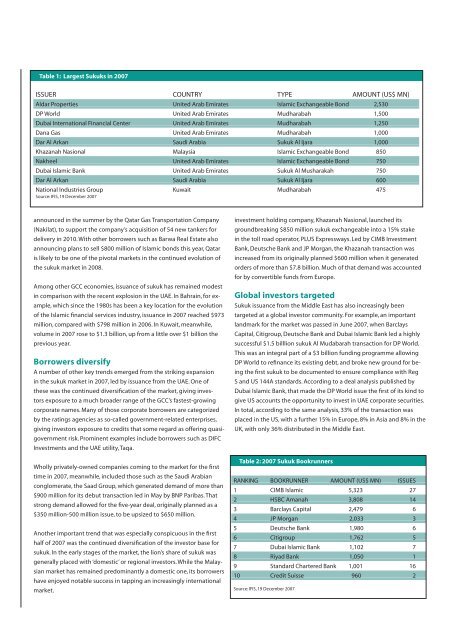

expanded Table 1: to Largest more than Sukuks $5 billion, <strong>in</strong> 2007buoyedchiefly by a $2.5 billion dealThat was most graphically illustrated <strong>in</strong> June, when Malaysia’s stateISSUER COUNTRY TYPE AMOUNT (US$ MN)Aldar Properties United Arab Emirates <strong>Islamic</strong> Exchangeable Bond 2,530DP World United Arab Emirates Mudharabah 1,500Dubai International F<strong>in</strong>ancial Center United Arab Emirates Mudharabah 1,250Dana Gas United Arab Emirates Mudharabah 1,000Dar Al Arkan Saudi Arabia Sukuk Al Ijara 1,000Khazanah Nasional Malaysia <strong>Islamic</strong> Exchangeable Bond 850Nakheel United Arab Emirates <strong>Islamic</strong> Exchangeable Bond 750Dubai <strong>Islamic</strong> Bank United Arab Emirates Sukuk Al Musharakah 750Dar Al Arkan Saudi Arabia Sukuk Al Ijara 600National Industries Group Kuwait Mudharabah 475Source: IFIS, 19 December 2007announced <strong>in</strong> the summer by the Qatar Gas Transportation Company(Nakilat), to support the company’s acquisition of 54 new tankers fordelivery <strong>in</strong> 2010. With other borrowers such as Barwa Real Estate alsoannounc<strong>in</strong>g plans to sell $800 million of <strong>Islamic</strong> bonds this year, Qataris likely to be one of the pivotal markets <strong>in</strong> the cont<strong>in</strong>ued evolution ofthe sukuk market <strong>in</strong> 2008.Among other GCC economies, issuance of sukuk has rema<strong>in</strong>ed modest<strong>in</strong> comparison with the recent explosion <strong>in</strong> the UAE. In Bahra<strong>in</strong>, for example,which s<strong>in</strong>ce the 1980s has been a key location for the evolutionof the <strong>Islamic</strong> f<strong>in</strong>ancial services <strong>in</strong>dustry, issuance <strong>in</strong> 2007 reached $973million, compared with $798 million <strong>in</strong> 2006. In Kuwait, meanwhile,volume <strong>in</strong> 2007 rose to $1.3 billion, up from a little over $1 billion theprevious year.Borrowers diversifyA number of other key trends emerged from the strik<strong>in</strong>g expansion<strong>in</strong> the sukuk market <strong>in</strong> 2007, led by issuance from the UAE. One ofthese was the cont<strong>in</strong>ued diversification of the market, giv<strong>in</strong>g <strong>in</strong>vestorsexposure to a much broader range of the GCC’s fastest-grow<strong>in</strong>gcorporate names. Many of those corporate borrowers are categorizedby the rat<strong>in</strong>gs agencies as so-called government-related enterprises,giv<strong>in</strong>g <strong>in</strong>vestors exposure to credits that some regard as offer<strong>in</strong>g quasigovernmentrisk. Prom<strong>in</strong>ent examples <strong>in</strong>clude borrowers such as DIFCInvestments and the UAE utility, Taqa.Wholly privately-owned companies com<strong>in</strong>g to the market for the firsttime <strong>in</strong> 2007, meanwhile, <strong>in</strong>cluded those such as the Saudi Arabianconglomerate, the Saad Group, which generated demand of more than$900 million for its debut transaction led <strong>in</strong> May by BNP Paribas. Thatstrong demand allowed for the five-year deal, orig<strong>in</strong>ally planned as a$350 million-500 million issue, to be upsized to $650 million.Another important trend that was especially conspicuous <strong>in</strong> the firsthalf of 2007 was the cont<strong>in</strong>ued diversification of the <strong>in</strong>vestor base forsukuk. In the early stages of the market, the lion’s share of sukuk wasgenerally placed with ‘domestic’ or regional <strong>in</strong>vestors. While the Malaysianmarket has rema<strong>in</strong>ed predom<strong>in</strong>antly a domestic one, its borrowershave enjoyed notable success <strong>in</strong> tapp<strong>in</strong>g an <strong>in</strong>creas<strong>in</strong>gly <strong>in</strong>ternationalmarket.