tourist traffic through <strong>the</strong>casino due to its proximity to <strong>the</strong> airport, <strong>the</strong> Las Vegas Strip, <strong>the</strong> University of Nevada - Las Vegas and <strong>the</strong> Las VegasC<strong>on</strong>venti<strong>on</strong> Center.Henders<strong>on</strong> CasinoThe Town Casino & Bowl is located in Henders<strong>on</strong>, Nevada (“Henders<strong>on</strong> Casino”), a suburb sou<strong>the</strong>ast of Las Vegas. Theproperty has approximately 4,000 square feet of gaming space with approximately 95 slot machines, a 16-lane bowling alleyand a 24-hour café.Primm Casinos<strong>Affinity</strong> <strong>Gaming</strong> owns <strong>the</strong> business and leases <strong>the</strong> real estate <strong>on</strong> which Primm Valley Resort & Casino (“Primm Valley”),Buffalo Bill’s Resort & Casino (“Buffalo Bill’s”) and Whiskey Pete’s Hotel & Casino (“Whiskey Pete’s” and toge<strong>the</strong>r withPrimm Valley and Buffalo Bill’s, <strong>the</strong> “Primm Casinos”) are located in Primm, Nevada. Primm is <strong>on</strong> <strong>the</strong> Nevada-Cali<strong>for</strong>nia stateline al<strong>on</strong>g Interstate 15, <strong>the</strong> major interstate route between Los Angeles and Las Vegas. The Primm Casinos collectively ownand manage three gas stati<strong>on</strong>/c<strong>on</strong>venience stores, a Starbucks Coffee outlet and <strong>on</strong>e Cali<strong>for</strong>nia Lottery store. Two 18-hole, TomFazio-designed golf courses with a full-service restaurant and club house, leased and managed by a third-party, are locatednearby.5

Primm Valley. Primm Valley offers approximately 822 slot machines, 26 table games and a race and sports bookoperated by a third party. Additi<strong>on</strong>ally, Primm Valley has a 625 room hotel and 21,000 square feet of c<strong>on</strong>venti<strong>on</strong> space.Primm Valley has a full-service coffee shop operated by a third party, an Original House of Pancakes, a buffet and <strong>the</strong> GPSteakhouse. The resort has a swimming pool and a 13,000 square foot full-service spa. Primm Valley is c<strong>on</strong>nected to <strong>the</strong>“Fashi<strong>on</strong> Outlets of Las Vegas,” a retail complex owned by a third party that houses over <strong>10</strong>0 designer outlet stores, including aNeiman Marcus “Last Call,” a Williams S<strong>on</strong>oma Outlet store, Coach, Tommy Bahama, Banana Republic and Versace factoryoutlet stores.Buffalo Bill’s. Buffalo Bill’s offers approximately 889 slot machines, 29 table games and a race and sports book operatedby a third party. In additi<strong>on</strong> to a 1,243 room hotel, Buffalo Bill’s has a Denny’s operated by a third party, a buffet and aMexican restaurant. The western-<strong>the</strong>med property also has extensive entertainment amenities, including <strong>the</strong> 6,800 seat “Star of<strong>the</strong> Desert” arena that hosts headline entertainers throughout <strong>the</strong> <strong>year</strong>. Buffalo Bill’s has a roller coaster as well as water parklog rides, a movie <strong>the</strong>ater and a midway-style arcade.Whiskey Pete’s. Whiskey Pete’s offers approximately 554 slot machines, <strong>10</strong> table games and two full service bars.Additi<strong>on</strong>ally, Whiskey Pete’s has a 779 room hotel, a full service coffee shop operated by a third party, a weekend buffet, aMcD<strong>on</strong>ald’s restaurant, an Internati<strong>on</strong>al House of Pancakes, an 8,000 square foot special events and c<strong>on</strong>cert venue with 650seats, and a swimming pool.Rail CityRail City Casino in Sparks, Nevada (“Rail City”) has approximately 24,000 square feet of gaming space housingapproximately 882 slot machines, 7 table games, keno, a sports book operated by a third party, a 24-hour family-style restaurantand an ale house and brew pub.Midwest CasinosSt JoThe St Jo Fr<strong>on</strong>tier Casino (“St Jo”), a riverboat casino located in a man-made basin adjacent to <strong>the</strong> Missouri River inSt. Joseph, Missouri, offers approximately 566 slot machines and 11 table games. St Jo also has a coffee-shop-stylerestaurant/buffet and lounge, as well as 2,400 total square feet of c<strong>on</strong>ference and meeting space. The casino and its amenitieshave a locally-popular western <strong>the</strong>me based <strong>on</strong> St. Joseph’s heritage as <strong>the</strong> founding locati<strong>on</strong> and headquarters of <strong>the</strong> P<strong>on</strong>yExpress. St Jo owns 54 acres of land, 32 acres of which are undeveloped.Mark TwainMark Twain Casino (“Mark Twain”), a riverboat casino located in a man-made basin adjacent to <strong>the</strong> Mississippi River inLaGrange, Missouri, offers approximately 649 slot machines and 13 table games, as well as eight RV parking spots. MarkTwain also has a coffee shop style restaurant/bar and an additi<strong>on</strong>al bar in <strong>the</strong> casino. The casino has a locally popular <strong>the</strong>mebased <strong>on</strong> Mark Twain, who grew up in and wrote about nearby Hannibal, Missouri.Lakeside IowaLakeside Casino Resort (“Lakeside Iowa”), a riverboat casino located <strong>on</strong> West Lake in Osceola, Iowa, 40 miles southwestof Des Moines, offers approximately 1,027 slot machines and 13 table games. Lakeside Iowa also offers a 150-room hotel,<strong>10</strong>,000 square feet of c<strong>on</strong>ference and meeting facilities that may also be used <strong>for</strong> c<strong>on</strong>certs, a fitness center, an outdoorc<strong>on</strong>cert/entertainment venue, an indoor pool and a gift shop. In additi<strong>on</strong>, Lakeside Iowa has a coffee-shop-stylerestaurant/buffet and lounge located in <strong>the</strong> main lobby, two bars located in <strong>the</strong> casino, a c<strong>on</strong>venience store and Pilot/Flying Jbranded truck stop and gas stati<strong>on</strong> located adjacent to <strong>the</strong> casino, and 47 RV spaces with utility hookups. Lakeside Iowa owns<strong>10</strong>9 acres of land, 75 acres of which are undeveloped.6

