iSTOXX® EUROPE MINIMUM VARIANCE INDEX - STOXX.com

iSTOXX® EUROPE MINIMUM VARIANCE INDEX - STOXX.com

iSTOXX® EUROPE MINIMUM VARIANCE INDEX - STOXX.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STRATEGY <strong>INDEX</strong><br />

<strong>i<strong>STOXX</strong>®</strong> <strong>EUROPE</strong> <strong>MINIMUM</strong> <strong>VARIANCE</strong> <strong>INDEX</strong><br />

<strong>STOXX</strong>® GLOBAL TMI<br />

<strong>STOXX</strong>® GLOBAL 1800<br />

REGIONS SIZES SUPERSECTORS STYLE, STRATEGIES & THEME BLUE CHIPS<br />

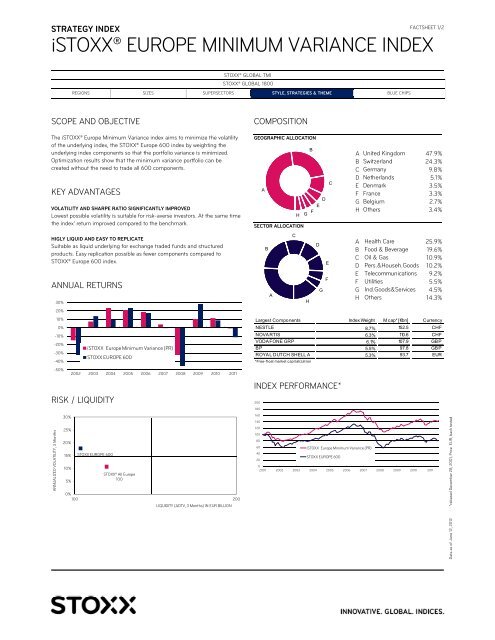

SCOPE AND OBJECTIVE<br />

The <strong>i<strong>STOXX</strong>®</strong> Europe Minimum Variance index aims to minimize the volatility<br />

of the underlying index, the <strong>STOXX</strong>® Europe 600 index by weighting the<br />

underlying index <strong>com</strong>ponents so that the portfolio variance is minimized.<br />

Optimization results show that the minimum variance portfolio can be<br />

created without the need to trade all 600 <strong>com</strong>ponents.<br />

KEY ADVANTAGES<br />

VOLATILITY AND SHARPE RATIO SIGNIFICANTLY IMPROVED<br />

Lowest possible volatility is suitable for risk-averse investors. At the same time<br />

the index’ return improved <strong>com</strong>pared to the benchmark.<br />

HIGLY LIQUID AND EASY TO REPLICATE<br />

Suitable as liquid underlying for exchange traded funds and structured<br />

products. Easy replication possible as fewer <strong>com</strong>ponents <strong>com</strong>pared to<br />

<strong>STOXX</strong>® Europe 600 index.<br />

ANNUAL RETURNS<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

i<strong>STOXX</strong> Europe Minimum Variance (PR)<br />

<strong>STOXX</strong> <strong>EUROPE</strong> 600<br />

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

RISK / LIQUIDITY<br />

ANNUALIZED VOLATILITY, 3 Months<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

<strong>STOXX</strong> <strong>EUROPE</strong> 600<br />

<strong>STOXX</strong>® All Europe<br />

100<br />

0%<br />

100 200<br />

LIQUIDITY (ADTV, 3 Months) IN EUR BILLION<br />

COMPOSITION<br />

GEOGRAPHIC ALLOCATION<br />

A<br />

SECTOR ALLOCATION<br />

B<br />

A<br />

C<br />

B<br />

D<br />

E<br />

F<br />

H G<br />

H<br />

D<br />

G<br />

E<br />

F<br />

C<br />

FACTSHEET 1/2<br />

A United Kingdom 47.9%<br />

B Switzerland 24.3%<br />

C Germany 9.8%<br />

D Netherlands 5.1%<br />

E Denmark 3.5%<br />

F France 3.3%<br />

G Belgium 2.7%<br />

H Others 3.4%<br />

A Health Care 25.9%<br />

B Food & Beverage 19.6%<br />

C Oil & Gas 10.9%<br />

D Pers.&Househ.Goods 10.2%<br />

E Tele<strong>com</strong>munications 9.2%<br />

F Utilities 5.5%<br />

G Ind.Goods&Services 4.5%<br />

H Others 14.3%<br />

Largest Components Index Weight M cap* [€ bn] Currency<br />

NESTLE 8.7% 152.5 C H F<br />

NOVA RTIS 6.3% 110.6 C H F<br />

VODAFONE GRP 6.1% 107.9 GB P<br />

B P 5.5% 97.8 GBP<br />

ROYAL DUTCH SHELL A 5.3% 93.7 EUR<br />

*Free-f loat market capit alization<br />

<strong>INDEX</strong> PERFORMANCE*<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

i<strong>STOXX</strong> Europe Minimum Variance (PR)<br />

40<br />

20<br />

0<br />

<strong>STOXX</strong> <strong>EUROPE</strong> 600<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Data as of June 12, 2012 *rebased December 28, 2001, Price EUR, back tested

FACTSHEET 2/2<br />

STRATEGY <strong>INDEX</strong><br />

<strong>i<strong>STOXX</strong>®</strong> <strong>EUROPE</strong> <strong>MINIMUM</strong> <strong>VARIANCE</strong> <strong>INDEX</strong><br />

<strong>INDEX</strong> METHODOLOGY<br />

On the basis of the <strong>STOXX</strong>® Europe 600 index, the <strong>com</strong>ponents are ranked<br />

according to their liquidity (ADTV over 50 days). The top 300 constituents are<br />

selected.<br />

The remaining index constituents are then weighted using an optimization<br />

procedure that aims to minimize portfolio variance under certain constraints.<br />

