Grade 12 Accounting Question Paper 2012 - Times LIVE

Grade 12 Accounting Question Paper 2012 - Times LIVE

Grade 12 Accounting Question Paper 2012 - Times LIVE

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

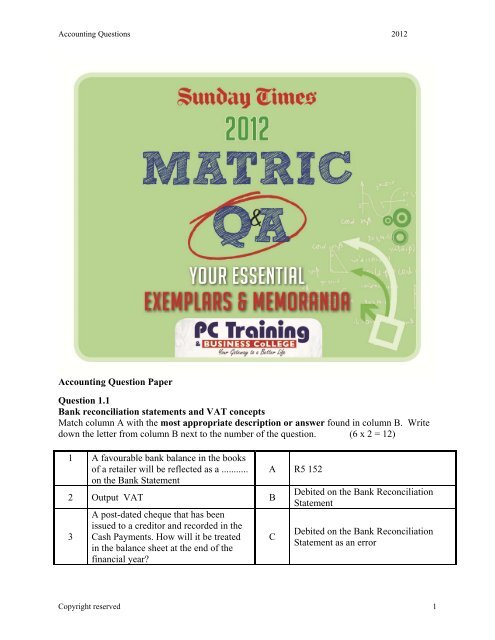

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong>2. Transactions during the year:2.1 Raw materials bought during the year:Credit 2 688 000Carriage on goods bought paid by cheque R165 600Raw materials returned to the suppliers R39 4802.2 The following salaries and wages were paid:Factory workers R447 000Factory cleaners R48 800Admin salaries R97 200Note: The UIF contribution must be brought into account at 1% of the Gross salaries of allthe employees.2.3 Other expenses for the year:• Consumable stores bought R14 400 (the factory uses 80% of the consumable stores)• Factory maintenance R90 000. An amount of R5 200 has been paid for a job that willbe completed during March 2011.• Depreciation on factory equipment R24 000• Depreciation on delivery vehicles R19 200• Insurance R99 000. Included in the insurance is a new annual premium of R36 000 onthe machinery paid on 1 December 2010. (The factory uses 70%.)• Rent paid R<strong>12</strong>0 000. All the rent has been paid for the year but the bookkeeper hasforgotten to bring a 10% increase for January and February 2011 into account. (Thetotal rent is divided between the factory and the admin departments in the ratio 3 : 1)• Selling and delivery expenses R36 0002.4 Sales for the year amounted to R5 000 000. 403.2 Bongi Gifts Centre (22 marks)The Nxumalo Family owns Bongi Gifts Centre. They manufacture and pack quality giftpacks for special occasions and deliver these to the recipients. The family is worried that thebusiness is not performing as well as it did in the previous year. There were no goods inprocess at the beginning or at the end of the year. Their accounting period ends on 30 Juneeach year.<strong>Question</strong>s:3.2.1 Give two examples where indirect labour can be involved in the manufacturingprocess. (2)3.2.2 Explain the following terms in relation to one another:Raw material and indirect materialDirect labour and indirect labour (4)3.2.3 Calculate the variable costs per unit (4)Copyright reserved 7

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong><strong>Question</strong> 4Cash flow and interpretation of a company(65 marks)You have been appointed as a bookkeeper for Apex Ltd at financial year end. You have been asked bythe internal auditor to complete the following information in preparation for the external audit.Fixed/Tangible AssetsCarrying value at beginning of yearVehiclesCost 460 000Accumulated depreciation (190 000)MovementsAdditions 265 000Disposal (171 250)DepreciationCarrying value at end of yearCost 420 000Accumulated depreciationCash Flow Statement of Apex Ltd. for year ended 28 February 2011Cash effects of operating activitiesDividends paid (209 135)Cash flows from investing activitiesCopyright reserved 9

