VISA Steel Limited Annual Report 2007-08

VISA Steel Limited Annual Report 2007-08

VISA Steel Limited Annual Report 2007-08

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

proxy<strong>VISA</strong> STEELAT A GLANCE<strong>VISA</strong> <strong>Steel</strong> is part of the <strong>VISA</strong> Group; a conglomerate with decade-longexperience in global minerals and metals industry. <strong>VISA</strong> <strong>Steel</strong> is in theprocess setting up a 0.5 MTPA integrated <strong>Steel</strong> Plant – as Phase I of the 1.5MTPA integrated Special and Stainless <strong>Steel</strong> project in Orissa.<strong>VISA</strong> <strong>Steel</strong> has production facilities in Kalinganagar and Golagaon, located inthe eastern Indian state of Orissa.THE INTEGRATED SPECIAL AND STAINLESS STEEL PLANT AT THEKALINGANAGAR INDUSTRIAL COMPLEX INCLUDES THE FOLLOWINGFACILITIES:• 225,000 TPA Pig Iron Plant• 400,000 TPA Coke Oven Plant• 50,000 TPA Ferro Chrome Plant• 300,000 TPA Sponge Iron Plant• 75 MW Power Plant• 500,000 TPA <strong>Steel</strong> Melt Shop• 500,000 TPA Bar & Wire Rod Mill<strong>VISA</strong> StEEL’S GOLaGaON OPEratIONS INCLUDE:• 100,000 TPA Chrome Ore Beneficiation Plant (COBP)• 100,000 TPA Chrome Ore Grinding Plant (COGP)BACKWARDINTEGRATIONTO ENHaNCE ItS COMPEtItIVENESS, <strong>VISA</strong> StEEL IS INtEGratING ItS OPEratIONSBaCKWarDS INtO tHE MINING OF IrON OrE, CHrOME OrE aND COaL.Specific initiatives toWARDS this end includeS:• Developing chrome ore deposits in Orissa through its subsidiary, Ghotaringa Minerals <strong>Limited</strong>.• The Company also procures additional chrome ore from IDCOL and OMC.• <strong>VISA</strong> <strong>Steel</strong> has a long term agreement for procuring iron ore supplies from OMC and Sesa Goa.• The Company has also been jointly allocated the Patrapada Coal Block at Talcher, Orissa.<strong>VISA</strong> <strong>Steel</strong> also has active plans to set up integrated <strong>Steel</strong> Plants in other mineral rich states such asChhattisgarh and Jharkhand.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>3Locational and logistic advantagesAc c e s s to r aw m at e r i a l s:• Talcher Coalfields are situated 110 kms away.• The Daitari iron ore mines are located 30 kms away while the Keonjhar andBarbil mines are 100 to 150 kms away.• The Sukinda chrome ore mines are 35 kms away.Ac c e s s to i n f ra s t r u c t u r e:• The Paradip port is located within 120 kms away from the Plant.• The Banspani – Jakhapura railway line is being developed.

integrating the value chain<strong>VISA</strong> <strong>Steel</strong> took steps to install a new pusher car withplate system and shut down the Blast Furnace forrefractory relining, which shall restart from second quarterof 20<strong>08</strong>-09. The new pusher car has already beencommissioned in March 20<strong>08</strong> and coke production hasreached 90% capacity utilisation levels during April 20<strong>08</strong>.De-bottlenecking these facilities led to the creation ofmultiple revenue streams from which the Company willderive full benefits in the coming year.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>9Taking tactical steps to increase efficiencywill strengthen <strong>VISA</strong> <strong>Steel</strong>’s backendproduction of vital inputs.With the production assets in placeimproving efficiencywas the next stepThe production efficiency is vital once the manufacturing assets are in place. A series ofdifficulties arose requiring the need to de-bottleneck facilities and improve efficiency. Boththe Blast Furnace and Coke Oven experienced technical difficulties. The Blast Furnaceexperienced problems due to quality of water and power trippages affecting the refractorylining of the furnace. Additionally, the Coke Oven had problems due to its pusher carequipment with coal box getting deformed. These issues resulted in the below parproduction of coke and pig iron during <strong>2007</strong>-<strong>08</strong>.de-bottlenecking the Coke Ovenand the Blast Furnace led tothe creation of multiple revenuestreams from which the Companywill Derive full benefits in thecoming year.

integrating the value chainWith commitments to stakeholders madesteadily commissioning capacitieswas the next step<strong>VISA</strong> <strong>Steel</strong> has, in setting up its Integrated <strong>Steel</strong> Plant, faced seriouspolitical disturbances in addition to a major contractor resource crunch,which together have delayed the commissioning of key facilities. These,however, have not deterred the Company from keeping its commitmentsand facilities have been steadily coming on stream. In addition tothe Ferro Chrome Plant, a 50 MW Captive Power Plant and 300,000TPA DRI Plant are soon to be commissioned. Further, the <strong>Steel</strong> MeltShop, Rolling Mills and additional 25 MW Power Plant are expected togenerate revenues and profits from financial year 2010 -11 onwards.In addition to the ferro chromeplant, a 50 MW captive power plantand a 300,000 TPA dri plant are soonto be commissioned.The steel industry is on an upswing, driven by higher input prices. <strong>Steel</strong>prices will continue to remain firm due to high coking coal and iron oreprices. With pig iron, sponge iron, ferro chrome and coke prices at alltime record high levels, <strong>VISA</strong> <strong>Steel</strong> will benefit significantly given thattheir capacities are coming on stream at the best possible time.<strong>VISA</strong> <strong>Steel</strong>’s superior management of its IPO proceeds have alsobenefited the Company in terms of the financing and upkeep of keyfacilities.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>Resolute in its commitment, <strong>VISA</strong> <strong>Steel</strong>’s prudent fundmanagement supports a steady commissioning offacilities through challenging situations.11

integrating the value chainWith China emerging as a stainless steel huba strategic alliance withBaosteel was the next stepIndia is a major exporter of chrome ore and chromeconcentrates to China with over 1 million TPAexports over last 4 years. The Government of Indiaencourages value addition of ore within India byimposing export tax on exports of chrome ore andconcentrates. Over time, India shall emerge as a largeexporter of ferro chrome instead of chrome ore.China accounts for 25% of world’s stainless productionthereby emerging as a large buyer of chrome ore andferro chrome. Baosteel, one of the largest stainlesssteel producers in China has been a buyer of <strong>VISA</strong>Comtrade’s chrome ore for several years. <strong>VISA</strong><strong>Steel</strong> signed a joint venture agreement with BaosteelResources Co. Ltd. and <strong>VISA</strong> Comtrade AG to seizethe opportunity in value addition of chrome ore intoferro chrome. The Joint Venture Company, <strong>VISA</strong> BAO<strong>Limited</strong>, will set up a 100,000 TPA Ferro Chrome Plantin Orissa having a capex of Rs. 2,600 million and adebt equity ratio of 65:35.<strong>VISA</strong> <strong>Steel</strong>, Baosteel and <strong>VISA</strong> Comtrade AG eachrespectively hold 51%, 35% and 14% stake in <strong>VISA</strong>BAO <strong>Limited</strong>. The ground work for this project is set tobegin by October 20<strong>08</strong>. On commissioning, <strong>VISA</strong> <strong>Steel</strong>and <strong>VISA</strong> BAO put together will be one of the largestFerro Chrome producers in India. A majority of thetotal ferro chrome production will be sold to Baosteel.Baosteel’s immense market credibility and theadvantage of having a ready customer for enhancedproduction will help improve <strong>VISA</strong> <strong>Steel</strong>’s profitmargins.The union between Baosteel and <strong>VISA</strong><strong>Steel</strong> will offer advantages of scale andde-risked investment.on commissioning, visa steel and visabao put together will be one of thelargest ferro chrome producers inindia.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>13

integrating the value chainWith the significant investments in placesustainability of growthwas the next stepWhile project implementation integrates the value chain,it is transparent corporate governance that ensuressustainability of the growth. At <strong>VISA</strong> <strong>Steel</strong>, the commitmentto create shareholder value manifests itself throughinvestments in environmentally sound and sustainablemanufacturing practices. The 50 MW Waste Heat PowerPlant within the Kalinganagar premises will not only reducethe dependence on grid power but also minimize itscarbon impact. Additionally, the installation of Electro StaticPrecipitators (ESPs) in key capacities helps filter emissionsand minimise environmental impact.<strong>VISA</strong> <strong>Steel</strong> imbibes exemplary people practices creatingan environment which is conducive to personal growth.The Company offers a performance-oriented structure, andempowers employees to prove their worth. The end resultof our people oriented practices is lower attrition and highmorale.As a socially responsible Company, <strong>VISA</strong> <strong>Steel</strong> undertakesseveral measures for the betterment of the society itoperates in. The Company has built temples, dug borewells and planted trees.When sustainability is viewed as an impacton employees, stakeholders, environmentand society, benefits will naturally beincorporated in every interaction.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>15As a socially responsible Company,<strong>VISA</strong> <strong>Steel</strong> undertakes severalmeasures for the betterment of thesociety it operates in.

