Willet - Cortland County

Willet - Cortland County

Willet - Cortland County

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

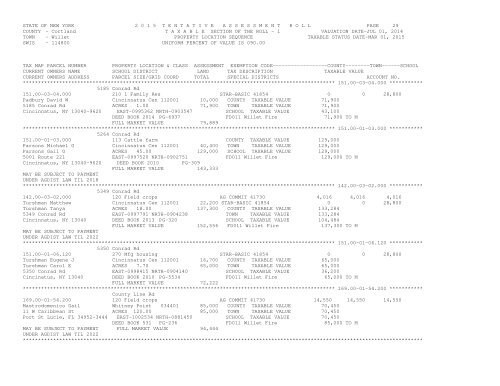

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 29COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Willet</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 114800 UNIFORM PERCENT OF VALUE IS 090.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 151.00-03-04.000 ***********5185 Conrad Rd151.00-03-04.000 210 1 Family Res STAR-BASIC 41854 0 0 28,800Padbury David W Cincinnatus Cen 112001 10,000 COUNTY TAXABLE VALUE 71,9005185 Conrad Rd ACRES 1.00 71,900 TOWN TAXABLE VALUE 71,900Cincinnatus, NY 13040-9620 EAST-0995362 NRTH-0903547 SCHOOL TAXABLE VALUE 43,100DEED BOOK 2014 PG-6937 FD011 <strong>Willet</strong> Fire 71,900 TO MFULL MARKET VALUE 79,889******************************************************************************************************* 151.00-01-03.000 ***********5264 Conrad Rd151.00-01-03.000 113 Cattle farm COUNTY TAXABLE VALUE 129,000Parsons Michael G Cincinnatus Cen 112001 40,400 TOWN TAXABLE VALUE 129,000Parsons Gail G ACRES 45.00 129,000 SCHOOL TAXABLE VALUE 129,0005001 Route 221 EAST-0997520 NRTH-0902751 FD011 <strong>Willet</strong> Fire 129,000 TO MCincinnatus, NY 13040-9620 DEED BOOK 2010 PG-309FULL MARKET VALUE 143,333MAY BE SUBJECT TO PAYMENTUNDER AGDIST LAW TIL 2018******************************************************************************************************* 142.00-03-02.000 ***********5349 Conrad Rd142.00-03-02.000 120 Field crops AG COMMIT 41730 4,016 4,016 4,016Turshman Matthew Cincinnatus Cen 112001 22,200 STAR-BASIC 41854 0 0 28,800Turshman Tanya ACRES 18.00 137,300 COUNTY TAXABLE VALUE 133,2845349 Conrad Rd EAST-0997791 NRTH-0904238 TOWN TAXABLE VALUE 133,284Cincinnatus, NY 13040 DEED BOOK 2013 PG-320 SCHOOL TAXABLE VALUE 104,484FULL MARKET VALUE 152,556 FD011 <strong>Willet</strong> Fire 137,300 TO MMAY BE SUBJECT TO PAYMENTUNDER AGDIST LAW TIL 2022******************************************************************************************************* 151.00-01-06.120 ***********5350 Conrad Rd151.00-01-06.120 270 Mfg housing STAR-BASIC 41854 0 0 28,800Turshman Eugene J Cincinnatus Cen 112001 16,700 COUNTY TAXABLE VALUE 65,000Turshman Carol E ACRES 7.70 65,000 TOWN TAXABLE VALUE 65,0005350 Conrad Rd EAST-0998415 NRTH-0904140 SCHOOL TAXABLE VALUE 36,200Cincinatus, NY 13040 DEED BOOK 2010 PG-5534 FD011 <strong>Willet</strong> Fire 65,000 TO MFULL MARKET VALUE 72,222******************************************************************************************************* 169.00-01-54.200 ***********<strong>County</strong> Line Rd169.00-01-54.200 120 Field crops AG COMMIT 41730 14,550 14,550 14,550Mastrodomenico Gail Whitney Point 034401 85,000 COUNTY TAXABLE VALUE 70,45011 W Caribbean St ACRES 120.00 85,000 TOWN TAXABLE VALUE 70,450Port St Lucie, FL 34952-3444 EAST-1002534 NRTH-0881450 SCHOOL TAXABLE VALUE 70,450DEED BOOK 531 PG-236 FD011 <strong>Willet</strong> Fire 85,000 TO MMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 94,444UNDER AGDIST LAW TIL 2022************************************************************************************************************************************