• until the third anniversary from the Implementation Date, the Voting Pool Members may notdispose of their shares without prior written consent from the Company, and in the event of anydisposal of shares, the disposing Voting Pool Members must first offer their shares <strong>to</strong> theexisting Voting Pool Members; and• the Voting Pool Agreement shall endure so long as:– the Voting Pool Members beneficially own at least 5% of the entire issued capital ofGold Reef; and– until in terms of BEE regulations and regulations of the relevant gaming boards, Gold Reefshares can be transferred without Gold Reef’s BEE Status being negatively affected.The existing BEE economic interests in the subsidiaries, joint venture and management contractsof the Company are set our below:BEE shareholder Subsidiary, Joint venture or PercentageManagement contracteconomic interestALI BEE <strong>shareholders</strong> Akani Egoli 25,02ALSH BEE <strong>shareholders</strong> Silverstar 50,00ALICM BEE <strong>shareholders</strong> Akani Egoli Contract 25,00ALMI BEE <strong>shareholders</strong> Akani Msunduzi 15,00ALGI BEE <strong>shareholders</strong> Goldfields Casino 12,00Reygrande West Coast Leisure 10,00Satara Goldfields Contract 30,00The <strong>ordinary</strong> resolution authorising the Proposed Share Exchange is contained in the attachednotice of general meeting of <strong>shareholders</strong> (<strong>ordinary</strong> resolution number 1). The Proposed ShareExchange is subject <strong>to</strong> approval by a 50% majority of the votes, excluding the votes of the BEE<strong>shareholders</strong> and their associates, at the general meeting of <strong>shareholders</strong>.4.2 The ALI acquisition4.2.1 Nature of business of ALIGold Reef owns a direct and economic interest of 50,00% in the <strong>ordinary</strong> share capital ofAkani Egoli and a 49,98% direct and economic interest in ALI. The remaining 50,02% of ALIis owned by the ALI BEE <strong>shareholders</strong>. This results in the ALI BEE <strong>shareholders</strong> owning anindirect and economic interest of 25,02% in Akani Egoli.The ALI BEE <strong>shareholders</strong> that Gold Reef will be transacting with are as follows:• Black Management Forum Investment Company Limited;• G7 Investments Holdings (Proprietary) Limited;• Mary Jantjies Family Trust;• Newshelf 698 (Proprietary) Limited;• Newshelf 800 (Proprietary) Limited;• Pla<strong>to</strong>on Trade and Invest 15 (Proprietary) Limited;• Prime Portfolio Investments “A” (Proprietary) Limited;• Saddle Path Props 20 (Proprietary) Limited;• XAU Investments CC;• Y Investments Limited; and• Young Women’s Christian Association – Dube Charitable Trust.4.2.2 Details of the ALI acquisitionGold Reef will acquire the remaining 50.02% interest in ALI from the ALI BEE <strong>shareholders</strong>for approximately R384,8 million. The effect of the ALI acquisition is that Gold Reef will havea direct and economic interest of 100,00% in ALI and consequently Akani Egoli.The ALI acquisition will be settled by the issue of 16 881 426 Gold Reef shares andR64,1 million in cash. The cash component will be used by the ALI BEE <strong>shareholders</strong> <strong>to</strong>settle various taxes arising from the ALI acquisition and <strong>to</strong> settle the Outstanding ALI BEEPreference Shares.12

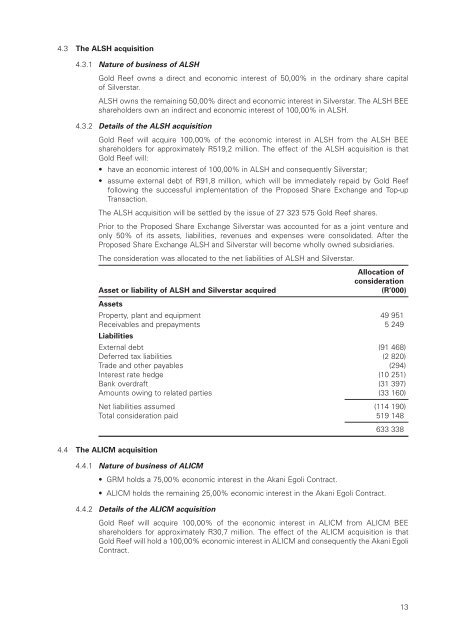

4.3 The ALSH acquisition4.3.1 Nature of business of ALSHGold Reef owns a direct and economic interest of 50,00% in the <strong>ordinary</strong> share capitalof Silverstar.ALSH owns the remaining 50,00% direct and economic interest in Silverstar. The ALSH BEE<strong>shareholders</strong> own an indirect and economic interest of 100,00% in ALSH.4.3.2 Details of the ALSH acquisitionGold Reef will acquire 100,00% of the economic interest in ALSH from the ALSH BEE<strong>shareholders</strong> for approximately R519,2 million. The effect of the ALSH acquisition is thatGold Reef will:• have an economic interest of 100,00% in ALSH and consequently Silverstar;• assume external debt of R91,8 million, which will be immediately repaid by Gold Reeffollowing the successful implementation of the Proposed Share Exchange and Top-upTransaction.The ALSH acquisition will be settled by the issue of 27 323 575 Gold Reef shares.Prior <strong>to</strong> the Proposed Share Exchange Silverstar was accounted for as a joint venture andonly 50% of its assets, liabilities, revenues and expenses were consolidated. After theProposed Share Exchange ALSH and Silverstar will become wholly owned subsidiaries.The consideration was allocated <strong>to</strong> the net liabilities of ALSH and Silverstar.Allocation ofconsiderationAsset or liability of ALSH and Silverstar acquired(R’000)AssetsProperty, plant and equipment 49 951Receivables and prepayments 5 249LiabilitiesExternal debt (91 468)Deferred tax liabilities (2 820)Trade and other payables (294)Interest rate hedge (10 251)Bank overdraft (31 397)Amounts owing <strong>to</strong> related parties (33 160)Net liabilities assumed (114 190)Total consideration paid 519 1484.4 The ALICM acquisition4.4.1 Nature of business of ALICM• GRM holds a 75,00% economic interest in the Akani Egoli Contract.• ALICM holds the remaining 25,00% economic interest in the Akani Egoli Contract.4.4.2 Details of the ALICM acquisition633 338Gold Reef will acquire 100,00% of the economic interest in ALICM from ALICM BEE<strong>shareholders</strong> for approximately R30,7 million. The effect of the ALICM acquisition is thatGold Reef will hold a 100,00% economic interest in ALICM and consequently the Akani EgoliContract.13