Jenson Seed EIS Fund - Clubfinance

Jenson Seed EIS Fund - Clubfinance

Jenson Seed EIS Fund - Clubfinance

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

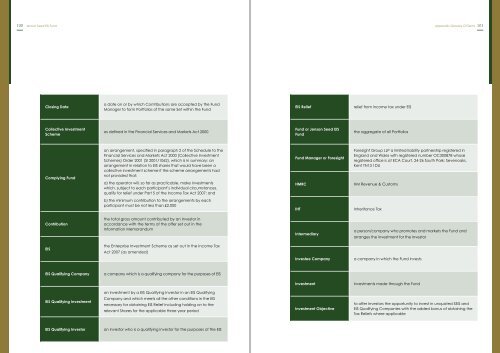

100 <strong>Jenson</strong> <strong>Seed</strong> <strong>EIS</strong> <strong>Fund</strong>Appendix: Glossary Of Terms 101Closing Datea date on or by which Contributions are accepted by the <strong>Fund</strong>Manager to form Portfolios of the same Set within the <strong>Fund</strong><strong>EIS</strong> Reliefrelief from income tax under <strong>EIS</strong>Collective InvestmentSchemeas defined in the Financial Services and Markets Act 2000<strong>Fund</strong> or <strong>Jenson</strong> <strong>Seed</strong> <strong>EIS</strong><strong>Fund</strong>the aggregate of all PortfoliosComplying <strong>Fund</strong>an arrangement, specified in paragraph 2 of the Schedule to theFinancial Services and Markets Act 2000 (Collective InvestmentSchemes) Order 2001 (SI 2001/1062), which is in summary: anarrangement in relation to <strong>EIS</strong> shares that would have been acollective investment scheme if the scheme arrangements hadnot provided that:a) the operator will, so far as practicable, make investmentswhich, subject to each participant’s individual circumstances,qualify for relief under Part 5 of the Income Tax Act 2007; and<strong>Fund</strong> Manager or ForesightHMRCForesight Group LLP a limited liability partnership registered inEngland and Wales with registered number OC300878 whoseregistered office is at ECA Court, 24-26 South Park; Sevenoaks,Kent TN13 1DUHM Revenue & Customsb) the minimum contribution to the arrangements by eachparticipant must be not less than £2,000IHTInheritance TaxContributionthe total gross amount contributed by an Investor inaccordance with the terms of the offer set out in theInformation MemorandumIntermediarya person/company who promotes and markets the <strong>Fund</strong> andarranges the investment for the Investor<strong>EIS</strong>the Enterprise Investment Scheme as set out in the Income TaxAct 2007 (as amended)Investee Companya company in which the <strong>Fund</strong> invests<strong>EIS</strong> Qualifying Companya company which is a qualifying company for the purposes of <strong>EIS</strong>Investmentinvestments made through the <strong>Fund</strong>an investment by a <strong>EIS</strong> Qualifying Investor in an <strong>EIS</strong> Qualifying<strong>EIS</strong> Qualifying InvestmentCompany and which meets all the other conditions in the <strong>EIS</strong>necessary for obtaining <strong>EIS</strong> Relief including holding on to therelevant Shares for the applicable three year periodInvestment Objectiveto offer Investors the opportunity to invest in unquoted S<strong>EIS</strong> and<strong>EIS</strong> Qualifying Companies with the added bonus of obtaining theTax Reliefs where applicable<strong>EIS</strong> Qualifying Investoran investor who is a qualifying investor for the purposes of the <strong>EIS</strong>