<strong>in</strong>vestment hold<strong>in</strong>g company, Khazanah Nasional, launched itsgroundbreak<strong>in</strong>g $850 million sukuk exchangeable <strong>in</strong>to a 15% stake<strong>in</strong> the toll road operator, PLUS Expressways. Led by CIMB InvestmentBank, Deutsche Bank and JP Morgan, the Khazanah transaction was<strong>in</strong>creased from its orig<strong>in</strong>ally planned $600 million when it generatedorders of more than $7.8 billion. Much of that demand was accountedfor by convertible funds from Europe.Global <strong>in</strong>vestors targetedSukuk issuance from the Middle East has also <strong>in</strong>creas<strong>in</strong>gly beentargeted at a global <strong>in</strong>vestor community. For example, an importantlandmark for the market was passed <strong>in</strong> June 2007, when BarclaysCapital, Citigroup, Deutsche Bank and Dubai <strong>Islamic</strong> Bank led a highlysuccessful $1.5 billlion sukuk Al Mudabarah transaction for DP World.This was an <strong>in</strong>tegral part of a $3 billion fund<strong>in</strong>g programme allow<strong>in</strong>gDP World to ref<strong>in</strong>ance its exist<strong>in</strong>g debt, and broke new ground for be<strong>in</strong>gthe first sukuk to be documented to ensure compliance with RegS and US 144A standards. Accord<strong>in</strong>g to a deal analysis published byDubai <strong>Islamic</strong> Bank, that made the DP World issue the first of its k<strong>in</strong>d togive US accounts the opportunity to <strong>in</strong>vest <strong>in</strong> UAE corporate securities.In total, accord<strong>in</strong>g to the same analysis, 33% of the transaction wasplaced <strong>in</strong> the US, with a further 15% <strong>in</strong> Europe, 8% <strong>in</strong> Asia and 8% <strong>in</strong> theUK, with only 36% distributed <strong>in</strong> the Middle East.Table 2: 2007 Sukuk BookrunnersRANKING BOOKRUNNER AMOUNT (US$ MN) ISSUES1 CIMB <strong>Islamic</strong> 5,323 272 HSBC Amanah 3,808 143 Barclays Capital 2,479 64 JP Morgan 2,033 35 Deutsche Bank 1,980 66 Citigroup 1,762 57 Dubai <strong>Islamic</strong> Bank 1,102 78 Riyad Bank 1,050 19 Standard Chartered Bank 1,001 1610 Credit Suisse 960 2Source: IFIS, 19 December 2007

The grow<strong>in</strong>g diversification of the <strong>in</strong>vestor base for <strong>Islamic</strong> securities <strong>in</strong>2006, which gathered momentum <strong>in</strong> the early months of 2007, turnedout to be someth<strong>in</strong>g of a double-edged sword. International <strong>in</strong>vestorsbecame <strong>in</strong>creas<strong>in</strong>gly nervous about committ<strong>in</strong>g funds to newcorporate issuance as the credit crunch tightened its global grip <strong>in</strong> thesecond half of 2007, which had an <strong>in</strong>evitable knock-on impact on thesukuk sector at both the primary and secondary level. Issuance of newsukuk slowed <strong>in</strong> the second half of the year, while spreads of those<strong>in</strong>struments that had been widely placed among <strong>in</strong>ternational <strong>in</strong>vestorswidened. That widen<strong>in</strong>g, bankers <strong>in</strong> the Middle East rightly <strong>in</strong>sisted,was purely a reflection of global liquidity flows, rather than of any shifts<strong>in</strong> the underly<strong>in</strong>g credit quality of issuers <strong>in</strong> the sukuk space. After all,buoyed by high oil prices and economic diversification, growth <strong>in</strong> theInfrastructure prospectsLook<strong>in</strong>g to 2008 and beyond, there is a grow<strong>in</strong>g belief that one of themost excit<strong>in</strong>g areas for <strong>Islamic</strong> f<strong>in</strong>ance will be as a means of f<strong>in</strong>anc<strong>in</strong>g thegigantic <strong>in</strong>frastructure <strong>in</strong>vestments that are now either be<strong>in</strong>g implementedor are on the draw<strong>in</strong>g board throughout the Middle East. Estimates ofthe total <strong>in</strong>vestment that will be channelled by public and private sector<strong>in</strong>vestors <strong>in</strong>to <strong>in</strong>frastructure <strong>in</strong> the <strong>Islamic</strong> world vary, but a recent reportpublished by the Dubai-based Abraaj Capital describes the requirement<strong>in</strong> the Middle East, North Africa and South Asia as “noth<strong>in</strong>g shortof spectacular”. The Abraaj report says that “<strong>in</strong> the first half of 2006, theMiddle East, for the first time <strong>in</strong> its history, became the largest source of<strong>in</strong>frastructure related project f<strong>in</strong>ance <strong>in</strong> the world, account<strong>in</strong>g for $33 billion,or one dollar for every three that was raised <strong>in</strong> the <strong>in</strong>dustry globally”.