integrating the value chainWith Ferro Chrome production in placeFerro chrome production is apower-intensive process, as is theentire steel manufacturing chain.<strong>VISA</strong> <strong>Steel</strong> is in the process ofsetting up a 75 MW captive powerplant, in two phases.Captive power supplyis the next stepDuring the year <strong>2007</strong>-<strong>08</strong>, <strong>VISA</strong> <strong>Steel</strong> commissioned its50,000 TPA Ferro Chrome Plant. The plant is equipped withtwo electric submerged arc furnaces of 16.5 MVA each.These state-of-the-art machines produce High CarbonFerro Chrome. <strong>VISA</strong> <strong>Steel</strong> has actualised its strategy of“getting the metallics in place”. The Ferro Chrome Planthas enabled the Company enter the league of majormanufacturers of this critical alloy. This is a key elementin the integration of the steel value chain. Moreover, <strong>VISA</strong><strong>Steel</strong>’s proximity to the Sukinda Valley chrome ore reservesreduces logistics costs and allows for a steady supply ofraw material. Production of Ferro Chrome during the yearwas 18,014 onnes.Ferro chrome production is a power-intensive process,as is the entire steel manufacturing chain. <strong>VISA</strong> <strong>Steel</strong>is in the process of setting up a 75 MW captive powerplant, in two phases. The first phase of this project is thecommissioning of a 50 MW Power Plant by utilising wasteheat generated by the Coke Oven, Blast Furnace and DRIPlant, further capturing value. An additional 25 MW PowerPlant using coal and char shall follow. <strong>VISA</strong> <strong>Steel</strong> hasalso commissioned the 220 kv power transmission line tofacilitate stable supply of power at the Kalinganagar facility.With a current power requirement of around 35 MW,these steps will offer the twin benefits of assured powersupply and steady cash flow by using captive power. TheCompany will bolster its profit margins by leveraging asubstantial cost saving compared to existing costs.The Captive Power Plant will help <strong>VISA</strong> <strong>Steel</strong>in the years ahead to establish itself as a lowcost producer of Ferro Chrome.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>17

CHAIRMAN’SSTATEMENTWe shall continue to growrapidly in the coming years inthe Iron and <strong>Steel</strong> Sector inorder to deliver sustainablegrowth and create value forour shareholders.Dear Shareholders,On behalf of the Board, I am pleased to report that the Company has significantly exceededexpectations and registered a robust financial performance in <strong>2007</strong>-<strong>08</strong> against a challengingeconomic environment with rising inflation, rising interest rates, volatile exchange rates and risinginput costs.During the financial year <strong>2007</strong>-<strong>08</strong>, we have commissioned the Ferro Chrome Plant and achievedsignificant growth in our Coke Oven operations. We also entered into a Joint Venture with Baosteelof China for setting up a Ferro Chrome Plant in India.<strong>VISA</strong> <strong>Steel</strong> shall continue to create value by establishing global scale capacities and deliveringsustainable growth while reinforcing our commitment to achieve the best standards of safety,corporate social responsibility, corporate governance and maintaining effective communication withall our stakeholders.<strong>Annual</strong> ResultsFor the year ended 31 March 20<strong>08</strong>, <strong>VISA</strong><strong>Steel</strong> recorded a revenue growth of 27% toRs. 6,828.1 million from Rs. 5,379.3 millionin the previous year and EBIDTA growth of103% to Rs. 939.3 million from Rs. 463.6million in the previous year. The PBT grewby 96% to Rs. 671.4 million from Rs. 343.1million and PAT grew by 110% to Rs. 431.5million in financial year <strong>2007</strong>-<strong>08</strong> fromRs. 205.2 million during the previous financialyear.The growth in revenue and profits havebeen driven by volume growth and betterrealisations from the Coke and Ferro Chromebusinesses. The Company was able toVISHaMBHar SaraNdeliver a commendable performance whichreflects on its knowledge and understandingof the business.We plan to establish a globally competitiveand world-class integrated facility of specialand stainless steel making in Orissa, withcaptive power generation and backwardlinkage of mines for vital raw materials.As the commissioning of the Sponge IronPlant, Captive Power Plant and Special andStainless <strong>Steel</strong> Plant unfold, our performancewill be boosted and we shall be poised toemerge as one of the most exciting andvaluable companies in the Indian and GlobalSpecial and Stainless <strong>Steel</strong> Sector.The IndustryThe Indian economy is growing at a GDPgrowth rate of more than 9% per annumand considering the multiplier effect, it isexpected that demand for <strong>Steel</strong> will grow at aCAGR of over 10% during the next 15 to 20years. Demand in the domestic steel industryhas been fuelled by the infrastructure,construction, automobile and consumergoods sector. India has turned into a netimporter of <strong>Steel</strong> during <strong>2007</strong>-<strong>08</strong> and thisoffers tremendous opportunities for growth in<strong>Steel</strong> making capacities in India.The imposition of export tax of 15% onPrimary <strong>Steel</strong> products with export tax on IronOre being negligible is an anomaly and thepolicy of the Government of India needs tobe corrected to discourage exports of natural/ primary raw materials and to promote valueaddition of raw materials within the country.The increase in export tax of Chrome Oreand Chrome Concentrates from Rs. 2,000per MT to Rs. 3,000 per MT should help inimproving availability of Chrome Ore for theFerro Chrome industry in India. However,the proper solution lies in completely banningexport of these items.There has been a sharp increase of over200% in Coking Coal prices due to floods inAustralia affecting supplies and in Iron Oreprices due to growing demand from theChinese <strong>Steel</strong> Industry. This raw materialcost push has resulted in higher steel prices.Further, the increase in export tax on ChineseCoke from 15% to 25% along with closureof a few Coking Coal mines in China hasresulted in sharp increase in prices of Coke.It is also expected that Ferro Chrome pricesshall remain firm due to the power crisis inSouth Africa affecting supplies and growingdemand for Ferro Chrome from the ChineseStainless <strong>Steel</strong> Plants.Leveraging OpportunitiesThis throws open several opportunities forthe Indian Iron and <strong>Steel</strong> sector and withearly mover advantages in the Coke andFerro Chrome businesses, <strong>VISA</strong> <strong>Steel</strong> is in avery favourable position to derive significantbenefits. Orissa is blessed with abundance ofnatural resources and the Company plans tointegrate backwards into mining of coal, ironore and chrome ore to have better control onraw material costs.Our Plant at Kalinganagar offers excellentlocational and logistical advantages throughclose proximity to key raw material sourcesand infrastructure which contribute inoptimising costs and in ease of operationsand reflects foresight in locational planning.Additionally, the Company employs cuttingedge technology and its domestic andinternational vendors are of the highestrepute and provide the best qualityequipment. The consultants and contractorsbeing engaged are also among the best inthe industry.During the year, <strong>VISA</strong> <strong>Steel</strong> executed a JointVenture Agreement with Baosteel ResourcesCo. Ltd., China and <strong>VISA</strong> Comtrade AG,Switzerland to set up a 100,000 TPA FerroChrome Plant in Orissa. <strong>VISA</strong> BAO <strong>Limited</strong>(VBL) has been incorporated on 1 February20<strong>08</strong> to give effect to this Joint Venture. VBLis a subsidiary of <strong>VISA</strong> <strong>Steel</strong> holding 51% ofVBL’s paid-up share capital with the balance35% being held by Baosteel Resources and14% by <strong>VISA</strong> Comtrade.OutlookWe shall continue to grow rapidly in thecoming years in the Iron and <strong>Steel</strong> Sectorin order to deliver sustainable growth andcreate value for our shareholders.The Company thrives on its human capitaland I would like to congratulate andcommend the efforts, thoughts, commitmentand passion put in by our team. I would liketo express my gratitude to all members ofthe Board of the Company for their preciouscontribution. I would also like to convey mygrateful thanks to all the stakeholders fortheir confidence and faith and the regulatoryauthorities for their valued support.Warm Regards.Vishambhar Saran<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>19

