1fjzeJ0

1fjzeJ0

1fjzeJ0

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

9. Locate W1 on the main logic board and cut through the join point ofthe two triangles, as shown in Figure 3.W2 W1Solder pointCut here 1 mm minimumMON10. Locate the two triangles designated as W2 and connect them with asoldering iron using a small drop of solder, as shown in Figure 3.11. Locate the 28-pin I.C. designated as MON (in Figure 3) at location D19on the printed circuit board.12. Carefully remove the MON IC. using the I.C. extractor and replace itwith the new ROM. Make sure that pin 1 is oriented correctly by liningup the notch on the end of the I.C. with the end of the socket with thewhite dot. Make sure all pins are aligned with holes in the socketbefore applying pressure.Installation Procedure 3

MaritimeProfessional2446Credit: FARO3D Laser Scanning is helpingmaritime designers and builderswith effi ciency gains.18 | InsuranceWhen is a Ship Not a Ship? Does your insurancecoverage fi t your operation?By Christopher Cooke16 | Maritime M&AFinancial Crisis to Present Day: Why the wildride for company valuations?By Harry Ward24 | Training & RecruitmentShipyards get creative in their approach to fi nding,training and keeping qualifi ed shipfi tters.By Joseph Keefe30 | OpinionWe Need to Save Our Ships.By Matt Paxton43 | Energy is the AnswerDamen looks offshore energy - both traditionaloil and gas as well as wind - to build its future.By Eric Haun46 | 3D Laser ScanningFARO 3D laser scanning allows you to work indetail with 3D model shots of machinery spaceswith increased accuracy and reduced costs.By Daryl Johnson49 | Decision Support ToolsTechnology can drive risk management as maritimeprofessionals optimize security.By Luke Ritter52 | Boundaries, Standards& Business of IntegrityAs maritime security evolves, so too is the need forincreased and standardized professionalism in theranks of Private Mari-time Security Companies.By Charlie Butterworth43244 I Maritime Professional I 4Q 20138 | Editor’s Desk9 | The List58 | Statistics60 | Editorial Calendar61 | Shipyard Directory64 | Advertiser’s Index

MaritimeProfessionalMarPro ContributorsChristopher CookeChristopher Cooke is Vice President of General Liabilityfor XL Group’s North America Marine business.Daryl JohnsonDaryl Johnson is a registered Professional Engineer inWashington State. He has 30 years of management, engineeringand design experience in the refi ning, power,marine, process and integrated chip industry. He establishedSummit Engineering and Design, LLC in 1998 andwas fi rst introduced to 3D laser scanning in 2001.Randy KullmannRandy Kullmann is Vice President at CDM Smith. Kullmannhas over 27 years of experience in consulting,engineering, construction and operations. His experiencespans all aspects of water treatment and he has beenleading CDM Smith’s marine services, including compliance,information and safety management, as well aswater treatment.Robert KunkelRobert Kunkel, President of Alternative Marine Technologies(Amtech), is currently serving as the technicaladvisor to Alterna Capital Partners, a private equity fi rm,Mid Ocean Tanker Company of Norwalk CT and variouslending institutions around the world.Barry ParkerBarry Parker, bdp1 Consulting Ltd provides strategicand tactical support, including analytics and communications,to businesses across the maritime spectrum.Luke RitterLuke Ritter is Principal at Ridge Global, the internationalstrategic consulting fi rm founded by former Secretaryof Homeland Security Tom Ridge. Mr. Ritter leads RidgeGlobal’s maritime practice, Flag Bridge, and is the coauthorof Securing Global Transportation Networks(McGraw Hill).Christopher R. SchulzChristopher R. Schulz, P.E., is Senior Vice President atCDM Smith. Chris Schulz has over 30 years of experiencein the planning and design of water treatment facilitiesin the United States and throughout the world.He served on the expert review panel for the USCG’sShipboard Technology and Evaluation Program (STEP),which evaluated prototype ballast water treatment systemsin shipboard environments.Harry WardWard leads the transportation and logistics practice atThe McLean Group, based in the Washington, DC area.He has executive management experience in the marineindustry and focuses on mergers and acquisitionsfor mid-sized companies.MaritimeProfessionalURL www.maritimeprofessional.comEmail trauthwein@marinelink.comProductionNicole Ventimiglianicole@marinelink.comCorporate StaffVladimir Bibik, ITRhoda Morgan, Sales AdministrationMark O’Malley, Public RelationsEsther Rothenberger, AccountingSubscriptionKathleen Hickeymarprocirc@marinelink.comEditorJoseph Keefekeefe@marinelink.com+1 704 661 8475Web EditorEric Haunhaun@marinelink.comBlogger Roster @ MaritimeProfessional.comLead CommentatorU.S. EastU.S. WestBrazilMumbaiHong KongPublisherJohn C. O’Malleyjomalley@marinelink.comAssociate Publisher/Editorial DirectorGregory R. Trauthweintrauthwein@marinelink.comVP SalesRob Howardhoward@marinelink.comCopyright © 2013 New Wave Media. Maritime Professional (ISSN 2159-7758) volume3, issue 4 is published quarterly (4 times per year) by New Wave Media, 118E. 25th St., 2nd Floor, New York, NY 10010. Periodicals postage paid at New York,NY and additional mailing offices. POSTMASTER: Send address changes to: MaritimeProfessional, Maritime Professional 850 Montauk Hwy. #867 Bayport, NY 11705. Publishersare not responsible for the safekeeping or return of editorial material. All rightsreserved. No part of this publication may be reproduced or transmitted in any formor by any means mechanical, photocopying, recording or otherwise without the priorwritten permission of the publishers.MemberHQ 118 E. 25th St., 2nd FloorNew York, NY 10010 USAJoseph KeefeDennis BryantMartin RushmereClaudio PaschoaJoseph FonsecaGreg KnowlerTel +1 212 477 6700Fax +1 212 254 6271ISSN - 2159-7758USPS # 005-893Advertising SalesTerry Breesebreese@marinelink.com+1 561 732 1185Frank Covellacovella@marinelink.com+1 561 732 1659Mitch Engelengel@marinelink.com+1 561 732 0312Mike Kozlowskikozlowski@marinelink.com+1 561 733 2477Dawn Trauthweindtrauthwein@marinelink.com+1 631 472 2715Jean Vertuccivertucci@marinelink.com+1 212 477 67006 I Maritime Professional I 4Q 2013

EDITOR’S DESKAker Rhymes with “Soccer”In an extraordinary end to an unusually buoyant year for U.S. shipyards, a flurryof new blue water, commercial orders flooded into Tier I shipbuilders in the 4thquarter of 2013. As the year comes to a close, the biggest problem facing U.S.builders was solving the quandary of how to find, train and ultimately retain qualifiedshipfitters to toil on the vessels sitting on those fat backorder books. While these arenominally ‘good’ problems to have, they are problems nonetheless. Industry is, nevertheless,finding imaginative ways to adapt existing human resources models as a wayto cope. Within the pages of this edition, you’ll find out how and why.Small and large, brown water or blue water, East Coast, West Coast and Gulf Coast,everyone is busy. And, while the newbuild and replacement work going on in the OSVand inland sectors was perhaps easy enough to predict in a rebounding economy, theblue water commercial revival was not. U.S. yards are now accomplishing the seeminglyunthinkable: flourishing in an environment that does not necessarily include asteady diet of government, Coast Guard and/or Navy hulls.Leading the charge to redefine American shipbuilding is Aker Philadelphia Shipyardand its youthful CEO, Kristian Rokke. Riding an enviable backlog of pure commercial,deep draft hulls that stretches all the way to 2018, Rokke and his managementteam are not resting on their laurels. Nor have they forgotten from where theycame: the nadir of 2011, when their total workforce shrank to just 300 employees.The completely modernized shipbuilder – already negotiating for more options withexisting customers – has succeeded in this location where others could not. Utilizinginnovative partnerships, public/private financing and profit sharing deals, Aker gladlyshares risk with closely aligned customers. Arguably the model for the market that itserves, the story of Aker’s remarkable resurgence begins on page 32.Perhaps more interesting than the shipbuilding revival itself has been the seed fromwhich the entire upswing has emanated. The so-called ‘shale boom’ and the superchargedenergy production of the lower 48 states has changed not only global shippingpatterns, but also redefined demand for U.S. tonnage in any number of vesselcategories. Within these pages, Barry Parker’s simultaneous look at energy and shippingexplains how the equation of the energy transportation business and the countlessvariables that form the sum of its whole, are changing.Finally, I can’t look at success and the maritime markets without also noting thatthis edition marks our third full year of publishing Maritime Professional magazine.Our fully audited subscription list, coupled with the Web site of the same name, combineswith our in-depth coverage to create industry’s best business journal. As wetackle the most interesting and compelling aspects of today’s maritime markets, I’malso mindful that we need to raise the bar even further. That we have the opportunityto do that is in large part due to the support and input of readers – like you. Join us in2014 for more of the same.Joseph Keefe, Editor | keefe@marinelink.comDownload our AppiPhone & Android8 I Maritime Professional I 4Q 2013