“One of the most excit<strong>in</strong>g areas for <strong>Islamic</strong> f<strong>in</strong>ance will be as a means off<strong>in</strong>anc<strong>in</strong>g the gigantic <strong>in</strong>frastructure <strong>in</strong>vestments that are now either be<strong>in</strong>gimplemented or are on the draw<strong>in</strong>g board throughout the Middle East”Middle East <strong>in</strong> general and the GCC <strong>in</strong> particular cont<strong>in</strong>ues to outpacemost of the rest of the world.Over the com<strong>in</strong>g decade, adds the Abraaj analysis, the MENSA regionwill call for <strong>in</strong>frastructure <strong>in</strong>vestment of more than $630 billion acrossa number of key economic sectors. Power and utilities will account forOne notable positive by-product of the grow<strong>in</strong>g risk averseness ofglobal <strong>in</strong>vestors <strong>in</strong> the second half of 2007 was the <strong>in</strong>creased flexibilityof borrowers <strong>in</strong> the sukuk market. In the case of a transaction launched<strong>in</strong> November by the Jebel Ali Free Zone (JAFZ), led by Barclays Capital,$155 billion of this huge total, with the other areas identified as hav<strong>in</strong>gsubstantial <strong>in</strong>vestment requirements <strong>in</strong>clud<strong>in</strong>g water ($133 billion),healthcare ($49 billion), education ($18 billion), transportation ($188billion) and petrochemicals ($87 billion).Deutsche Bank, Dubai <strong>Islamic</strong> Bank and Lehman Brothers, the anticipationof weak <strong>in</strong>ternational demand did not lead to a cancellation of thedeal. Instead, it led to its denom<strong>in</strong>ation <strong>in</strong> dirham rather than dollars,with the transaction eventually offered as a very successful Dh7.5billion ($2 billion equivalent) float<strong>in</strong>g-rate note (FRN), which made theJAFZ deal the largest ever non-convertible sukuk, with local <strong>in</strong>vestorsaccount<strong>in</strong>g for 62% of distribution.Much of the focus for <strong>in</strong>vestment will <strong>in</strong>evitably be concentrated onthe Middle East, but the populous and fast-grow<strong>in</strong>g Indian economyalso has a massive <strong>in</strong>frastructure requirement. The government hasrecently put the size of that requirement at $500 billion between 2007and 2012, mean<strong>in</strong>g that some 9% of GDP will need to be <strong>in</strong>vested <strong>in</strong><strong>in</strong>frastructure over the next five years.Table 3: Key project f<strong>in</strong>anc<strong>in</strong>g transactions <strong>in</strong> 2007Project Country Sector AMOUNT (US$ mn) Type of F<strong>in</strong>anc<strong>in</strong>gIndian Economic Zone India Infrastructure 10,000 <strong>Islamic</strong> F<strong>in</strong>anc<strong>in</strong>g FacilityEnergy City Ch<strong>in</strong>a Ch<strong>in</strong>a Power 5,000 Istisna’aTunisian F<strong>in</strong>ancial Harbour Tunisia Real Estate - Commercial 3,000 <strong>Islamic</strong> F<strong>in</strong>anc<strong>in</strong>g FacilityDeyaar Park UAE Real Estate 3,000 Istisna’aSaudi Telecoms Saudi Arabia Telecommunications 2,500 Murabaha FacilityAl Raha Beach Project UAE Real Estate 2,100 IjarahLeisure & real estate projects UAE Real Estate 1,850 IjarahRoyal Metropolis Jordon Gate Jordan Real Estate - Residential 1,000 <strong>Islamic</strong> F<strong>in</strong>anc<strong>in</strong>g FacilityDurrat Al Bahra<strong>in</strong> Bahra<strong>in</strong> Real Estate - Residential 1,000 <strong>Islamic</strong> FundBarwa Real Estate expansions Qatar Real Estate 800 Murabaha FacilityDubai Bus<strong>in</strong>ess Park UAE Real Estate - Commercial 700 <strong>Islamic</strong> F<strong>in</strong>anc<strong>in</strong>g FacilityLow Sulphur Diesel Production Facility Bahra<strong>in</strong> Oil & Gas 685 IjarahQueen Alia Intl Airport Expansion Jordan Infrastructure - Airports 680 <strong>Islamic</strong> F<strong>in</strong>anc<strong>in</strong>g FacilityEthylene-Glycol Plant Saudi Arabia Petrochemical 650 Istisna’aMarafiq IWPP Saudi Arabia Water & Power Plants 600 <strong>Islamic</strong> F<strong>in</strong>anc<strong>in</strong>g FacilitySource: IFIS, 19 December 2007<strong>Islamic</strong> capital markets still break<strong>in</strong>g records11