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong>Cash flows from financing activities216 000Net change in cash and cash equivalentsCash and cash equivalents: beginning of year (25 000)Cash and cash equivalents: end of year 16 425Required:Complete the following:4.1 Tangible Asset Note (vehicles only) to the Balance Sheet on 28 February 2011. (8)4.2 Asset Disposal Account on 31 August 2011. (7)4.3 Cash Flow Statement for the year ended 28 February 2011. (18)4.4 Calculate the following ratios/percentages for 2011:4.4.1 Debt : Equity Ratio4.4.2 Dividends per share4.4.3 Net Asset value per share(4)(5)(4)4.5 “Shareholders are concerned about the increase in borrowed capital. The increase ininterest expense will impact negatively on the net profit before tax.” Do you agree withthem? Discuss by quoting two financial indicators and comment briefly to support youranswer. (8)4.6 Your family owns 10 000 shares in Apex Limited.4.6.1 According to the books of the company, how much was each share worth on28 February 2010? (1)4.6.2 Why is the price of shares on the JSE different to the figures quoted above?(Provide 1 reason) (2)4.6.3 Your family are tempted to sell their 10 000 shares at market price in ApexLimited.• Provide 1 point in support of their decision to sell their shares. (Quotefigures/ratios)• Provide 1 point against their decision to sell their shares. (Quote(2)(2)Copyright reserved 10

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong>figures/ratios)4.7 Apex Limited takes pride in focusing on proper procedures in managing and directing.List 2 primary characteristics that might have led to this conclusion of goodcorporate governance. (4)Information:1. Tangible assets:• An old vehicle was traded in at carrying value on 31 August 2011 against anew vehicle.• Depreciation on vehicles is written off at 20% on cost.2. Interest on loan and loan:• Interest on loan is capitalised.• A new loan of R205 000 was advanced on 1 September 2010.• Repayments of R100 000 were made this past financial year.• R10 000 per month will be repaid off of the capital sum in the nextfinancial year.3. Operating profit before changes in working capital R629 <strong>12</strong>5Changes in working capital (R452 765)4. Net profit before tax amounted to R655 0005. Income tax for the year amounted to R183 4006. New shares were issued on 1 March 20107. The following extracts were taken from the Post Closing Trial Balance on28 February 2011.6528 Feb 2011 28 Feb 2010Loan (8% pa) 753 200 585 000SARS (Income Tax) 16 150 (CR) 14 200 (DR)Shareholders for dividends 150 865 90 000Ordinary Share Capital (par R5) 1 700 00 1 500 000Ordinary Share premium 151 000 135 000Retained Income 60 000 67 5008. The following additional calculations were made available to you.28 Feb 2011 28 Feb 2010Debt : Equity Ratio * 0.34:1Copyright reserved 11

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong>Return on total capital employed 18.5% 16%Dividends per share * 70cEarnings per share 105c 100cReturn on shareholders equity 14.6% 13%Net Asset Value per share * 568cMarket price (JSE listed price) 390c 550c<strong>Question</strong> 5Company Financial Statements(75 marks)5.1 Happy Stores LtdThe financial year-end is 30 June. Their inexperienced accountant prepared the finalaccounts and the Post-closing Trial Balance of the business on 30 June 2011 withouttaking certain adjustments into account.Required:5.1.15.1.2Calculate the correct net income after tax after taking all the adjustmentsinto account.Complete the following note to the Balance Sheet on 30 June 2011:• Trade and other payables(13)(<strong>12</strong>)5.1.3 Complete the Balance Sheet on 30 June 2011.(Show calculations in brackets where the notes are not required.) (32)FIGURES OBTAINED FROM THE POST-CLOSINGTRIAL BALANCE ON 30 JUNE 2011DebitRCreditROrdinary share capital R2 per share 500 000Retained income (1 July 2010) 85 000Ordinary share premium 30 000Fixed assets at book value 780 540Loan: Labola Bank 140 200Fixed deposit: Thando Investments 30 000Trading stock 104 000Debtors’ control 28 450Provision for bad debts 1 250Bank 23 000SARS: PAYE 3 200Copyright reserved <strong>12</strong>

