1.99 mb - Investcorp.com

1.99 mb - Investcorp.com

1.99 mb - Investcorp.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

1. BUSINESS DESCRIPTION<br />

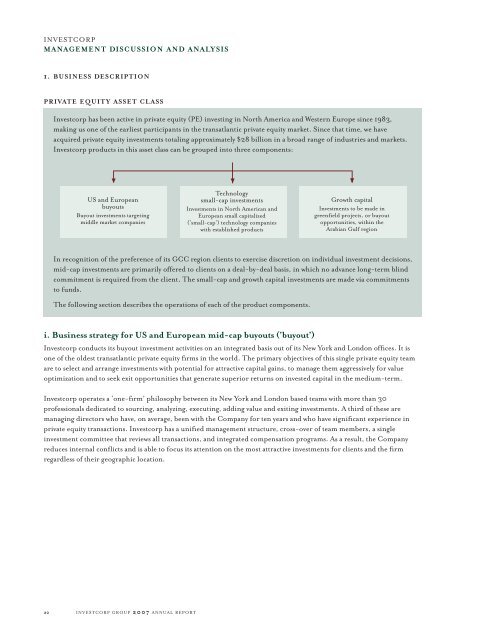

PRIVATE EQUITY ASSET CLASS<br />

<strong>Investcorp</strong> has been active in private equity (PE) investing in North America and Western Europe since 1983,<br />

making us one of the earliest participants in the transatlantic private equity market. Since that time, we have<br />

acquired private equity investments totaling approximately $28 billion in a broad range of industries and markets.<br />

<strong>Investcorp</strong> products in this asset class can be grouped into three <strong>com</strong>ponents:<br />

US and European<br />

buyouts<br />

Buyout investments targeting<br />

middle market <strong>com</strong>panies<br />

In recognition of the preference of its GCC region clients to exercise discretion on individual investment decisions,<br />

mid-cap investments are primarily offered to clients on a deal-by-deal basis, in which no advance long-term blind<br />

<strong>com</strong>mitment is required from the client. The small-cap and growth capital investments are made via <strong>com</strong>mitments<br />

to funds.<br />

The following section describes the operations of each of the product <strong>com</strong>ponents.<br />

i. Business strategy for US and European mid-cap buyouts (‘buyout’)<br />

<strong>Investcorp</strong> conducts its buyout investment activities on an integrated basis out of its New York and London offices. It is<br />

one of the oldest transatlantic private equity firms in the world. The primary objectives of this single private equity team<br />

are to select and arrange investments with potential for attractive capital gains, to manage them aggressively for value<br />

optimization and to seek exit opportunities that generate superior returns on invested capital in the medium-term.<br />

<strong>Investcorp</strong> operates a ‘one-firm’ philosophy between its New York and London based teams with more than 30<br />

professionals dedicated to sourcing, analyzing, executing, adding value and exiting investments. A third of these are<br />

managing directors who have, on average, been with the Company for ten years and who have significant experience in<br />

private equity transactions. <strong>Investcorp</strong> has a unified management structure, cross-over of team me<strong>mb</strong>ers, a single<br />

investment <strong>com</strong>mittee that reviews all transactions, and integrated <strong>com</strong>pensation programs. As a result, the Company<br />

reduces internal conflicts and is able to focus its attention on the most attractive investments for clients and the firm<br />

regardless of their geographic location.<br />

22 INVESTCORP GROUP 2007 ANNUAL REPORT<br />

Technology<br />

small-cap investments<br />

Investments in North American and<br />

European small capitalized<br />

(‘small-cap’) technology <strong>com</strong>panies<br />

with established products<br />

Growth capital<br />

Investments to be made in<br />

greenfield projects, or buyout<br />

opportunities, within the<br />

Arabian Gulf region

The business is centered on the following key principles:<br />

■ Investment approach<br />

<strong>Investcorp</strong>’s investment opportunities are primarily sourced through its contacts with a broad range of financial<br />

institutions and intermediaries throughout North America and Western Europe, which have been built up over its 25<br />

years in private equity. The Company invests in maintaining and strengthening these relationships, and ensures that its<br />

relationships have a strong understanding of its business model and strategy and therefore the type of investments in<br />

which it is interested. In addition to sourcing investment opportunities through financial intermediaries, <strong>Investcorp</strong> also<br />

places heavy emphasis on identifying opportunities through extensive networks of senior executives across the corporate<br />

landscapes in North America and Western Europe.<br />

Target ownership<br />

Asset class<br />

Investment thesis<br />

Deal size (EV)<br />

Target profile<br />

Deal frequency<br />

Deal flow sources<br />

Industry focus<br />

Minority Club 50-50% with ability to<br />

execute post-acq model<br />

Senior debt High Yield Mezzanine Venture<br />

capital<br />

Globalization<br />

Drive scale/<br />

sector cons. Operational<br />

improvements<br />

Market<br />

growth<br />

Majority<br />

Buyouts<br />

Cash flow<br />

generation<br />

$300 million $1.3 billion<br />

Turnarounds Family owned<br />

and managed Corporate<br />

carve-outs<br />

Relationship PE<br />

firms<br />

Sector focus<br />

Not in current scope<br />

3–5 deals annually<br />

Global<br />

business<br />

Generalist<br />

Domestic<br />

leaders<br />

Executive contacts Investment banks Proprietary<br />

Initiatives in process Within current scope<br />

<strong>Investcorp</strong> has created a systematic approach to this crucial <strong>com</strong>ponent of its investment process, through hosting<br />

periodic informative events of interest for senior corporate executives as well as keeping in regular contact personally and<br />

through the use of email newsletters and personal correspondence.<br />

The enterprise value of each targeted <strong>com</strong>pany is between $300 million and $1.3 billion, where each requires<br />

$100 – $350 million of equity and where the expected holding period is between three and seven years. <strong>Investcorp</strong>’s<br />

investment thesis is based on a strategy of value enhancement by partnering with talented managers in a given industry<br />

and focusing on business fundamentals, rather than reliance on multiple arbitrage or use of excessive leverage.<br />

<strong>Investcorp</strong> seeks investment opportunities in <strong>com</strong>panies with capable management teams, prominent positions in their<br />

industry, a strong track record and potential for growth. Specifically, the Company looks for opportunities where a<br />

co<strong>mb</strong>ination of revenue growth, margin enhancement through operational improvement and scale economies, and the<br />

introduction of more sophisticated management techniques and best practices is expected to generate an increase in value<br />

in the medium-term. The team aims to <strong>com</strong>plete three to five acquisitions in any given year.<br />

<strong>Investcorp</strong> and its economic and voting co-investors generally acquires controlling interests in its targets and it generally<br />

does not engage in transactions in collaboration with other investors unless it acquires the controlling position in<br />

the acquisition.<br />

Buyout strategy<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 23

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

■ Institutionalized due diligence and risk management<br />

<strong>Investcorp</strong> has developed rigorous internal processes that provide the framework and discipline for an institutionalized<br />

approach to up-front due diligence and post acquisition value enhancement.<br />

Value addition focuses on applying the co<strong>mb</strong>ination of financial, strategic and operating skills across the business<br />

throughout the life-cycle of ownership. Over one third of the buyout team me<strong>mb</strong>ers have strategic or operational<br />

backgrounds. The specific investment risks associated with private equity are controlled and mitigated by a team of<br />

experienced acquisition and post-acquisition professionals and advisory directors.<br />

