Sustainable Insight: Water Scarcity – A dive into global ... - KPMG

Sustainable Insight: Water Scarcity – A dive into global ... - KPMG

Sustainable Insight: Water Scarcity – A dive into global ... - KPMG

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Sustainable</strong> <strong>Insight</strong><strong>Water</strong> <strong>Scarcity</strong>: A <strong>dive</strong> <strong>into</strong><strong>global</strong> reporting trendsOctober 2012kpmg.com/sustainability

| <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

ContentsIn brief 2Introduction 2Key findings 4<strong>Water</strong> reporting: behind the leaders, a gap remains 4Shortage focuses the mind 6The missing footprint 7Reduction and treatment strategies need work 8Reduction 8Treatment and reuse 8The 60 percent gap: more than half lack long term strategies 11Suppliers: the hidden water users 13Conclusion 14How <strong>KPMG</strong> can help 15Methodology 16Participating countries 2011 16© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

2 | <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsIn briefIn this edition of <strong>KPMG</strong>’s <strong>Sustainable</strong> <strong>Insight</strong> we explore how the world’s majorbusinesses are setting out their approaches to water scarcity via their keycommunication vehicles on corporate responsibility (CR) and sustainability. 1We investigate what they are reporting on and – sometimes more importantly –what they are not reporting on, and we draw out significant variances betweensectors and geographic regions.The enlightening results suggest that while most companies are at least paying lipservice to the issue in their reports, far fewer are presenting a convincing picture ofa thorough and robust response to the challenge.Reading this paper will help executives understand what best practice lookslike; how – and why – they should improve their company’s response to waterscarcity; and how they can communicate that response more effectively to theirstakeholders.We conclude with ten key questions designed to help executives develop andcommunicate strategic responses to the water scarcity challenge.Introduction<strong>Water</strong> scarcity has risen to the top of the corporate agenda over the past few years.In the face of dire predictions about dwindling supplies, a growing number ofbusinesses are taking measures to become better stewards of this vital resource.The momentum has been catalyzed, in part, by the immediate and tangible threatthat water scarcity poses. Global demand for freshwater will exceed supply by40 percent by 2030, according to the <strong>Water</strong> Resources Group, with potentiallycalamitous implications for business, society and the environment. Whencompared with the more gradual and indirect implications of climate change, waterscarcity seems not only a more immediate issue, but also a more manageable one.Like other sustainability megaforces, water scarcity brings both risks andopportunities for businesses. Diminishing water supplies can disrupt – or evencurtail – business operations, power generation capacity and the supply of keybusiness inputs. Simply put: no water, no products, no business.<strong>Water</strong> scarcity also brings about a number of indirect impacts. Governments arealready introducing regulations to manage supplies more effectively which, in turn,are creating new compliance requirements and/or cost increases for businesses.For example, in 2008, the Portugese government introduced a tax on major waterusers in agriculture and industry. More recently, in June 2012, China announced thatit will adopt high water rates for water-intensive industries and will encourage thereuse of recycled water. 2 And Singapore’s regulators have priced water to reflect itsscarcity value.1Sources for this paper were CR and sustainability reports, annual financial reports and corporate websites.2http://news.xinhuanet.com/english/china/2012-06/22/c_131669919.htm.© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

<strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends | 3More dramatically, water scarcity has sparked conflicts between local communitiesand businesses; corporate reputations have been threatened and licenses tooperate questioned. We have seen mining companies in Peru, Argentina and Chileimpacted by community protests over water; in one case, the mining companyconcerned relinquished access to 3.9 million ounces of gold reserves as a result. 3Beverage companies operating in India have experienced similar protests which inone case led to the closure of a bottling plant. 4Some businesses recognize that they need to change their operating models.Many are reducing the potential for business disruption, cutting costs, preparingfor future policy developments and – in a growing number of cases – building valuethrough innovation. We have seen more companies bringing products and servicesto market using more water-efficient processes or providing water managementsolutions to other businesses.Business leaders are also collaborating on new ideas and solutions. At the Rio+20Conference on <strong>Sustainable</strong> Development in June 2012, water was one of thepriority themes put to delegates. In attendance were more than 45 CEOs ofworld-leading companies such as Coca-Cola, Dow Chemical, Levi Strauss,Nestlé, Royal Dutch Shell and Tata Steel. They not only reinforced the importanceof achieving water sustainability, but also shared examples of corporatecommitments, actions and public policy recommendations. Most notable was a callfor water pricing to reflect a ‘fair and appropriate’ resource value: effectively a call forwater prices to be raised.Investors are also becoming more aware of the risks and opportunities thatwater scarcity represents within their portfolios and are increasingly looking forcompanies to build responses <strong>into</strong> their longer-term strategies. For example, morethan 350 institutional investors (who, together, manage more than USD43 trillion inassets) supported the Carbon Disclosure Project’s 2011 water survey. 5At <strong>KPMG</strong>, our member firms believe that companies need to demonstrate a robustresponse to water scarcity through their corporate reporting in order to convinceinvestors of future growth and profitability.As the publishers of the most comprehensive <strong>global</strong> survey on corporateresponsibility (CR) reporting trends – the <strong>KPMG</strong> Survey of Corporate ResponsibilityReporting – we are also in a unique position to help companies respond to thechallenge of water scarcity and report effectively on their strategies and actions.In this edition of <strong>Sustainable</strong> <strong>Insight</strong>, we have analyzed data gathered from theCR reports of the largest companies across 34 countries, including the world’s top250 companies (based on the Fortune Global 500 ranking) to provide a definitivesnapshot of the evolving state of water reporting. We have also tapped <strong>into</strong> ournetwork of sustainability professionals to deliver advice for companies seeking toimprove their approach.I hope that this paper catalyzes further action within the business community andI encourage you to contact your local <strong>KPMG</strong> member firm to discuss theimplications of our findings.3Murky <strong>Water</strong>s? Corporate Reporting on <strong>Water</strong> Risk. Ceres. 2010.4http://www.reuters.com/article/2009/06/16/us-water-beverages-idUSTRE55F054200906165CDP <strong>Water</strong> Disclosure Global Report 2011. Carbon Disclosure Project. 2011.Wim BartelsGlobal Head ofSustainability Assurance<strong>KPMG</strong> Climate Change &Sustainability Services© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

4 | <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsKey findings• Most (76 percent) of the world’s 250largest companies now addresswater issues in their CR reporting insome way.• In general, water use is addressedmore commonly in CR reports incountries where water scarcityis a significant problem and lesscommonly in countries where wateris comparatively abundant.• One third of the <strong>global</strong> 250 disclosewater footprint data for their wholecompany and one in five does so forpart of the company.• Just three of the world’s largest250 companies report on the waterfootprint of any part of their supplychain, and none has reported on thewater footprint of its entiresupply chain.• Less than half (44 percent) of the<strong>global</strong> 250 mention specific plansto reduce their water use in theirCR reports. Around one quarter(27 percent) report that they aretreating waste or contaminatedwater.• A majority of the world’s largestcompanies (60 percent) do not yetdemonstrate a long-term strategy todeal with water scarcity in theirCR reporting. Companies inthe mining, automotive, andpharmaceuticals sectors are the mostlikely to report such a strategy.• Only around one in ten of the world’sbiggest companies report thatthey are adapting their business tochanges in water availability or thatthey are mitigating the impacts ofwater scarcity on their company orstakeholders.© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

<strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends | 5<strong>Water</strong> reporting: behind the leaders, a gap remainsToday, just over three quarters(76 percent) of the world’s 250 largestcompanies address water issues inCR reports in some way. This suggeststhat companies around the world havelargely recognized the need for placinggreater attention on water managementto respond to the threat of waterscarcity.All the mining and pharmaceuticalcompanies among the G250 addresswater in their CR reports as do almost allthe electronics (95 percent) and oil andgas companies (92 percent).Lagging in the list, however, is thetransportation sector where only halfof the largest companies addresswater issues in their CR reports. Theutilities sector also demonstratescomparatively low rates of reporting (thesecond lowest at 62 percent), which issomewhat surprising given the waterintensity of power generation.100%Number of G250 companies that address water issues in their CR reports100% 95% 92% 90% 81%80%Mining75%Pharmaceuticals75%Electronics &Computers74%Oil & Gas71%Food & Beverage66%Automotive62%Metals &Engineering50%Chemicals andSyntheticsConstruction &Building MaterialsCommunications& MediaFinance, Insurance& SecuritiesTrade & RetailUtilitiesTransportSource: <strong>KPMG</strong> International Survey of Corporate Responsibility Reporting 2011© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