Colorado CasinosThe Golden Mardi Gras Casino, Golden Gates Casino and Golden Gulch Casino are located in close proximity to <strong>on</strong>eano<strong>the</strong>r al<strong>on</strong>g a half-mile strip of casino and casino-hotel properties in <strong>the</strong> historic mining town of Black Hawk, Colorado. TheBlack Hawk Casinos collectively feature approximately 31,000 square feet of gaming space, 1,065 slot machines, 22 tablegames and 17 live poker games, as well as three restaurants, four bars and a parking garage with 750 spaces. The casinos arewell-positi<strong>on</strong>ed within <strong>the</strong> market with <strong>the</strong>ir large parking garage located in <strong>the</strong> center of <strong>the</strong> main gaming district at a keyintersecti<strong>on</strong> between o<strong>the</strong>r properties.Disc<strong>on</strong>tinued Operati<strong>on</strong>sOn February 27, 20<strong>12</strong>, we sold our casino in Searchlight, Nevada and <strong>the</strong> porti<strong>on</strong> of our slot route operati<strong>on</strong>s relatingsolely to <strong>the</strong> Terrible Herbst c<strong>on</strong>venience stores in Nevada to JETT <strong>Gaming</strong>, LLC (“JETT”), a Las Vegas-based slot routeoperator (<strong>the</strong> “JETT Transacti<strong>on</strong>s”). On February 29, 20<strong>12</strong>, we sold <strong>the</strong> remainder of our slot route operati<strong>on</strong>s, as well as ourtwo Pahrump, Nevada casinos, to Golden <strong>Gaming</strong>, a Las Vegas based casino, tavern and slot route operator (<strong>the</strong> “Golden<strong>Gaming</strong> Dispositi<strong>on</strong>”).Sands Regency Casino HotelSands Regency Casino Hotel in Downtown Reno, Nevada has approximately 26,000 square feet of gaming space,including approximately 548 slot machines and eight table games, bingo, live poker and a sports book operated by anindependent third party. Additi<strong>on</strong>ally, <strong>the</strong> Sands has 833 hotel rooms and a spa. Dining opti<strong>on</strong>s at <strong>the</strong> Sands include CabanaCafé, a coffee house/deli-style restaurant, a buffet and Copa Bar and Grill. The property also has a Mel's, <strong>the</strong> original, dinerstyle restaurant, and a quick serve restaurant, both of which are operated by third parties. The facility also includesapproximately <strong>12</strong>,000 square feet of c<strong>on</strong>venti<strong>on</strong> and meeting space. Third parties lease space from <strong>the</strong> Sands and operate awedding chapel, a bicycle and ski rental shop and a beauty shop.Gold Ranch Casino & RV ResortThe Gold Ranch Casino and RV Resort in Verdi, Nevada offers approximately 240 slot machines in an 8,000 square footcasino, a sports book operated by a third party, a family-style restaurant, a Jack-in-<strong>the</strong>-Box restaurant leased to and operated bya third-party, a bar, a <strong>10</strong>5-space RV park, a Cali<strong>for</strong>nia lottery store, a gas stati<strong>on</strong> and a c<strong>on</strong>venience store.Dayt<strong>on</strong> Depot CasinoThe Dayt<strong>on</strong> Depot Casino is located in Dayt<strong>on</strong>, Nevada. The Dayt<strong>on</strong> Casino has approximately 14,000 square feet ofcasino space, a family-style restaurant, 219 slot machines and a sports book operated by a third party.Terrible's Town CasinoTerrible's Town Casino in Pahrump, Nevada, which is approximately 60 miles from Las Vegas, has approximately 14,000square feet of gaming space with approximately 343 slot machines, six table games, a race and sports book, a <strong>12</strong>0-seat bingofacility and a restaurant with a buffet.Terrible's Lakeside Casino & RV ParkTerrible's Lakeside Casino & RV Park is located in Pahrump, Nevada and has approximately <strong>10</strong>,000 square feet of gamingspace with 186 slot machines, a race and sports book, 159 RV spaces and a restaurant with buffet.7

Terrible's Searchlight CasinoTerrible's Searchlight Casino is located in Searchlight, Nevada which is approximately 50 miles from Las Vegas, and hasapproximately 4,000 square feet of gaming space with approximately 75 slot machines, a full-service truck stop and a 24-hourcafé.Slot Route Operati<strong>on</strong>sOur slot route operati<strong>on</strong>s, which we divested in February 20<strong>12</strong>, involved <strong>the</strong> exclusive installati<strong>on</strong> and operati<strong>on</strong> of slotmachines in chain store and street account locati<strong>on</strong>s. We defined chain stores as grocery stores, drug stores, merchandise storesand c<strong>on</strong>venience stores, each with more than five locati<strong>on</strong>s. Our chain store c<strong>on</strong>tracts were primarily with large, nati<strong>on</strong>alretailers such as Alberts<strong>on</strong>s, V<strong>on</strong>s, Safeway, CVS and Smith's, as well as Terrible Herbst gas stati<strong>on</strong>s and c<strong>on</strong>venience stores.Street accounts include local bars, restaurants and n<strong>on</strong>-chain c<strong>on</strong>venience stores. Nevada law limits slot route operati<strong>on</strong>s tocertain types of n<strong>on</strong>-casino locati<strong>on</strong>s including bars, taverns, c<strong>on</strong>venience stores, grocery stores and drug stores. Most locati<strong>on</strong>swere limited to offering no more than 15 slot machines. We generally entered into two types of slot route c<strong>on</strong>tracts: spacelease arrangements and revenue-sharing arrangements. Under space lease arrangements, which we principally entered into withchain stores, we paid a fixed m<strong>on</strong>thly fee <strong>for</strong> each locati<strong>on</strong> in which we placed slot machines and we kept <strong>the</strong> revenuesgenerated by <strong>the</strong> slot machines. Under revenue-sharing arrangements, which we typically entered into with street accounts, wepaid <strong>the</strong> locati<strong>on</strong> owner a percentage of <strong>the</strong> revenues generated by our slot machines located at that particular street account.To enter into a revenue-sharing arrangement, <strong>the</strong> locati<strong>on</strong> owner had to hold a gaming license. Both space lease and revenuesharingarrangements typically involved l<strong>on</strong>g-term c<strong>on</strong>tracts that provided us with <strong>the</strong> exclusive right to install our slotmachines at particular locati<strong>on</strong>s. In <strong>the</strong> case of chain stores, our c<strong>on</strong>tracts also gave us <strong>the</strong> exclusive right to install slotmachines at stores opened in <strong>the</strong> future.COMPETITIONNevada MarketTerrible’s Las Vegas and <strong>the</strong> Henders<strong>on</strong> casino compete <strong>for</strong> local gaming customers with o<strong>the</strong>r locals-oriented casinohotelsin Las Vegas. We do not believe that Terrible’s Las Vegas or <strong>the</strong> Henders<strong>on</strong> casino directly compete with many of <strong>the</strong>resort-casino properties <strong>on</strong> <strong>the</strong> Las Vegas Strip, which focus primarily <strong>on</strong> attracting tourist players; instead, its principalcompetitors are o<strong>the</strong>r locals-oriented