Timing<br />

Major<br />

Focus<br />

Mix of<br />

skills<br />

Pre-close to 1st 150 days<br />

Acquire<br />

<strong>com</strong>pany<br />

Kick-start<br />

agenda<br />

Manage<br />

aggressively<br />

Provide<br />

support<br />

Optimize<br />

exit<br />

Risk is further mitigated by <strong>Investcorp</strong>’s established infrastructure and Value-at-Risk (VaR) based risk assessment using<br />

the MSCI Barra equity models, adjusted for private equity. These risk models have been developed, thoroughly tested and<br />

improved over time through various market cycles. A detailed description of the VaR-based risk approach is covered in<br />

the risk management discussion.<br />

■ Unique offering structure<br />

<strong>Investcorp</strong> initially underwrites the equity portion of each acquisition, and most of this equity is subsequently syndicated<br />

to its client base. Management of the acquired <strong>com</strong>panies is economically aligned with <strong>Investcorp</strong> and its clients through<br />

their equity participation.<br />

<strong>Investcorp</strong> retains a proportion of the equity on its own balance sheet as a co-investment. It exercises a controlling<br />

interest over the invested <strong>com</strong>panies via fiduciary agreements with its clients. This co-investment between <strong>Investcorp</strong><br />

and management creates a strong partnership of aligned interests. Furthermore, clients have the opportunity, with full<br />

discretion, to invest equally in each transaction, leading to superior portfolio diversification and risk-return profile.<br />

<strong>Investcorp</strong> is also able to structure a portion of its deal-by-deal private equity offerings in Islamic shariah-<strong>com</strong>pliant<br />

form in order to attract investors seeking such investments. The Company expects shariah-<strong>com</strong>pliant offerings to be an<br />

increasingly important source of its private equity AUM in the future. This unique offering structure permits <strong>Investcorp</strong><br />

to earn a large proportion of its overall fees upfront, thereby enhancing the quality of its revenue streams.<br />

For certain large institutional investors, <strong>Investcorp</strong> offered its buyout product line in the form of a pledge fund. The<br />

limited nu<strong>mb</strong>er of clients who participated in its pledge fund invested an agreed upon minimum amount in a specified<br />

nu<strong>mb</strong>er of its buyout transactions. In return, the pledge fund investors were entitled to a preferential allocation in each<br />

of <strong>Investcorp</strong>’s buyout transactions.<br />

24 INVESTCORP GROUP 2007 ANNUAL REPORT<br />

Strategic<br />

Operating<br />

Financial<br />

Value creation<br />

Leverage<br />

best practices<br />

Exit

In fiscal 2007 <strong>Investcorp</strong> launched a $1 billion buyout fund targeted at North American and Western European<br />

institutional investors. This fund, which will co-invest alongside our traditional buyout product line, will replace the<br />

pledge fund such that from fiscal 2008 the original pledge fund investors will participate through this new fund. The<br />

fund is additive to <strong>Investcorp</strong>’s placement capacity, thereby allowing for a <strong>com</strong>mensurate enlargement of potential deal<br />

sizes as the fund invests over the expected five year life cycle.<br />

■ Commitment to portfolio <strong>com</strong>panies<br />

Investments are designed to support the Company’s long-term goals and to build value. This theme is consistent with the<br />

way <strong>Investcorp</strong> has supported its portfolio <strong>com</strong>panies during difficult times by providing additional resources and capital,<br />

when there is a clearly identified and supportive value thesis.<br />

■ Deal financing edge<br />

<strong>Investcorp</strong> manages a well capitalized and highly liquid balance sheet. This, coupled with the broad access to financing<br />

and capital markets and established investment banking relationships, assists in deal sourcing and successful execution of<br />

acquisitions, even in difficult or <strong>com</strong>petitive market environments.<br />

Investment process<br />

Deals are sourced directly or via intermediaries such as investment banks, industry contacts or other financial sponsors.<br />

Of the 400+ potential opportunities presented throughout the year on average, about 5% will make it through an initial<br />

screening process following application of <strong>Investcorp</strong>’s strict selection criteria. Acquisition due diligence and risk analysis<br />

will then lead to three to five actual acquisitions every year and a targeted annual deployment of equity of $750 – $900<br />

million, prior to client syndication.<br />

Acquisition Post-acquisition Realization<br />

■ Strict investment<br />

parameters/selection criteria<br />

- Deal size ($300m–1,300m)<br />

- Industry attractiveness<br />

■ Strong due diligence involving postacquisition<br />

experience/skills<br />

■ Quality control and dynamic risk<br />

modeling<br />

■ Two-tiered, team-based investment<br />

approval process<br />

- Investment Committee<br />

- Commitment Committee<br />

Network strength<br />

Banks, advisors, industry<br />

experts and previous<br />

management teams<br />

■ Alignment phase—agree management<br />

agenda<br />

■ Specific programs and metrics for key<br />

value drivers<br />

■ Advisory directors and industry<br />

specialists for operating expertise<br />

■ Portfolio Review Committee focused<br />

on strategy, management and<br />

resources<br />

■ Fresh Look program<br />

■ Lessons Learned program<br />

■ Formalized training program<br />

■ Support funding (same approval<br />

process)<br />

Culture<br />

Active ownership<br />

■ Exit planning starts at acquisition<br />

■ Prepare and position <strong>com</strong>pany<br />

for exit<br />

■ Evaluate multiple divestiture options<br />

■ Divest opportunistically (flexible<br />

timing)<br />

Internal expertise<br />

Co<strong>mb</strong>ination of buyout and<br />

strategic/operational<br />

specialists<br />

All acquisitions undergo rigorous analysis at a nu<strong>mb</strong>er of Investment Committee meetings and all such acquisitions,<br />

add-on financings or exit arrangements also require final approval by an independent cross-functional Commitment<br />

Committee.<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 25

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Investment Committee: first tier review for all<br />

The Investment Committee <strong>com</strong>prises the most experienced buyout partners from the New York and London<br />

offices. The <strong>com</strong>mittee meets at least once a week to review new investment proposals and any proposed subsequent<br />

capital injection. Each new investment is reviewed at least three times during the transaction process. The<br />

<strong>com</strong>mittee shapes the due diligence effort and allocates resources in a phased approach, in light of critical issues<br />

identified. At the last stage, the investment <strong>com</strong>mittee will approve the valuation and the structure of the bid,<br />

pending <strong>com</strong>mitment <strong>com</strong>mittee approval, and advise on deal negotiations.<br />

Each new investment proposal is supported by detailed analyses that identify the business rationale, relevant<br />

risks/returns and valuations. The analyses highlight all major risks associated with achievement of targeted returns<br />

and provide parameters to thoroughly test the business plan for risk mitigation and return optimization<br />

characteristics.<br />

Commitment Committee: second tier review of Investment Committee re<strong>com</strong>mendations<br />

The Commitment Committee is a cross-functional group drawn from the senior management team of the<br />

Company, to ensure interests of <strong>Investcorp</strong>’s balance sheet and clients are represented, along with appropriate<br />

oversight and review, before final approval to make an acquisition or provide add-on funding. The <strong>com</strong>mittee<br />

<strong>com</strong>prises the COO, the CFO, a senior me<strong>mb</strong>er of the placement and relationship management team, the head<br />

of risk management and three senior executives from the buyout team.<br />

The <strong>com</strong>mittee reviews each new investment proposal at least twice during the transaction process. The first<br />

review is an initial briefing that takes place when the deal team believes there is a reasonable likelihood of the<br />

consummation of the transaction. The second is a final approval meeting, which takes place immediately after the<br />

investment <strong>com</strong>mittee has re<strong>com</strong>mended making or accepting a binding bid. The <strong>com</strong>mittee also examines<br />

proposals for realization alternatives for existing investments and makes re<strong>com</strong>mendations on the most optimal<br />

strategy for the eventual realization of each portfolio <strong>com</strong>pany.<br />

The <strong>com</strong>mittee approves or rejects a proposed investment or realization from two perspectives: its attractiveness to<br />