THE LIST People & Companies in This EditionA, B, CA.P. Moller-Maersk ........................ 16Aker Shipbuilding ... 8, 14, 33, 34, 35,................................. 36, 37, 38, 39American Bureau of Shipping......... 23American Petroleum Institute ......... 12Amtech .................................. 41, 42Andersen, Nils .............................. 16APT ............................................. 20Araltec SL .................................... 16Arcus Infrastructure Partners......... 16ARES Security Corporation ............ 49AVERT ............................. 49, 50, 51Baltic Exchange ........................... 12Bollinger Shipyards ................. 26, 27Brisbane, Port of .......................... 16Brostrom AB ................................ 16Butterworth, Charlie................ 52, 53Clapham, Scott ...................... 34, 37Colby College............................... 34Crowley Maritime........ 34, 37, 38, 39Cooke, Christopher ...................... 18D, E, FDaewoo (DSME/DSEC) ..... 20, 22, 23Damen Shipyards ............. 43, 44, 45Defense Acquisition University ....... 20Dow Jones Shipping Index ....... 16, 17Edda Accommodation ................... 41EIA ........................................ 10, 12Energy Transfer Partners .............. 10EXXON Mobil ................................ 34Eymard, Jerome ..................... 26, 27FARO ............................... 46, 47, 48Forth Ports PLC ........................... 12G, H, I, JGeneral DynamicsNASSCO .................... 20, 21, 22, 23Goliath Crane ............................... 34Gulf States ShipbuildersConsortium ...................... 26, 27, 28Harris, Fred ................................. 22Harvey Gulf Marine ....................... 39Highclere, LTD ........................ 41, 42IMO ................................. 54, 55, 58Ingalls Shipbuilding ................. 27, 28Irving Oil ...................................... 10Johnson, Daryl ....................... 46, 47Jones Act ............ 12, 19, 34, 37, 39K, L, M, N, OKirby Corporation ......................... 16Kongsberg Maritime ............... 41, 42Kullmann, Randy ........................... 54Kunkel, Robert ............................. 40Kyriacou, Stelios .......................... 58Larson, Parker ........... 20, 21, 22, 23Laurtizen Offshore A/S ................. 41Lehman Brothers .................... 16, 17Lloyd’s Register............................ 53London School of Economics ........ 34Lotshaw, John .................. 27, 28, 29Macondo ..................................... 40Maersk Tankers ............................ 16MAN ............................................ 42Mass. Inst. Of Technology ............. 20Matson ...................... 34, 35, 38, 39McClean Group LLC, The .............. 36McClone, Matt ........................ 26, 27Moody’s ....................................... 39Murray, Senator Patty ................... 30Nat’l Maritime Education Council ... 24,........................... 25, 26, 27, 28, 29Navigator Holdings, LTD ................ 17NCCER ...................... 25, 26, 27, 28P, Q, RParker, Barry ........................... 8, 10Paxton, Matt ................................ 30Petrobras .................................... 44PVI .............................................. 53RBN Consulting ............................ 10Ritter, Luke .................................. 49Robert, Peter ............................... 45Rokke, Kristian 8, 14, 34, 35, 37, 38,Rolls Royce .................................. 42Ross, Wilber ................................ 17Ryan, Senator Paul ....................... 30S, TSchulz, Christopher ...................... 54Seacor Holdings ........................... 20SeaRiver ...................................... 38Severn-Trent de Nora .................... 56Shipbuilder’s Council of America 24, 30SOLAS ........................................ 53Summit Engineering and Design 47, 48Theisen, Jeffrey ...................... 34, 38TOTE, Inc. ............................. 20, 22Tradesmen International ......... 25, 26,............................................. 27, 29Trafi gura ...................................... 10TRG Holdings AS .......................... 34Tsakos Energy Navigation ............. 10U, V, WUNCLOS ...................................... 53United Kingdom AccreditationService ........................................ 52U.S. Coast Guard .............. 8, 23, 39,.......................... -43, 54, 55, 57, 58U.S. Dept. of Energy ............... 10, 12U.S. Department of Defense ......... 51U.S. Department of Labor ............. 19U.S. Dept. of Homeland Security ... 49U.S. Department of Transportation 38U.S. Merchant Marine Academy ..... 20U.S. Navy .............. 8, 30, 31, 34, 39U.S. Outfi tters .............................. 42van Os, Jan ...................... 43, 44, 45Virginia Ship Repair Assn ............... 29Voith............................................ 42VT Halter Marine........................... 39Ward, Harry ................................. 16Warton School, the ....................... 34Wä rtsilä ...................................... 58World Wide Supply ........................ 44www.maritimeprofessional.com | Maritime Professional | 9

InsightsBy Barry ParkerEnergy & ShippingWith “America’s Energy Renaissance” oil trade patternsare changing. The impact is far reaching, but not easily defined.Ship spotters around the Hudson River, which snakesnorth from New York towards Albany, have been abuzzsince the middle of the year when the medium range(MR) tanker Afrodite, owned by Tsakos Energy Navigation,has been sighted regularly. The 2005-built 53,000 deadweightvessel commenced a two-year charter to Irving Oil, at a rate of$16,000/day, topped off by a profit-split. The Afrodite, alongwith a sister vessel, are hauling crude oil produced in the Bakkenfields, in North Dakota. Since U.S. producers are not permittedto export crude oil, the limited quantities sent to Canadaare one exception granted by the U.S. Department of Energy.Along the U.S. Gulf Coast, around Corpus Christi /Aransas,the seascape there has also changed; tanker watchers have seenhordes of vessels lining up, waiting their turn to load cargoesof refined products destined for Europe and South America.As pipeline expansions and re-routings bring crude oil intoCorpus and Houston, inbound capacity grew by nearly 1.5Mbd in 2012 and 2013, according to RBN Consulting, basedin Houston. These consultants anticipate a further growth of1.9 Mbd in 2014 – 2015, much coming from the Eagle Fordand Permian Basins in Texas.Symptomatic of all the optimism is a move by oil traderTrafigura, which recently announced plans to spend $500 millionto increase capacity at its export docks at Corpus Christi,in conjunction with the conversion of a gas pipeline by EnergyTransfer Partners that will move 100 Kbd to the port fromEagle Ford – some 80 miles inland.Game ChangerWords like “game changer,” “tectonic shift” and “new paradigm”have all been applied to developments that were underway,albeit under the radar, in late 2009, as energy pricesratcheted upwards, following the financial upheavals of a yearearlier. Simply put, at sustained oil prices above $80/barrel,recently fine-tuned hydraulic fracturing technologies and enhancedhorizontal drilling capabilities have enabled extractionof oil and gas from “tight” rock formations including shale.The Energy Information Administration (EIA), part of theU.S. Department of Energy (USDOE) said, in a report releasedin mid November, “U.S. crude oil production averaged7.7 million barrels per day (bbl/d) in October. Monthly estimateddomestic crude oil production exceeded crude oil importsin October for the first time since February 1995, whiletotal petroleum net imports were the lowest since FebruaryMedium range tanker Afrodite has created a buzz, as it has been sighted regularly alongthe Hudson River. What’s the excitement for a 2005-built 53,000 dwt ship? It has commenceda two-year charter to Irving Oil, at a rate of $16,000/day, topped off by a profitsplit,hauling crude oil produced in the Bakken fields, in North Dakota.(Source: Tanker “AFRODITE” by Christina Sun)10 I Maritime Professional I 4Q 2013