casinos located near its properties. Terrible’s Las Vegas and <strong>the</strong> Henders<strong>on</strong> casinocompete with o<strong>the</strong>r locals-oriented casino-hotels <strong>on</strong> <strong>the</strong> basis of <strong>the</strong> desirability of locati<strong>on</strong>; payout rates; pers<strong>on</strong>alizedapproach; casino promoti<strong>on</strong>s; <strong>the</strong> availability, com<strong>for</strong>t and value of restaurants and hotel rooms; and <strong>the</strong> variety and value ofentertainment. The c<strong>on</strong>structi<strong>on</strong> of new casinos or <strong>the</strong> expansi<strong>on</strong> of existing casinos near Terrible’s Las Vegas or <strong>the</strong>Henders<strong>on</strong> casino could negatively impact our results of operati<strong>on</strong>s and financial c<strong>on</strong>diti<strong>on</strong>.Our properties in Primm compete <strong>for</strong> value-oriented customers with casinos in <strong>the</strong> Las Vegas market and outside of <strong>the</strong> LasVegas market in places like Henders<strong>on</strong>, Jean, Laughlin and Mesquite, Nevada. The Primm casinos also compete with NativeAmerican properties in Sou<strong>the</strong>rn Cali<strong>for</strong>nia. Primm’s business levels are heavily dependent <strong>on</strong> <strong>the</strong> number of customers it candraw from Interstate 15, which stretches between Las Vegas and Cali<strong>for</strong>nia. We compete with o<strong>the</strong>r gaming companies as wellas o<strong>the</strong>r hospitality companies that provide accommodati<strong>on</strong>s and amenities <strong>for</strong> leisure and business travelers. In many cases,our competiti<strong>on</strong> has greater name recogniti<strong>on</strong> and financial resources to reinvest in <strong>the</strong>ir properties. They offer similarrestaurant, entertainment and o<strong>the</strong>r amenities and target <strong>the</strong> same demographic group we do.Competiti<strong>on</strong> am<strong>on</strong>g casinos in <strong>the</strong> Reno/Sparks market where Rail City is located is intense. The expansi<strong>on</strong> andmaturati<strong>on</strong> of Native American gaming in Nor<strong>the</strong>rn Cali<strong>for</strong>nia has had an adverse impact <strong>on</strong> total gaming revenue of <strong>the</strong> greaterReno area. More Native American casinos and <strong>the</strong> planned expansi<strong>on</strong> of existing casinos in Nor<strong>the</strong>rn Cali<strong>for</strong>nia will increase<strong>the</strong> competitive market. In additi<strong>on</strong>, many of our direct competitors in <strong>the</strong> Reno market have greater financial and o<strong>the</strong>rresources than we do, and competing Reno resorts that <strong>for</strong>merly focused <strong>on</strong> tourists have now turned <strong>the</strong>ir attenti<strong>on</strong> to <strong>the</strong> localsmarket in an attempt to recoup or minimize lost business.Our Nevada properties may face increased competiti<strong>on</strong> from <strong>on</strong>line poker services in Nevada, which would allowcustomers to wager from home via <strong>the</strong> Internet. On February 21, 2013, Nevada, <strong>the</strong> first state in <strong>the</strong> U.S. to legalize <strong>on</strong>linepoker <strong>on</strong> an intrastate basis, expanded its existing interactive gaming laws that permit and regulate <strong>on</strong>line gambling.Specifically, Governor Sandoval signed into law Assembly Bill 114, a law that will also allow Nevada to enter into compactswith o<strong>the</strong>r states that authorize <strong>on</strong>line poker to increase player liquidity by facilitating games between players located inside8

and outside Nevada. The law in this area has been rapidly evolving and additi<strong>on</strong>al legislative developments, in Nevada andelsewhere, may accelerate <strong>the</strong> proliferati<strong>on</strong> of certain <strong>for</strong>ms of <strong>on</strong>line gambling, including, but not limited to, poker, in Nevadaand throughout <strong>the</strong> United States. In additi<strong>on</strong>, many of our competitors in <strong>the</strong> Nevada market have greater financial resourcesthan we do and have already applied or been approved <strong>for</strong> interactive gaming licenses in Nevada to provide <strong>on</strong>line pokerservices. Increases in <strong>the</strong> popularity of and competiti<strong>on</strong> from such services could negatively impact our results of operati<strong>on</strong>sand financial c<strong>on</strong>diti<strong>on</strong>.Midwest MarketEach of Lakeside Iowa, Mark Twain and St Jo competes <strong>for</strong> local gaming customers with o<strong>the</strong>r casinos in <strong>the</strong>ir respectivemarkets.Lakeside Iowa is located al<strong>on</strong>g Interstate 35, approximately 40 miles southwest of Des Moines, Iowa. Its primarycompetitors are <strong>the</strong> Prairie Meadows Casino, <strong>the</strong> Riverside Casino and Golf Resort and <strong>the</strong> Meskwaki Bingo Casino Hotel. ThePrairie Meadows Casino is located approximately 60 miles from Lakeside Iowa, east of Des Moines. Riverside Casino andGolf Resort is located in Riverside, Iowa, approximately 175 miles from Osceola. The Meskwaki Bingo Casino Hotel islocated in Tama, Iowa and is approximately 1<strong>10</strong> miles from Lakeside Iowa. Additi<strong>on</strong>ally, <strong>the</strong> Warren County Board ofSupervisors approved a special electi<strong>on</strong> <strong>for</strong> May 7, 2013 <strong>for</strong> voters in <strong>the</strong> county to decide whe<strong>the</strong>r to approve gambling in <strong>the</strong>county, with certain business and civic leaders proposing to build a casino with an events center, hotel and bowling alley innorthwest Norwalk, approximately 35 miles from Lakeside Iowa, south of Des Moines.Mark Twain is <strong>the</strong> <strong>on</strong>ly casino in nor<strong>the</strong>ast Missouri and is approximately 15 miles from Quincy, Illinois andapproximately 25 miles from Hannibal, Missouri. The closest casino to Mark Twain is <strong>the</strong> Catfish Bend Casino, located inBurlingt<strong>on</strong>, Iowa, which is approximately 75 miles from LaGrange.St Jo is approximately 50 miles north of Kansas City, Missouri. St Jo primarily targets residents of St. Joseph, Missouriand is <strong>the</strong> <strong>on</strong>ly casino in St. Joseph. However, St Jo competes indirectly with five casinos in and around Kansas City, Missouri.In February 20<strong>12</strong>, <strong>the</strong> newest entrant