MEWAH INTERNATIONAL INC. Unaudited ... - Mewah Group

MEWAH INTERNATIONAL INC. Unaudited ... - Mewah Group

MEWAH INTERNATIONAL INC. Unaudited ... - Mewah Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

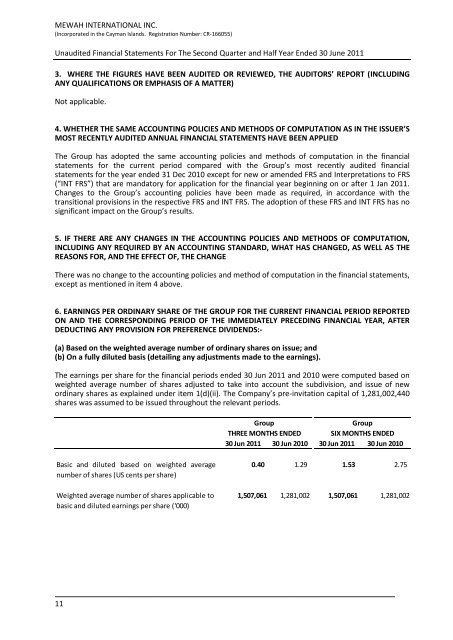

<strong>MEWAH</strong> <strong>INTERNATIONAL</strong> <strong>INC</strong>.(Incorporated in the Cayman Islands. Registration Number: CR-166055)<strong>Unaudited</strong> Financial Statements For The Second Quarter and Half Year Ended 30 June 20113. WHERE THE FIGURES HAVE BEEN AUDITED OR REVIEWED, THE AUDITORS’ REPORT (<strong>INC</strong>LUDINGANY QUALIFICATIONS OR EMPHASIS OF A MATTER)Not applicable.4. WHETHER THE SAME ACCOUNTING POLICIES AND METHODS OF COMPUTATION AS IN THE ISSUER’SMOST RECENTLY AUDITED ANNUAL FINANCIAL STATEMENTS HAVE BEEN APPLIEDThe <strong>Group</strong> has adopted the same accounting policies and methods of computation in the financialstatements for the current period compared with the <strong>Group</strong>’s most recently audited financialstatements for the year ended 31 Dec 2010 except for new or amended FRS and Interpretations to FRS(“INT FRS”) that are mandatory for application for the financial year beginning on or after 1 Jan 2011.Changes to the <strong>Group</strong>’s accounting policies have been made as required, in accordance with thetransitional provisions in the respective FRS and INT FRS. The adoption of these FRS and INT FRS has nosignificant impact on the <strong>Group</strong>’s results.5. IF THERE ARE ANY CHANGES IN THE ACCOUNTING POLICIES AND METHODS OF COMPUTATION,<strong>INC</strong>LUDING ANY REQUIRED BY AN ACCOUNTING STANDARD, WHAT HAS CHANGED, AS WELL AS THEREASONS FOR, AND THE EFFECT OF, THE CHANGEThere was no change to the accounting policies and method of computation in the financial statements,except as mentioned in item 4 above.6. EARNINGS PER ORDINARY SHARE OF THE GROUP FOR THE CURRENT FINANCIAL PERIOD REPORTEDON AND THE CORRESPONDING PERIOD OF THE IMMEDIATELY PRECEDING FINANCIAL YEAR, AFTERDEDUCTING ANY PROVISION FOR PREFERENCE DIVIDENDS:-(a) Based on the weighted average number of ordinary shares on issue; and(b) On a fully diluted basis (detailing any adjustments made to the earnings).The earnings per share for the financial periods ended 30 Jun 2011 and 2010 were computed based onweighted average number of shares adjusted to take into account the subdivision, and issue of newordinary shares as explained under item 1(d)(ii). The Company’s pre-invitation capital of 1,281,002,440shares was assumed to be issued throughout the relevant periods.<strong>Group</strong><strong>Group</strong>THREE MONTHS ENDED SIX MONTHS ENDED30 Jun 2011 30 Jun 2010 30 Jun 2011 30 Jun 2010Basic and diluted based on weighted averagenumber of shares (US cents per share)0.40 1.29 1.53 2.75Weighted average number of shares applicable to 1,507,061 1,281,002 1,507,061 1,281,002basic and diluted earnings per share ('000)11