Insights1991.” Enhanced drilling and hydraulic fracturing have madethis possible. Crude oil produced in Eagle Ford reached 400Kbd barrels/day by late 2013 - more than double its levels oftwo years ago. In November, the USDOE was forecasting thatcrude produced in the Bakken region would exceed 1 Mbd,nearly triple the pace of 2011. The USDOE added, “EIA forecastsU.S. crude oil production will average 7.5 million bbl/din 2013 and 8.5 million bbl/d in 2014.”The International Energy Agency (IEA), representing a consortiumof developed countries, looks for the U.S. oil (includinggas liquids and condensate) production to reach 11.6 Mbdin 2020 (compared to 9.2 Mbd in 2012 ), exceeding that ofSaudi Arabia. During the upcoming decade, China is forecastto become the world’s largest oil importer. But, what does allof that actually mean?Energy’s Net ImpactParticipants in the maritime business, ranging from fueltraders to ship spotters, have seen a multitude of impacts. IncreasedU.S. oil production has already led to reduced importsof crude oil; most dramatically, imports of crudes from WestAfrica (the same type of “light” oils characteristic of shaleoil) have been reduced. These shipments (typically moving inSuezmax or VLCCs, have instead moved to Europe and Asia.VLCC shipments inbound from the Middle East (except forSaudi Arabia) have also declined. Imports into PADD 3 (theU.S. Gulf Coast) have dropped from a high of 7.9 Mbd in June2005 to as low as 3.9 Mbd in February 2013. As imported oilhas become more attractively priced (with a falling Brent –WTI spread), imports into PADD 3 rose up to 4.9 Mbd laterin 2013.Since 2005, product imports have fallen from 4 Mbd downto a rate of 2 Mbd. Exports have risen from around 1 Mbd to3.3Mbd, as the U.S. has become a net exporter of products.Perhaps the most vivid glimpse into the changing tradescan be seen in the North Atlantic marketplace for MR tankershauling refined products. Two important routes, Rotterdam/New York and Houston / Amsterdam are both widely followedand closely analyzed by oil traders and shipowners. In the pasttwo years, PADD 1 (East Coast) products imports have fallenfrom 1.6 Mbd down to 0.8 Mbd, while exports (llargely fromPADD 3 representing the Gulf Coast) exports have risen from1.5 Mbd to nearly 3.5 Mbd.The actual time charter equivalent (TCE) hires experiencedby operators of vessels in these trades have mirrored the US-DOE statistics. Using calculations provided by the Baltic Exchange,which evaluates these routes (and many others) on adaily basis, shown in the graph, daily hires for the Rotterdam/ New York route, with gasoline as the main cargo, have fallensteadily in 2013. The route now described as “the new fronthaul”for such vessels, exports of diesel from Houston andCorpus Christi, to Amsterdam, has seen rising hires throughoutthe year. Indeed, it has bolstered the daily posting on theBaltic Exchange’s “MR basket” for a notional tanker making14 knots on 36 tons /day of IFO consumption. Industry analystsestimate that daily results for “Eco-tankers” would likelybe around $3,000/day higher. For example, if the Baltic basketshows $22,000/day, a 2013 built Eco-tanker (which wouldconsume far less fuel) would likely return $25,000/day to itsowners.Without a doubt, the Energy Renaissance has, in part, alsofueled the robust rebound of domestic, commercial blue watershipbuilding. And not a moment too soon. Sequestration fearshave some big shipyards scrambling to shift their governmentbacklogs to something a little more balanced. But, the currentsituation belays the notion that U.S. yards cannot survive withouta steady diet of Navy and/or government work. Beyondthis, the energy renaissance has some Jones Act freight ratessoaring to record highs. For the time being then; so far, so good.Unanswered QuestionsEnergy issues and attempts at forecasting go hand in hand;a number of important issues- with an unpredictable locus ofgeopolitics, environmentalism and economics are looming inthe future. Though this article has emphasized the here andnow – with a focus on movements of refined petroleum products,natural gas (found alongside crude oil and condensates inshale formations) is also part of the story. Beginning as earlyas 2016, the U.S. will begin exporting LNG from a handful ofnewly approved terminals in the Gulf Coast. Observers shouldbe watching the willingness of the USDOE to continue grantingapprovals for exports, as well as the efforts of domesticconsumers of natural gas (led by chemical producers whobenefit from its availability and low price) to stymie continuedexport growth. Some twenty additional applications aresaid to be in the works.Other questions worth asking concern crude oil exports –presently prohibited (unlike refined products such as dieselfuel and gasoline), with a handful of exceptions. The AmericanPetroleum Institute (API), a trade association led by majoroil companies, has publicly stated that it supports a fresh lookat the applicable rules, and will be aiming for the eliminationof restrictions on exports of crude oil. But, loosening crude oilexport controls could also have the unintended effect of endingthe most pronounced U.S. domestic shipbuilding cycle inthree decades.12 I Maritime Professional I 4Q 2013

www.maritimeprofessional.com I Maritime Professional I 13

InsightsAker Shipbuilding CEO Kristian Rokke, for example, embracesthe “direct exposure to the shale boom and … the risk/reward of the investment.”Any loosening of crude oil export limits and/or a softeningof the Jones Act would therefore likely spell an end to thekinds of creative newbuild deals emanating from Aker that alsohelp to sustain the current shipbuilding boom. A variation onthis approach is the suggestion that the U.S. export light crudes(produced from shale), in an agreed swap for supplies of heavycrudes- suitable for many U.S. refineries.Tanker trade patterns over a longer period are also highlyuncertain. Attendees at numerous industry events and symposiumshave heard that product movements are set to grow,which in the short term, appears to be the correct call. Overtime, as drilling techniques successfully finetuned in NorthAmerica spread across the globe, major “importers,” notablyChina, thought to be a big component of VLCC demand in thecoming decade, may have their own versions of the EnergyRenaissance. Likewise, LNG trades may be impacted by vastamounts of shale gas thought to exist in China, but also inAlgeria and Argentina.Another set of questions, presently without real answers,concerns the move of offshore oil exploration and productioninto deeper waters. Like “tight oil,” tapping offshore reservesbecomes economical at higher oil prices. But, with vast newhydrocarbon supplies available onshore, will moves into inhospitableregions (for example, the Arctic reaches) and ultradeepwaters continue to be viable? And, if not, is the OSVbuilding boom for the expected deepwater play also sustainable?And, of course, the big elephant in the room is the priceof crude oil – with futurists wondering what might happenin the event of a prolonged lowering of the prices across theentire hydrocarbon barrel.In the end, there will be benefactors and casualties as theultimate outfall from “America’s Energy Renaissance.” Moreimmediately, it is changing the equation of the energy transportationbusiness and the countless variables that form thesum of its whole.Source: BDP1 Consulting14 I Maritime Professional I 4Q 2013

InsightsBy Harry WardMaritime M&A:Financial Crisis to Present DayWhy the wild ride for company valuations?The financial crisis and global recession that began in2008 had a major impact on almost every major worldindustry. Its effects can be examined by analyzing historicaldata and trends for the highly cyclical maritime industry,including both public company values and mergers andacquisitions (M&A) transaction records. All major stock indicesand deal metrics fell in concert at the outset of the crisis,which is usually marked by the collapse of Lehman Brotherson September 15, 2008. Over the ensuing five years, individualsegments such as ocean shipping, marine terminals and offshoreservice vessels experienced varying market fluctuationsand recovered at different rates for different reasons.Boom to BustFigure 1 shows the effects of the crisis as the boom turned tobust from 2007 to 2009, with decreasing M&A deal flow andoverall reduced company valuations. The red numbers on thegraph in Figure 1 represent the average multiple of operatingearnings, or EBITDA (Earnings Before Interest, Taxes, Depreciationand Amortization) for each year. The EBITDA multipleenables us to compare transaction values by adjusting outnon-cash items such as depreciation, and financial variablessuch as interest payments that can change from buyer to buyer.Until late 2008, the deal environment was decent, with dealssuch as Maersk Tankers’ $1.3 billion acquisition of SwedishBrostrom AB. At the time, Maersk CEO Nils SmedegaardAndersen was cited as saying that A.P. Moller-Maersk A/Swas ready to grow via acquisitions of shipping companies.However, by the middle of the following year, stock priceshad dropped across the board and Maersk fell 60% from its2008 high to 2009 low.Market dysfunction caused by the financial crisis resultedin a very low number of maritime deals in 2009, of whichmany were marked by relatively low valuations. In March of2009, the Dow Jones Shipping Index (see Figure 2) hit alow EBTIDA multiple of 2.8X, meaning that the collectiveaverage multiple for the public companies that constitute thatparticular Dow index were trading at that low valuation. Laterin the year, Araltec SL of Spain bought a $112 million stakein Kirby Corporation (NYSE: KEX) at an opportune timewith an EBITDA multiple of 6.7X. Since that time, Kirby’sstock price is up 280% and the dominant US inland and coastalliquid product carrier trades today at an expansive multipleof 11.1X EBITDA.Trending Upward: with caveats …In 2010, the market began to trend upward in completeddeals, and stock prices had begun to rise steadily in anticipationof a market recovery. By Feb 2010, the Dow Jones ShippingIndex was up 58% from its low point just a year earlier,and the stocks in the index traded at a very generous multipleof 8.9X EBITDA. The large gyrations evident in Figure 2show that publicly-traded shares often experience more pronouncedswings than those of private companies. Toward theend of 2010, the pace and value of deals had picked up in bothlarge shipping and ports deals. In November, a consortium ofinvestors acquired the Port of Brisbane in a $2.8 billion dealwith a healthy 16.3X multiple.Moving into 2011, deal multiples continued to rise overalland we saw a significant jump in the overall weighted averagemultiple for the year (Figure 1). Much of this was driven bya number of large port and port services deals, including twoin Hong Kong and China with multiples north of 40X. A bitcloser to home, Forth Ports PLC of the UK was acquiredby Arcus Infrastructure Partners in a $1.3 billion deal thatyielded a 14.9X multiple. However, it was during this periodthat the impact of excessive building and overcapacity in theocean shipping markets became clear. New ship deliveries thathad been booked during the boom in 2007-2008 continued onschedule, despite the slowing recovery in demand for internationalbulk and container transport. These conditions put pressureon carriers, and we can see a significant drop in the DowJones Shipping Index beginning in April, 2011.Recovery and a Look AheadIt wasn’t until 2012 that the wild market fluctuations beganto steady out a bit, though at stock and deal values somewhatlower than pre-crisis levels. From this point, the most noticeabletrend is the divergence of company performance and valuesamong the various maritime sub-segments. The sustainedseparation of public company values in the past few yearsincludes containerships, drybulk, tankers and inland/offshorecompanies. Energy-focused companies in the inland/offshoreworkboat market have outperformed all larger shipping segmentsby a wide margin, while oceangoing tanker stocks havefared better than cargo and bulk carriers.On the acquisition front, Kirby Corporation has been themost prominent player in the inland and coastal segment, withsix acquisitions since 2008 totaling about $800 million. Themost interesting story among the larger carriers has been the16 I Maritime Professional I 4Q 2013