to <strong>the</strong> Kansas City market began operating at <strong>the</strong> Kansas Speedway. Additi<strong>on</strong>ally, <strong>the</strong>legislature has authorized <strong>the</strong> operati<strong>on</strong> of slot machines in a closed race track. To date, <strong>the</strong> owner of that facility has declinedto reopen but c<strong>on</strong>tinued increased competiti<strong>on</strong> could adversely affect our revenue. To a lesser extent, St Jo also competes withseveral Native American casinos, <strong>the</strong> closest of which is approximately 45 miles from St. Joseph.Certain states have recently legalized, and o<strong>the</strong>r states are c<strong>on</strong>sidering legalizing, casino gaming in certain areas. Inadditi<strong>on</strong>, states such as Illinois and Kansas have awarded additi<strong>on</strong>al gaming licenses or are expanding permitted gaming. Inadditi<strong>on</strong>, Iowa was c<strong>on</strong>sidering awarding additi<strong>on</strong>al gaming licenses in <strong>the</strong> state. The award of <strong>on</strong>e or more additi<strong>on</strong>al licensesin Iowa or in o<strong>the</strong>r locati<strong>on</strong>s close to Lakeside Iowa, Mark Twain or St Jo would be expected to adversely affect our results ofoperati<strong>on</strong>s and financial c<strong>on</strong>diti<strong>on</strong>.Colorado MarketThe Black Hawk Casinos compete with approximately 25 o<strong>the</strong>r gaming operati<strong>on</strong>s located in <strong>the</strong> Black Hawk/Central Citygaming market in Colorado. The Black Hawk Casinos are situated directly across <strong>the</strong> street from <strong>on</strong>e of <strong>the</strong> largest casinos in<strong>the</strong> market and collectively have 1,065 slot machines and 39 table games, including 17 live poker tables. Additi<strong>on</strong>ally, <strong>the</strong>Black Hawk Casinos have <strong>on</strong>e of <strong>the</strong> <strong>on</strong>ly parking garages in <strong>the</strong> market with approximately 750 parking spaces. The BlackHawk and Central City gaming market is insulated from o<strong>the</strong>r casino gaming markets, with no casinos within 50 miles. In <strong>the</strong>past, proposals have been made <strong>for</strong> <strong>the</strong> development of Native American, racetrack and video lottery terminal casinosthroughout <strong>the</strong> state. Nei<strong>the</strong>r <strong>the</strong> state’s electorate nor <strong>the</strong> state’s legislature has adopted any of <strong>the</strong>se proposals. Should any<strong>for</strong>m of additi<strong>on</strong>al gaming be authorized in <strong>the</strong> Denver metropolitan area, <strong>the</strong> Black Hawk Casinos would be adversely affected.In 20<strong>12</strong>, <strong>the</strong> House Finance Committee of <strong>the</strong> Colorado House of Representatives c<strong>on</strong>sidered House Bill <strong>12</strong>80, which wouldauthorize <strong>the</strong> installati<strong>on</strong> of video lottery terminals at a locati<strong>on</strong> west of <strong>the</strong> c<strong>on</strong>tinental divide, which is approximately <strong>on</strong>ehundred miles from <strong>the</strong> Central City and Black Hawk gaming markets; however, that bill died in committee.9

INTELLECTUAL PROPERTYThe development of intellectual property is part of our overall business strategy, and we regard our intellectual property tobe an important element of our success. While our business as a whole is not substantially dependent <strong>on</strong> any <strong>on</strong>e patent orcombinati<strong>on</strong> of our patents or o<strong>the</strong>r intellectual property, we seek to establish and maintain our proprietary rights in ourbusiness operati<strong>on</strong>s and technology through <strong>the</strong> use of patents, copyrights, trademarks and trade secret laws. We fileapplicati<strong>on</strong>s <strong>for</strong> and obtain patents, copyrights and trademarks in <strong>the</strong> United States. We also seek to maintain our trade secretsand c<strong>on</strong>fidential in<strong>for</strong>mati<strong>on</strong> by n<strong>on</strong>disclosure policies and through <strong>the</strong> use of appropriate c<strong>on</strong>fidentiality agreements.On December 31, 20<strong>10</strong>, in c<strong>on</strong>necti<strong>on</strong> with <strong>the</strong> Restructuring Transacti<strong>on</strong>s, we acquired all of <strong>the</strong> trademark rights ownedby Predecessor. This included trademarks licensed to Predecessor pursuant to a Trademark License Agreement (<strong>the</strong>“Trademark License”) between Predecessor and Terrible Herbst, Inc., dated August 24, 2001, <strong>for</strong> <strong>the</strong> trademarks “TerribleHerbst,” “Terrible's,” and <strong>the</strong> “bad guy logo.” The license allows <strong>for</strong> exclusive use of <strong>the</strong> marks in <strong>the</strong> states of Nevada,Missouri and Iowa in <strong>the</strong> gaming and casino industry. We have licensed <strong>the</strong> Terrible Herbst trade name from TerribleHerbst, Inc., a related party of Predecessor, through June 2013. Subject to mutual c<strong>on</strong>sent as to <strong>the</strong> amount of <strong>the</strong> license feeand c<strong>on</strong>tinued use, we may extend <strong>the</strong> term of <strong>the</strong> license agreement; however, we cannot assure you whe<strong>the</strong>r or when we willbe able to renew <strong>the</strong> license agreement. Additi<strong>on</strong>ally, we were assigned trademark rights <strong>for</strong>merly owned by Predecessor <strong>for</strong><strong>the</strong> following trademarks and <strong>the</strong> respective design logos: “Buffalo Bill's Resort & Casino,” “Desperado,” “Pi<strong>on</strong>eer Pete's,”“Primm Center,” “Primm Rewards Players Club,” “Primm Valley Casino Resorts,” “Primm Valley Lotto Store,” “PrimmValley Resort,” “Primm Valley Resort & Casino,” “Star of <strong>the</strong> Desert Arena,” “Whiskey Pete's,” “Whiskey Pete's HotelCasino,” “Rail City,” and “Rail City Ale House.” Since <strong>the</strong> Emergence Date, we have applied <strong>for</strong> federal registrati<strong>on</strong>s <strong>for</strong> <strong>the</strong>trademarks, “<strong>Affinity</strong> <strong>Gaming</strong>” and “A-Play,” and recently acquired all of <strong>the</strong> trademark rights <strong>for</strong> <strong>the</strong> Black Hawk Casinos.We c<strong>on</strong>sider all of <strong>the</strong>se marks, and <strong>the</strong> associated name recogniti<strong>on</strong>, to be valuable to our business, and we