An Introduction to The CBOE S&P 500 PutWrite Index - CBOE.com

An Introduction to The CBOE S&P 500 PutWrite Index - CBOE.com

An Introduction to The CBOE S&P 500 PutWrite Index - CBOE.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

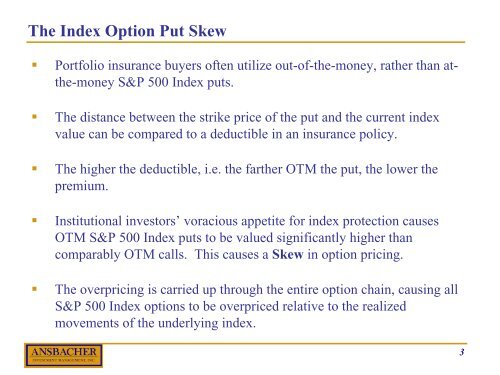

<strong>The</strong> <strong>Index</strong> Option Put Skew• Portfolio insurance buyers often utilize out-of-the-money, rather than atthe-moneyS&P <strong>500</strong> <strong>Index</strong> puts.• <strong>The</strong> distance between the strike price of the put and the current indexvalue can be <strong>com</strong>pared <strong>to</strong> a deductible in an insurance policy.• <strong>The</strong> higher the deductible, i.e. the farther OTM the put, the lower thepremium.• Institutional inves<strong>to</strong>rs’ voracious appetite for index protection causesOTM S&P <strong>500</strong> <strong>Index</strong> puts <strong>to</strong> be valued significantly higher than<strong>com</strong>parably OTM calls. This causes a Skew in option pricing.• <strong>The</strong> overpricing is carried up through the entire option chain, causing allS&P <strong>500</strong> <strong>Index</strong> options <strong>to</strong> be overpriced relative <strong>to</strong> the realizedmovements of the underlying index.3