The mathematical model minimizes the variance of the <strong>STOXX</strong>® Europe 600<br />

index portfolio.<br />

To avoid extreme <strong>com</strong>pany or sector concentrations, the constituent level is<br />

capped at 4.5% and the sector level at 20%.<br />

Quick Facts<br />

Weighting scheme Free float market capitalization and liquidity<br />

Review frequency M onthly<br />

Components Variable<br />

Component capping 4.5% for <strong>com</strong>ponents, 20% for sectors<br />

Currencies EUR<br />

Calculation hours 9:00 - 17:45 CET<br />

Calculation frequencies Realtime 15 sec., End-of-Day<br />

Launch date June 24, 2011<br />

Base value 100 as of December 28, 2001<br />

History back to December 28, 2001<br />

VERSIONS AND SYMBOLS<br />

Index ISIN Symbol Bloomberg Reuters<br />

Price EUR CH0124001618 ISEM VP ISEM VP Index .ISEM VP<br />

Net Ret. EUR CH0124001543 ISEM VT ISEM VT Index .ISEM VT<br />

Grs. Ret. EUR CH0128395313 ISEM VGT ISEM VGT Index .ISEM VGT<br />

<strong>STOXX</strong> is part of Deutsche Börse and SIX<br />

ABOUT <strong>STOXX</strong><br />

<strong>STOXX</strong> Ltd. is part of Deutsche Börse and SIX Group, and is an independent, leading index<br />

specialist. <strong>STOXX</strong> is providing innovative index solutions for global markets and across all asset<br />

classes. The indices are licensed to the world’s largest issuers of financial products, capital owners<br />

and asset managers as well as to more than 400 <strong>com</strong>panies around the world.<br />

CUSTOMIZATION<br />

The index can be used as basis for the definition of Customized indices, which can be tailored to<br />

specific client or mandate needs. <strong>STOXX</strong> offers customization in almost unlimited forms for<br />

example in terms of <strong>com</strong>ponent selection, weighting schemes and personalized calculation<br />

methodologies.<br />

DISCLAIMER<br />

<strong>STOXX</strong>® indices are protected through intellectual property rights. ‘<strong>STOXX</strong>’ and ‘EURO <strong>STOXX</strong> 50’<br />

are registered trademarks. The use of the <strong>STOXX</strong>® indices for financial products or for other<br />

purposes requires a license from <strong>STOXX</strong>. <strong>STOXX</strong> does not make any warranties or<br />

representations, express or implied with respect to the timeliness, sequence, accuracy,<br />

KEY RATIOS<br />

Name<br />

i<strong>STOXX</strong> Europe<br />

Minimum Variance (PR)<br />

Performance YTD 2.3% -0.4%<br />

Performance 1 Y -0.4% -9.4%<br />

Performance 3 Y (annualized) 8.0% 4.3%<br />

Performance 5 Y (annualized) -3.8% -9.2%<br />

Volatility 30 D (annualized) 10.5% 18.0%<br />

Volatility 1 Y (annualized) 13.4% 22.9%<br />

Sharpe ratio 1 Y -0.13 -0.47<br />

M arket capitalization (EUR) 1762 bn 4864 bn<br />

M arket capitalization (USD) 2507 bn 6920 bn<br />

ADTV (3 months, EUR) 120 bn 104 bn<br />

P/E (trailing) 19.0 22.2<br />

P/E (projected) 15.4 13.4<br />

Dividended yield 2.3% 2.5%<br />

Price/Book 3.1 1.6<br />

KEY PERFORMANCE<br />

<strong>STOXX</strong> <strong>EUROPE</strong> 600<br />

The <strong>i<strong>STOXX</strong>®</strong> Europe Minimum Variance index shows a significant increase of<br />

return <strong>com</strong>pared to the underlying <strong>STOXX</strong>® Europe 600 index.<br />

<strong>com</strong>pleteness, currentness, merchantability, quality or fitness for any particular purpose of its<br />

index data. <strong>STOXX</strong>® is not providing investment advice through the publication of the <strong>STOXX</strong>®<br />

indices or in connection therewith. In particular, the inclusion of a <strong>com</strong>pany in an index, its<br />

weighting, or the exclusion of a <strong>com</strong>pany from an index, does not in any way reflect an opinion of<br />

<strong>STOXX</strong> on the merits of that <strong>com</strong>pany. Financial instruments based on the <strong>STOXX</strong>® indices are in<br />

no way sponsored, endorsed, sold or promoted by <strong>STOXX</strong>.<br />

BACK TESTED PERFORMANCE<br />

This document contains index performance data based on back testing, i.e. calculations of how<br />

the index might have performed prior to launch if it had existed using the same index<br />

methodology and based on historical constituents. Back tested performance information is purely<br />

hypothetical and is provided in this document solely for information purposes. Back tested<br />

performance does not represent actual performance and should not be interpreted as an<br />

indication of actual performance.<br />

CONTACT DETAILS<br />

<strong>STOXX</strong> Customer Support Zurich/Headquarters Madrid: P +34 (0)91 369 1229 New York: P +1 212 669 6426 Singapore: P +65 9189 7970<br />

P +41 (0)58 399 5900 P +41 (0)58 399 5300 Frankfurt: P +49 (0)69 211 0 London: P +44 (0)207 862 7680 Tokyo: P + 81 (0)3 5847 8215<br />

customersupport@stoxx.<strong>com</strong> www.stoxx.<strong>com</strong> Paris: P +33 (0)1 4070 8004 Stockholm: P +46 (0)8 4600 6090 Hong Kong: P +852 6307 9316