workings of distressed asset investor Wilbur Ross. Mr. Rosshas set his sights on the shipping sector, having acquired 44%of liquefied gas carrier Navigator Holdings LTD out of theLehman Brothers bankruptcy for $110 million in 2012. Helater increased his equity position to 60% of Navigator, whichwas recently valued at about $1 billion after a successful initialpublic offering (IPO).Today, Mr. Ross and other investors see the potential forstrong returns in the shipping sector. As the world economyseems to be slowly improving, international trade is increasingand the industry remains very fragmented. Despite poorperformance over a longer period, containership stocks havemirrored the strong performance of the S&P 500 in 2013, anddry bulk carriers have bested the returns in all other maritimesegments through November. The shale petroleum and frackingbooms have driven increased demand for shipping in theUS, and Gulf of Mexico oil production continues to drive theoffshore market. Barring a major macroeconomic setback,maritime companies and deal flow are poised for a solid showingin 2014.Figure 1Figure 2www.maritimeprofessional.com I Maritime Professional I 17

InsightsWhen is a Ship Not a ShipBy Christopher CookeDoes your insurance coverage fit your operation?No business likes to hear the word “denied” from their insurancecompany. But when a business purchases an insurancepolicy, it enters into a contract that carefully outlines what insuranceprotection is being offered to the business, and what isnot. To avoid being caught off guard, it is especially necessaryfor marine businesses, and those that provide service to them,to make sure their insurance coverage fits their operations, andthe scope of work they are providing.Consider the hustle and bustle of a shipyard operation. It is afacility on or around a waterway, and filled with people comingand going. Some of those people are shipyard employees,others can be the crew of vessels being repaired, and many ofthe others are the numerous subcontractors performing variousoperations such as cutting or welding, engine installationand testing, electronics installation, or ship joinery.To minimize their liability, most shipyards require each subcontractorto maintain liability coverage, and provide a certificateof insurance to assure that those companies or individualcontractors working on their premises have the required insurancecoverage. Because of the diversity of work being performedon site, how does a business assure that the insurancecoverage that they require is the coverage that is really whatis need? There are definitely exceptional insurance challengeswhen working on, or around waterfront – for any type business.Complex Operations Demand Tailored Risk AssessmentsIn fact; the uniqueness and complexity of marine operationshave prompted very industry-specific tailored insurancecoverage(s) to address maritime risks. Contractors providingservices to various industries might not be aware of the nuancesinvolved in covering marine risks or might not evenconsider the work they are doing to be marine-specific. Theymay also assume that their standard general liability or workerscomp policies will respond just fine. These assumptions,however, could prove costly in the event of a claim.So when is a ship not a ship? Here’s an example: A dieselengine manufacturer put engines in a ship being newly built.When the engines are test fired, a cylinder head blows throughthe engine case and the ensuing fire destroys the ship. Theengine manufacturer presents the claim to their Ship RepairersLegal Liability insurer. Ship Repairers Legal Liability coverageprovides protection against property damage to vesselsin their care, custody and control for the purpose of beingrepaired. The claim, however, is rightfully declined. Why?According to maritime law, a ship is not a ship until it haslaunched and put to its intended use (which usually meansit has been delivered to the owner). In this instance, this shipwas being built and had yet to be delivered, or put to its intendeduse. Therefore, it was not covered by the Ship RepairersLegal Liability policy. So you need to ask yourself, do youwork on new ships being built? Or maybe you work on the occasionaldiesel truck or crane. Does your Ship Repairers LegalLiability policy have an “Other Work” endorsement, whichprovides coverage for similar types of work on other thanships? Perhaps you work at other people’s repair facilities?Does your Ship Repairers Legal Liability policy have a scheduleof premises that coverage is subject to? Does your policyhave a “Travelling Workman’s” endorsement, which providedcoverage for your work at other than scheduled premises?Defining the Law – and the RisksWork performed on or around the water often falls into awhole other jurisdiction than many businesses are used to– maritime law. Even though they might not consider themselvesmarine businesses, if they are working on a ship or nearnavigable waters, they may very well be considered a marineoperation that requires particular marine insurance protection,not offered by standard policies.Workers compensation coverage offers a prime example.If employees are performing an operation around navigablewaters, state-mandated workers compensation would not applybut rather Longshore and Harbor Workers’ compensationwould. The Longshore and Harbor Workers’ CompensationAct (LHWCA), enacted in 1927 provides employment-injuryand occupational-disease protection to approximately 500,000workers who may suffer bodily injury on the navigable watersof the United States, or in adjoining areas. It provides compensationto an employee if an injury or death occurs uponnavigable waters of the US - including any adjoining pier,wharf, dry dock, terminal, building-way, marine railway orother adjoining area customarily used by an employer in loading,unloading, repairing, dismantling or building a vessel.While originally enacted to protect workers engaged in stevedoringand ship building operations, the act has been expandedto encompass nearly any employee or company whosework takes them on “navigable waters.” That can includemarine contractors, diving contractors, service companiessupplying equipment “on the water” and ship repair operations.And, it works entirely different than standard workerscompensation coverage. While workers compensation is state18 | Maritime Professional | 4Q 2013

egulated, longshore claims fall under the jurisdiction of theUS Department of Labor and more severe penalties and legalramifications can be imposed for noncompliance.When working on a vessel, individuals are typically coveredwith the Merchant Marine Act of 1920, more commonlyknown as the Jones Act. The Jones Act is a federal act, whichprovides benefits – similar to Workers’ Compensation – to employeeswho are working on a US-flagged vessel, which can bedefined as anything from a small watercraft to a larger tanker.Specific CoverageMarine insurers have developed marine general liabilitycoverage for a variety of business risks that are either excludedor under-insured in GL policies. Marine general liabilitypolicies provide general liability coverage, and additionallyproperty damage coverage for property in your care, custodyand control. The c,c,c coverage sections of the policy can betitled Marina Operators, Wharfinger Legal, Stevedores Legal,Terminal Operators Legal, among others. Again, the rightquestions must be asked in order to define the proper policies.Is coverage limited to ships, or private pleasure-type watercraft,or marine cargoes? Is coverage marine operations specific?Is coverage location specific?Quite simply, there is no blanket insurance coverage thatprotects everything equally. And that is not a bad thing. Nobusiness wants to pay for insurance coverage they do notneed. Instead, their real aim is to buy insurance coverage thatfits their individual needs.For marine businesses, navigating the various insurance policiescan be like moving through murky water. It can be especiallychallenging for businesses unfamiliar with maritime lawthat still significantly guides marine operations. With the experiencethey bring from servicing various marine operations andkeeping a close eye on case law and legal precedent in marinecoverage litigation, specialized marine insurance brokers andinsurance carriers can provide some valuable guidance to assureinsurance coverage fits the operation and or work at hand.Because there are times that a ship may not be a ship, everybusiness wants to be sure its insurance coverage is insurance coveragethat is right, reliable, and appropriate to the expected risks.www.maritimeprofessional.com | Maritime Professional | 19