ManagingDirector’s ReviewOur priority is to be aresponsible and respectedCorporate Citizen andcontinue to place significantemphasis on Health, Safety &Environment.The financial year <strong>2007</strong>-<strong>08</strong> was another year of exciting growth with improved performance ofour Coke Oven operations, commissioning of Ferro Chrome Plant and progress in execution ofnew projects. We shall continue to focus our efforts to maintain high quality growth and maximiseshareholder value.We have taken initiatives to improve internal control systems and optimise and enhance realisationsfor our saleable products. We have further improved our HR practices and as a responsiblecorporate citizen, we continue to give top priority to Health, Safety and Environment.Growth in Coke Oven PlantOperations and commissioningof new Pusher CarDuring the financial year <strong>2007</strong>-<strong>08</strong>, wehave achieved 196% growth in our Cokeproduction to 176,422 MT from 59,643 MTduring the previous financial year. We havecommissioned the new pusher car whichshall further improve capacity utilisationduring 20<strong>08</strong>-09.Commissioning of FerroChrome PlantDuring the year, the Company commissioneda 50,000 TPA Ferro Chrome Plant inNovember <strong>2007</strong>. The Ferro Chromeproduction was 18,014 during <strong>2007</strong>-<strong>08</strong> andthe full year benefit shall come from 20<strong>08</strong>-09onwards.VISHaL aGarWaLSponge Iron and Powerprojects nearing completionThe 300,000 TPA Sponge Iron Plant and 50MW Waste Heat Recovery Captive PowerPlant projects are on the verge of completion.These projects will start generating revenuesfrom second quarter of the financial year20<strong>08</strong>-09 onwards.Rapid progress inproject execution andinfrastructure developmentThe construction of 0.5 million TPA Special& Stainless <strong>Steel</strong> Plant, 0.5 million TPABar & Wire Rod Mill and an additional 25MW Power Plant is progressing rapidly. Wecontinue to thrive on the best domestic andinternational equipment suppliers for ourprojects such as SMS Demag for EAF andLRF, Concast Caster, SMS Meer for Bar &Wire Rod Mill and Turbines from BHEL. Wealso continue to use the best contractorssuch as GDC and Bridge & Roof for our civiland fabrication work and Areva & ABB for ourelectrical work to ensure high standards ofquality.During the year under review, we havecommissioned the 220 KV power lineand water pipeline. We have also madesignificant progress in developing roadsand drainage and in constructing modernGT Hostel cum guest house, administrationbuilding and colony.Efforts to improve controlsystemsThe efforts to streamline our SAP systemshave resulted in us receiving the ‘BestImplementation Award’ from SAP India.The scope of our internal audit has alsobeen expanded in order to further improveour internal control systems and ensuretransparency in management.Raw Materials costs andMining LeasesThe sourcing of vital raw materials such asIron Ore and Chrome Ore is mainly fromOMC whereas Coking Coal is importedfrom Australia, primarily through long termcontracts.We have also made progress towardsbackward integration into mining of Iron Ore,Chrome Ore and Coal in order to reduce ourraw material costs.Improvement in marketrealisation for our productsOur realisation for Coke and Ferro Chromehas improved significantly during the yeardue to high international prices. Coke pricesare firm due to increase in export tax on Cokeexports from China from 15% to 25% andclosure of a few Coking Coal mines in China.Ferro Chrome prices have also been veryfirm on the back of growing demand from theStainless <strong>Steel</strong> Plants in China and supplyshortage due to the power crisis in SouthAfrica.Human Resource InitiativesWe have a young and passionate team whomwe continue to nurture and develop throughtraining in technical and managerial skills atour Learning Centre and on the job trainingon the shop floor. The Company continuesto induct fresh engineers & MBAs throughcampus recruitment and provide opportunityfor development and encourage them togrow with the Company. We have a verytransparent performance appraisal systemto decide upon increments and promotions.We also have an annual Social Calendar withactivities for improving team building andbetter family bonding.Corporate SocialResponsibilitiesOur priority is to be a responsible andrespected Corporate Citizen and continueto place significant emphasis on Health,Safety & Environment. We have providedbetter safety devices at critical locationsunder proper supervision to achieve thehighest standards of safety. We have directedour community development initiatives inthe areas of education, health care, ruraldevelopment and sports & culture.I would like to take this opportunity toexpress my sincere gratitude to our teamof professionals for their commitment,dedication and hard work which has been thekey to our growth.Vishal Agarwal<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>21

0103 05 07 09 11PROFILE OF THEBOARD OF DIRECTORS02 04 06 <strong>08</strong>10010203Vishambhar Saran, ChairmanMr. Saran has an enriched experience ofover 38 years in the iron & steel industry, withover 25 years with Tata <strong>Steel</strong> in the areas ofdevelopment & operations of mines, mineralbeneficiation plants and ferro alloy plants, portoperations and international trading of rawmaterials for the iron & steel industry.A mining engineer from BHU, he rose to thelevel of Director (Raw Materials) in Tata <strong>Steel</strong>before taking over as Chairman of the <strong>VISA</strong>Group in 1994. In a short span of time, he builtthe <strong>VISA</strong> Group into a minerals and metalsconglomerate with a strong global presencein seven countries, namely, Australia, China,India, Indonesia, Singapore, Switzerland andU.K. He is the Chairman of the InternationalTrade Committee of the CII-Eastern RegionCouncil and the Vice President of the IndianChamber of Commerce.Maya Shanker Verma, Chairman,Finance & Banking and SelectionCommitteesMr. Verma is a career banker with a multileveland wide ranging experience of over 45years, encompassing an understanding of thecommercial, developmental and investmentbanking as well as asset management andcapital market operations.A Master of Arts and Certified Associate ofthe Indian Institute of Bankers, Mr. Vermahas held senior-most and critical positionsin India’s financial system and regulatoryregimes like Chairman, State Bank of India,IDBI Bank and Telecom Regulatory Authorityof India.Arvind Pande, Chairman, ShareTransfer & Investor Grievance &Remuneration CommitteesMr. Pande has over 40 years of experiencein the Indian Administrative Services andthe corporate public sector. He was also0405Joint Secretary to the Prime Minister forhis expertise in Economics, Science andTechnology. As Director of the Department ofEconomic Affairs in the Ministry of Finance,Government of India, he has been involvedwith many World Bank aided projects.A Bachelor of Science and Master of Arts inEconomics from Cambridge University, Mr.Pande is the former Chairman of the <strong>Steel</strong>Authority of India <strong>Limited</strong> and brings to theCompany his in-depth knowledge of the iron& steel industry.Debi Prasad Bagchi, Chairman,Audit CommitteeMr. Bagchi brings to the Board his deepknowledge of the administrative services andthe state of Orissa, especially in the steel& mining sector. He has held prestigiouspositions of authority like AdditionalSecretary, Commerce - Government of India,Secretary, Ministry of Small Scale Industry- Government of India, Chief Secretary -Government of Orissa, etc.A Master of Arts in Economics and anM.Phil in Public Administration, Mr. Bagchiwas also the Chairman cum ManagingDirector of Orissa Lift Irrigation Corporationand Managing Director of Orissa MiningCorporation <strong>Limited</strong>.Pradip Kumar KhaitanMr. Khaitan is a legal luminary and hasextensive experience in the fields ofcommercial & corporate laws, tax laws,arbitration, foreign collaborations, mergers &acquisitions and corporate restructuring.Mr. Khaitan is a Bachelor of Commerce, anLL.B and an Attorney-at-Law (Bells Chamber,Gold Medalist). He is the Senior Partner ofKhaitan & Co., a leading Indian law firm andalso member of the Bar Council of India, theBar Council of West Bengal and the IndianCouncil of Arbitration0607<strong>08</strong>09Shanti NarainMr. Narain brings with him his expertise instrategic management of transport systems,especially the Railways in the areas ofplanning, marketing, monitoring and controlof operational & commercial activities anddevelopment of transport infrastructure.He holds a Masters degree in Science(Mathematics) and had been the Member(Traffic) Railway Board for 4 years tillFebruary 2001. He is a member of severalcommittees set up by the Government ofIndia and professional societies.Saroj AgarwalMrs. Agarwal laid the foundation of the <strong>VISA</strong>Group during the mid-eighties. She guidesthe organisation along its growth chart whileupholding its values and spirit.A Bachelor of Arts from BHU, she takesactive part in philanthropic activities andcontributes to the community through the<strong>VISA</strong> Charitable Trust where she is a trustee.She is currently the Managing Director of<strong>VISA</strong> International <strong>Limited</strong>.Vikas AgarwalMr. Agarwal is responsible for developingand nurturing the global coal and cokebusiness of the <strong>VISA</strong> Group and has beeninstrumental in securing investments inthe Group’s coking coal mining venture inAustralia.He holds a Masters degree in ManufacturingEngineering from Trinity College, CambridgeUniversity and is currently the ManagingDirector of <strong>VISA</strong> Power <strong>Limited</strong> and <strong>VISA</strong>Coal Pty Ltd.Vivek AgarwalMr. Agarwal is Managing Director of <strong>VISA</strong>Comtrade Asia Ltd and is responsible fordeveloping the minerals, metals and shippingbusiness of the <strong>VISA</strong> Group and has beeninstrumental in the Group’s joint venture withBaosteel.1011Mr. Agarwal has worked as SeniorConsultant with Booz Allen Hamilton,London, a global strategy consulting firmfor 2 years till 2004, before joining the<strong>VISA</strong> Group. He holds a Masters degreein Manufacturing Engineering from TrinityCollege, Cambridge University.Vishal Agarwal, Managing DirectorMr. Agarwal has in-depth experience ofcommissioning of greenfield projects ofthe Company by successfully establishingthe plants at Golagaon and Kalinganagar.As Managing Director of the Company, heis responsible for overall management ofoperations and implementation of projectsand is the driving force behind many of theCompany’s strategic and human resourceinitiatives. He is also actively involvedin various philanthropic activities in thebackward districts of Orissa and WestBengal.He is a Bachelor in Economics fromLondon School of Economics and alsoholds a Masters degree in Economics fordevelopment from Oxford University.Basudeo Prasad Modi, DeputyManaging DirectorMr. Modi has over 35 years of enrichingexperience in the field of operations andprojects. He holds a degree in BusinessManagement and a Diploma in IndustrialEngineering and is a Council Member ofthe Indian Institute of Metals. Prior to joiningthe Company as Deputy Managing Director,he was Managing Director of NeelachalIspat Nigam Ltd. Mr. Modi is responsible foroverall operations in Kalinganagar, Orissa.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>23