<strong>Investcorp</strong>’s investor base and its attractiveness to <strong>Investcorp</strong> as a co-investor, thereby maintaining alignment and<br />

balance of its fiduciary responsibilities to Investors and shareholders.<br />

Post acquisition oversight is provided by regular meetings of senior executives, operating <strong>com</strong>pany management<br />

and advisory directors, who are seasoned industry executives each with an average of more than 30 years’ experience in<br />

specific industries or functional areas. The advisory directors have strong operational experience and, therefore, are a<br />

strong influential factor in helping achieve successful growth in enterprise value in portfolio <strong>com</strong>panies over the<br />

investment period. On occasion, they will have daily interaction with the business, including meetings with junior levels<br />

of management, to implement operational plans.<br />

Throughout the buyout investment cycle, the focus is on a systematic and defined process that draws on <strong>Investcorp</strong>’s<br />

25 years of operating experience in the US and European marketplace. In addition to the advisory directors, <strong>Investcorp</strong><br />

actively uses its industry contact network and close relationships with global and boutique executive search firms to<br />

source industry experts. These experts can provide focused, sector-based value-add ideas, advice and counsel with<br />

diligence on specific deals or post acquisition focus on individual portfolio <strong>com</strong>panies. Rigorous internal business<br />

processes and decision making such as the Alignment Phase and Fresh Look and Lessons Learned programs are designed to<br />

continuously add value.<br />

26 INVESTCORP GROUP 2007 ANNUAL REPORT

Portfolio reviews formally establish annual objectives for each portfolio <strong>com</strong>pany and develop quantifiable annual<br />

objectives against which progress can be measured. A portfolio review <strong>com</strong>mittee, <strong>com</strong>prising senior partners and<br />

advisory directors, meets at least twice a year for each portfolio <strong>com</strong>pany to focus on strategy, management talent and<br />

resources required to execute the Company’s value enhancement strategy. Companies with more <strong>com</strong>plex issues are<br />

reviewed more frequently.<br />

Each senior associate, principal and managing director undertakes a structured training program in conjunction with<br />

senior executive training experts, major corporate relationships and advisory directors. This is aimed at maintaining<br />

up-to-date thinking on the techniques used to enhance strategic and operating performance of portfolio <strong>com</strong>panies,<br />

which ultimately drives value enhancement.<br />

US Advisory Directors<br />

(Portfolio Company Board)<br />

Dick Jalkut (TelePacific)<br />

Former President & Group Executive –<br />

NYNEX Tele<strong>com</strong>munications<br />

Jim Hardymon (PlayPower, FleetPride,<br />

American Tire, Berlin Packaging)<br />

Former CEO – Textron<br />

COO – Emerson Electric<br />

Bob Geckle (PlayPower, CCC, FleetPride, Greatwide)<br />

Former Group President – Textron<br />

Business Unit GM – Emerson Electric<br />

Dana Snyder (Associated Materials)<br />

Former COO – Plygem Industries<br />

President – Alcoa Building Products Group<br />

Marty Maleska (CCC, SourceMedia)<br />

Former SVP & Group Executive – Macmillan<br />

Former President, International & Professional<br />

Publishing – Simon & Schuster<br />

Former CEO, Business Information – Primedia, Inc.<br />

European Advisory Directors<br />

(Portfolio Company Board)<br />

Germany<br />

Stephan Kessel (TimePartner)<br />

Former CEO – Continental AG<br />

France<br />

Alain Redheuil (American Tire,<br />

Autodistribution, Orefi)<br />

Former CEO – Rexel Group<br />

Me<strong>mb</strong>er of Pinault Printemps Redoute<br />

executive <strong>com</strong>mittee<br />

Former COO – Michelin Europe<br />

CEO – Autodistribution<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 27

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Alignment phase<br />

A structured approach<br />

designed to increase<br />

likelihood that<br />

<strong>com</strong>pany achieves its<br />

return targets<br />

(especially, first year’s<br />

financial targets)<br />

Fresh Look program<br />

Objectives<br />

■ Briefly review performance against<br />

original business case investment<br />

thesis – understand areas of under<br />

performance<br />

■ Assess industry outlook and<br />

<strong>com</strong>petitive dynamics<br />

■ Evaluate strategy, business plans,<br />

performance objectives, outlook<br />

and potential<br />

■ Review exit options and their<br />

implications and develop<br />

independent point of view<br />

■ Frame options and re<strong>com</strong>mend<br />

course of action<br />

■ Test and <strong>com</strong>plete investment thesis and kick off strategic planning<br />

process<br />

■ Complete/extend management and organizational assessment<br />

■ Decide on action plan to address potential upsides to the<br />

management plan (revenue and cost)<br />

■ Benchmark fundamental business processes<br />

■ Agree management agenda with CEO and senior managers,<br />

including prioritized initiatives and ongoing monitoring<br />

mechanisms<br />

■ Establish strategic, operational and financial metrics tied to CEO<br />

agenda and management bonus scheme and incorporate into<br />

management dashboard<br />

Lessons Learned program<br />

Objectives<br />

Objective<br />

assessment<br />

without<br />

management<br />

bias<br />

■ Identify lessons to be learned<br />

from each successful deal<br />

process<br />

■ Incorporate learning into PE<br />

business processes<br />

■ Educate PE team on lessons<br />

learned and resulting<br />

improvements to key business<br />

processes<br />

ii. Business strategy for global technology small cap (‘TSI’)<br />

Process<br />

■ Timing<br />

- Conducted every two years by<br />

an independent <strong>Investcorp</strong><br />

partner; or<br />

- Investment <strong>com</strong>mittee<br />

decision ad-hoc<br />

■ Duration: four-six weeks<br />

■ Participants: managing director<br />

or principal and associate;<br />

advisory director; supported by<br />

outside consultants, as needed<br />

Continuous<br />

process<br />

improvement<br />

through formal<br />

study of recent<br />

transaction<br />

experiences<br />

Process<br />

■ Timing<br />

- upon <strong>com</strong>pletion of transaction<br />

- as part of Fresh Look process<br />

- following exit<br />

■ Deal team to conduct formal<br />

post-mortem assessment<br />

■ Deal team presents lessons learned<br />

and re<strong>com</strong>mendations for process<br />

improvements at new business<br />

meetings in each office<br />

The TSI line of business offers <strong>Investcorp</strong>’s clients the opportunity to invest in select technology sectors in the US and<br />

Europe. With <strong>Investcorp</strong> as a co-investor, clients participate on a portfolio basis through dedicated technology investment<br />

funds. The TSI team manages $530 million through two separate funds: the 2001 <strong>Investcorp</strong> Technology Ventures<br />

Fund I (Fund I), with a <strong>com</strong>mitment size of $230 million, and the 2005 <strong>Investcorp</strong> Technology Ventures Fund II<br />

(Fund II). Fund II had strong participation from <strong>Investcorp</strong>’s traditional GCC investors as well as a diverse group of new<br />

limited partners from North America, Europe and Asia in the TSI team’s first formal offering to these markets.<br />

The team is focused on making small size investments in control-oriented corporate carveouts, buyouts and public<br />

situations. With the team targeting these more <strong>com</strong>plex transactions that fall between the focus of traditional venture<br />

capital firms and traditional buyout firms, the TSI group applies a distinct skill set and operating model.<br />

28 INVESTCORP GROUP 2007 ANNUAL REPORT

The TSI partners have worked together for over five years with many years of financial, operating, technical and<br />

investing experience between them, and the team has the balance and diversity from different cultural, professional<br />

and technical backgrounds.<br />

The TSI business is built on the following key principles:<br />

■ Disciplined investment approach<br />

The TSI business benefits from the institutional excellence of <strong>Investcorp</strong> as a global manager of alternative assets. It has<br />

developed formal processes for reviewing new investments, determining which investments to pursue, undertaking due<br />

diligence, engaging advisors and <strong>com</strong>municating within the team. These disciplined institutional processes – more<br />

<strong>com</strong>mon to successful buyout funds than to most venture firms — are intended to ensure that the team invests in solid<br />