6 | <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsShortage focuses the mindCorporate reporting rates on waterare at their highest in countries wherewater scarcity is most pressing. In June2012, The Times of India reported thatthe Indian capital New Delhi was reelingunder water shortages, 6 in 2008 Israelannounced its worst water crisis sincerecords began and in 2011 the EU’s JointResearch Centre reported that in largeparts of Spain demand for wateris three to ten times higher thanavailable supply. 7Correspondingly, in India every companyamong the top 100 (that produces a CRreport) addresses water issues, whilenine in ten do so in Israel, Spain, Taiwan,Greece and Portugal.By the same token, our analysis alsoshows that corporate reporting rateson water tend to be lower in countrieswhere water scarcity is not perceived asan immediate challenge such as Canada,Denmark and Finland.Corporate reporting rates on water10 countries with the highest rates:100%94%92%91%91%90%86%86%84%83%IndiaIsraelTaiwanGreeceSpainPortugalItalyAustraliaGermanyJapan10 countries with the lowest rates:58%54%53%52%49%47%44%40%37%26%CanadaFinlandMexicoBulgariaDenmarkRussiaSlovakiaSingaporeNew ZealandNigeriaSource: <strong>KPMG</strong> International Survey of Corporate Responsibility Reporting 20116http://articles.timesofindia.indiatimes.com/2012-06-14/delhi/32234195_1_munak-haiderpur-supply Accessed14 August 20127http://www.bloomberg.com/news/2012-03-14/spain-eastern-europe-lack-water-availability-eu-research-shows.htmlAccessed 14 August 2012© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

<strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends | 7The missing footprintOur research shows that whereasthree quarters of the world’s top 250companies address water in their CRreports, far fewer are stating their waterfootprint. One third of the <strong>global</strong> top 250report the water footprint of their fullcompany; one in five reports the waterfootprint of part of the company only.However, when one examines theresults by industry, it becomes clear thatreporting on the full water footprint ofthe company is more common in somesectors than others.Mining (100 percent) andpharmaceuticals (89 percent)companies are the most likely to reportthe water footprint of their wholecompany whereas only 20 percent offood and beverage companies do so andonly one third of oil and gas, and utilitiescompanies.Given that the food and beverageindustry faces some of the greatestchallenges around water scarcity, itseems inevitable that pressure willincrease for companies in this sector toimprove the level of their water footprintreporting. Companies in the oil andgas sector are also likely to experiencesuch pressure given the water intensivenature of modern extraction methodssuch as fracking.Reported water footprinting by G250 companiesFor part of the company’s water usage onlyFor the full company’s water usageMiningPharmaceuticalsElectronics & ComputersAutomotiveChemicals and SyntheticsConstruction &Building MaterialsOil & GasTransportCommunications & MediaUtilitiesMetals & EngineeringTrade & RetailFinance, Insurance& SecuritiesFood & Beverage0%0%10%19%25%25%25%17%16%23%10%21%29%30%100%89%62%50%50%38%33%33%32%31%30%24%20%20%Source: <strong>KPMG</strong> International Survey of Corporate Responsibility Reporting 2011© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