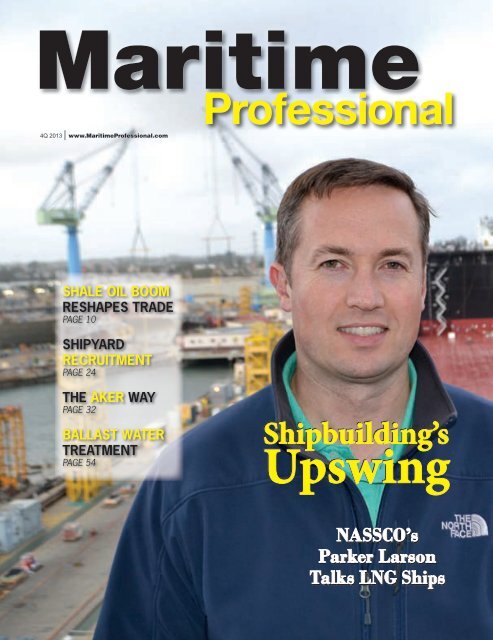

IInterviewMARPRO PROFILEParker LarsonDirector of Commercial ProgramsGeneral Dynamics NASSCO Shipyard, San Diego, CABy Joseph KeefeWhen we caught up with NASSCO’s Parker Larsonin December, he had only just been promoted toDirector of Commercial Programs at the sprawlingSan Diego, CA shipyard. Previously NASSCO’s ProgramManager for Commercial Contracts, he no doubt played alarge role in the recent high profile deals won by NASSCO,in particular the two 3,100 TEU LNG-powered containershipsfor TOTE, Inc. Additionally, he was responsible for design,planning, and construction of over $1B in commercial newconstruction work at NASSCO that includes four 50K DWTproduct tankers for APT, two 50K DWT product tankers forSeacor Holdings, and the design contract for the conversionof two TOTE Orca Class trailerships to operate on LNG. Theimpressive commercial backlog promises to keep him evenbusier for the foreseeable future in his new role.Starting his career at NASSCO in 2003 as a Production Associatefor the Ship’s Management Team, Larson then movedinto roles of increasing responsibility including ProductionArea Manager on the T-AKE program for the Navy, DeputyProgram Manager on the PC-1 product tanker program forAPT, Manager of Commercial Engineering Projects, and ProgramManager in Business Development & Strategic Planning.Larson’s love for shipbuilding began with his educationalexperience(s).Parker attended the United States MerchantMarine Academy in Kings Point, NY, graduating magna cumlaude with a Bachelor of Science Degree in Marine Engineering& Shipyard Management. Along the way, he also receiveda Master of Science Degree in Oceans Systems Managementfrom the Massachusetts Institute of Technology in Cambridge,MA where he wrote his thesis on LNG infrastructure in theUnited States. Parker has spent the past two years developinghis knowledge of LNG propulsion in the commercial marketplace.He also completed the Program Manager’s Course atthe Defense Acquisition University in 2009.Along the way, Larson has served in several shipyard rolesincluding production, engineering, business development, andprogram management. Directly involved in the transformationof NASSCO’s business model for commercial new constructionthrough collaboration with Daewoo (DSME/DSEC) startingin 2006, he naturally hit the ground running in his new role.Nevertheless, MarPro convinced him to slow down in December,if only briefly, to get his take on all things shipbuilding.Reflecting on his chosen career path, Larson told MarPro,“Shipbuilding, as a facet of the maritime industry, is an incrediblysatisfying career path. There are very few careers inthe world where you can design and construct such a finelyengineered product and then watch it become an operationalentity that lives on for 30+ years. For me, being part of thatprocess is uniquely special.”Perhaps the most interesting part of Larson’s CV is his knowledgeof LNG and how that eventually could play a big role inthe construction of the containerships and trailerships. As hewas promoted to Director of Commercial Programs at NASS-CO earlier this year, that experience and knowledge base nodoubt didn’t hurt him on his climb up the food chain. More thanLarson’s job billet will change as he assumes a new role. He explained,“In addition to the program management responsibilitiestied to NASSCO’s existing commercial new constructionbacklog, I have direct production interface. For example, I willmanage the commercial ship management team which serves as20 | Maritime Professional | 4Q 2013

the production organization responsible for the delivery of eachcommercial vessel. Additionally, I will be continually engagedin business development given my direct experience with LNGpropulsion and commercial program execution.”As his career evolved, Larson has been witness to and a partof the many changes in shipbuilding, particularly on this sideof the pond. Even in the midst of the most profound shipbuildingrevival in this country has seen in some time, over the pastdecade, NASSCO has shifted its commercial shipbuildingbusiness model. Larson says, “Prior to the mid-2000s, we designedand procured all material for our new construction projectsat NASSCO. In 2005, NASSCO partnered with DaewooShip Engineering Company (DSEC), a subsidiary of DaewooShipbuilding & Marine Engineering (DSME), to collaborateon international projects. DSEC became the lead design andprocurement agent and we lead the efforts to integrate DSEC’sdesign into NASSCO’s shipyard’s planning, purchasing, andconstruction processes. Leveraging the world-class commercialdesign standards and purchasing power from DSME hashelped NASSCO become more competitive in the Jones Actshipbuilding market.”Also during that time frame, NASSCO also adjusted its approachto construction schedules. Today, NASSCO does not cuta single piece of steel until the ship design is fully complete anda large portion of planning effort is finalized. NASSCO’s Directorof Commercial Programs insists, “This ensures we identifyand address risks in new-construction programs as early as possible.As a result, we have reduced the construction cycle timesand improved quality in our past three new-build programs.”As Jones Act shipbuilding sees what can only be describedas a robust and arguably unexpected revival, we asked Larsonhow long this trend – a cyclical boom, really – can continue.Enthusiastically, he replied, “As more domestic oil and gasis recovered, there is increased demand to move the productbetween U.S. ports, which invokes the Jones Act and drivesthe need for additional tonnage in the market. With NorthAmerican Emission Control Areas (ECAs) in 2015 (addressingSOx), Tier III regulations in 2016 (addressing NOx), andan Energy Efficiency Design Index (EEDI) currently in place(addressing CO2), ship owners need to evaluate their existingpropulsion plants onboard. Ship replacement can be a costeffectivemethod to address these increasingly stringent emissionregulations. There are still several ships in the U.S. coastwisefleet that are more than 30 years of age operating withwww.maritimeprofessional.com | Maritime Professional | 21

MARPRO PROFILErelatively inefficient power plants. This tonnage will need tobe replaced over the next 5-10 years.” Clearly, Larson, likeother U.S. blue water builders, remains bullish on the marketsfor the near term.Despite all the good news, however, a key ‘knock’ on U.S.yards has always been that they cannot compete with foreignbuilders in terms of efficiency, costs and a raft of other metrics.Larson’s boss, Fred Harris, on the other hand, has alwaysbeen a big believer in emulating the Korean art of the seriesbuild technique. Larson shares his enthusiasm. “Over the pastseven years, NASSCO has learned a lot from our partnershipwith the expert shipbuilders at DSME and DSEC. As a resultwe’ve made several facility improvements, including anew blast and paint facility, usage of transporters and updatedground outfitting process lanes. We’ve seen a positive impactto both our commercial and government shipbuilding programs.”He continues, “A key metric we follow is completingthe design prior to starting construction. This becomes moreimportant when building a series of ships. A shipyard must getthe lead ship right or the impact of change will permeate negativelythroughout the entire class of vessels. Changes madeonce construction has started impacts the design and directlyaffects the supply chain, schedules and quality.”Larson, without neglecting his other responsibilities, clearlyhas a passion for the TOTE ship projects. That’s only natural,especially considering his affinity for LNG and the intendedpropulsion of this new class of vessel. He explained, “The TOTEships are 764-foot-long, 3,100 TEU LNG-powered container-NASSCO is arguably one the the nation’s more progressive shipyards,with a healthy Navy and Commerical orderbook, including pioneering workin building state-of-the-art LNG-powered tonnage.22 | Maritime Professional | 4Q 2013

