Asset Consultants Survey - The Climate Institute

Asset Consultants Survey - The Climate Institute

Asset Consultants Survey - The Climate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

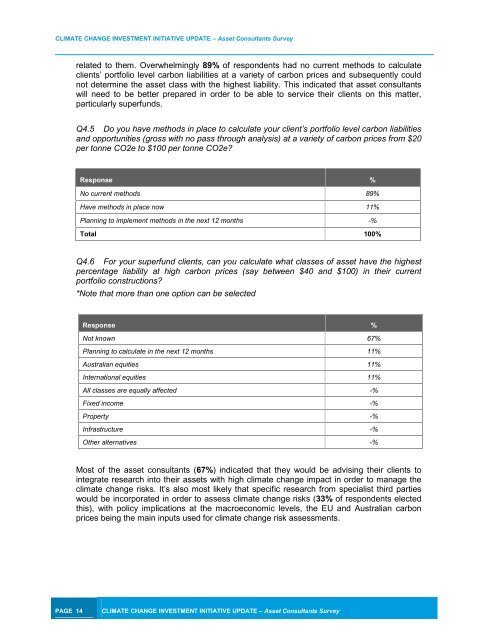

CLIMATE CHANGE INVESTMENT INITIATIVE UPDATE – <strong>Asset</strong> <strong>Consultants</strong> <strong>Survey</strong>related to them. Overwhelmingly 89% of respondents had no current methods to calculateclients’ portfolio level carbon liabilities at a variety of carbon prices and subsequently couldnot determine the asset class with the highest liability. This indicated that asset consultantswill need to be better prepared in order to be able to service their clients on this matter,particularly superfunds.Q4.5 Do you have methods in place to calculate your client’s portfolio level carbon liabilitiesand opportunities (gross with no pass through analysis) at a variety of carbon prices from $20per tonne CO2e to $100 per tonne CO2e?Response %No current methods 89%Have methods in place now 11%Planning to implement methods in the next 12 months -%Total 100%Q4.6 For your superfund clients, can you calculate what classes of asset have the highestpercentage liability at high carbon prices (say between $40 and $100) in their currentportfolio constructions?*Note that more than one option can be selectedResponse %Not known 67%Planning to calculate in the next 12 months 11%Australian equities 11%International equities 11%All classes are equally affected -%Fixed income -%Property -%Infrastructure -%Other alternatives -%Most of the asset consultants (67%) indicated that they would be advising their clients tointegrate research into their assets with high climate change impact in order to manage theclimate change risks. It’s also most likely that specific research from specialist third partieswould be incorporated in order to assess climate change risks (33% of respondents electedthis), with policy implications at the macroeconomic levels, the EU and Australian carbonprices being the main inputs used for climate change risk assessments.PAGE 14CLIMATE CHANGE INVESTMENT INITIATIVE UPDATE – <strong>Asset</strong> <strong>Consultants</strong> <strong>Survey</strong>