are not awareof any third party claims against <strong>the</strong> use or registrati<strong>on</strong> of our trademarks at this time.E-T-T, Inc. (“E-T-T”), a subsidiary of Predecessor which c<strong>on</strong>verted to E-T-T, LLC as part of <strong>the</strong> RestructuringTransacti<strong>on</strong>s, is <strong>the</strong> owner of technology and pending patents <strong>for</strong> a casino player payment system. These inventi<strong>on</strong>s are referredto as <strong>the</strong> “Secure Safe System” and “Safe Patents.” In c<strong>on</strong>necti<strong>on</strong> with <strong>the</strong> sale of <strong>the</strong> slot route, we sold <strong>the</strong> Secure SafeSystem and Safe Patents to Golden <strong>Gaming</strong>.SEASONALITYWe do not believe that our business reflects seas<strong>on</strong>al trends to any significant degree. However, our casinos in <strong>the</strong>Midwest and in Nor<strong>the</strong>rn Nevada do experience some business interrupti<strong>on</strong> during <strong>the</strong> winter m<strong>on</strong>ths. Additi<strong>on</strong>ally, ourcasinos in Missouri are subject to flooding depending <strong>on</strong> <strong>the</strong> water levels of <strong>the</strong> Missouri and Mississippi Rivers. We alsoexpect that our Black Hawk Casinos will experience similar business disrupti<strong>on</strong> during <strong>the</strong> winter m<strong>on</strong>ths.ENVIRONMENTAL LAWSCompliance with federal, state and local laws enacted <strong>for</strong> <strong>the</strong> protecti<strong>on</strong> of <strong>the</strong> envir<strong>on</strong>ment to date had no material effectup<strong>on</strong> our capital expenditures, earnings or competitive positi<strong>on</strong>. We are currently building a new travel center in Primm,Nevada. In c<strong>on</strong>necti<strong>on</strong> with <strong>the</strong> c<strong>on</strong>structi<strong>on</strong>, we have encountered c<strong>on</strong>taminated soil requiring remediati<strong>on</strong>. Thec<strong>on</strong>taminati<strong>on</strong> resulted from a gas stati<strong>on</strong> operated more than 30 <strong>year</strong>s ago, and from aband<strong>on</strong>ed underground fuel lines.Through December 31, 20<strong>12</strong>, we have spent approximately $3.2 milli<strong>on</strong> <strong>on</strong> remediati<strong>on</strong> work, and we estimate that suchamount could increase to approximately $4 milli<strong>on</strong>. The amounts spent <strong>on</strong> remediati<strong>on</strong> are incremental to our plannedexpenditures <strong>on</strong> <strong>the</strong> project. We cannot provide assurance that we have accurately estimated or identified <strong>the</strong> scope of <strong>the</strong> issueor <strong>the</strong> impact that this remediati<strong>on</strong> will have <strong>on</strong> our capital expenditures, earnings or competitive positi<strong>on</strong> as we complete <strong>the</strong>project. Although we maintain insurance coverage, and have submitted an insurance claim <strong>for</strong> <strong>the</strong> cost of remediati<strong>on</strong>, <strong>the</strong>potential liability related <strong>the</strong>reto may exceed <strong>the</strong> amount of our insurance coverage or may be excluded under <strong>the</strong> terms of <strong>the</strong>policy, which could have a material adverse effect <strong>on</strong> our business, financial c<strong>on</strong>diti<strong>on</strong> and results of operati<strong>on</strong>s. Additi<strong>on</strong>ally,we may be required to make additi<strong>on</strong>al expenditures to remain in, or to achieve, compliance with envir<strong>on</strong>mental laws in <strong>the</strong>future and such expenditures may be material.<strong>10</strong>

GOVERNMENTAL REGULATIONThe gaming industry is highly regulated, and we must maintain our licenses and pay gaming taxes to c<strong>on</strong>tinue ouroperati<strong>on</strong>s. Each of our casinos is subject to extensive regulati<strong>on</strong> under <strong>the</strong> laws, rules and regulati<strong>on</strong>s of <strong>the</strong> jurisdicti<strong>on</strong> whereit is located. These laws, rules and regulati<strong>on</strong>s generally c<strong>on</strong>cern <strong>the</strong> resp<strong>on</strong>sibility, financial stability and character of <strong>the</strong>owners, managers, and pers<strong>on</strong>s with financial interests in <strong>the</strong> gaming operati<strong>on</strong>s. Violati<strong>on</strong>s of laws in <strong>on</strong>e jurisdicti<strong>on</strong> couldresult in disciplinary acti<strong>on</strong> in o<strong>the</strong>r jurisdicti<strong>on</strong>s.Our businesses are subject to various federal, state and local laws and regulati<strong>on</strong>s in additi<strong>on</strong> to gaming regulati<strong>on</strong>s. Theselaws and regulati<strong>on</strong>s include, but are not limited to, restricti<strong>on</strong>s and c<strong>on</strong>diti<strong>on</strong>s c<strong>on</strong>cerning alcoholic beverages, envir<strong>on</strong>mentalmatters, employees, currency transacti<strong>on</strong>s, taxati<strong>on</strong>, z<strong>on</strong>ing and building codes, and marketing and advertising. Such laws andregulati<strong>on</strong>s could change or could be interpreted differently in <strong>the</strong> future, or new laws and regulati<strong>on</strong>s could be enacted.Material changes, new laws or regulati<strong>on</strong>s, or material differences in interpretati<strong>on</strong>s by courts or governmental authorities couldadversely affect our operating results.NevadaThe ownership and operati<strong>on</strong> of casino gaming facilities and slot routes in Nevada are subject to <strong>the</strong> Nevada <strong>Gaming</strong>C<strong>on</strong>trol Act and <strong>the</strong> regulati<strong>on</strong>s promulgated <strong>the</strong>reunder, or <strong>the</strong> Nevada Act, and various local regulati<strong>on</strong>s.Our gaming operati<strong>on</strong>s are subject to <strong>the</strong> licensing and regulatory c<strong>on</strong>trol of <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong>, <strong>the</strong> NevadaState <strong>Gaming</strong> C<strong>on</strong>trol Board, <strong>the</strong> Clark County Liquor and <strong>Gaming</strong> Licensing Board, and <strong>the</strong> Cities of Reno, Henders<strong>on</strong> ando<strong>the</strong>r local regulatory authorities (collectively, <strong>the</strong> “Nevada <strong>Gaming</strong> Authorities”).The laws, regulati<strong>on</strong>s and supervisory procedures of <strong>the</strong> Nevada <strong>Gaming</strong> Authorities are based up<strong>on</strong> declarati<strong>on</strong>s of publicpolicy which are c<strong>on</strong>cerned with, am<strong>on</strong>g o<strong>the</strong>r things:• <strong>the</strong> preventi<strong>on</strong> of unsavory or unsuitable pers<strong>on</strong>s from having a direct or indirect involvement with gaming at any timeor in any capacity;• <strong>the</strong> establishment and maintenance of resp<strong>on</strong>sible accounting practices and procedures;• <strong>the</strong> maintenance of effective c<strong>on</strong>trols over <strong>the</strong> financial practices of licensees, including <strong>the</strong> establishment of minimumprocedures <strong>for</strong> internal fiscal affairs and <strong>the</strong> safeguarding of assets and revenues, providing reliable record keeping andrequiring <strong>the</strong> filing of periodic reports with <strong>the</strong> Nevada <strong>Gaming</strong> Authorities;• <strong>the</strong> preventi<strong>on</strong> of cheating and fraudulent practices; and• providing a source of state and local revenues through taxati<strong>on</strong> and licensing fees.Changes in <strong>the</strong>se laws, regulati<strong>on</strong>s and procedures could have an adverse effect <strong>on</strong> our gaming operati<strong>on</strong>s.Entities that operate casinos in Nevada are required to be licensed by <strong>the</strong> Nevada <strong>Gaming</strong> Authorities. A gaming license<strong>for</strong> such activities requires <strong>the</strong> periodic payment of fees and taxes and is not transferable. <strong>Affinity</strong> <strong>Gaming</strong> is registered by <strong>the</strong>Nevada <strong>Gaming</strong> Commissi<strong>on</strong> as a publicly traded corporati<strong>on</strong> (a “registered corporati<strong>on</strong>”). As a registered corporati<strong>on</strong>, we arerequired periodically to submit detailed financial and operating reports to <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> and furnish anyo<strong>the</strong>r in<strong>for</strong>mati<strong>on</strong> that <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> may require. <strong>Affinity</strong> <strong>Gaming</strong> has been found suitable by <strong>the</strong> Nevada<strong>Gaming</strong> Commissi<strong>on</strong> to own <strong>the</strong> membership interests of various licensed limited liability companies that own and operatecasinos licensed by <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> (all of which are collectively referred to as <strong>the</strong> “<strong>Gaming</strong> Subsidiaries”).No pers<strong>on</strong> may become a member of, or receive any percentage of <strong>the</strong> profits from any of <strong>the</strong> <strong>Gaming</strong> Subsidiaries without firstobtaining licenses and approvals from <strong>the</strong> Nevada <strong>Gaming</strong> Authorities. <strong>Affinity</strong> <strong>Gaming</strong> and all of its <strong>Gaming</strong> Subsidiarieshave obtained from <strong>the</strong> Nevada <strong>Gaming</strong> Authorities <strong>the</strong> various registrati<strong>on</strong>s, approvals, permits and licenses required in orderto engage in <strong>the</strong> various gaming businesses that each respectively operates in Nevada.The Nevada <strong>Gaming</strong> Authorities may investigate any individual who has a material relati<strong>on</strong>ship to, or materialinvolvement with, <strong>Affinity</strong> <strong>Gaming</strong> or any of <strong>the</strong> <strong>Gaming</strong> Subsidiaries in order to determine whe<strong>the</strong>r such individual is suitableor should be licensed as a business associate of a gaming licensee. Officers, directors, managers and certain key employees of<strong>Affinity</strong> <strong>Gaming</strong> or any of <strong>the</strong> <strong>Gaming</strong> Subsidiaries must file applicati<strong>on</strong>s with <strong>the</strong> Nevada <strong>Gaming</strong> Authorities and arerequired to be licensed by <strong>the</strong> Nevada <strong>Gaming</strong> Authorities. The Nevada <strong>Gaming</strong> Authorities may deny an applicati<strong>on</strong> <strong>for</strong>11

licensing <strong>for</strong> any cause that <strong>the</strong>y deem reas<strong>on</strong>able. A finding of suitability is comparable to licensing, and both requiresubmissi<strong>on</strong> of detailed pers<strong>on</strong>al and financial in<strong>for</strong>mati<strong>on</strong> followed by a thorough investigati<strong>on</strong>. Changes in licensed positi<strong>on</strong>smust be reported to <strong>the</strong> Nevada <strong>Gaming</strong> Authorities and, in additi<strong>on</strong> to <strong>the</strong>ir authority to deny an applicati<strong>on</strong> <strong>for</strong> a finding ofsuitability or licensure, <strong>the</strong> Nevada <strong>Gaming</strong> Authorities have jurisdicti<strong>on</strong> to disapprove any change in corporate positi<strong>on</strong>.If <strong>the</strong> Nevada <strong>Gaming</strong> Authorities were to find an officer, director, manager or key employee unsuitable <strong>for</strong> licensing orunsuitable to c<strong>on</strong>tinue having a relati<strong>on</strong>ship with us, we would have to sever all relati<strong>on</strong>ships with that pers<strong>on</strong>. In additi<strong>on</strong>, <strong>the</strong>Nevada <strong>Gaming</strong> Commissi<strong>on</strong> may require us to terminate <strong>the</strong> employment of any pers<strong>on</strong> who refuses to file appropriateapplicati<strong>on</strong>s. Determinati<strong>on</strong>s of suitability or of questi<strong>on</strong>s pertaining to licensing are not subject to judicial review in Nevada.