04177 CFSA BROCHURE.qxd - TÄ°DE

04177 CFSA BROCHURE.qxd - TÄ°DE

04177 CFSA BROCHURE.qxd - TÄ°DE

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

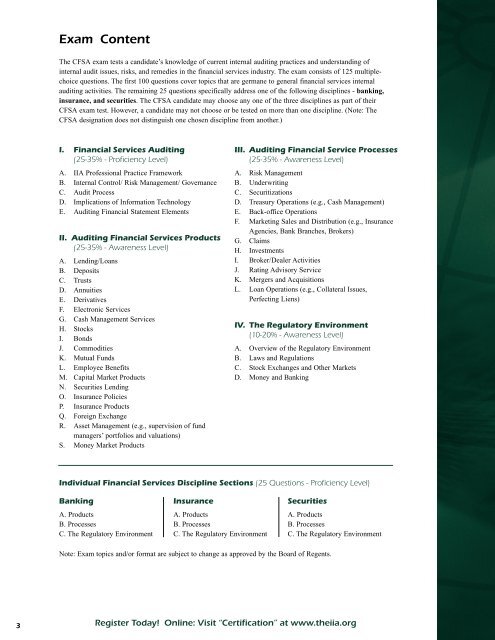

Exam ContentThe <strong>CFSA</strong> exam tests a candidate’s knowledge of current internal auditing practices and understanding ofinternal audit issues, risks, and remedies in the financial services industry. The exam consists of 125 multiplechoicequestions. The first 100 questions cover topics that are germane to general financial services internalauditing activities. The remaining 25 questions specifically address one of the following disciplines - banking,insurance, and securities. The <strong>CFSA</strong> candidate may choose any one of the three disciplines as part of their<strong>CFSA</strong> exam test. However, a candidate may not choose or be tested on more than one discipline. (Note: The<strong>CFSA</strong> designation does not distinguish one chosen discipline from another.)I. Financial Services Auditing(25-35% - Proficiency Level)A. IIA Professional Practice FrameworkB. Internal Control/ Risk Management/ GovernanceC. Audit ProcessD. Implications of Information TechnologyE. Auditing Financial Statement ElementsII. Auditing Financial Services Products(25-35% - Awareness Level)A. Lending/LoansB. DepositsC. TrustsD. AnnuitiesE. DerivativesF. Electronic ServicesG. Cash Management ServicesH. StocksI. BondsJ. CommoditiesK. Mutual FundsL. Employee BenefitsM. Capital Market ProductsN. Securities LendingO. Insurance PoliciesP. Insurance ProductsQ. Foreign ExchangeR. Asset Management (e.g., supervision of fundmanagers’ portfolios and valuations)S. Money Market ProductsIII. Auditing Financial Service Processes(25-35% - Awareness Level)A. Risk ManagementB. UnderwritingC. SecuritizationsD. Treasury Operations (e.g., Cash Management)E. Back-office OperationsF. Marketing Sales and Distribution (e.g., InsuranceAgencies, Bank Branches, Brokers)G. ClaimsH. InvestmentsI. Broker/Dealer ActivitiesJ. Rating Advisory ServiceK. Mergers and AcquisitionsL. Loan Operations (e.g., Collateral Issues,Perfecting Liens)IV. The Regulatory Environment(10-20% - Awareness Level)A. Overview of the Regulatory EnvironmentB. Laws and RegulationsC. Stock Exchanges and Other MarketsD. Money and BankingIndividual Financial Services Discipline Sections (25 Questions - Proficiency Level)BankingA. ProductsB. ProcessesC. The Regulatory EnvironmentInsuranceA. ProductsB. ProcessesC. The Regulatory EnvironmentSecuritiesA. ProductsB. ProcessesC. The Regulatory EnvironmentNote: Exam topics and/or format are subject to change as approved by the Board of Regents.3 Register Today! Online: Visit “Certification” at www.theiia.org