MANAGEMENTPROFILESKrishna Murari Lai, ExecutiveDirector (Raw Materials)Mr. Lal, former CGM, Southern EasternCoalfields Ltd. at Gevra (the largest coalmine in Asia) brings his extensive industryexperience to the procurement of rawmaterials and the development of captivemines for iron ore, chrome ore and steamcoal for the Company.Vinod Kumar, President (Projects)Mr. Kumar has over 30 years of experience inproject execution, operation and maintenanceof DRI, SMS & Rolling Mill. He is responsiblefor the implementation of the DRI, SMS &Rolling Mill projects at Kalinganagar.Manoj Kumar Digga, ChiefFinancial OfficerMr. Digga has been a core member of theGroup’s Finance and Accounts team since1995 and is responsible for the Company’sfinancial strategy. He oversees the financeand accounting functions. He has alsoplayed a vital role in mobilising funds for theexpansion projects of <strong>VISA</strong> <strong>Steel</strong>.Ranjan Mishra, Vice President(Ferro Chrome)Mr. Mishra, a metallurgical engineer, hasabout 20 years of experience in operationsof ferro chrome plants and in procurementof raw materials, which includes workingwith the ferro chrome plant of Tata <strong>Steel</strong> atBamnipal. He is currently responsible forsetting up operations of the Ferro ChromePlant at Kalinganagar.Manoj Kumar, Vice President(Purchase)A mechanical engineer, Mr. Kumarpossesses rich experience in the domesticand international procurements for the ironand steel industry, having honed it in Tata<strong>Steel</strong> and Jindal <strong>Steel</strong> & Power beforejoining the Company. Currently, he headsthe procurement function of the Company’sprojects and operations.P. R. Bose, Vice President (Coke Oven)Mr. Bose is Bachelor of Science in the fieldof chemical engineering and brings withhim over 30 years of rich experience. Hewas previously associated with SISCOL asGeneral Manager and is responsible for theoperations of the coke oven plant.K. Bhaskar Rao, Vice President(Blast Furnace)Mr. Rao holds a degree in metallurgy fromthe Indian Institute of Metals and has over 24years expertise in commissioning & operationof Foundry, DRI, Blast Furnace and hasimplemented ISO & TPM in various plants inhis previous assignment with Mid West Iron& <strong>Steel</strong>. He is currently responsible for theoverall Blast Furnace operations.Manish Jaiswal, Vice President(Marketing)A mechanical engineer, Mr. Jaiswal iscurrently in charge of marketing pig iron,coke and ferro chrome. His rich sectoralexperience and knowledge enables him tomarket the product in a very effective manner.Bhawna Agarwal, Vice President(Corporate Communications)A Master’s Degree holder in Economics,Mrs. Agarwal has been spearheading theCorporate Communication strategy of theCompany. She is responsible for creatingand managing the internal and externalcommunication process and extends this tocorporate brand building. She was previouslyassociated with one of India’s leadingnewspapers, Dainik Bhaskar.K. K. Singh, Vice President (RawMaterials)Mr. Singh, a graduate in chemicalengineering, holds a post graduate diplomain Mineral Engineering from ISM, Dhanbadand a masters in Business Administration.He brings with him 31 years of experience inthe field of Marketing, Business Development& Project Management. He is currentlyresponsible for procurement of raw materialscoordination and development of captivemines for the Company.Ashok Agarwal, Vice President(Commercial)Mr. Agarwal has more than 25 years ofexperience in marketing and commercialmatters. Prior to his joining <strong>VISA</strong> <strong>Steel</strong>,he worked and gained experience forover 20 years in Sales and Marketing andCommercial matters in Tata <strong>Steel</strong>. He iscurrently responsible for overseeing thecommercial aspects of the Company’soperations at Kalinganagar.Maninath Sahoo, Vice President(Finance and Accounts)Mr. Sahoo was working as Division Head ofAccounts Department of Ferro Alloys andMineral Division; profits centre of Tata <strong>Steel</strong>Ltd. and brings with him over 27 years of richexperience. He is looking after the financeand accounts of the Company.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>25

CORPORATESOCIAL RESPONSIBILITYCOMMIttED tO ENHaNCING PrOSPErItY, <strong>VISA</strong> StEEL, aS a rESPONSIBLE COrPOratE,FOCUSES ON SPrEaDING tHE WEaLtH CrEatED tHrOUGH ItS OPEratIONS tO ItSExtErNaL COMMUNItY. DEVELOPMENt OF SUrrOUNDING rEGIONS, tHErEFOrE, PLaYSaN INtEGraL rOLE IN <strong>VISA</strong>’S SOCIaL aCtIVItIES.EducationEstablished two premier education institutions in Kolkata – The Heritage School and TheHeritage Institute of Technology, through the Kalyan Bharti Trust.Introduced scholarship opportunities for brilliant and needy students.Offered scholarships to needy girls at the Smt. Sarala Devi Saraswati Balika Inter College in theTilhar district of Shahjahanpur, Uttar Pradesh.Provided facilities such as libraries and science labs to enhance computer literacy.HealthcareSet up medical check-up camps in the backward areas of Orissa and West Bengal.Contributed to the construction of a blood bank in Jajpur, Orissa.Offered advice on treatment of common diseases and hygiene; also provided free medicines andmedical facilities.Rural developmentInstalled bore-wells for providing clean drinking water in the backward areas.Provided employment according to the rehabilitation policy of the Government.Constructed the boundary wall of the local school in Jajpur, Orissa.Contributed towards renovation of various temples in Orissa.environmentLaunched water harvesting initiatives to protect ground water levels.Planted 43,000 trees planted in and around the plant through a plantation drive.Sports and CultureActively promotes contemporary Indian art through exhibitions and organises paintingcompetitions to promote talented young artistsSponsors and organizes an annual ladies golf tournament at the Tollygunge Club in Kolkata.ADDItIONaLLY, <strong>VISA</strong> StrENGtHENED ItS EMPLOYEE rELatIONS StratEGIES tO ENSUrEa SaFE ENVIrONMENt CONDUCIVE tO PErSONaL aND PrOFESSIONaL GrOWtH. ASSUCH, tHE COMPaNY IMPLEMENtS SaFEtY traINING SESSIONS FOr tHE BENEFIt OFBOtH EMPLOYEES aND CONtraCt LaBOUr. POStErS ExHOrtING tHE INCOrPOratIONOF SaFEtY MEaSUrE aND DaILY INSPECtION OF WOrKErS aLSO FEatUrE aMONG tHECOMPaNY’S PrOaCtIVE INItIatIVES.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>27

REPORT OF THEDIRECTORSDear Shareholders,Your Directors are pleased to present the Twelfth <strong>Annual</strong> <strong>Report</strong> together with the auditedaccounts of the Company for the year ended 31 March 20<strong>08</strong>.FINANCIAL RESULTS(Rs. Million)PARTICULARS <strong>2007</strong>-<strong>08</strong> 2006-07Net Revenue 6,807.65 5,311.80Other Income 20.40 67.48Total Income 6,828.05 5,379.28Profi t before interest, depreciation & tax 939.28 463.64Interest (Net) 85.34 22.92Depreciation 182.59 97.67Profi t before Taxation 671.35 343.05Taxation – Current 84.00 39.00– Deferred 151.27 93.84– Fringe Benefi t Tax 4.60 5.00Profi t after Tax 431.48 205.21Balance brought forward 329.98 124.77Appropriation - Proposed Dividend 110.00 -- Corporate Tax on Dividend 18.69 -Balance Carried to Balance Sheet 632.77 329.98OPERATIONSDuring the year under review, your Companyhas exceeded expectations and recorded arobust fi nancial performance with revenuegrowth of 27% to Rs. 6,828.1 million, PBTgrowth of 96% to Rs. 671.4 million and PATgrowth of 110% to Rs. 431.5 million.The Coke production grew by 196% to176,422 MT in <strong>2007</strong>-<strong>08</strong> from 59,643 MT inthe previous fi nancial year. The new pushercar has been commissioned which shallfurther improve capacity utilisation.In <strong>2007</strong>-<strong>08</strong>, your Company achieved HotMetal production from the Blast Furnace of67,330 MT from 181,<strong>08</strong>6 MT in the previousfi nancial year due to shutdown for refractorylining, disruption in iron ore supplies andpower trippages. The 220 KV power linehas been commissioned and the relining ofFurnace is nearing completion.Your Company commissioned 50,000 TPAFerro Chrome Plant in November <strong>2007</strong> andproduced 18,014 MT of Ferro Chrome duringthe year. The full year benefi t shall comefrom 20<strong>08</strong>-09 onwards.The project work of 300,000 TPA Sponge IronPlant and the 2x25 MW Waste Heat RecoveryCaptive Power Plant is in the final stages ofcompletion and shall generate revenues fromsecond quarter of 20<strong>08</strong>-09 onwards.The project work for 0.5 million TPA Specialand Stainless <strong>Steel</strong> Plant, 0.5 million TPABar & Wire Rod Mill and an additional 25MW Power Plant is progressing satisfactorily.Whilst there have been some delays due toshortage of manpower from contractors, lawand order problems and delay in equipmentdeliveries, we have been able to make rapidprogress compared to our peers.A detailed analysis of your Company’soperations, segment-wise performance,project review, risk management, strategicinitiatives and fi nancial review & analysis,as stipulated under Clause 49 of the ListingAgreement with the Stock Exchanges ispresented under a separate section titled“Management Discussion & Analysis <strong>Report</strong>”forming part of the <strong>Annual</strong> <strong>Report</strong>.DIVIDENDIn view of the performance and keeping inview the fund requirements of your Companyfor its expansion plans, your Directors<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>29