<strong>Affinity</strong> <strong>Gaming</strong> and <strong>the</strong> <strong>Gaming</strong> Subsidiaries are required to submit detailed financial and operating reports to <strong>the</strong> Nevada<strong>Gaming</strong> Commissi<strong>on</strong>. Substantially all material loans, leases, sales of securities and similar financing transacti<strong>on</strong>s by <strong>Affinity</strong><strong>Gaming</strong> and its <strong>Gaming</strong> Subsidiaries must be reported to and/or approved by, <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong>.If it were determined that <strong>Affinity</strong> <strong>Gaming</strong> or any of its <strong>Gaming</strong> Subsidiaries violated <strong>the</strong> Nevada gaming laws, our gaminglicenses and registrati<strong>on</strong>s with <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> could be limited, c<strong>on</strong>diti<strong>on</strong>ed, susp<strong>ended</strong> or revoked, subject tocompliance with certain statutory and regulatory procedures. In additi<strong>on</strong>, <strong>Affinity</strong> <strong>Gaming</strong>, <strong>the</strong> <strong>Gaming</strong> Subsidiaries and <strong>the</strong>pers<strong>on</strong>s involved could be subject to substantial fines <strong>for</strong> each separate violati<strong>on</strong> of <strong>the</strong> Nevada laws at <strong>the</strong> discreti<strong>on</strong> of <strong>the</strong>Nevada <strong>Gaming</strong> Commissi<strong>on</strong>. Fur<strong>the</strong>r, <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> could appoint a supervisor to operate our gamingproperties and, under certain circumstances, earnings generated during <strong>the</strong> supervisor's appointment (except <strong>for</strong> <strong>the</strong> reas<strong>on</strong>ablerental value of our gaming properties) could be <strong>for</strong>feited to <strong>the</strong> State of Nevada. Limitati<strong>on</strong>, c<strong>on</strong>diti<strong>on</strong>ing or suspensi<strong>on</strong> of anygaming license or <strong>the</strong> appointment of a supervisor could (and revocati<strong>on</strong> of any gaming license would) materially adverselyaffect our operati<strong>on</strong>s.Any beneficial holder of <strong>Affinity</strong> <strong>Gaming</strong>'s voting or n<strong>on</strong>-voting securities, regardless of <strong>the</strong> number of shares owned, maybe required to file an applicati<strong>on</strong>, be investigated and have his or her suitability as a beneficial holder of <strong>Affinity</strong> <strong>Gaming</strong>'svoting or n<strong>on</strong>-voting securities determined if <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> has reas<strong>on</strong> to believe that such ownership wouldbe inc<strong>on</strong>sistent with <strong>the</strong> declared policies of <strong>the</strong> State of Nevada. If such beneficial holder who must be found suitable is acorporati<strong>on</strong>, limited liability company, partnership or trust, it must submit detailed business and financial in<strong>for</strong>mati<strong>on</strong> includinga list of its beneficial owners. The applicant must pay all costs of investigati<strong>on</strong> incurred by <strong>the</strong> Nevada <strong>Gaming</strong> Authorities inc<strong>on</strong>necti<strong>on</strong> with c<strong>on</strong>ducting such investigati<strong>on</strong>.The Nevada Act requires any pers<strong>on</strong> who acquires more than 5% of a registered corporati<strong>on</strong>'s voting securities to report <strong>the</strong>acquisiti<strong>on</strong> to <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong>. The Nevada Act requires beneficial owners of more than <strong>10</strong>% of a registeredcorporati<strong>on</strong>'s voting securities apply to <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> <strong>for</strong> a finding of suitability within 30 days after <strong>the</strong>Chairman of <strong>the</strong> Nevada State <strong>Gaming</strong> C<strong>on</strong>trol Board mails <strong>the</strong> written notice requiring such filing. However, an “instituti<strong>on</strong>alinvestor,” as defined in <strong>the</strong> Nevada Act, that beneficially owns more than <strong>10</strong>%, but not more than 11%, of a registeredcorporati<strong>on</strong>'s voting securities as a result of a stock repurchase by <strong>the</strong> registered corporati<strong>on</strong> may not be required to file such anapplicati<strong>on</strong>. Fur<strong>the</strong>r, an instituti<strong>on</strong>al investor that acquires more than <strong>10</strong>%, but not more than 25%, of a registered corporati<strong>on</strong>'svoting securities may apply to <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> <strong>for</strong> a waiver of a finding of suitability if that instituti<strong>on</strong>alinvestor holds <strong>the</strong> voting securities <strong>for</strong> investment purposes <strong>on</strong>ly. An instituti<strong>on</strong>al investor that has obtained a waiver may holdmore than 25%, but not more than 29%, of a registered corporati<strong>on</strong>'s voting securities and maintain its waiver if <strong>the</strong> additi<strong>on</strong>alownership results from a stock repurchase by <strong>the</strong> registered corporati<strong>on</strong>. An instituti<strong>on</strong>al investor will not be deemed to holdvoting securities <strong>for</strong> investment purposes unless <strong>the</strong> voting securities were acquired and are held in <strong>the</strong> ordinary course ofbusiness as an instituti<strong>on</strong>al investor and not <strong>for</strong> <strong>the</strong> purpose of causing, directly or indirectly, <strong>the</strong> electi<strong>on</strong> of a majority of <strong>the</strong>members of <strong>the</strong> board of directors of <strong>the</strong> registered corporati<strong>on</strong>, any change in <strong>the</strong> corporate charter, bylaws, management,policies or operati<strong>on</strong>s of <strong>the</strong> registered corporati<strong>on</strong>, or any of its gaming affiliates or any o<strong>the</strong>r acti<strong>on</strong> which <strong>the</strong> Nevada <strong>Gaming</strong>Commissi<strong>on</strong> finds to be inc<strong>on</strong>sistent with holding <strong>the</strong> registered corporati<strong>on</strong>'s voting securities <strong>for</strong> investment purposes <strong>on</strong>ly.Activities which are not deemed to be inc<strong>on</strong>sistent with holding voting securities <strong>for</strong> investment purposes <strong>on</strong>ly include:• <strong>the</strong> preventi<strong>on</strong> of unsavory or unsuitable pers<strong>on</strong>s from having a direct or indirect involvement with gaming at any timeor in any capacity;• <strong>the</strong> establishment and maintenance of resp<strong>on</strong>sible accounting practices and procedures;• <strong>the</strong> maintenance of effective c<strong>on</strong>trols over <strong>the</strong> financial practices of licensees, including <strong>the</strong> establishment of minimumprocedures <strong>for</strong> internal fiscal affairs and <strong>the</strong> safeguarding of assets and revenues, providing reliable record keeping andrequiring <strong>the</strong> filing of periodic reports with <strong>the</strong> Nevada <strong>Gaming</strong> Authorities;• <strong>the</strong> preventi<strong>on</strong> of cheating and fraudulent practices;<strong>12</strong>