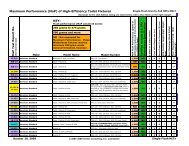

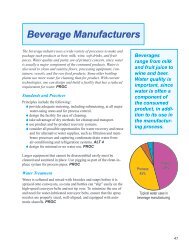

8 | <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsReduction andtreatment strategiesneed workWe analyzed the number of companiesthat report specific plans to reducethe amount of water their businessuses, and those that report on treatingwaste or contaminated water.ReductionLess than half the G250 (44 percent)report on plans to reduce the amount ofwater they use.Once again, companies in themining and pharmaceuticals sectorsdemonstrate strong commitment towater reporting, with 100 percentdetailing plans to reduce their waterusage in their CR reports. <strong>Water</strong>reduction plans are also reportedby a high proportion of large <strong>global</strong>electronics and computer firms(71 percent) and automotive companies(69 percent).However, some industries that relyheavily on water have relatively lowrates of reporting on water reductionplans. For example, less than half(46 percent) of oil and gas companies inthe G250 articulate plans to reduce theirwater consumption.The financial services sector (29 percent)and the communications and mediasector (32 percent) have the lowest ratesof reporting on water reduction plansbut – it could be argued – they have a lowreliance on water, and therefore may notsee water reduction as a high priority.So while the issue of water scarcityis rising in the public consciousness,many leading companies are not yettaking steps to reduce their waterconsumption. As a result, they will likelyexperience increasing public or investorpressure to do so.Results also vary by country. Of thosethat produce a CR report, 95 percentof Indian companies, 69 percent ofSpanish companies and 66 percent ofUK companies include specific plans toreduce water usage. This contrasts withjust 24 percent of Chinese companiesand 27 percent of Japan-basedcompanies.Treatment and reuseJust over one quarter (27 percent) of theworld’s top 250 companies report onwater treatment.Sectors with high water usage havethe highest rates of reporting on watertreatment: mining (100 percent),chemicals (75 percent), electronicsand computers (67 percent) and oil andgas (63 percent). Only 11 percent ofcommunications and media companiesand just one percent of financialservices companies do the same.Once again, we find that Indiancompanies record some of thehighest levels of reporting. Some95 percent report on water treatment,with companies based in Spain(48 percent), South Korea and Australia(both 42 percent) exhibiting the nexthighest rates. When it comes to watertreatment reporting, the UK – unusually– falls to near the bottom of the list (27percent) while only 19 percent of UScompanies provide similar data.© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

<strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends | 9Reported water reduction and treatment by G250 companies<strong>Water</strong> reduction<strong>Water</strong> treatment/reuseMiningPharmaceuticalsElectronics & ComputersAutomotiveFood & BeverageChemicals and SyntheticsMetals & EngineeringOil & GasTrade & RetailConstruction &Building MaterialsUtilitiesTransportCommunications & MediaFinance, Insurance& Securities100%100%71%69%60%50%50%46%41%38%38%33%32%29%100%56%67%38%30%75%20%63%17%38%23%50%11%1%Source: <strong>KPMG</strong> International Survey of Corporate Responsibility Reporting 2011© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

10 | <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsReported water reduction and treatment by country (N100 companies)<strong>Water</strong> reduction<strong>Water</strong> treatment/reuse95%95%69%66%48%27%52%36%51%38%47%42% 42% 42%IndiaSpainUnitedKingdomGermanyItalyAustraliaSouth Korea42%19%40%33% 39% 25%38%25%34%27% 27% 25% 24%39%United StatesBrazilCanadaSouth AfricaNetherlandsJapanChinaSource: <strong>KPMG</strong> International Survey of Corporate Responsibility Reporting 2011© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

<strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends | 11The 60 percent gap:more than half lack longterm strategiesBusinesses in most sectors will almostcertainly face growing risks as climatechange, population growth, urbanizationand other megaforces place increasingstrain on the world’s water supplies.<strong>KPMG</strong> members firms believe it isvital for companies to take a long-termview of water scarcity and developfar-reaching strategies to ensurecontinued growth and profitability,particularly within water-constrainedenvironments. Such strategies shouldinclude measures to adapt the businessto changes in water availability,for example by changing industrialprocesses or developing new productsand service lines that require less water.Many of the most effective waterstrategies also include measures tomitigate the impact of water scarcity,not only on the business itself butalso on key stakeholders such aslocal communities. In many sectors,a company’s license to operateincreasingly depends on demonstratingnot only that the company does notadversely impact community watersupplies, but also that it makes apositive contribution to local watermanagement systems.Despite this, our data suggests that lessthan half the world’s top 250 companies(40 percent) currently have long-termwater strategies in place.Only around one in ten of the world’stop 250 companies reports that theyare adapting to changes in wateravailability, and a similarly small numbersay they are mitigating the impactsof water scarcity on their company orstakeholders.When looking at national trends,companies in the UK (75 percent), India(80 percent), Spain ( 68 percent) andBrazil (59 percent) are much more likelyto have a water strategy in place thancompanies in Canada (16 percent), theUSA (20 percent) or China (7 percent).Reported long term water strategy by country (N100 companies)80%India75%UnitedKingdom68%Spain59%Brazil53%Italy48%Germany46%SouthKorea44%Australia35%Japan33%Netherlands32%SouthAfrica20%UnitedStates16%Canada7%ChinaSource: <strong>KPMG</strong> International Survey of Corporate Responsibility Reporting 2011© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

12 | <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsReported long-term water strategy among G250 companies100%78%75%67%58%50%50%MiningPharmaceuticalsAutomotiveElectronics &ComputersOil & GasFood & BeverageChemicals andSynthetics50%46%38%33%31%23%21%Metals &EngineeringUtilitiesConstruction &Building MaterialsTransportTrade & RetailFinance, Insurance& SecuritiesCommunications& MediaSource: <strong>KPMG</strong> International Survey of Corporate Responsibility Reporting 2011© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

<strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends | 13Suppliers: the hiddenwater usersThe business risks of water scarcityextend well beyond companies’ ownoperations and deep <strong>into</strong> their supplychains. For most companies, far morewater is used in the supply chain than indirect operations. Indeed, according toa recent <strong>KPMG</strong> study, three quarters ofwater consumption by companies listedon Japan’s Nikkei 225 Index occurs inthe supply chain. 8It is clear, therefore, that changes inthe availability of water could pose asignificant threat to business operationsby disrupting the supply of key inputs aswell as increasing manufacturing costsand commodity prices. The impact ofthe recent drought in the US providesevidence of this; as the drought startedto take its toll, the price of corn andwheat rocketed by 25 percent in onemonth alone. 9It is not surprising then, that investorsare increasingly looking to understandthe financial risks posed by waterrelatedchallenges in the supply chain.Moreover, companies can increasinglyexpect to be held accountable bystakeholders (such as customers,NGOs and pressure groups) forthe amount of water used in theirproduction processes and embeddedin end products and services.Reporting on the water footprint ofsupply chains is an essential first stepto demonstrating improvement overtime. This will be particularly importantfor water intensive industries such asthe food and beverage sector whereagricultural water inputs account fora significant proportion of the finalproduct’s water footprint. For example,almost the entire water footprint forbeef (99 percent) comes from theproduction of animal feed. 10However, our data shows that veryfew companies have yet come to gripswith the challenge of measuring andreporting on water use in the supplychain. In fact, in our survey only threeof the world’s largest 250 companiesreported on the water footprint of anypart of their supply chain, and none hasreported on the water footprint of itsentire supply chain.This challenge is further compoundedby the shifting of production to countriesthat are particularly vulnerable to therisks posed by water scarcity andfloods, Asian countries in particular. Theflood in Thailand in 2011, for example,crippled the manufacturing capabilitiesof more than 400 suppliers of computercomponents and automotive parts,sending ripples down the supply chain. 11The complexity of multi-country andmulti-continent supply chains serves toincrease exposure to water-related risks.So while companies headquarteredin water-rich jurisdictions may be lessinclined to report on their water usage,those with international operationsshould be acutely aware of the potentialrisks that water scarcity poses to theirsupply chain and <strong>global</strong> operations.Ultimately, effective management ofwater risks requires companies to gaina clear understanding of the impact oftheir water footprint and risk exposureboth up and down the value chain.8Peak water: Risks embedded in Japanese supply chains © 2012 <strong>KPMG</strong> AZSA Sustainability Co., Ltd.9http://www.bbc.co.uk/news/world-1943189010<strong>Water</strong> Footprint Network www.waterfootprint.org Accessed 30 July 201211Peak water: Risks embedded in Japanese supply chains © 2012 <strong>KPMG</strong> AZSA Sustainability Co., Ltd.© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