<strong>com</strong>panies at reasonable valuations. Generally, at least three investment professionals work on every transaction, and all<br />

investments are vetted by the whole team. This team-based approach allows for the identification of potential risks and<br />

also serves as a check on the transaction team’s deal evaluations.<br />

■ Exit focus<br />

As part of its pre-investment due diligence process for all potential investments, the team spends a substantial amount of<br />

time analyzing exit strategies, including the consideration of likely acquirers, analysis of relevant precedent transactions<br />

and public <strong>com</strong>panies as proxies for valuation ranges, and development of an exit ‘waterfall’ to ensure that deals are<br />

structured appropriately. The TSI team will only invest in situations where it is confident that an exit can be engineered<br />

within a reasonable time frame. The team’s post investment oversight remains exit-oriented as it works with management<br />

to drive the <strong>com</strong>pany toward growth and continues to evaluate exit strategies in light of business performance, market and<br />

technology trends and public/private market conditions.<br />

■ Offering structure<br />

Unlike the majority of our private equity and real estate investments (which are marketed to our clients on a deal by<br />

deal basis), our venture capital product is offered to our clients on a dedicated fund basis. Accordingly, capital is raised<br />

from our investors, and <strong>Investcorp</strong> as co-investors in each of our venture capital funds, in the form of firm capital<br />

<strong>com</strong>mitments prior to the fund’s closing. Such capital is subsequently drawn and utilized by the funds to make equity<br />

investments in the targeted range of technology related <strong>com</strong>panies.<br />

■ Institutionalized investment experience<br />

In addition to its institutionalized investment discipline, the TSI team uses its influence to institute or encourage ‘best<br />

practices’ at its portfolio <strong>com</strong>panies, including the installation of corporate governance controls, audited financials<br />

and formalized business processes in order to position its portfolio <strong>com</strong>panies for eventual sales or public listings. In<br />

addition, the team benefits from <strong>Investcorp</strong>’s extensive network of corporate relationships with current and past buyout<br />

and TSI portfolio <strong>com</strong>panies; more than 20 chief information officers of current buyout portfolio <strong>com</strong>panies are<br />

available for due diligence as well as for potential customer introductions. The investment team also works closely with<br />

colleagues in the buyout business <strong>com</strong>plementing the team’s capabilities with extensive local expertise and networks.<br />

These are used to generate cross-border deal flow, structure sophisticated technology deals and support <strong>com</strong>panies in<br />

the investment portfolio.<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 29

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Investment process<br />

The team generally targets four types of investment opportunity:<br />

TSI investment focus<br />

Transaction type<br />

Divestitures and<br />

corporate spinouts<br />

Take-privates and<br />

PIPE transactions<br />

Venture buyouts<br />

Expansion stage<br />

financing<br />

Since inception, TSI has avoided investing in businesses that rely on the success of specific point technologies or<br />

standards. Instead, the TSI team examines broader multi-year trends and evaluates the growth potential of businesses<br />

based on these trends. TSI technology sector trends are long-term in nature:<br />

■ Corporate focus on cost reduction and return on investment<br />

■ Emergence of next generation data networks<br />

■ Advancement of mobility and ‘anytime, anywhere’ access<br />

■ Expansion of IT security solutions<br />

■ Continued penetration of digital content and media<br />

■ Convergence trend in consumer electronics<br />

Driver Examples<br />

Non-core assets or corporate orphans that<br />

have strong growth prospects but limited<br />

access to capital<br />

Small public <strong>com</strong>panies with<br />

growth prospects but limited access<br />

to public capital<br />

Mature technology <strong>com</strong>panies lend<br />

themselves to a leveraged buyout<br />

Volatile public markets force<br />

later stage growth <strong>com</strong>panies to<br />

seek private capital<br />

30 INVESTCORP GROUP 2007 ANNUAL REPORT<br />

■ Magnum (Cirrus Logic spinout)<br />

■ Antares (Kulicke & Soffa spinout)<br />

■ Willtek (Acterna spinout)<br />

■ Softek (Fujitsu spinout)<br />

■ Utimaco (Frankfurt Exchange PIPE)<br />

■ Viewlocity (Nasdaq take private)<br />

■ Mania (Frankfurt Exchange PIPE)<br />

■ InfoNXX (a venture buyout of Conduit)<br />

■ PortalPlayer (IPO Nove<strong>mb</strong>er 2004)<br />

■ Trema (Trade sale July 2006)

The team focuses on <strong>com</strong>panies that broadly fall into four key areas: mobile data technologies and applications,<br />

enterprise software, <strong>com</strong>munications infrastructure products and applications, and digital content enablement.<br />

The following chart illustrates how these key trends drive the four focus areas of the Funds:<br />

Technology trends<br />

■ Advancement of mobility and ‘anytime, anywhere’<br />

access<br />

■ Emergence of next-generation data networks<br />

■ Continued penetration of digital content and media<br />

■ Corporate focus on cost reduction and ROI<br />

■ Expansion of IT security solutions<br />

■ Emergence of next-generation data networks<br />

■ Emergence of next-generation data networks<br />

■ Corporate focus on cost reduction and ROI<br />

■ Expansion of IT security solutions<br />

■ Continued penetration of digital content and media<br />

■ Convergence trend in consumer electronics<br />

■ Advancement of mobility and ‘anytime, anywhere’<br />

access<br />

A unique advantage for the TSI business in its deal sourcing is its ability to leverage the network of relationships of the<br />

senior management team as well as those of <strong>Investcorp</strong>. Investment opportunities are sourced through several avenues,<br />

including: (i) other lines of business at <strong>Investcorp</strong>; (ii) existing portfolio <strong>com</strong>panies within the funds or other parts of<br />

<strong>Investcorp</strong>; (iii) venture capital firms that approach <strong>Investcorp</strong>; (iv) banking intermediaries; and (v) entrepreneurs who<br />

make a direct approach. The majority of the transactions that have been reviewed by the TSI team are internally sourced<br />

with no intermediaries or <strong>com</strong>petitive processes involved.<br />

Potential investments undergo a detailed and extensive selection process intended to identify investments which meet<br />

<strong>Investcorp</strong>’s and its clients’ investment criteria and provide the potential for sizeable capital gains at exit, including:<br />

■ extensive pre-investment due diligence on all aspects of the business model, market dynamics, technology, financial<br />

and accounting processes, and management viability;<br />

■ detailed valuation modeling; and<br />

TSI focus areas<br />

Mobile data<br />

technologies and<br />

applications<br />

Enterprise<br />

software and<br />

technology<br />

outsourcing<br />

Communication<br />

infrastructure<br />

products and<br />

applications<br />

Digital content<br />

enablement<br />

Sample sectors<br />

■ Location-based services<br />

■ Chips for mobile routing<br />

■ Wireless data infrastructure<br />

■ Wireless test equipment<br />

■ Enterprise security<br />

■ Financial software<br />

■ Legacy integration<br />

■ Supply chain management<br />

■ Media processing<br />

■ Network devices<br />

■ Network security<br />

■ Wireless backhaul<br />

■ Chips for video applications<br />

■ ‘Digital home’ applications<br />

■ Electronic Payment<br />

■ On-line advertising<br />

■ detailed VaR-based risk modeling of the impact of new investments on the overall fund<br />

Example<br />

investment<br />

Willtek<br />

Softek<br />

Dialogic<br />

Magnum<br />

Progressive approval and buy-in from the TSI team is sought throughout the process, with all final investment decisions<br />

subject to unanimous approval by the me<strong>mb</strong>ers of the team. This dynamic and rigorous process approach is increasingly<br />

important in a <strong>com</strong>petitive venture capital environment.<br />

With respect to corporate governance, <strong>Investcorp</strong> typically requires board representation or board observer rights for<br />

each investment. In certain situations, it will also seek representation on audit and executive <strong>com</strong>pensation <strong>com</strong>mittees<br />

and look to implement appropriate corporate governance practices within each portfolio <strong>com</strong>pany. <strong>Investcorp</strong> does<br />

not seek to run a portfolio <strong>com</strong>pany on a day-to-day basis but is <strong>com</strong>mitted to continually monitoring the operational<br />

performance of individual portfolio investments through regular update calls, board meetings, strategy sessions and<br />

day-to-day interaction on specific projects.<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 31