ships, which are setting a new benchmarkin green ship technology. When completedthey are expected to be the largest ships ofany type in the world primarily poweredby liquefied natural gas.”NASSCO and Larson approachedthese ships like any other program. Afteridentifying the risks associated with thedesign, procurement, and construction,each one of those metrics was addressedthrough execution of a risk managementplan. Larson adds, “For example, it is paramountthat we work closely with UnitedStates Coast Guard (USCG) and ABSto understand any regulatory and designchallenges associated with the LNG fuelgas system, from arrangement configurationto hazardous zone definition to trimand stability calculation. We have workedclosely with USCG and ABS personnelsince the outset of the program in conjunctionwith DSEC and our equipmentsuppliers. This program is on track andthe design will complete on time beforethe end of 2013.”We finished up by asking about the 600pound gorilla in the room – concerns overthe potential cutbacks from the federalgovernment and shipbuilding programsas a function of the ongoing sequestrationbattles. That discussion has NASSCO’sChief commercial executive square inthe middle of it. For his part, Larson likeswhere the yard is sitting, saying only,“NASSCO has a well-balanced portfoliowith commercial new construction, governmentnew construction, and U.S. Navyrepair projects. This provides NASSCOthe ability to shift resources when the allocationof work changes between eachbusiness segment.” Nevertheless, keepingthat portfolio balanced going forwardcould be Larson’s biggest challenge. Helikes his chances of doing just that.As NASSCO launches a new era for itsupgraded facilities, filled with a fat backlog,Parker Larson is arguably the perfectcandidate to lead the firm’s commercialsector as it takes on some of the most excitingand cutting edge shipbuilding projectson the planet. And, there’s no placeelse he’d like to be.

TTrainingTRAINING & RECRUITMENTBeyond ShipbuildingDomestic shipyards get creative in its approach to finding,training and keeping qualified shipfitters.By Joseph KeefeThe domestic, U.S. shipbuilding boom is here: blue water,brown water, offshore support, inland, and exportmaritime security platforms, too. The robust comebackhas just about everyone on this side of the pond very happy;unless of course, you are in the ‘human resources’ departmentand find yourself scrambling on a daily basis to recruit, trainand retain qualified help to competently build all those orderson your fat backlog. That said; these are good problems to have.According to the Shipbuilders Council of America (SCA),private shipyards in the United States support 402,000 jobs and36 Billion in GDP. Even with those staggering numbers theshipyards are still faced with a severe skilled worker shortage.Issues facing the industry include an aging workforce, lack ofindividuals entering the trades, a dearth of training opportunitiesand the rapidly rising cost of recruiting, hiring, testing, andtraining. There are answers out there. You just have to knowwhere to look. Many shipyards have done just that.Resources for Human Resources ProfessionalsFor starters, the National Maritime Education Council(NMEC) is a Gulf Coast-based group seeking to standardizeand improve craft training within the maritime industry.As the spearhead for efforts to standardize and provide credentialsfor shipyard workers, backed by a coalition of 20+industry trade groups and companies, what the NMEC doesnext could well be the template for industry human resourcesdevelopment that we have been thirsting for.The NMEC is funded by its members and a financial commitmentis involved based on a company’s headcount. Thereare five investment levels in addition to an annual membershipWhile shipbuilding is booming across nearly every sector in the United States,there remains a serious need for talented workers across several trades.(Tradesmen International credit)24 | Maritime Professional | 4Q 2013

fee. There are also membership levels foracademic institutions and affiliate organizationssuch as equipment manufacturers,suppliers, trade associations, etc. Thefunds collected are utilized to develop industrydriven, modularized, craft specificstandardized curriculum and assessmentsto meet the demands of the industry.Through NCCER, the NMEC has programsthat can be utilized to recruit andenhance the image of the shipbuildingand repair industry and generate nationalexposure. NCCER is a not-for-profit501 (c)(3) education foundation createdby the construction industry to developstandardized curriculum with portablecredentials and to help address theskilled construction workforce shortage.NCCER is recognized by the industry asthe training, assessment, certification,and career development standard for theconstruction and maintenance craft professional.And now, those standards arecoming to the waterfront.Another equally attractive way forshipyards to reach the Promised Land iscontract with a group such as TradesmenInternational. Tradesmen is recognizedfor their ability to supply contingent labor,but it is their consultative services– particularly Labor Productivity Consulting– that has gotten notice by constructionbusinesses. That tried-and-trueformula, using a contractor’s historicallabor data, enables companies to determinewhat their optimal permanent orcore workforce total should be, and isalso being applied to help the nationalshipyard industry. In essence, clients areultimately able to run their businesseswith a leaner permanent payroll and,through close interaction with Tradesmen,are capable of supplementingtheir core employees with Tradesmen’shigh-caliber craftsmen only as workloadwarrants it. The goal is two-pronged:substantially increase workforce productivityand project profit margins.This bottom line gain gets put back intogrowing the business, providing enhancedbenefits for their employees andkeeping up with technology.www.maritimeprofessional.com | Maritime Professional | 25

TRAINING & RECRUITMENTWeeks Marine, Inc.PORT ENGINNERSJR PORT ENGINNERSwww.weeksmarine.compecov@weeksmarine.com985-875-2575Tradesmen: National Coverage &a Skilled, Diverse WorkforceAccording to Matt McClone, Tradesmen International VicePresident Workforce Development, the key advantages of engagingTradesmen as a staffing partner is rooted in their abilityto meet the distinct trade requirements of shipyards, beginningwith their national team of shipyard coordinators: formermariners, merchant captains, shipbuilding professionals, navalofficers, and enlisted men. “With these insights, they havethe unique ability to understand the unique and dynamic needsof the shipyard industry. That, along with our national reachincluding a permanent presence in 36 port cities allows us toaccess a very large pool of skilled marine craftsmen and provideuniform service in all shipyard locations.”Tradesmen International’s screening process is stringent: aminimum of two interviews; skill-testing using MOCode testsand available hands-on testing; verification of a minimumthree years of experience; reference checks with a minimumof three employers; background checks that meet client standards;drug testing as required by the client; E-Verification toprove U.S. Citizenship; a valid driver’s license and reliabletransportation verification and confirmation of PPE and appropriatetools-of-the trade ownership. Not just anyone gets towork under the Tradesmen umbrella.Arguably the ideal fit for a cyclical industry such as shipbuilding,Tradesmen’s biggest challenge is often just educatingthe clients to understand the benefits and importance ofchoosing the right staffing firm. McClone Adds, “With thesevere shortage of skilled craft professionals weighing onthe industry’s shipyards, the emphasis is not on convincingshipyards to include a variable labor partner into their staffingsolution; the recession did a good job of explaining that tothe shipyards. The recession certainly opened the door for ourbusiness model but it also flooded the market place with staffingfirms, temp agencies, and similar companies. It’s importantthat shipyards choose the right firm researching the company’shistory, treatment of employees, standards of businessand overall ethical standards. Can the firm do what they saythey will and stand behind their employees? We can, and do.”Today, Tradesmen International’s strong suits include shipyardand yacht trades; both repair and new construction. Thefirm prides itself on its ability to staff all size marine projectsranging from extremely specialized mega yacht constructionprojects that may only require a handful of niche craftsmento large repair jobs that require several hundred craftsmen ina short amount of time. McClone calls it “local presence andnational reach.”Bollinger BelievesAccording to Bollinger Shipyard Human Resources ManagerJerome Eymard, Bollinger’s primary reason for becominginvolved with NMEC was to actively support an associationwhose initiative is to address a major concern of theshipbuilding and repair industry; namely, workforce development.Eymard told MarPro in November, “Bollinger has beena member of Gulf States Shipbuilders Consortium (GSSC)since 2008 and we were involved in the GSSC’s creation ofthe NMEC to address industry workforce development issueson a national level, so we were a member of the NMEC fromits inception in 2012.”The NMEC/NCCER curriculum models offers flexibilitywith training. For example, member organizations can takessteps through the NCCER to become an approved accreditedtraining sponsor and/or assessment center. With these options,companies can rate their current workers through assessmentsin order to identify areas for skill improvement. The assessmentsin turn determine what modules workers would need tocomplete in order to attain a higher classification. Also, companiescan utilize their NCCER accredited local technical andcommunity colleges to train their existing workers and extendthe training to high schools to generate new skilled workersfor the industry.Bollinger’s Eymard explains further, “Overall, we will use26 | Maritime Professional | 4Q 2013