Our priority is to be aresponsible and respectedCorporate Citizen andcontinue to place significantemphasis on Health, Safety& Environment.recommend a dividend of 10% for the yearcarrying out the business of mining of chromethe Companies Act, 1956. Mr. Saran’s re-In terms of Article 158 of the Articles ofended 31 March 20<strong>08</strong>, i.e., Rs. 1 per equityore and /or other minerals. GML is currentlyappointment is subject to the approval ofAssociation of the Company, Mr. Mayashare in respect of 11,00,00,000 fully paidcarrying out drilling & prospecting work overthe Members and the said re-appointmentShanker Verma, Mr. Vikas Agarwal andup equity shares of Rs. 10 each. The totalan area allotted to ORIND in Dhenkanal,together with the remuneration and terms &Mr. Vivek Agarwal retire by rotation atoutlay on account of dividend payment will beRs. 110 million excluding Rs. 18.69 million onaccount of dividend distribution tax.Orissa.Your Company’s investment in GML willenable the Company to directly procureconditions are proposed in the notice for theforthcoming <strong>Annual</strong> General Meeting for yourapproval.the forthcoming <strong>Annual</strong> General Meetingand, being eligible, offer themselves forreappointment.Joint VenturesDuring the year, your Company executeda Joint Venture Agreement with BaosteelResources Co. Ltd., China and <strong>VISA</strong>Comtrade AG, Switzerland to set up a100,000 TPA Ferro Chrome Plant in Orissa.This Joint Venture is being set up through aseparate company titled “<strong>VISA</strong> BAO <strong>Limited</strong>”(VBL), which has been incorporated with theRegistrar of Companies, Orissa. VBL is asubsidiary of your Company. 51% of VBL’spaid-up share capital is held by your Company,35% by Baosteel Resources and balance14% by <strong>VISA</strong> Comtrade AG.Your Company had been jointly allotted acoal block in Orissa together with 7 othercompanies. A Joint Venture company whichwill primarily be engaged in mining anddevelopment of the Patrapada coal block,by the name of “Patrapada Coal MiningCompany Private <strong>Limited</strong>,” has been formedby 7 of the allotees.SubsidiariesYour Company has two subsidiaries namely,Ghotaringa Minerals <strong>Limited</strong> and<strong>VISA</strong> BAO <strong>Limited</strong>:(i) Ghotaringa Minerals <strong>Limited</strong> (GML) hasbeen incorporated to give effect to the jointventure agreement between your Companyand Orissa Industries <strong>Limited</strong> (ORIND) forchrome ore, mined by GML, for its ChromeOre Beneficiation Plant, Chrome OreGrinding Plant and the Ferro Chrome Plant.The audited accounts of GML for the yearended 31 March 20<strong>08</strong> are attached asrequired under Section 212 of the CompaniesAct, 1956.(ii) <strong>VISA</strong> BAO <strong>Limited</strong> (VBL) has beenincorporated to give effect to the JointVenture between your Company, BaosteelResources Co. Ltd., China and <strong>VISA</strong>Comtrade AG, Switzerland to set up a100,000 TPA Ferro Chrome Plant in Orissa.Promoter Group CompaniesThe names of Promoters and companiescomprising the “Group” as defined in theMonopolies and Restrictive Trade PracticesAct, 1969, have been disclosed in the <strong>Annual</strong><strong>Report</strong> for the purpose of Regulation 3(1)(e)of the SEBI (Substantial Acquisition of Sharesand Takeovers) Regulations, 1997.DirectorsAt the meeting held on 4 December <strong>2007</strong>,the Board of Directors had approved there-appointment of Mr. Vishambhar Saran asWhole-time Director, designated as Chairmanfor a period of 3 years with effect from 15December <strong>2007</strong>, pursuant to the provisionsof Sections 198, 269, 309, Schedule XIIIand other applicable provisions, if any, ofAt the meeting held on 31 March 20<strong>08</strong>, theBoard of Directors had approved appointmentof Mr. Basudeo Prasad Modi as AdditionalDirector and subsequently as DeputyManaging Director for a period of 3 yearswith effect from 1 April 20<strong>08</strong>, pursuant tothe provisions of Sections 260, 198, 269,309, Schedule XIII and other applicableprovisions, if any, of the Companies Act,1956. Your Company has received a noticefrom a Member of the Company proposingthe appointment of Mr. Modi as Directorunder Section 257 of the Companies Act,1956 and Mr. Modi’s appointment as Directorand Deputy Managing Director together withthe remuneration and terms & conditions areproposed in the notice for the forthcoming<strong>Annual</strong> General Meeting for your approval.At the meeting held on 28 May 20<strong>08</strong>,the Board of Directors had approved reappointmentof Mr. Vishal Agarwal asManaging Director for a period of 3 yearswith effect from 25 June 20<strong>08</strong>, pursuant tothe provisions of Sections 198, 269, 309,Schedule XIII and other applicable provisions,if any, of the Companies Act, 1956. Mr.Agarwal’s re-appointment is subject to theapproval of the Members and the said reappointmenttogether with the remunerationand terms & conditions are proposed in thenotice for the forthcoming <strong>Annual</strong> GeneralMeeting for your approval.Directors’ ResponsibilityStatementIn terms of the provisions of Section 217(2AA) of the Companies Act, 1956, yourDirectors state:a. That in the preparation of the annualaccounts, the applicable accountingstandards had been followed along withproper explanation relating to materialdepartures;b. That the Directors had selected suchaccounting policies and applied themconsistently and made judgements andestimates that are reasonable and prudentso as to give a true and fair view of thestate of affairs of the Company at the endof the financial year and of the profit of theCompany for that period;c. That the Directors had taken properand sufficient care for the maintenance ofadequate accounting records in accordancewith the provisions of the Companies Act,1956 and for safeguarding the assets of theCompany and for preventing and detectingfraud and other irregularities;d. That the Directors had prepared theannual accounts on a going concern basis.Your Company’s internal auditors,M/s. L.B. Jha & Co., Chartered Accountants,have conducted periodic audits to providereasonable assurance that establishedpolicies and procedures are being followed.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>31

Employee growth seamlesslyaligned with organisational growththrough empowerment and byoffering a challenging workplace,aimed towards the realisation oforganisational goals.CEO / CFO CertificationA Certificate from the Managing Directorand the Chief Financial Officer, pursuant toClause 49(V) of the Listing Agreement hadbeen tabled at the Board Meeting held on 28May 20<strong>08</strong> and is also annexed to this <strong>Report</strong>.AuditorsThe Auditors of the Company, M/s. Lovelock& Lewes, Chartered Accountants, Kolkata,retire at the conclusion of the forthcoming<strong>Annual</strong> General Meeting and being eligible,offer themselves for re - appointment.Qualification to Auditors’reportThe Auditors’ qualification under Paragraph4 of their report read along with the notes toItem no. 9 of Schedule 17 is self explanatoryand does not require any further commentsfrom the Directors.Particulars ofConservation of Energy,Technology Absorbtion andForeign Exchange Earningsand OutgoInformation pursuant to Section 217 (1) (e)of the Companies Act, 1956 read with theCompanies (Disclosure of Particulars in the<strong>Report</strong> of the Board of Directors) Rules,1988 in respect of Conservation of Energyand Technology Absorption and ForeignExchange Earnings and Outgo is given inAnnexure I forming part of this <strong>Report</strong>.Human Resourceshuman resources, which assumes utmostsignificance in achievement of corporateobjectives. Your Company integratesemployee growth with organisational growthin a seamless manner through empowermentand by offering a challenging workplace,aimed towards realisation of organisationalgoals. To this effect, your Company hasset up an HR training centre at its plant forknowledge-sharing and imparting needbased training to its employees.The information required under Section217 (2A) of the Companies Act 1956read with the Companies (Particulars ofEmployees) Rules 1975, as amended are setout in Annexure II to this report.Consolidated FinancialStatementsIn terms of Clause 32 of the ListingAgreement with Stock Exchanges,Consolidated Financial Statements,conforming to Accounting Standard 21 issuedby the Institute of Chartered Accountants ofIndia, are attached as a part of the <strong>Annual</strong><strong>Report</strong>.Corporate GovernanceYour Company is committed in maintainingthe highest standards of CorporateGovernance and adheres to the stipulationsprescribed under Clause 49 of the ListingAgreement with the Stock Exchanges.A <strong>Report</strong> on Corporate Governance &Shareholder Information together with theAuditors’ Certificate thereon is annexed aspart of the <strong>Annual</strong> <strong>Report</strong>.Management, as required under Clause 49of the Listing agreement and all Directorsand Senior Managers have affirmedcompliance with the Code for <strong>2007</strong>-<strong>08</strong>. Acertificate, signed by the Managing Director,affirming compliance of Directors & SeniorManagement, forms part of the <strong>Report</strong> onCorporate Governance.AcknowledgementYour Directors record their sincereappreciation for the assistance, supportand guidance provided by banks, financialinstitutions, customers, suppliers, regulatory& government authorities, project & otherbusiness associates and stakeholders.Your Directors also thank the employeesof the Company for their contributionand commitment towards your Companyperformance and growth during the periodunder review.Your Directors value your involvementas shareholders and look forward to yourcontinuing support.For and on behalf of the BoardKolkataVishambhar Saran28 May 20<strong>08</strong> Chairman<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>33Your Company places emphasis onrecruitment, training & development ofYour Company had also adopted a “Codeof Conduct” for its Directors and Senior

