2011 Annual Illustrative IFRS Financial Statements - BDO Canada

2011 Annual Illustrative IFRS Financial Statements - BDO Canada

2011 Annual Illustrative IFRS Financial Statements - BDO Canada

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

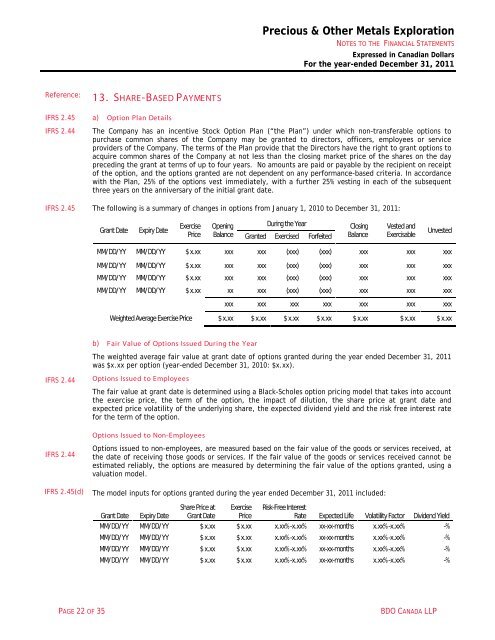

Precious & Other Metals ExplorationNOTES TO THE FINANCIAL STATEMENTSExpressed in Canadian DollarsFor the year-ended December 31, <strong>2011</strong>Reference:<strong>IFRS</strong> 2.45<strong>IFRS</strong> 2.4413. SHARE-BASED PAYMENT Sa) Option Plan DetailsThe Company has an incentive Stock Option Plan (“the Plan”) under which non-transferable options topurchase common shares of the Company may be granted to directors, officers, employees or serviceproviders of the Company. The terms of the Plan provide that the Directors have the right to grant options toacquire common shares of the Company at not less than the closing market price of the shares on the daypreceding the grant at terms of up to four years. No amounts are paid or payable by the recipient on receiptof the option, and the options granted are not dependent on any performance-based criteria. In accordancewith the Plan, 25% of the options vest immediately, with a further 25% vesting in each of the subsequentthree years on the anniversary of the initial grant date.<strong>IFRS</strong> 2.45 The following is a summary of changes in options from January 1, 2010 to December 31, <strong>2011</strong>:Grant DateExpiry DateExercisePriceOpeningBalanceDuring the YearGranted Exercised ForfeitedClosingBalanceVested andExercisableUnvestedMM/DD/YY MM/DD/YY $ x.xx xxx xxx (xxx) (xxx) xxx xxx xxxMM/DD/YY MM/DD/YY $ x.xx xxx xxx (xxx) (xxx) xxx xxx xxxMM/DD/YY MM/DD/YY $ x.xx xxx xxx (xxx) (xxx) xxx xxx xxxMM/DD/YY MM/DD/YY $ x.xx xx xxx (xxx) (xxx) xxx xxx xxxxxx xxx xxx xxx xxx xxx xxxWeighted Average Exercise Price $ x.xx $ x.xx $ x.xx $ x.xx $ x.xx $ x.xx $ x.xxb) Fair Value of Options Issued During the YearThe weighted average fair value at grant date of options granted during the year ended December 31, <strong>2011</strong>was $x.xx per option (year-ended December 31, 2010: $x.xx).<strong>IFRS</strong> 2.44Options Issued to EmployeesThe fair value at grant date is determined using a Black-Scholes option pricing model that takes into accountthe exercise price, the term of the option, the impact of dilution, the share price at grant date andexpected price volatility of the underlying share, the expected dividend yield and the risk free interest ratefor the term of the option.Options Issued to Non-Employees<strong>IFRS</strong> 2.44Options issued to non-employees, are measured based on the fair value of the goods or services received, atthe date of receiving those goods or services. If the fair value of the goods or services received cannot beestimated reliably, the options are measured by determining the fair value of the options granted, using avaluation model.<strong>IFRS</strong> 2.45(d)The model inputs for options granted during the year ended December 31, <strong>2011</strong> included:Share Price at Exercise Risk-Free InterestGrant Date Expiry Date Grant Date PriceRate Expected Life Volatility Factor Dividend YieldMM/DD/YY MM/DD/YY $ x.xx $ x.xx x.xx% -x.xx% xx-xx-months x.xx% -x.xx% -%MM/DD/YY MM/DD/YY $ x.xx $ x.xx x.xx% -x.xx% xx-xx-months x.xx% -x.xx% -%MM/DD/YY MM/DD/YY $ x.xx $ x.xx x.xx% -x.xx% xx-xx-months x.xx% -x.xx% -%MM/DD/YY MM/DD/YY $ x.xx $ x.xx x.xx% -x.xx% xx-xx-months x.xx% -x.xx% -%PAGE 22 OF 35<strong>BDO</strong> CANADA LLP