the NMEC program to supplement our existing training programs.With the availability of a nationally recognized maritimecurriculum, we can recruit new workers into our companythat will be well-rounded and knowledgeable in the workwe perform. These individuals can aggressively move quickerwith on the job programs in addition to advancing their skilllevels with after-hour NMEC courses.”Today, Bollinger’s greatest need is for pipe fitters and shipfitters. Eymard adds, “Overall, we will need all crafts rangingfrom welders, fitters, marine electricians, operators, etc.in order to build the next generation of skilled workers for theindustry.” And, he says, “We are also actively participating insupplying subject matter experts for the creation of new curriculumand we are communicating with regional industry associations,informing them of the NMEC’s initiatives in orderto generate interest among other shipbuilders/repairers.”National Maritime Education Council (NMEC):A Template for SuccessJohn Lotshaw is the Gulf Coast Director of Training andWorkforce Development at Ingalls Shipbuilding, and is responsiblefor training all of Ingall’s craft personnel. Beyondthis, he also serves as the inaugural chair of the National MaritimeEducation Council (NMEC). As the spearhead for effortsto standardize and provide credentials for shipyard workers,backed by a coalition of 20+ industry trade groups and companies,what he and the NMEC do next could well be the templatefor industry human resources development that we havebeen thirsting for.The new shipyard workforce development effort on the GulfCoast is an exciting concept. The initial efforts at standardizedcurriculum development were started with a post-KatrinaDepartment of Commerce grant in 2006. The Alabama, Mississippiand Louisiana Manufacturing Extension Partnerships(MEPs) joined together with gulf coast shipyards to formthe Gulf States Shipbuilders Consortium (GSSC). Lotshawexplains, “After considerable effort and three years of developmentGSSC rolled out the Shipfitting Boot Camp. Theprogram has been very successful with a 100% rate of employmentfor graduates.”GSSC wanted to expand the curriculum and credentialingeffort from a regional to a national effort, launching what wasnamed the Lighthouse Campaign to raise funds. NMEC wasestablished in March of 2012 with 12 founding members representingthe shipbuilding and ship repair industries. NMECwill, says Lotshaw, “… work from a common set of definitions,defining exactly what each craft does, documentingeach craft’s required skill sets, and based on those skill sets,developing curriculum and assessments that ensures craftsmenwho are certified through the system can perform to industrystandards.”“With the severe shortage of skilled craftprofessionals weighing on the industry’sshipyards, the emphasis is not on convincingshipyards to include a variable laborpartner into their staffing solution; therecession did a good job of explaining thatto the shipyards. The recession certainlyopened the door for our business model butit also flooded the market place with staffingfirms, temp agencies, and similar companies.It’s important that shipyards choosethe right firm researching the company’shistory, treatment of employees, standardsof business and overall ethical standards.”Matt McClone, Tradesmen InternationalVice President Workforce Developmentwww.maritimeprofessional.com | Maritime Professional | 27

TRAINING & RECRUITMENTA key part of the NMEC effort is its partnershipwith the National Center for ConstructionEducation & Research (NCCER).At the time of its inception,NMEC was searching for best practices toimplement its vision, they looked at whatNCCER was doing in industrial construction,pipeline and power line curriculumand credentialing.John Lotshaw, Gulf Coast Director ofTraining and Workforce Development,Ingalls Shipbuilding, and chair of the NationalMaritime Education Council.A key part of the NMEC effort is its partnership with theNational Center for Construction Education & Research (NC-CER). At the time of its inception, NMEC was searching forbest practices to implement its vision, they looked at what NC-CER was doing in industrial construction, pipeline and powerline curriculum and credentialing. Lotshaw adds, “We foundthat when NCCER was formed as a non-profit education foundationin the early 1990’s, those industries were facing thesame challenges that the shipbuilding and repair industry isfacing now. Their model is effective, efficient, and has mademeasurable impacts related to safety, profitability and workforcedevelopment in those industries. We were offered theopportunity to partner with them and build on their success.”Already in place is a secure National Registry where crafttraining, assessment records and credentials are available forreview by potential employers (with applicant approval), and aproven track record. Hence, with NMEC standardization, andregardless of where the individual receives training, employershave assurance that persons with this credential are well trainedand have the skill sets they need. Lotshaw further insists, “Partneringwith NCCER gives our industry the best bang for thebuck and the quickest, surest pathway to meeting our goals.”The Shipfitting curriculum at NMEC addresses – and standardizes– one of the most in-demand skills in the business.(Tradesmen International credit)28 | Maritime Professional | 4Q 2013

Lotshaw defines shipfitting by saying, “Think of shipfitting ascarpentry with steel or aluminum. A skilled shipfitter knowshow to read a blueprint, measure accurately, and how to cut andjoin metal for form different structures. He understands basicmetal working and is familiar with maritime terminology.”GSSC’s successful shipfitting boot camp program and theshipfitting curriculum were the precursors to and the mainreasons behind the establishment of NMEC. During the program’spilot period, the boot camp was offered three times andgraduated 31 entry-level shipfitters. Instructors used and vettedthe shipfitting curriculum during the pilot. Lotshaw adds,“The outcomes were impressive. In addition to 100% placementof its graduates, after employment, employers reportedsavings on initial training costs and declines in probationaryreleases, disciplinary actions, and absenteeism. Perhaps a betterindicator of employer satisfaction, though, is the fact thatemployers wanted more workers trained under the model usingthe curriculum. As a result, it has been adopted by at leastthree community colleges and one for-profit training provider,and the interest in the program continues to grow.”Common Goals: Different VehiclesOne of the reasons NMEC was formed and then partneredwith NCCER was to create a national approach to training, assessment,and credentialing. NMEC and John Lotshaw reasonthat the common skills sets required of craft workers in themaritime industry do not vary based on the region of the countryand the curriculum used to train workers should not either.Today’s NMEC membership of 20+ organizations includesseveral trade associations, including GSSC and the VirginiaShip Repair Association and some larger, Gulf Coast-basedshipyards. Once the programs have had time to prove theirmettle and get benchmarked, that’s expected to grow.Two levels of pipefitting completed this fall and two levelsof shipfitting have been added to the curriculum. Lotshawsays, “We haven’t started marine electrical, or coatings, orother crafts that also need to be addressed. Our ability to dothat is dependent on the industry’s coming together and supportingthe initiative.”Whether home-growing talent or engaging contract skilledlabor from organizations such as Tradesmen International,the goals should be the same: producing skilled craft workersby offering individuals industry exposure and the opportunityto choose a career in shipbuilding/repair as early as highschool, and offering them a career path through industry-andcraft-specificcurriculum in order for them to be work-readyat point of graduation and/or after additional training in thecommunity colleges. It’s all an important building block ingenerating a pipeline of skilled workers into the shipbuildingindustry. And, it’s here now. Take your pick.

OOp/EdOPINIONWe Need to Save Our ShipsBy Matt Paxton“We must show the world, both ourenemies and our allies, that our Navyand its ships will continue to have apositive influence abroad and providea stabilizing presence on the seaswherever it is needed.”Matt Paxton, President of theShipbuilders Council of AmericaAmerica’s Navy is arguably the most powerful in theworld, and the most immediate threat it faces may notbe from China, Russia or Iran, but Congress. The useof sequestration as a budget reduction tool has resulted in aclumsy cost-cutting approach that will continue to have disastrouseffects into the next year and beyond, as the nation’snaval fleet will not be able to be maintained or repaired. Theultimate hypocrisy of this Congressional budget technique isthat deferred maintenance on ships costs a lot more when itdoes not get done and will actually shorten vessel lifespan andcost the taxpayer much more in the coming, as these shipsmust leave service and need to be replaced prematurely.Our nation’s leaders must immediately address the disastrouseffects of indiscriminately cutting core shipbuilding andrepair functions that keep this country safe and secure. Thiscritical maintenance is not only vital to national security, butit supports thousands of jobs and local economies. This iswhy the Shipbuilders Council of America (SCA) is issuing an“SOS” to Congressional budget conferees, led by RepresentativePaul Ryan and Senator Patty Murray, to “Save Our Ships.”The United States Navy plays a critical role around the worldby providing a stabilizing presence to keep the seas free andopen, which in turn allows global commerce to thrive. But thefleet relies on regular maintenance and repairs by the nation’sshipyards to extend the life of these strategic and costly assets.Sequestration’s funding cuts will force the Navy to reduceits vessel maintenance periods by fifty percent in fiscal year2014 and threaten the health of America’s shipyard facilitiesthat perform this critical maintenance. This drastic reductionin scheduled service calls will force the industry into a criticaljuncture and push it toward potentially massive layoffs. Theloss of these jobs will ripple across the country because America’sshipbuilding and repair industry is made up of a networkof parts and equipment suppliers from across all 50 states.These layoffs will leave America with a lost generation ofskilled workers while stifling innovation from reduced researchand development spending. Workforce reductions willalso mean higher prices for new assets like naval vessels becauseof forced consolidation in the defense industry and reducedcompetition. A shipyard or supplier that closes becauseof program cancellations will not be there when the Navy isready to build new ships again.Sequestration will not only damage our nation’s shipbuildingand repair industry, it will cripple America’s naval fleet. Deferralof one maintenance period at the 10-year point in a vessel’slifespan will shorten its overall service by about five years. Asthese vessels are retired early without ready replacements, thefleet will shrink by 30 to 40 ships over the next 30 years, leaving30 | Maritime Professional | 4Q 2013