• providing a source of state and local revenues through taxati<strong>on</strong> and licensing fees;• voting <strong>on</strong> all matters voted <strong>on</strong> by stockholders;• making financial and o<strong>the</strong>r inquiries of management of <strong>the</strong> type normally made by securities analysts <strong>for</strong> in<strong>for</strong>mati<strong>on</strong>alpurposes and not to cause a change in its management, policies or operati<strong>on</strong>s; and• o<strong>the</strong>r activities as <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> may determine to be c<strong>on</strong>sistent with such investment intent.Any pers<strong>on</strong> who fails or refuses to apply <strong>for</strong> a finding of suitability or a license within 30 days after being ordered to do soby <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> or by <strong>the</strong> Chairman of <strong>the</strong> Nevada State <strong>Gaming</strong> C<strong>on</strong>trol Board, may be found unsuitable.The same restricti<strong>on</strong>s apply to a record owner if <strong>the</strong> record owner, after request, fails to identify <strong>the</strong> beneficial owner. Anystockholder found unsuitable and who holds, directly or indirectly, any beneficial ownership of <strong>the</strong> comm<strong>on</strong> stock of aregistered corporati<strong>on</strong> bey<strong>on</strong>d <strong>the</strong> period of time as may be prescribed by <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> may be guilty of acriminal offense. <strong>Affinity</strong> <strong>Gaming</strong> and <strong>the</strong> <strong>Gaming</strong> Subsidiaries may become subject to disciplinary acti<strong>on</strong> if, after receipt ofnotice that a pers<strong>on</strong> is unsuitable to be a stockholder or to have any o<strong>the</strong>r relati<strong>on</strong>ship with <strong>Affinity</strong> <strong>Gaming</strong> or <strong>the</strong> <strong>Gaming</strong>Subsidiaries, <strong>Affinity</strong> <strong>Gaming</strong>:• pays that pers<strong>on</strong> any dividend or interest up<strong>on</strong> voting securities;• allows that pers<strong>on</strong> to exercise, directly or indirectly, any voting right c<strong>on</strong>ferred through securities held by that pers<strong>on</strong>;• pays remunerati<strong>on</strong> in any <strong>for</strong>m to that pers<strong>on</strong> <strong>for</strong> services rendered or o<strong>the</strong>rwise; or• fails to pursue all lawful ef<strong>for</strong>ts to require <strong>the</strong> unsuitable pers<strong>on</strong> to relinquish his voting securities <strong>for</strong> cash at fairmarket value.Additi<strong>on</strong>ally, <strong>the</strong> Clark County Liquor and <strong>Gaming</strong> Licensing Board, which has jurisdicti<strong>on</strong> over five of our six Nevadacasinos, has taken <strong>the</strong> positi<strong>on</strong> that it has <strong>the</strong> authority to approve all pers<strong>on</strong>s owning or c<strong>on</strong>trolling <strong>the</strong> stock of any entityc<strong>on</strong>trolling a gaming license.<strong>Affinity</strong> <strong>Gaming</strong> may be required to disclose to <strong>the</strong> Nevada State <strong>Gaming</strong> C<strong>on</strong>trol Board and <strong>the</strong> Nevada <strong>Gaming</strong>Commissi<strong>on</strong> <strong>the</strong> identities of all holders of its debt securities. The Nevada <strong>Gaming</strong> Commissi<strong>on</strong> may, in its discreti<strong>on</strong>, require<strong>the</strong> holder of any debt or similar security of a registered corporati<strong>on</strong> to file applicati<strong>on</strong>s, be investigated and be found suitable toown <strong>the</strong> debt or o<strong>the</strong>r security of a registered corporati<strong>on</strong>. If <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> determines that a pers<strong>on</strong> isunsuitable to own <strong>the</strong> security, <strong>the</strong>n pursuant to Nevada law, <strong>the</strong> registered corporati<strong>on</strong> can be sancti<strong>on</strong>ed, including <strong>the</strong> loss ofits approvals, if without <strong>the</strong> prior approval of <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong>, it:• pays to <strong>the</strong> unsuitable pers<strong>on</strong> any dividend, interest, or any distributi<strong>on</strong> whatsoever;• recognizes any voting right by <strong>the</strong> unsuitable pers<strong>on</strong> in c<strong>on</strong>necti<strong>on</strong> with debt securities;• pays <strong>the</strong> unsuitable pers<strong>on</strong> remunerati<strong>on</strong> in any <strong>for</strong>m; or• makes any payment to <strong>the</strong> unsuitable pers<strong>on</strong> by way of principal, redempti<strong>on</strong>, c<strong>on</strong>versi<strong>on</strong>, exchange, liquidati<strong>on</strong> orsimilar transacti<strong>on</strong>.<strong>Affinity</strong> <strong>Gaming</strong> is required to maintain a current stock ledger in Nevada, which may be examined by <strong>the</strong> Nevada <strong>Gaming</strong>Authorities at any time. If any securities are held in trust by an agent or by a nominee, <strong>the</strong> record holder may be required todisclose <strong>the</strong> identity of <strong>the</strong> beneficial holder to <strong>the</strong> Nevada <strong>Gaming</strong> Authorities. A failure to make such disclosure may begrounds <strong>for</strong> finding <strong>the</strong> record holder unsuitable. We are also required to render maximum assistance in determining <strong>the</strong>identity of <strong>the</strong> beneficial owner. The Nevada <strong>Gaming</strong> Commissi<strong>on</strong> has <strong>the</strong> power to require our securities to bear a legendindicating that <strong>the</strong> securities are subject to <strong>the</strong> Nevada Act.<strong>Affinity</strong> <strong>Gaming</strong> may not make a public offering of securities without <strong>the</strong> prior approval of <strong>the</strong> Nevada <strong>Gaming</strong>Commissi<strong>on</strong> if <strong>the</strong> proceeds from <strong>the</strong> offering are int<strong>ended</strong> to be used to c<strong>on</strong>struct, acquire or finance gaming facilities inNevada, or to retire or extend obligati<strong>on</strong>s incurred <strong>for</strong> those purposes or similar transacti<strong>on</strong>s. Fur<strong>the</strong>rmore, any such approval,if granted, does not c<strong>on</strong>stitute a finding, recommendati<strong>on</strong> or approval by <strong>the</strong> Nevada <strong>Gaming</strong> Commissi<strong>on</strong> or <strong>the</strong> Nevada State13