Key Performance Indicators - Vodafone

Key Performance Indicators - Vodafone

Key Performance Indicators - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

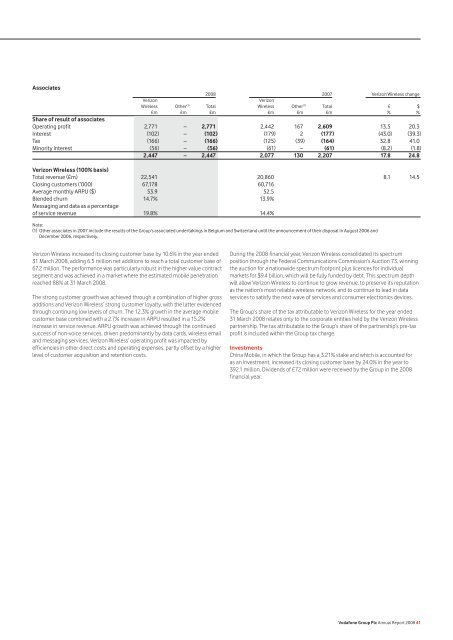

Associates<br />

2008 2007 Verizon Wireless change<br />

Verizon Verizon<br />

Wireless Other (1) Total Wireless Other (1) Total £ $<br />

£m £m £m £m £m £m % %<br />

Share of result of associates<br />

Operating profit 2,771 – 2,771 2,442 167 2,609 13.5 20.3<br />

Interest (102) – (102) (179) 2 (177) (43.0) (39.3)<br />

Tax (166) – (166) (125) (39) (164) 32.8 41.0<br />

Minority interest (56) – (56) (61) – (61) (8.2) (1.8)<br />

2,447 – 2,447 2,077 130 2,207 17.8 24.8<br />

Verizon Wireless (100% basis)<br />

Total revenue (£m) 22,541 20,860 8.1 14.5<br />

Closing customers (’000) 67,178 60,716<br />

Average monthly ARPU ($) 53.9 52.5<br />

Blended churn 14.7% 13.9%<br />

Messaging and data as a percentage<br />

of service revenue 19.8% 14.4%<br />

Note:<br />

(1) Other associates in 2007 include the results of the Group’s associated undertakings in Belgium and Switzerland until the announcement of their disposal in August 2006 and<br />

December 2006, respectively.<br />

Verizon Wireless increased its closing customer base by 10.6% in the year ended<br />

31 March 2008, adding 6.5 million net additions to reach a total customer base of<br />

67.2 million. The performance was particularly robust in the higher value contract<br />

segment and was achieved in a market where the estimated mobile penetration<br />

reached 88% at 31 March 2008.<br />

The strong customer growth was achieved through a combination of higher gross<br />

additions and Verizon Wireless’ strong customer loyalty, with the latter evidenced<br />

through continuing low levels of churn. The 12.3% growth in the average mobile<br />

customer base combined with a 2.7% increase in ARPU resulted in a 15.2%<br />

increase in service revenue. ARPU growth was achieved through the continued<br />

success of non-voice services, driven predominantly by data cards, wireless email<br />

and messaging services. Verizon Wireless’ operating profit was impacted by<br />

efficiencies in other direct costs and operating expenses, partly offset by a higher<br />

level of customer acquisition and retention costs.<br />

During the 2008 financial year, Verizon Wireless consolidated its spectrum<br />

position through the Federal Communications Commission’s Auction 73, winning<br />

the auction for a nationwide spectrum footprint plus licences for individual<br />

markets for $9.4 billion, which will be fully funded by debt. This spectrum depth<br />

will allow Verizon Wireless to continue to grow revenue, to preserve its reputation<br />

as the nation’s most reliable wireless network, and to continue to lead in data<br />

services to satisfy the next wave of services and consumer electronics devices.<br />

The Group’s share of the tax attributable to Verizon Wireless for the year ended<br />

31 March 2008 relates only to the corporate entities held by the Verizon Wireless<br />

partnership. The tax attributable to the Group’s share of the partnership’s pre-tax<br />

profit is included within the Group tax charge.<br />

Investments<br />

China Mobile, in which the Group has a 3.21% stake and which is accounted for<br />

as an investment, increased its closing customer base by 24.0% in the year to<br />

392.1 million. Dividends of £72 million were received by the Group in the 2008<br />

financial year.<br />

<strong>Vodafone</strong> Group Plc Annual Report 2008 41