14 | <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsConclusion10 Key Questions• How fully does yourorganization understand itsexposure to the risks of waterscarcity?• Where do your biggest waterrisks lie?• To what extent are yourinvestors looking atyour response to waterchallenges?• Does your organizationhave a long-term strategyto deal with or eliminaterisks associated with waterscarcity?• What resources havebeen allocated to lead andmaintain water strategies?• How much water is usedwithin your extended supplychain?• Which water-related metricsare most important to yourbusiness?• What processes are in placeto verify both internal andexternal water usage data?• What plans are in placefor integrating CR orsustainability data <strong>into</strong>your organization’s overallreporting framework?• How is your organizationcommunicating its waterstrategy to key stakeholders?Less than half the world’s top 250companies indicate through theirCR reports that they have a long-termwater strategy in place, despite growingacknowledgement of water scarcity as asignificant risk for many industry sectorsand regions.At best, this suggests that manycompanies do not yet see the need toset out their water strategies in theirCR reports. At worst, it indicates thatexecutives in many businesses haveyet to appreciate the potential impact ofwater scarcity on their business.Those that do have long-term waterstrategies but fail to report themshould note that the issue is a key andgrowing concern for their stakeholders,including shareholders. Institutionalinvestors are increasingly interestedin how companies are mitigating theirexposure to water risk and are lookingfor well-articulated response strategies.In other words, telling the markets thatyou understand the implications andrisks and that you have developed arobust response is simply good investorrelations.Companies that have yet to develop along-term strategy, however, are almostcertainly increasing their organization’soverall risk profile and exposing theirbusinesses to potential disruption. Thefirst and most immediate step must beto develop a clear understandingof the organization’s water footprintand identify which areas of thebusiness are at risk.It is not enough to measure wateruse only within the organization’sown fenceline; risks along the supplychain must be assessed as well. Arecent study by <strong>KPMG</strong> in Japan, forexample, showed that audio and videomanufacturers listed among the Nikkei225 are particularly exposed to waterscarcity via their suppliers of glass andpaperboard packaging. 12With a firm understanding of the risksand pain-points, executives can start todevelop a robust and realistic responseplan that not only sets targets for waterreduction and reuse, but also articulateshow risks in the supply chain will bemanaged and mitigated. Identifyingresources and attributing sufficientinvestment will be central requirements,as will processes and procedures toverify the data coming from suppliers.Best practice CR reporting around waterscarcity should clearly demonstrate thata company has:1. Thoroughly assessed its ownoperations and its supply chain toidentify where the business is mostexposed to water scarcity risks.This includes identifying water hotspots along the value chain andbenchmarking suppliers on water risk.2. Quantified the potential impacts ofthese risks.3. Implemented an effective watermanagement plan across theorganization to reduce or, wherepossible, eliminate risks.4. Developed a longer term strategyto prepare the company to operateprofitably in an increasingly waterconstrainedworld. This includesdemonstrating that the company iscapitalizing on opportunities suchas the development of less waterintensiveprocesses, products andservices.12Peak water: Risks embedded in Japanese supply chains © 2012 <strong>KPMG</strong> AZSA Sustainability Co., Ltd.,© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

<strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends | 15How <strong>KPMG</strong> can helpClimate change, urbanization,population growth and othersustainability megaforces will bringgreater levels of uncertainty and risk to<strong>global</strong> water supplies. Businesses thatrespond strategically and collaborativelynow can reduce future costs ofmitigation and adaption.At <strong>KPMG</strong> member firms, weunderstand that different businessesface different types of water challengesand opportunities. These must beaddressed locally and regionally. Ourservices take a long term approach towater resource management that islinked to value creation and sustainablegrowth.Assess• Assessing the materiality of water use to the business• Quantifying water inputs and outputs (operations and supply chain) and identifying data gaps• Mapping water risk hot spots• Competitor and supplier benchmarkingAccount• Preparing water accounts• Quantifying embedded water in products and services (LCA)AssessPlan• Preparing water resource management plans• Developing targets and KPIs linked to business value drivers• Preparing roadmap and implementation supportAct• Support for reporting and disclosure• Developing the business case water or initiatives/projects• Mapping and engaging stakeholders• Project managementr• Transaction services in relation to water impacts in acquisitions and mergersrstewardshipMonitoWateActPlanAccountMonitor• Conducting compliance audits• Providing independent assurance on reporting• Evaluating project and initiatives• Assessing the maturity of water programs© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

16 | <strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsMethodologyData for this report was sourced fromthe results of <strong>KPMG</strong> InternationalSurvey of Corporate ResponsibilityReporting 2011 which captured 34 datapoints about corporate responsibilityinformation disclosed (or not) by eachcompany in the sample.The research sample included the top250 companies listed on the FortuneGlobal 500 (G250) for the year 2010. Inaddition, the survey included the 100largest companies by revenue (N100)from 34 countries, listed below:Participating Countries 2011AustraliaBulgariaBrazilCanadaChileChinaDenmarkFinlandFranceGermanyGreeceHungaryIndiaIsraelItalyJapanMexicoNetherlandsNew ZealandNigeriaPortugalRomaniaRussiaSingaporeSlovakiaSouth AfricaSouth KoreaSpainSwedenSwitzerlandTaiwanUkraineUnited KingdomUnited States© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

<strong>Sustainable</strong> <strong>Insight</strong>: <strong>Water</strong> <strong>Scarcity</strong> – A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trends | 17The 100 largest companies in each ofthe 34 countries were identified usingrevenue rankings from a recognizednational source. In some instanceswhere a ranking was not available orwas incomplete, substitutes such asmarket capitalization or other sectorappropriatemeasures were usedto compile or complete the revenueranking list. All corporations wereeligible to be included regardless ofownership structure or operationalstructure.Sector comparisons are based on thetotal number of companies listed withinthe G250 and – as a result – data shouldbe considered indicative because anumber of sector groups representedsmall sample sizes. Countrycomparisons are based only on thosecompanies within the N100 that issueda CR report and therefore sample sizesmay be unequal (for example, with only20 of the top 100 companies in Indiaissuing a CR report, the sample size forIndia is limited to 20).© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong> International provides no client services. All rights reserved.