our nation with a decreased global presence.This poses a dire threat to the futureof U.S. naval operations because a smallerfleet will hobble America’s ability torespond to critical global missions andcrises. A weakened U.S. naval presenceabroad makes delivering humanitarianaid more difficult while also increasingthe potential length and cost, in dollarsand lives, of future conflicts. Recentevents in Syria, Libya and the Philippinesunderscore the need and importance ofa stabilizing American naval presencearound the world.The Navy’s surge capacity has alreadybeen significantly diminished becauseof sequestration according to the Chiefof Naval Operations, and the situationwill only get worse. Because of currentbudget cuts, the Service is no longer ableto deploy multiple aircraft carrier strikegroups simultaneously around the world.Previously, it had multiple strike groupswith the ability to respond just days afterbeing called up, where now it currentlyhas only one. The last time the Navy’svessel numbers were this low was in1916, before World War I. The Navy hassaid it will take years to recover from thecurrent budget cuts required by sequester,without taking into account the nextround happening in January.These proposed cuts must be immediatelyreplaced with targeted reductionsbefore sequestration damages our nation’sship repair industry beyond recovery,shortens the overall life span of thevessels in our sea services, and leavesAmerica without a robust and vibrant navalfleet. Maintaining these vessels, andretaining a capable and experienced U.S.workforce is vital to America’s nationaland economic security. We must showthe world, both our enemies and our allies,that our Navy and its ships will continueto have a positive influence abroadand provide a stabilizing presence on theseas wherever it is needed.www.maritimeprofessional.com | Maritime Professional | 31

32 | Maritime Professional | 4Q 2013

The Aker Wayfrom Surviving to ThrivingAker’s comeback story isn’t yet over, but the middle chapters certainlymake for compelling copy. The nation’s market leader in blue watertankers and containerships looks aft to (painful) lessons learned andat the same time, ahead for additional opportunities.By Joseph Keefewww.maritimeprofessional.com | Maritime Professional | 33

AKER PHILADELPHIA SHIPYARDAker Philadelphia Shipyard (Oslo: AKPS) is thesecond-largest commercial shipbuilder in theUnited States, having built more than one-half ofthe large ocean-going vessels in the US marketsince 2003. The key word in all of that is “commercial.” AkerPhiladelphia is a Jones Act builder, and was hit hard in thewake of the recent financial crisis. At the nadir of the marketcrisis, the company was forced to make more than 700 layoffs.In February 2011, Pennsylvania and Philadelphia taxpayerstook a significant gamble, infusing $42 million into thecompany to build two oceangoing petroleum product tankerson spec. The gamble – Aker prefers to call it ‘market vision’– paid off handsomely in August 2012 when Aker sold thetwo ships to Crowley. Since then, it’s been fair winds and followingseas for the Philadelphia-based shipyard. Figuring outwhat comes next requires a look back. How Aker (it rhymeswith “soccer”) went from merely surviving to its current conditionof thriving is therefore one of the more interesting maritimestories of this year; if not the entire decade.First time visitors to Aker’s Philadelphia operation immediatelynotice the massive, modern 660 metric tonne, 64 meter(210 feet) tall Goliath crane. Only slightly less impressive isthe gleaming infrastructure, reflecting a shipyard that has beencompletely refurbished and in some places, rebuilt from theground up. Established first in 1801 – with a rich history withNavy work at its heart – the yard waseventually was closed in 1996. Withseveral starts and stops and hiccupsalong the way, the location is now, likemany other American yards, a thrivingbeehive of activity. In late November,MarPro traveled to Pennsylvania for afirsthand look at this pure commercial,Jones Act builder.Market ConditionsA booming shale crude oil industryhas created high demand for US-flaggedships for the coastwise transport of oil,gasoline and chemicals. Since the successfulsale of the spec ships, AkerPhiladelphia has landed contracts fortwo petroleum tankers for Exxon Mobilaffiliate Sea River, as well as a $500million agreement to build and share inthe operation of up to eight additionalproduct tankers for Crowley. And inNovember, Aker also inked a deal withMatson for two 3600-teu Jones Act containerships– the largest ever to be builtin the United States. The contract priceMy AdviceKristian RokkePresident & CEO, AkerQuality“Pleased, but never satisfied.”Government/Navy Work“We offer value to our customers by focusing100% on commercial projects.”Foreign flag newbuild bids“Our attention is directed toward the Jones Act,but; never say never.”Repair Work“We have been approached, and there is potential,but our current focus is on newbuildings.”was reportedly $418 million for the pair, with deliveries quotedfor the 3rd and 4th quarters of 2018.With four of the Crowley tankers firmly contracted and bothparties looking hard at the additional four options, these areheady times for Aker. The shipyard’s solid backlog and strongcash position have pushed its stock price up more than 30times its market low in mid-2012. Despite the large run-upin market capitalization, the company’s debt load and TotalEnterprise Value (TEV) to EBITDA ratio both seem to be reasonable,as compared with its peers. That said; major risksinclude cancelled contracts and changes to the Jones Act, neitherof which seem to be likely in the current political andeconomic environment.Steering the ShipJust 30 years old, Kristian Rokke joined Aker PhiladelphiaShipyard in 2007. Prior to that, the Aker CEO held various roles,including SVP Operations and Senior Shop Manager within theshipyard and has experience from offshore service and shipbuildingfrom several companies in the Aker group. A BoardMember of TRG Holding AS, which owns 66.7% of Aker ASA,Rokke is currently completing his MBA at The Wharton Schooland has also studied economics and mathematics at Colby College,London School of Economics, and Political Science at theNorwegian School of Management (BI).Joining Rokke is Scott Clapham, SVPProjects and Business Improvementsand Jeffrey Theisen, the firm’s ChiefFinancial Officer. Together, they havehelped engineer the shipbuilding giant’sremarkable turnaround, and they havedone so in an arguably unconventionalstyle. As a management team, the trio isremarkably closemouthed, but Rokke,in his own quiet, understated manner,summed up some key metrics in the boxto the left.The Aker Way: Lucky or Prescient?Kristian Rokke eagerly looks ahead towhat will come next. He told MarPro inNovember, “Our order backlog gives usa golden opportunity to strengthen thecommercial edge of our shipyard andputs us in good position for whatevercomes next.” According to Aker’s CEO,the shipyard’s success in recent yearshas as much to do with Aker’s attitudeas anything else. He insists, “We believedin the product tanker market andput our own money behind that belief.”34 Maritime Professional I 4Q 2013

“We’re proud to be playing an important part in ourcountry’s oil boom, but at the same time, we remainhumbled by the events of 2010 and 2011. Today weare seizing opportunities like never before, but we willnot forget the lessons taken from those difficult”times.We will build off the past, but not be tied to it.Kristian Rokke, President and CEO, AkerRokke also describes his firm as nimble, creative, and opportunistic.Giving credence to that position, some of the dealsput together by Aker in order to survive and indeed thrive,have not been uncomplicated. For example, the recent Matsondeal is a straight sale, but others were not.When Aker built the two product tankers on spec, it waswidely considered by most analysts as “a leap of faith.” No one,of course, could know what would come next, and so soon. Or,perhaps the Aker management team did. The public/privatemove, as a minimum, took courage. The yard had previouslybuilt 14 product tankers for OSG and then went from 1,200 employeesto roughly 300 in the space of one year. Now lookingback from a more comfortable perch, Rokke explains, “We’reproud to be playing an important part in our country’s oil boom,but at the same time, we remain humbled by the events of 2010and 2011. Today we are seizing opportunities like never before,but we will not forget the lessons taken from those difficult

AKER PHILADELPHIA SHIPYARDSource: The McClean Group LLC36 I Maritime Professional I 4Q 2013