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong>SARS: Income tax 46 000Cash float 1 000Creditors’ control 67 340Net income before tax and additional adjustments 140 000989 990 989 990Additional information:The accountant calculated the net income before tax to be R140 000. The followingadjustments and other information were not taken into account:1.2.The amount due by debtor C Cheat, R1 000, must be written off as irrecoverable andthe provision for bad debts must be adjusted to R1 100.A credit note from creditor Saboo Suppliers for merchandise returned by Happy StoresLtd 28 June 2011 had not been entered, R1 820.3. A physical stocktaking on 30 June 2011 showed that the following were onhand:Trading stock R98 000Consumable stores R 940R98 9404. 75% of the fixed deposit at Thando Investments will mature on 31 March20<strong>12</strong>5. The loan from Labola Bank has been debited with R44 400 that is <strong>12</strong>payments of R3 700 per month including the interest. The loan statementshowed the following:Beginning of the year (1 July 2010): R184 600End of the year (30 June 2011): R162 <strong>12</strong>4An adjustment for interest must be made.Over the next financial year this loan will reduce by R30 000.6. Advertisements include an amount of R9 360 for a billboard advertisement atthe Oxford High School for a period of THREE years commencing on 1September 2010.7. The salary of one employee IM Cheese was not taken into account in June2011. Her salary and all the amounts owing for salary deductions will be paidon 2 July 2011.DEDUCTIONSNETCopyright reserved 13

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong>R20 000 R6 000 R1 800 R200 R<strong>12</strong> 000The business contributes on a rand-for-rand basis to the Pension Fund andUIF. These contributions are not included in the totals above.8. Income tax for the financial year has been calculated to be R42 500.9. The directors declared a final dividend of 35½ cents per share5.2 You are provided with an extract from the report of the independent auditors:Audit opinion – To the shareholders:We have examined the financial statements set out on pages 9 to 25.In our opinion, the financial statements fairly present, in all materialrespects, the financial position of the company at 28 February 2010 and theresults of their operations and cash flows for the year ended, in accordancewith International Financial Reporting Standards (IFRS), and in the mannerrequired by the Companies Act in South Africa.Hassan & ArchieChartered Accountants (SA)Registered Accountants and AuditorsCape Town 1 March 20115.2.1 State whether the shareholders would be satisfied or unsatisfied withthis audit report. Give a reason for your answer. (3)5.2.2 Explain why the auditors found it necessary to stipulate the pagenumbers (that is 9 to 25) in this report. (2)5.2.3 Explain why the Companies Act makes it a requirement for publiccompanies to be audited by an independent auditor. (2)5.2.4 Explain TWO major consequences for Hassan & Archie should theybe negligent in performing their duties. (4)5.2.5 What actions would Hassan & Archie have to perform to verify theFixed/Tangible Assets figure in the Balance Sheet? Provide 3points. (3)5.2.6 Albert Mamela, the major shareholder and managing director, hasinformed the auditors that he intends to buy the unissued shareshimself next year without advertising the new issue to the othershareholders or the public. What advice should the auditors give toAlbert? Briefly explain. (4)18Copyright reserved 14

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong>75<strong>Question</strong> 6Stock systemRequired(33 Marks)You are provided with information relating to MAPS Traders for the year ended28 February 2011. The business sells only a new financial calculatorThe periodic inventory system and the weighted average stock valuationmethod are in operation. They buy all their stock from one supplier.6.1 Explain ONE main difference between the periodic and continuous (perpetual)inventory systems. (2)6.2 Using the weighted average stock valuation method calculate the value of closingstock on 28 February 2011(10)6.3 Complete the Trading Account of Maps Traders to calculate the Gross Profit. (11)6.4 Moms – the owner – suspects that a number of calculators were stolen. Calculatethe number of units stolen. (5)6.5 Calculate the value of closing stock (including carriage) using the FIFO method. (5)Information:(Round answers to the nearest Rand)1. Stock on 1 March 2010 (200 calculators) R144 000 (includes R60 carriage onpurchases on each calculator).2. Purchases during the year excluding carriage on purchasesDate purchased Number of units Unit priceTotal purchasepriceMay 2010 400 R800.00 R320 000August 2010 900 R850.00 R765 000February 2011 200 R875.00 R175 000TOTAL 1 500 R1 260 000Copyright reserved 15

<strong>Accounting</strong> <strong>Question</strong>s 20<strong>12</strong>3. Carriage on purchases during the year was charged at R60 per calculator by thesupplier.4. Returned 50 defective calculators purchased during February 2011 to the supplier.The supplier granted a full refund including carriage.5. A selling price of R1 250 was maintained throughout the year. Sales amounted toR1 7<strong>12</strong> 5006. On 28 February 2011, a physical stock take revealed stock of 250 calculators onhand.33Copyright reserved 16