Willet - Cortland County

Willet - Cortland County

Willet - Cortland County

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

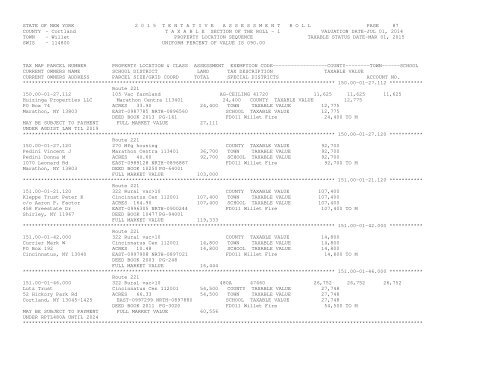

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 87COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Willet</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 114800 UNIFORM PERCENT OF VALUE IS 090.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 150.00-01-27.112 ***********Route 221150.00-01-27.112 105 Vac farmland AG-CEILING 41720 11,625 11,625 11,625Huizinga Properties LLC Marathon Centra 113401 24,400 COUNTY TAXABLE VALUE 12,775PO Box 74 ACRES 33.90 24,400 TOWN TAXABLE VALUE 12,775Marathon, NY 13803 EAST-0987785 NRTH-0896560 SCHOOL TAXABLE VALUE 12,775DEED BOOK 2013 PG-161 FD011 <strong>Willet</strong> Fire 24,400 TO MMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 27,111UNDER AGDIST LAW TIL 2019******************************************************************************************************* 150.00-01-27.120 ***********Route 221150.00-01-27.120 270 Mfg housing COUNTY TAXABLE VALUE 92,700Pedini Vincent J Marathon Centra 113401 36,700 TOWN TAXABLE VALUE 92,700Pedini Donna M ACRES 40.60 92,700 SCHOOL TAXABLE VALUE 92,7001070 Leonard Rd EAST-0989128 NRTH-0896887 FD011 <strong>Willet</strong> Fire 92,700 TO MMarathon, NY 13803 DEED BOOK 10250 PG-64001FULL MARKET VALUE 103,000******************************************************************************************************* 151.00-01-21.120 ***********Route 221151.00-01-21.120 322 Rural vac>10 COUNTY TAXABLE VALUE 107,400Kleppe Trust Peter K Cincinnatus Cen 112001 107,400 TOWN TAXABLE VALUE 107,400c/o Aaron P. Factor ACRES 164.90 107,400 SCHOOL TAXABLE VALUE 107,400458 Freestate Dr EAST-0996305 NRTH-0900244 FD011 <strong>Willet</strong> Fire 107,400 TO MShirley, NY 11967 DEED BOOK 10477 PG-94001FULL MARKET VALUE 119,333******************************************************************************************************* 151.00-01-42.000 ***********Route 221151.00-01-42.000 322 Rural vac>10 COUNTY TAXABLE VALUE 14,800Currier Mark W Cincinnatus Cen 112001 14,800 TOWN TAXABLE VALUE 14,800PO Box 192 ACRES 10.48 14,800 SCHOOL TAXABLE VALUE 14,800Cincinnatus, NY 13040 EAST-0997908 NRTH-0897021 FD011 <strong>Willet</strong> Fire 14,800 TO MDEED BOOK 2003 PG-248FULL MARKET VALUE 16,444******************************************************************************************************* 151.00-01-46.000 ***********Route 221151.00-01-46.000 322 Rural vac>10 480A 47460 26,752 26,752 26,752Lutz Trust Cincinnatus Cen 112001 54,500 COUNTY TAXABLE VALUE 27,74852 Hickory Park Rd ACRES 66.33 54,500 TOWN TAXABLE VALUE 27,748<strong>Cortland</strong>, NY 13045-1425 EAST-0997299 NRTH-0897880 SCHOOL TAXABLE VALUE 27,748DEED BOOK 2011 PG-3020 FD011 <strong>Willet</strong> Fire 54,500 TO MMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 60,556UNDER RPTL480A UNTIL 2024************************************************************************************************************************************