Asset Consultants Survey - The Climate Institute

Asset Consultants Survey - The Climate Institute

Asset Consultants Survey - The Climate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

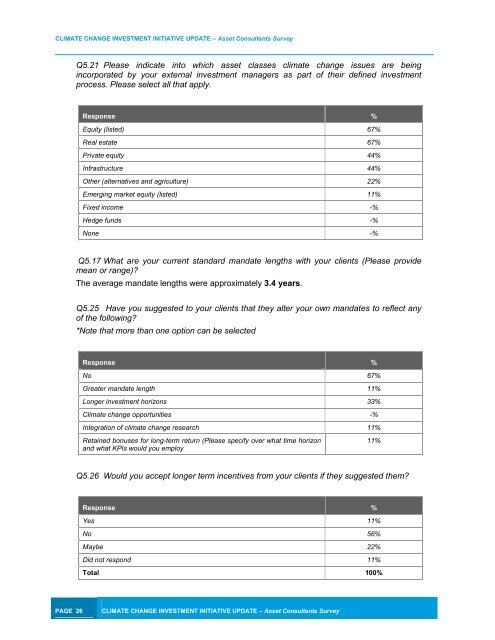

CLIMATE CHANGE INVESTMENT INITIATIVE UPDATE – <strong>Asset</strong> <strong>Consultants</strong> <strong>Survey</strong>Q5.21 Please indicate into which asset classes climate change issues are beingincorporated by your external investment managers as part of their defined investmentprocess. Please select all that apply.Response %Equity (listed) 67%Real estate 67%Private equity 44%Infrastructure 44%Other (alternatives and agriculture) 22%Emerging market equity (listed) 11%Fixed income -%Hedge funds -%None -%Q5.17 What are your current standard mandate lengths with your clients (Please providemean or range)?<strong>The</strong> average mandate lengths were approximately 3.4 years.Q5.25 Have you suggested to your clients that they alter your own mandates to reflect anyof the following?*Note that more than one option can be selectedResponse %No 67%Greater mandate length 11%Longer investment horizons 33%<strong>Climate</strong> change opportunities -%Integration of climate change research 11%Retained bonuses for long-term return (Please specify over what time horizonand what KPIs would you employ11%Q5.26 Would you accept longer term incentives from your clients if they suggested them?Response %Yes 11%No 56%Maybe 22%Did not respond 11%Total 100%PAGE 26CLIMATE CHANGE INVESTMENT INITIATIVE UPDATE – <strong>Asset</strong> <strong>Consultants</strong> <strong>Survey</strong>