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

The TSI team works closely with portfolio <strong>com</strong>panies in areas such as strategy development, budgeting, financial and<br />

<strong>com</strong>petitive analysis and sale or IPO process management. The portfolio <strong>com</strong>panies can also gain access to an extensive<br />

network of investment banking and consulting relationships in order to facilitate the execution of many business needs<br />

or goals, including financing, litigation and restructuring.<br />

iii. Business strategy for Gulf growth capital<br />

The Gulf growth capital (GGC) line of business was established in the second half of fiscal 2007 to provide investors the<br />

facility to participate in the growing nu<strong>mb</strong>er of private equity investment opportunities in the Gulf region.<br />

The Gulf Cooperation Council (GCC) and surrounding region is undergoing an unprecedented level of economic<br />

transformation driven mainly by the need to create employment for the millions of citizens looking to enter the job<br />

market over the <strong>com</strong>ing few years, the need to diversify the economy away from over-reliance on energy-based natural<br />

resources, and the need to generate greater value from hydrocarbon resources.<br />

In order to cope with these imperatives, governments in the region are channelling a large proportion of the fiscal<br />

surpluses generated by higher energy prices and production levels to invest in the long-term development of the region,<br />

including social infrastructure projects, energy production capacity expansion projects and non-hydrocarbon<br />

industrial development.<br />

Realizing that the private sector will have to assume a disproportionate role in meeting those imperatives, governments<br />

in the GCC are also promoting measures intended to create a more attractive investment environment (e.g., gradual<br />

liberalization of economies, improved legal environment, strengthening of eco-system for investment).<br />

As a result of these developments, the economic outlook for the GCC is robust and investment opportunities within the<br />

region are be<strong>com</strong>ing increasingly abundant.<br />

In parallel to these favorable economic conditions are several encouraging developments that have made the deployment<br />

of private equity more attractive in recent years. These developments include: strong growth in deal flow, availability<br />

of acquisition financing, ability to add value and exercise control, efforts to improve corporate governance, growth in<br />

exit options, and the willingness of family-owned businesses to seek third-party equity partners in order to enhance<br />

growth opportunities.<br />

<strong>Investcorp</strong> has created an inaugural Fund (the ‘Fund’) for its GGC business line to take advantage of these positive<br />

economic developments. The Fund will source, create, and execute unique investment opportunities by bridging the<br />

needs of the region with businesses, technologies and know-how from around the world.<br />

Investment strategy<br />

The Fund intends to make a nu<strong>mb</strong>er of investments over a period of approximately five years with a target gross IRR in<br />

the range of 30%. Through the application of rigorous investment criteria, these investments will be targeted towards the<br />

economic sectors that are expected to benefit most from the unprecedented growth in the GCC and which are in need<br />

of additional capital and expertise to finance transformation and expansion. To capture the investment return potential<br />

offered by the expansion in these high growth sectors, the Fund will target both ‘build’ and ‘buy’ opportunities.<br />

32 INVESTCORP GROUP 2007 ANNUAL REPORT

The Fund intends to focus on investment opportunities generated by four strategic drivers:<br />

GGC investment strategy<br />

Strategic drivers<br />

Massive level of investment required<br />

to increase region’s hydrocarbon<br />

production capacity<br />

Need to extract more value from<br />

hydrocarbon resources<br />

Demographic dynamics (massive<br />

population growth, entry of<br />

millions to job market, growth in<br />

senior citizen segment)<br />

Need to diversify economic base<br />

away from energy<br />

GGC will seek to source, create, and execute unique investment opportunities guided by the four strategic drivers with the<br />

aim of bridging the needs of the region with businesses, technologies and know-how from around the world.<br />

HEDGE FUNDS ASSET CLASS<br />

<strong>Investcorp</strong> offers clients a range of hedge fund (HF) products using carefully selected hedge fund managers with<br />

a strong pedigree whose performance is closely monitored. Though hedge fund products have historically been<br />

marketed primarily to GCC region clients, <strong>Investcorp</strong> recently established a distribution team to make its hedge<br />

fund product offerings available to institutional investors in North America and Europe. <strong>Investcorp</strong> currently<br />

offers several funds of hedge funds and acts as a distributor and incubator for emerging manager seeded funds.<br />

Business strategy for the hedge funds asset class<br />

<strong>Investcorp</strong> is notable in this sector as it has been involved in HF for 11 years. The Company has developed a strong<br />

performance track record utilizing a high degree of portfolio transparency and leading-edge risk management tools and<br />

techniques. <strong>Investcorp</strong>’s hedge fund business was established in 1996 to manage the Company’s own liquidity and was<br />

introduced to clients the following year. The business seeks to seamlessly integrate a diversity of hedge fund products<br />

and services, often on a customized basis, from a single investment platform.<br />

The hedge fund business has three principal product lines:<br />

Priority sectors Investment types<br />

Multiple opportunities in ancillary<br />

support services (e.g., oil services)<br />

Variety of investment opportunities<br />

in energy intensive down-stream<br />

industries (e,g., plastics)<br />

Additional opportunities in<br />

healthcare, education, housing, and<br />

consumer finance<br />

Investment opportunities in<br />

non-hydrocarbon sector (e.g.,<br />

tourism, transportation)<br />

■ Fund of hedge fund products, which invest in established hedge fund managers.<br />

■ Single manager funds 1, which are generally managed by new and up<strong>com</strong>ing hedge fund managers identified as having<br />

excellent potential for specific strategies. <strong>Investcorp</strong> shares in the revenues of each fund in return for providing initial<br />

seed capital, risk oversight and capital raising from <strong>Investcorp</strong>’s investor base.<br />

1 An emerging manager is typically one who is just starting their firm, but may also include an established manager at low AUM levels.<br />

A co<strong>mb</strong>ination of<br />

‘Build’ (i.e., greenfield<br />

projects) and ‘Buy’<br />

(i.e., minority or<br />

majority buyouts)<br />

transactions where<br />

<strong>Investcorp</strong> is uniquely<br />

positioned to act as<br />

a bridge between<br />

investment<br />

opportunities and<br />

the need for<br />

technology, know-how,<br />

and expertise<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 33

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

■ Structured products, which include: customized fund of funds, collateralized fund obligations, leveraged fund of<br />

funds, principal protected and index linked fund of funds.<br />

<strong>Investcorp</strong>’s hedge fund strategy is to make available to clients a suite of investment products that are relatively liquid,<br />

that aim to achieve attractive returns over the medium-term and show low correlation to traditional and other alternative<br />

asset classes.<br />

The HF product line employs about 70 professionals, including fund specialists and risk analysts. The co-heads of the<br />

business have each been with <strong>Investcorp</strong> for 14 years. The majority of the hedge funds team is located in New York.<br />

The HF team determines strategic asset allocations, selects top performing third party fund managers and monitors<br />

the performance of the various managers and investment strategies to ensure that the program’s risk/return objectives<br />

are met. To do this, they draw on sophisticated measures of risk and return, environmental and industry knowledge<br />

and portfolio stress testing, including through IT systems which are regularly reviewed to ensure that they are using the<br />

best technology available.<br />

The hedge fund business strategy is distinguished by:<br />

■ Distinct investment approach<br />

The team employs a highly advanced asset allocation methodology together with an intensive screening of the manager<br />

universe. This allows the Company to select the ‘best of breed’ hedge funds among the strategies that hold the best<br />

risk-return potential in the near- to medium-term.<br />

■ Highly developed risk management<br />

The business employs advanced risk measurement capabilities using proprietary analytical tools with strong<br />

operational controls to ensure rigorous ongoing performance monitoring and utilizes high levels of transparency.<br />