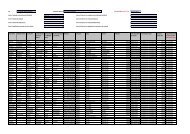

Installation of 25 MW PowerPlant based on CFBC Boilerto utilise the waste charand coal fines generatedfrom Sponge Iron Plant.Annexure I to the <strong>Report</strong> ofthe DirectorsStatement of particulars required under theCompanies (Disclosure of Particulars in the<strong>Report</strong> of the Board of Directors) Rules, 1988A. Conservation of Energy(a) Energy Conservation Measures Taken:1. 20 kVAR capacitor bank installed inFerro Chrome Plant to improve the powerfactor from 0.85 to 0.96.(b) Additional investment and proposals,if any, being implemented for reduction ofconsumption of energy:1. 2 x 25 MW Power Plant based onWaste Heat recovery boilers for utilising theFORM AA. Power & Fuel Consumption1. Electricity(a) Purchasedwaste heat generated from Blast Furnace,Non-recovery Coke Ovens and SpongeIron Plant.2. Installation of 25 MW Power Plantbased on CFBC Boiler to utilise the wastechar and coal fines generated from SpongeIron Plant.(c) Impact of Measures in (a) and (b)above have resulted in :i) Saving in electrical energy.ii)Effective utilisation of reactive power.(d) Total Energy Consumption and EnergyConsumption per Unit of Production (as perForm “A” below)Unit 94,755,610 33,830,760Total Amount - (Rs. Million) 313.49 107.05Rate / unit - (Rs.) 3.31 3.16(b) Own Generation(i) Through Diesel GeneratorUnit 78480 71256Units per ltr. of diesel oil 2.72 2.90Cost/unit 9.46 6.95(ii) Through Steam Turbine / Generator<strong>2007</strong> - <strong>08</strong> 2006 - 07Unit NIL NILUnits per ltr. of fuel oil/gas NIL NILCost/units NIL NILFORM A2. Coal (Hard & Soft coking coalused at Coke Oven plant)<strong>2007</strong> - <strong>08</strong> 2006 - 07Quantity (tonnes) 271677 80675Total cost - (Rs. Million) 1730.35 465.39Average Rate 6369.15 5768.723. Furnace OilQuantity (K. ltrs.) NIL NILTotal amount - (Rs. Million) NIL NILAverage Rate NIL NIL4. Others – CokeQuantity (tonnes) 7<strong>08</strong>77 133270Total cost - (Rs. Million) 683.03 1<strong>08</strong>1.22Rate. / Tonne - (Rs.) 9636.85 8113.00B. Consumption per unit of productionProducts1. Production of Pig Iron, including by-products MT 67670.00 181<strong>08</strong>6.79Electricity Kwh 130.00 186.82Furnace Oil Ltr NIL NILCoal Kg. NIL NILCoke Kg. 891.65 735.942. Production of Coke including by-products MT 176530.00 59642.98Electricity Kwh 12.00 14.90Furnace Oil Ltr NIL NILCoal (Hard & Soft coking coal) Kg. 1538.99 1352.633. Production of Ferrochromeincluding by-products MT 18032.00 NILElectricity Kwh 3965.25 NILFurnace Oil Ltr NIL NILCoke Kg. 584.43 NIL4. Production of Chrome Concentrate &Chrome powder MT 6054 13183Electricity Kwh 34.89 21.85Furnace Oil Ltr. NIL NIL<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>35

Modification in cooling systemof Blast furnace shall resultin increasing the life of theequipments and also marginallyimprove the yield.B. Technology AbsorptionFORM BResearch & Development (R&D)1. Specific areas in which R&D was carriedout by the Company(a) Blending of different varieties of cokingcoal.(b) New design of Pusher car has beeninstalled to improve the efficiency ofpushing of coking coal in the coke ovens.(c) Modification of water cooling system inBlast Furnace to improve the efficiency ofcooling of the furnace.2. Benefits derived as a result of the aboveR&D:(a) Cost reduction due to blending of semisoftcoking coal.(b) New Pusher car has improvedefficiency.(c) Modification in cooling system of Blastfurnace shall result in increasing the lifeof the equipments and also marginallyimprove the yield.3. Future plan of action:(i) Improvement in yield of pig iron byimproving mould design.(ii) Modification of quenching car toimprove efficiency.(iii) Installation of mechanised sizing &handling of ferro chrome to improve theproductivity.Technology absorption, adaptation and innovationa. Imported technology2005-06 2006-07 <strong>2007</strong>-<strong>08</strong>400,000 TPA Environment Electrode handling technology 0.5 MTPA <strong>Steel</strong> Meltingfriendly Clean type for Ferro-Chrome Plant. Technology consisting ofNon-recovery Coke OvenEAF, LRF etc.Technology0.5 MTPA Bar & WireRod Mill Technology.b. Year of Import : as given abovec. Has technology been fully absorbed: Coke Oven Technology and Electrode Handling technologyhas been fully absorbed.d. The <strong>Steel</strong> Melting Technology and Bar & Wire Rod Mill Technology are under implementation.Foreign Exchange Earnings and Outgoa) Activities relating to exports, initiatives taken to increase exports, development of new productsand services and export plans.The Company is making continuous efforts to increase its exports by exploring, creating anddeveloping new markets for its products. In this endeavor the Company has also converted itsChrome Ore Beneficiation Plant located at Golagaon, near Duburi, Dist-Jajpur Road, Orissafrom a Domestic Tariff Area (DTA) into an 100% Export Oriented Unit (100% EOU).b) Total Foreign Exchange used and earned: (Rs. Million)Particulars <strong>2007</strong> - <strong>08</strong> 2006 - 07Foreign Exchange EarningExport Sales 759.12 1<strong>08</strong>2.40Foreign Exchange Outgo Imports• Raw Materials 2,456.94 2285.88• Finished Goods 2,388.33 1269.64• Capital Goods 43.57 65.32Traveling 0.87 2.01Interest 27.61 41.93Others 0.11 9.40Annexure IIParticulars of Employees under Section 217(2A) of the Companies Act, 1956 read with theCompanies (Particulars of Employees) Rules, 1975 (as amended) and forming part of Directors’<strong>Report</strong> for the year ended on 31 March 20<strong>08</strong>A. Employed throughout the yearSl. Name Designa- Remunera- Qualifi- Experience Date of Age Last Employment,No. tion tion (Rs.) cation (years) Joining Designation,Employer1. Mr.Vishambhar Whole- 13,641,264 Mining 38 15-12-04 60 Chairman &Saran time Director Engg. Managing Director,designated<strong>VISA</strong> Energyas ChairmanResources <strong>Limited</strong>2. Mr.Vishal Agarwal Managing 9,944,705 B.Sc. 11 11-8-97 33 ---Director(Eco),Mastersin Eco.3. Mr. Krishna Executive 2,409,745 B.Sc. 41 10-10-02 65 Chief GeneralMurari Lal Director (Raw (Mining Manager, SECLMaterials)Engg.)4. Mr. Ashok Kumar President 2,945,337 B.E. 40 18-04-05 67 Project Incharge,Lamba * Electrical, Indian AluminumPGMCo. Ltd.5. Mr. Vinod Kumar President 3,359,707 B.E. 31 07-06-06 56 Vice President, AartiProjects -(Mech.) <strong>Steel</strong> & Power Ltd.6. Mr. Manoj Kumar Chief 2,829,030 M.Com, 18 24-03-05 39 Group GeneralDigga Financial ACS, Manager, <strong>VISA</strong>Officer ACA International<strong>Limited</strong><strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>37