ContactsArgentinaMartín Men<strong>dive</strong>lsúaE: mmen<strong>dive</strong>lzua@kpmg.com.arCzech RepublicEva RackovaE: evarackova@kpmg.czKazakhstanAlun BowenE: abowen@kpmg.kzSouth AfricaNeil MorrisE: neil.morris@kpmg.co.zaArmeniaAndrew CoxshallE: acoxshall@kpmg.ruDenmarkChristian HonoréE: chonore@kpmg.dkLuxemburgJane WilkinsonE: jane.wilkinson@kpmg.luSouth KoreaSungwoo KimE: sungwookim@kr.kpmg.comAustraliaAdrian V. KingE: avking@kpmg.com.auFinlandTomas OtterströmE: tomas.otterstrom@kpmg.fiMalaysiaLamsang HewleeE: lhewlee@kpmg.com.mySpainJose Luis Blasco VazquezE: jblasco@kpmg.esAustriaPeter ErtlE: pertl@kpmg.atAzerbaijanVugar AliyevE: valiyev@kpmg.azBalticsGregory RubinchikE: grubinchik@kpmg.comBelgiumMike BoonenE: mboonen@kpmg.comBrazilSidney ItoE: sito@kpmg.com.brBulgariaEmmanuel TotevE: etotev@kpmg.comCambodiaJonathan LevittE: jonathanlevitt@kpmg.com.vnCanadaBill J. MurphyE: billmurphy@kpmg.caChileAlejandro CerdaE: acerda@kpmg.comChina/Hong KongLeah JinE: leah.jin@kpmg.comColombiaLuis Orlando DelgadilloE: ldelgadillo@kpmg.comCyprusIacovos GhalanosE: iacovos.ghalanos@kpmg.com.cyNathalie ClémentE: nathalie.clement@kpmg.fiFrancePhilippe ArnaudE: parnaud@kpmg.frGeorgiaAndrew CoxshallE: acoxshall@kpmg.ruGermanyJochen PampelE: jpampel@kpmg.comGreeceGeorge RaounasE: graounas@kpmg.grHungaryGabor CserhatiE: gabor.cserhati@kpmg.huIndiaRaajeev BatraE: rbbatra@kpmg.comIndonesiaIwan AtmawidjajaE: iwan.atmawidjaja@kpmg.co.idIrelandEoin O’LideadhaE: eoin.olideadha@kpmg.ieIsraelOren GrupiE: ogrupi@kpmg.comItalyPierMario BarzaghiE: pbarzaghi@kpmg.itJapanYoshitake FunakoshiE: yoshitake.funakoshi@jp.kpmg.comMexicoJesus GonzalezE: jesusgonzalez@kpmg.com.mxNetherlandsBernd HendriksenE: hendriksen.bernd@kpmg.nlNew ZealandJamie SinclairE: jpsinclair@kpmg.co.nzNigeriaDimeji SalaudeenE: dimeji.salaudeen@ng.kpmg.comNorwayJan-Erik MartinsenE: jan.erik.martinsen@kpmg.noPhilippinesHenry D. AntonioE: hantonio@kpmg.comPolandKrzysztof RadziwonE: kradziwon@kpmg.plPortugalFilipa RodriguesE: filiparodrigues@kpmg.comRomaniaGheorghita DiaconuE: gdiaconu@kpmg.comRussiaIgor KorotetskiyE: ikorotetskiy@kpmg.ruSingaporeSharad SomaniE: sharadsomani@kpmg.com.sgSlovakiaQuentin CrossleyE: qcrossley@kpmg.skSri LankaRanjani JosephE: ranjanijoseph@kpmg.comSwedenÅse BäckströmE: ase.backstrom@kpmg.seSwitzerlandHans-Ulrich PfyfferE: hpfyffer@kpmg.comTaiwanCharles ChenE: charleschen@kpmg.com.twThailandPaul FlipseE: pflipse1@kpmg.co.thU.A.E.Sudhir ArvindE: sarvind@kpmg.comU.A.E. and Oman(Lower Gulf)Andrew RobinsonE: arobinson1@kpmg.comUKVincent NeateE: vincent.neate@kpmg.co.ukUkraineOlena MakarenkoE: omakarenko@kpmg.uaUSJohn R HickoxE: jhickox@kpmg.comVenezuelaJose O. RodriguesE: jrodrigues@kpmg.comVietnamJonathan LevittE: jonathanlevitt@kpmg.com.vnKazuhiko SaitoE: kazuhiko.saito@jp.kpmg.comkpmg.com/socialmediaThe information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurateand timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one shouldact on such information without appropriate professional advice after a thorough examination of the particular situation.© 2012 <strong>KPMG</strong> International Cooperative (“<strong>KPMG</strong> International”), a Swiss entity. Member firms of the <strong>KPMG</strong> network of independent firms are affiliated with <strong>KPMG</strong> International. <strong>KPMG</strong>International provides no client services. No member firm has any authority to obligate or bind <strong>KPMG</strong> International or any other member firm vis-à-vis third parties, nor does <strong>KPMG</strong>International have any such authority to obligate or bind any member firm. All rights reserved.The <strong>KPMG</strong> name, logo and “cutting through complexity” are registered trademarks or trademarks of <strong>KPMG</strong> International.Designed by Evalueserve.Publication name: <strong>Sustainable</strong> <strong>Insight</strong> – <strong>Water</strong> <strong>Scarcity</strong>: A <strong>dive</strong> <strong>into</strong> <strong>global</strong> reporting trendsPublication number: 121050Publication date: October 2012