RMS-3, an enhanced generation of risk management tools developed by <strong>Investcorp</strong>, has been rolled out for systematic<br />

use in identifying, managing and mitigating risk across <strong>Investcorp</strong>’s entire hedge fund investing platform.<br />

■ Specialist sales and distribution teams<br />

The Gulf-based placement team employs hedge fund product specialists who provide customized portfolio solutions for<br />

clients and offer a deeper insight into performance and trends. Interactions with clients lead to exchanges of ideas and the<br />

development of new products.<br />

The US-based distribution team, part of the group’s US initiative, progressed further in fiscal 2007 and succeeded in<br />

generating significant institutional interest and new investment mandates.<br />

■ Co-investment with clients<br />

<strong>Investcorp</strong>’s significant balance sheet <strong>com</strong>mitment of approximately $2 billion drives a strong alignment of interests<br />

with clients.<br />

34 INVESTCORP GROUP 2007 ANNUAL REPORT

■ Liquidity and diversified in<strong>com</strong>e for <strong>Investcorp</strong><br />

The strategic advantages of hedge fund investments to <strong>Investcorp</strong> include the efficient deployment of the Company’s high<br />

level of liquidity and the diversification of balance sheet risk, where hedge funds balance and <strong>com</strong>plement the risk-return<br />

profile of the Company’s medium-term private equity co-investments. The business provides a stable stream of recurring<br />

in<strong>com</strong>e through fees from client AUM and from returns on its own co-investment that offset <strong>Investcorp</strong>’s overall cost of<br />

funds and other operating expenses.<br />

Investment process<br />

<strong>Investcorp</strong> has developed sophisticated value-add processes to manage the investment cycle. The investment processes<br />

are robust and use quantitative tools, co<strong>mb</strong>ined with prudent qualitative judgment based on the collective business<br />

experience of the <strong>Investcorp</strong> HF team. The team <strong>com</strong>prises individuals with extensive experience and <strong>com</strong>plementary<br />

skills in the areas of trading, investment, risk management, research, portfolio management and operations.<br />

Investment philosophy and<br />

product definition<br />

Asset<br />

allocation<br />

Portfolio construction<br />

Monitoring<br />

Manager<br />

selection<br />

Recent developments<br />

■ Increased US based manager sourcing<br />

and networking<br />

■ Wider international search for new<br />

managers<br />

■ Black-Litterman techniques<br />

implemented for asset allocation<br />

■ Significant advances in alpha project<br />

research<br />

■ Developed next generation risk platform<br />

■ Extensive peer group research<br />

(including persistence analysis and<br />

alpha-beta analysis)<br />

Objective is to<br />

maintain top quartile performance<br />

Investment philosophy and product definition<br />

The investment philosophy is to use performance oriented managers with a proven track record in order to generate<br />

attractive returns. Diversification across different hedge fund strategies and investment styles results in a typical low level<br />

of correlation of portfolio returns to those of traditional asset classes such as bonds and equities and a controlled level of<br />

volatility of returns on a blended portfolio basis.<br />

A high level of transparency facilitates <strong>com</strong>prehensive risk assessment and proactive risk mitigation.<br />

The business continued to enhance the investment process during fiscal 2007 by: refining the asset allocation framework<br />

using Black-Littermann techniques, continuing a research project (described below) dedicated to uncovering drivers of<br />

hedge fund strategy performance, and developing the third generation of a proprietary risk management system (refer to<br />

the discussion of RMS-3 in the section ‘performance monitoring and risk management’). Significant investment in<br />

process continues in an effort to ensure that <strong>Investcorp</strong>’s <strong>com</strong>petitive edge and performance are sustainable.<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 35

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

The range of HF strategies included in <strong>Investcorp</strong>’s various fund of hedge funds offerings are listed in the table below:<br />

Hedge Fund Strategies<br />

Convertible arbitrage: purchase of convertible bonds, preferred stock or warrants and simultaneous sale of<br />

underlying equity, futures or baskets of securities essentially leaving the equity option exposure e<strong>mb</strong>edded in the<br />

convertible bond.<br />

Equity market neutral: capturing technical and fundamental inefficiencies in equity markets through a<br />

market-neutral long/short portfolio using statistical techniques and valuation models.<br />

Fixed in<strong>com</strong>e relative value: intra-yield curve (long/short positions along yield curve), inter-yield curve, basis and<br />

other types of trades in global fixed in<strong>com</strong>e markets.<br />

Risk (merger) arbitrage: trading in equities of <strong>com</strong>panies likely to undergo some M&A activity as an acquirer<br />

or acquiree.<br />

Multi-strategy: managers with allocations to convertible arbitrage, risk arbitrage and other strategies dynamically<br />

changing their exposures to the underlying strategies depending on opportunities and the market environment.<br />

Distressed: trading in equities, bonds and claims of <strong>com</strong>panies undergoing financial/operating difficulties or a<br />

restructuring process, with a view to capturing returns from mispricing of improved cash flow or value.<br />

Hedge equities: long or short investments in equities and their derivatives in three regional exposures: US, Europe<br />

and Japan.<br />

Macro: opportunistic long or short investments in a wide range of strategies and assets (financial and/or<br />

non-financial):<br />

Macro-discretionary: investment decisions based on qualitative factors such as fundamental<br />

macro-economic analysis.<br />

Macro-systematic: investment decisions based on technical trend-following models or on fundamentally<br />

based quantitative techniques.<br />

Portfolio insurance: provides cushion for the program during periods of substantial widening of credit spreads<br />

and declines in equities.<br />

Asset allocation<br />

Asset allocation is a key value-added process by which the HF team determines how the assets of a particular fund<br />

product will be invested across different hedge fund investment strategies. Our diversified products co<strong>mb</strong>ine hedge<br />

fund strategies to produce portfolios that are relatively uncorrelated, in their return generation, to each other and<br />

to global bond and equity markets. The majority of hedge fund assets under management are in products that are<br />

invested in multiple strategies.<br />

Certain of <strong>Investcorp</strong>’s funds of hedge funds invest in the hedge equities strategy in the US, European and Japanese<br />

markets. Emerging manager funds typically pursue a single strategy. In addition, structured funds provide customized<br />

risk/return features to investors.<br />

36 INVESTCORP GROUP 2007 ANNUAL REPORT

The well developed strategic and tactical asset allocation processes, described below, serve as powerful mitigants against<br />

the various risks related to the program.<br />

Strategic asset allocation Tactical asset allocation<br />

■ Generates optimal strategy allocations by<br />

selecting strategies that:<br />

- are forecasted to produce superior<br />

risk-adjusted returns<br />

- have exhibited staying power under<br />

various environments<br />

■ Modeling based on mean-variance<br />

optimization<br />

■ Capped diversification across strategies<br />

■ Over/under weighting specific strategies<br />

to reflect near-term opportunities<br />

■ Based on quantitative research on<br />

environment, markets and strategies<br />

■ Portfolio optimized to incorporate tactical<br />

views and maximize manager alpha<br />

■ Constrained allocations to managers<br />

minimizes event risk<br />

Strategic asset allocation — development of investment guidelines that meet a product’s objective of generating returns<br />

while ensuring that the expected volatility corresponds to the product’s philosophy. These guidelines take into account<br />

strategy-specific risks, such as illiquidity, a medium-term market outlook and insights from proprietary research on<br />

hedge fund strategies. They also place allocation constraints on individual strategies within a product. Historical data are<br />

processed by a proprietary optimizing model, generating a range of model allocations. In addition, a sensitivity analysis<br />

is conducted to determine the stability of strategy allocations.<br />

Tactical asset allocation — deciding actual investment allocations for each strategy within a product. Once strategic<br />

allocation bands are established and a core portfolio determined as described above, allocations are made tactically within<br />

the strategic ranges, based on a thorough review of the macro-economic environment and a bottom-up review of each<br />

strategy. This process provides the flexibility to take advantage of short-term macro-economic opportunities or to<br />

manage risks emanating from unfavorable market conditions. Adjustments are made at regular intervals throughout<br />

the year.<br />

Advisory board — <strong>Investcorp</strong> also takes informal counsel from an advisory board. The board’s mandate is to provide<br />

external and objective advice on topical issues, including (but not limited to): macroeconomic analysis, hedge fund<br />

specific areas of interest, standards for best-in-class investment processes, and broader investment issues.<br />