New design of Pushercar has been installed toimprove the efficiency ofpushing of coking coal inthe coke ovens.CEO / CFO CERTIFICATION TO THE BOARDThe Board of Directors 28 May 20<strong>08</strong><strong>VISA</strong> <strong>Steel</strong> <strong>Limited</strong>Kolkata 700 027B. Employed for part of the yearSl. Name Designa- Remunera- Qualifi- Experience Date of Age Last Employment,No. tion tion (Rs.) cation (years) Joining Designation,Employer1. Mr.Basudeo Director 525,945 B.Sc. 37 01-02-<strong>08</strong> 61 Managing Director,Prasad Modi Kalinganagar (Engg.) Neelachal Ispat(Mech.),Nigam <strong>Limited</strong>P G PGDiplomain IndustrialEngg.2. Mr.Surya Bhan Executive 1,753,600.00 B.E. 39 01-06-06 60 Director (Operations)Singh ** Director - (Metall- Ispat IndustriesKalinganagar urgy) <strong>Limited</strong>.Pursuant to the provisions of Clause 49 (V) of the Listing Agreement, we, Vishal Agarwal, ManagingDirector and Manoj Kumar Digga, Chief Financial Officer hereby certify that:a. we have reviewed the financial statements and the cash flow statement for the year <strong>2007</strong>-<strong>08</strong>and that to the best of our knowledge and belief:• these statements do not contain any materially untrue statement or omit any material fact orcontain statements that might be misleading;• these statements together present a true and fair view of the company’s affairs and are incompliance with existing accounting standards, applicable laws and regulations.b. there are, to the best of our knowledge and belief, no transactions entered into by the companyduring the year which are fraudulent, illegal or violative of the company’s code of conduct.c. we accept responsibility for establishing and maintaining internal controls for financial reportingand that we have evaluated the effectiveness of internal control systems of the companypertaining to financial reporting and there have been no deficiencies in the design or operationof such internal controls.d. we have indicated to the auditors and the Audit Committee that:i. there have been no significant changes in internal control over financial reporting during theyear;ii. there have been no significant changes in accounting policies during the year; andiii. there have been no instances of significant fraud of which we have become aware.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>39Notes:1. Remuneration includes Salary, House Rent Allowance, Commission, Company’s contributionto Provident Fund and Perquisites. Value of perquisites have been calculated on the basis ofIncome-Tax Act, 1961.2. Information about qualification and last employment are based on particulars furnished by theemployees concerned.3. None of the employees hold by himself or along with his / her spouse and dependent children,2% or more of the equity shares of the Company.4. Mr.Vishambhar Saran is the father of Mr.Vishal Agarwal, Mr.Vikas Agarwal and Mr.VivekAgarwal, and husband of Mrs. Saroj Agarwal all being Directors of the Company.5. Nature of employment in all cases is contractual in nature.* Mr. Ashok Kumar Lamba has retired w.e.f. 1 April 20<strong>08</strong>.** Mr.Surya Bhan Singh has resigned w.e.f. 15 September <strong>2007</strong>For and on behalf of the BoardPlace: KolkataVishambhar SaranDate: 28 May 20<strong>08</strong>ChairmanVishal AgarwalManaging DirectorPersons constituting group coming within the definition of “group” as defined in the Monopolies andRestrictive Trade Practices Act, 1969 include the following:Bodies Corporate<strong>VISA</strong> Minmetal AG<strong>VISA</strong> International <strong>Limited</strong><strong>VISA</strong> Comtrade AG<strong>VISA</strong> Comtrade (Asia) <strong>Limited</strong>, Hongkong<strong>VISA</strong> Comtrade (Asia) <strong>Limited</strong>, Singapore<strong>VISA</strong> PLC<strong>VISA</strong> Power <strong>Limited</strong><strong>VISA</strong> Comtrade <strong>Limited</strong><strong>VISA</strong> Coal Pty <strong>Limited</strong><strong>VISA</strong> BAO <strong>Limited</strong><strong>VISA</strong> Aviation <strong>Limited</strong>North East Resources <strong>Limited</strong><strong>VISA</strong> Infrastructure <strong>Limited</strong>Ghotaringa Minerals <strong>Limited</strong>Khandadhar Minerals <strong>Limited</strong>manoj Kumar DiggaChief Financial OfficerIndividual PromotersVishambhar SaranSaroj AgarwalVishal AgarwalVikas AgarwalVivek AgarwalVishambhar Saran & Sons (HUF)

MANAGEMENTDiscussion and Analysisoverviewconsolidation along the lines of Arcelorcompany OverviewRs. MillionYour Company registered a healthyperformance during <strong>2007</strong>-<strong>08</strong> with a 27%growth in revenues to Rs. 6,828.1 million,103% increase in EBIDTA to Rs. 939.3million, 96% increase in PBT to Rs. 671.4million and 110% rise in PAT to Rs. 431.5million. Your Company’s performance wasdriven primarily by the Coke Oven, BlastFurnace and Ferro Chrome operations andis expected to grow in the coming years withthe commissioning of new projects includingSponge Iron, Power and Special & Stainless<strong>Steel</strong> Plant.INDUSTRY STRUCTURE ANDDEVELOPMENTS<strong>Steel</strong> Industry OverviewThe global <strong>Steel</strong> industry is experiencinga long-term growth phase with expectedCAGR of 5-6 per cent over the next 5 yearsaided by a steady world economic growthinspite of US slowdown due to rising share ofemerging economies in Global GDP. Global<strong>Steel</strong> production recorded a production highof 1.34 billion tonnes in <strong>2007</strong> out of whichChina accounted for over one-third. FurtherMittal and Tata Corus is expected which willrationalise production with growth in demand.<strong>Steel</strong> prices globally have increaseddrastically due to cost push by increase inraw material prices of Iron Ore and CokingCoal and also rise in demand, especially fromChina, India, Brazil, Russia and Middle East.Domestic <strong>Steel</strong> prices have spurted in linewith international prices because of thesteep hike in Coking Coal prices due to theAustralian flood situation and Iron Ore pricesdue to Chinese demand. Domestic Pig Iron,Sponge Iron and <strong>Steel</strong> prices will continueto be firm due to global <strong>Steel</strong> prices, thedomestic demand-supply gap and high rawmaterial prices.Coke prices have increased drastically asChina dominates the global Coke trade andChinese Government has recently increasedexport tax to 25%. The Ferro Chrome priceshave also been buoyant due to the powercrisis in South Africa affecting supplies andstrong demand from the Stainless <strong>Steel</strong>industry in China.Your Company has embarked on anexpansion plan to realise its vision ofbecoming one of the largest, low costIntegrated Special and Stainless <strong>Steel</strong> playerby setting up a fully integrated 0.5 millionTPA Special and Stainless <strong>Steel</strong> Plant atKalinganagar Industrial Complex, Orissa.Your Company’s current saleable productsinclude Pig Iron, Coke, Ferro Chrome,Chrome Concentrates and Sponge Iron andSpecial & Stainless <strong>Steel</strong> will be added indue course. Going forward, your Companywill consume a part of its products captivelyin the manufacture of Special and Stainless<strong>Steel</strong>, once the respective plants arecommissioned.SEGMENT-WISE / PRODUCT-WISEBUSINESS REVIEWThe current business of your Companycomprises of manufacturing of Pig Iron, Coke,Ferro Chrome and Chrome Concentrates andtrading of Coal and Coke. During the yearunder review, the share of Manufacturing andTrading segment in Gross Revenue was52:48 and key financials of each segment isgiven below:Particulars Manufacturing Trading<strong>2007</strong>-<strong>08</strong> 2006-07 <strong>2007</strong>-<strong>08</strong> 2006-07Revenue 3,570.39 2,797.77 3,257.66 2,581.51SegmentResult (beforeinterestand tax)794.52 564.90 168.84 (70.88)ManufacturingThe manufacturing facilities of yourCompany are located in Kalinganagar (BlastFurnace, Coke Oven and Ferro Chrome)and Golagaon (Chrome Ore Beneficiation &Chrome Ore Grinding Plant) in Orissa.Pig IronThe Blast Furnace with a total capacity of225,000 TPA is currently producing Hot Metalwhich is poured into moulds to produce PigIron. Basic grade Pig Iron is sold to various<strong>Steel</strong> plants in eastern India while foundrygrade Pig Iron to major customers in easternand northern India.The total hot metal production during <strong>2007</strong>-<strong>08</strong>was 67,330 MT compared to 181,<strong>08</strong>6 MTof hot metal in 2006-07, due to shutdownfor refractory lining, disruption in Iron Oresupplies and power trippages. Meanwhile,<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>41