Hedge funds advisory board:<br />

Ronald Liesching, Chairman of Pareto New York LLC, the appointed representative office of Pareto Investment<br />

Management Limited, a London-based investment management firm specializing in currency overlay strategies<br />

with over $50+ billion in assets under management. Ron is a founding me<strong>mb</strong>er of Pareto and has over 20 years’<br />

experience in quantitative modeling and currency management. He has written and lectured extensively on risk<br />

management techniques.<br />

Lawrence Lindsey, the Chief Executive of The Lindsey Group. Larry held the position of assistant to the President<br />

and Director of the National Economic Council at the White House and was the chief economic adviser to candidate<br />

George W. Bush during the 2000 Presidential campaign. Dr. Lindsey also served as a Governor of the Federal<br />

Reserve System from 1991 to 1997 and was on the faculty of Harvard University for five years.<br />

Robert Schulman, the Chief Executive Officer for Tremont Group Holdings, Inc. Bob oversees all global strategic<br />

planning for the firm. He is a me<strong>mb</strong>er of the investment advisory board where he provides strategic top-down<br />

insights in the determination of Tremont’s strategy allocations.<br />

Barry Colvin, Vice Chairman of Balyasny Asset Management, a multi-strategy hedge fund based in Chicago.<br />

Barry plays an active role in helping to grow and institutionalize the business. He also provides advisory services<br />

through Colvin Capital LLC and serves as an investment counselor to a family office in New York.<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 37

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Manager selection<br />

Manager selection is based on extensive due diligence with an emphasis on investment style, philosophy and risk<br />

management discipline, using both qualitative and quantitative approaches. Each manager’s track record is analyzed,<br />

focusing on profit attribution and performance in periods of market volatility. The strategies used by the managers and<br />

their investment exposures are also analyzed and correlated to others in the portfolio. Once the HF team has short-listed<br />

potential managers, it will typically hold a series of meetings with each manager to review their business, risk management<br />

processes and operational infrastructure. The team <strong>com</strong>pletes the due diligence process by conducting a background<br />

investigation on managers and their underlying fund vehicles.<br />

Allocations to individual managers are monitored, thus protecting against manager concentration risks. The HF team<br />

also takes into consideration redemption characteristics of the underlying investment vehicles to facilitate relatively rapid<br />

availability of liquidity should any adverse event arise.<br />

Portfolio construction<br />

Using a co<strong>mb</strong>ination of asset allocation (quantitative) and manager selection (quantitative and qualitative) processes<br />

allows the construction of a range of diversified and theme funds using the underlying managers. Ultimately, <strong>Investcorp</strong><br />

aims to integrate seamlessly a diversity of hedge fund products and services, often on a customized basis, from a single<br />

investment platform.<br />

<strong>Investcorp</strong> co-invests the majority of its own surplus liquidity into two of the diversified funds of hedge funds, IBF and<br />

DSF, on a 50:50 basis.<br />

Performance monitoring and risk management<br />

<strong>Investcorp</strong> continues to strengthen its administrative, risk management and performance management architecture and<br />

uses best-in-class proprietary risk systems for this. RMS-3 (see description overleaf) is now more integrated into the<br />

Company’s infrastructure, thereby enhancing monitoring and reporting systems. This emphasis on risk identification<br />

and mitigation is also viewed positively by the Company’s long-term investors, particularly institutions.<br />

Prime broker/fund manager<br />

Quality assurance process<br />

Monte Carlo based risk<br />

management system<br />

VaR<br />

consolidation<br />

Exposure<br />

analysis<br />

Scenario based on risk<br />

tracking<br />

Valuation, reconciliation,<br />

guidelines monitoring<br />

Simulation based, full<br />

valuation risk engine—<br />

position by position<br />

Consolidated risk analysis.<br />

Strategy specific exposure<br />

analysis<br />

Monitoring procedures address such risks as under-performance, excessive risk-taking, style drift, fraud/valuation errors<br />

and legal/documentation errors. <strong>Investcorp</strong>’s risk team monitors manager adherence to the program’s investment<br />

guidelines and independently verifies valuations. In most instances, <strong>Investcorp</strong> seeks to obtain position-level transparency<br />

on a frequent basis with its underlying hedge fund managers. This facilitates ongoing <strong>com</strong>prehensive assessment<br />

and mitigates risks across the entire portfolio, while allowing independent verification of valuations and adherence<br />

to guidelines.<br />

38 INVESTCORP GROUP 2007 ANNUAL REPORT

RMS-3<br />

This risk analytics platform is used to support the investment process from manager selection to portfolio<br />

construction and manager monitoring besides monitoring the aggregate risk levels across the various investment<br />

products. The third generation of this risk measurement platform is designed to extend the HF team’s capability<br />

in each of these processes through analytical and technological improvements.<br />

Specifically, the platform deepens the analytical toolset available for the monitoring of several of the strategies<br />

including convertible arbitrage, special situations, risk arbitrage and credit arbitrage. It also has analytical modules<br />

to monitor capital structure arbitrage, distressed and volatility arbitrage strategies. The platform will improve the<br />

ability to monitor the risks of the portfolio with a wider set of portfolio risk metrics. These include extension of the<br />

VaR-based analytics as well as better tail risk monitoring with extensive scenario analysis.<br />

From a technology perspective, the platform is designed to be more flexible and accessible. Users are able to define<br />

and process targeted ad hoc analytics within a reporting infrastructure that help to ‘slice and dice’ information, and<br />

the system can be deployed over a wider network for ready accessibility of risk data.<br />

Each manager’s operations infrastructure is reviewed on a regular basis to ensure the presence of appropriate controls and<br />

procedures. <strong>Investcorp</strong> maintains a ‘watch list’ for those managers whose risk profiles or performance levels deviate from<br />

targeted guidelines and will redeem investments with such managers if the deviation is not corrected. Transparency is<br />

enhanced through the establishment of separate accounts with some of the managers, making it easier for the team to<br />

monitor the managers effectively.<br />

The Company employs a wide range of qualified experts to monitor managers:<br />

■ Investment analysts: senior strategy specialists review quality assurance data and risk analytics to develop an overall<br />

understanding of the portfolio. They maintain an extensive ongoing dialog with each fund manager to understand<br />

trades and market outlook.<br />

■ Investment risk unit: creates risk analytics across the entire portfolio using best-in-class risk tools.<br />

■ Operational risk unit: monitors operational risk with managers including in-person due diligence meetings.<br />

■ PRIM unit: provides valuation and reconciliation based on daily transaction level data from prime brokers and fund<br />

administrators.<br />

Alpha project<br />

As part of <strong>Investcorp</strong>’s strategy to strengthen its manager selection and asset allocation process, a multi-year research<br />

effort was launched in 2005 to determine — based on security level data — the fundamental drivers of hedge fund returns.<br />

The objective of <strong>Investcorp</strong>’s alpha research is not only to build pure indices of hedge fund returns, but also to better<br />

understand the drivers behind hedge fund returns and isolate manager alpha. The four areas of focus are to:<br />

■ identify underlying trades of each fund strategy;<br />

■ use security level data to create time series of returns by hedge fund strategies and sub-strategies;<br />

■ break down each strategy into <strong>com</strong>ponents of trade; and<br />

■ engineer the trades to create return series of indices usually by passive (baseline <strong>com</strong>parison or buy/hold) and active<br />

strategies (alpha generation or rule based).<br />

The alpha project is benefiting our asset allocation decisions by helping to determine factors that drive periods of outperformance<br />

and use insights to develop forward looking views. It also enables benchmarking of manager performance.<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 39

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

REAL ESTATE ASSET CLASS<br />

Since 1995 <strong>Investcorp</strong> has <strong>com</strong>pleted real estate (RE) acquisitions approximating $6 billion in value and today<br />

oversees a portfolio with a total investment value approximating $4.1 billion. The real estate team invests in<br />

properties throughout the United States in all sectors including office, retail, residential, hotel and industrial as<br />

well as <strong>com</strong>mercial, residential and lifestyle/resort development. The team focuses on acquiring controlling<br />

interests in properties to guarantee unimpeded decision-making on leasing, capital investment and realization.<br />

Properties are typically aggregated in a series of multi-property portfolios to create an appropriate critical mass for<br />

placement with clients. Portfolios are categorized by level of risk, and these portfolios are then offered to clients on<br />

a unique deal-by-deal basis, in which no advance long-term blind <strong>com</strong>mitment from the client is required.<br />

Instead, real estate assets are initially acquired using <strong>Investcorp</strong>’s own financial resources and underwritten on the<br />

balance sheet. A significant portion of the economic interests in the real estate assets are then placed with clients.<br />

Business strategy<br />

The RE asset class continues to provide important diversification and low correlation benefits within the range of<br />

alternative asset products offered by <strong>Investcorp</strong>. Attractive returns with lower inherent volatility and current cash yield<br />

through rental in<strong>com</strong>e make real estate investments a valuable <strong>com</strong>ponent of <strong>Investcorp</strong>’s balance sheet and offering to<br />

clients. Real estate also provides an accretive stream of both fee and asset-based in<strong>com</strong>e for <strong>Investcorp</strong>.<br />

The RE team <strong>com</strong>prises around 20 real estate professionals based in New York and Los Angeles, who are dedicated to<br />

sourcing, analyzing, executing and managing investments. The co-heads of the real estate business have each been with<br />

<strong>Investcorp</strong> for more than 11 years and the senior me<strong>mb</strong>ers of the team have a strong mix of acquisition and post<br />

acquisition expertise in the US real estate industry.<br />

<strong>Investcorp</strong>’s RE business is centered on the following principles:<br />

■ Investment approach<br />

<strong>Investcorp</strong> has a strong real estate capability based in the US and is focused on properties across all sectors and<br />

geographies within that market targeting top tier risk-adjusted returns. The Company annually invests in properties<br />

totalling $1.5 – $1.8 billion in aggregate purchase price and <strong>com</strong>prising assets from the ‘core plus’ and ‘opportunistic’<br />

sectors. Core plus properties aim to produce current yield, based on strong occupancy rates and good tenancy, as well as<br />

solid capital gains. Opportunistic properties aim to produce higher capital gains by investing in slightly higher risk<br />

projects involving renovation, refurbishment, conversion or ground-up development. Opportunistic property portfolios<br />

were a product extension during the last five years and have now developed into an established part of the business.<br />

<strong>Investcorp</strong>’s investment process seeks to minimize the risk, while enhancing returns for both core plus and opportunistic<br />

properties. The Company targets annual cash distributions of 7 – 9% net and overall net IRRs of 9 – 10% for core plus<br />

and 14% or more for opportunistic.<br />

■ Investment structure<br />

While <strong>Investcorp</strong> initially underwrites the equity portion of each acquisition, most of this equity is subsequently<br />

syndicated to its client base. <strong>Investcorp</strong> typically retains 5 – 10% for its own balance sheet as a co-investment and,<br />

therefore, aligns its interests with those of its clients. <strong>Investcorp</strong> often asse<strong>mb</strong>les multiple properties into portfolios to<br />

ensure diversification by property sector and geography. These portfolios are structured for either conventional or<br />

Islamic investors, thereby meeting the demands of both investor classes.<br />

40 INVESTCORP GROUP 2007 ANNUAL REPORT

■ Partnership approach<br />

The RE business has developed strong relationships with regional operating partners in the US who have extensive local<br />

expertise, are virtually integrated operators, co-invest and ensure quality deal flow. This is <strong>com</strong>plemented by the use of<br />

external advisors with relevant track records in the market. Access to a broad base of industry expertise augments<br />

<strong>Investcorp</strong>’s ability to create value through the post acquisition property management process.<br />

■ Managed risk profile<br />

Real estate portfolios are constructed to provide diversification across properties, financed with debt that is non-recourse<br />

to <strong>Investcorp</strong> and use financing techniques that aim to mitigate the negative impact from higher interest rates.<br />

■ Balance sheet edge<br />

<strong>Investcorp</strong>’s ability to access its own balance sheet, and its entrenched relationships within the financing markets, provide<br />

a critical edge in the successful execution of property acquisitions, even in difficult market environments.<br />

■ Unique offering structure<br />

As with our private equity product line, we package our real estate offerings in a variety of ways in order to satisfy the<br />

varying investment goals and preferences of our clients. In general, the properties are acquired using a variety of holding<br />

<strong>com</strong>panies in order to provide flexibility, and asse<strong>mb</strong>led as single assets or portfolios held by us and our voting and<br />

economic co-investors prior to equity placement to our clients. The real estate investments are then offered to clients<br />

on a deal by deal basis in order to provide diversification across properties and geographies.<br />

We are able to package certain of our deal by deal real estate investments both as conventional and as shariah-<strong>com</strong>pliant<br />

investments. We will typically approach our clients with approximately six real estate investments in a given year. On<br />

average our placement and relationship management team will <strong>com</strong>plete the placement of a real estate investment to our<br />

clients within four to five weeks after <strong>com</strong>pletion of the portfolio. The client focus for our deal-by-deal product is high<br />

net worth individual and institutional investors in the GCC region.<br />

In fiscal year 2007 we launched and closed a real estate fund, in association with TriLyn, dedicated to mezzanine<br />

investments and targeted at a co<strong>mb</strong>ination of North American and GCC region investors. TriLyn is an established real<br />

estate investment firm with a focus on mezzanine investments in real estate. Of the total amount <strong>com</strong>mitted, $80 million<br />

is through <strong>Investcorp</strong> and the balance of $20 million <strong>com</strong>mitted by another financial institution. The fund is targeted at<br />

capitalizing on market conditions that provide attractive opportunities to originate, invest in and hold mezzanine debt,<br />

preferred equity and/or leveraged first mortgage investments in high quality US properties.<br />

Investment process<br />

<strong>Investcorp</strong>’s RE team selects and underwrites a range of properties that can then be aggregated into a series of multiproperty<br />

portfolios. These diversify risk both for <strong>Investcorp</strong> and for clients evaluating the investments. The RE team<br />

works closely with <strong>Investcorp</strong>’s marketing specialists to place these portfolios with investors.<br />

The real estate investment process, in <strong>com</strong>mon with <strong>Investcorp</strong>’s private equity process, is based on a controlled and<br />

methodical approach carried out by a team of experienced in-house professionals and involves two tiers of approval.<br />

To augment its own capabilities, <strong>Investcorp</strong> works with regional and local property management firms, providing access<br />

to local expertise.<br />

INVESTCORP GROUP 2007 ANNUAL REPORT 41

INVESTCORP<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

<strong>Investcorp</strong>’s strong investment process and unique value proposition is shown below:<br />

Value<br />

proposition<br />

Experienced,<br />

professional team<br />

<strong>Investcorp</strong> and RE<br />

team co-investment<br />

Exclusive<br />

operating<br />

relationships<br />

Tax-efficient<br />

structuring for<br />

non-US investors<br />

Cash flow and total<br />

return focus<br />

Investment control<br />

Proven track record<br />

In evaluating acquisitions, the team seeks a range of attributes from targeted properties:<br />

Attributes for real estate acquisitions<br />

Acquisition Post-acquisition Realization<br />

■ High quality and well located US<br />

real estate<br />

■ Acquisitions across major asset<br />