The Joint Venture Company withBaosteel Resources Co. Ltd.,China and <strong>VISA</strong> Comtrade AG,Switzerland will set upa 100,000 TPA Ferro ChromePlant in Orissa.the furnace refractory relining is nearingcompletion, Iron Ore production of OMC fromDaitari has resumed and our 220 KV powerline has been commissioned.The primary raw materials for the Blast Furnaceare Iron Ore and Coke. While Iron Ore wassourced from Sesa Goa and OMC, Coke wasutlised mainly from the Coke Oven plant.Pig iron sales contributed to 17% of the totalrevenues of the Company during the year underreview, amounting to Rs. 1185 million.CokeThe Coke Oven Plant, with a total capacityof 400,000 TPA, operates on the stampchargingtechnology which allows blendingof Semi-soft Coking Coals with Hard CokingCoals to produce Low Ash Metallurgical Coke.The total coke production during <strong>2007</strong>-<strong>08</strong>was 176,422 MT compared to 59,643 MT in2006-07 thereby registering an increase of196%. Coking coal, the primary raw materialfor producing coke, was imported fromAustralia. Coke was partly consumed in theBlast Furnace and partly sold with total salescontribution amounting to Rs. 1,907 million,equating to 26% of total revenues.Ferro ChromeThe Ferro Chrome Plant, with a total capacityof 50,000 TPA was commissioned duringNovember <strong>2007</strong> and produced 18,014 MT ofFerro Chrome. The sales contributed 5.5%of total revenues during the year amountingto Rs. 370 million.Chrome Concentrates and Chrome OrePowderThe Chrome Ore Beneficiation Plant and theChrome Ore Grinding Plant, has a capacityof 100,000 TPA each, and produces highgrade Chrome concentrates for exports andChrome Ore powder for sale to Chromechemical plants in India respectively.Chrome concentrates and Chrome Orepowder sales were negligible compared tothe total revenues of the Company. The keyraw material, Chrome Ore, was procuredfrom IDCOL, OMC and B.C. Mohanty.tradingThe trading segment has performed well dueto rise in prices of Coal & Coke. However,going forward, the trading operations willbe strategically limited and with the projectsof your Company getting commissioned,revenues from trading activities are expected toform a negligible portion of its total revenues.Coal & CokeCoal and Coke sales contributed 44% of thetotal revenues of the Company. These weremainly obtained from South Africa, Indonesia,China and Australia and were supplied to theIron & <strong>Steel</strong>, Cement and Power Sectors.PROJECT OVERVIEWSponge Iron Plant – with a total capacityof 300,000 TPA, the plant is equipped with2 x 500 TPD Coal-based Rotary Kilns withOutokumpu (Lurgi) technology for producingSponge Iron is under execution.Waste Heat Recovery Power Plant – witha total capacity of 50 MW (2 x 25 MW TG)power generation from the waste heat gasesfrom the Blast Furnace, Coke Oven andSponge Iron plants is under execution.Special and Stainless <strong>Steel</strong> Plant – is settingup a 70 ton Electric Arc Furnaces (EAF)with AOD, LRF, VD/VOD and a ContinuousCasting Machine with a Billet / Bloom Casterto manufacture 0.5 million TPA of Special andStainless <strong>Steel</strong>.Bar and Wire Rod Mill – is setting up a 0.5million TPA Bar and Wire Rod Mill to besupplied by SMS Meer, Germany.Power Plant – is setting up additional 25 MWPower Plant based on CFBC Boiler.Associated manufacturing facilities – issetting up requisite infrastructure facilities,such as water pipelines, roads, railwaysiding, stockyards, buildings, colony etc.STRATEGIC INITIATIVESJoint Venture with BaosteelDuring the year, your Company executeda Joint Venture Agreement with BaosteelResources Co. Ltd., China and <strong>VISA</strong>Comtrade AG, Switzerland to set up a 100,000TPA Ferro Chrome Plant in Orissa. <strong>VISA</strong>BAO <strong>Limited</strong> (VBL) has been incorporatedon 1 February 20<strong>08</strong> to give effect to this JointVenture. VBL is a subsidiary of your Company,holding 51% of VBL’s paid-up share capitalwith the balance 35% being held by BaosteelResources and 14% by <strong>VISA</strong> Comtrade.Orissa Project - Location &Logistics and Raw MaterialLinkages<strong>Steel</strong> manufacturing is a raw materialintensive industry, requiring 4 tonnes of rawmaterials for every tonne of <strong>Steel</strong> and to thiseffect, location and logistics play a major rolein the viability of <strong>Steel</strong> manufacturing units.Your Company’s Integrated Special andStainless <strong>Steel</strong> Plant is strategically locatedin the Kalinganagar Industrial Complex,Orissa, to leverage advantages of havingTalcher Coalfields 110 kms away, Daitari IronOre mines 30 kms away, Keonjhar and BarbilIron Ore mines are 100 to 150 kms away,Sukinda Chrome Ore mines 35 kms away,and Paradip port 120 kms away.Your Company has also taken necessarysteps for securing its growing raw materialrequirements and integrating backwards intomining of Iron Ore, Chrome Ore and Coal.OPPORTUNITIES AND THREATSYour Company is poised to seize theopportunities in the Iron & <strong>Steel</strong> Industry(both for steel & intermediary saleableproducts) through its strengths of locationaland logistical advantages, raw materiallinkages, technology edge and managementexpertise. These opportunities will belinked directly to the growing demand fromthe automobile and auto components,infrastructure, construction and powersectors. Your Company’s strategic locationin Kalinganagar offer scope for seamlessvalue addition in its manufacturing processfrom hot metal to stainless steel. YourCompany is also well positioned in itsconscious adherence to a modular projectimplementation, thereby enabling ploughingof internal accruals in future projects, therebyreducing costs related to financing.The threats for your Company would comefrom adverse fluctuations in input and capitalcosts, foreign exchange variations andtaxes and duties. The buoyancy in the Iron& <strong>Steel</strong> Sector has attracted many players,resulting in reduced availability of skilledmanpower and contractor workforce. Delayin implementation of project may lead toopportunity loss in revenue generation andrise in costs.<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>43

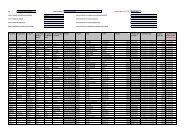

27% revenue growth.96% PBT growth. 110%PAT growth.RISK MANAGEMENTYour Company has identified the major thrustareas to concentrate on, which it believes tobe critical to achievement of organisationalgoals. A well defined structure has beenlaid down to assess, monitor and mitigaterisks associated with these areas, brieflyenumerated below:a) Project implementation – Project status ismonitored on a regular basis by the projectmanagement team to counter slippages andreviewed on a monthly basis by the executivemanagement. Consultants are presenton-site for mitigating contingencies on theimplementation front. Necessary coveragehas been taken in the form of an extensiveErection All Risk Policy.FINANCE REVIEW AND ANALYSISYour Company reported a revenue of Rs. 6,828.1 million, registering a 27% increase over 2006-07and Rs. 431.5 million in profits after tax, an increase of 110% over 2006-07. Your Company hasposted an EBITDA of Rs. 939.3 million in the year <strong>2007</strong>-<strong>08</strong>, an increase of 103% from the year2006-07.HIGHLIGHTSb) Foreign Exchange – Your Company dealsin sizeable amount of foreign exchange inimports of capital items and raw materialsand exports of finished products. Necessaryguidance is provided by the forex consultanton mitigating foreign exchange exposure.c) Systems – Your Company hasimplemented SAP, the leading software forEnterprise Resource Planning, to integrateits operations and to use best business andcommercial practices. Your Company hasappointed a support partner for smootherstabilisation & to derive significant benefitsfrom SAP.d) Statutory compliances – Procedure is inplace for monthly reporting of complianceof statutory obligations and reported to theBoard of Directors at its meetings.Rs. Million<strong>2007</strong>-<strong>08</strong> 2006-07 Change %Net Sales / Income from Operations 6,807.65 5,311.80 1495.85 28.16Other Income 20.40 67.48 (47.<strong>08</strong>) (69.77)Total Income 6,828.05 5,379.28 1448.77 26.93(Increase) / decrease in stock (871.96) 301.06 (1173.02) (389.63)Raw Materials consumed 2,741.53 1,837.96 903.57 49.16Purchase of Trading Products 2,977.38 2,280.93 696.45 30.53Employee Cost 140.16 50.61 89.55 176.94Other expenses 901.66 445.<strong>08</strong> 456.58 102.58Operating Profit 939.28 463.64 475.64 102.59Interest (Net) 85.34 22.92 62.42 272.34Depreciation 182.59 97.67 84.92 86.95Profit before Tax 671.35 343.05 328.30 95.70Provision for Tax 239.87 137.84 102.03 74.02Profit after Tax 431.48 205.21 226.27 110.26Sales & Other IncomeSales were primarily driven by the Cokeand Ferro Chrome business on the back ofimproved volumes and better realisationsinspite of lower pig iron volumes. OtherIncome constitutes mainly income from saleof scrap, DEPB licence, foreign exchangegain, receipt of insurance claim proceeds,etc.Purchase of Traded ProductsPurchase cost of traded goods increasedon account of increase in prices, despitedecrease in volumes compared to theprevious year.Raw materials consumed,Employee Cost and OtherExpensesRaw material consumption increased by49.16% due to production volumes andimproved productivity . Employee costincreased due to rise in manpower strengthfor the expanding facilities. Other expensesincreased with more manufacturing facilities.Interest ChargesThe net interest charges increasedsubstantially during the year due to increasedterm loan and working capital interest onaccount of commencement of additionalmanufacturing facilities and operations andreduced interest income earned on fixeddeposits with banks.DepreciationDepreciation increased significantly duringthe year mainly due to commissioning of theFerro Chrome Plant.Profit after TaxPAT improved on account of improvedperformance of the Coke Oven and FerroChrome Plants and the captive use of themajority of the coke production facilitatedimprovement in margins. PAT was adverselyimpacted by the incidence of deferred taxprovisions due to addition of fixed assets.Cash ProfitCash profit improved substantially by 87%,during the year to Rs. 792.12 million from Rs.423.7 million in the year 2006-07 on accountof improved performance of Coke Oven,Ferro Chrome and trading operations.BALANCE SHEET ANALYSISFixed Assets & InvestmentsYour Company made major commitmentsduring the year on account of capitalexpenditure for the Sponge Iron Plantand Power Plant, which are reflected asCapital WIP in the Fixed Assets Schedule.Your Company has been jointly allotted thePatrapada coal block in Talcher, Orissa,through a joint venture company, PatrapadaCoal Mining Company Private <strong>Limited</strong>. Asreported last year, your Company has a89 per cent controlling stake in GhotaringaMinerals <strong>Limited</strong>, which plans to developa chrome ore deposit in Orissa and withwhom your Company had entered into along term agreement for securing its ChromeOre requirements. Your Company has alsoentered into a Joint Venture Agreementwith Baosteel Resources Co. Ltd. and <strong>VISA</strong>Comtrade AG for setting up a 100,000 TPAFerro Chrome Plant.InventoriesInventory of raw materials went up duringthe year due to increased Coke Oven &Ferro Chrome operations and also due tobulk purchase of imported coke and coking<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>-<strong>08</strong>45